Download a PDF copy of the weekly economic commentary here.

Markets

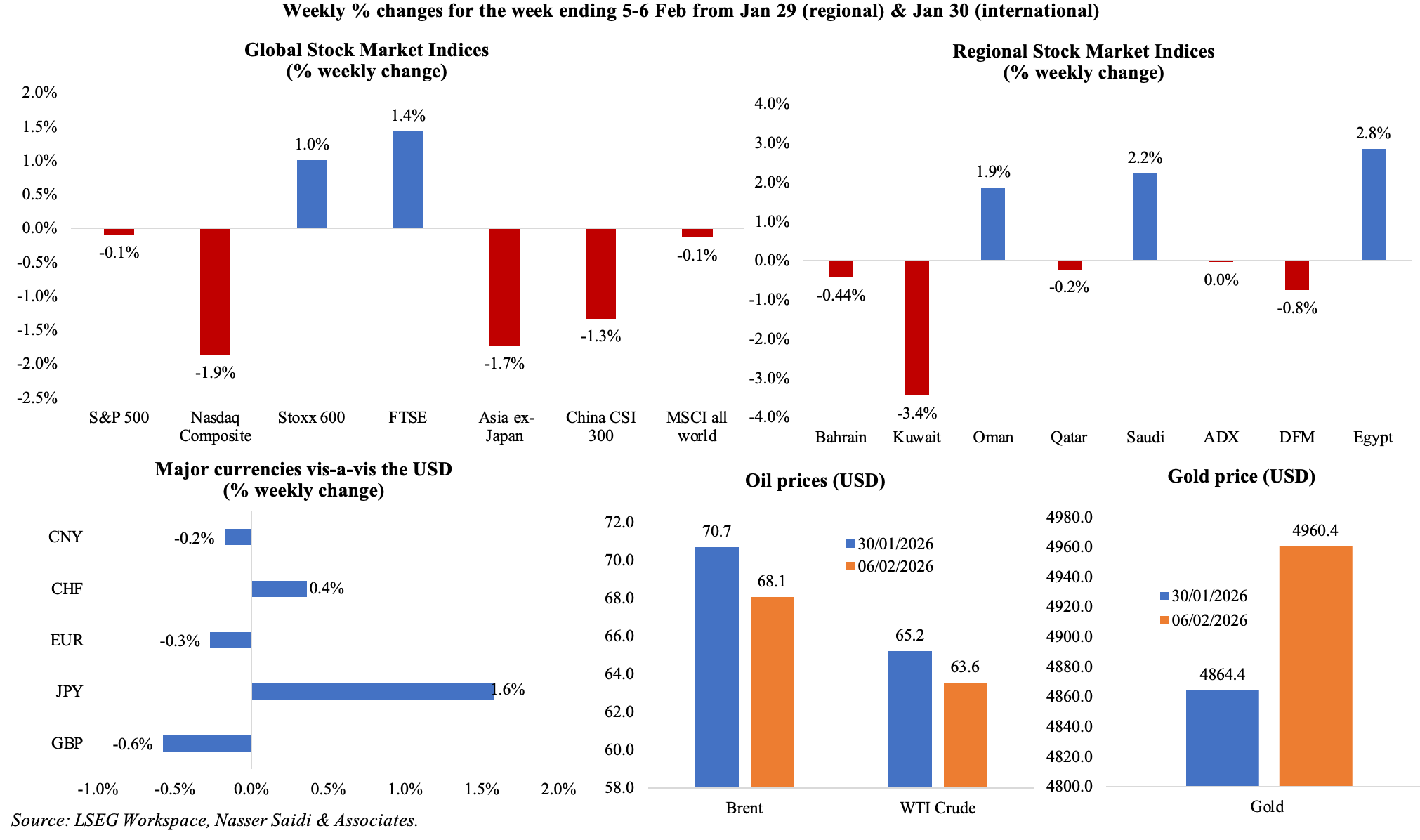

Global equities markets ended mostly in the red last week, including the MSCI index of global. Stocks, on renewed concerns over AI spend and despite some recovery seen towards end of the week (e.g. DJIA posted a record closing high and its first above the 50,000 mark). Regional markets were mixed, with many affected by oil price fluctuations: Saudi saw some profit-taking while multi-year highs were reached in Dubai (highest since 2006) and Abu Dhabi (a 3-year high) indices during the week. The dollar strengthened versus the yen ahead of the elections (which Prime Minister Takaichi won on Monday). Oil prices fell for the week (given broader market selloff and concerns about oversupply) though settled higher by end of the week on potential cooling of US-Iran conflict woes, while gold price rose building on its safe haven status.

Global Developments

US/Americas:

- US private sector payrolls increased by 22k in Jan (Dec: 37k), thanks to the hiring in education and health services (+74k). ADP also revised full year 2025 numbers downwards: private employers added 398k jobs during the year, down from 771k in 2024.

- JOLTS job openings slipped to 6.542mn in Dec (Nov: 6.928mn), the lowest since Sep 2020, and there were almost 1mn more unemployed people at end-2025 than there were available jobs for them – the widest such gap (excluding the pandemic) since 2017. There were 87 job openings for every unemployed person in Dec much below the pre-pandemic high of 1.24.

- Initial jobless claims increased by 22k to 231k in the week ended Jan 31, with the 4-week average inching up by 6k to 212.25k. Continuing jobless claims jumped by 38k to 1.827mn in the week ended Jan 24.

- Michigan consumer sentiment index rose to a 6-month high of 57.3 in Feb (Jan: 56.4), improving for the third month in a row. The one-year inflation expectation slipped to a 13-month low of 3.5% (Jan: 4%) while the five-year expectation ticked up to 3.4% (3.3%).

