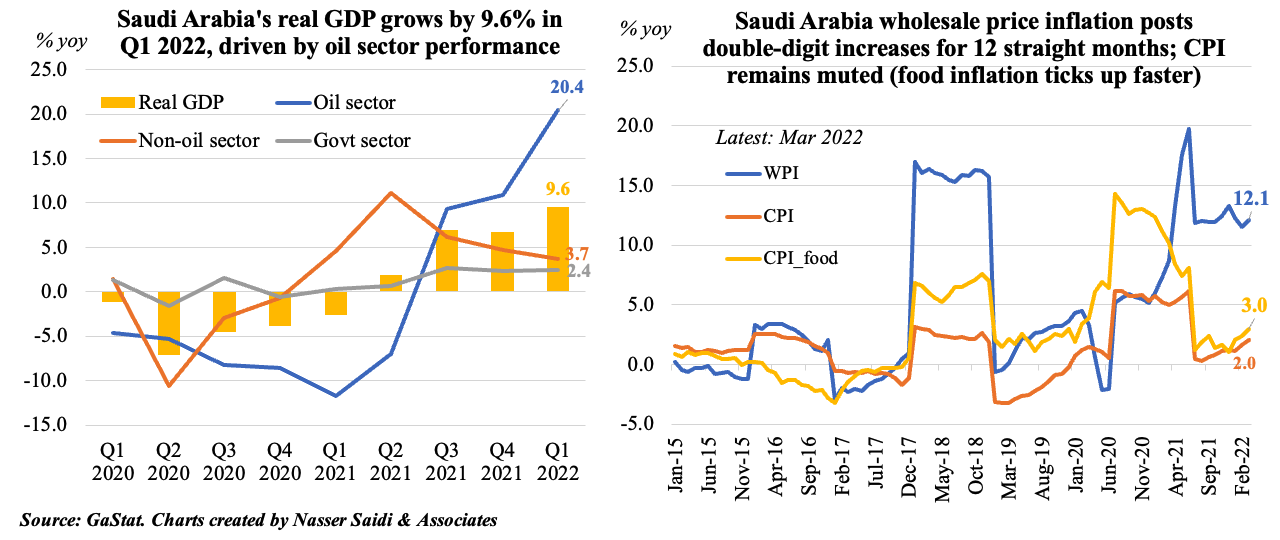

Weekly Insights 6 May 2022: Saudi Arabia thrives on oil gains; will the Fed hike be a bane or a boon?

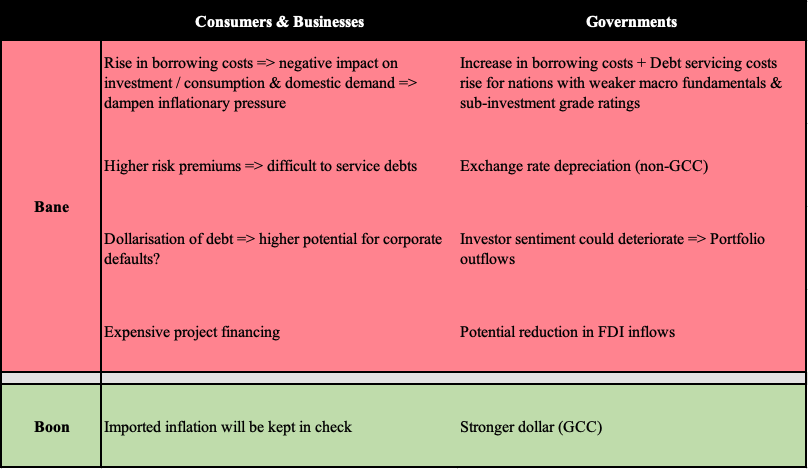

1. Saudi Arabia grows by 9.6% yoy in Q1 2022, the highest rate in a decade, thanks to oil sector growth

- Saudi Arabia’s flash GDP estimates for Q1 2022 placed overall growth at 9.6%, the highest in a decade. This was supported largely by the oil sector (20.4%) amid growth in non-oil (3.7%) and government (2.4%) sectors. In qoq terms, overall GDP was up by 2.2%, aided by oil (2.9%) and non-oil (2.5%) sector activity while government services slipped (-0.9%)

- Meanwhile, prices are inching up: consumer price inflation has been relatively muted, but is rising on higher food and transport prices. Rising transport costs will likely spillover into further price increases, affecting overall cost of living. Wholesale price inflation has been rising in double-digits for the past 12 months: other transportable goods are driving the increase given its weight in the index (includes refined petroleum products, basic chemicals)

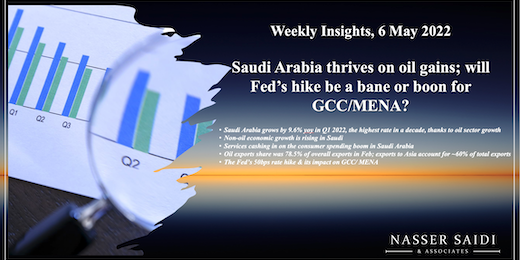

2. Non-oil economic growth is rising in Saudi: Covid cases & related deaths declining + 70% population fully vaccinated => rising mobility + resumption of religious tourism

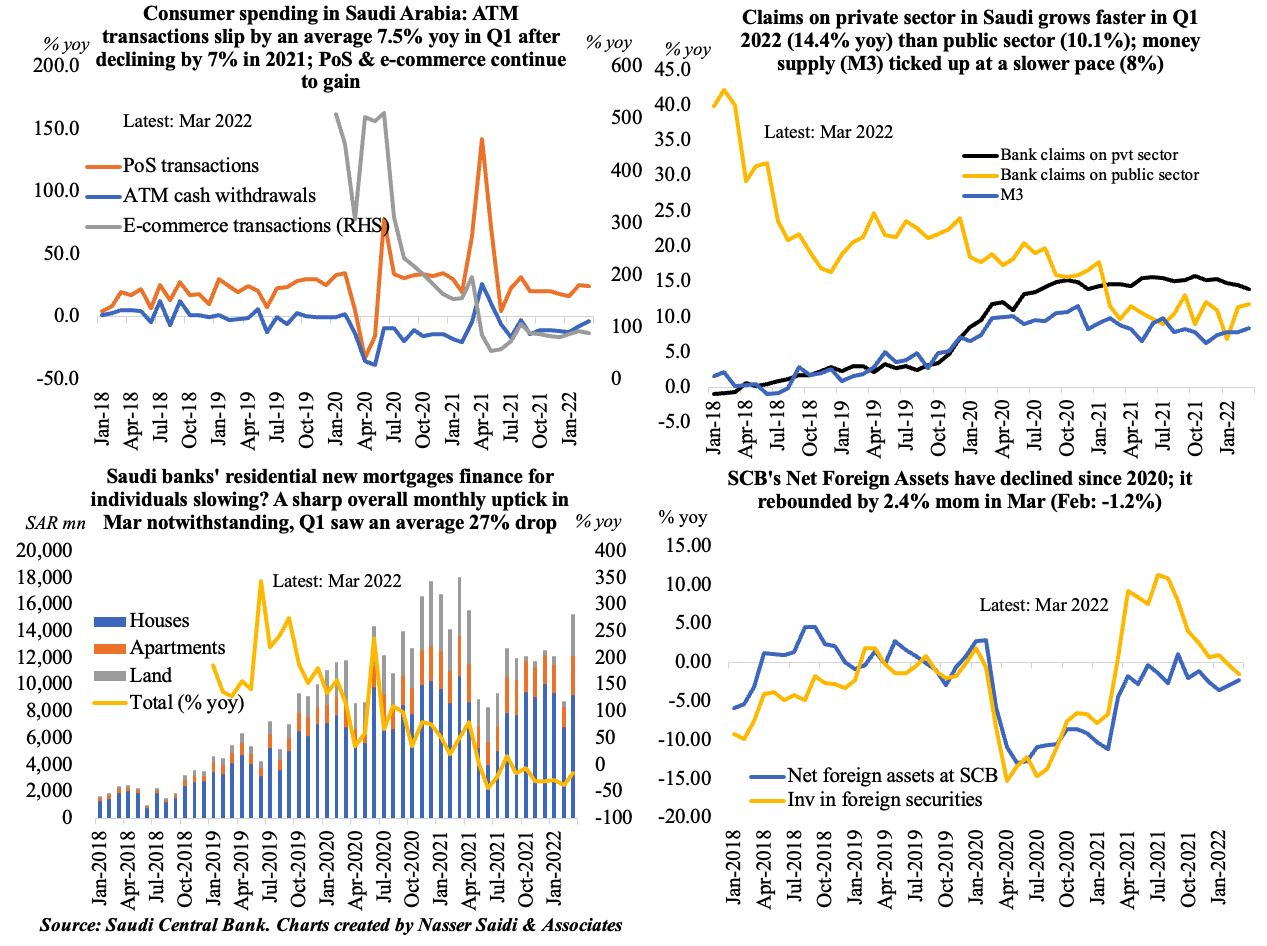

3. Services cashing in on the consumer spending boom in Saudi Arabia: PoS transactions show uptick in hotels, restaurants, food & beverages categories

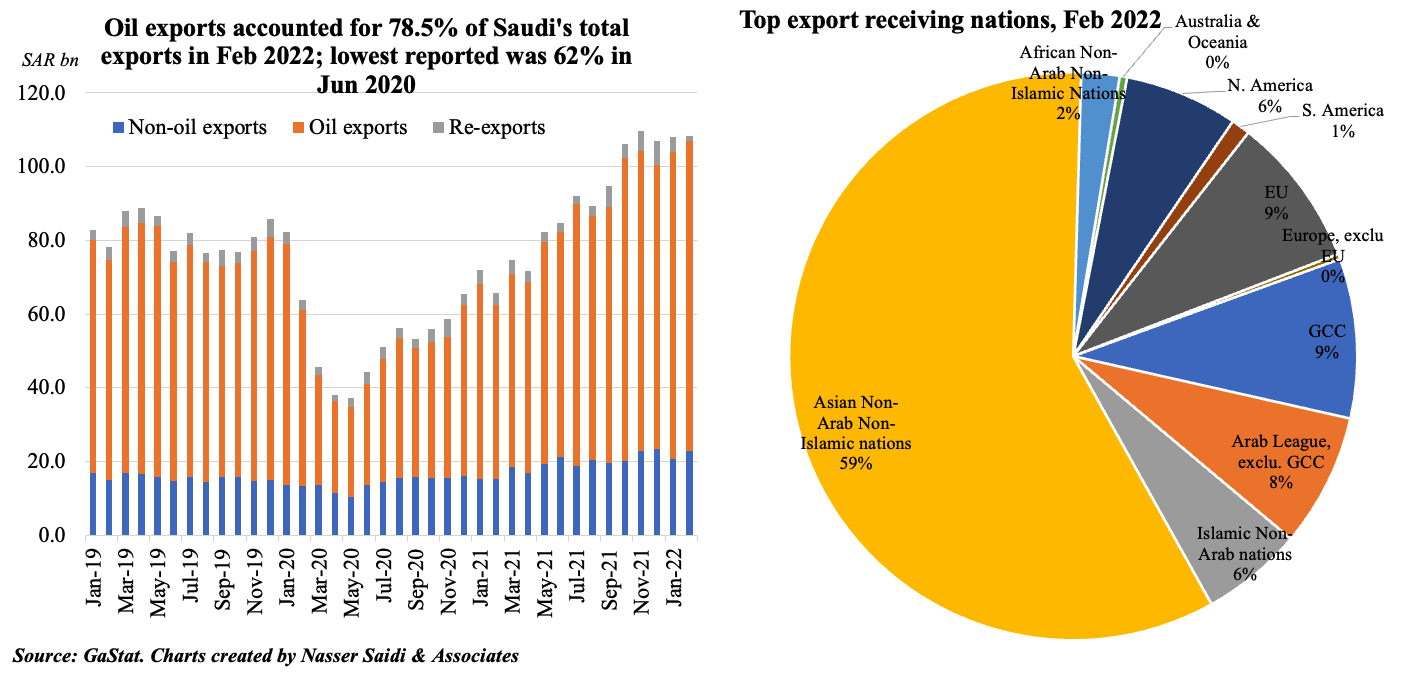

4. Oil exports accounted for 78.5% of overall exports in Feb; exports to Asia account for ~60% of total exports

- Oil exports are rising along with higher oil prices, accounting for 78.5% of total exports in Feb 2022; the lowest share was recorded in Jun 2020 when the share of oil in overall exports was just 62%

- Non-oil exports (including re-exports) grew by 31% yoy to SAR 24.4bn in Feb 2022. The ratio of non-oil exports to imports surged to 50.6% in Feb 2022, up from 45.7% a year ago

- The top region for Saudi Arabia’s exports is still Asian nations, and much of the exports is oil

5. When the Fed sneezes, emerging markets catch a cold: 50bps rate hike & its impact on GCC/ MENA