Weekly Insights 24 Jun 2022: Covid-hit sectors’ recovery is underway amid improving trade linkages

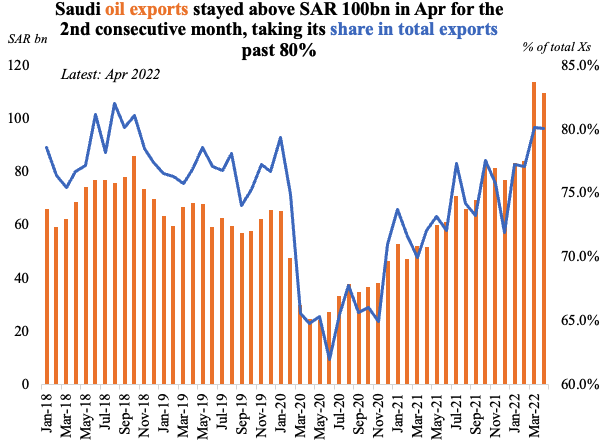

1. Saudi trade flourishes, thanks to oil exports (SAR100bn+)

- Non-oil exports grew by 34.2% yoy to SAR 22.7bn in Apr 2022; however, this accounted for just 17% of total exports

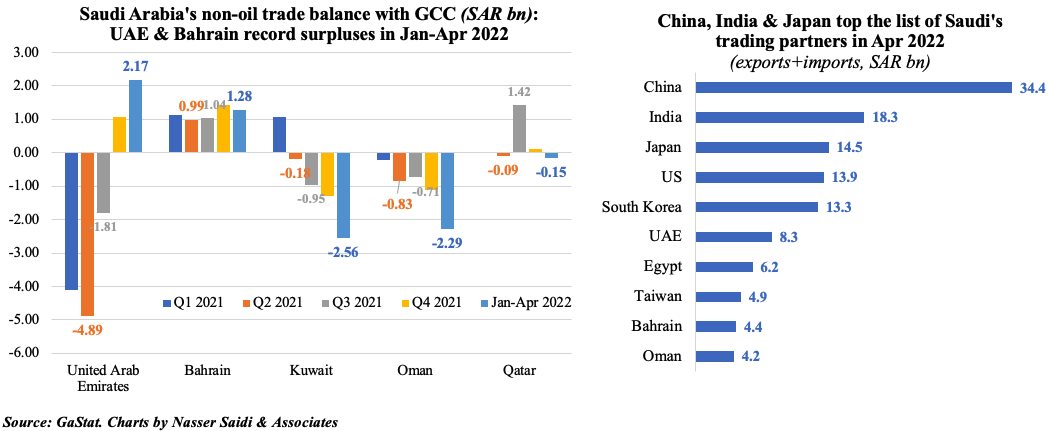

- China, India, South Korea, Japan and the US were the main destinations for Saudi exports, together accounting for more than 50% of total exports in Apr 2022

- Saudi imported most from China, US and India, together amounting to 43% of total Ms in Apr 2022. The top 15 nations accounted for ¾-th of all imports, and among them were Egypt (7th largest), Oman (10th) and Bahrain (14th)

- Within the GCC, Saudi has been running a non-oil trade surplus with both the UAE and Bahrain year-to-date

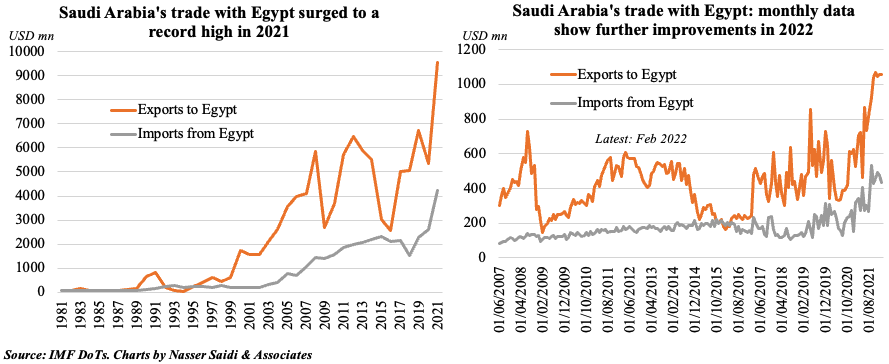

2. Saudi Arabia and Egypt to further cement economic linkages, including trade

- The Saudi Crown Prince visited Egypt this week, in a bid to enhance the growing economic relations between the two nations

- Trade between Saudi Arabia and Egypt grew to a record high of USD 14bn in 2021, coming off a slight dip in exports in 2020 (Source: IMF DoTS). Latest available data show the top exports to Egypt comprised mostly of fuels & minerals (~50%) and plastics (~25%) while top imports from Egypt were fuels (~20%), vegetable products (~15%) and metals (~15%)