- S&P Global manufacturing PMI in the US rose to 52.4 in Jan (Dec: 51.8), thanks to output growth rising the most since May 2022 alongside an increase in new orders while exports fell for the seventh month in a row. Services PMI moved up to 52.7 in Jan (Dec: 52.5), with financial and business service providers more resilient than other sub-sectors.

- ISM manufacturing PMI increased to 52.6 in Jan (Dec: 47.9), expanding for the first time in a year, and the most since 2022. This was largely due to growth in new orders (57.1 from 47.4), employment (48.1 from 44.8) and production (55.9 from 50.7); prices paid stood at 59 (little changed from Dec’s 58.5).

- ISM services PMI stood unchanged at 53.8 in Jan, with the rise in production (57.4 from Dec’s 55.2) offset by slight declines in new orders (53.1 from 56.5) and employment (503 from 51.7) while prices paid rose (66.6 from 65.1).

Europe:

- Inflation in the eurozone eased to 1.7% in Jan (Dec: 1.9%), the lowest since Sep 2024 and below the ECB’s target 2.0%. Core CPI eased to 2.2% (Dec: 2.3%), the lowest reading since Oct 2021. Services clocked in the highest annual rate (3.2% from 3.4%), food, alcohol and tobacco accelerated slightly to 2.7% while energy prices plunged (-4.1% from -1.9%).

- Manufacturing PMI in the eurozone ticked up to 49.5 in Jan (Dec: 48.8), thanks to an expansionary reading in output (50.5 from 48.9) while input prices accelerated to a 3-year high. French PMI surged to a 43-month high but additional gains in Greece and Netherlands (54.2 and 50.1) were more than dragged down by contractions in Germany, Italy and Austria.

- Producer price index in the euro area declined by 0.3% mom and 2.1% yoy in Dec (Nov: 0.7% mom and -1.4% yoy). This was the fifth consecutive yoy decline, as energy prices plunged (-8.8% yoy from -6.5%).

- Exports from Germany grew by 4% mom in Dec (Nov: -2.5%), thanks to increase in shipments to the US (8.9%) and China (10.7%), while imports rose 1.4% (Nov: 0.7%). Trade surplus widened to EUR 17.1bn in Dec (Nov: EUR 13.6bn). For the full year 2025, exports grew by 1.0% yoy, slower than imports which were up by 4.4%.

- German industrial production slumped in Dec, down by 0.6% mom and 1.9% yoy, largely due to weaker production in the automotive (-8.9%), manufacture of machinery & equipment (-6.8%) and machine maintenance & assembly (-17.6%).

- In contrast, German factory orders surged 7.8% mom in Dec (Nov: 5.7%), the biggest increase in two years. Orders were propped up by large-scale orders: fabricated metal products (30.2%) and machinery & equipment (11.5%). Excluding these, new orders were 0.9% higher.

- German manufacturing PMI inched up to 49.1 in Jan (Dec: 48.7), as output levels returned to above 50 alongside a rise in new orders while new exports stayed in contraction and input cost inflation rose to a 37-month high. Services PMI slipped to 52.4 (from 53.3), as employment fell at joint-fastest rate since June 2020, and despite new export business moving to growth for the first time in 1.5 years in Dec.

- Retail sales in Germany rebounded in Dec, up 0.1% mom (Nov: -0.5%). In yoy terms, sales grew by 1.5% (Nov: 1.3%). Retail sales in the eurozone fell by 0.5% mom in Dec (Nov: 0.1%), with non-food sales leading the decline. France, Spain and Italy reported monthly declines in sales (-1.4%, -0.9%, -0.5%) whereas Germany posted a modest increase (0.1%).

- The Bank of England held interest rates unchanged at 3.75%, following a cut in Dec: however, the vote was quite divided to a majority of 5-4 indicating that more cuts are. The governor stated that inflation is expected to hit the 2% target a year earlier than expected while MPC forecasts GDP to grow by 0.9% this year (down from 1.2% expected three months ago).

- UK manufacturing PMI jumped to a 17-month high of 51.8 in Jan (Dec: 51.6), thanks to an acceleration in output and order book growth while new export orders rose for the first time in 4 years. Business optimism jumped to the highest since before the 2024 Autumn budget.

Asia Pacific:

- China’s manufacturing PMI ticked up to 50.3 in Jan (Dec: 50.1), supported by higher new orders and new export orders while selling prices rose for the first time since Nov 2024; business sentiment weakened to a 9-month low. Services PMI inched up to 52.3 (from 52.0), supported by sustained inflows of new business and with staffing levels rising for the first time in six months.

- Overall household spending in Japan fell by 2.6% yoy in Dec (Nov: 2.9%). In 2025, monthly spending ticked up by 0.9%, the first rise in three years and the ratio of household spending on food hit a 44-year high of 28.6% – reflecting elevated food prices.

- Japan’s leading economic index rose to 110.2 in Dec (Nov: 109.9), the highest reading since May 2024, while cost pressures eased to the lowest level since Mar 2022. Coincident index meanwhile declined to a 4-month low of 114.5 (from 114.9).

- Japan manufacturing PMI moved up to 51.5 in Jan (Dec: 50), clocking in the quickest improvement since Aug 2022, supported by new orders (expanding for the first time since May 2023), export orders (rising for the first time since Feb 2022) and employment (“the rate of job creation…most pronounced in 40 months”). However, input costs rose at the quickest pace in nearly a year and selling price inflation hit a 19-month high.

- India and the US reached an interim deal: Trump announced that duties on Indian exports would be cut to 18% from 50% in exchange for India stopping purchases of Russian oil and lowering trade barriers. Additionally, India announced it will slash tariffs on high-end American cars to 30% from as high as 110% (EVs are excluded) and eliminate duties on Harley-Davidson bikes.

- The Reserve Bank of India left repo rates unchanged at 5.25% while reverse repo stayed at 3.35%. Inflation projection for the current fiscal year was revised upwards to 2.1% and Q1 and Q2 of the next financial year, mainly due to higher prices of precious metals.

- Manufacturing PMI in India rose to 55.4 in Jan (Dec: 55.0), supported by domestic demand drive increase in output and new orders and employment ticking up to a 3-month high. However, business confidence fell to a 3.5-year low, with only 15% of firms expecting output growth over the year.

- Retail sales in Singapore grew by 2.7% yoy in Dec (Nov: 6.2%), with more than half of industries recording higher sales including recreational goods (13.4% yoy, highest in Dec) and the computer & telecommunications equipment industry (12.8%).

Bottom line: While AI investments and geopolitics dominate investor concerns, businesses are seemingly adjusting to the new abnormal. S&P’s global manufacturing PMI ticked up to a 3-month high of 50.9 in Jan, and the encouraging datapoint was the “rise in the numbers of economies reporting higher production”. However, the steady increase in industrial input prices is causing overall input and output costs to rise to 3-year highs, while central banks are pausing policy rate cuts; ongoing threats of further US tariff hikes are not helping, and confidence hence remains well below its long run average.

Regional Developments

- US President Trump signed an executive order authorizing potential tariffs (up to 25%) on countries that “directly or indirectly” trade with Iran.The measure formalizes a “maximum pressure” economic strategy, signalling a tougher stance with nations engaging with Iran. China (USD 14.5bn), Iraq (USD 10.5bn), UAE (USD 7.5bn) and Turkey (USD 7.3bn) were top trade partners of Iran during the period Jan-Oct 2025, according to official statistics; Oman also fell within the top 10 (USD 1.8bn). If implemented, these tariffs could incentivize diversification of trading partners away from Iran and accelerate shifts toward non-US markets, potentially reshaping trade networks in the Middle East and Asia. While the US tariff threat introduces uncertainty, Iran’s major diversified export partners (China, UAE, Turkey) are likely well-positioned to absorb the shock by switching suppliers. The pain will be felt primarily by Iran (revenue loss, isolation, inflationary impact) and Iraq (energy security crisis).

- Iran and the US resumed high-stakes indirect talks in Oman primarily centred around Iran’s nuclear programme.Prolonged uncertainty around these negotiations (that were off to a “good start”, according to Iran) will keep risk premiums elevated for energy markets and investment decisions across the region.

- Bahrain’s non-oil exports of national origin grew by 5.0% yoy to BHD 1.047bn in Q4 2025, driven by products such as unwrought aluminum alloys (29% of total) and other industrial goods.Saudi Arabia, UAE, and US accounted for the largest shares of non-oil domestic exports (together a share of 42.2%), while overall non-oil imports also expanded (9% yoy to BHD 1.628bn), leaving the trade deficit wider (BHD 355mn from BHD 277mn in Q4 2024).

- PMI in Egypt edged down to 49.8 in Jan (Dec: 50.2), despite output expanding for a third straight month.Data point to slower new orders and easing domestic demand, though overall activity remains above its long-run average. Easing cost pressures contributed to the first drop in prices charged in 5.5 years.

- Egypt’s record-high engineering exports stood at USD 6.5bn in 2025, up 13% yoy, with Saudi Arabia, UK, Turkey and UAE were top destination markets. This reflects growing competitiveness in Egypt’s manufacturing and value-added industrial goods alongside project expansions and export campaigns.

- Egypt aims to raise USD 2bn from international bonds by end-Jun, disclosed the finance minister, to support government spending and external financing needs. The government aims to lower external debt by USD 1-2bn annually by diversifying its funding sources and is also planning to issue retail bonds for individual investors (no timeline was given).

- The World Bank’s International Finance Corporation (IFC) plans to invest USD 1.2bn in Egypt during 2025-26, nearly 10% above last year’s level.These investments target infrastructure, renewable energy and transport projects (accounting for 32% of total) in addition to finance (accounting for the largest share of 47%) – bolstering structural development priorities. IFC’s investment in Egypt was USD 6.5bn over the past seven years.

- Egypt and Turkiye aim to increase trade volume to USD 15bn by 2028 (from around USD 9bn currently), with industrial exports and manufacturing cooperation as core drivers. Cooperation will also extend to the energy and transportation sectors.

- Kuwait’s PMI remained in robust expansion territory, though easing to 53 in Jan (Dec: 54), as output and new orders grew albeit at a slower pace.

- Trade surplus in Kuwait narrowed by nearly 29% yoy to KWD 6.6bn in Jan-Sep 2025, as exports softened (-8.0% to KWD 16.2bn, dragged down by oil exports) and imports rose (+12.5% to KWD 9.5bn).This underscores vulnerabilities in Kuwait’s export revenues amid lower oil volumes and highlights the limits of current diversification efforts.

- Kuwait Oil Company (KOC) is engaging with US energy operators (such as Devon Energy and EOG) to develop its shale oil and shale gas resources: this is a first for Kuwait’s energy strategy as it seeks to explore unconventional oil and gas opportunities, leveraging technological advances and lower costs.

- Oman’s OQ Group and Kuwait Petroleum International (KPI) have signed an agreement to advance a major petrochemical venture in Duqm, even after the withdrawal of Saudi partner Sabic, reinforcing bilateral industrial cooperation. The project will utilise feedstock from the Duqm Refinery (including liquefied petroleum gas, naphtha and natural gas) to produce downstream chemicals, positioning the Duqm SEZ as a regional processing hub.

- Oman’s budget deficit was smaller than expected in 2025: at OMR 480mn, it was 23% below the official forecast as total revenues (OMR 11.76bn, up by about 5% versus budget forecast) outpaced spending. The tax authority reported tax revenues growing strongly – OMR 1.373bn in 2025, with number of tax returns filed up 37% to 353k – underscoring the effectiveness of broadening the revenue base beyond hydrocarbons. The authority also flagged a continuing compliance drive for 2026, to tighten enforcement and boost collection efficiency, a key component of revenue reform.

- The Oman Investment Authority (OIA) outlined plans to divest stakes in up to 30 companies, allowing to unlock government capital and improve state asset efficiency while supporting Vision 2040 objectives. By monetising select holdings, about five to six per year, the OIA aims to deepen capital markets and redirect resources towards capital investments that support economic diversification.

- Qatar’s PMI ticked up to 50.4 in Jan (Dec: 50), showing modest improvement despite weak underlying demand.

- Qatar’s foreign reserves ticked up to USD 71.95bn in Jan, underpinned by increased gold holdings and stable balances with foreign banks even as investments in foreign treasury bonds declined (fell by 9% mom to USD 30.1bn, the lowest in 5 years). Qatar’s gold holdings surged 12.8% mom to a high of USD 18.13bn.

- Qatar Investment Authority announced plans to invest in five additional VC funds as part of an expanded USD 3bn “Fund of Funds” programme, aiming to attract international fund managers and build Doha into a hub for global venture capital and entrepreneurial activity.

- QatarEnergy secured landmark long-term LNG supply agreements: a 27-year, 3 million-ton per year deal with Japan’s JERA and a 20-year, 2 million-ton supply pact with Malaysia’s Petronas. Qatar’s North Field expansion, which will raise LNG output capacity to over 120 mtpa by 2027, will strengthen Qatar’s role as a cornerstone supplier and these agreements will boost the country’s foothold in key Asian energy markets.

- India and the GCC formally agreed to launch negotiations for a comprehensive free trade agreement, marking a pivotal step toward deeper economic integration. This initiative builds on existing bilateral trade agreements (e.g., India-UAE CEPA) and strategically positions India (one of the GCC’s largest trading partners) to benefit from reduced tariffs and expanded services and investment linkages.

- MENA IPO activity was strong in Q4 2025, according to EY’s MENA IPO Eye: 10 IPOs raised USD 1.7bn during the quarter and Saudi Arabia led listings and attracted robust investor interest across sectors (6 IPOs raising USD 561.6mn).

- Bloomberg reported that Saudi and UAE firms are set to receive copper shipments from the Democratic Republic of Congo, reflecting Gulf strategic interests in securing key industrial metals critical to energy transition and electrification supply chains.

- Work is underway to interconnect the UAE and Oman’s electricity networks as part of the USD 700mn GCC-linked power grid project, aiming to enhance regional energy security, grid flexibility and support integration of renewable energy into the GCC grids.

Saudi Arabia Focus

- Saudi Arabia’s non-oil private sector activity moderated to a 6-month low in Jan, with the PMI down to3 (Dec: 57.4). Though business activity was underpinned by strong demand and new orders inched up (61.9 from 61.8), employment growth softened (to the slowest in a year) and input cost pressures rose.

- Saudi Arabia’s USD 8bn NEOM Green Hydrogen complex is reported to be around 80–90% complete, with production expected to begin mid-2027. AGBI reported that negotiations on a major ammonia export deal are in its final stages. This investment will be powered by up to 4GW of solar and wind generation to produce roughly 600 tonnes of green hydrogen daily.

- Saudi Arabia and Syria signed a framework agreement to launch 45 development initiatives covering critical sectors such as aviation (two airports and a new carrier Flynas Syria), telecoms (USD 1bn telecom project SilkLink aimed at boosting digital connectivity), real estate and infrastructure (including Aleppo’s airport infrastructure), signalling Saudi’s intent to play a leading economic role in the country’s recovery process. Earlier in the week, the Saudi invest authority head, revealed that majority of the planned investments would take the form of ready-to-implement contracts (as opposed to non-binding MoUs). These projects could result in Syria’s reintegration into regional markets, but will depend on political stability, effective project execution and sustained investor confidence.

- Saudi Arabia will invest roughly USD 2bn to build two large-scale solar farms in Turkey: work is expected to start in 2027 and generate enough electricity for over 2.1mn households once operational (by 2029). This cross-border clean energy cooperation reflects a shift towards low-carbon infrastructure as a pillar of regional economic integration.

- The Saudi Fund for Development will provide USD 40mn towards the construction an industrial city in Oman, expected to boost industry and logistics. This financing reflects deepening bilateral cooperation and will support bilateral trade and economic diversification.

- Saudi Arabia’s Capital Market Authority is reviewing existing foreign ownership restrictions on listed equities, with discussions under way to potentially raise (or even fully remove) the 49% foreign-ownership limit currently applied. This initiative follows recent broad market liberalisation measures, including permission for non-resident investors (individuals and institutions) to trade directly on the exchange. Financial institutions estimate that lifting the cap could channel USD 10bn+ of new foreign capital into the market, strengthening liquidity and depth.

UAE Focus

- UAE PMI increased to an 11-month high of 54.9 in Jan (Dec: 54.2), driven by a sharp increase in new orders (to 60 from 57.2 – the fastest pace in 22 months) and a surge in output and purchasing surged given robust demand. However, input cost inflation reached an 18-month high amid competitive pricing that limited selling price increases. Dubai PMI also jumped to 55.9 in Jan (Dec: 54.3) and witnessed new business growth (at a 22-month high) as well as uptick in employment.

- Dubai’s economy grew by 5.3% yoy (to AED 113.8bn) in Q3 and 4.7% (to AED 355bn) in Jan-Sep 2025 underpinned by broad-based expansion across health & social work (15.4% yoy in Jan-Sep), finance (8.5%), construction (8.5%), real estate (6.7%) and trade (4.6%) sectors. Gains in tourism and international visitors also supported the accommodation and food services segments, reinforcing Dubai’s role as a global hub.

- UAE signed Comprehensive Economic Partnership Agreements (CEPAs) with Sierra Leone and the Democratic Republic of the Congo last week, aiming to strengthen bilateral trade ties, reduce tariffs, and enhance investment in strategic sectors such as mining, agriculture and clean energy. The UAE–Vietnam CEPA entered into force, reducing tariffs and enhancing regulatory predictability for businesses trading between the two markets, covering close to 99% of export values in both directions. Separately, negotiations with Japan on a CEPA has reached its final stages, disclosed UAE’s minister of foreign trade; negotiations with the EU and Ecuador were also progressing well.

- UAE and Armenia signed a Services Trade & Investment Agreement: UAE was the largest foreign investor in Armenia and bilateral non-oil trade touched a record USD 4.5bn in 2025.

- Non-oil trade between the UAE and Kuwait grew 9.1% yoy to AED 54.5bn (USD 14.8bn) in 2025, underscoring the role of intra-GCC commerce as a driver of regional diversification. Trade growth complements rising UAE-Kuwait investment activity: bilateral investment stood at over USD 10bn in 2024 (60%+). Separately, Kuwait invested an estimated AED 1.049bn in Sharjah in 2025, highlighting growing cross-border private direct investment within the GCC outside oil-dominant sectors; number of properties owned by Kuwaitis reached 5,660.

- DIFC reported a nearly 40% surge in new company registrations to 1,525 in 2025, driven by firms including hedge funds, a sign of strong global appetite for the DIFC’s financial ecosystem. The total number of active registered firms grew 28% yoy to around 8,840 in 2025 and includes 557 wealth and asset management firms. The DIFC’s governor also stated that the DIFC achieved a net profit of around USD 400mn.

- The Ras Al Khaimah Economic Zone also reported robust performance in 2025, attracting about 19k new companies, up 24% yoy, and taking the total number of firms to over 40k. Growth was broad-based, with services-related licences accounting for 40% of new company registrations, followed by commercial and trading licences (33%) and e-commerce (17%).

- Abu Dhabi’s AD Ports Group signed a30-year concession to manage and operate Jordan’s Aqaba Port, taking a 70% stake in a joint venture with the Aqaba Development Corporation and committing AED 141mn of capital. The port handles about 80% of Jordan’s exports and 65% of its imports, making it a vital gateway for trade to neighbouring markets including Saudi Arabia and Iraq; this venture will strengthen regional connectivity, enhancing Jordan’s role in Red Sea trade corridors.

- ADNOC is planning to issue its first Chinese yuan-denominated “dim sum” bond, potentially raising up to RMB 14bn(USD 2bn) in offshore markets, reported Bloomberg. This move would tap deepening financial ties with China and diversify credit markets beyond traditional dollar-based issuance.

- Greenfield FDI into the UAE surged 78% yoy to USD 33.2bn in 2025; India emerged as the largest source of capital, contributing approximately USD 12.6bn across 275 projects — anchored by a USD 10bn smart manufacturing investment for EVs in Ras Al Khaimah. The UAE ranked 10th globally for greenfield capital inflows and second by project count, underscoring its continued attractiveness as a base for new productive investment.

Media Review:

Global Economic Diversification Index 2026, issued at the World Governments Summit

https://economicdiversification.com/app/uploads/2026/02/global_economic_diversifiation_index_2026.pdf

Will the US tariff threat have a major impact on Iran’s key trading partners? (with Dr Saidi’s comments)

https://www.thenationalnews.com/business/economy/2026/02/09/will-the-us-tariff-threat-have-a-major-impact-on-irans-key-trading-partners/

Euro zone ministers to weigh euro-stablecoins, more joint debt issuance to boost role of euro, economic security

https://www.reuters.com/sustainability/boards-policy-regulation/euro-zone-ministers-weigh-euro-stablecoins-more-joint-debt-issuance-to-boost-2026-02-06/

How to hedge a bubble, AI edition

https://www.economist.com/finance-and-economics/2026/02/08/how-to-hedge-a-bubble-ai-edition

Powered by: