Download a PDF copy of the weekly economic commentary here.

Markets

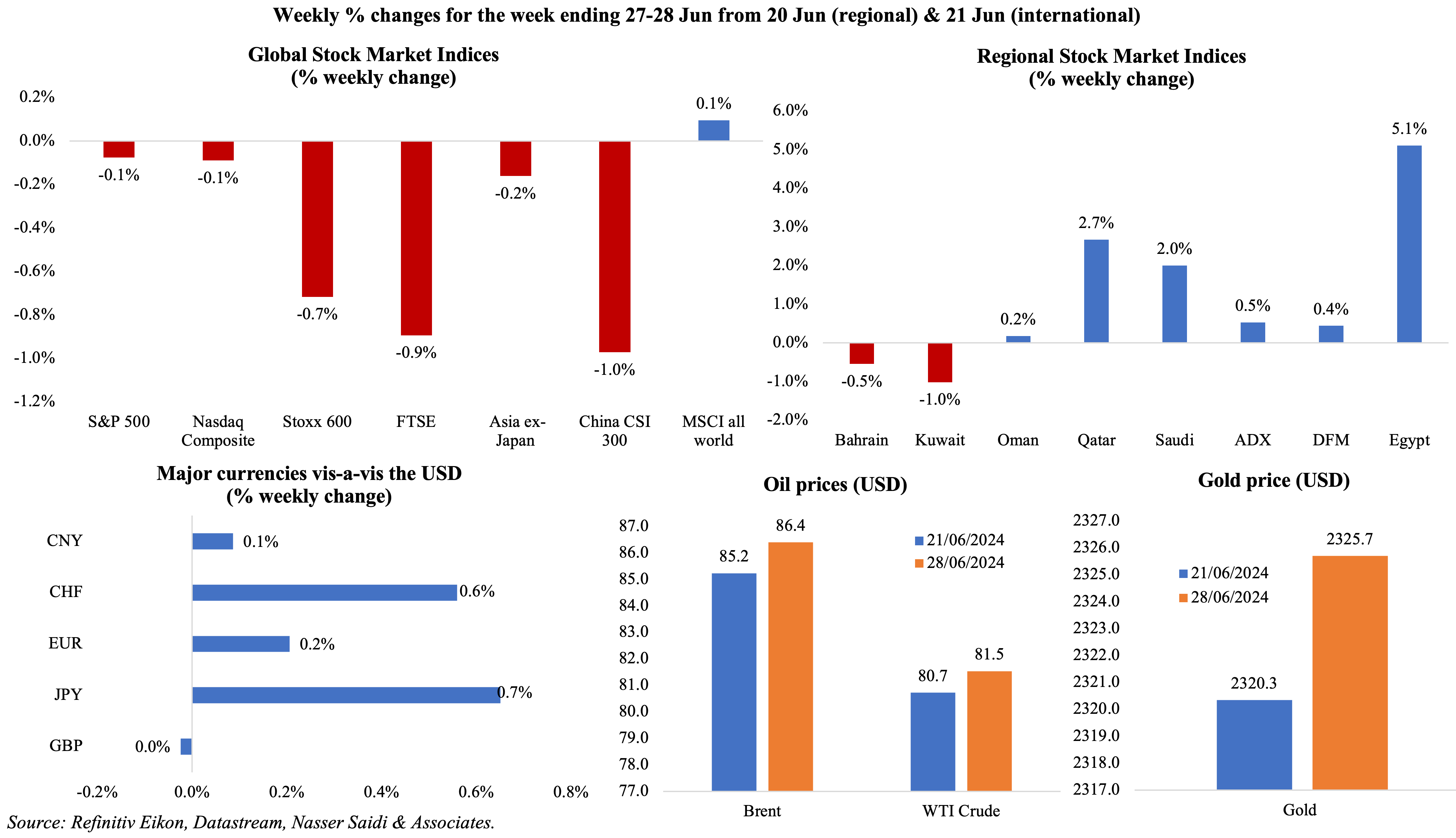

Equities markets were mostly down on Friday, reversing gains after the MSCI world stock index, S&P 500 and Nasdaq hit record highs. Japan’s Topix stock index touched a 34-year high, supported by tech stocks, while the FT reported that US stocks’ 14% gain in H1 2024 could be traced back to 5 “megacap” companies (Nvidia, Microsoft, Amazon, Meta and Apple). Regional markets were mostly up thanks to oil prices gain; Dubai clocked in a monthly gain in Jun, following 3 months in the red. The yen hit fresh 38-year lows against the greenback, weakening to as low as JPY 161.27 against the dollar before ending the week around JPY 160.815. Oil prices gained on worries of a possible expansion of the war in Gaza and impact on supplies from the Middle East. Gold price also increased on expectations of earlier-than-expected rate cuts after the PCE inflation reading was unchanged in May.

Global Developments

US/Americas:

- US GDP grew at a 1.4% annualised rate in Q1, the slowest growth since Q2 2022. The slowdown from Q4’s 3.4% was largely due to a jump in non-residential investment (4.4%) alongside exports revised higher (1.6% vs. 1.2%) and imports’ lower revision (6.1% vs. 7.7%).

- Personal income increased by 0.5% mom in May while spending grew by 0.2% (Apr: 0.1%). The personal saving rate inched up to 3.9% in May (Apr: 3.6%).

- PCE inflation was unchanged in May, following a 0.3% gain in Apr, with goods prices down by 0.4%, energy prices down by 2.1% while services prices rose by 0.2% (a second monthly decline). Core PCE eased in May, clocking in 0.1% mom and 2.6% yoy (Apr: 0.3% mom and 2.8% yoy): the yoy reading was the lowest since Mar 2021.

- US durable goods orders grew by 0.1% mom in May (Apr: 0.6%), gaining for the fourth month in a row. Orders for capital goods fell by 0.5% mom while non-defence capital goods orders excluding aircraft fell by 0.6% mom (Apr: +0.3%).

- Goods trade deficit in the US widened further in May, to USD 100.6bn (Apr: USD 99.2bn) – the largest deficit on record since May 2023. Exports and imports clocked in at USD 166.7bn and USD 267.3bn respectively.

- US S&P Case Shiller home price index grew by 0.4% mom and 7.2% yoy in Apr (Mar: 7.5% yoy) to set new record highs.

- New home sales in the US fell sharply by 11.3% mom to 619mn in May: the decline was the most since Sep 2022 and sales was the lowest in 6 months. Sales fell by 16.5% yoy. Pending home sales declined by 2.1% mom (Apr: -7.7%); in yoy terms, it fell by 6.6%.

- Dallas Fed manufacturing business index improved in Jun, rising to -15.1 from May’s -19.4: new orders were still negative (-1.3 in Jun from -11.8) while production inched up to 0.7 (May: -2.8) and shipments turned positive (+6 points to 2.8).

- Richmond Fed manufacturing index fell to -10 in Jun (May: 0), as new orders slipped (-17 from -6 in May) and shipments declined (-9 from 13). Kansas Fed manufacturing activity plummeted to -11 in Jun (May: -1) as production and employment fell to -11 amid expansionary employment readings.

- Chicago PMI moved up to 47.4 in Jun (May: 35.9), staying in contraction territory for the 7th month in a row.

- Michigan consumer sentiment index rose to 68.2 in Jun (May: 65.6), with current conditions and expectations rising to 65.9 and 69.6 respectively. The 1- and 5-year consumer inflation expectation eased to 3% (May: 3.3% and 3.1% respectively).

- Initial jobless claims slipped to 233k in the week ended Jun 21, down 6k from the week before; the 4-week average jumped by 3.25k to 236k, the highest reading since mid-Sep. Continuing jobless claims jumped by 18k to 839mn in the week ended Jun 14th – the highest since Nov 2021.

Europe:

- The Economic Sentiment indicator moved to 95.9 (May: 96) in the euro area while employment expectations declined for the third consecutive month (-16 points to 99.7).

- Pessimistic business sentiment: German Ifo business climate index slipped to 88.6 in Jun (May: 89.3) while expectations moved down by 1.3 points to 89; the current assessment reading remained steady at 88.3.

- Germany’s GfK consumer confidence worsened in Jul, down to -21.8 from -21 the month before, as income expectations and economic prospects readings edged down by 4.3 points (to 8.2) and 7.3 points (to 2.5) respectively.

- Unemployment rate in Germany inched up to 6% in Jun (May: 5.9%), the highest reading since May 2021. The number of unemployed persons rose by 19k to 2.781mn in Jun.

- GDP in the UK grew by 0.7% qoq and 0.3% yoy in Q1: this was higher than the initial estimate of 0.6% qoq and 0.2% yoy, thanks to an uptick in the volume of net trade and consumer spending (0.4% from 0.2%). Though total business investment fell by 1% yoy, it was up in qoq terms, by 0.5%. GDP per head expanded on a quarterly basis for the first time in two years albeit 0.6% lower than a year ago. Real households’ disposable income grew by 0.7%, raising saving rates to 11.1%, the highest since Q2 2021.

Asia Pacific:

- Manufacturing PMI in China remained unchanged at 49.5 in Jun, with sub-50 readings across new orders (49.5), foreign sales (48.3), employment (48.1) and buying levels (48.1) while output stood at 50.6). However, business sentiment improved (54.4 from 54.3 in May).

- Non-manufacturing PMI in China stayed expansionary for the 18th month in a row but edged down to 50.5 (May: 51.1), thanks to weak new orders (46.7), new export orders (48.8) and employment (45.8).

- Inflation in Tokyo rose to 2.3% yoy in Jun (May: 2.2%). Excluding food and energy, prices gained to 1.8% (May: 1.7%). Excluding only fresh food, prices moved up to 2.1% (May: 1.9%), thanks partly to rising fuel bills and services inflation (0.9% from 0.7% in May). This strengthens the case for a rate hike from the BoJ, as soon as the next meeting.

- Japan’s leading economic index declined to 110.9 in Apr, the lowest since Jan, and lower than the preliminary reading of 111.6 and Mar’s 111.7. The coincident index stayed at 115.2, the highest since Dec 2023 and up from Mar’s 114.2.

- Industrial production in Japan rebounded in May, rising 2.8% mom and 0.3% yoy (Apr: -0.9% mom and -1.8% yoy). The monthly increase was supported by rebounds in output of motor vehicles (18.1% from -0.6%) and electrical machinery & electronics (5.1% from -2.4%). In yoy terms, it was first expansion in seven months.

- Retail trade in Japan grew by 1.7% mom and 3% yoy in May (Apr: 1.2% mom and 2% yoy). Sales increased across the board, in its 26th consecutive month of expansion: other retail products (7.1%), department stores (5.4%), non-store retail trade (5.3%) and machinery & equipment (5.3%) among others.

- Japan’s unemployment rate remained unchanged at 2.6% in May, the highest since Sep 2023. The jobs-to-applications unexpectedly fell to 1.24 in May (Apr: 1.26), the lowest level in two years.

- Balance of payment surplus in India widened to USD 30.8bn in Jan-Mar (Sep-Dec: USD6bn). Current account balance moved to a surplus USD 5.7bn (Sep-Dec: deficit of USD 8.7bn) or 0.6% of GDP, after 10 quarters of deficits, supported by net services receipts (USD 42.7bn). Trade deficit narrowed to USD 50.9bn (prev: USD 71.6bn).

- Inflation in Singapore inched up to 3.1% in May (Apr: 2.7%) while core inflation remained unchanged at 3.1% for the third month in a row. Services inflation ticked up to 3.6% while food inflation was unchanged (2.8%). The Ministry of Trade and Industry (MTI) and MAS maintained estimates for both core and overall inflation at 2.5% to 3.5% in 2024.

- Industrial production in Singapore grew by 1.1% mom and 2.9% yoy in May (Apr: 7.5% mom and -1.2% yoy). The yoy rebound was led by electronics (20.1% from -1.1%) while growth expanded at a faster pace in chemicals (7.9% from 3%).

Bottom line: Politics has been dominating the news cycles vis-a-vis economic data. The initial Presidential debate in the US saw a shaky start for Biden – it had allies bracing for another Trump Presidency though, for now, the Democrats are standing steadfastly behind their Presidential frontrunner. The first round of elections in France saw the far-right party winning, garnering 33% of the vote while Macron’s centrist bloc was behind with 21%; the final round of voting is to be held on 7th July. This week’s UK elections are projected to bring the Labour Party into power after 14 years – with a significant impact on markets. Lastly, after last week’s PCE reading in the US, the focus shifts to non-farm payrolls for further signs that inflation is easing and/or that labour market is worsening.

Regional Developments

- Bahrain’s non-oil exports fell by 12% yoy to BHD 316mn (USD 838.3mn) in May, with Saudi Arabia, US and UAE the top three export destinations. Value of non-oil re-exports declined by 28% yoy to BHD 51mn: private cars were the top re-export (6.5% of total).

- Exports from Egypt grew by 9.8% yoy to USD 16.551bn in Jan-May 2024, with exports rising to USD 3.5bn in May alone. Saudi Arabia, Turkey and UAE were the top export partners this year till May while building materials and food products were the top export products.

- A report from the Central Bank of Egypt found that foreign trade totalled USD 51.555bn in H1 of the financial year of 2023-2024. UAE was the largest trade partner (split into USD 2.817bn in imports and USD 1.962bn in exports), followed by Saudi Arabia, US, China and Germany.

- Egypt’s money supply (M2) grew by 27.166% yoy to EGP 10.352trn in May, as per central bank data.

- The EU Commission President disclosed that more than 20 new deals / MoUs had been signed by European firms and Egyptian partners (potentially worth over EUR 40bn or USD 42.85bn). About half the deals were in the energy sector while others on water management, construction, chemicals, shipping and aviation. It was also revealed that Egypt’s sovereign fund inked four green ammonia deals worth USD 33bn with European developers.

- The World Bank approved USD 700mn in financing to support Egypt. The funds will be used to support short-term economic challenges, support the private sector via structural reforms and to scale up renewable energy while increasing efficiency in utilities.

- According to the Electricity Minister, Egypt plans to raise its target for the renewable share of energy generation to 58% by 2040 in an updated strategy for expanding green power; currently the target is 42% through renewables by 2030.

- Egypt’s government will delay implementing a hike in electricity prices (set for beginning of Jul) until Sep. Earlier last week, on June 25, the government allocated USD 1bn to end its power outage crisis. The PM had stated that Egypt would need to import around USD 1.18bn worth of mazut fuel oil and natural gas to mitigate persistent power cuts – these shipments are expected by the third week of July.

- Parliamentary election in Iraq’s Kurdistan region has been set for Oct 20th, following multiple delays. Originally supposed to be held in 2022, delays had pushed it to June 10th.

- Oman’s inflation inched up to 0.9% yoy in May, the highest since Sep 2023, driven by an uptick in food and non-alcoholic beverages (3.8%) while prices fell in transport (-1.6%), education (-0.4%) and communication (-0.2%).

- Total credit disbursed by Oman’s banking sector grew by 2.6% to OMR 30.8bn by end-Apr; credit to the private sector grew by 3.2% to OMR 25.9bn. Private sector deposits meanwhile grew by 12.4% yoy to OMR 20.1bn.

- Data released by the Muscat Stock Exchange showed a 19% increase in foreign investments into the exchange, with focus concentrated on the industrial and service sectors (15.8% and 15.7% respectively). Trading volumes surged to 3.1bn securities at end-May, surpassing OMR 517mn (USD 1.3bn, + 38.4% yoy) in value.

- Oman plans to build a “Film City”, to produce and export films: the OMR 12mn (USD 31.2mn) project is estimated to create 100 job opportunities for Omanis. This is part of a larger set of projects that includes the OMR 2.2mn ‘Ibda’a Park/Creativity Park’ to attract Omani creators and OMR 1.1mn ‘Yaj’ to boost MICE tourism.

- Qatar’s Ministry of Commerce announced a reduction in fees for many services by over 90%: for example, annual fee for registration in the commercial register with one main activity has been changed from up to QAR 10k to QAR 500. A new commercial registration and/or licence, for example, has now been set at only QAR 500.

- QatarEnergy signed a second long-term naphtha supply agreement with Japan: starting July, Qatar will provide Eneos Corporation, a refining and petrochemical company, with up to 9 million tonnes of naphtha over 10 years.

- Qatar Airways is in talks to buy up to a 20% stake in Bain Capital-owned Virgin Australia, reported the Australian Financial Review. An official announcement is expected this week.

- Bloomberg’s Capital Markets League Tables showed a 48% surge in sukuk issuance across the MENA to USD 6.2bn in H1 2024. Saudi Arabia led with 5 issuances totalling USD 3.98bn while the UAE accounted for the remainder from 3 issuances.

- Remittances inflows into MENA declined in 2023, down by 15% yoy to USD 55bn, following the 3.2% drop in 2022. This stemmed partly from the decline in Egypt. Egypt was still the largest remittance recipient, but it plummeted by 31.1% to USD 19.5bn. Lebanon and West Bank were the most dependent on remittances, at 27.5% and 18.8% of GDP.

Saudi Arabia Focus

- Exports from Saudi Arabia fell by 1.7% mom to SAR 101.7bn in Apr, with declines across the board: oil (-0.3%) alongside a 6.3% drop in both non-oil exports and re-exports. Imports fellby 17.4% mom and 1.3% yoy to SAR 60.3bn, thereby moving trade surplus to SAR 41.4bn (vs Mar: SAR 30.4bn; Apr 2023: SAR 41.6bn). China was the top trade partner in Apr: share of 16.6% of overall exports and 22.4% of imports.

- Saudi Arabia’s official data showed a 5.6% yoy increase in net flow of FDI to SAR 9.5bn (USD 2.53bn) in Q1 2024.Inflows grew by 0.6% yoy to SAR 17bn while outflows declined by 5.1% to SAR 7.5bn.

- Unemployment rate in Saudi Arabia held steady at 3.5% in Q1 2024, a slight increase of 0.1% compared to Q4 2023. Saudi unemployment rate reached 7.6% in Q1, down by 0.2% from a quarter ago. While unemployment rate for Saudi females inched up to 14.2%, their labour force participation rate rose by 0.8 percentage points to 35.8%.

- Saudi Capital Market Authority reported that the domestic sukuk and debt instruments market reached 18.3% of GDP in 2023. Furthermore, net foreign investments in the Saudi capital market grew by 7.7% yoy to SAR 198bn in 2023, with foreign investor ownership rising to SAR 401bn.

- Saudi Arabia’s market regulator approved Fourth Milling Company (MC4)’s plan to sell 162mn shares, or 30% of its share capital, through an IPO. Separately, Arabian Mills for Food Products, formerly known as Second Milling Company (MC2), will list 15.4mn shares, or a 30% stake, on the Saudi stock exchange.

- Point-of-sale spending in Saudi Arabia clocked in at SAR 8.34bn (USD 2.22bn) from June 16 to 22, with transactions at restaurants & cafes accounting for the largest share (19.3%).

- Eyeing expansions in gas: Saudi Aramco awarded contracts worth more than USD 25bn to progress its strategic gas expansion. Separately, the firm also agreed to buy 5mn tonnes of LNG per annum from US-based company Sempra over a 20-year period. Additionally, Saudi Arabia signed a USD 1.5bn agreement for two new gas-fired power plantsthat will produce a combined 4 gigawatts of electricity – these will be connected to the grid in 2026 and will help reduce carbon emissions by up to 60% compared to oil-fired equivalents.

- NEOM, in a bid to attract private sector investments, is offering stabilisation guarantees (aiming for a Debt Service Coverage Ratio of 1.2% over five years) and varied partnership models such as joint ventures and build-operate-transfer agreements. Financial arrangements are also on offer: the Ministry of Finance’s Infrastructure Fund offered finance to some of Neom’s schools and healthcare assets (e.g. providing 50% of debt “at a very attractive cost”).

- Saudi Arabia’s construction output value is forecast to reach USD 181.5bn by end-2028, a 28% surge over five years (2023: USD 141.5bn), according to Knight Frank. Riyadh accounts for 38% of the existing contract award value, followed by Makkah (USD 28.7bn) and Tabuk province (USD 28.5bn).

- Reuters reported that Saudi Aramco is planning to take a 10% stake in Horse Powertrain, a thermal engine joint venture between Renault and China’s Geely, which supplies gasoline engines, hybrid systems and gear boxes for thermal vehicles.

- Saudi Arabia granted the Approved Destination Status arrangement to China, effective July 1, allowing Chinese tourist groups to visit Saudi Arabia more easily. This will support the target of making China the third largest source market for international arrivals (around 5mn Chinese tourists) by 2030.

UAE Focus

- The UAE Ministry of Finance offering of a USD denominated 10-year USD 1.5bn bond was sold at a yield of 60bps over US Treasuries, after the order book touched USD 6.5bn. Investors from the Middle East, the US and the UK accounted for 38%, 34% and 18% respectively of the total.

- The Dubai Executive Council approved the FDI Development Programme, with the goal of attracting AED 650bn (USD 177bn) in investments by 2033.

- UAE issued a Public-Private Partnership Manual lays out guidelines for PPP contracts and their governance in a bid to encourage the private sector to actively participate in strategic projects. The Ministry of Finance has also identified priority sectors for the first phase of future partnership projects, including infrastructure, energy, healthcare, social services, and education.

- Dubai announced the AED 30bn project “Tasreef” to boost rainwater drainage system, to be completed by 2033, to ensure “readiness to face future climate-related challenges”. The project will raise the capacity of Dubai’s rainwater drainage system by 700% to more than 20mn cubic metres of water per day.

- Abu Dhabi is set to launch a Family Business Index, in coordination with the UAE University. The index will measure and rank various metrics related to family-owned and family-controlled businesses in Abu Dhabi including revenue, employment, governance structures, leadership gender ratios and succession planning among others.

- The Central Bank of the UAE introduced regulations focusing on Payment Token Services: this regulation enables the central bank to take control of issuing licences and regulating all dirham-backed stablecoins. These regulations do not apply to retail payment services or the regulation of “stored value facilities” such as debit, credit or prepaid cards or digital wallets. Separately, Dubai’s VARA oversees non-dirham backed stablecoins.

- The Chairman of the Sharjah Chamber of Commerce disclosed that construction on a new international airport in Uganda will begin in Aug. The project costs were not disclosed.

- Fitch affirmed “AA-” rating for the UAE with a stable outlook, citing its strong external assets and high GDP per capita levels. It also affirmed Abu Dhabi’s rating at “AA” with a stable outlook, citing its strong fiscal position.

Media Review:

Central Bank Digital Currencies: Will they replace the cash in our wallets? (op-ed by Dr. Nasser Saidi)

https://www.thenationalnews.com/business/markets/2024/06/28/central-bank-digital-currencies-will-they-replace-the-cash-in-our-wallets/

Will services make the world rich?

https://www.economist.com/finance-and-economics/2024/06/24/will-services-make-the-world-rich

Mapping the World’s Readiness for Artificial Intelligence Shows Prospects Diverge

https://www.imf.org/en/Blogs/Articles/2024/06/25/mapping-the-worlds-readiness-for-artificial-intelligence-shows-prospects-diverge

The fate of the dollar rests on the US election

https://www.ft.com/content/ba8d3ed7-fa6c-4862-a382-10026dbd39b3

Powered by: