Download a PDF copy of this week’s economic commentary here.

Markets

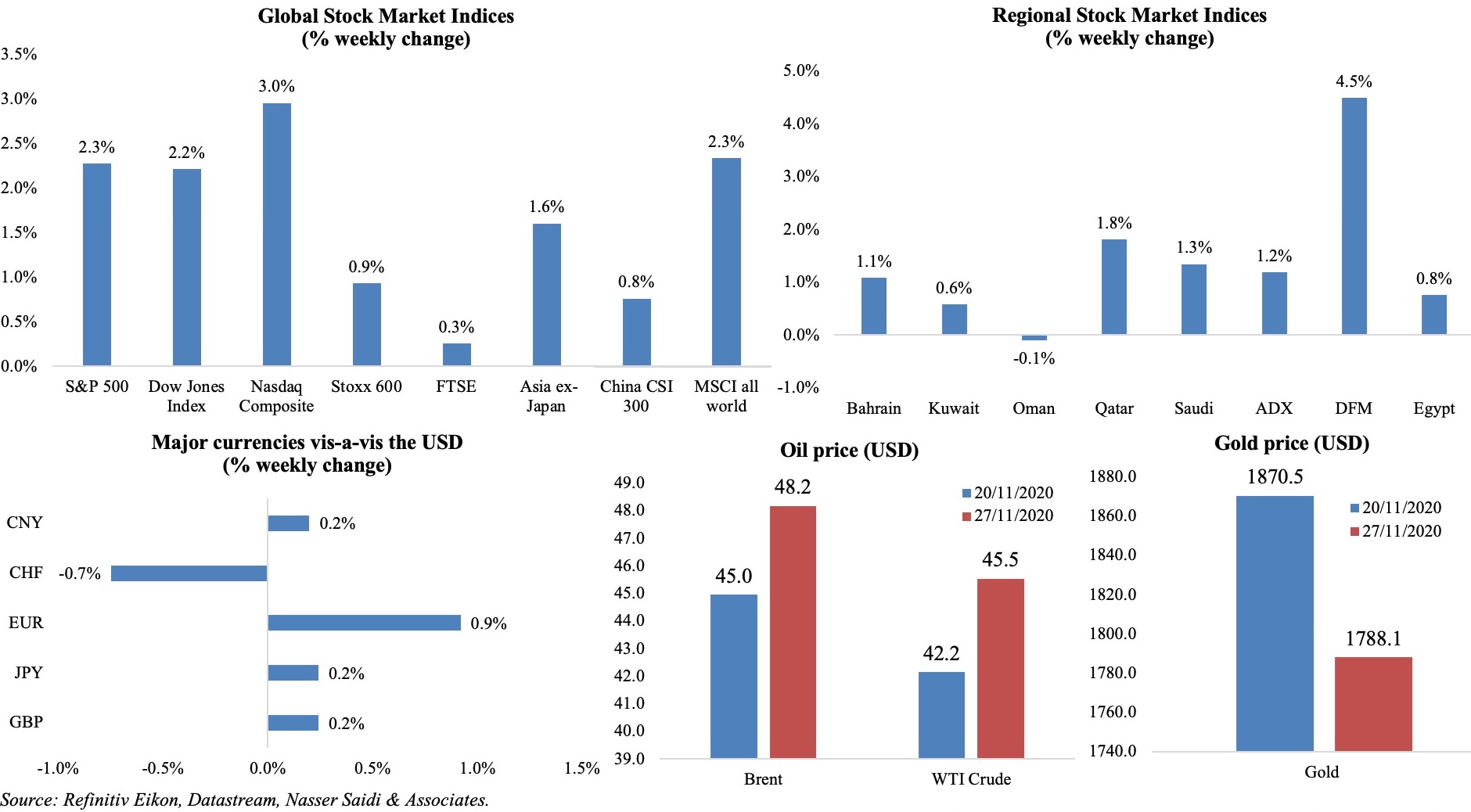

Equity markets are riding an optimism wave, with the MSCI’s main world index touching a record high: gains are linked to news of vaccines, its production and distribution plans (even as global cases crossed 60mn) while US President-elect Biden began the presidency transition. Regional markets were mostly higher, with Dubai leading the gains (+4.5%) while Abu Dhabi gained for the 9th consecutive week. Among currencies, the dollar has fallen more than 2% this month (global FX rates: tmsnrt.rs/2egbfVh). Oil prices ended the week up 7-8% on hopes of a rebound in oil demand, rising almost 30% this month, while gold price fell to its lowest since Jul.

Weekly % changes for last week (27-28 Nov) from 19 Nov (regional) and 20 Nov (international).

Global Developments

US/Americas:

- Durable goods orders inched up by 1.3% mom in Oct (Sep: 2.1%). Non-defense capital goods orders excluding aircraft inched up by 0.7%, following a 1.9% gain the month before.

- Core PCE was unchanged at 3.5% qoq in Oct. Personal income declined by 0.7% mom in Oct while personal spending eased to 0.5% (Sep: 1.2%).

- Markit manufacturing PMI increased to 56.7 in Nov (Oct: 53.4), the strongest expansion in activity since Sep 2014, while services PMI ticked up by 0.8 points to 57.7. Both rises supported an increase in the composite index to 57.9 (Oct: 56.3), with new orders growth was the strongest since Jun 2018, largely due to domestic demand.

- S&P/ Case-Shiller home price index inched up by 6.6% yoy in Sep (Aug: 5.3%), while the National Composite Index gained 7% yoy – matching the May 2014 reading.

- New home sales declined by 0.3% mom to an annual rate of 999k in Oct though in yoy terms sales surged by 41.5%. The 30-year fixed mortgage rate is around an average of 2.72% while the median new house price increased 2.5% yoy to USD 330,600.

- The Chicago Fed national activity index improved to 0.83 in Oct (Sep: 0.32) though the index’s three-month moving average fell to +0.75 in Oct (Sep: +1.37).

- The Richmond Fed manufacturing index plunged to 15 in Nov (Oct: 29), though survey respondents remained optimistic about the future.

- Initial jobless claims increased by 30k to 778k in the week ended Nov 21, with the 4-week average rising to 748.5k. Continuing claims fell by 299k to 6.07mn in the week ended Nov 14. To add to these worries, emergency federal assistance expires by end of the year, as weill student debt relief and eviction moratoriums.

Europe:

- Germany’s GDP grew by 8.5% qoq in Q3 (flash estimate: 8.2%; Q2: -9.8%) though in yoy terms, growth was down by 4% (Q2: -4.3%). Later last week, Germany extended its “lockdown light” restriction measures to Dec 20th.

- Germany’s manufacturing PMI declined to 57.9 in Nov (Oct: 58.2). Services PMI slipped further below-50, to a 6-month low of 46.2 this month (Oct: 49.5). Together, the composite index moved down by 3 points to 52 – the weakest expansion since recovery began in Jul.

- Eurozone manufacturing PMI slowed to a 3-month low of 53.6 in Nov (Oct: 54.8) while the services PMI plummeted to a 6-month low of 41.3 from the previous month’s 46.9, bringing the composite PMI below-50 to 45.1 (Oct: 50), another 6-month low. France’s composite PMI dived to 39.9 from 47.5 – the steepest drop since May.

- Germany’s Ifo business climate index fell to 90.7 in Nov (Oct: 92.5), with manufacturing the lone bright spot as the service sector fell back into negative territory for the first time since Jun. Current assessment edged down by 0.4 points to 90 while expectations declined to 91.5 from 94.7 the month before.

- EU Economic Sentiment fell sharply by 3.6 points to 86.6 in Nov, the first time since sentiment fell during the first Covid19 wave, with employment expectations falling for the second months in a row (-3.3 points to 87.2). The flash consumer confidence index was down by 2.2 points to -18.7 in Nov (far below the long-term average of -10.6).

- Manufacturing PMI in the UK accelerated to 55.2 in Nov – the joint highest level since 2018 – while services PMI declined to 45.8 from 51.4 the month before. The composite PMI slipped below 50, for the first time since Jun, clocking in 47.4 in Nov (Oct: 52.1).

Asia Pacific:

- GDP in India declined by 7.5% in Jul-Sep this year, as the country moved into recessionary territory though it improved from the 23.9% plunge recorded in Q2. Manufacturing industry surprisingly picked up by 0.6% after a massive 39.3% drop in the prior quarter; agriculture sector growth remained unchanged at 3.4%. Worrisome among the numbers is the dip in private consumption by 11.5%.

- Fiscal deficit in India stood at INR 9.53trn (USD 128.9bn) in Apr-Oct: this was 126.7% of the budgeted target for the full fiscal year (to end in Mar 2021).

- Inflation in Japan’s Tokyo fell by 0.7% yoy in Nov (Oct: -0.3%). Excluding food and energy, prices were lower by 0.2%.

- Japan’s manufacturing PMI declined to 47.6 in Nov (Oct: 48.7) and composite index dimmed by 1 point to 47, as demand conditions weakened, new businesses fell for a 10th consecutive month and export orders dropped.

- Singapore GDP contracted by 5.8% yoy in Q3, while growing by 35.4% qoq (Q2: 13.3% yoy). The Ministry of Trade and Industry estimates growth to shrink between 6-6.5% this year.

- Industrial production in Singapore plunged by 19% mom – the first fall in five months – and by 0.9% yoy (Sep: 25.6%) – the fastest drop in nearly a decade. Excluding biomedical manufacturing, Oct’s fall was even steeper, at 2.7%.

- Inflation in Singapore slipped by 0.2% yoy in Oct, from a flat reading in Sep: food prices increased by 1.7% while costs fell for housing and utilities (-0.3% vs -0.7%) and clothing (-4.3% vs -4.6%) among others.

Bottom line: This week sees the OPEC+ meeting, where member countries are likely to delay plans to raise output by at least 3 months; a last-minute meeting of OPEC+ ministers was organized this weekend to discuss the upcoming decision. Meanwhile, the last stretch of Brexit discussions continue ahead of the end of the transition period on Dec 31st. As practical aspects of the vaccines – production and distribution – are being sorted out, there is some hope from Europe’s less severe lockdowns this time round: R (the average number of new people who contract the virus from each infected person) fell to an average 0.9 in the week after restrictions were imposed (from 1.1 before), meaning new infections would fall by 21% vs rising by 36% (read more: “Why Europe’s second, less severe lockdowns are working”).

Regional Developments

- Bahrain is expected to grow by 3.5% in 2021, following a sharp decline of 5% this year, according to S&P While profitability is expected to decline, retail banks’ net external debt is forecast to climb to around 15% in the next two year from 9.8% in end-2019.

- The central bank of Egypt offered EGP 9.5bn (USD 606.9mn) worth treasury bills over three tranches last week.

- Exports from Egypt to the Nile basin nations grew by 1.4% to USD 1.22bn in 2019; imports from the nations declined by 4.6% to USD 640mn.

- Egypt’s Export Development Fund released lump-sum payment of their export subsidy dues last week to about 323 companies totaling EGP 3.2bn. This was done as part of an initiative that allows 85% of the value of export subsidy dues to be paid to companies versus payment in instalments.

- Iraq’s oil minister disclosed that the nation would not be requesting an exemption from the OPEC+ deal. Separately, Bloomberg reported that the country was proposing that buyers pay upfront for a 1-year oil supply (estimated at just above USD 2bn at current prices) in exchange for a 5-year supply contract delivering 4mn barrels a month, or ~130k barrels a day.

- Jordan’s central bank extended the loan moratorium period till end-Jun next year. Banks have postponed repayments of individuals’ loan instalments since the beginning of the pandemic at a total value of JOD 800mn, while the amount of the companies’ structured credit facilities surpassed JOD 3bn.

- Foreign investments into Jordan increased by 17% yoy in H1 this year, according to UNCTAD’s latest report.

- The first phase of Jordan’s national military service programme has been postponed due to the Covid19 outbreak, disclosed the cabinet.

- Oman raised USD 500mn in its return to the debt market, reopening two bonds issued in Oct: it sold USD 200mn in bonds maturing in 2027 at a 6.30% yield and USD 300mn in bonds maturing in 2032 paying 6.90% versus the initial guidance of 6.45% and 7.05% respectively.

- Private sector deposits in Oman grew by 9.5% yoy to OMR 16.4bn by end-Sep. Of total credit disbursed to the private sector, the non-financial corporate sector and the household sector (mainly under personal loans) received a share of 46.3% and 45.1% respectively.

- The number of expats in Oman declined by 17% yoy to 1.44mn at end-Oct, according to the labour ministry. A further 7689 expats requested permission to depart between Nov 15-19, reported the Times of Oman.

- Saudi Aramco completed the issuance of USD 8bn bonds to supports its payout to its shareholders. A Tadawul filing disclosed that Aramco has issued a total of 40,000 bonds/ sukuk, with a yield of 1.25% for bonds maturing in three years, 1.625% for bonds maturing in five years, 2.25% for 10 years, 3.25% for 30 years and 3.5% for bonds maturing in 50 years.

- Saudi Arabian Monetary Authority has been renamed the Saudi Central Bank, according to a new law and will be directly linked to the monarch, while possessing full financial and managerial independence. Its 3 core objectives included maintain cash stability, boost confidence and trust in the financial sector, and support economic growth.

- SAMA’s governor disclosed that the apex bank is considering an extension of its stimulus plans relating to payment deferral until end of Q1 2021.

- According to Saudi Arabia’s finance minister, there is no plan to reconsider the VAT hike to 15% in the short or medium term. He also forecast economic growth of 3.1-3.2% next year, supported by private sector participation, boosted by PIF’s investments locally.

- Saudi Arabia’s exports plunged by 31% yoy to SAR 53.3bn (USD 14.2bn) in Sep, thanks to a slump in demand for oil. Oil exports plunged by 38.7% to around SAR 35bn while non-oil exports were down by 9.3% to about SAR 18bn. China, US and UAE were top trade partners.

- Saudi Tadawul delisted SAR 3bn of government debt instruments, on the request of the ministry of finance, given its maturity by the end of 24 Nov 2020.

- About 40% of Saudis employed in the private sector will benefit from the recent decision to raise minimum monthly wage of Saudis for Nitaqat program.

- Saudi Arabia approved a 48-hour and 96-hour transit visas: these will cost SAR 100 and SAR 300 respectively.

- ACWA Power is planning an IPO next year, disclosed the company’s Chairman. Currently carrying out deals worth USD 59bn, the firm is expected to list on Tadawul though size of the IPO has not been decided yet.

UAE Focus

- The liberalization of foreign ownership laws in the UAE breaks down major barriers to the rights of establishment and will be a game-changer for the country. This reform will help to reduce costs of doing business, lead to a recapitalization of existing jointly owned companies and encourage entrepreneurs to invest in new businesses and new ventures, supporting innovation and the introduction of new technologies while also promoting inflows of foreign direct investment. Read more: https://nassersaidi.com/2020/11/26/weekly-insights-26-nov-2020-uae-needs-to-attract-fdi-into-viable-sustainable-economic-diversification-sectors-projects/

- Abu Dhabi discovered 2bn barrels of conventional oil reserves and 22bn barrels of unconventional oil reserves

- Abu Dhabi’s Crown Prince announced (coinciding with UAE’s 49th National Day celebrations this week) housing loans, homes and land to be granted to citizens, worth AED 7.2bn, while also waiving loan repayments for 381 Emiratis amounting to AED 340mn.

- Dubai government raised USD 1.5bn from a private bond placement, reported Bloomberg, by reopening existing debt instruments.

- UAE banks’ assets increased by 7.6% yoy and 2% qoq to AED 3.252trn at end-Sep, according to the central bank. Gross credit picked up by 4.9% yoy and 0.8% qoq to AED 1.805trn.

- Dubai expects economic growth rate to increase by upto 1% from the UAE’s plan to extend a 10-year residency to doctorate degree holders, medical doctors and those with specialized degrees in AI and epidemiology.

Media Review

Biden’s Modest Multilateralism

https://www.project-syndicate.org/commentary/joe-biden-america-modest-multilateralism-by-jeffrey-frankel-2020-11

Saudi Arabia’s Many Transformations: Op-ed by Nasser Saidi

In Arab News French: https://www.arabnews.fr/node/33451/nasser-sa%C3%AFdi

In English: https://nassersaidi.com/2020/11/26/saudi-arabias-many-transformations-op-ed-in-arab-news-french-nov-2020/

How knowledge-based human capital can drive UAE’s diversification efforts: Oped in The National

https://www.thenationalnews.com/business/how-knowledge-based-human-capital-can-drive-uae-s-diversification-efforts-1.1119636

Bitcoin: a record intra-day high in volatile week

https://www.ft.com/content/1e02322a-7225-4c01-a41c-3caa8a0b91cf

Playing video games in lockdown can be good for mental health

https://www.economist.com/graphic-detail/2020/11/27/playing-video-games-in-lockdown-can-be-good-for-mental-health

Powered by: