Weekly Insights 17 Jun 2022: Will Central Bank aggressive Monetary Tightening disrupt the Global Tourism Recovery?

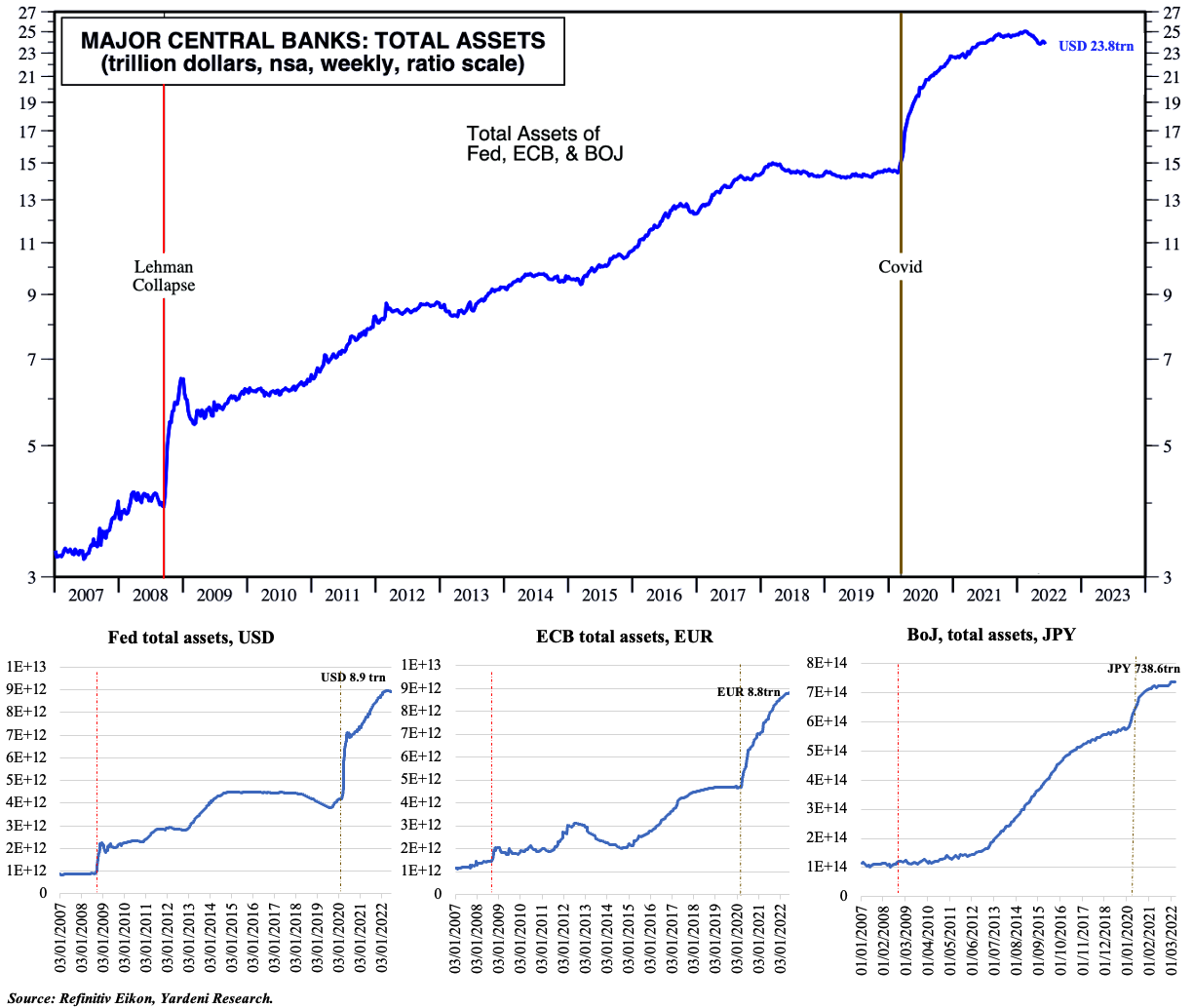

1. Will monetary tightening= higher rates + smaller balance sheets as CB start QT disrupt recovery?

- This week has seen multiple rate hikes across major developed nations: Switzerland (50bps); the Fed (75bps); UK (25bps)

- Bank of Japan remains the only major central bank, citing the current cost-push inflation as temporary, even as core CPI rose 2.1% yoy in Apr (exceeding the BoJ’s target)

- The unwinding of central bank balance sheets is important: it affirms central bank independence (i.e. QE is not permanent support for market liquidity/ financing deficits) + gives leeway for CBs to raise rates more gradually + likely have a more direct impact on market liquidity.

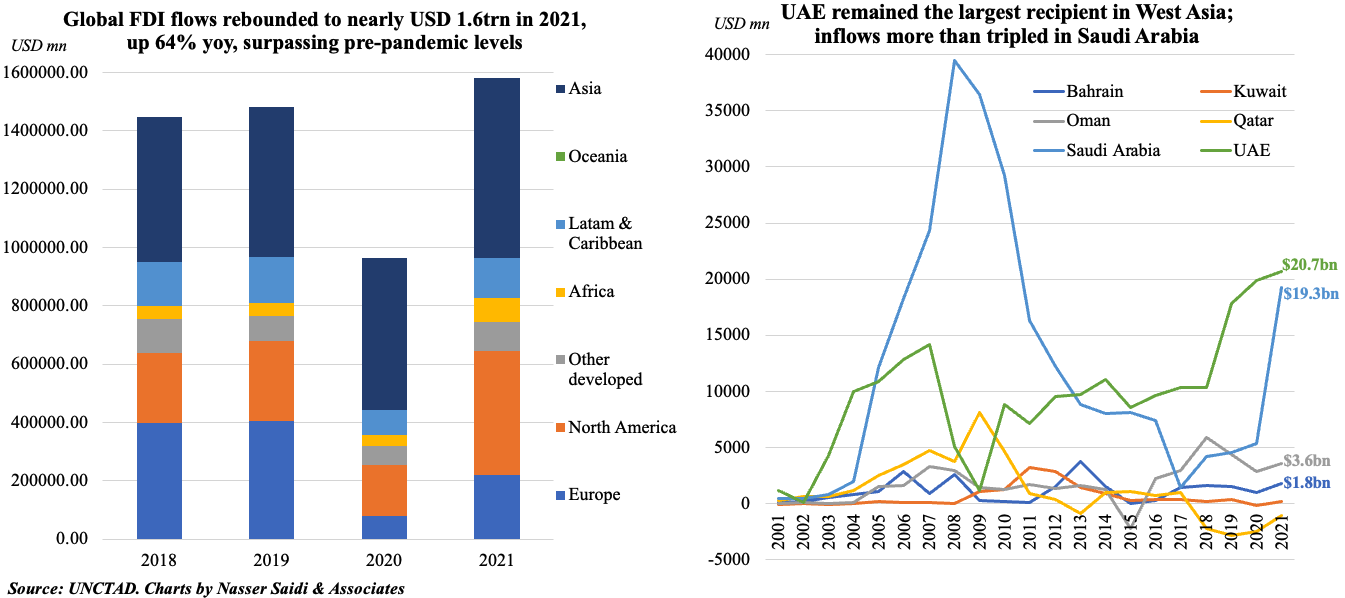

2. Global FDI inflows increase; UAE & Saudi Arabia major beneficiaries in the region

- UNCTAD’s World Investment Report highlighted that while three quarters of global FDI growth was in developed nations last year (+134% yoy), flows to developing nations rose to a record high of USD 837bn

- Flows to developing Asia rose for the 3rd straight year to an all-time high of USD 619bn. UAE was among the top 6 recipients in this region (together accounting for 80%+ of inflows). Cross-border M&A’s resulted in strong FDI growth in the Middle East

- Driven by the war in Ukraine, higher food and fuel prices as well as interest rate hikes, business confidence and investment climate this year will be lower vs 2021 => expect flat or slight decline in global FDI flows in 2022

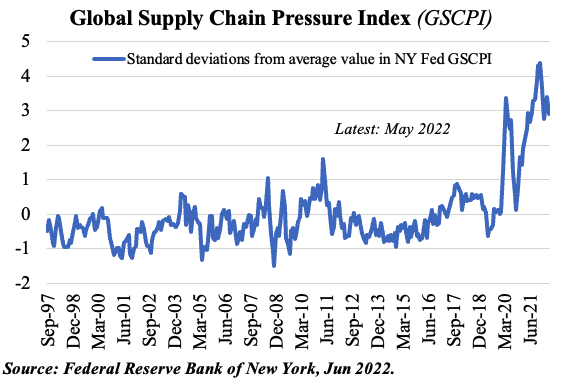

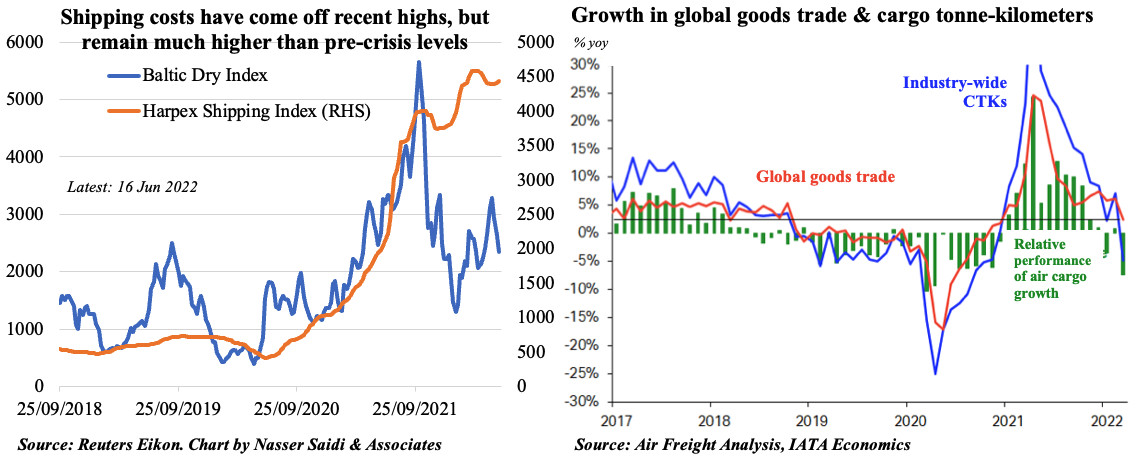

3. Supply chain concerns moderated in May as China opens up slowly

- While the Fed’s index shows a slight decline in supply chain pressure index, there are 2 main disruptions: (a) China’s zero-Covid policy; (b) disruptions due to the Ukraine war => congestion + capacity issues + delays in shipping + limited movement of air cargo

- Shipping costs remain high + significant decline in CTK volumes; export orders are contracting => downward pressure on international trade

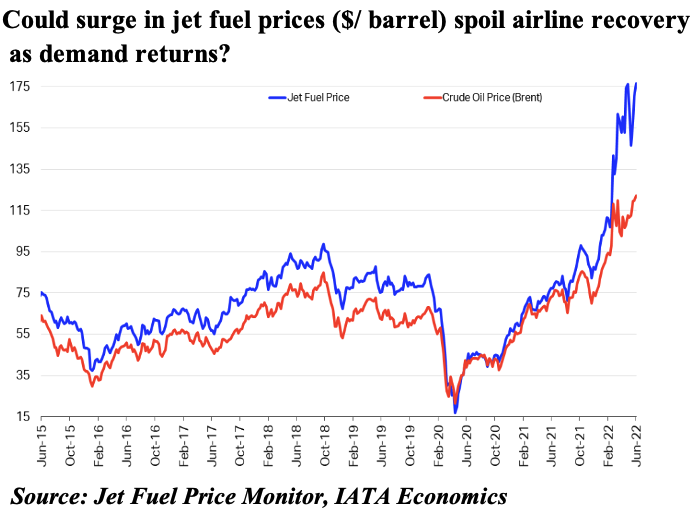

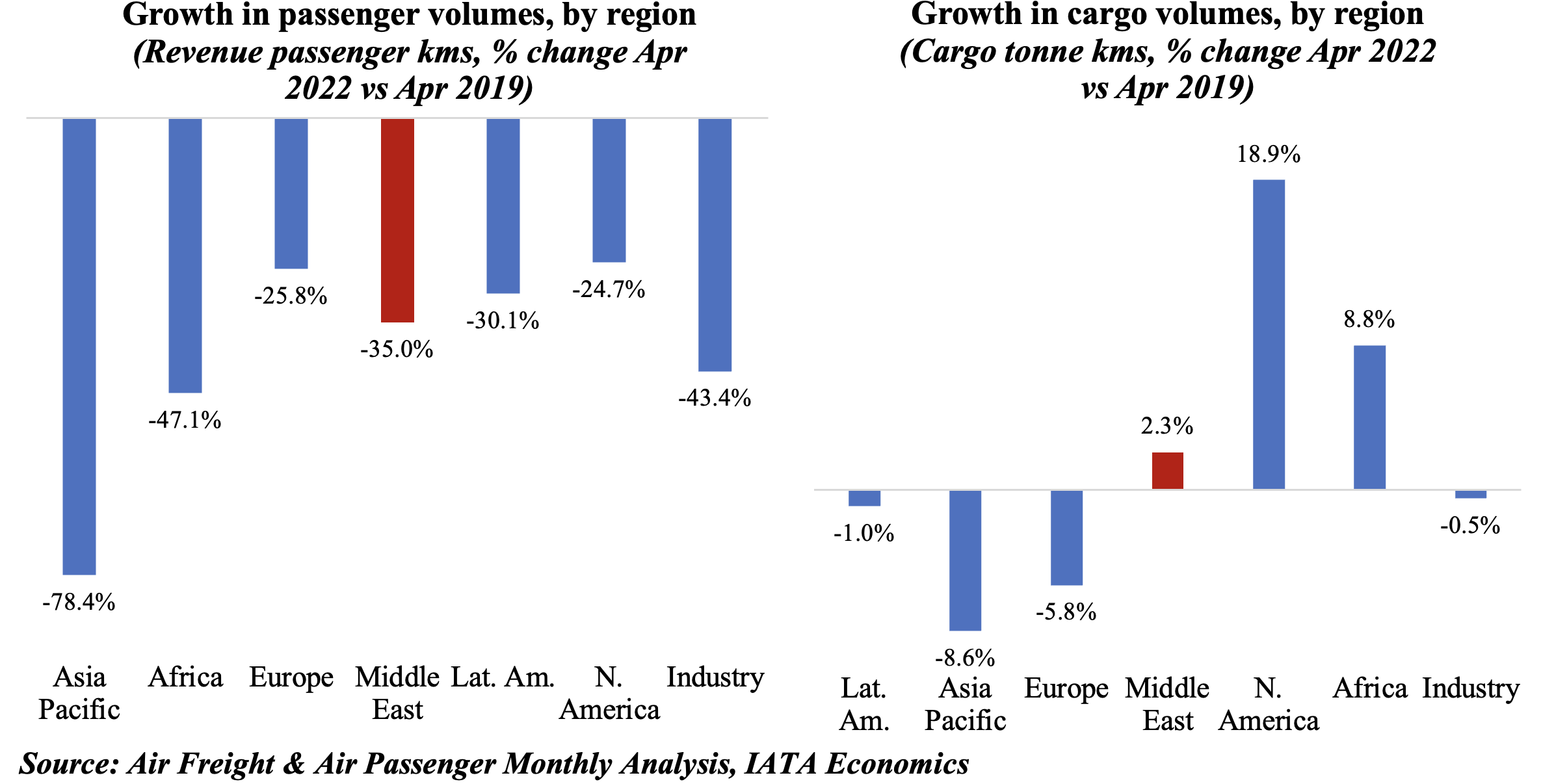

4. Air traffic taking off in Apr; will fuel prices spoil the party?

- Passenger traffic picks up in Apr, with some routes above pre-pandemic levels (Europe-C. America; Middle East-N. America; N. America –C. America), thanks to a tourism spike in Apr. International bookings are on the rise: revenge travel + summer plans

- Air cargo movements has been limited due to supply chain & capacity issues; gap between jet fuel & crude oil remains significant => pressure on recovery

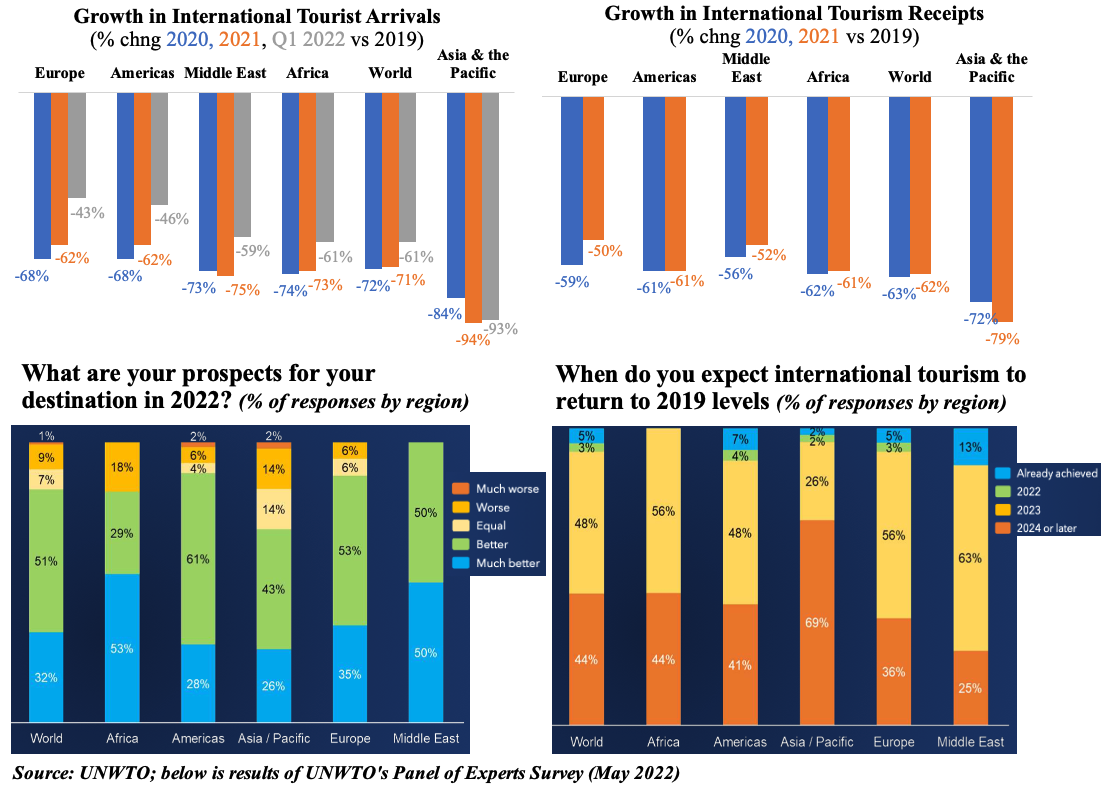

5. A global tourism recovery is underway, though still below pre-pandemic levels; inflation could be a threat with rising transport & hospitality costs

- Intl arrivals increased three-fold in Q1 2022 vs Q1 2021 (117mn vs 47mn)

- Europe & Americas lead the recovery

- While Middle East recovered in % yoy terms, arrivals were 59% below pre-pandemic levels

- Tourism receipts are rising as well: global amount spent per trip grew to USD 1400 in 2021 (2019: USD 1000)

- Experts are very bullish about the Middle East. In 2022, it is an even split between faring better or much better; furthermore, 63% of those surveyed (in May) believe 2019 levels will be achieved by 2023; 13% believe that tourism has already returned to pre-pandemic levels!

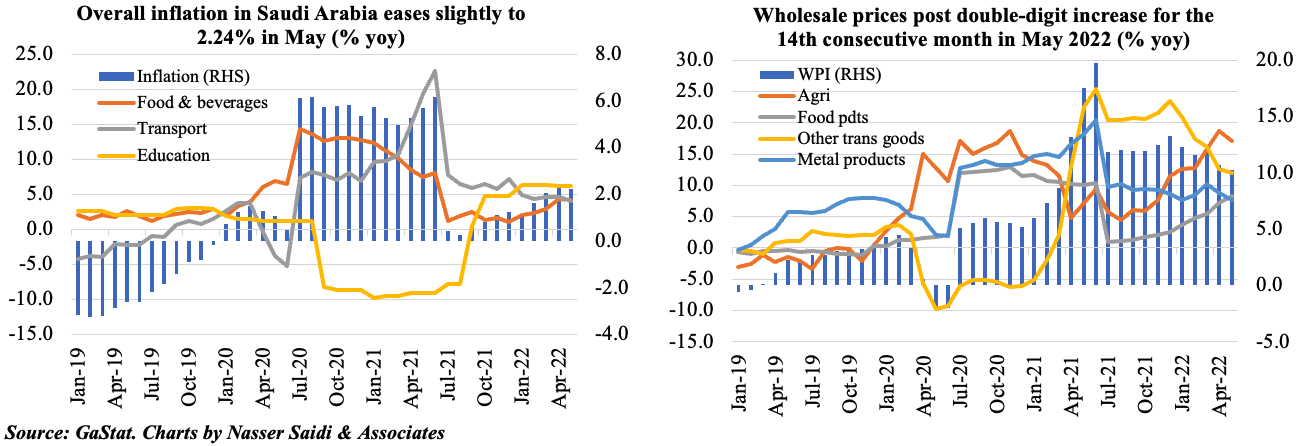

- Consumer price inflation in Saudi Arabia eased in May, thanks to deceleration in miscellaneous goods, transport as well as clothing and footwear prices; transport category has benefitted partly from the cap on petrol prices. Upticks were registered in restaurants/ hotel (4.13% from Apr’s 3.22%) and recreation (5.51% from 5.4%) sub-categories. Overall, inflation has averaged just 1.9% this year

- Wholesale prices posted a double-digit increase for the 14th straight month in May, averaging 11.4% in 2022

- Saudi Central Bank raised key interest rates by only 50bps instead of mirroring the Fed’s 75bps hike. A similar move was done in Mar 2020 when SCB cut rates by 75bps instead of the 1% cut by the Fed. According to SCB, 3m SAIBOR rose to 2.3675 in Apr from 1.9585% in Mar and 0.8736 at end-Dec 2021; will rise further