Markets

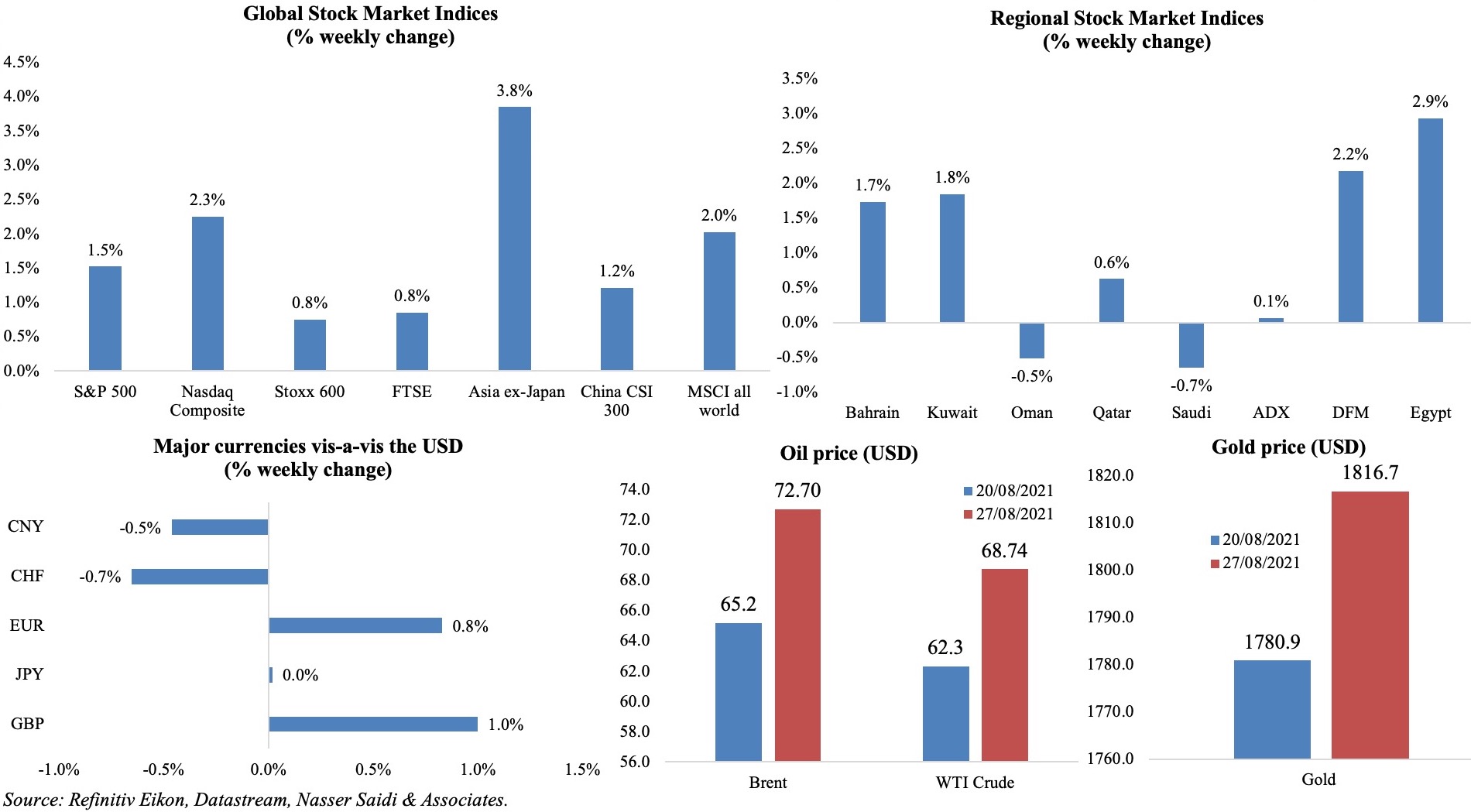

Another week where investors overlooked rising Covid19 cases, vaccine efficacies and growth concerns: major global equity markets ended the week higher, with the US markets rallying after the Fed chair’s Jackson Hole speech indicating a gradual removal of stimulus measures this year; Europe’s Stoxx600 closed higher, helped by commodity linked stocks; MSCI Asia ex-Japan rose as well, posting its best weekly gain since Feb. Regional markets showed a mixed picture, with Tadawul clocking in a second consecutive weekly loss while Egypt and Dubai gained upwards of 2%. Among currencies, dollar slipped after Powell’s speech while the British pound posted a 1% weekly gain. Brent and WTI oil prices closed higher by more than 10% (on supply concerns after companies shut production ahead of Hurricane Ida) – the biggest weekly gains since Jun 2020 – while gold price also gained by 2% compared to a week ago.

Weekly % changes for last week (26-27 Aug) from 19 Aug (regional) and 20 Aug (international).

Global Developments

US/Americas:

- GDP growth in the US increased by 6.6% at an annualized rate in Q2, higher than the initial estimate of 6.5%. Consumer spending also nudged up, rising by 11.9% in Q2 (from the 11.8% reading in the previous estimate). The PCE core index jumped by 6.1% yoy in Apr-Jun from the previous quarter after rising 2.7% in the previous three months.

- Personal income grew by 1.1% while spending increased by 0.3% in Jul. Goods spending fell by 1.1%, dragged down by motor vehicles, while spending on services was up by 1%. The PCE index (excluding food and energy) inched up by 0.3% mom in Jul (Jun: 0.5%), posting the smallest gain in 5 months.

- Durable goods orders inched down by 0.1% mom in Jul (Jun: 0.8%), the first decline in 3 months. Non-defense capital goods excluding aircraft remained unchanged after Jun’s 1% uptick.

- Initial jobless claims inched up to 353k in the week ended Aug 20th, from 349k the week before, slowing the 4-week average to 366.5k. Continuing claims dropped 3k to 2.86mn in the week ended Aug 13th.

- Markit manufacturing PMI fell to 61.2 in Aug (Jul: 63.4), with new orders slowing slightly while the rate of both input and output price inflation was the fastest on record; services PMI slowed to 55.2 (Jul: 59.9) – the weakest pace of expansion since Dec 2020 – with new export orders falling for the first time since Feb.

- Richmond Fed manufacturing index tumbled to 9 in Aug (Jul: 27), posting the lowest reading since Jul 2020; wage index hit a record-high but workers were difficult to find, according to many respondents. Separately, Chicago Fed national activity index inched up to 0.53 in Jul (Jun: -0.01).

- Existing home sales were up by 2% mom and 1.5% yoy to a seasonally adjusted annualized rate of 5.99mn in Jul, rising for the 2nd consecutive month. The median price of an existing home sold in July was higher by 17.8% yoy to USD 359,900. New home sales inched up by 1% mom to 708k units in Jul though sales declined by 27.2% yoy.

Europe:

- Germany’s GDP rebounded by 1.6% qoq and 9.4% yoy in Q2, as per the last and final reading, up from a downwardly revised 2% contraction in Q1. Both private consumer (+3.2%) and government spending (+1.8%) supported growth in the quarter. The Bundesbank on Mon disclosed that the full-year growth targets may not be met given the Delta variant’s impact.

- Germany’s Ifo business climate index declined by 1.3 points to 99.4 in Aug; expectations posted a drop of 5 points to 97.5. However, the current assessment of business situation increased to 101.4 in Aug (Jul: 100.4).

- The preliminary manufacturing PMI in Germany declined to a 6-month low of 62.7 in Aug (Jul: 65.9), with the output index slipping to 59, its joint lowest in almost a year. Services PMI fell to 61.5 from 61.8 in the previous month. Overall, inflationary pressures remained high with a near-record rise in business costs.

- Eurozone’s manufacturing PMI (preliminary) fell to a 6-month low of 61.5 in Aug (Jul: 62.8), with slower growth linked primarily to supply chain constraints while inflows of new orders remained strong thanks to growing demand. Services PMI ticked down to 59.7 from 59.8 the month before though service sector jobs growth reached the highest since Sep 2018.

- German GfK consumer confidence survey declined further to -1.2 in Sep (Aug: -0.4), the lowest level in three months.

- UK’s preliminary composite PMI dropped for the 3rd consecutive month in Aug, falling to a 6-month low of 55.3 (Jul: 59.2). Manufacturing PMI slipped to 60.1 from 60.4 in Jul, with supply issues resulting in weaker production growth alongside a slowdown in job creation. Services PMI declined at a much sharper rate: down to 55.5 in Aug (Jul: 59.6).