- Saudi companies’ investments in Egypt amounted to USD 30bn. During this trip, Saudi and Egypt have signed 14 investment deals worth USD 7.7bn, with a focus on infrastructure and green energy. Saudi Arabia’s ACWA Power announced an investment worth USD 1.5bn in a wind power plant (in the Gulf of Suez) in Egypt

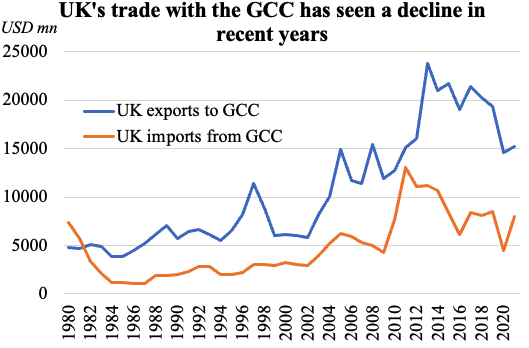

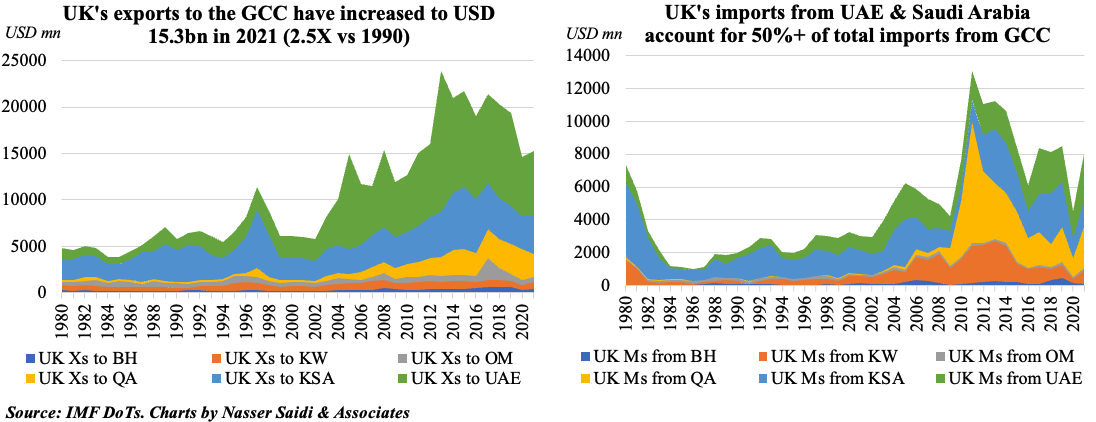

3. UK initiates free trade talks with the GCC

- UK’s trade minister is in the GCC and is expected to begin free trade deal discussions with the region; this follows other post-Brexit trade discussions with India and Mexico

- The GCC bloc together is equivalent to UK’s 7th largest export market. Saudi Arabia and the UAE are the major trade partners

- Given GCC’s dependence on food imports, the FTA is expected to significantly reduce or remove tariffs on UK food & drink exports

- Data from the UK government shows that UK is the second largest services exporter in the world, and services exports to the GCC were worth GBP 12.1bn in 2021

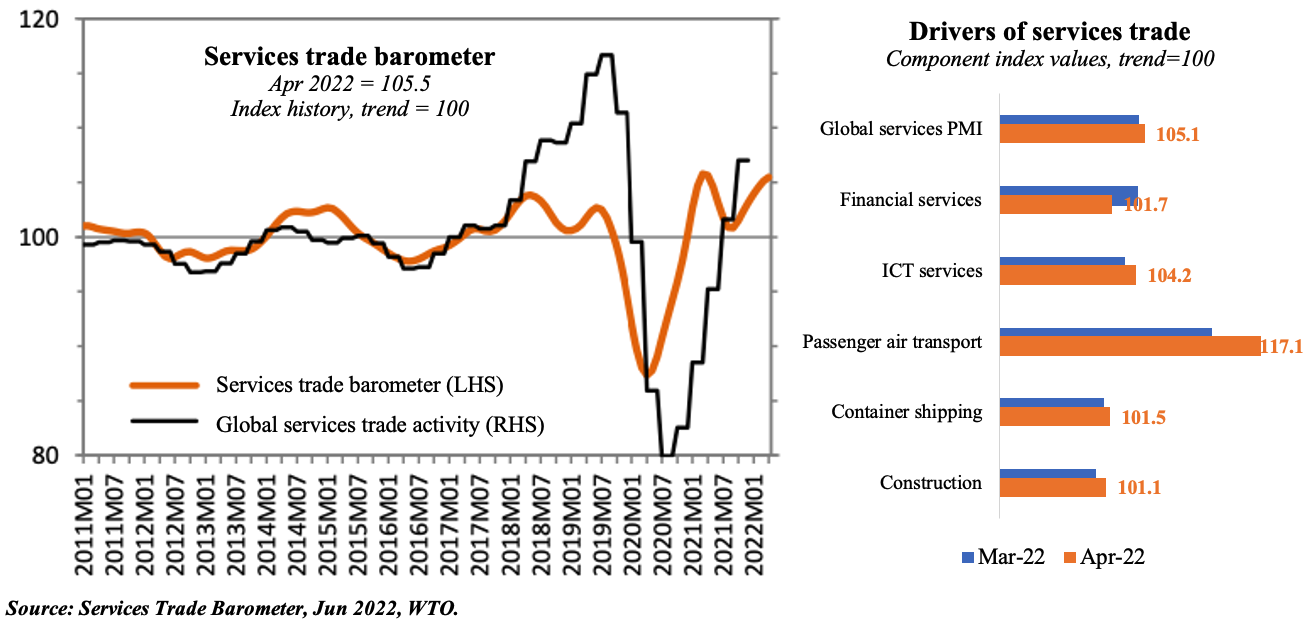

4. Services Trade Continues Recovery in spite of the Russia-Ukraine war

- Services trade is picking up faster than goods trade, as shown by the latest Services Trade Barometer from the World Trade Organisation (WTO). This is a possible sign of a shift in consumption patterns i.e. away from goods and more to services, as was the case pre-Covid

- The services trade activity index showed a recovery in Q4 2021 (bottom left chart, black line), but it is about 9% below its pre-pandemic peak (in Q2 2019)

- Among the main drivers of services trade, passenger air transport posts the strongest gain (supported by IATA data of passenger traffic from last week’s Insight piece), followed by services PMI and ICT services

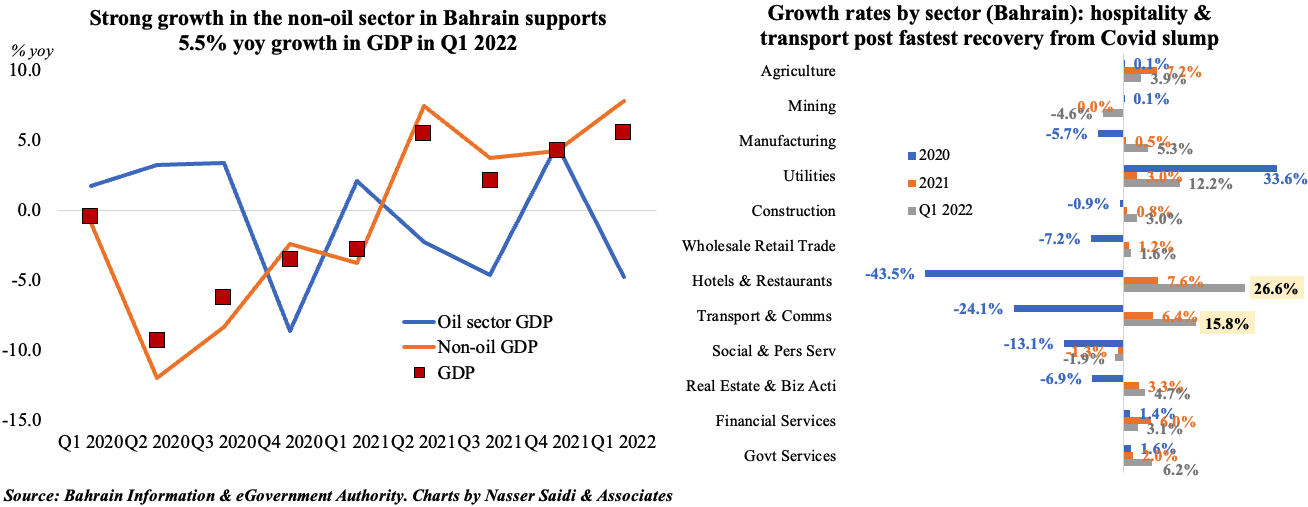

5. Bahrain GDP grows by 5.5% yoy in Q1 2022, supported by non-oil sector activity

- Non-oil sector GDP grew by 7.8% yoy in Q1 2022 (Q4: 4.2%), supporting an overall growth of 5.5% (Q4: 4.3%), while oil sector activity declined by 4.7% (Q4: +4.7%)

- Recovery in the non-oil sector was supported by the hotels and restaurants sector (+26.6% yoy) as well as the transportation and telecommunications sector (+15.8%): both had plunged as the pandemic hit

- The IMF expects Bahrain to post an overall growth of 3.4% in 2022, with a strong reading of 4% in the non-oil sector (supported by manufacturing); furthermore, the increase in VAT to 10% is expected to result in a balanced budget by 2024