Weekly Insights 28 Jun 2024: Foreign Direct Investment dips in MENA/ GCC; project pipeline indicates stronger growth

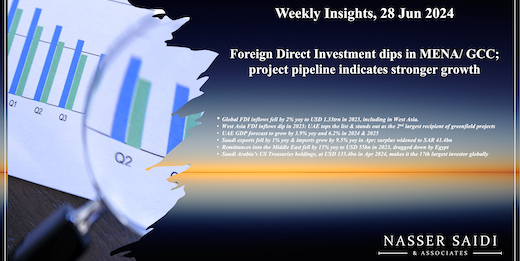

1. Global FDI inflows fell by 2% yoy to USD 1.33trn in 2023.

- UNCTAD’s World Investment Report 2024 showed global FDI fell by 2% yoy in 2023, to USD 1.33trn, with developed nations accounting to 35% of global FDI flows (falling below 50% for the first time since 2019). Growing protectionism and trade distortions are affecting FDI flows and their changing patterns.

- There was an uneven growth across the globe in 2023: US was the world’s largest recipient of FDI, but inflows declined by 6.3% yoy to USD 311bn. Flows to developing nations fell by 7% to USD 867bn, with Asia posting an 8% drop while flows to Africa & Latam were down 3% and 1%. China and India saw FDI inflows drop by 14% and 43% to USD 163.3bn and USD 28.2bn respectively in 2023, ranking second and 15th globally in terms of value of FDI inflows.

- In contrast to FDI flows, both the number and value of greenfield project announcements jumped – especially in developing nations, driven largely by an uptick in manufacturing industries. This signals better prospects in the medium term.

- Developing Asia remained the most attractive destination for greenfield project announcements (22% in 2022-23 to 5,798): they were home to 60% of the world’s megaprojects. West Asia’s UAE and Saudi Arabia saw greenfield project announcements surge by 31% and 62% (to 1323 and 389) respectively. India was among the top 5 destinations for greenfield project announcements (1058, 4th largest) and international project finance deals (163, 2nd largest).

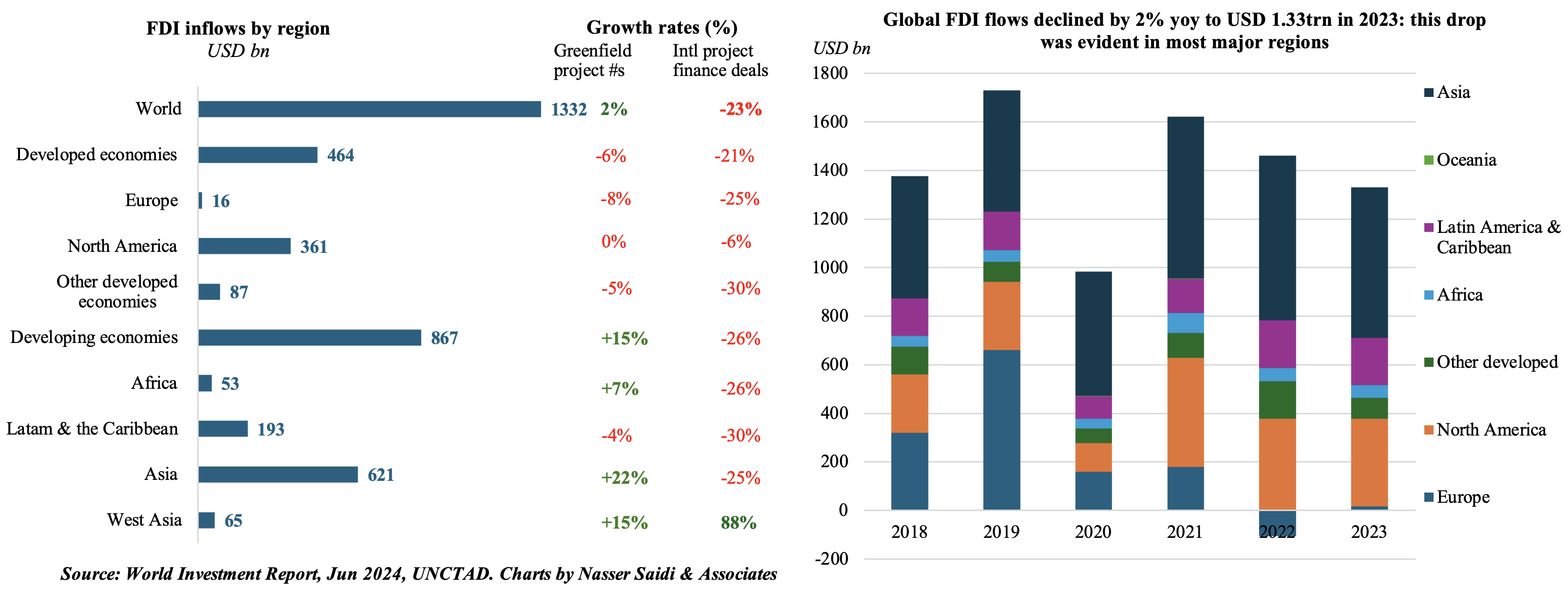

2. West Asia FDI inflows dip in 2023: UAE tops the list & stands out as the 2nd largest recipient of greenfield projects (after the US)

- FDI flows to developing Asia fell in 2023: a further breakdown showed that South-East Asia posted a slight increase (+1% to USD 226bn). The decline was pronounced in South Asia (-37%) and Central Asia (-27%) while in West Asia, FDI declined by 9% to USD 65bn.

- Within West Asia, UAE emerged as the best performer, attracting USD 30.7bn in 2023 (+35% yoy). The country also moved up the ranks of nations attracting most inflows – 11th largest in 2023, from 21st in 2022.

- UAE was also the second largest globally in terms of number of greenfield project announcements (1323 projects, with a value of USD 15.6bn). Saudi Arabia’s greenfield project announcements surged by 62% in 2022-23 to 389 while its value jumped by 108% to USD 28.3bn.

- While the number of international project finance deals in developing Asia declined by 25%, West Asia was the only exception: total deals rose to 94 in 2023 (2022: 50) while the value increased by 32% to USD 57bn; the number of deals increased in both Saudi Arabia and the UAE. The report identifies an important trend in the region: the decline in international project finance in renewable energy (along with most industrial sectors) and the increase in petrochemicals.

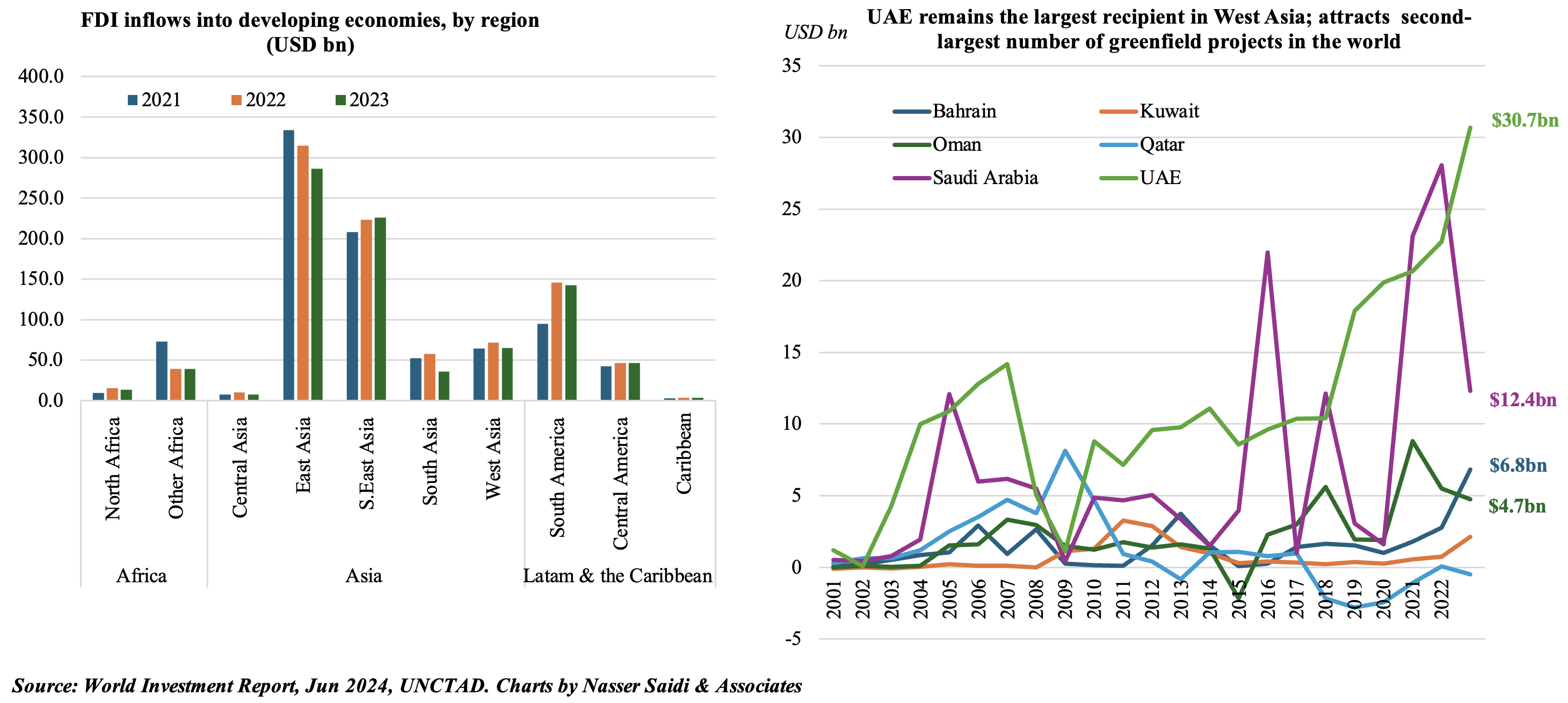

3. UAE GDP forecast to grow by 3.9% yoy and 6.2% in 2024 & 2025. Inflation in UAE to moderate in 2024-25.

- The UAE central bank forecasts real GDP to grow by 3.9% this year (2023: 3.6%), supported by gains in the non-hydrocarbon sector (5.4%) while hydrocarbon GDP is estimated to grow by just 0.3% (given extended oil production cuts). This falls in line with the uptick in greenfield project announcements, in addition to early indicators related to trade, tourism and real estate among others.

- Growth is projected to accelerate further in 2025 (6.2%), supported by the uptick in oil & gas production (8.4% in 2025 vs 2024’s 0.3%) alongside robust non-hydrocarbon sector (5.3%).

- Inflation is estimated to average 2.3% in 2024-25 (from an earlier forecast of 2.5%), as both wages and rents are projected to rise at a pace slower than previously estimated. An increase in domestic demand and costs of non-tradeable categories will drive inflation – in line with Dubai’s recent inflation data.

- Inflation has eased in Dubai to 3.8% in May 2024 (Apr: 3.9%): most categories have either remained stable or declined, though a few have gained including housing & utilities (6.6% from 6.5%) & recreation costs (1.5% from -0.2%).

4. Saudi exports and imports fell by 1% yoy & 1.3% yoy in Apr; surplus moved to SAR 41.4bn

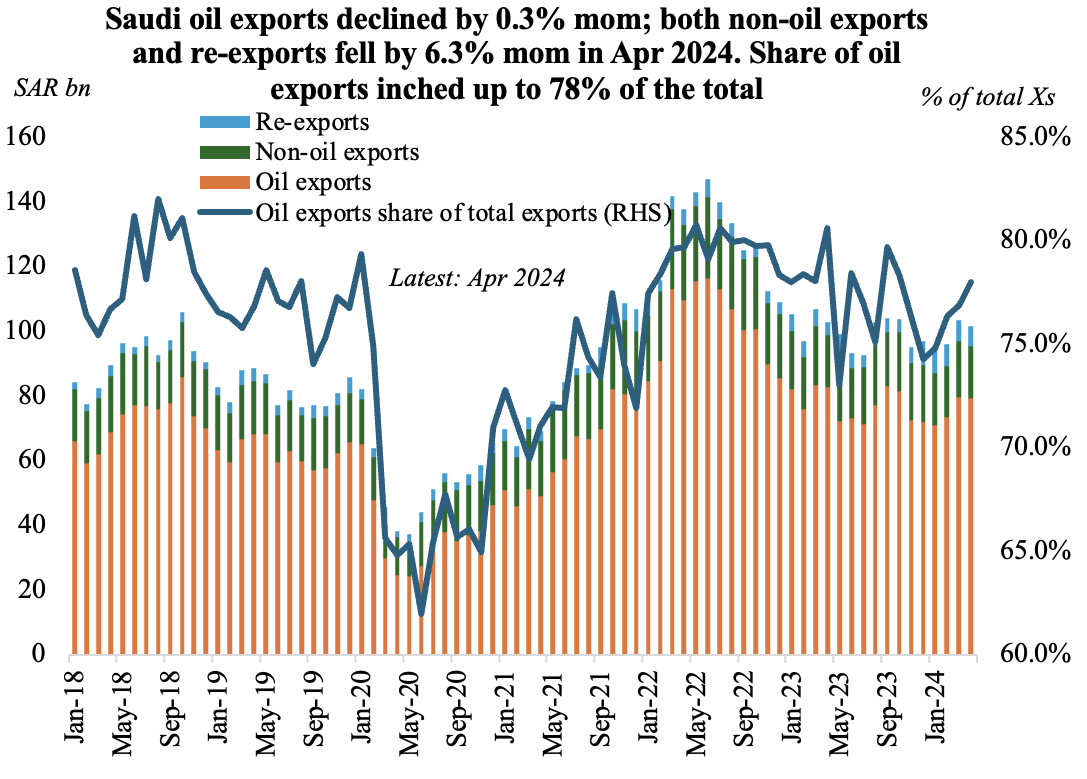

- Exports from Saudi Arabia fell by 1.7% month-on-month to SAR 101.7bn in Apr, with declines across the board: oil (-0.3%) alongside a 6.3% drop in both non-oil exports and re-exports.

- In yoy terms, oil exports fell by 4.2% to SAR 79.3bn in Apr; its share in overall exports stood at 78%. Meanwhile, both non-oil exports and re-exports grew by 1.6% and 56.4% to SAR 16.2bn and SAR 6.2bn respectively in Apr.

-

Imports fell by 17.4% mom and 1.3% yoy to SAR 60.3bn, thereby moving trade surplus to SAR 41.4bn (vs Mar: SAR 30.4bn; Apr 2023: SAR 41.6bn).

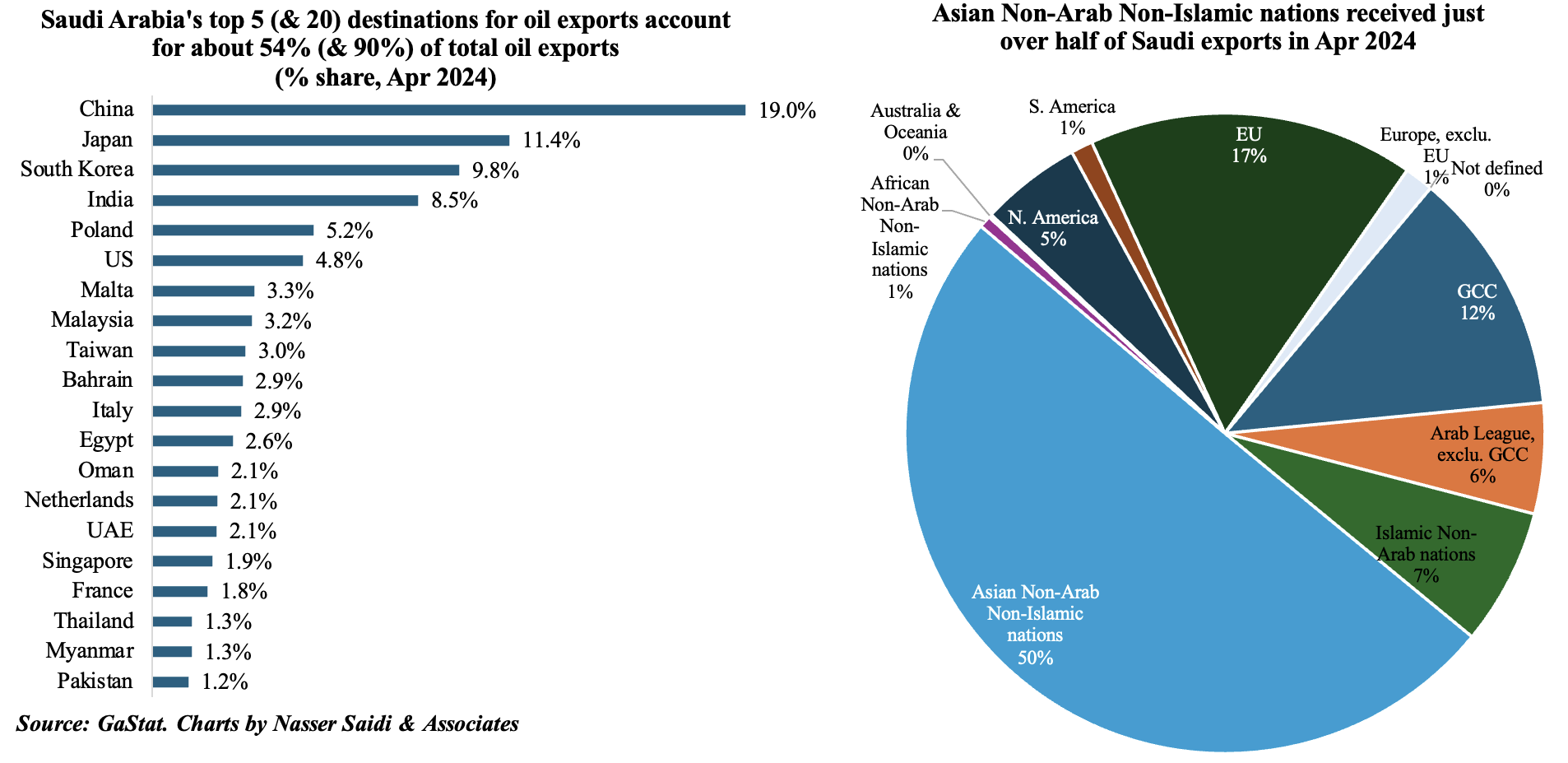

- Oil exports to top 5 destinations (China, Japan, South Korea, India & Poland) stood at 54% of total oil exports in Apr. Share of top 25 nations was 94.8%.

- China was the top trade partner in Apr: accounting for 16.6% of overall exports and 22.4% of total imports.

- Asian Non-Arab Non-Islamic nations received 50.2% of Saudi exports in Apr 2024 & GCC 12%.

5. Remittances into the Middle East fell by 15% yoy to USD 55bn in 2023, dragged down by Egypt

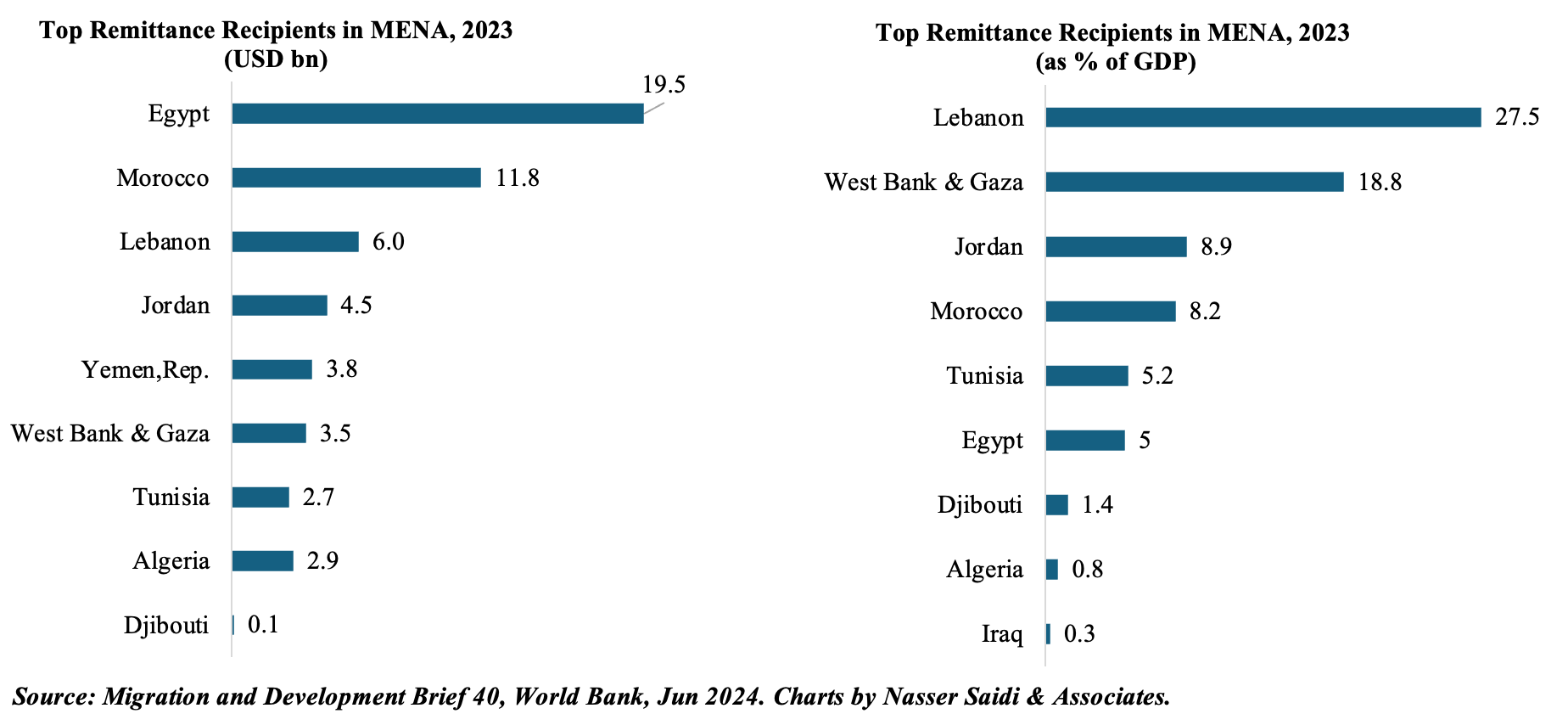

- Remittances inflows into MENA declined in 2023, down by 15% yoy to USD 55bn, following the 3.2% drop in 2022.

- This stemmed partly from the decline in Egypt. Egypt was still the largest remittance recipient, but it plummeted by 31.1% to USD 19.5bn. The existence of a gap between the official and parallel market exchange rates resulted in a sharp fall in official remittances (as money moved through informal channels). The official move to a flexible exchange rate could see remittances return to previous levels.

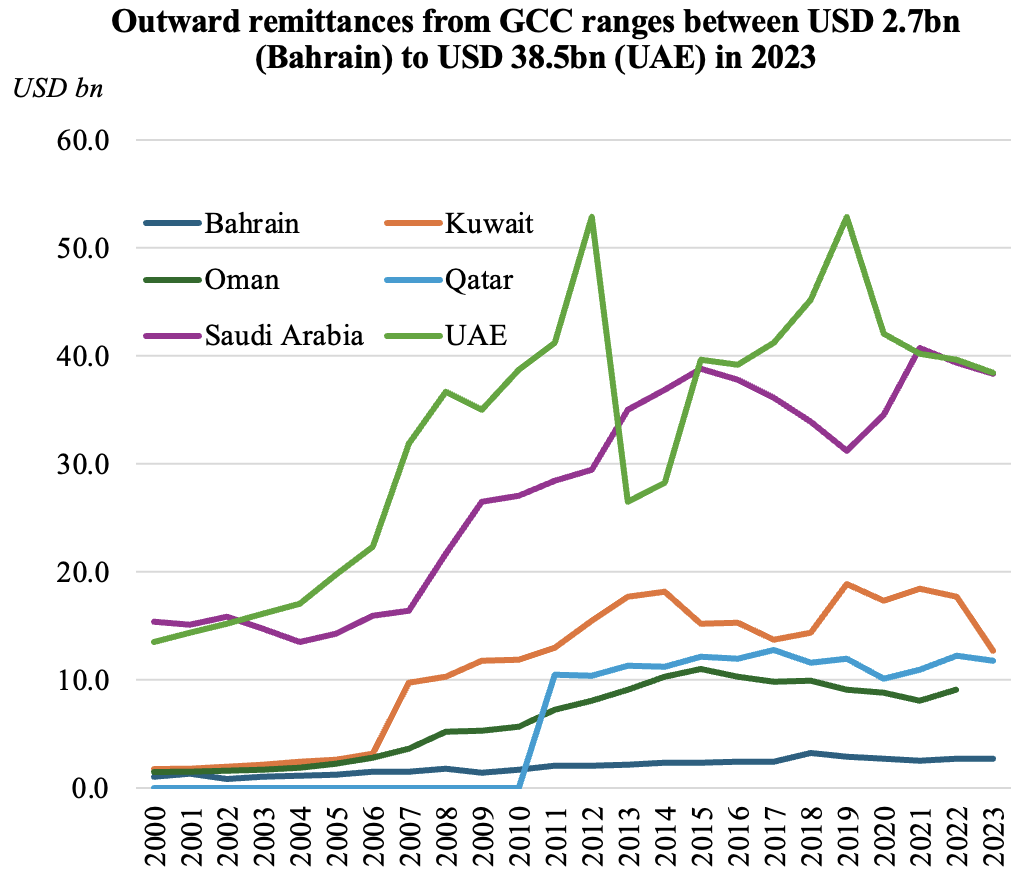

- Furthermore, there was a soft decline in outward remittances from both the UAE and Saudi Arabia, which affected regional inflows.

- Inflows into Morocco grew, especially following the earthquake in Sep, while remittances into West Bank & Gaza dropped sharply.

- Lebanon and West Bank are the most dependent on remittances: 27.5% and 18.8% of GDP respectively last year.

- The World Bank estimates remittance flows to MENA to recover by 4.3% in 2024 and 5.5% in 2025. Both UAE and Saudi Arabia are estimated to grow at a faster pace in 2024-25, further supporting the case for an increase in remittances.

- Risks to the outlook include economic uncertainty in labour-exporting nations such as Egypt and Lebanon and broader uncertainty in regional prospects.

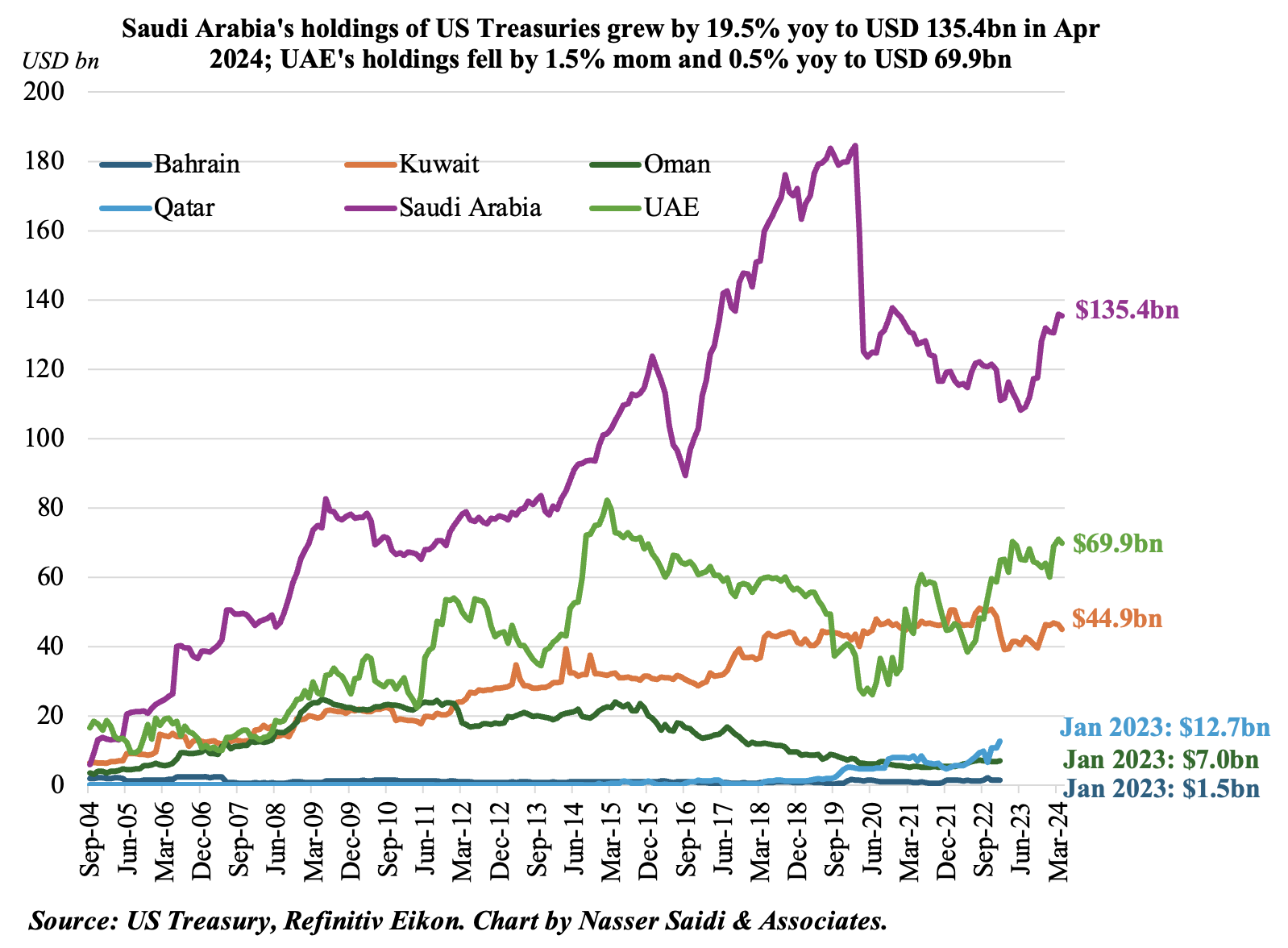

6. Saudi Arabia’s US Treasuries holdings, at USD 135.4bn in Apr 2024, makes it the 17th largest investor globally; UAE’s holdings stood at USD 69.9bn

- Foreign holdings of Treasuries declined to USD 8.018trn in Apr from Mar’s record high of USD 8.084trn. The ongoing US-China trade war and a potential for weaponization of the dollar has seen China reduce its holdings by USD 45.6bn since end-2023.

- Saudi Arabia is currently the 17th largest investor in US Treasury bonds as of Apr 2024 (USD 135.4bn).

- This pales in comparison to the top of the list Japan (USD 1.150trn) and China (USD 770.7bn), but it is still highest among the GCC.

- While Kuwait decreased their holdings compared to end-2023 (by 3.0%), Saudi Arabia and UAE holdings have increased by 2.6% and 9.2% respectively.

- KSA saw holdings fall by 0.3% mom to USD 135.41bn in Apr 2024, but in yoy terms, it has surged by 19.5%.

- UAE’s holdings clocked in at USD 69.9bn in Apr, down 1.5% mom and 0.5% yoy.

Powered by: