The GCC must take leadership at a time of global fragmentation and successfully lead the MENA region into becoming an inter-linked trade and investment hub. This, while unfolding the GCC strategy of pursuing globalization as a regional group through new trade and investment agreements, foreign aid, and direct and portfolio investment. We envisage two complementary ways to move forward, away from political differences & correcting failures of past implementation: one, implement the GCC Common Market & two, GCC should develop new deep trade agreements – both much more extensive in scope than just trade & investment.

Our article titled “A Mercantile Middle East” was published in the IMF’s Finance and Development’s Sep 2023 issue.

A Mercantile Middle East

By Nasser Saidi and Aathira Prasad

The world has witnessed a tectonic shift in global economic geography and trade toward emerging Asia in the past two decades. However, the Middle East and North Africa (MENA) region has remained one of the least dominant, accounting for just 7.4 percent of total trade in 2022. The region’s trade is characterized by a relatively high concentration of exports in a narrow range of products or trading partners, limited economic complexity, and low participation in global value chains.

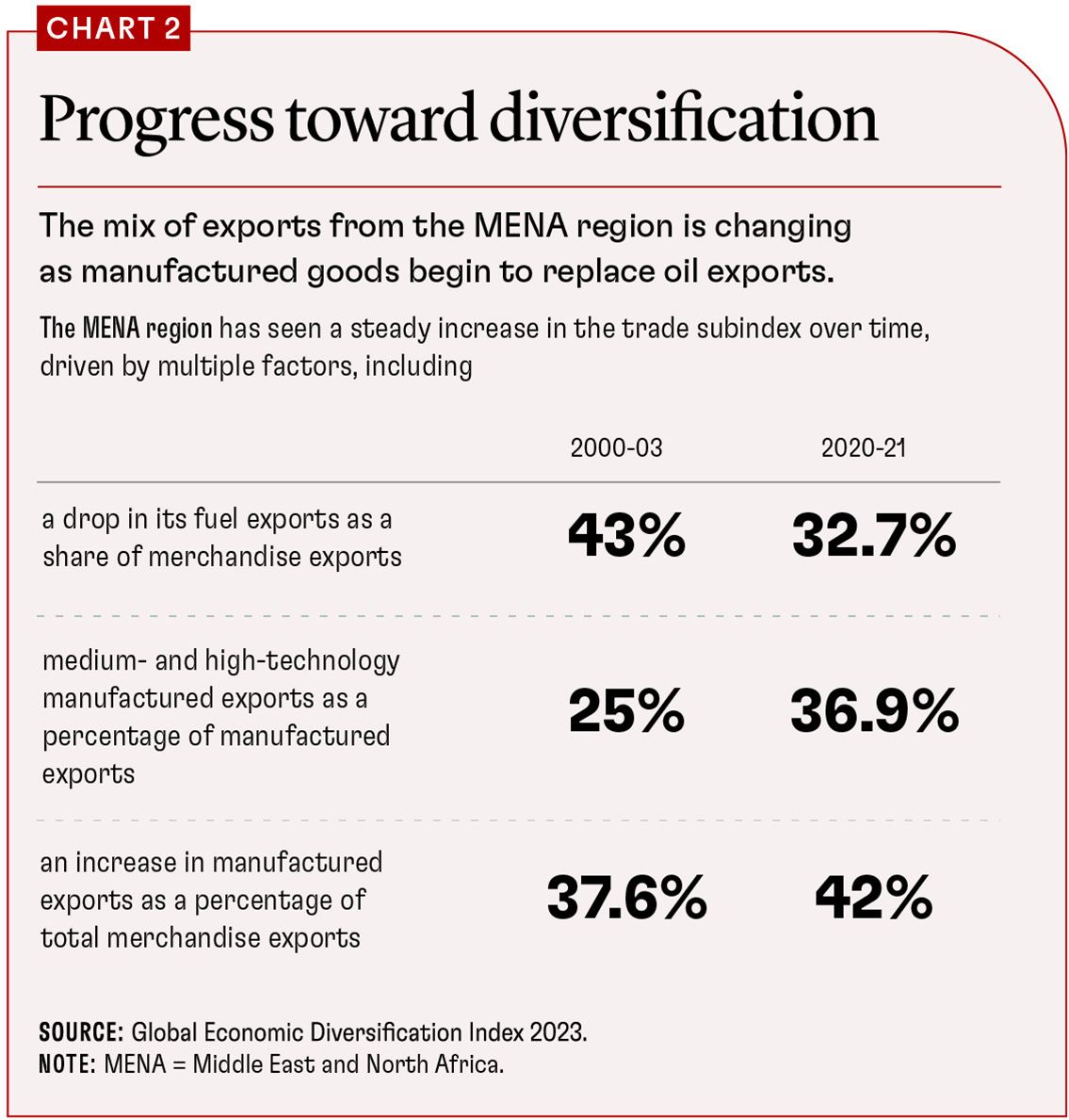

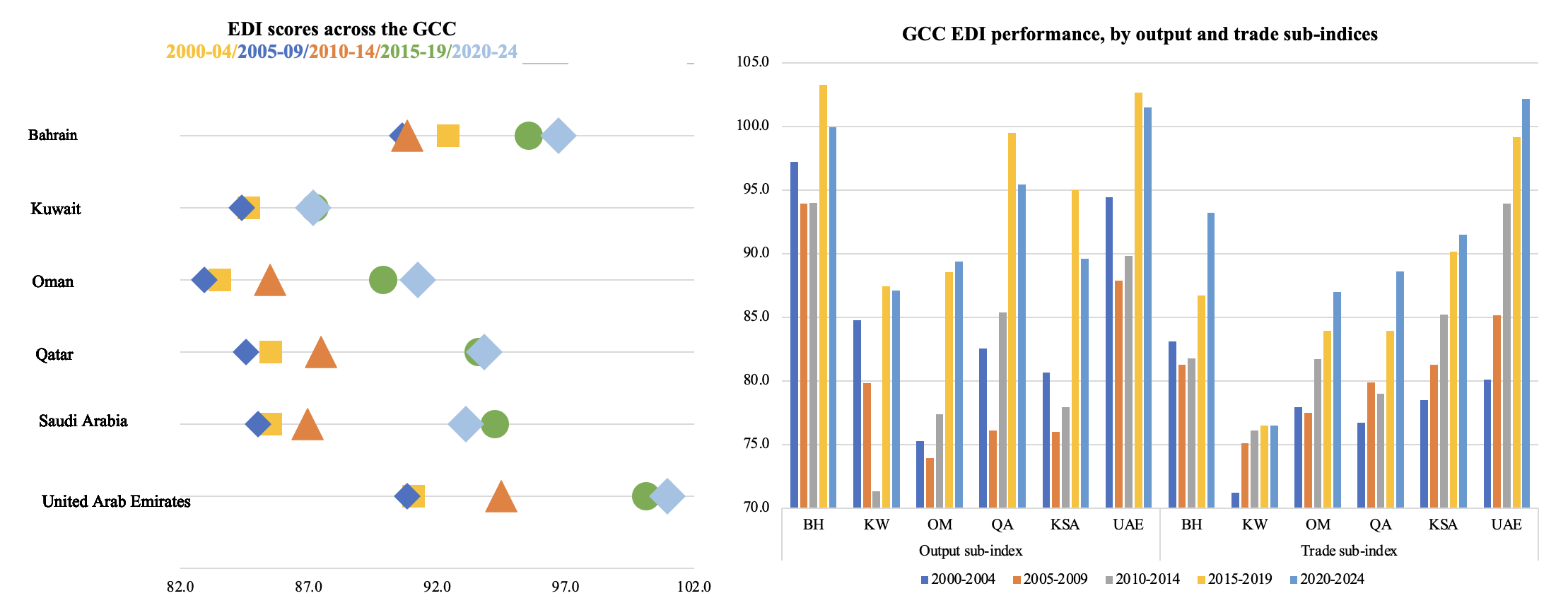

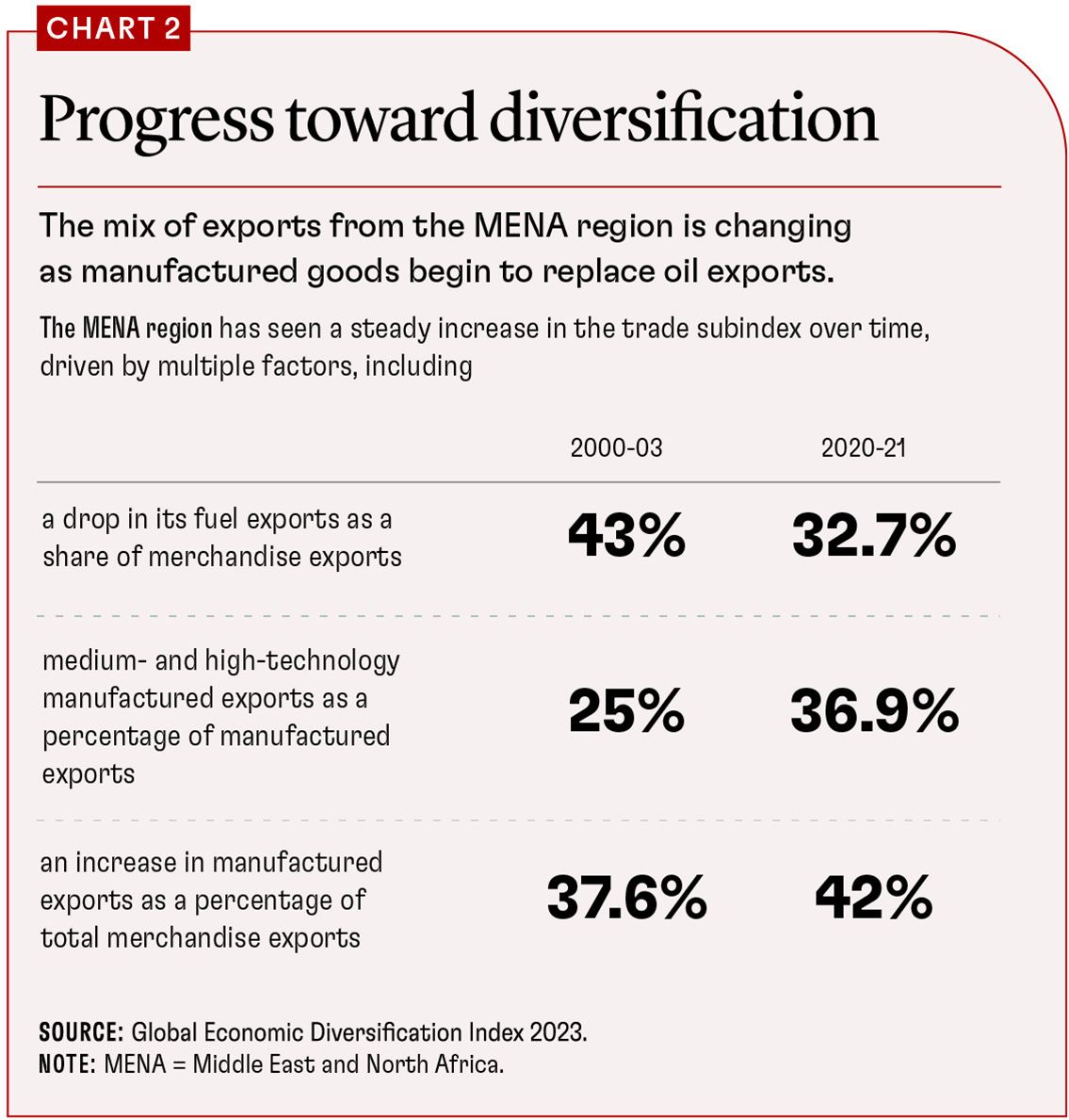

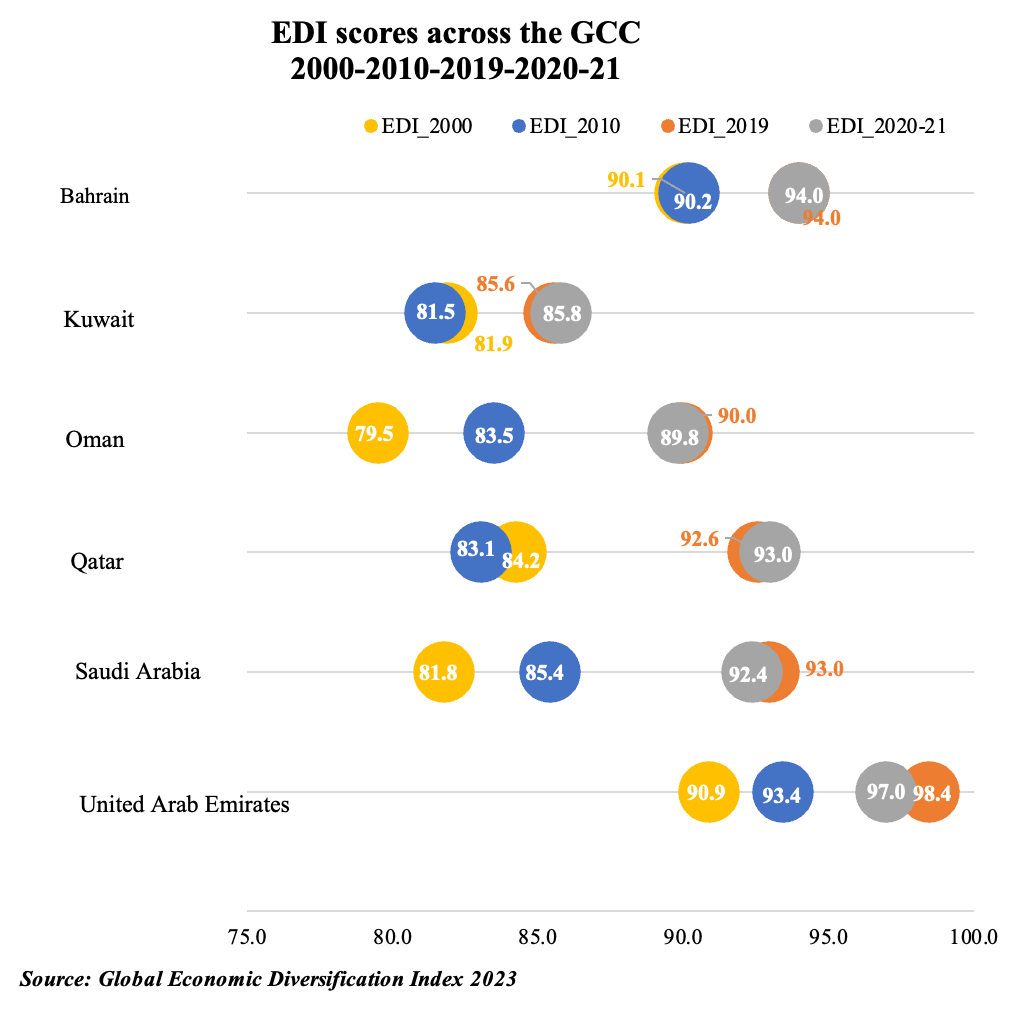

Even so, commodity-dependent nations in the MENA region have made substantial gains over time, specifically in trade diversification, as shown by the Global Economic Diversification Index, which tracks the extent of economic diversification from multiple dimensions, including economic activity, international trade, and government revenues.

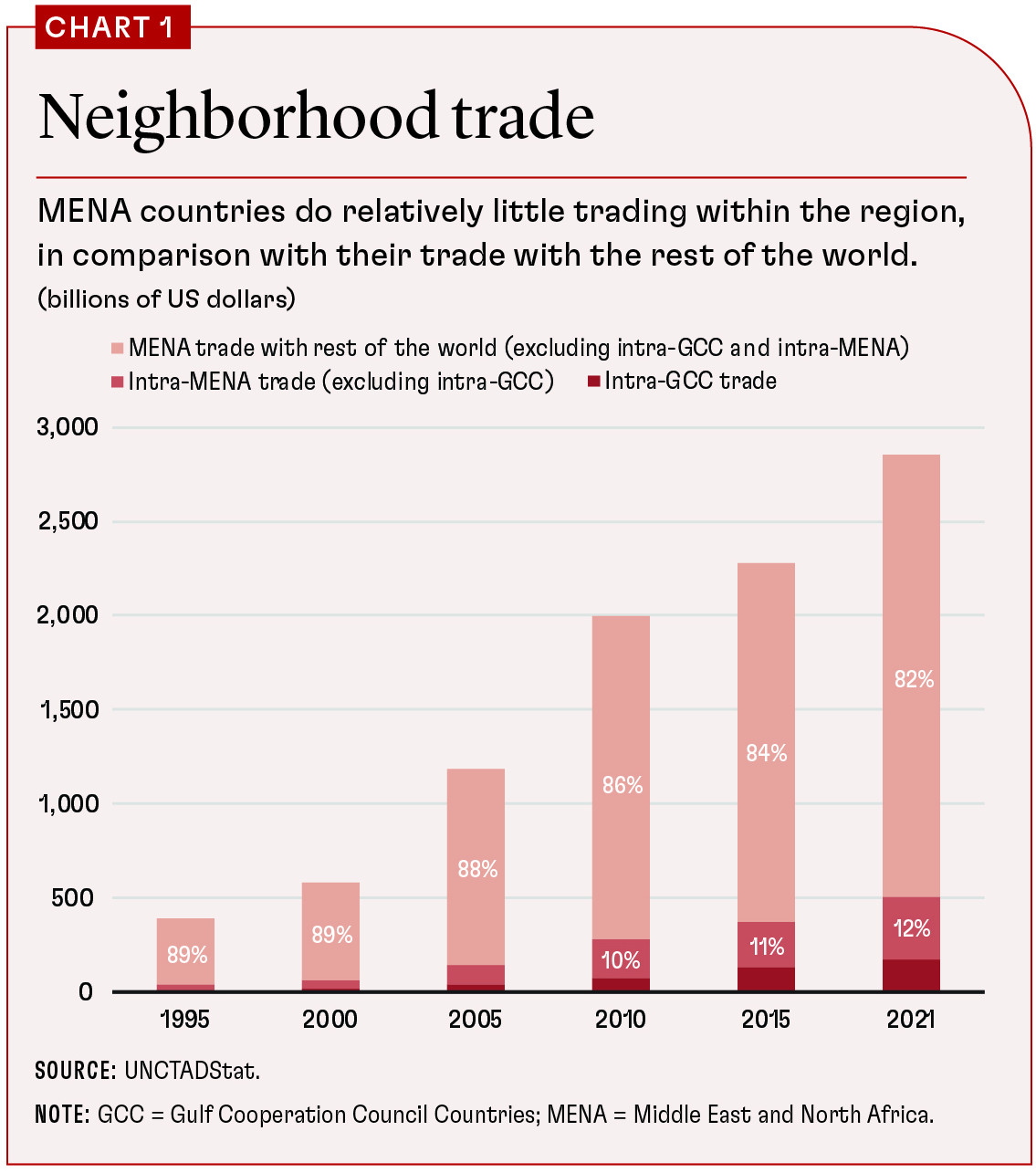

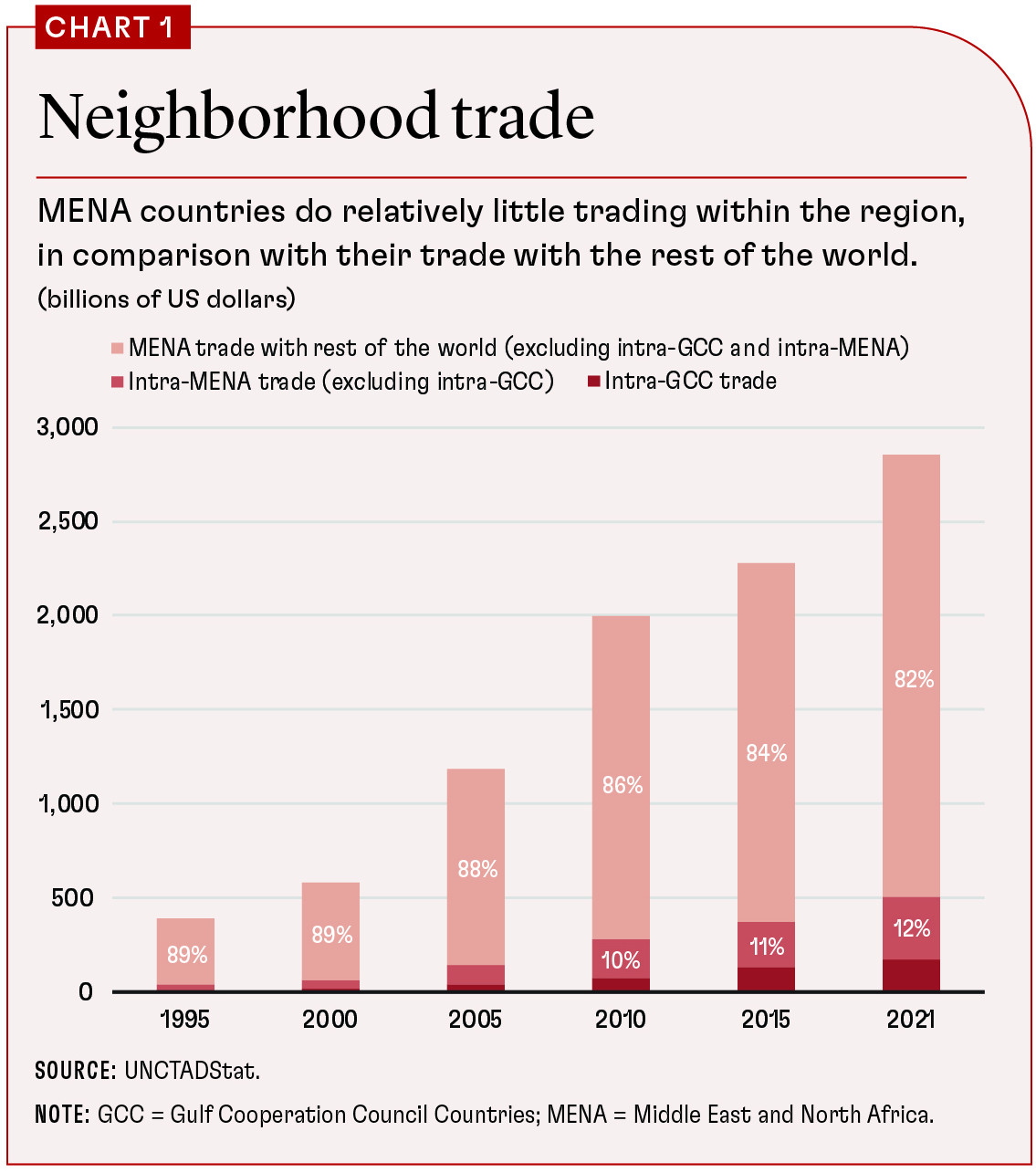

The MENA region’s total trade in goods as a percent of GDP (an indicator of openness) was 65.5 percent in 2021, indicating a relatively open regional economy. Yet, as shown in Chart 1, intraregional trade is low, representing only 17.8 percent of total trade and 18.5 percent of total exports, despite a common language and culture as well as geographic proximity. The six oil-exporting Gulf Cooperation Council (GCC) nations—Saudi Arabia, Bahrain, Oman, Qatar, Kuwait, and the United Arab Emirates—account for the bulk of intraregional trade.

Their dominance of intraregional trade suggests that the Gulf nations could become a catalyst for regional trade integration, helping lower barriers to trade, improving trade infrastructure, and diversifying the region’s economies.Greater integration of non-GCC Middle East nations with the GCC will lead to more intraregional trade and greater global integration (via the GCC’s existing global linkages and participation in global value chains). With the growing global economic integration of the GCC nations and their concerted effort in supporting the region’s other nations (via increased trade and investment deals with Egypt and Iraq, for example), they can be a conduit for greater integration of the rest of the region into world trade.

Region’s laggards

Why have non-GCC countries lagged when it comes to intraregional trade? In part it is a failure of the MENA region’s multiple regional trade (and investment) agreements. The share of intragroup exports in the Arab region, excluding the GCC, has remained below 2 percent of their trade flows, partially a reflection of regional fragmentation, violence, and wars since the mid-1990s and following the Arab Spring in 2011. The region comprises a group of nations characterized by significant political differences, and this is reflected in trade patterns as well. For example, the orientation of the Maghreb nations of North Africa has been toward Europe, with the regional Euro-Med program and agreements supporting such linkages.

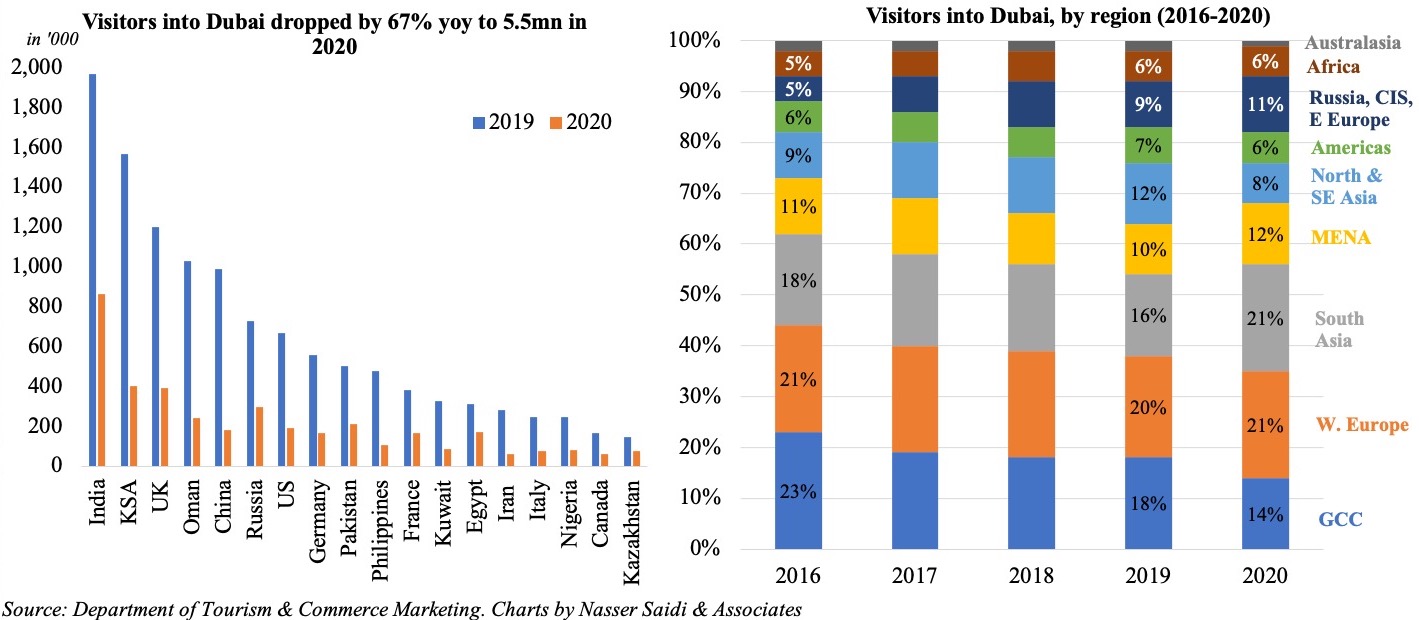

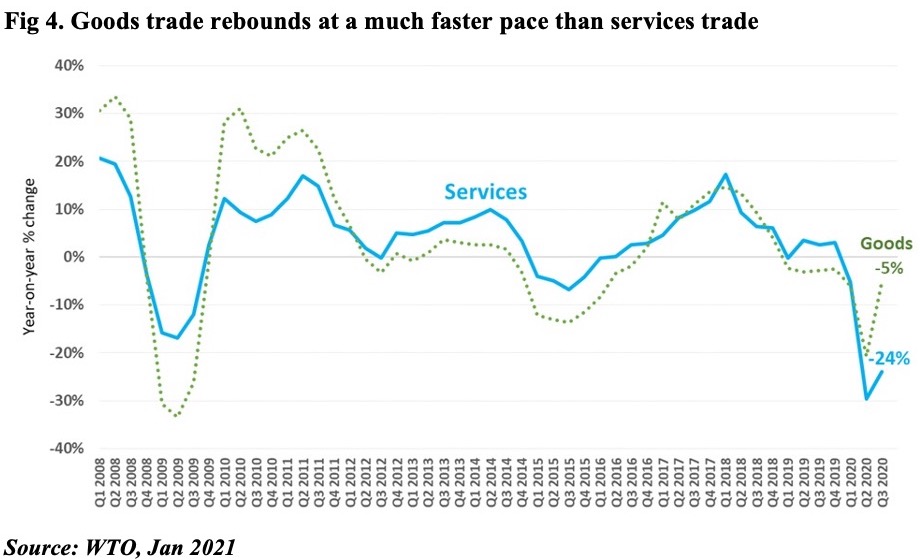

A contributing factor to the stagnation of intraregional trade is the lack of growth of trade in services. MENA services trade has ranged between 4 and 6 percent of global services trade in the past two decades. This pales in comparison with the Organisation for Economic Co-operation and Development countries, which account for more than two-thirds of global services trade. Within the MENA region, the GCC accounts for the bulk of services trade, with the largest shares in relatively low-value-added sectors like travel (and tourism) and transportation. The services trade is held back by restrictive policies that limit entry in sectors dominated by state-owned enterprises, such as telecommunications, or that impose high fees and license requirements, especially in professional and transportation services.

Such restrictive policies, along with structural deficiencies, encumber MENA nations’ trade both within the region and globally.

MENA nations apply more, and more restrictive, nontariff measures than in any other region. These almost doubled between 2000 and 2020. Lack of uniform standards and harmonization, pervasive red tape, and corruption compound the effects of these barriers. Business and investment barriers include cumbersome licensing processes, complex regulations, and opaque bidding and procurement procedures.

MENA as a region underperforms on trade facilitation measures to ease the movement of goods at the border and reduce overall trade costs, though there are wide disparities across the region. The quality of trade- and transportation-related infrastructure is significantly lower in the non-GCC MENA nations. Furthermore, delays at the port result in excessive “dwell times” (delays of more than 12 days) for imported goods in some MENA countries. Algeria and Tunisia delays average about 20 days versus less than five days in the United Arab Emirates (among the top three globally).

Knocking down barriers

Overcoming these impediments to wider trade for the region requires removing barriers to trade and investment, diversifying the region’s economies, and improving infrastructure.

A new generation of trade agreements, including more knowledge-intensive services, would not only support export diversification policies but would also help bridge gender gaps, improve women’s economic empowerment, and subsequently result in more inclusive economic growth and integration.

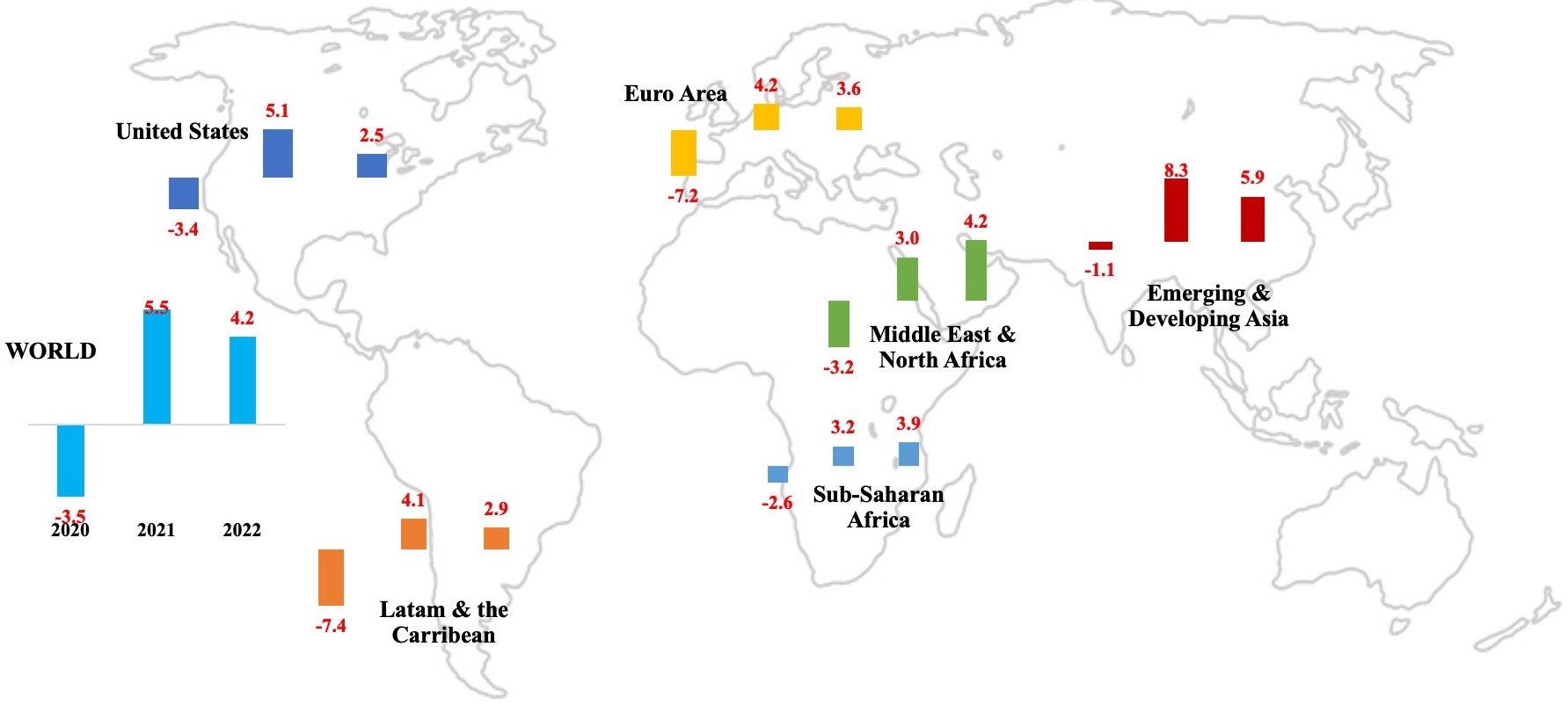

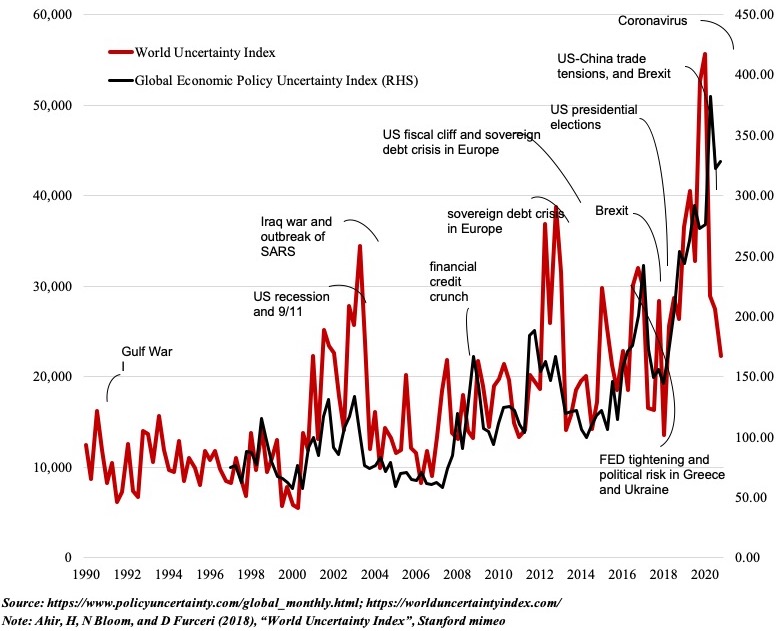

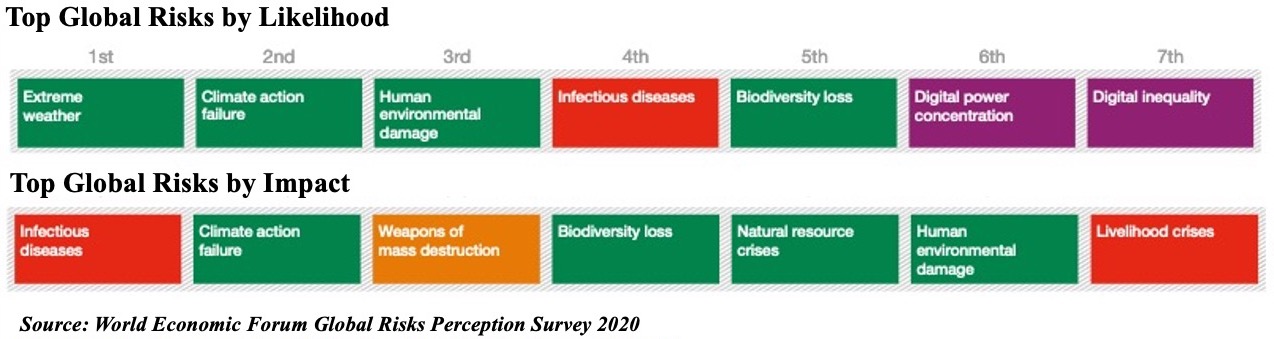

The pandemic has underscored the need for trade diversification (both of products and partners) and development of new supply chains. Although the GCC’s oil trade remains dominant, its members have embarked on various policies and structural reforms, such as increasing labor mobility and opening capital markets across borders, to diversify away from overdependence on fossil fuels and associated revenues. This has resulted in diversification of both the output mix (for example, increased focus on manufacturing) and the export product mix (for example, more services exports) alongside an evident shift in trade patterns toward Asia and away from the United States and Europe. More recently, the war in Ukraine further highlighted the plight of food-importing nations in the Middle East in the context of food security. (Ukraine and Russia accounted for a third of global wheat exports; Lebanon and Tunisia were importing close to 50 percent of their wheat from Ukraine.)

The Global Economic Diversification Index trade subindex shows that the commodity-dependent nations with the most improved scores over time have either reduced dependence on fuel exports, reduced export concentration, or witnessed a massive change in the composition of exports. An example of the latter is Saudi Arabia’s increased focus on medium- and high-tech exports, which rose as a share of overall manufacturing exports, to almost 60 percent right before COVID from less than 20 percent in 2000. The MENA region as a whole has already made some headway toward diversification, as shown in Chart 2.

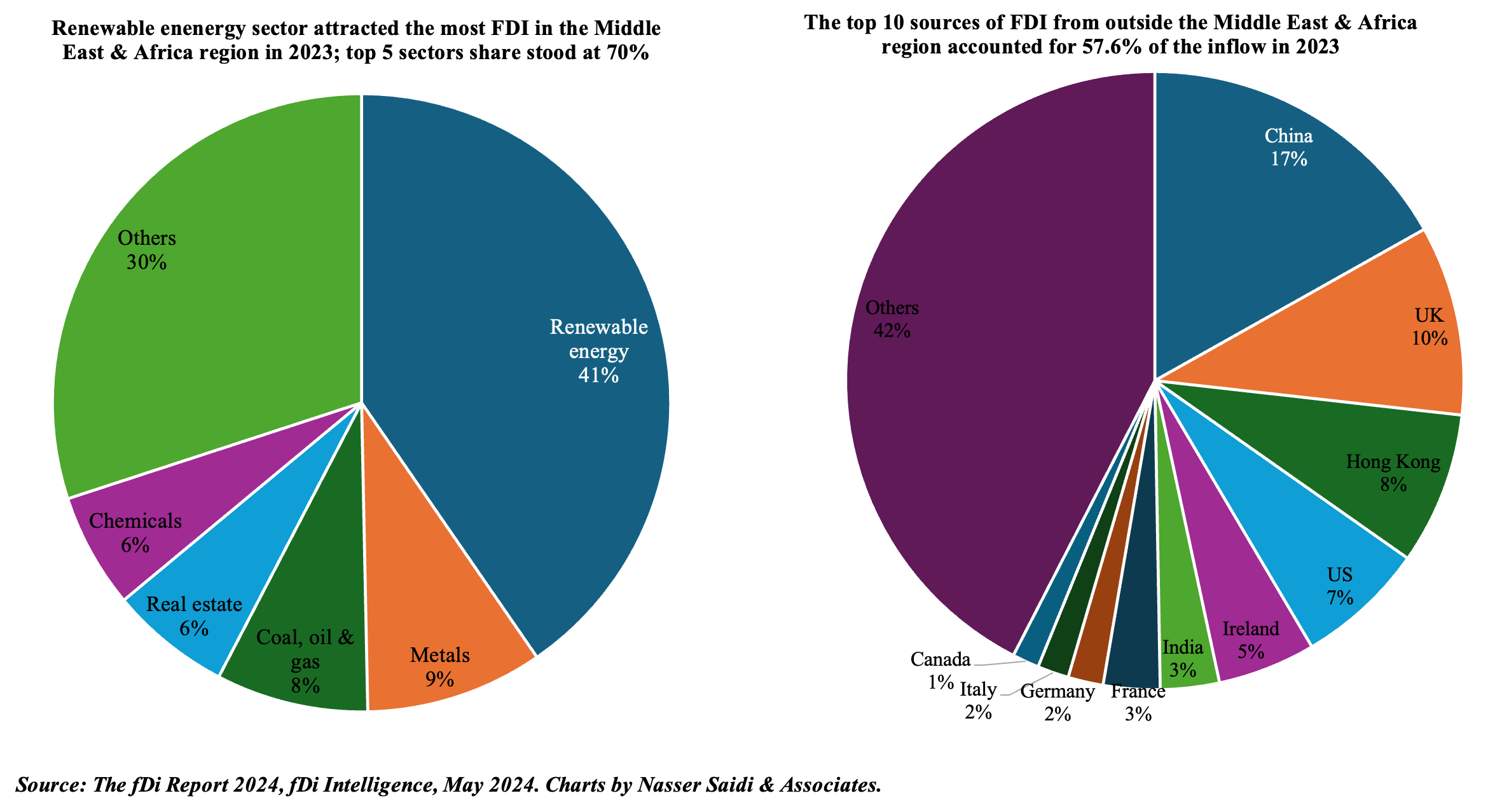

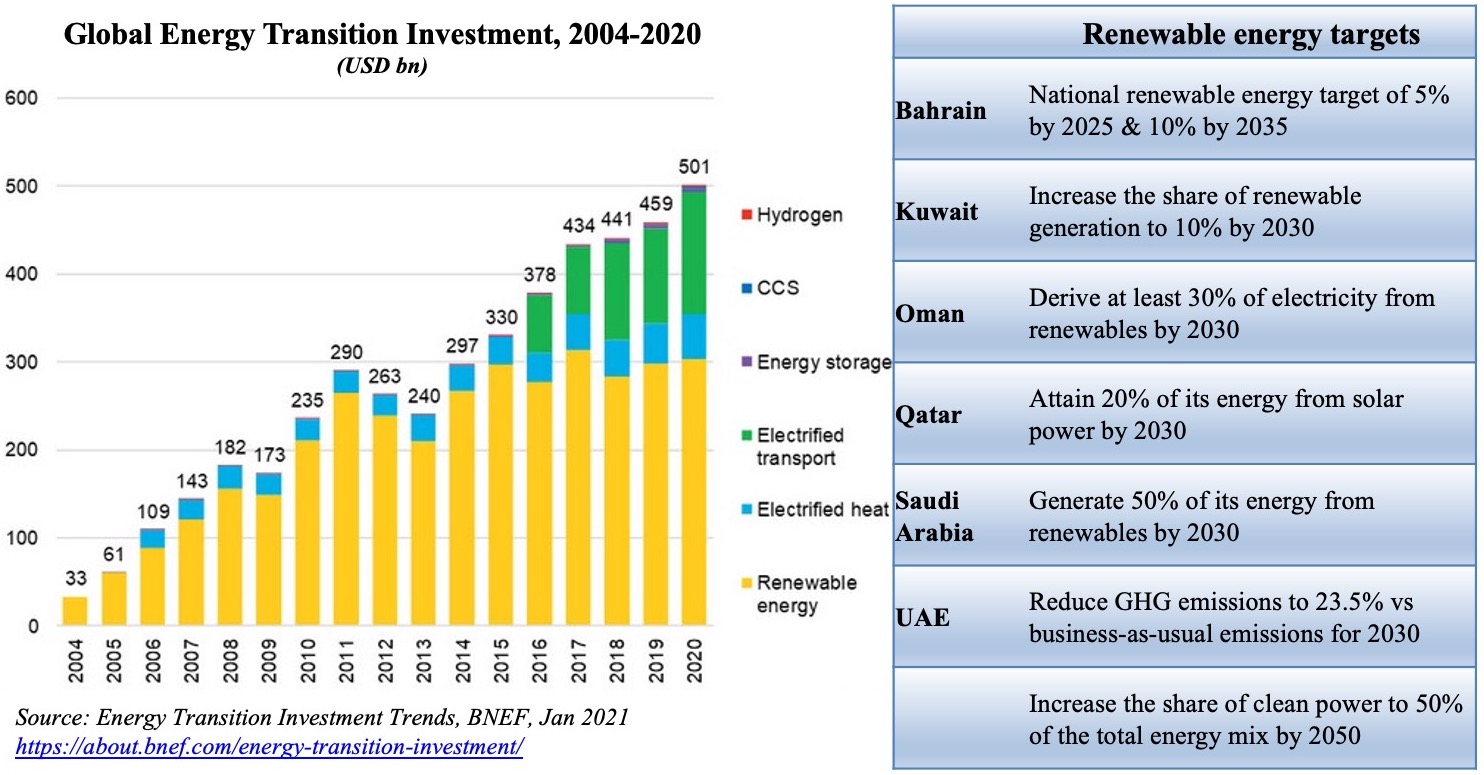

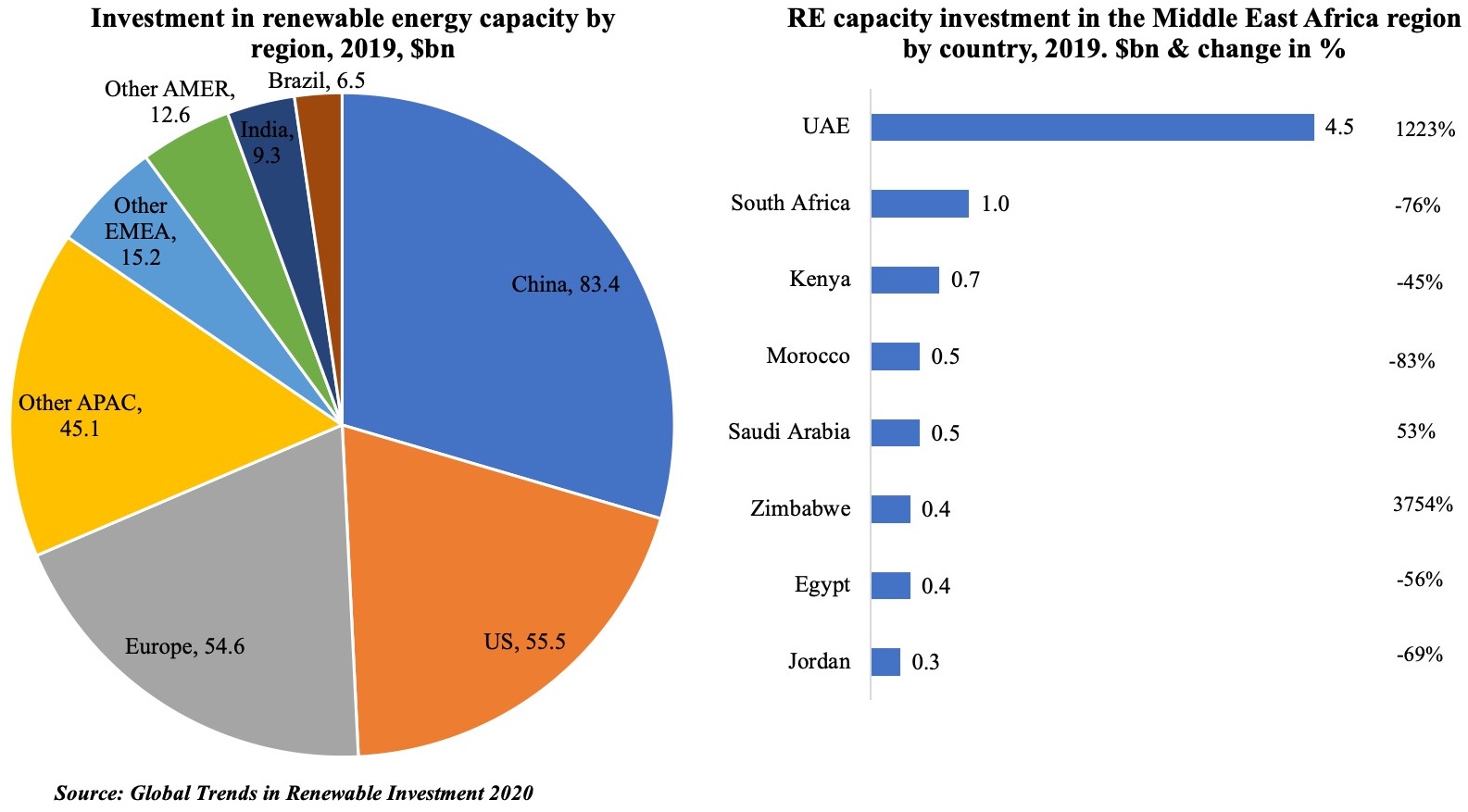

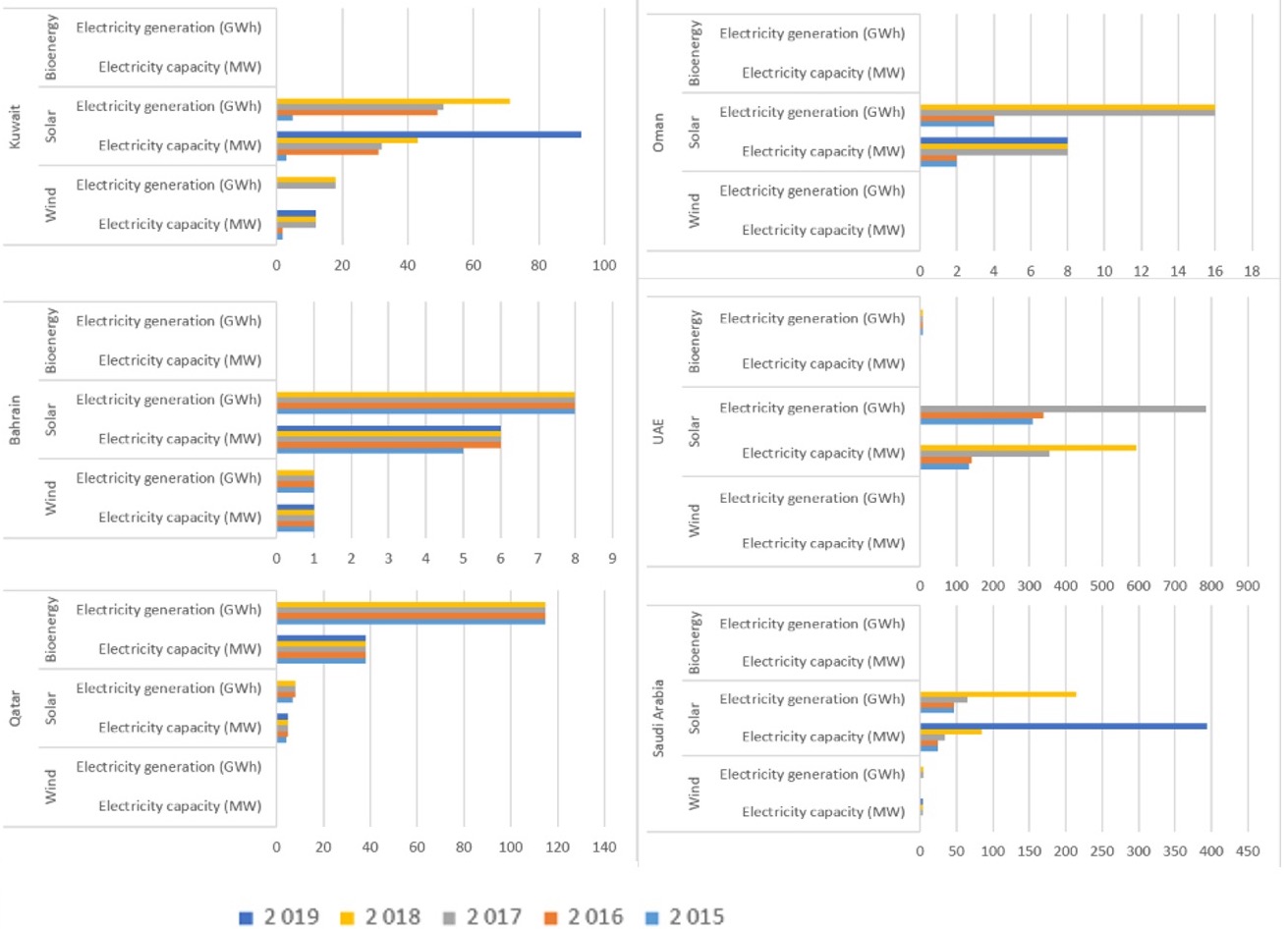

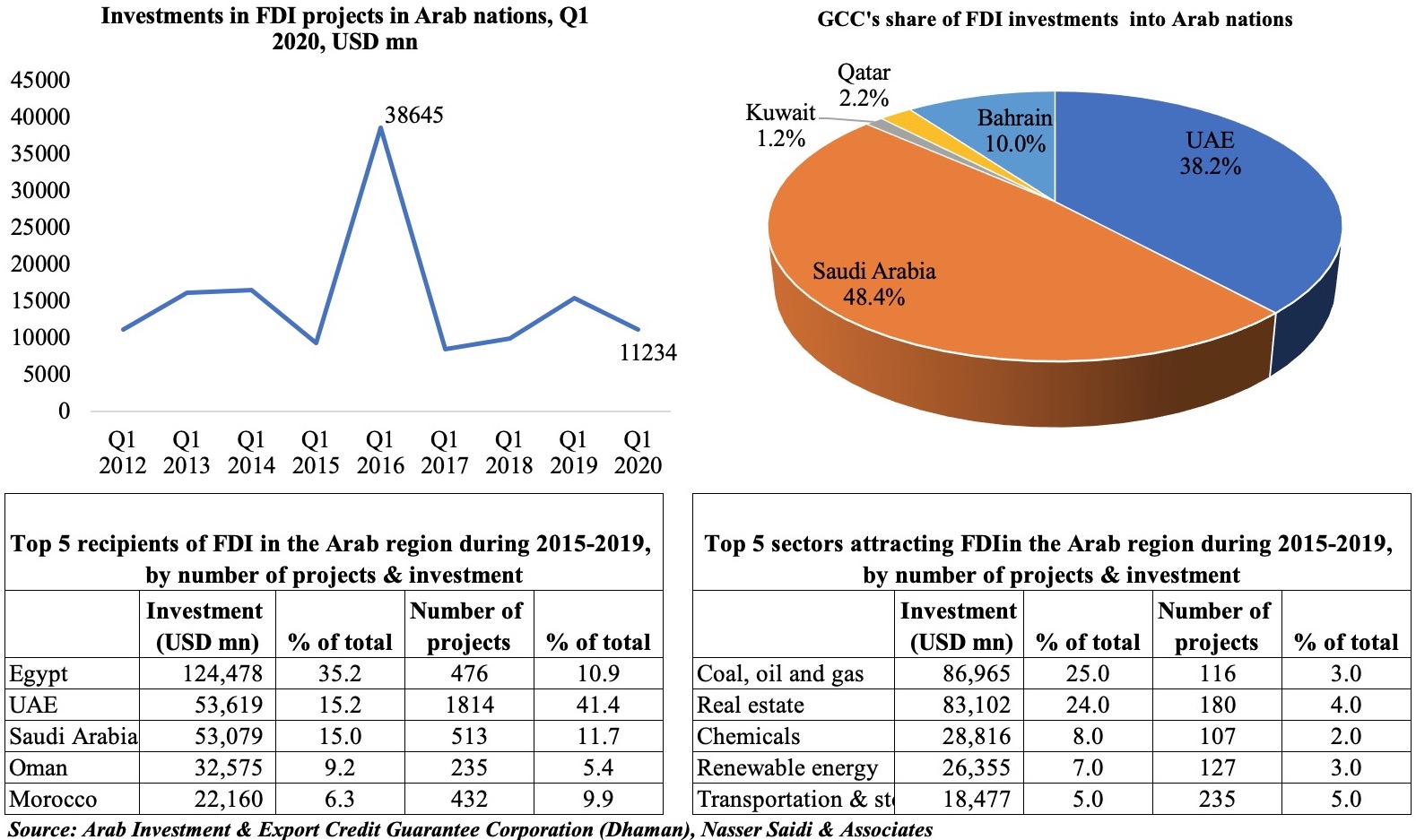

The GCC nations have benefited from the recent rise in commodity prices, but the pandemic reinforced strategies, including the development of free zones and special economic zones, to diversify into new sectors. These policies range from attracting investment (including foreign direct investment) to higher-value-added, higher-tech manufacturing; investing in new sectors (renewable energy, fintech, artificial intelligence); and opening markets to new investors and investments (as is evident in the recent spate of initial public offerings in both the oil and non-oil sectors). These reforms help expand markets (within the MENA region and toward Africa, Europe, and South Asia), while up-and-coming sectors like renewable energy and agritech offer sustainable ways of expanding the extensive and intensive margins of trade and generating new job opportunities.

Engine for regional integration

Full achievement of the benefits of regional trade integration requires a reform of trade policies to break down barriers, including restrictive nontariff measures, complex regulation, corruption, and logistical roadblocks.

Integrating the MENA region’s trade infrastructure (ports, airports, logistics) with that of the GCC would lower costs and facilitate intraregional trade, leading to greater regional integration and generating gains from trade for all parties. The GCC can lead the economic integration and transformation of the region via investments in hard infrastructure and trade-related infrastructure and logistics, in addition to developing an integrated GCC power grid. A GCC renewable-energy-powered, integrated electricity grid could extend all the way to Europe, Pakistan, and India.

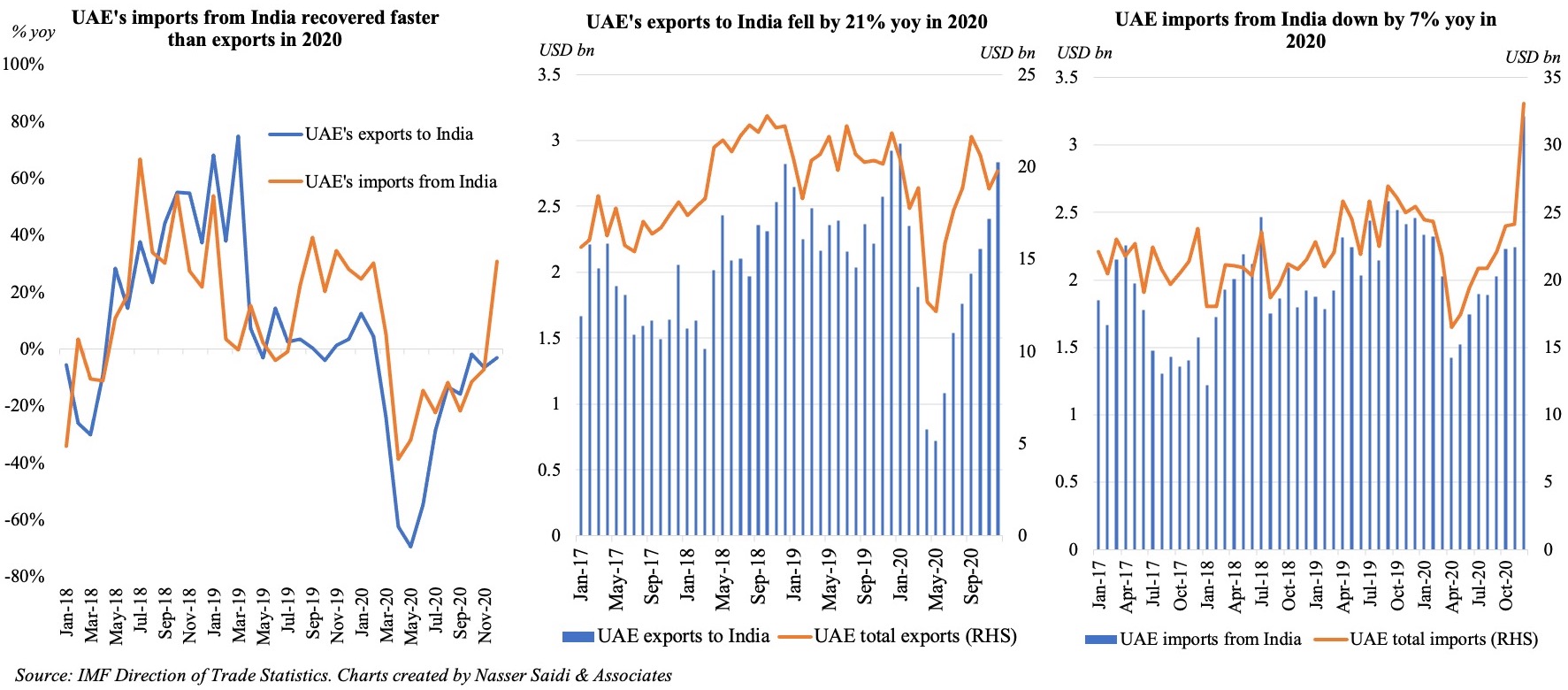

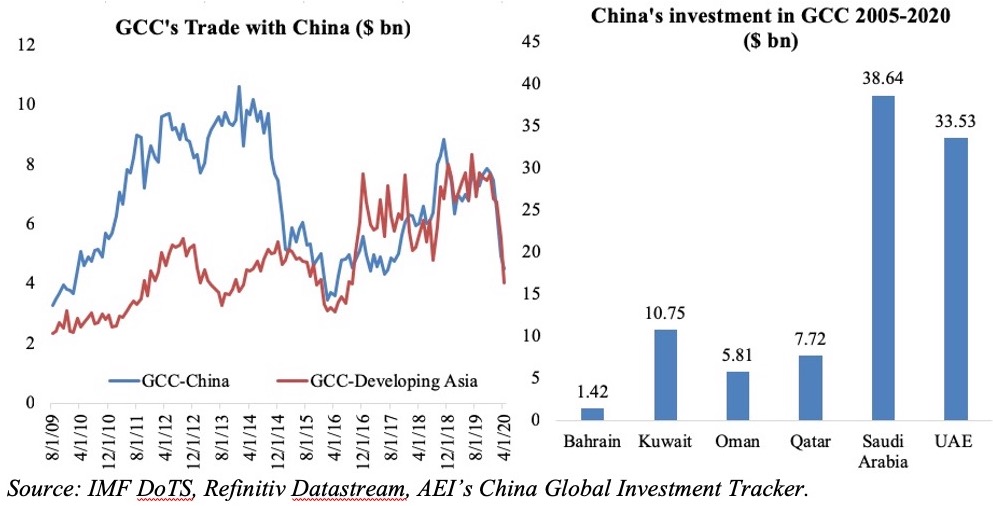

The GCC nations have an opportunity to benefit from global decoupling and fragmentation with their unfolding strategy of pursuing globalization as a regional group through new trade and investment agreements, foreign aid, and direct and portfolio investment. The ongoing disengagement from long-standing regional conflicts, in Israel, the West Bank and Gaza, Yemen, the Islamic Republic of Iran, Libya, and elsewhere, and the forging of new links (diplomatic opening such as the Abraham Accords) reduce the geopolitical risks of promoting regional trade and investment. The GCC can use this as an opportunity to shape the MENA region into an interlinked trade and investment hub. The GCC’s accelerated new free trade negotiations with key partners in the MENA region, including Egypt and Jordan, and in Asia, including China and South Korea, could become the cornerstone of this transformation. The United Arab Emirates have already signed comprehensive economic partnership agreements with India, Indonesia, and Türkiye covering services, investment, and regulatory aspects of trade.

There are two complementary ways to move forward. One is to implement the GCC Common Market, invest in digital trade, lower tariff and nontariff barriers, and reduce restrictions on trade in services, along with reforms to facilitate greater mobility of labor and enhance financial and capital market linkages. Second, the GCC should develop new deep trade agreements with the other MENA countries, going beyond international trade to encompass agreement on nontariff measures, direct investment, e-commerce and services, labor standards, taxation, competition, intellectual property rights, climate, the environment, and public procurement (including mega projects). The GCC nations, which have historically used foreign aid and humanitarian aid to support MENA nations, should opt for an “aid for trade” policy to support their partners in implementing trade-boosting reforms that lower business and investment barriers, improve logistics infrastructure, and facilitate the movement of goods.

The MENA region has lagged behind its regional peers with respect to diversification yet it has caught up relatively fast. This has been supported by diversification strategies introduced by many oil-producing nations in recent years, including the introduction of non-oil taxes (excise, customs and value added taxes to name a few), alongside various liberalisation measures ranging from rights to establishment to trade facilitation measures, and improvements to hard and soft infrastructure.For resource-dependent countries, economic diversification (activity, trade and government revenue) is a strategic imperative given their demographics and job creation requirements, as well as their need to achieve sustainable development and to mitigate the macroeconomic risks of volatile commodity prices and markets. The Global EDI aims to provide guidance for countries, policy makers and analysts to design successful diversification strategies and policies, turning resource rents into an engine of growth rather than a barrier to economic development and thereby avoiding the “resource curse”.

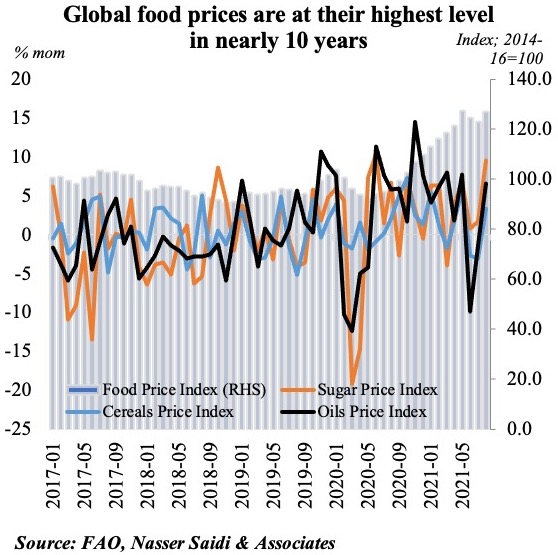

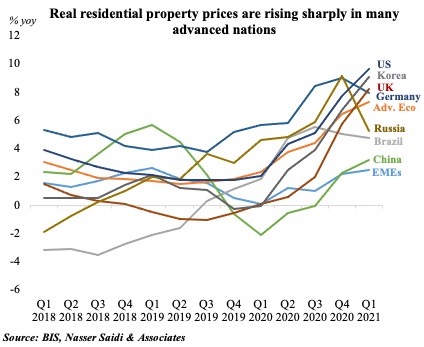

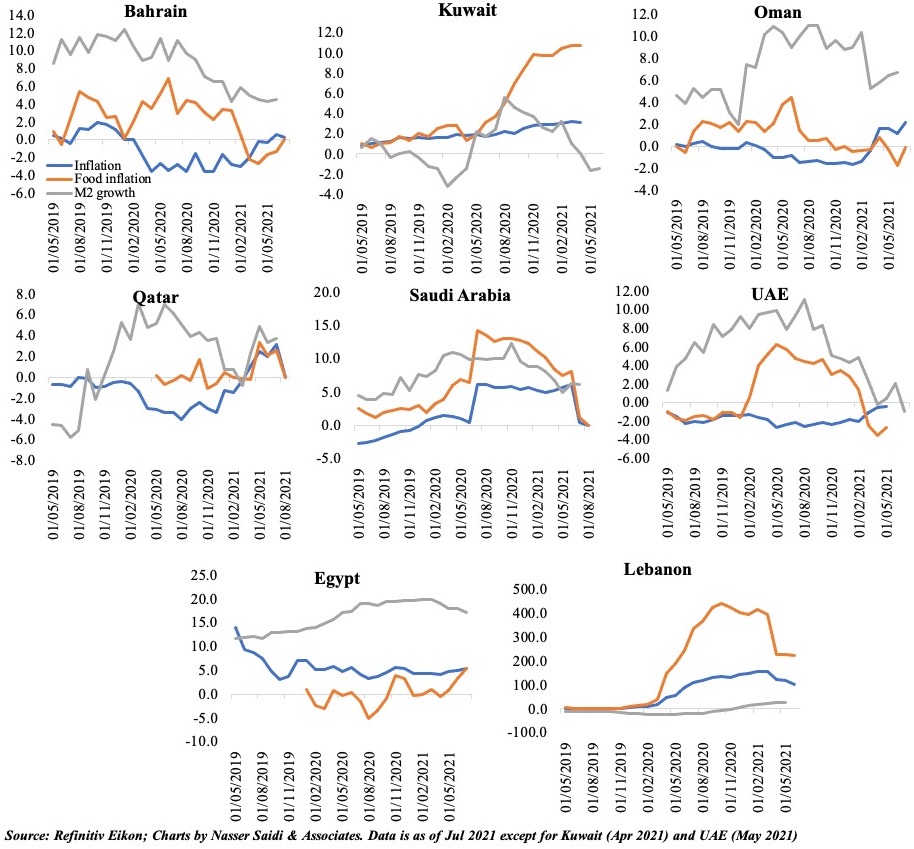

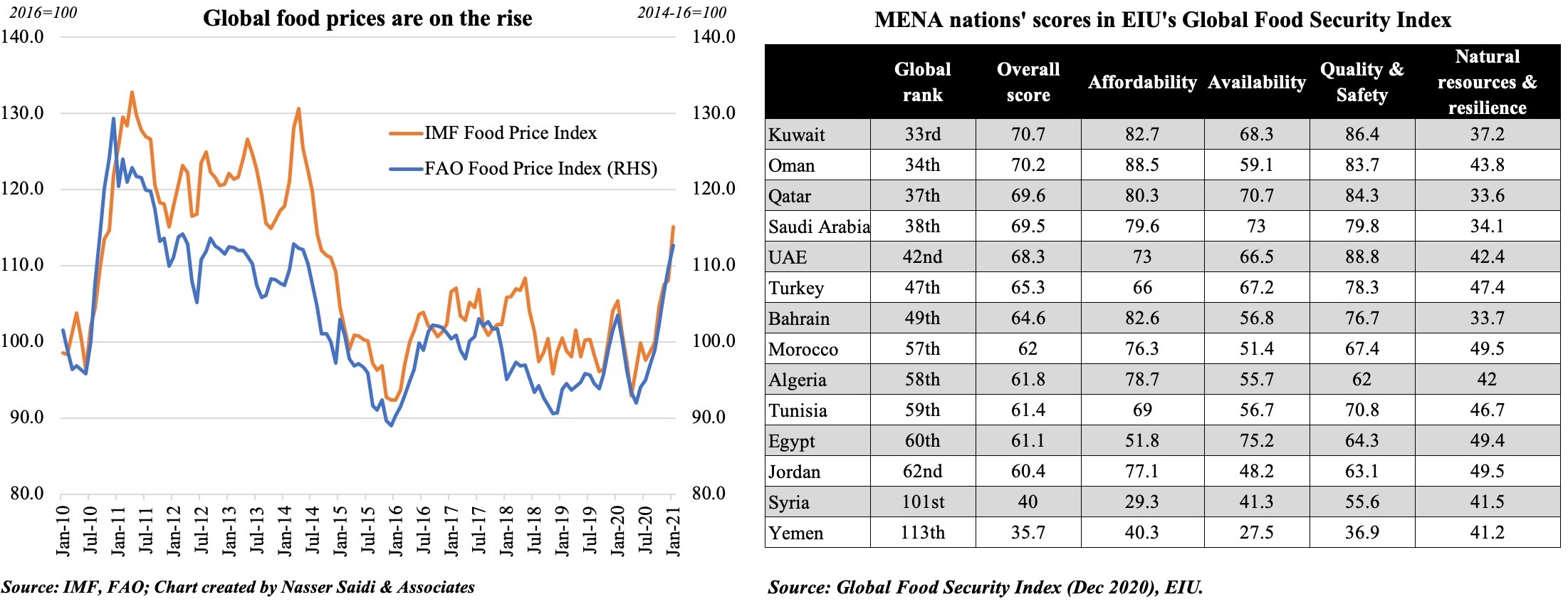

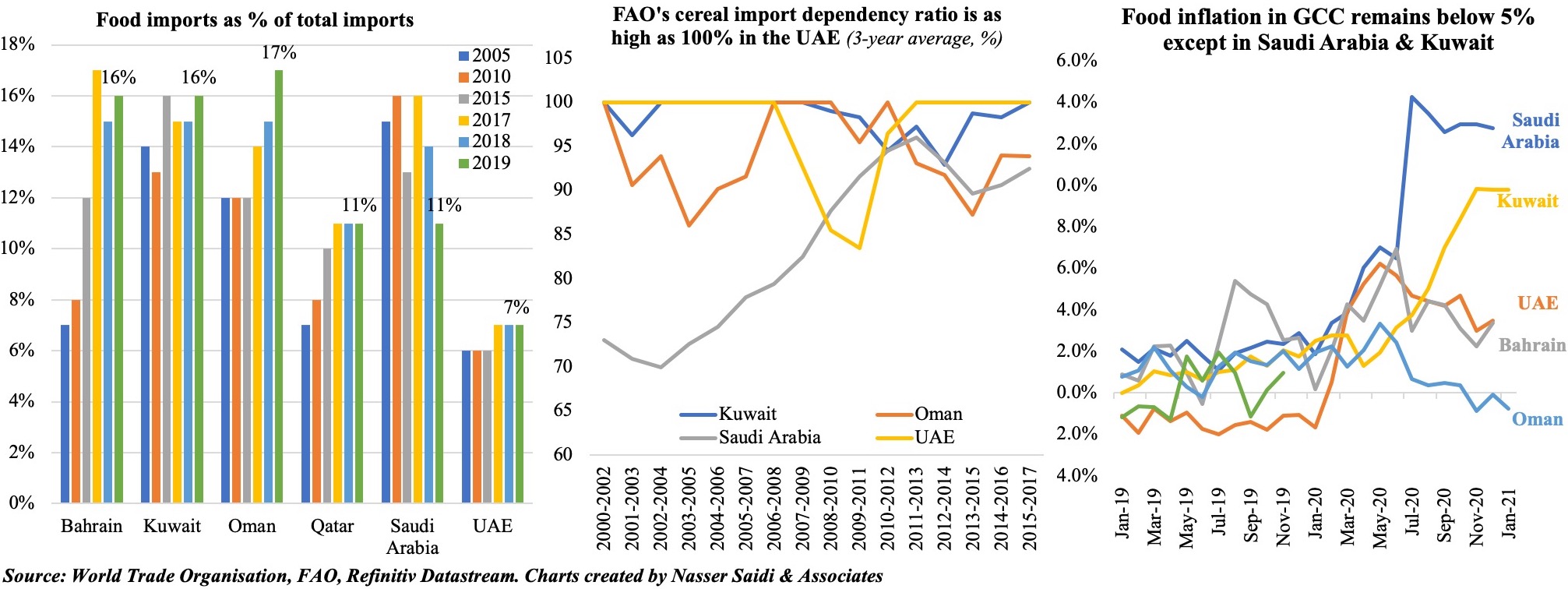

The MENA region has lagged behind its regional peers with respect to diversification yet it has caught up relatively fast. This has been supported by diversification strategies introduced by many oil-producing nations in recent years, including the introduction of non-oil taxes (excise, customs and value added taxes to name a few), alongside various liberalisation measures ranging from rights to establishment to trade facilitation measures, and improvements to hard and soft infrastructure.For resource-dependent countries, economic diversification (activity, trade and government revenue) is a strategic imperative given their demographics and job creation requirements, as well as their need to achieve sustainable development and to mitigate the macroeconomic risks of volatile commodity prices and markets. The Global EDI aims to provide guidance for countries, policy makers and analysts to design successful diversification strategies and policies, turning resource rents into an engine of growth rather than a barrier to economic development and thereby avoiding the “resource curse”. Both food and energy prices have been rising the past few months. The FAO food price index for Aug showed a 3.1% mom and 32.9% yoy increase, rebounding after 2 consecutive months of declines. Since prices had been subdued during the initial stages of the pandemic, the year-on-year surge can be associated with base effects, but the month-on-month prices have been creeping up as well. For countries highly dependent on food and other staple goods imports (especially the MENA region), the inflationary pressure will grow if this persists and also affect poorer countries disproportionately. It is worthwhile to remember that social unrest leading up to the Arab Spring a decade back came after months of rising food costs (food price inflation in Egypt had hit ~19%)!

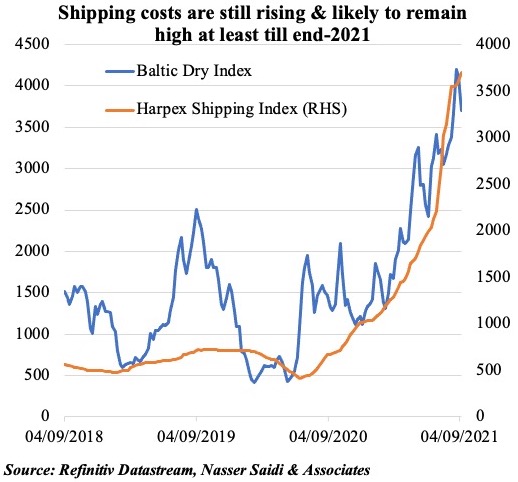

Both food and energy prices have been rising the past few months. The FAO food price index for Aug showed a 3.1% mom and 32.9% yoy increase, rebounding after 2 consecutive months of declines. Since prices had been subdued during the initial stages of the pandemic, the year-on-year surge can be associated with base effects, but the month-on-month prices have been creeping up as well. For countries highly dependent on food and other staple goods imports (especially the MENA region), the inflationary pressure will grow if this persists and also affect poorer countries disproportionately. It is worthwhile to remember that social unrest leading up to the Arab Spring a decade back came after months of rising food costs (food price inflation in Egypt had hit ~19%)!

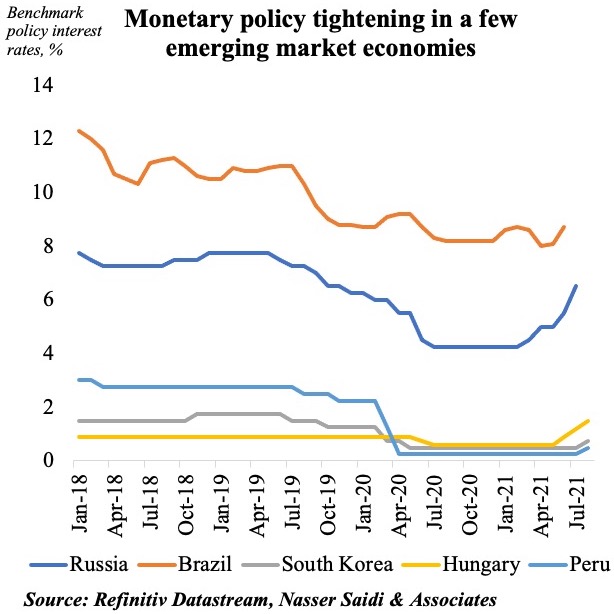

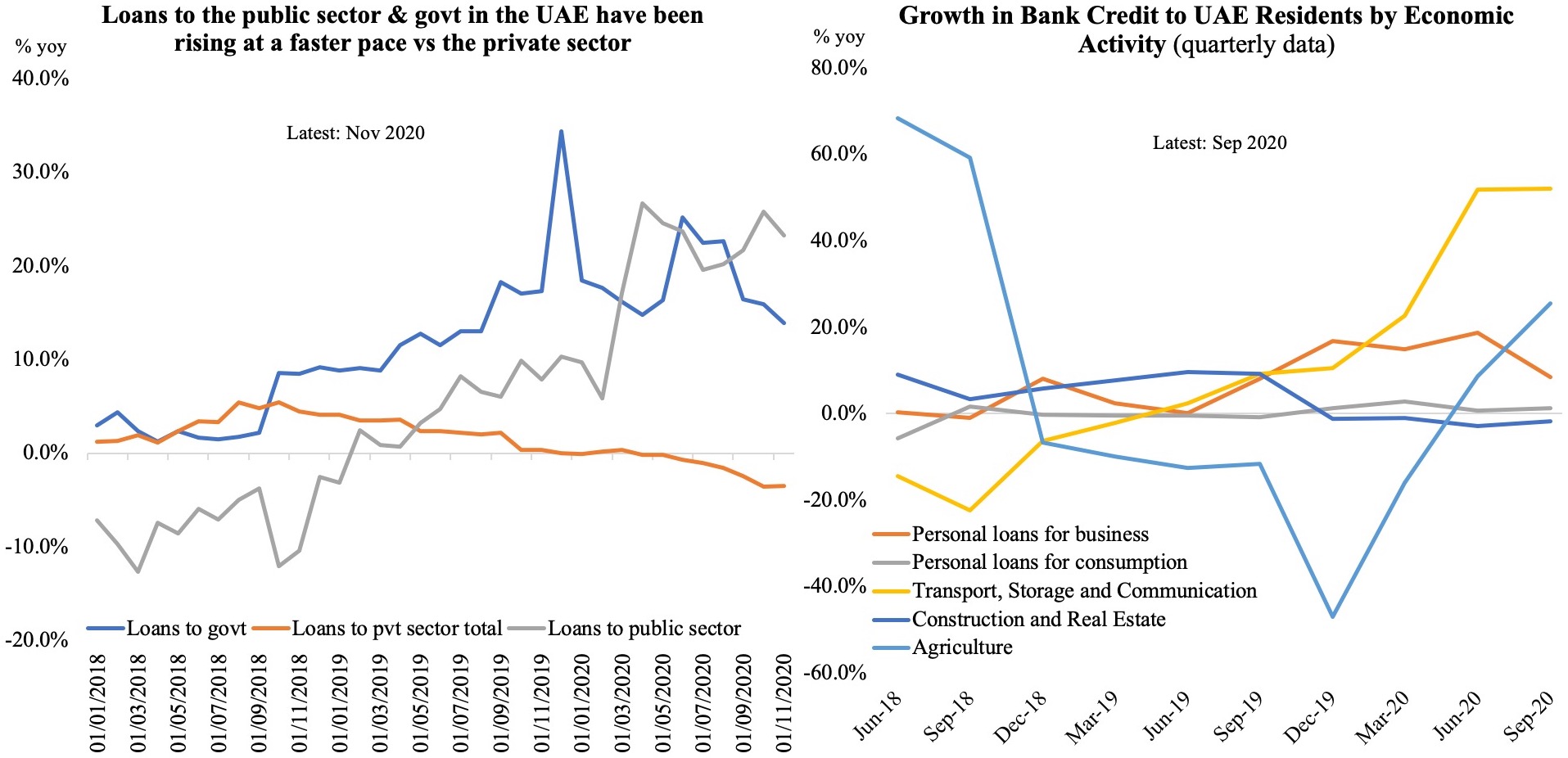

Public and external debt have risen significantly for the median emerging market economy, reaching 59 and 44% of GDP, respectively, in 2020, and gross financing needs are projected to stay above 10% of GDP in 2020–21, according to

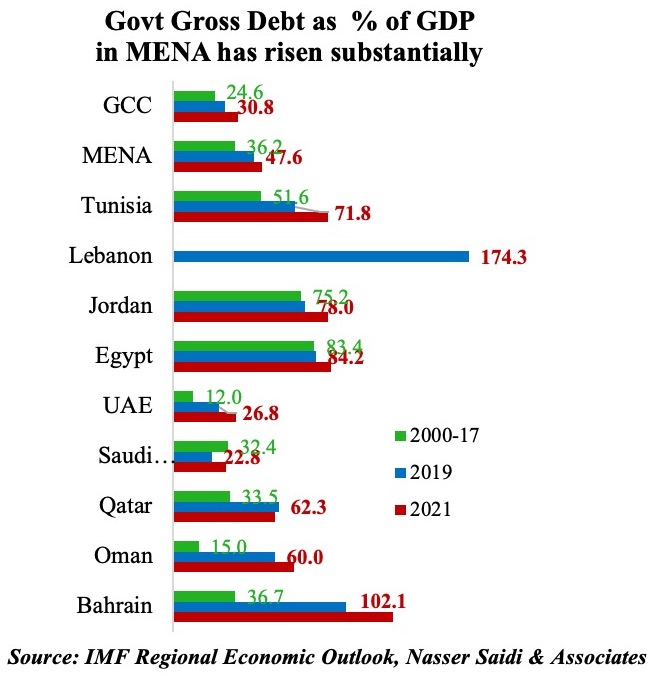

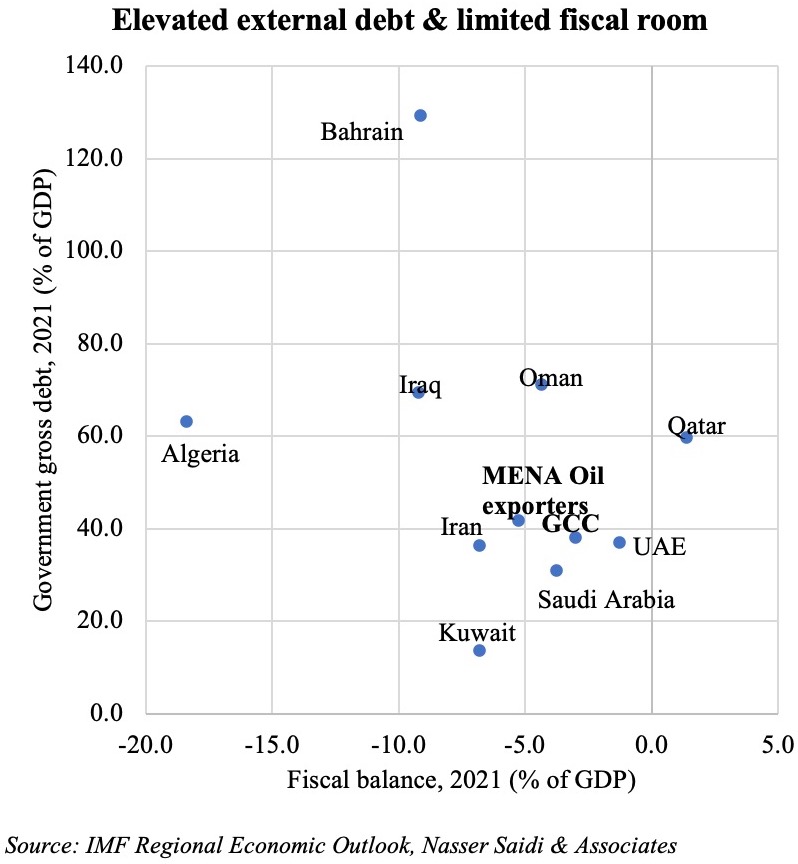

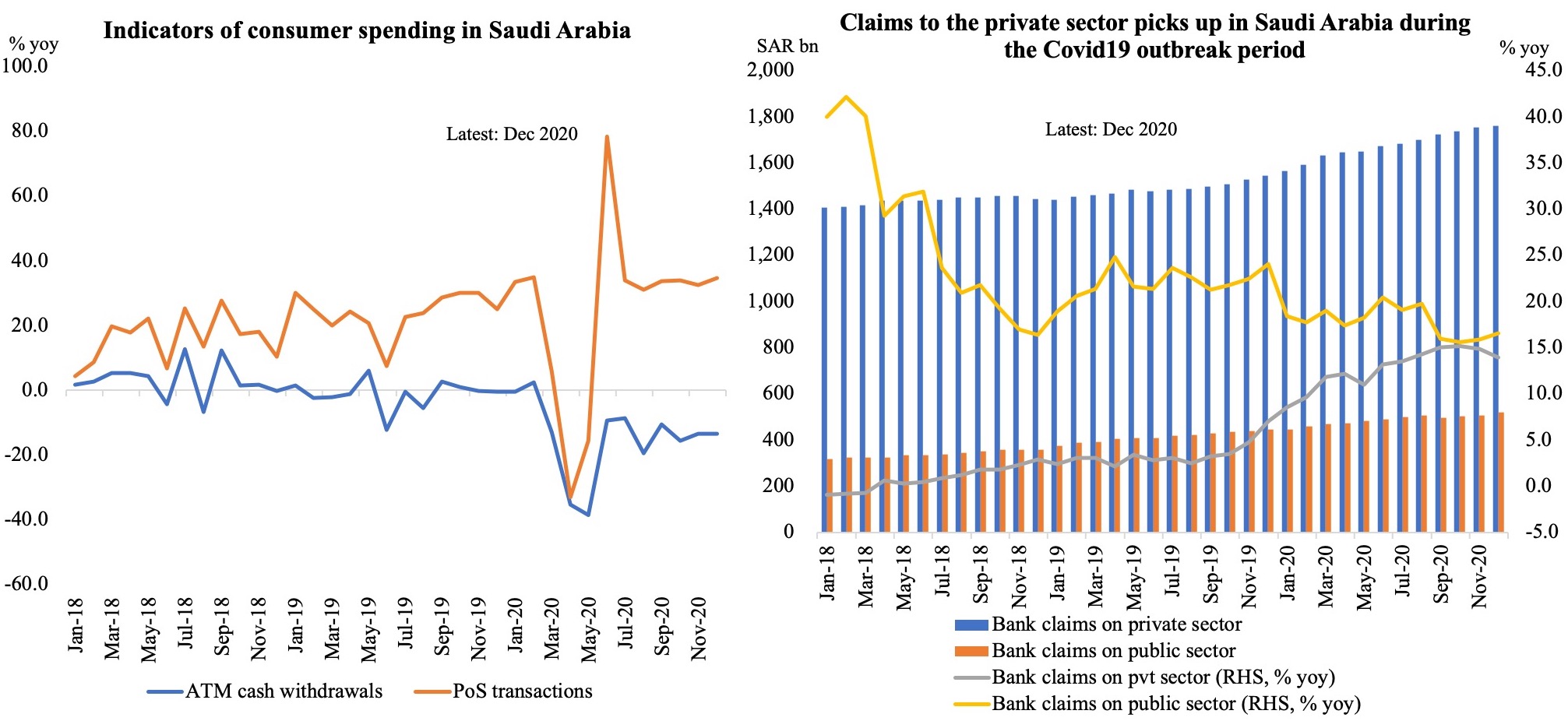

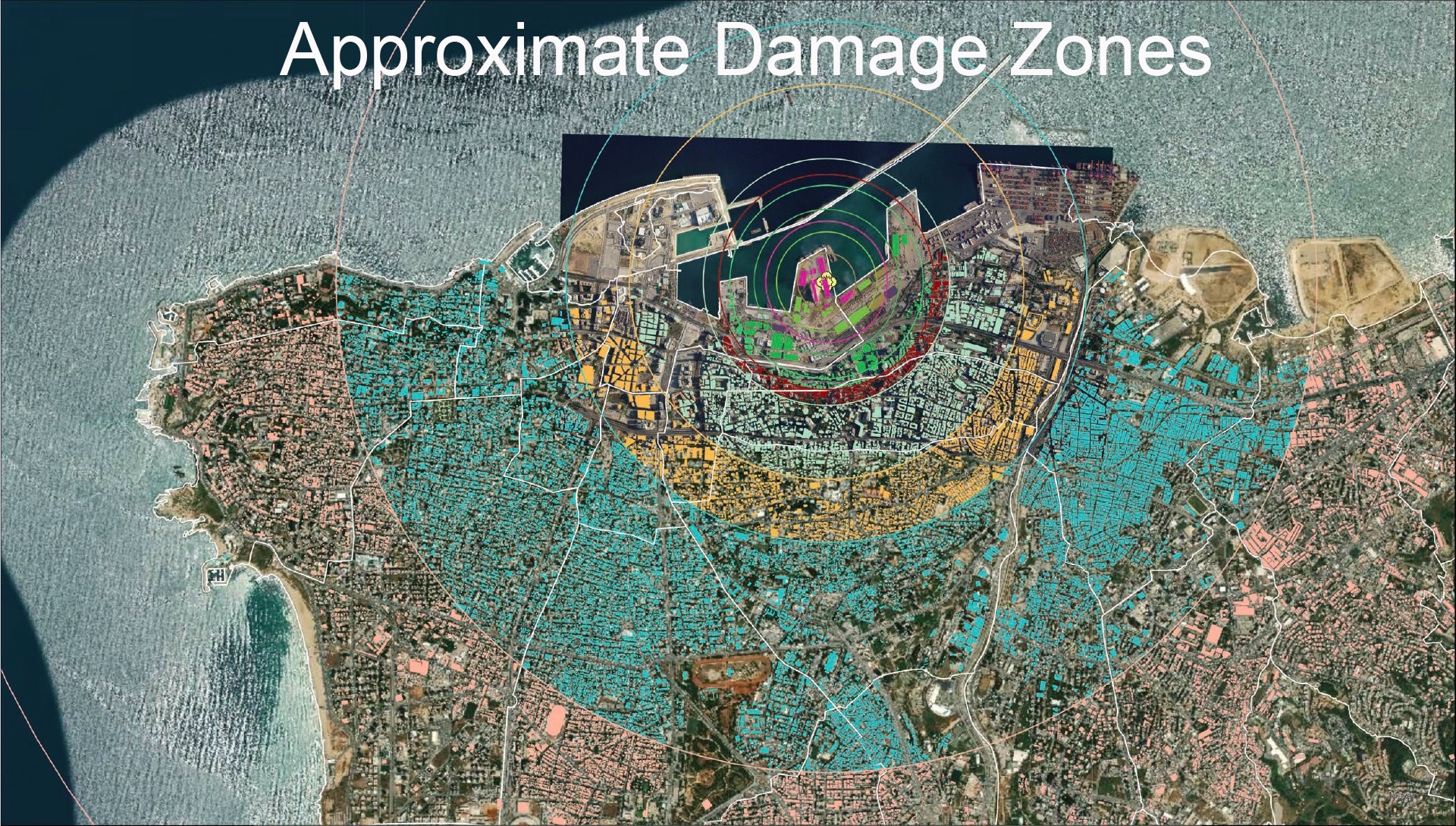

Public and external debt have risen significantly for the median emerging market economy, reaching 59 and 44% of GDP, respectively, in 2020, and gross financing needs are projected to stay above 10% of GDP in 2020–21, according to  In the MENA region, almost half the nations have gross government debt above 70% of GDP and one in 4 had public gross financing needs above 15% of GDP by end-2019. The pandemic led to a significant loss in revenues (both oil and non-oil) and though international financial markets were tapped, domestic financing increased. According to the IMF, governments in Egypt, Jordan, and Tunisia covered more than 50% of their public gross financing needs with domestic bank financing in 2020. Such bank exposure to the public sector could also crowd out the private sector at a time when a private activity push is required for higher economic growth and job creation. A surge in inflation can lead to a reduction in the real value of domestic debt – Lebanon is a good example, but the sharp currency depreciation makes the debt burden unsustainable.

In the MENA region, almost half the nations have gross government debt above 70% of GDP and one in 4 had public gross financing needs above 15% of GDP by end-2019. The pandemic led to a significant loss in revenues (both oil and non-oil) and though international financial markets were tapped, domestic financing increased. According to the IMF, governments in Egypt, Jordan, and Tunisia covered more than 50% of their public gross financing needs with domestic bank financing in 2020. Such bank exposure to the public sector could also crowd out the private sector at a time when a private activity push is required for higher economic growth and job creation. A surge in inflation can lead to a reduction in the real value of domestic debt – Lebanon is a good example, but the sharp currency depreciation makes the debt burden unsustainable.

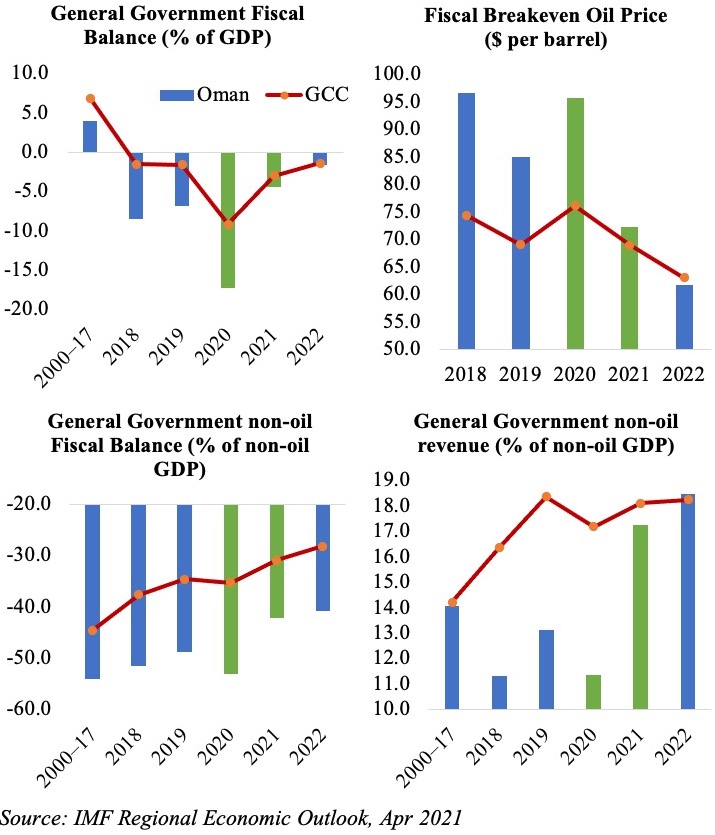

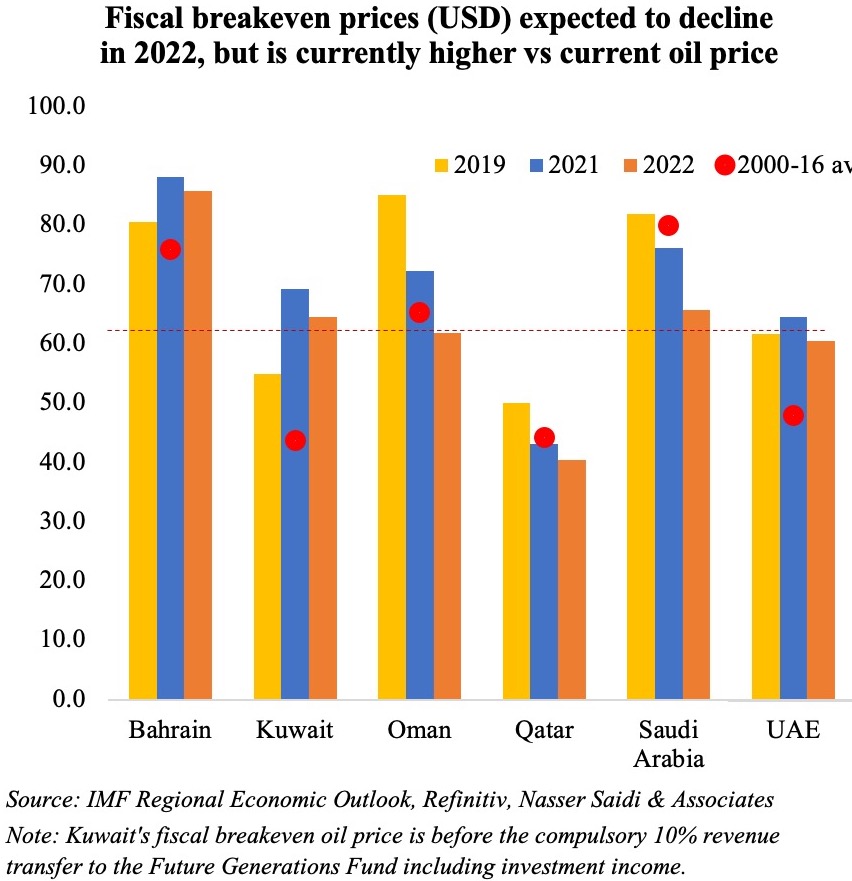

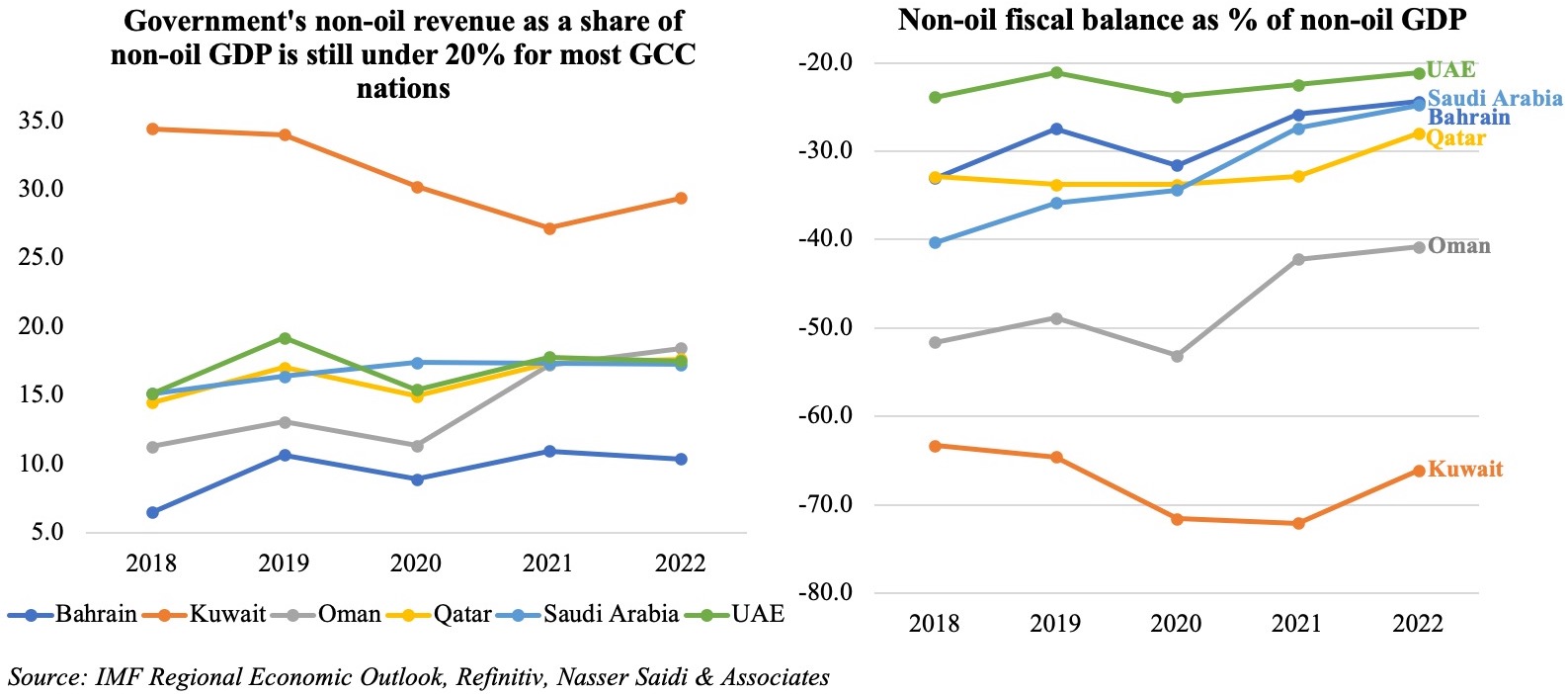

However, policy measures introduced to support the economy during the pandemic is creating immense fiscal strain. Fiscal deficits widened to 10.1% of GDP in 2020 in the MENA region from 3.8% in 2019. It was severe in the GCC as well: fiscal deficit widened to 7.6% of GDP last year (2019: -1.6%), as the impact was from both lower oil and non-oil revenues. The fiscal breakeven price this year ranges from a high USD 88.2 in Bahrain to a low USD 43.1 in Qatar. While, it is expected to decline across the board next year, it still remains higher than the current oil price levels for most nations. Given new rounds of restrictions and with oil demand not yet at pre-pandemic levels, the OPEC+’s recent decision to roll back production cuts are likely to depress oil prices. As real oil prices trend downward, fiscal sustainability becomes increasingly vulnerable.

However, policy measures introduced to support the economy during the pandemic is creating immense fiscal strain. Fiscal deficits widened to 10.1% of GDP in 2020 in the MENA region from 3.8% in 2019. It was severe in the GCC as well: fiscal deficit widened to 7.6% of GDP last year (2019: -1.6%), as the impact was from both lower oil and non-oil revenues. The fiscal breakeven price this year ranges from a high USD 88.2 in Bahrain to a low USD 43.1 in Qatar. While, it is expected to decline across the board next year, it still remains higher than the current oil price levels for most nations. Given new rounds of restrictions and with oil demand not yet at pre-pandemic levels, the OPEC+’s recent decision to roll back production cuts are likely to depress oil prices. As real oil prices trend downward, fiscal sustainability becomes increasingly vulnerable.

Higher deficits and negative economic growth resulted in governments resorting to multiple financing options: borrowing from commercial banks, tapping international and regional markets (bond issuances, commercial loans) as well as drawing down from international reserves at the central banks/ sovereign wealth funds. Government debt levels increased to 56.4% and 41% in the MENA and GCC regions last year. Though it is forecast to fall slightly this year, it still remains higher than the 2000-17 average of 36.2% and 24.6% respectively. The IMF estimates financing needs in the MENA to touch USD 919bn for this year and next. Public-financing requirements were likely to stay above 15% of GDP in most parts of the region through end-2022.

Higher deficits and negative economic growth resulted in governments resorting to multiple financing options: borrowing from commercial banks, tapping international and regional markets (bond issuances, commercial loans) as well as drawing down from international reserves at the central banks/ sovereign wealth funds. Government debt levels increased to 56.4% and 41% in the MENA and GCC regions last year. Though it is forecast to fall slightly this year, it still remains higher than the 2000-17 average of 36.2% and 24.6% respectively. The IMF estimates financing needs in the MENA to touch USD 919bn for this year and next. Public-financing requirements were likely to stay above 15% of GDP in most parts of the region through end-2022.

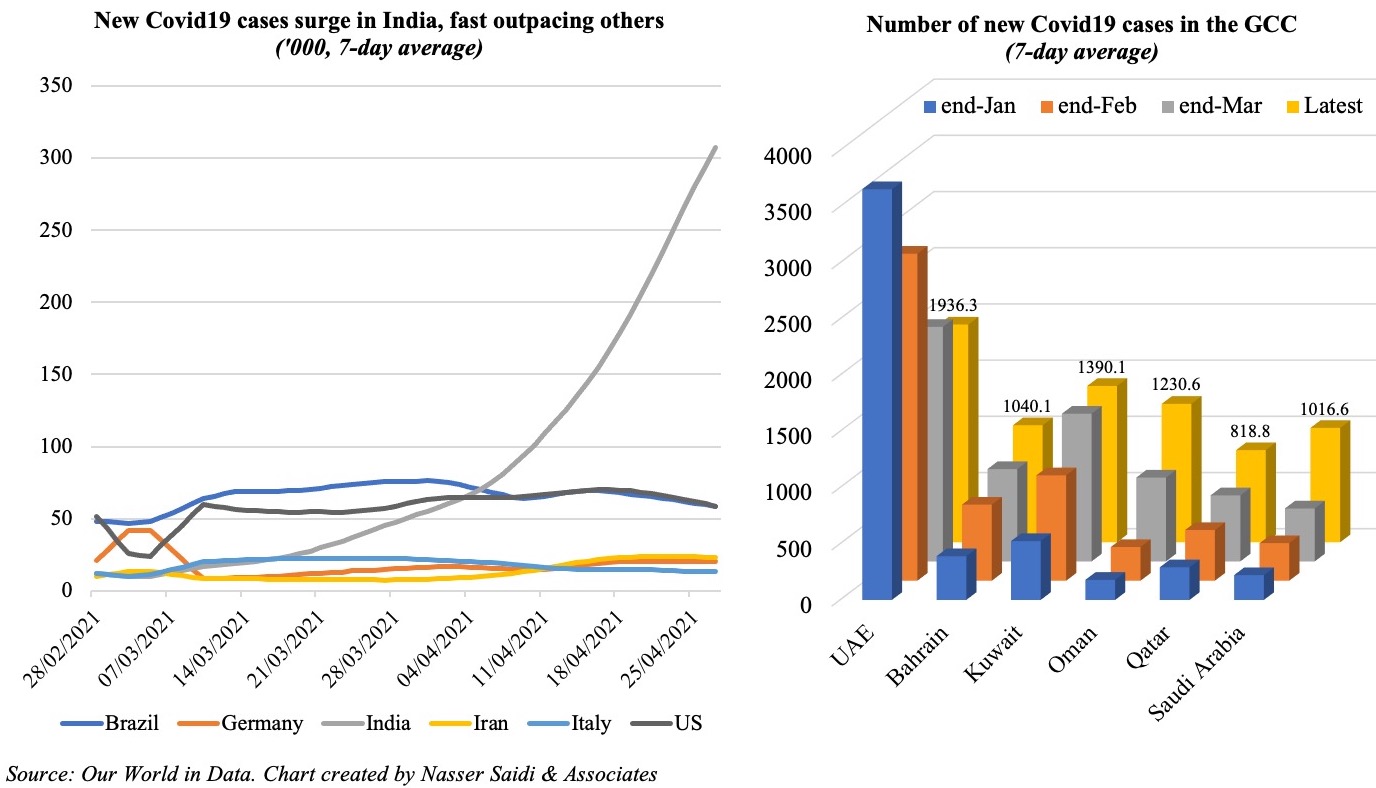

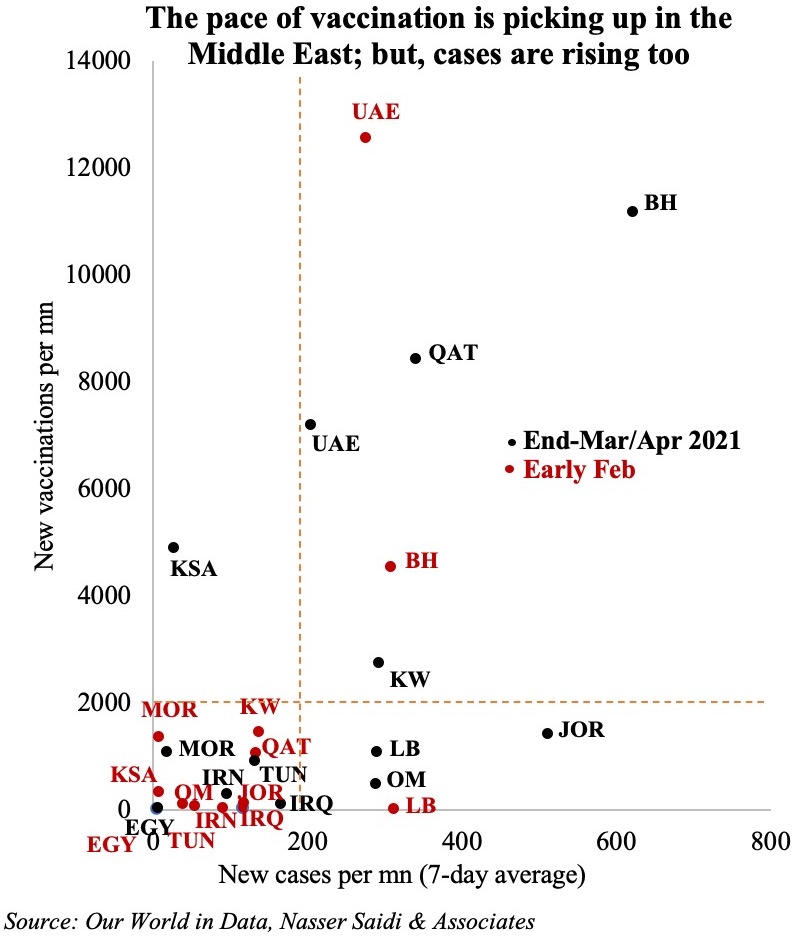

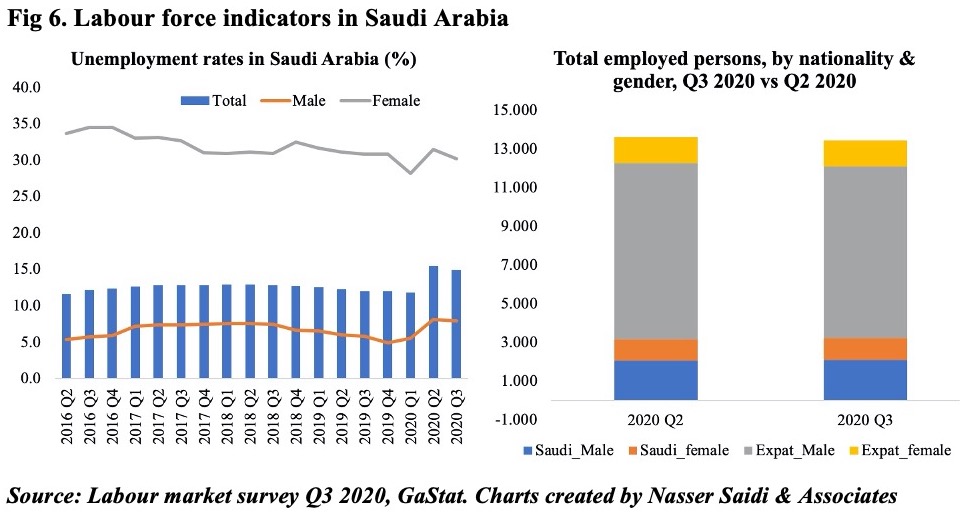

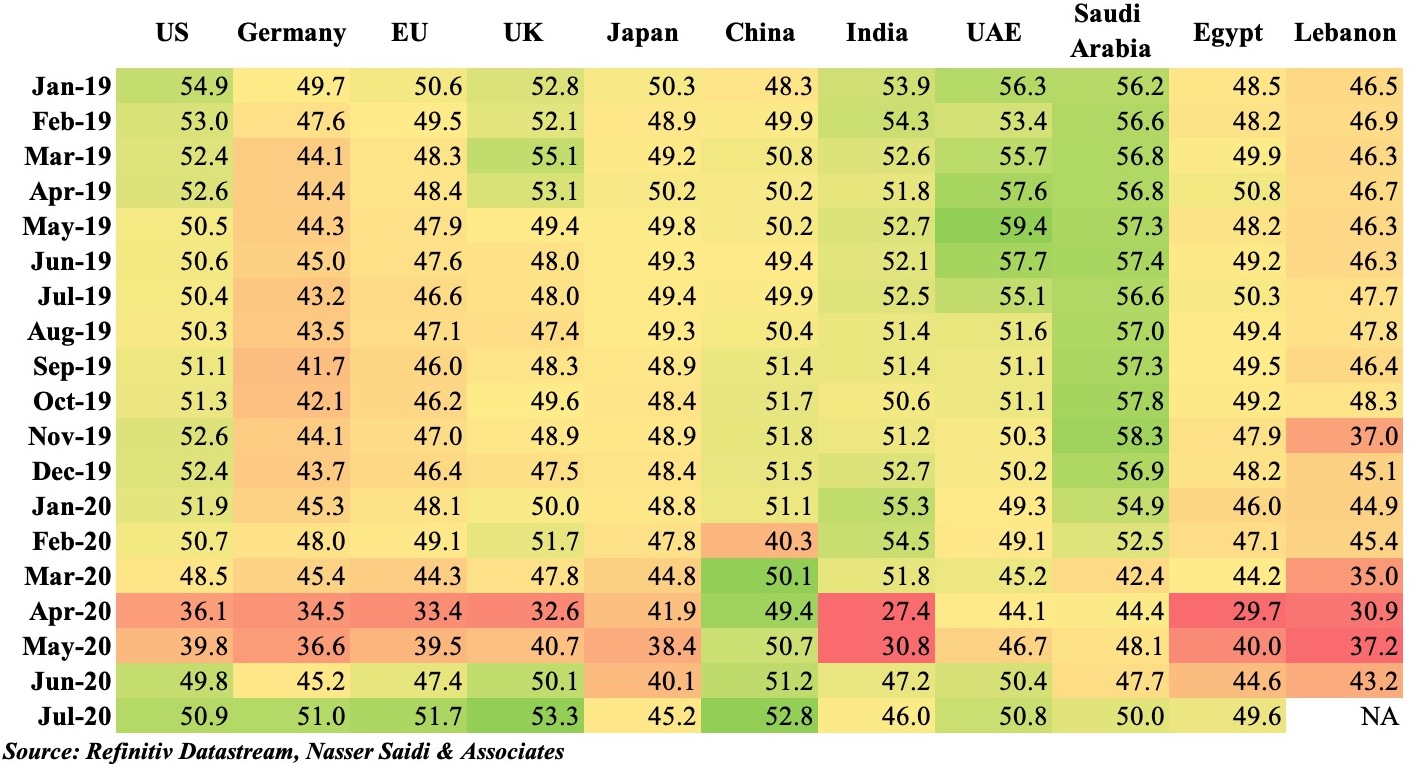

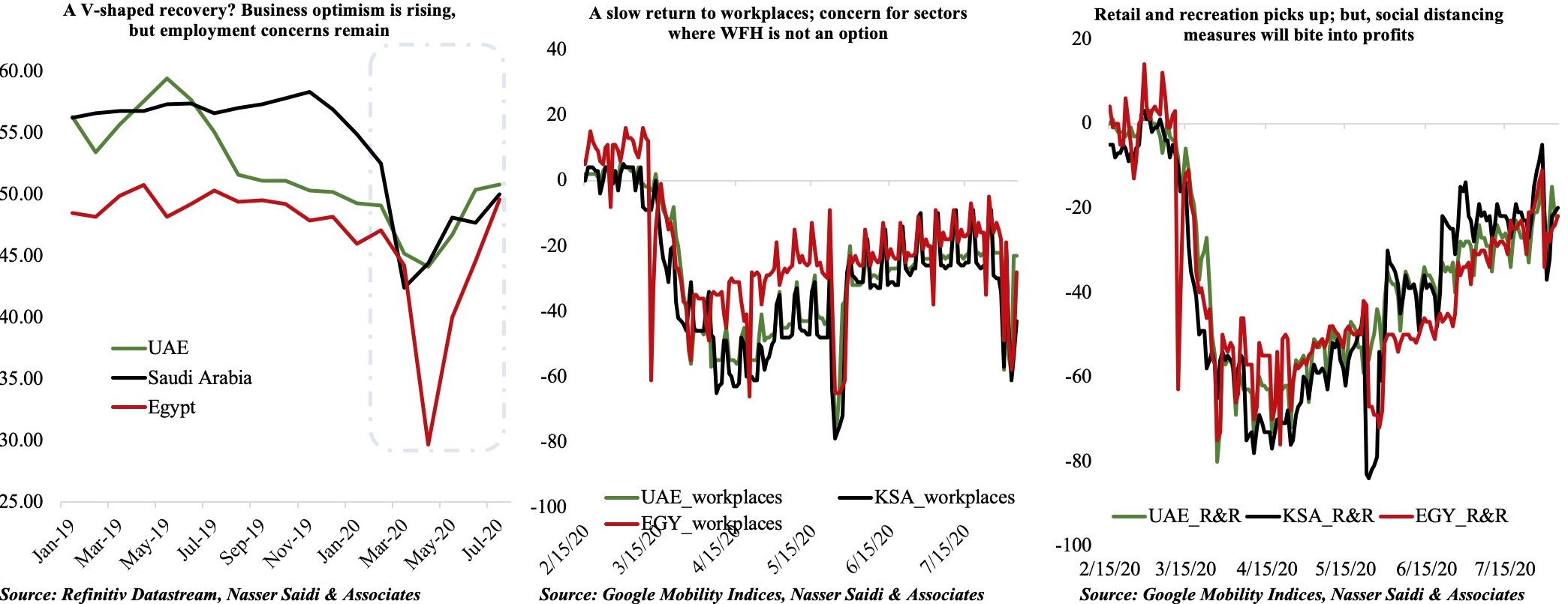

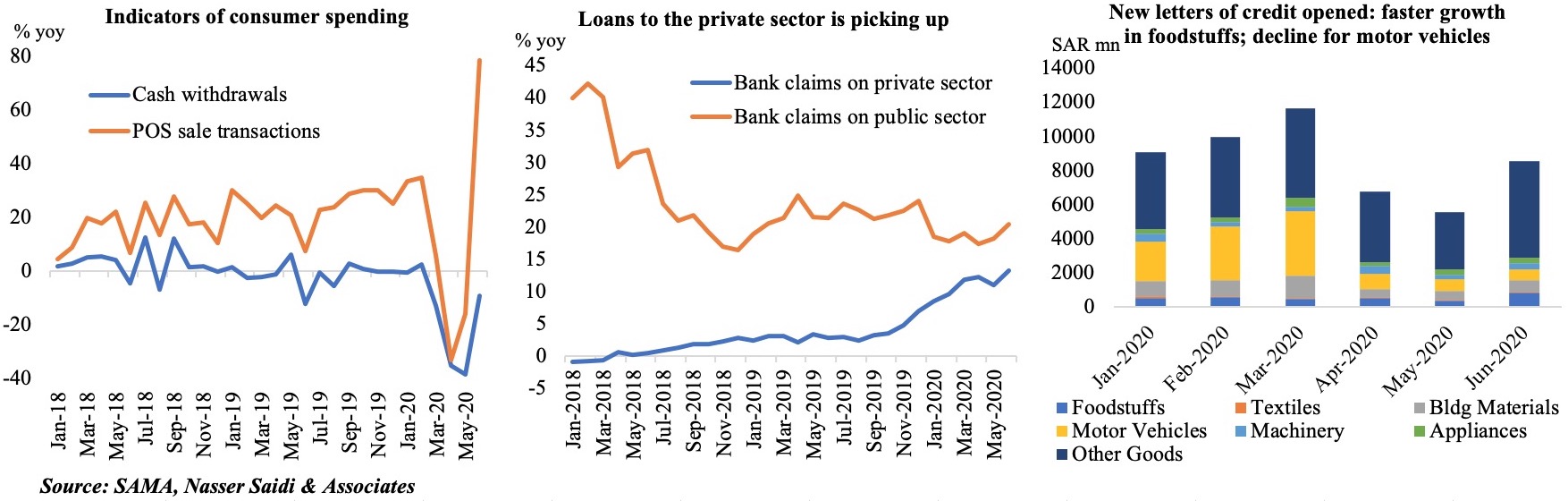

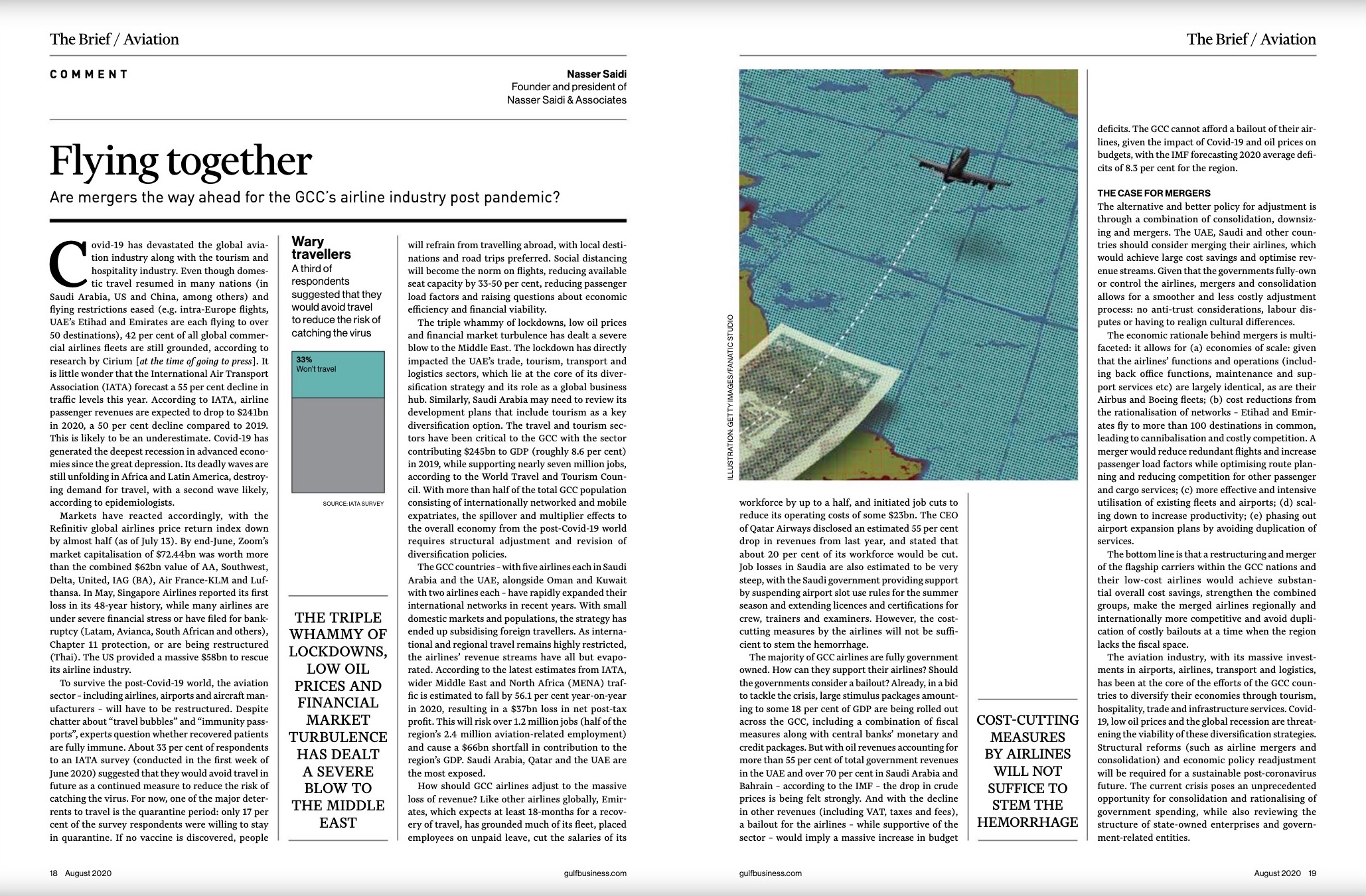

Middle Eastern and Gulf Cooperation Council (GCC) economies are heading toward a recession in 2020 as a result of the COVID-19 pandemic, collapsing oil prices, and the unfolding global financial crisis.