The opinion piece titled “The GCC will benefit from a US-China chill” was published in the Arabian Gulf Business Insight (AGBI) on 4th Jun 2024.

A slightly longer version of the article is posted below.

The GCC will benefit from a US-China chill

The Gulf’s expanding strategic links with Asia mean higher growth at home

The US-China tech and trade war has ramped up with President Biden imposing new tariffs on Chinese goods and quadrupling of tariffs on EVs from 25% to a staggering 100 percent! The economic war will intensify in this US election year. Spillover into Europe and Chinese retaliation mean greater global trade and investment fragmentation and dislocation. Trade restrictions have surged, tripling since 2019 to more than three thousand last year, depressing trade growth. Growing protectionism and economic policies increasingly dominated by national security considerations are also negatively affecting capital flows and FDI. The growth of FDI is no longer aligned with growth in trade and GDP. FDI growth has stagnated to near zero since 2010, versus trade and GDP growing annually by an average 4.2% and 3.4% respectively.[1]

In sharp contrast to the gloomy global landscape, President Sheikh Mohamed Bin Zayed is visiting Korea and China to deepen economic, tech, trade, and strategic ties. The growing strategic links of the GCC with Asia & China reinforce three external sector growth drivers acting in conjunction with domestic growth drivers: foreign direct investment (FDI), trade policy reforms and liberalisation, and attraction of human capital. These support non-oil diversification and growth including tech, digital economy & innovation, green economy, and services.

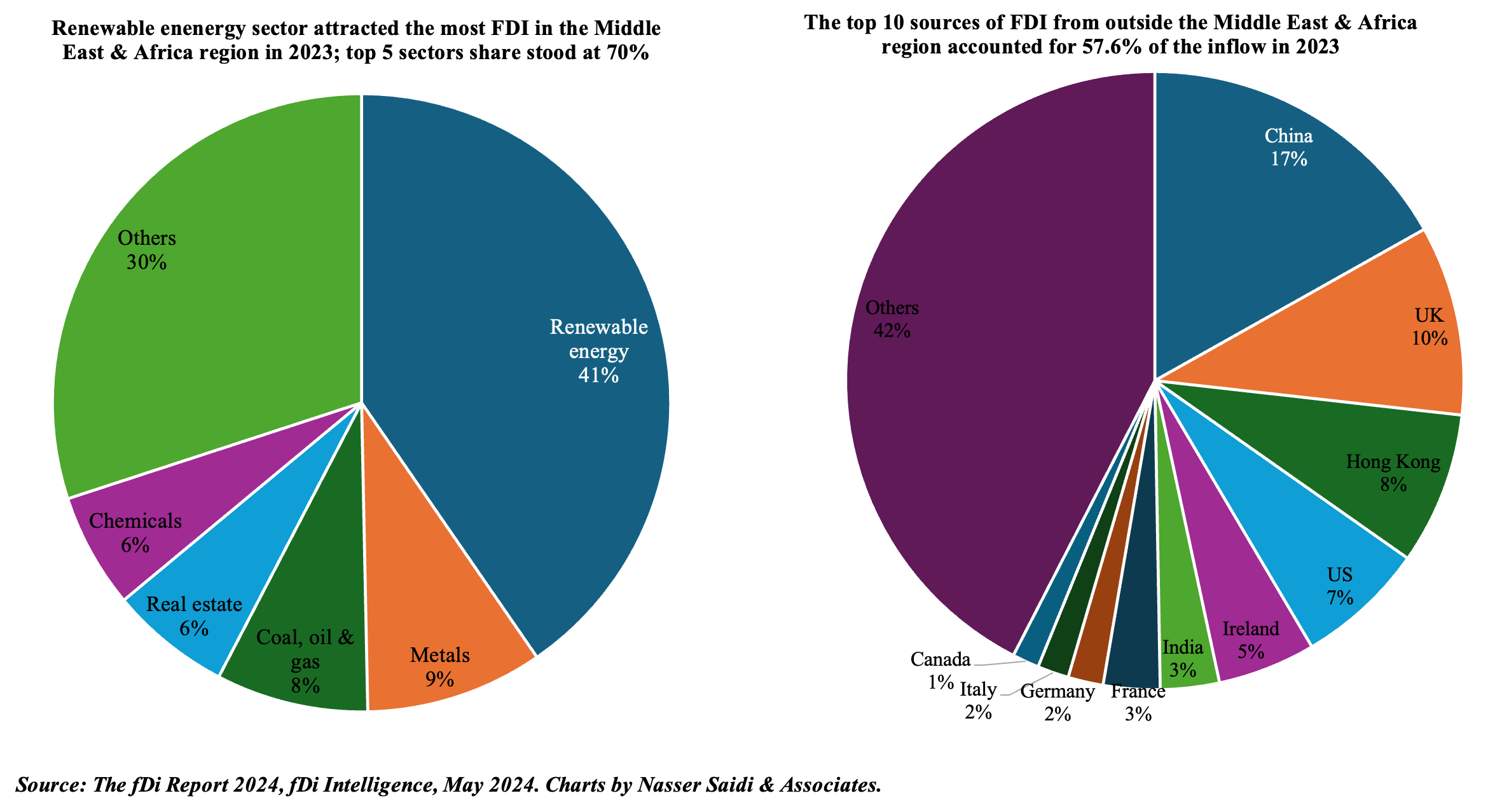

Data from fDi Intelligence shows that greenfield FDI in the Middle East & Africa region, measured by number of projects, bucked the global trend, and grew by 19% yoy to 2658 in 2023 (roughly 16% of global FDI projects). While capital investment fell by 6% to USD 249.8bn in 2023 (due to the spike in green hydrogen projects in 2022), the number of projects and investment were up by 46% and 111% respectively compared to pre-pandemic 2019. Two major takeaways from the data are the growing investments into the Middle East & Africa region from China and the increasing focus on investments into clean energy and renewables.

As the US & EU’s economic war with China widens, the GCC and its Middle East hinterland is becoming an increasingly strategic partner for China. Not only have state-owned investors in the GCC invested more than USD 2.3 billion into China in 2023 (versus USD 100 million in 2022), but recent official trips to China by both Saudi Arabia and the UAE herald further deepening existing economic ties.

China was the top source of FDI from outside the region: at USD 42.1 billion, the country’s share was around 16% of total inflows. The pattern is also changing: Saudi Arabia was the largest recipient of Chinese FDI in 2023 (USD 16.8 billion), with a 10% share of the country’s total outbound capital investment. FDI into Saudi Arabia surged by 111% yoy to USD 28.8 billion; one-fifth going to the EV sector. Such investments not only support asset prices in both regions, but also facilitate adoption of innovative technologies and knowledge transfer into the non-oil sectors.

Investments into renewable energy accounted for just over 40% of total FDI capital investment in the region. China-based Human Horizons EV research, development, manufacturing, and sales joint venture facility in Saudi Arabia is one of the examples, a USD 5.6 billion deal aimed at boosting EV production in the region.

Not only has the region been attracting investments, but more interestingly, firms from the region are growing their global FDI footprint in line with its “Middle Powers” status. UAE’s Dubai World was among the top ten foreign investors in 2023 by project, while Mubadala Investment Group was the top-ranked foreign investor in 2023 by capex and Saudi Aramco was fourth in this list.

Ranging from investments into infrastructure projects (e.g., BRI projects, Etihad Rail in the UAE) and energy transition (e.g., in UAE’s power plants, EVs factories in Saudi Arabia) to Asian investment and asset managers/ family offices setting up operations in the region’s financial centres, economic and financial ties are deepening and widening. In the near-term, cooperation could range from industrial policy partnerships (given institutional and governance similarities in the role of SEZs and SOEs) to linking Saudi & UAE financial markets to Shanghai and Hong Kong, facilitating financial flows. The latter can fund the expansion of partnership in BRI projects, energy, clean tech, and climate tech (given China’s global dominance in green tech), sustainable funding for long-term projects and PPPs. From a medium to longer-term perspective, linkages could involve the adoption of the yuan for trade (the PetroYuan can be used both for energy and non-oil trade, payments and settlement), in addition the extension of the Cross-Border Interbank Payment System (CIPS, an alternative to SWIFT) and arranging central bank digital currency transfers (facilitating cross-border flows). Considering the ambitions of the GCC and China, the setup of a GCC space port, exploration of space including commercial space travel would be another major potential avenue for cooperation.

GCC will benefit from global fragmentation and China disconnect and decoupling. GCC’s investment deals with China (and more broadly Asia), especially inward FDI, will support a higher growth path in the region (including in the non-oil sector) supported by trade liberalisation.

[1] UNCTAD research.