Asia Pacific:

- The preliminary reading of Japan’s manufacturing PMI stood at 52.4 in Aug, edging down from Jul’s 53. New order inflows increased, but supply chain disruptions affected production inputs. Staffing levels increased at the quickest pace since Jan 2020.

- Japan’s leading economic index increased to 104.1 in Jun (May: 102.6), unrevised from the preliminary estimate – the highest reading since Feb 2014.

- Inflation in Tokyo remained unchanged at -0.4% in Aug (Jul: -0.4%). Excluding food and energy, inflation was at -0.1% (Kul: -0.4%). Core CPI (excluding food but including oil products) was flat in yoy terms, not declining for the 1st time in 13 months.

- India announced an INR 6trn National Monetization Pipeline last week, to be undertaken over the next 4 years, with an aim to monetize its state assets covering roads, railways, power, oil and gas pipelines, and telecommunication In the current fiscal year, assets monetization is expected to be to the tune of INR 880bn.

- South Korea became the first developed Asian nation to raise interest rates since the beginning of the pandemic: rate was increased from a record low of 0.5% to 0.75%. The move is expected to curtail the surge in household debt and home prices. (Sri Lanka was the first Asian nation to raise rates earlier this month, at its Aug 19th meeting).

- Inflation in Singapore edged up to 2.5% in Jul (Jun: 2.4%), largely a result of higher electricity and gas costs. Core inflation rose by 1% yoy – the highest increase since Jun 2019.

- Industrial production in Singapore fell by 2.6% mom in Jul (Jun: -2.6%), though declining by a larger 7.9% when the volatile biomedical manufacturing was excluded. IP grew by 16.3% yoy, moderating from Jun’s 28% rise.

Bottomline: Preliminary PMI readings for Aug have mostly been on the lower side compared to Jul, with most respondents citing supply side disruptions as one of the key factors dragging down production. At the Jackson Hole meeting, the Fed Chair focused on strong US labour market improvements (“clear progress” towards the maximum employment goal) and signaled the onset of tapering while warning about the risks of tightening prematurely. Markets, including emerging markets, can no longer count on a steady injection of liquidity – be on the lookout for vulnerable corporates & countries with high debt exposure. With mixed signals in the markets (weaker demand from parts of Asia facing a resurgence in Covid19 cases, calls by US President for reversal of production cuts), the OPEC+ meeting this week to potentially revive oil production will be closely watched: we expect OPEC+ to ease supply cuts as planned for Oct (though the Kuwait oil minister reportedly stated that “there may be a halt to the 400k bpd increase”).

Regional Developments

- Value of tenders issued in Bahrain jumped by 60% yoy to USD 3.4bn in H1 2021, with the number up to 1070 (+38.4%). Non-oil contracts stood at 762, at a total value of USD 1.6bn. Outside oil, aviation and construction sectors had the highest value of tenders at USD 476mn and USD 413mn respectively.

- Egypt’s finance minister disclosed that the country was planning to issue its first sovereign sukuk in H2 of the current fiscal year. The government is planning to form a state-owned company to manage sukuk issuance; returns on the sukuk will be taxed in the same manner as Egypt’s treasury bonds.

- Revenues from Egypt’s Suez Canal grew by 11.2% yoy to USD 3.88bn from Jan 20th to Aug 20th compared to a year ago.

- Egypt allocated total investments of EGP 65.3bn (USD 4.1mn) for the petroleum sector in the current fiscal year 2021-22: this includes EGP 48.7bn for extraction activities and about EGP 16.6bn for petroleum refining activities. Output from extraction and refining is estimated to touch EGP 710bn at current prices during the year (up 10.5% from 2020-21’s EGP 642.5bn).

- In a bid to boost Covid19 vaccination rates, Egypt will vaccinate all 4.5mn of its state employees in Aug and Sep. About 15mn doses of Sinovac has been produced locally, and the nation will receive about 5.2mn Pfizer and Moderna doses in Sep.

- Iraq signed a contract with China’s state-owned PowerChina to build its first solar power plants: the first plant will have a capacity of 750MW and the plan is to boost total capacity to 2000 MW from multiple plants. Though no details were provided about when production would begin, the aim is to reduce dependence on Iranian power imports.

- Jordan is forecast to grow by 2% this year, according to the IMF, based on a gradual return of tourists to the country and amid rising global demand. This was disclosed after a review of Jordan’s Extended Fund Facility (EFF). The IMF released USD 206mn under the EFF arrangement, bringing the total disbursements to the country to USD 900mn since 2020.

- Kuwait-based logistics company Agility disclosed that it had applied for a license to establish a digital bank.

- Kuwait suspended passenger transport by sea due to Covid19 concerns, but shipping operations are expected to continue, according to the ports authority.

- Fuel prices in Lebanon increased by 66-67% after the subsidy cut: cost of fuels has now almost tripled in the last 2 months since support for imports was decreased.

- Iranian-backed Hezbollah arranged for a 3rd shipment of fuel from Iran to help ease the fuel shortage in Lebanon, according to a statement on Fri.

- Lebanon picked Dubai’s ENOC in a tender to swap 84,000 tons of Iraqi high sulfur fuel oil with 30,000 tons of Grade B fuel oil and 33,000 tons of gasoil. The swap tenders are essential as Iraqi fuel is unsuitable for Lebanese electricity generation.

- The UN secretary general called on all “political leaders [in Lebanon] to urgently form an effective government of national unity” to “bring immediate relief, justice and accountability”.

- Oman will allow entry for anyone with a Covid19 vaccine certificate from Sep 1st.

- Qatar’s first legislative polls for 30 members of the 45-seat advisory Shura Council will be held on Oct 2nd, according a decree issued last Sun.

- Qatar and UAE have helped evacuate more than 40k and 36,500 persons respectively from Afghanistan. Qatar has agreed with the US to temporarily host 8k Afghan nationals while the UAE and Kuwait would host 5k.

- The total number of funding deals reached 220 in the Middle East and Africa region till mid-Aug this year, compared to 310 investment deals closed in full year 2020, according to a report from Red Seer. Early stage and Series A funding rounds contributed 65% and 18% to the total number of deals. Financial technology and food services were identified as the best performing industries when it comes to investor interest.

- Saudi lenders increased loan books by a net 13.1% in Q2 from the previous three months, the most in the GCC, according to a Kamco Invest report. Average return on equity was 11.0% for Saudi banks, second in the region after Qatar, and above the average of 9.1%.

- More than 75% of respondents from the Middle East revealed that their use of digital payment modes has increased by about 10% due to the pandemic, according to a McKinsey report. About 90% of those surveyed believe that at least half of new users will stick with digital payments and not revert to cash in the post-pandemic era.

- Covid19 led to an expansion of e-commerce in the Middle East, according to Sitecore research. The region witnessed a 54% yoy growth last year to USD 12.1bn; electronics and retail accounted for over 42% of the total.

Saudi Arabia Focus

- Non-oil exports in Saudi Arabia grew by 40.5% yoy and 7.2% mom to SAR 23.6bn (USD 6.2bn) in Jun. Oil exports, which accounted for 72% of Jun’s total exports, surged by 123% yoy to SAR 61.5bn (USD 16.4bn). Overall exports in Jun were up by nearly 91.8% compared to a year ago, largely given the low base last year given the Covid19-related impact. Exports to China (its largest trading partner in Jun) accounted for 20% of the total.

- Saudi Arabia’s industrial sector attracted investments worth SAR 70bn (USD 18.7bn) in Jan-Jul 2021. The number of industrial units totaled 10,166 in the country, with investments over SAR 3trn. In Jul alone, establishment of 48 new factories were approved, with a total investment of SAR 50bn.

- The vice minister for mining affairs in Saudi Arabia disclosed that mining investments are expected to surge by 150% in the next decade from the current SAR 170-180bn. The investment is likely to create upto 220k jobs.

- Saudi Arabia’s ICT sector is expected to grow at a compound annual rate of nearly 10% to exceed USD 27bn by 2025. Cloud services are expected to make up to 30% of the total ICT spend in the country by 2030. Various tech initiatives were launched last week, including a new program Hima, which supports innovation in enterprises with a value of SAR 5bn (USD 670mn). The nation aims to be among the top 5 globally in AI, creating almost 25k jobs in data science and AI before 2030.

- Start-up costs for commerce fees register in Saudi Arabia was reduced by 96% for companies and between 33-75% for enterprises for the first 5 years. SMEs will be exempt from commerce fees register for 3 years. Fees will start in the fourth and fifth year, but at a reduced rate of SAR 500 (USD 133) for entrepreneurs and SAR 200 for entrepreneurs with a capital of less than SAR 375k and whose employees do not exceed five.

- The contribution of sports to Saudi Arabia’s GDP grew to SAR 5bn in 2019 from SAR 2.4bn (USD 640mn) in 2016; this is expected to rise to SAR 18bn by 2030. Currently, SAR 11bn worth of major sports projects are being planned or under construction in the country.

- Saudi Arabia’s General Authority for Military Industries has identified 74 investment opportunities to which foreign and local firms are being invited to invest in. The number of licensed companies in Saudi Arabia’s military sector reportedly increased by 41% to 99 in H1 this year (85% were local firms).

UAE Focus![]()

- Abu Dhabi Securities Exchange announced that trading commissions would be halved to 0.025% starting Sep 1st. Separately, both ADX and DFM will extend trading hours by one hour from Oct 3rd. Both moves are aimed at increasing market activity and liquidity.

- The UAE’s Emirates Global Aluminium is planning to IPO in 2022, and likely to offer between 10-20% of its shares, reported Reuters. The company, one of the world’s largest aluminium producers, is valued between USD 16-19bn.

- Dubai will establish a specialized court within the Court of First Instance and Court of Appeal to focus on financial crimes including money laundering.

- Abu Dhabi DED identified 725 industrial activities eligible for full foreign ownership. Separately, in a bid towards self-sufficiency, the Abu Dhabi Industrial Development Bureau plans to add 50 industrial facilities over the next three years to manufacture locally basic commodities from food to medical supplies.

- The Fujairah Oil Terminal is investing an estimated USD 45mn to upgrade infrastructure by end-2022: this will see the terminal connected to the Port of Fujairah’s very large crude carrier (VLCC) loading facility and the Abu Dhabi Crude Oil Pipeline pipeline.

- The Mohammed bin Rashid Innovation Fund will support 24 new businesses (selected as part of the Fund’s accelerator programme) to expand operations and enter new markets. Of these 13 businesses are based in the UAE while the others have a presence in the country.

- The DIFC Courts revealed an 11% increase in volume of cases in H1 2021 in its main Court of First Instance, with its value totaling AED 2.8bn (+27% yoy). Virtual hearings have supported the Courts handling of rising claims, and 50% of claims originated from parties (not located within the centre) electing to use the DIFC courts to resolve disputes.

- Masdar City’s new business packages, with license fees that range from AED 1,000 to 12,000, is expected to attract more companies to set up in the free zone.

- Dubai schools’ regulator announced a return to 100% in-person learning from Oct 3rd, with a switch to online learning should positive cases be detected.

- UAE’s unvaccinated Federal employees are required to take a PCR test every 48 hours, according to the latest set of regulations. This is also required of consultants and experts visiting government buildings or attending meetings.

- All fully vaccinated (as per the WHO-approved list) tourists from across the world will be eligible to apply for UAE visit visas starting Aug 30th. The visitors will require a mandatory rapid PCR test at the airport and need to register on the Al Hosn app.

Media Review

Analysis: Leaderless Lebanon on slippery slope to mayhem (with Dr. Nasser Saidi’s comments)

https://www.reuters.com/world/middle-east/leaderless-lebanon-slippery-slope-mayhem-2021-08-23/

What are SDRs and how might Lebanon use them? L’Orient Today (with Dr. Nasser Saidi’s comments)

https://today.lorientlejour.com/article/1272940/what-are-sdrs-and-how-might-lebanon-use-them.html

Nemesis: Why the west was doomed to lose in Afghanistan

Rich countries want to strike trade deals in Africa

Is There a Nuclear Option for Stopping Climate Change?

https://www.nytimes.com/2021/08/26/opinion/climate-change-nuclear.html

The Arab League has done little for its members in nearly 70 years (with Dr. Nasser Saidi’s comments)

Central banks should not mandate ‘green’ investments: Raghuram Rajan

Powered by: