[This is an edited version of the post issued originally on 29th Sep; Table 1 & related text have been updated]

Supporting the recovery of UAE’s private sector: focus on SME finance

To support the UAE economy in the backdrop of Covid19, the central bank (since Mar 2020) has rolled out a number of measures including liquidity injection via loosening of banks’ capital requirements, loan repayment deferrals and the Targeted Economic Support Scheme (TESS) among others. According to the UAE central bank, as of end-Jul, banks and financial institutions had availed AED 44.72bn worth of interest-free loans (89.44% of total) as part of the TESS facility. It needs to be highlighted that banks used close to 95% of these funds towards postponing loan payments for the affected sectors. It was also disclosed separately that 300k individuals, 10k SMEs and more than 1500 private sector firms had used the economic stimulus.

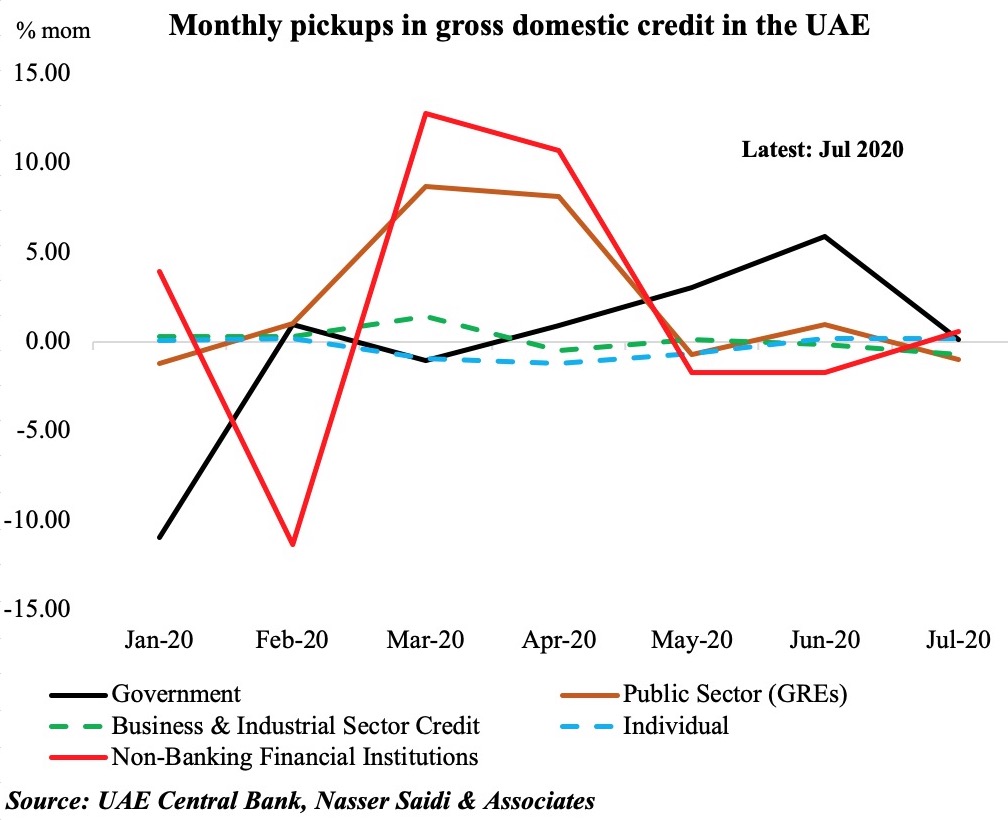

The latest data from the UAE cent ral bank shed some light on the broader credit movements: the accompanying chart shows the monthly changes in gross domestic credit. The dotted lines are credit to businesses and individuals (the private sector) which show no substantial increases – in fact, it increased by an average 0.9% year-to-date (ytd) for businesses and dropped by 2.1% ytd for individuals. The uptick in lending to the public sector (government related entities) and government have been discussed previously here and here, but the non-bank financial institutions (which include private equity & venture capital firms, other investment firms, alternative asset managers, insurance firms and others) has also witnessed a 11.8% rise in credit ytd. There is not much visibility of the activities of NBFIs in the UAE (in terms of publicly available data), and it is not clear if the SME customer segment, important for recovery, was catered to (via consumer finance, SME financing & credit card products, to name a few).

ral bank shed some light on the broader credit movements: the accompanying chart shows the monthly changes in gross domestic credit. The dotted lines are credit to businesses and individuals (the private sector) which show no substantial increases – in fact, it increased by an average 0.9% year-to-date (ytd) for businesses and dropped by 2.1% ytd for individuals. The uptick in lending to the public sector (government related entities) and government have been discussed previously here and here, but the non-bank financial institutions (which include private equity & venture capital firms, other investment firms, alternative asset managers, insurance firms and others) has also witnessed a 11.8% rise in credit ytd. There is not much visibility of the activities of NBFIs in the UAE (in terms of publicly available data), and it is not clear if the SME customer segment, important for recovery, was catered to (via consumer finance, SME financing & credit card products, to name a few).

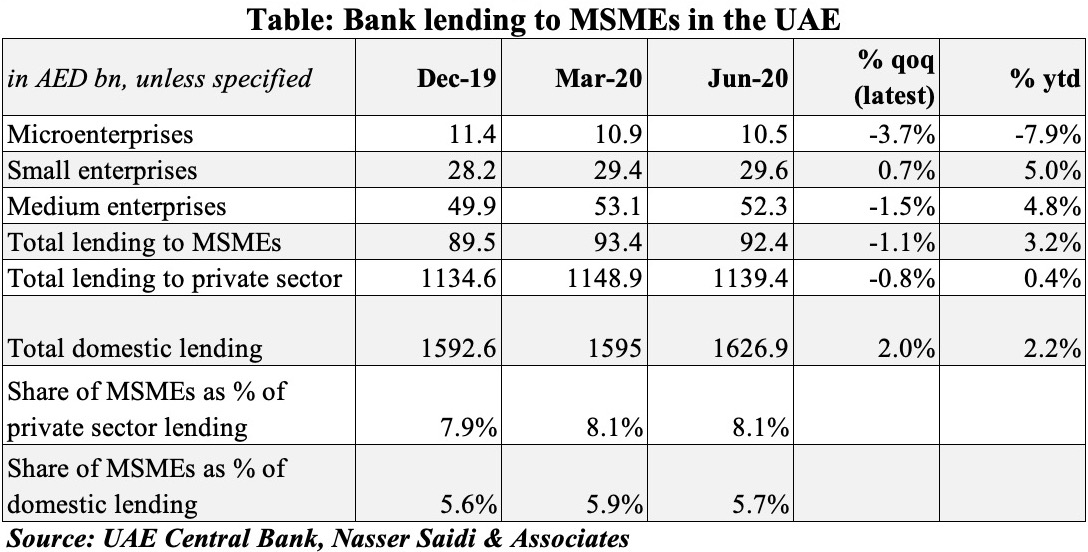

However, at the risk of sounding like a broken record, the question is whether the package has achieved its goal of supporting the economy or whether it resulted in a crowding out of the private sector (businesses and individuals) in favour of the government, public sector & also the financial institutions? The UAE central bank’s latest quarterly report does mention that MSMEs (Micro, Small and Medium Enterprises) benefitted from the economic package – highlighting the 10.4% yoy increase in lending in Q2 this year. But, at the end of the day, share of SME lending in total domestic lending was at 5.7% in Q2 (Q2 2019: 5.6%), lower than 5.9% share as of end-Q1.

Additional data is beneficial: the tables below provide more details of bank lending to the MSMEs, segregated by micro, small and medium enterprises[1]. Within the MSME segment, as of end-Q2, the largest share of loans was disbursed to medium-sized firms (56.6%) and close to 1/3-rd to the small enterprises.

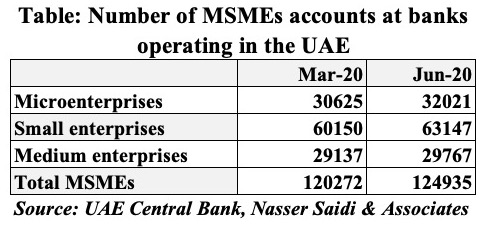

The number of MSMEs in the UAE have increased by 3.9% qoq to 124,935 as of end-Jun – not surprising given the central bank’s mandate of reduced duration for opening new SME accounts (all banks need to open accounts for SME customers within a maximum timeframe of two days, provided documentation and AML/CTF obligations are met). The number of accounts in the micro- and small segments increased by 4.6% and 5% qoq in Q2. Nevertheless, if we consider the amount disbursed per firm, medium enterprises pocketed AED 1.76mn in Q2: this is 3.7 times the amount disbursed per small firm and more than 5.3 times the amount disbursed to microenterprises.

The results are quite eye-opening, but not surprising (unfortunately): the GREs have benefitted in terms of the pace of overall domestic lending during the Covid19 period (remember that many of these firms are part of the sectors most affected by the pandemic!) and while lending to the SMEs has been dismal, within the SMEs, the medium-sized firms have benefitted the most. Considering how significant SMEs are to the UAE[2], it is imperative that financial institutions support them to bring the economy back on track. Some of the policies rolled out by the central bank had a 6-month deadline, and since no announcements have been made (yet) regarding extensions, anecdotal evidence points to banks winding down loan repayment deferrals and similar policies (for businesses/ individuals).

With the economy not yet back on the pre-Covid19 track, and the central bank’s own call of a 4.5% decline in non-oil GDP this year, targeted policy stimulus measures need to continue. With rising indebtedness of both individuals (due to job losses or pay cuts) and businesses (directly and indirectly affected by Covid19), there are likely to be spillovers into the financial sector via rising non-performing loans.

Furthermore, as companies wind down operations in the near- to medium-term, nascent insolvency and bankruptcy frameworks in the UAE are likely to be tested. According to the World Bank Doing Business 2020 report’s resolving insolvency sub-category, the UAE’s recovery rate was 27.7 cents on the dollar (vs OECD high income nation’s average of 70.2 and MENA average of 27.3), at a cost of 20% of the estate (vs 9.3 in OECD and 14% in MENA), taking 3.2 years to resolve (vs OECD’s 1.7 and MENA’s 2.7)[3]. However, the strength of the insolvency framework – given recent but untested legislation – stood at an impressive 11 (out of a total score of 16; compares to the OECD average of 11.9 and higher than MENA’s 6.3).

Support of the private sector is critical for economic recovery

To provide adequate ongoing backing to the private sector (including the SMEs) is essential. What policy measures need to be in place? (a non-exhaustive list)

- Banking sector continues to support the private sector via reduced bank charges and fees, reduction in minimum balance requirements, zero-interest instalment plans etc.; of course, banks’ compliance/regulatory departments need to ensure that firms they lend to follow practices of good financial reporting and governance.

- Limited funding to SMEs from the banking sector is likely to continue, given the current status of opaque information/ reporting/ data. Lack of collateral and issues of transparency are oft-cited constraints to SME lending in the region. The recently announced credit guarantees for loans to SMEs is likely to provide support and if successful, could be continued at a nominal rate. Open lines of communication with the credit bureaus can help manage credit risks and ease SME’s access to credit. Two ways to resolve the issue of collateral: 1. Expand the nature of acceptable collateral to both movables and immovables; 2. Establish transparent, blockchain-based collateral registries/ platforms. Furthermore, an SME rating agency (like in India) could provide additional information to lenders. Resolving this constraint alone could kickstart a new wave of entrepreneurship in the country.

- Backing from the government can come via a simple move like reducing the cost of doing business (various free zones have reduced fees and related charges for a short period) or ensuring no payment delays or boosting specific sectors (Abu Dhabi’s recent announcement to develop AgriTech) or through a wider mandate by instructing the various sovereign wealth funds to invest in local companies, through a dedicated fund, based on best practices.

- Leapfrog on the massive changes Covid19 has brought about in the adoption of technology: varied e-commerce offerings, such as helping SMEs establish interactive websites, to creating innovative payment systems to neo-banking options. Alongside embracing the technology and greater digitalisation, it is necessary to also invest in and create the right ecosystem (bringing together the necessary skillset, retraining existing employees, reducing set-up and ongoing/ recurring business costs etc.).

[1] The UAE central bank expanded the definition of SMEs so that a larger segment will be in a position to qualify for SME lending.

[2] According to Ministry of Economy, the SME sector represents more than 94% of total firms operating in the UAE, accounting for more than 86% of the private sector’s workforce. In Dubai alone, SMEs make up nearly 95% of all companies, employing 42% of the workforce and contributing ~40% to Dubai’s GDP.

[3] https://www.doingbusiness.org/content/dam/doingBusiness/country/u/united-arab-emirates/ARE.pdf