Markets

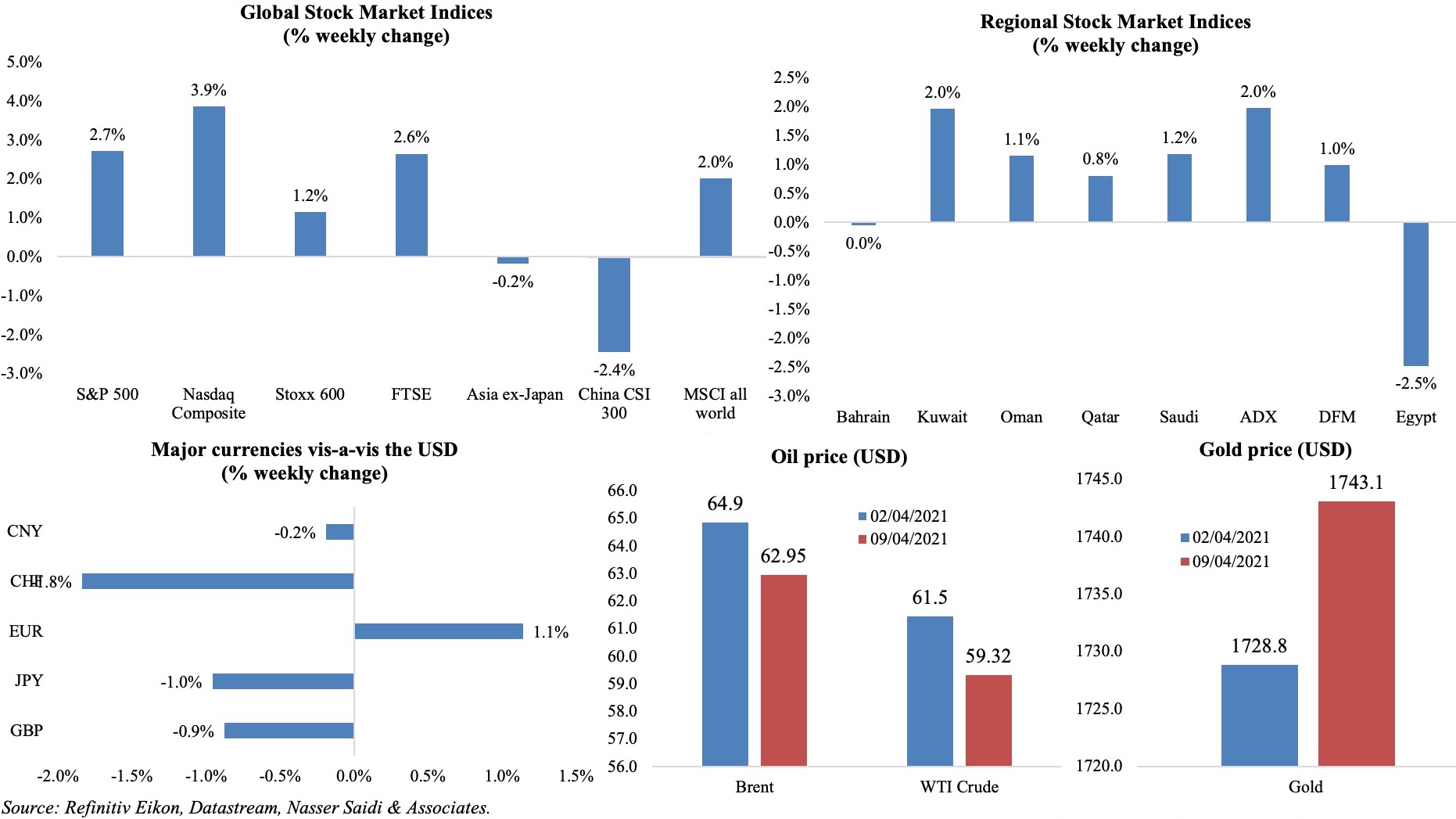

Another week of record-highs across equity markets: US indices weekly gains were thanks to upbeat economic data and dovish Fed’s commitment to support recovery; European markets gained despite the slow pace of vaccination while the FTSE100 posted the best weekly performance since early Jan as the country emerges out from lockdown. Among regional markets, Saudi Arabia’s Tadawul crossed the 10k-point for the first time since Nov 2014 last week and Abu Dhabi-based International Holdings Company was on a 13-day gaining streak (See Media Review) and Egypt fell on blue-chip sell-offs. The dollar retreated and had the worst week of the year; crude oil prices dropped, and gold price touched a 1-month peak last Thursday.

Weekly % changes for last week (8-9 Apr) from 1 Apr (regional) and 2 Apr (international).

Global Developments

US/Americas:

- Factory orders declined by 0.8% mom in Feb (Jan: 2.7%), likely a result of the winter storms that hit parts of the country in the second half of Feb. Orders for non-defense capital goods excluding aircraft, a proxy of business spending, fell 0.9% in Feb.

- Producer price index excluding food and energy increased by 3.1% yoy in Mar (Feb: 2.5%). The headline PPI grew by 4.2% yoy and 1% mom – the largest annual gain since Sep 2011.

- Trade deficit in the US widened to a record high of USD 71.1bn in Feb (Jan: USD 67.8bn). Exports dropped by 2.6% to USD 187.3bn, with declines in exports of consumer and capital goods as well as food and services (especially travel). Imports dipped by 0.7%, mostly due to supply-chain constraints though imports of capital goods hit a record high.

- ISM services PMI jumped to 63.7 in Mar (Feb: 55.3), thanks to the pickup in business activity (69.4 from 55.5 in Feb), new orders (67.2 from 51.9) and employment (57.1 from 52.7).

- Markit services and composite PMIs gained in Mar, rising to 60.4 and 59.7 respectively (Feb: 59.8 and 59.5). Within the services PMI, new businesses expanded the most in 6 years and job creation was the quickest in 3 months.

- Initial jobless claims unexpectedly increased to 744k in the week ended Apr 3, rising from the upwardly revised 728k the prior week, with the 4-week average edging higher to 723.75k. Continuing claims provided the silver lining: it fell to 3.734mn in the week ended Mar 27 compared to the previous week’s 3.75mn.

Europe:

- German factory orders grew by 1.2% mom in Feb (Jan: 0.8%), rising for the second consecutive month, supported by domestic orders (+4%). Orders from the EU nations were up by 2.7% though from the rest of the world dropped by 2.3%.

- Industrial production in Germany declined by 1.6% mom and 6.4% yoy in Feb (Jan: -2% mom and -4% yoy). While production of capital and intermediate goods declined by 3.2% and 1%, consumer goods nudged up by 0.2%.

- Exports from Germany increased by 0.9% mom and imports by 3.6% in Feb, shrinking the trade surplus to EUR 19.1bn (Jan: EUR 21.3bn). Exports to China increased by 25.7% yoy.

- Markit services PMI in Germany inched up to 51.5 in Mar (Feb: 50.8), with business activity rising for the first time in 6 months as lockdown restrictions were being lifted. Composite PMI ticked up by 0.5 points to 57.3, supported by a surge in manufacturing export orders while businesses’ expectations about future activity improved to a series-record high.

- In the eurozone, Markit composite PMI rose to 53.2 in Mar (Feb: 48.8) – the highest level since Jul 2020 – while services PMI stayed under-50 at 49.6, though rising from Feb’s 45.7 reading. Within composite PMI, growth was led by Germany while France was the only country to not record an expansion in activity.

- Sentix investor confidence in the Eurozone surged to 13.1 in Apr (Mar: 5) – the highest level since Aug 2018. An expectations index climbed to a record 34.8 from Mar’s 32.5, while the current situation index improved to -6.5 (Mar: -19.3).

- Unemployment rate in the eurozone remained steady at 8.3% in Feb while youth unemployment edged down to 17.3%. These are still higher compared to the pre-pandemic unemployment readings: 7.4% overall and 15.4% among youth.

- Markit services PMI in the UK jumped up sharply to 56.3 in Mar (Feb: 49.5), thanks to strong increases in output and incoming new work (ahead of easing lockdown measures).

Asia Pacific:

- Consumer price index in China rose to 0.4% yoy in Mar (Feb: -0.2%), as food prices fell to -0.7% (Feb: +0.2%) and non-food prices rose by 0.7%. Producer price index jumped by 4.4% yoy in Mar (Feb: 1.7%) – the most in 3 years – as producers passed on rising raw material prices.

- China’s Caixin services PMI ticked up to 54.3 in Mar (Feb: 51.5), as domestic demand strengthened, and new orders expanded the most since Dec 2020; export orders however fell for the 2nd straight month.

- Overall household spending in Japan slipped for a 3rd consecutive month, falling by 6.6% yoy in Feb (Jan: -6.1%). Major drivers of the decline were travel package tours, eating out and transportation. Separately, inflation-adjusted real wages rose for the first time in a year in Feb, largely due to prices weakening.

- The preliminary reading of Japan’s leading economic index for Feb grew to 99.7 in Feb (Jan: 98.5) – the highest reading since Jun 2018, given the launch of the vaccination program. However, the coincident index declined to 89 from 90.3 amid fears of another Covid19 wave.

- Current account surplus in Japan widened to JPY 2.9trn in Feb (Jan: JPY 644.4bn): goods trade resulted in a surplus JPY 2bn while services trade clocked in a deficit of JPY 75.7bn.

- The Reserve Bank of India left both its repo and reverse repo rates unchanged at the latest meeting. The apex bank stated that it would remain accommodative as long as necessary to sustain growth on a durable basis.

- PMI in manufacturing fell to a 7-month low of 55.4 in Mar (Feb: 57.5), with production, new orders and input buying expanding at softer rates. Services PMI in India fell to 54.6 in Mar (Feb: 55.3): though new orders expanded given improved domestic demand, external demand worsened, declining for the 13th straight month.

- Singapore retail sales expanded by 5.2% yoy in Feb, following a 6.1% drop in Jan, thanks to a boost from the Chinese New Year celebrations. Comparing Jan-Feb together, retail sales fell by 1.2% yoy.

- The official PMI in Singapore inched up by 0.3 points to 50.8 in Mar – the highest since Mar 2019.

Bottom line: Optimism is rife, as vaccination drives kick off even in Europe, after the AstraZeneca setback: France has inoculated 10mn persons and Italy aims to vaccinate about 80% of population by end-Sep. South Asia is still witnessing a new surge, resulting in partial lockdowns again. Are the IMF forecasts too optimistic too soon, given the multiple risk-factors? Our weekly insight report highlights the various risks: https://nassersaidi.com/2021/04/08/weekly-insights-8-apr-2021-risks-to-the-rosy-outlook-as-world-recovery-seemingly-accelerates/. Separately, global composite PMI rose to a 79-month high of 54.8 in Mar, with US leading the pack along with expansions in Germany, UK, India and Australia while price pressures continue to build (selling prices rose at the steepest pace since data gathering began in Oct 2009).

Regional Developments

- GDP in Bahrain declined by 5.51% yoy in Q4, thereby posting a drop in economic growth by 5.8% for the full year. In Q4, hospitality and transport sectors accounted for the sharpest declines, falling by 42% and 30.8% yoy respectively.

- Bahrain declared its backing for the UAE’s bid for UN Security Council membership for the period 2022-23. The next elections are scheduled for Jun 2021.

- Drilling in Bahrain’s new offshore shale oil discovery is expected to start at the end of 2022, according to the oil minister. The field is estimated to house at least 80bn barrels of tight shale oil.

- In a bid to boost vaccination rates, Bahrain has announced that cinemas, spas and swimming pools will permit entry to all vaccinated persons during Eid.

- PMI in Egypt fell for the 4th straight month, with a reading of 48 in Mar (Feb: 49.3) – the lowest since Jun 2020- after weak market demand and Covid19 restrictions resulted in faster reductions in output and new orders; export orders dropped below-50 (48.6 vs Feb’s 56.3) and employment shrunk further (48.9 vs 49.3 in Feb).

- The IMF expects Egypt to grow at 2.5% yoy this year (down from its previous forecast of 2.8%) and then strengthen further in 2022, growing at 5.7%. Separately, the finance minister revealed that economic growth could touch 2.8% in the financial year ending Jun.

- Annual urban inflation in Egypt stood at 4.5% yoy in Mar, unchanged from Feb; core inflation however increased to 3.7% yoy (Feb: 3.65%).

- Net foreign reserves in Egypt increased to USD 40.337bn in Mar from USD 40.201bn the month before, according to central bank data. Net foreign assets increased by 18.5% mom to EGP 325.514bn in Feb.

- Egypt’s trade deficit narrowed by 17.9% yoy to USD 3.15bn in Jan 2021. Exports declined by 8.4% to USD 2.5bn, driven down by the prices of oil and oil products as well as clothes and food products. Imports declined by 13.9% to USD 5.65bn, with commodities like cars and iron and steel posting 14.1% and 3.7% falls.

- The food sector in Egypt, which contributes 24.5% to GDP and accounts for 23.2% of overall employment, accounted for 22% of total exports in 2020, stated the minister of trade.

- The tourism sector in Egypt likely lost between USD 12-13bn in revenues last year, according to the Treasurer of the Cultural Tourism Association.

- Following the 1-ship Suez Canal blockage, the Authority is considering improvements in services: including an expansion of the southern section of the waterway as well as procuring cranes that could unload cargo at heights of up to 52mn, it was disclosed in a Reuters interview.

- Egypt plans to borrow EGP 642.5bn (USD 40bn) from the local market in Q2 2021, reported Daily News Egypt.

- Egypt plans to produce up to 80mn doses of the Covid19 vaccine domestically, as per an agreement with China’s Sinovac Biotech Ltd.

- UAE plans to invest USD 3bn in Iraq, in a bid to strengthen the existing economic and investment ties between the two nations. Furthermore, Iraqi Airways plans to start direct flights to UAE’s capital Abu Dhabi on May 1.

- Jordan’s tax burden totaled 24.4% of personal income in 2020, revealed the finance minister. Last year, sales tax revenues stood at JOD 3.533bn and income tax at JOD 1.138bn.

- Last week around 20 persons were detained in Jordan, including Prince Hamzeh and former ministers, accused of attempting to jeopardise the safety and stability of Jordan. Many Arab states, including the GCC nations, Lebanon, Egypt and others expressed solidarity with the King while the US vouched its “full support”.

- Kuwait’s central bank governor stated that the country will see “positive growth” this year, though cautioning that it will “take time” for pre-pandemic levels to be achieved. He highlighted the resilience of the banking sector, with coverage and net stable funding ratios reaching 184.2% and 114.3% respectively at end-2020 (vs the 100% required benchmark).

- The May official selling price for Kuwait Export Crude was raised by 45 cents to USD 1.35 per barrel above the average of DME Oman and Platts Dubai quotes for Asian refiners.

- Lebanon PMI touched a 17-month high of 46.4 in Mar (Feb: 42.2), with rate of decline in new orders slowest since Oct 2019. However, cost burdens remain severe: rate of inflation accelerated to quickest since Jun 2020 and was the 5th-fastest since records began (May 2013).

- France and the EU are developing proposals for a sanctions regime including asset freezes and travel bans on Lebanese politicians to nudge them to agree upon a new government.

- Reuters reported that foreign lenders including HSBC and Wells Fargo were cutting ties with Lebanon’s central bank; other lenders have reduced activities like cross border payments and letters of credit.

- According to the Ministry of Finance, Lebanon’s central bank agreed to provide documents required by Alvarez & Marsal to conduct a forensic audit by end of this month.

- Oman’s finance ministry disclosed that, to partly finance its 2021 budget, OMR 600mn (USD 1.56bn) had been borrowed from its sovereign fund (Oman Investment Authority) and another OMR 1.77bn via external and internal borrowings. Together, it accounts for 56% of the OMR 2bn worth of financing required this year.

- VAT comes into force in Oman from Apr 16 onwards: the number of food commodities exempted from VAT has been raised to 488 from 93 earlier, reported the Oman News Agency. It was also clarified that rentals earned on residential properties will not be subject to VAT. Furthermore, level of subsidies on fuel, electricity and water consumption for families receiving government financial support will be raised.

- Oman Investment Authority established a management board for the securities market ahead of transforming the bourse into a closed shareholding company. Two women were appointed to the 7-member board, in a bid to improve gender diversity.

- PMI in Qatar increased to 54.9 in Mar (Feb: 53.2), the 4th-highest reading ever, thanks to upticks in output and new work. Sector-wise, manufacturing was the best performer (58), followed by wholesale & retail (56.0), services (53.5) and construction (52.9) respectively.

- Startups in MENA raised USD 170mn in March (up 6% mom) from 43 deals, according to Wamda. This brings the Q1 figure to USD 396mn from 125 deals, with UAE, Egypt and Saudi Arabia accounting for bulk of the startup and investment activity.

- Optimistic business executives in EY’s latest Global Capital Confidence Barometer: 81% of MENA executives anticipate growth and investment opportunities in the Middle East, 71% and 69% of survey respondents expect to see revenues and profitability return to pre-pandemic levels by 2022 or earlier.

Saudi Arabia Focus

- Saudi Arabia’s PMI slipped to 53.3 in Mar (Feb: 53.9), bringing the Q1 average to 54.8 – still the highest since end-2019. New orders sub-index fell to the lowest since last Oct, while employment numbers held steady. Respondents were the least optimistic in the current nine-month sequence of positivity.

- Saudi Tadawul transformed into a holding company (named Saudi Tadawul Group) ahead of its IPO this year, and will consist of 4 subsidiaries: the Saudi Exchange, a dedicated stock exchange business (previously known as Tadawul), the Securities Clearing Center Company (Muqassa), the Securities Depository Center Company (Edaa), and Wamid, a new innovative applied technology services business.

- More than 850 firms have applied to join the “Made in Saudi” program, revealed the Secretary General of Saudi Exports.

- Aramco agreed a USD 4bn leaseback deal with a consortium led by EIG Global Energy Partners. A newly formed unit called Aramco Oil Pipelines Company, of which Aramco holds the 51% majority stake, will lease usage rights in Aramco’s stabilized crude oil pipelines network for a 25-year period.

- The General Authority for Competition in Saudi Arabia approved 22 applications for corporate acquisitions in Q1 2021. Manufacturing and the mining and quarrying sector were the most active.

- While 129k expats left Saudi Arabia during the last year, about 74k Saudi nationals joined the workforce. Expat workers fell by 2% yoy to 6.35mn at the end of 2021.

- Saudi Arabia implemented its new minimum wage of SAR 4000 per month (USD 1066) for Saudi workers over the age of 50. Any such worker being paid less than the minimum wage will count only as 0.5 worker under the nationalization program.

- New labour directives mandate that only Saudi nationals can be hired in the shopping malls: this would mean jobs for around 51k Saudis. Some roles will be exempt, though these were not specified.

- The PIF launched the Sudair Solar Energy project in Sudair Industrial City, one of the largest solar parks in the country. About SAR 3.4bn (USD 907mn) will be invested in the 1.5 GW solar PV project, and the first phase is expected to produce electricity in H2 2022. Separately, a report by Riyadh Chamber revealed that the National Renewable Energy Program is targeting SAR 60bn (USD 9bn) worth of project investments.

- Privatization of Saudi Arabia’s Third Milling Company from Saudi Grains Organisation (SAGO) and the National Center for Privatization and PPP (NCP) has been completed.

- Saudi Arabia’s Ministry of Hajj and Umrah announced that only vaccinated pilgrims and worshippers or those who have recovered from Covid19 will be allowed into the Grand Mosque in Makkah (contrary to a previous announcement).

- The total number of Saudis working in the tourism sector (around 189k persons) account for around 26% of the total workforce in the sector.

UAE Focus![]()

- UAE PMI edged up by 2 points to 52.6 in Mar, thanks to the fast pace of vaccination boosting business confidence and spending. Meanwhile, input price inflation ticked higher given rising raw material prices and shipping fees amid global delivery delays.

- The IMF expects UAE to grow by 3.1% this year, following last year’s 5.9% drop, though GDP growth is forecast soften to 2.6% in 2022.

- Abu Dhabi expects its economy to grow by 6% to 8% in the next 2 years, supported by government spending, FDI and the oil sector, according to the Chairman of the Abu Dhabi Department of Economic Development.

- Dubai’s foreign trade touched AED 1.182trn in 2020, strongly rebounding in H2: exports grew by 8% to AED 167bn while imports and re-exports stood at AED 686bn and AED 329bn respectively. China remained Dubai’s largest trading partner in 2020 with AED 142bn worth of trade, followed by India with AED 89bn, and the US with AED

- The Emirates Development Bank will provide AED 30bn in financial support to businesses and start-ups in aid of the recently announced “Operation 300bn” program.

- Effective 21st April, UAE central bank will introduce a new liquidity management facility to provide eligible counterparties access to AED funding on an intraday basis.

- The UAE central bank issued a Small to Medium Sized Enterprises Market Conduct Regulation to promote best practices among licensed financial institutions (LFIs) when engaging with SMEs. This regulation sets standards of market conduct of LFIs, strengthens governance over the design, promotion and sale of financial products and services, and promotes responsible financing practices and appropriate disclosure of risks.

- Dubai government entities awarded AED 5mn worth of contracts to Dubai SME members in 2020, with the RTA topping the list. As part of the Government Procurement Programme, SMEs were supported with contracts from 61 local and federal government entities and other firms worth AED 896mn in 2020.

- Reuters reported that ADNOC is considering a listing of its drilling business on the local stock exchange. Sources suggest that the IPO size could be more than USD 1bn, and could happen this year itself.

- UAE posted the second highest hotel occupancy rate (54.7%) globally for 2020, behind China’s 58%: the country hosted 14.8mn guests who spent an average of 3.7 nights at 1,089 establishments last year. Global occupancy rate was 37% and that in the Middle East 43%, according to the World Tourism Organisation and the Emirates Tourism Council.

Media Review

IMF: An Asynchronous and Divergent Recovery May Put Financial Stability at Risk

https://blogs.imf.org/2021/04/06/an-asynchronous-and-divergent-recovery-may-put-financial-stability-at-risk/

The Economic Effects of Social Networks | NBER

https://www.nber.org/reporter/2021number1/economic-effects-social-networks

Bill Hwang Had USD 20bn, Then Lost It All in Two Days

https://www.bloomberg.com/news/features/2021-04-08/how-bill-hwang-of-archegos-capital-lost-20-billion-in-two-days

Virtual meetings are here to stay

https://www.economist.com/international/2021/04/10/love-them-or-hate-them-virtual-meetings-are-here-to-stay

The Challenge of Big Tech Finance

https://www.project-syndicate.org/commentary/regulatory-challenges-of-big-tech-finance-by-barry-eichengreen-2021-04

Chile’s lauded vaccine rollout & Covid surge

https://www.theguardian.com/world/2021/apr/06/israel-and-chile-both-led-on-covid-jabs-so-why-is-one-back-in-lockdown

https://www.ft.com/content/89992bc9-051a-42b5-8be0-60edad4165cb

The UAE stock that is up 70% in 3 weeks and nobody knows why

https://www.bloomberg.com/news/articles/2021-04-07/the-uae-stock-that-s-up-70-in-three-weeks-and-nobody-knows-why