“Global Economic Diversification Index 2024” was released by the Mohammed Bin Rashid School of Government (MBRSG) at the World Governments Summit held in Dubai on 12th Feb 2023. Dr. Nasser Saidi & Aathira Prasad were co-authors of the report, which was developed in cooperation with Keertana Subramani, Salma Refass and Fadi Salem (MBRSG) and Ben Shepherd (Developing Trade Consultants).

Access the latest and past reports as well as the underlying data on the website.

Economic diversification is a gradual, transformative process for countries that are dependent on commodities or a limited set of products or services.

Diversification for commodity producers leads to greater macroeconomic stability, more sustainable growth patterns, enables a gradual move to higher value-added economic activities (from over-dependence on primary commodities) and helps lower trade concentration (i.e., increase a country’s ability to export a wider set of products to a larger set of trade partners). This requires active and productive private sector participation, and in parallel, governments need to rollout effective policy reforms (often structural) and undertake productive investments – while diversifying the government revenue base by raising non-commodity-related revenues.

The Global Economic Diversification Index (EDI), based on publicly available indicators, data and information,provides a quantitative measure of the state and evolution of the economic diversification of countries going back to 2000. The current edition expands the coverage of countries to a total of 112 countries (7 additional countries compared to the previous EDI edition) owing to improved data availability.

The United States, China and Germany retain the top 3 ranks in the EDI for 2022, with the top 10 nations having small margins between scores (implying the strength of diversification). Western European nations account for almost two-thirds of the top 20 highly-ranked nations and while 26 of the top 30 nations are high income, there are representatives from upper-middle income (China, Mexico, and Thailand) and one lower middle-income nation (India).

At the other end of the spectrum, however, the diversification process has been long and slow. Four nations – three from Sub-Saharan Africa alongside Kuwait from the Middle East and North Africa region (MENA) – continue to remain in the bottom 20 ranks of the EDI over the period. The share of MENA nations in the bottom 20 ranks fell to just 10% from one-fourth in 2000. At the same time, there were 13 Sub-Saharan African nations among the lowest 20-ranked nations in the year 2022 from nine in 2000. Furthermore, the catch up for lower ranked nations in the post-Covid era will be a tougher ask, given the long-term scarring effects and output loss induced by the pandemic in addition to an already limited fiscal space and existing debt burdens.

As the global economy slowly recovers post-pandemic, it is contending with a lasting structural change: the accelerated adoption of digital technologies, which has resulted in societal gains such as higher labour force participation rates and productivity gains among others (especially in nations where the basic infrastructure was already in place). Despite challenges in data availability in this realm, this edition of the EDI includes indicators that aim to capture the growth of the digital economy: three digital-specific indicators are added to the trade sub-index.

Using this updated list of indicators and availability of data, a revised trade+ (“trade-plus”) sub-index is calculated for the years 2010-2022, for a subset of 106 countries. The revised trade+ sub-index is also used to calculate a digital augmented EDI+ (“EDI-plus”) score and ranking. Other than the Sub-Saharan Africa region, all regional groups improved their trade+ sub-index scores in 2020-2022. While the top four ranked countries are the same in both the trade and trade+ sub-indices, of the bottom 20-ranked nations in the original trade sub-index, thirteen are worse-off when including digital indicators. This finding is in line with what other studies have shown i.e. if adoption is delayed, existing digital divides can widen leading to deteriorating outcomes and prospects in the absence of an acceleration of reforms. South Asia shows a significant upwards jump in trade+ scores over time and this is reflected as well in the EDI+ scores as well.

A clear outcome across countries is that digital economy investments improve trade diversification, notably through the ability to export services. For commodity producers and exporters, the report finds that they can strongly improve their overall EDI and trade rankings by investment in and adoption of new digital technology and its services. Additionally, country geographical size does not appear to be an impediment to economic diversification and EDI scores (e.g. highly-ranked nations such as Singapore, Ireland and Netherlands among others are relatively small economies, both in the EDI and EDI+ versions).

Commodity producing nations are vulnerable to volatility in commodity prices. Prices can be more or less volatile depending on the type of commodity. For instance, price of oil has been more volatile than the price of copper, wheat or cotton and other commodities, as shown by historical data. In the EDI sample of countries, more than 50% of the commodity dependent nations are reliant on fuels. The demand and supply shocks that occurred during the pandemic and those caused by ongoing wars, in addition to the planned energy transition to Net-Zero Emissions, increase the urgency for fossil fuel exporters to diversify – else these nations run the risk of being left with lower valued or stranded assets.

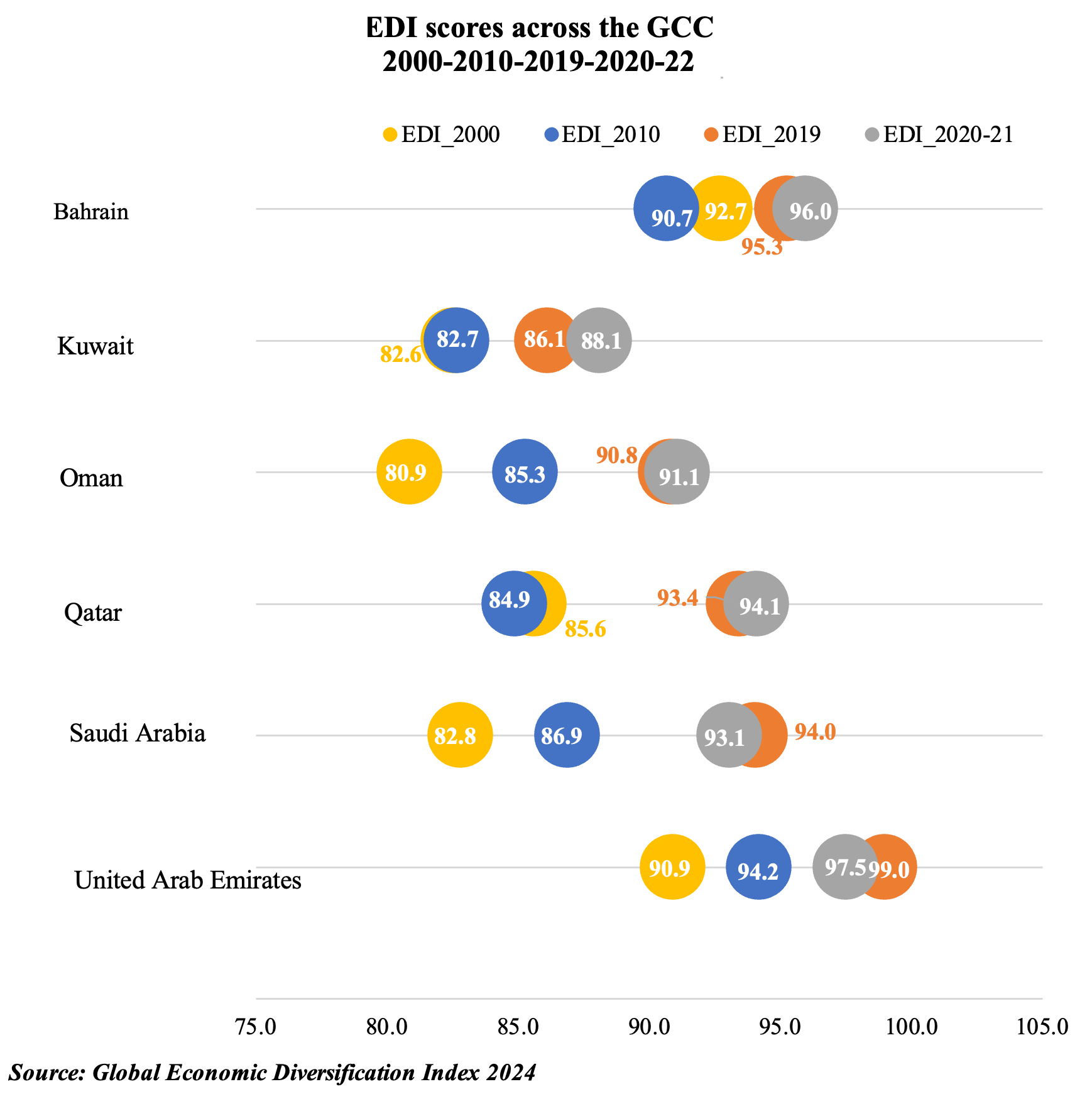

Sub-Saharan Africa’s commodity exporters posted the lowest EDI scores over time, with the 2020-2022 average score falling below the 2012-2015 period, underscoring not only the pandemic’s  negative impact on performance but also the divergent paces of recovery. However, both the MENA and Eastern Europe & Central Asia regions reported a slight improvement in the 2020-2022 period versus pre-pandemic scores: these nations were all fuel exporters (i.e. not exporters of any other commodities). The report also finds that countries that reduced (increased) the share of resource rents have seen an increase (decline) in EDI scores, but the relation is one of correlation and not causation. Among the GCC, UAE and Bahrain have higher EDI scores compared to their peers, while Saudi Arabia and Oman have both gained over 10-points in 2020-2022 compared to their EDI score in 2000. Improvements in GCC scores have resulted from the implementation of reforms at a much more aggressive pace after the pandemic – including incentives to invest in new tech sectors, plans to broaden tax bases, trade liberalisation through free trade agreements and improvements to regulatory and business environment among others facilitating rights of establishment and labour mobility – that support diversification efforts and provide long-term economic resilience.

negative impact on performance but also the divergent paces of recovery. However, both the MENA and Eastern Europe & Central Asia regions reported a slight improvement in the 2020-2022 period versus pre-pandemic scores: these nations were all fuel exporters (i.e. not exporters of any other commodities). The report also finds that countries that reduced (increased) the share of resource rents have seen an increase (decline) in EDI scores, but the relation is one of correlation and not causation. Among the GCC, UAE and Bahrain have higher EDI scores compared to their peers, while Saudi Arabia and Oman have both gained over 10-points in 2020-2022 compared to their EDI score in 2000. Improvements in GCC scores have resulted from the implementation of reforms at a much more aggressive pace after the pandemic – including incentives to invest in new tech sectors, plans to broaden tax bases, trade liberalisation through free trade agreements and improvements to regulatory and business environment among others facilitating rights of establishment and labour mobility – that support diversification efforts and provide long-term economic resilience.

Lastly, the report highlights an increasingly relevant discussion related to climate change and the vulnerability of commodity-dependent nations. As countries adapt to and mitigate climate change risks, energy transition and “Green economy” investments, such as renewable energy, can play a key role in transforming economies and output structures. Fossil fuels are likely to remain in the global energy mix for decades, but a potential sustained decline in demand necessitates the roll-out of diversification policies at the earliest. With many oil-exporting nations in the Middle East already diversifying energy sources, potential export of clean energy from these nations could widen their export base (both in terms of products and trade partners). Furthermore, regional integration would aid diversification efforts of commodity producers and also provide a massive opportunity to link with domestic or regional value chains, adding to diversification efforts.