Download a PDF copy of the weekly economic commentary here.

Markets

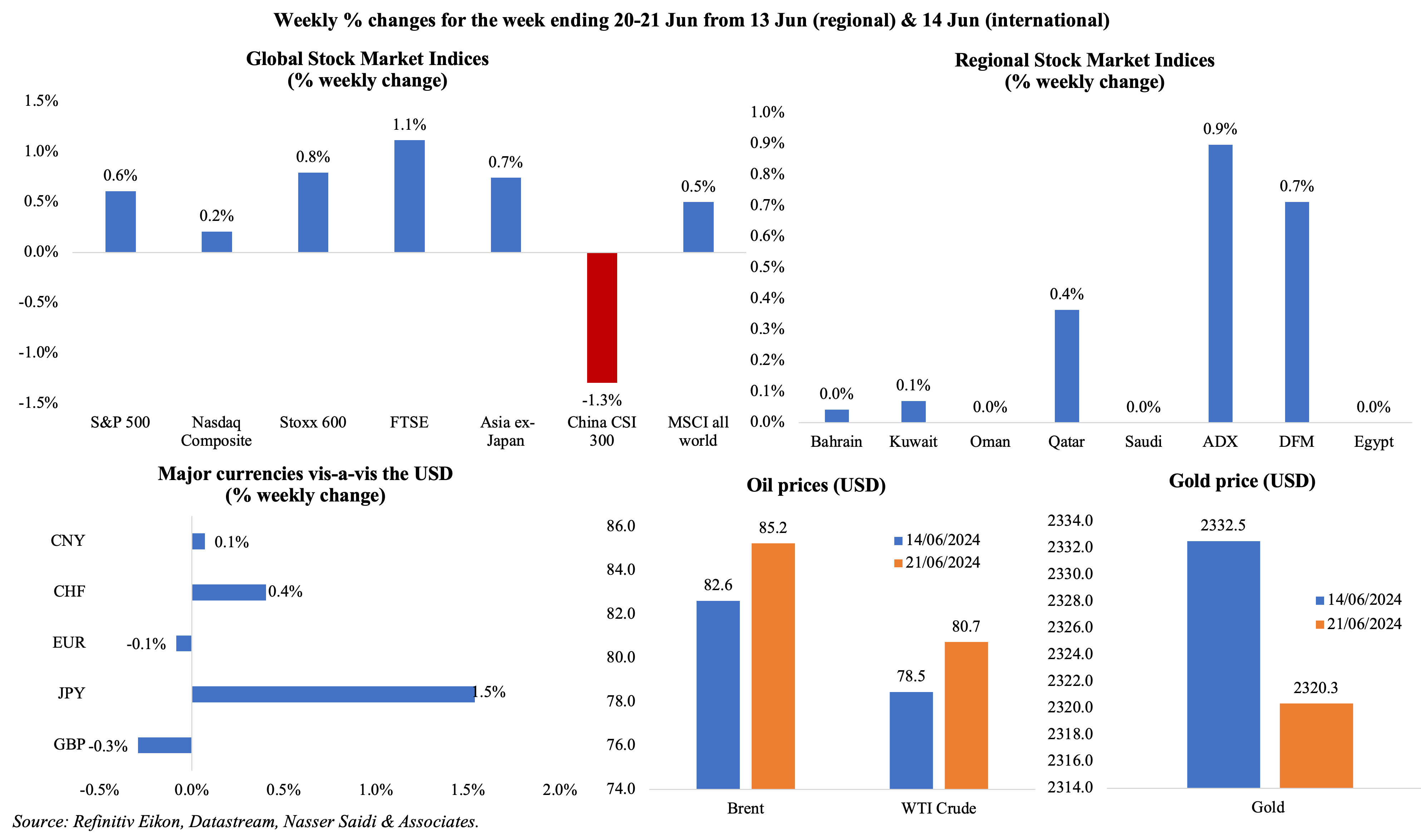

Equities markets mostly gained last week, with the MSCI index of global stocks gaining for the third week in a row. While a few regional markets were closed for the Eid holidays (Oman, Saudi and Egypt), those that were open reported weekly gains. The dollar was strong last week: it touched a new 8-week high versus the JPY and clocked in a 5-week high versus the GBP; the CNY dropped to a 7-month low and the INR fell to a record low of 83.6650 (vs the USD) on Thursday. Oil prices inched up by around 3% weekly, with the Brent and WTI settling at USD 85.2 and USD 80.7 respectively. Gold price declined by 0.5% weekly on dollar strength.

Global Developments

US/Americas:

- US industrial production grew by 0.9% mom in May, the largest uptick in 10 months and following a flat reading in Apr. The gains could broadly be traced back to manufacturing (0.9%), led by consumer goods and business equipment. Capacity utilisation increased to 78.7% (Apr: 78.2%).

- US retail sales rebounded in May, gaining a slight 0.1% mom (Apr: -0.2%): sales at gas stations fell by 2.2% and sales at food & drinking places dropped by 0.4% (the largest decline since Jan) while both motor vehicles & parts and online sales gained by 0.8% each.

- NY Empire State manufacturing index improved to -6 in Jun (May: -15.6): new orders improved but remained negative (-1 from -16.5) amid flat inventories (1 from 2) and rising shipments (3.3 from -1.2).

- Philadelphia Fed manufacturing survey eased to a 5-month low of 1.3 in Jun (May: 4.5): current shipments were at the lowest since Dec (down 6 points to -7.2) while new orders and employment indices remained negative.

- Current account deficit in the US widened to USD 237.6bn in Q1 (Q4: USD 221.8bn) or 3.4% of nominal GDP (Q4: 3.2%). Primary income surplus declined to USD 12.3bn in Q1 (from USD 15.5bn) and goods deficit rose to USD 277.7bn (from USD 264.6bn).

- Building permits fell by 3.8% mom to 1.386mn in May, the lowest since Jun 2020, with single-family permits down by 2.9% to 949k (the lowest in a year). Housing starts also fell to the lowest since Jun 2020 – by 5.5% to 1.277mn; single-family starts dropped by 5.2% to 982k units, to lowest since Oct.

- Existing home sales fell by 0.7% mom to 4.11mn in May while median dales prices surged by 5.8% yoy to a record-high USD 419,300.

- S&P manufacturing PMI inched up to 51.7 in Jun (May: 51.3), boosted by both new orders and employment; payrolls rose the most in 21 months. Services PMI jumped to 55.1, the most since Apr 2022, and from 54.8 the month before; employment rose the most in 5 months.

- Initial jobless claims slipped to 238k in the week ended Jun 14, down 5k from the 10-month peak recorded the week before; the 4-week average slipped by 5.5k to 232.75k, the highest reading since mid-Sep. Continuing jobless claims rose by 15k to 828mn in the week ended Jun 7th – the highest since Jan.

Europe:

- Flash manufacturing PMI in the eurozone slipped to a 6-month low of 45.6 in Jun (May: 47.3), staying in contractionary territory for more than a year: new orders, export orders and employment declined. Services PMI also slowed to 52.6 (May: 53.2), dragged down by new export orders while both input and output costs continued to rise.

- Labour costs in the eurozone increased by 5.1% yoy in Q1, higher than the preliminary estimate (4.9%) and Q4’s 3.4% gain. By sector, labour costs were the highest in construction (5.2%) and services (5%) and by country Bulgaria clocked in the highest gain (15.8%) while Germany and France reported increases of 5.9% and 2.7% respectively.

- Consumer confidence in the euro area moved up to -14 in Jun (May: -14.3) – the highest reading since Feb 2022. In the EU, sentiment also inched up by 0.3 points to -12.9.

- Preliminary data showed a further drop in German manufacturing PMI to 43.4 in Jun (May: 45.4): employment remained below-50 for the 12th month while both new orders and export sales declined. Services PMI also slowed to 53.5 (May: 54.2), with inflation staying well above its historical series average.

- Germany ZEW economic sentiment inched up to 47.5 in Jun (May: 47.1), the most since Feb 2022, while the current situation slipped to -73.8 from -72.3. The eurozone’s sentiment index accelerated to 51.3 (May: 47) though the situation indicator remained steady at -38.6.

- Producer price index in Germany remained deflationary for the 11th consecutive month in May, down 2.2% (Apr: -3%) as energy prices fell (-6.4%). Capital goods prices rose by 2.4% as did non-consumer durables (+0.4%) while intermediate goods costs dropped (-1.8%).

- The Bank of England left rates unchanged at a 16-year high of 5.25% while signalling a potential reduction as early as the meeting in Aug. The governor highlighted inflation falling to the 2% target though some MPC members called for “more evidence” that inflation continues to stay low before lowering rates.

- Inflation in the UK eased to 2.0% in May (Apr: 2.3%), in line with the BoE’s target for the first time since Jul 2021. While core inflation eased to 3.5% (Apr: 3.9%) as did services inflation (5.7% from Apr’s 5.9%), both remain relatively high. The annual inflation rates for both input and output PPI are at their highest levels since May 2023: producer output prices rose by 1.7% yoy and fell by 0.1% on the input side. Retail price index inched up by 0.4% mom and 3% yoy in May (Apr: 0.5% mom and 3.3% yoy).

- UK’s flash manufacturing PMI moved up by 0.2 points to 51.4 in Jun, as new orders edged up. Services PMI dropped to a 7-month low of 51.2 (May: 52.9), and wages continued to be the main factor raising service cost inflation.

- Retail sales in the UK grew by 2.9% mom and 1.3% yoy in May (Apr: -1.8% mom), following a weather-affected April. Non-food sales gained by 3.5% (the most since Apr 2021) and online sales surged by 5.9% mom (the most since Apr 2022).

- UK GfK consumer confidence rose to -14 in Jun (May: -17), the highest reading since Nov 2021.

Asia Pacific:

- The PBoC left its loan prime rates unchanged as expected. The apex bank governor hinted at new policymaking tools including trading of government bonds in the secondary market, interest rate reform (move to using a single short-term rate to guide markets) and a narrowing of the interest rate corridor.

- China’s industrial production accelerated by 5.6% yoy in May (Apr: 6.7%). Retail sales grew by 3.7% yoy (Apr: 2.3%), the quickest increase since Feb. Fixed asset investment increased by 4.0% yoy in Jan-May (Jan-Apr: 4.2%) and manufacturing investment jumped by 9.6%. Private sector investment edged up by a weak 0.1% and in comparison, investment in the state sector accelerated by 7.1%.

- Property sector in China data continued to disappoint. Property investment fell by 10.1% in Jan-May (Jan-Apr: 9.8%). New home prices declined in month-on-month terms for the 11th month in a row, down by 0.7% in May (the steepest decline since Oct 2014).

- FDI into China fell by 28.2% in Jan-May (Jan-Apr: 27.9%): FDI into the manufacturing and high-tech manufacturing sectors accounted for 28.4% and 12.2% respectively of the total.

- The Bank of Japan meeting minutes indicated that the board discussed the possibility of further rate hikes amidst persistent inflationary pressure. The apex bank will reveal a more detailed plan about reduced government bond purchases at the next meeting.

- Exports from Japan grew by 13.5% yoy in May, the fastest pace since Nov 2022, supported by the weak yen and exports of auto and chip-making machinery. Exports to the US and Asia surged by 23.9% and 13.6% respectively. Imports were up by 9.5% to nearly JPY 9.5trn taking the trade deficit to JPY 1.22trn.

- Inflation in Japan rose to 2.8% in May (Apr: 2.5%). Excluding food and energy, prices eased for the 9th consecutive month, to 2.1% (Apr: 2.4%) – the lowest yoy uptick since Sep 2022. Excluding fresh food, prices rose by 2.5% (Apr: 2.2%), largely due to a hike in the renewable energy levy.

- Jibun Bank’s preliminary manufacturing PMI for Japan showed a slight drop to 50.1 in Jun (May: 50.4), given a decline in new orders and steep declines in export sales and purchasing activity. Services PMI slipped below-50 for the first time since Aug 2022, to 49.8 (May: 53.8), as the pace of growth in new orders, new export orders and employment slowed. Composite PMI slipped to 50 in Jun (May: 52.6), the lowest since Dec 2023.

- Japan machinery orders fell sharply by 2.9% mom in Apr (Mar: +2.9%), led by the manufacturing sector (-11.3% to JPY 419.4bn). The non-manufacturing sector orders posted a 5.9% jump to JPY 475.3bn.

- India’s preliminary manufacturing PMI moved up one point to 58.5 in Jun, thanks to robust output and new orders readings while output prices rose the most in a year. Services PMI inched up to 60.4 (May: 60.2), staying expansionary for the 35th month in a row.

- Unemployment rate in Singapore stayed put at 2.1% in Q1. The unemployment rate for Singaporeans was 3.1% and it was 3.0% for residents (including permanent residents).

Bottom line: Attention is still focused on central banks following the BoJ’s dovish stance – Ueda signalling a rate hike, leaving the door open for as early as July – and the BoE is eying a post-election rate cut (maybe as soon as the next meeting). This week’s US PCE print will be crucial for the Fed’s rate decisions. Separately, election heat is building up across the globe – the Sunak-Starmer and the Biden-Trump debates are set for this week, as is the first round of voting in France’s snap parliamentary election.

Regional Developments

- Bahrain attracted USD 6.8bn in FDI flows in 2023, according to UNCTAD’s World Investment Report 2024, exceeding the previous record of USD 2.8bn in 2022. According to Bahrain’s Information & eGovernment Authority, nations contributing to the country’s FDI stocks include Kuwait (36%), Saudi Arabia (23%) and the UAE (10%).

- Exports from Egypt grew by 9.8% yoy to USD 16.55bn in Jan-May 2024, with exports to the Arabi region up 8.7% to USD 13.6bn. Year-to-date, Saudi Arabia was Egypt’s largest export market, totalling USD 1.39bn, followed by Turkiye (USD 1.31bn), UAE (USD 1.13bn), Italy (USD 974mn) and the US (USD 904mn). Export

- Egypt’s finance minister stated that the government aims to lower debt services bill to 30% of public spending in the medium term and lower debt-to-GDP ratio to 80% by Jun 2027.

- Egypt’s annual urban inflation eased to 28.15% in May(Apr: 32.5%), the lowest reading since Jan 2023. Prices continued to ease for the third month in a row but remains much higher than the upper limit of the central bank target of 5-9%. Food and beverage costs were up by 31% (Apr: 40.5%) but core inflation also eased (to 27.1% from 31.8% in Apr).

- Kuwait’s trade surplus with Japan widened by 2.3% yoy to JPY 82.7bn (USD 522mn) in May. Exports from Kuwait grew by 3.9% yoy to JPY 102.8bn while imports from Japan increased by 11.5% (rising for the first time in 6 months) to JPY 20.1bn.

- Inflation in Lebanon fell to 59.7% yoy in Apr 2024(Mar: 70.4%), the lowest reading since May 2020, and massively lower than the peak rate of 269% touched a year ago. Food and beverages costs declined sharply to 33.5% (from Mar’s 51.3%) while transport costs slipped to 9.2% (from 13.2%). Growing dollarization has seen some sectors’ inflation rates remain high: education (589.2%), owner-occupied housing (128.2%), recreation & culture (64.1%) and restaurants & hotels (30.2%) among others.

- Oman posted a trade surplus of OMR 2.61bn at end-Mar (Mar 2023: OMR 1.93bn): exports increased by 16.7% yoy to OMR 6.5bn while imports grew by 6.9% to IMR 3.89bn. Exports were supported by the 3.1% uptick in oil and gas exports (to OMR 3.72bn) while non-oil exports surged by 44.9% to OMR 2.33bn.

- Foreign investments to the Muscat Stock Exchange increased by 19% as of May; the capital markets attracted investors from 135 nationalities, up from 67 in 2023.

- The revenue of three- to five-star hotels in Oman accelerated by 11% yoy to OMR 93mn (USD 242mn) as of end-Apr. Hotel guests grew by 15% yoy to 767,900 (Asian guests grew by 23% yoy) and room booking were up by 10% to 241,058.

- Inflation in Qatar eased to 0.93% yoy in May(Apr: 1.4%): food prices ticked up to 4.6% (from 3.2%) as did recreation costs (11.97% from 10%) while transport costs slowed (0.82% from 1.2%). Communication costs plunged by 12.73% in May while housing & utilities and restaurants & hotels continued in deflationary territory (at -3.4% and -1.9% respectively).

- Qatar’s industrial production declined by 3.1% mom and 5.9% yoy in Apr; this is the third consecutive month of yoy decline. Among the major sectors, mining & quarrying (with a relative weight of 82.46%) fell by 3.3% mom and 6.1% yoy. Manufacturing, with a 15.85% weight,also fell in Apr: down by 2.5% mom and 5% yoy.

- Qatar’s trade surplus narrowed to QAR 17.4bn in May, down by 1% mom and 20.8% yoy. Total exports declined by 3.6% mom to QAR 27.48bn in May, with exports of petroleum gases accounting for nearly 60% of total exports (vs. 62.2% a year ago). Top export destinations were China (18.9% of total exports), South Korea (15.4%) and India (10.8%).

- Point of sale transactions in Qatar grew by 8.6% yoy to QAR 7.95bn in May while the value of e-commerce transactions were up by 29.2% to QAR 3.58bn, as per central bank data. Foreign currency reserves and liquidity of the Qatar central bank increased by 3.96% yoy to QAR 249.165bn in May while gold reserves increased by QAR 7.3bn to QAR 28.33bn.

- Total credit in Qatar grew by 4.7% yoy in Apr(Mar: 4.9%): claims to the private and government sectors increased by 5.1% (to QAR 867.3bn) and 7.8% (to QAR 111.1bn) respectively. Credit to government institutions accounted for 20% of total credit and edged up by 1.5% yoy to QAR 248.41bn.

- The IMD’s World Competitiveness Report 2024 placed UAE 7th globally (+3 places), Qatar (11th) and Saudi Arabia 16th (from 24th). The UAE ranked among the top 10 globally in over 90 key and sub-indicators.

- Startup Genome’s latest Global Startup Ecosystem report ranked Abu Dhabi as the fastest-growing startup ecosystem in the region, with a global rank between 61 and 70. The city created USD 4.2bn in ecosystem value between Jul 2021 and Dec 2023 while early-stage and VC funding for the period touched USD 324mn and USD 1.1bn respectively. Within the region, Riyadh and Dubai were the two ecosystems making the global list of cities with four or more unicorns in the last 10 years.

- UNCTAD’s World Investment Report 2024 showed that (a) FDI into West Asia declined by 9% to USD 65bn in 2023; (b) number of international project finance deals in West Asia rose to 94 in 2023 (2022: 50), with value up 32% yoy to USD 57bn – in contract to the decline in wider developing Asia; and (c) UAE ranked second in greenfield FDI project announcements (+33% yoy to 1323) among others. UAE and Saudi Arabia attracted USD 30.688bn (+35% yoy) and USD 12.3bn in FDI.

- Bloomberg reported that Saudi Arabia was the top issuer of international bonds among emerging markets to date: this is the first time in 12 years that China has not been in the top spot. Saudi entities bond sales to date were up 8% to USD 33.2bn – the government accounted for more than half of this amount.

- MAGNiTT reported that MENA recorded 43 startup exits in 2023, up from just 15 in 2015. The UAE accounted for 24 of the 43 exits last year (with 60% of the deals happening in Jan-Sep) while this year saw 10 exits being completed.

Saudi Arabia Focus

- Consumer price inflation in Saudi Arabia eased to 1.55% yoy in May(Apr: 1.58%), though multiple categories posted slight increases including food & beverages (1.43% from 0.8%) and hotels & restaurants (2.48% from 2.0%) and education costs remained steady at 1.1% (from 1.2%); housing costs held steady at 8.7% (with housing rents up by 10.5%).

- Wholesale prices in Saudi Arabia slowed to 3.2% in May(Apr: 3.4%), with most categories posting declines. “Other transportable goods” category posted the highest readings (8.02% from 8.06% in Apr); within this category, prices accelerated most in basic chemicals (47%) and refined petroleum products (12.0%). Deflation continued in ores & minerals (-2.8% vs -2.3% in Apr) and in metal products, machinery & equipment (-0.42% from Apr’s -0.55%).

- Gross fixed capital formation in Saudi Arabia grew by 7.9% yoy to SAR 317.5bn (USD 84.7bn) in Q1 2024: the government sector, contributing 7% of total GFCF, grew at 18% while the non-government sector accelerated by 7.2%.

- The IMF, in its concluding statement of the Article IV mission to Saudi Arabia, disclosed that Saudi’s “unprecedented economic transformation is progressing well” while forecasting 4.5% growth in 2025 and a stable “3.5% per year over the medium term”. The current account is expected to clock in a deficit in 2024, averaging 2.3% of GDP between 2026-29 while fiscal deficit is estimated to average 2.5%-3% of GDP. More: https://www.imf.org/en/News/Articles/2024/06/13/mission-concluding-statement-saudi-arabia-concluding-statement-of-the-2024-article-iv-mission

- Crude oil production in Saudi Arabia increased by 13k barrels per day (bpd) to 8.99mn in Apr, according to JODI. Exports however declined by 445k bpd from March to 6mn.

- Saudi Aramco signed a non-binding agreement with US-based NextDecade to expand its LNG portfolio. Under the agreement, Aramco expects to buy 1.2mn tonnes per annum of LNG for 20 years on a free on board basis, at a price indexed to Henry Hub.

- China approved its first exchange-traded funds investing in Saudi Arabia equities: with this, investors in China will be able to trade Saudi stocks.

- Saudi Arabia’s international reserve assets increased by 6% yoy to SAR 1.75trn in May, an 18-month high. Currency holdings accounted for 95% of the total (SAR 1.66trn, up 6% yoy) while SDRs accounted for 4% (+0.3% to SAR 77.68bn).

- Remittances from Saudi Arabia grew by 14% yoy to SAR 11.35bn in Apr, according to SAMA data.

- The total number of women leaders in the Saudi labour market reached 1,707, exceeding the target of 1000 in the Vision 2030 document. Women’s share in the labour market rose to 34% in 2023 (2017: 21.2%) and women in middle and senior administrative positions jumped to 43.8% (2017: 28.6%).

- Total M&A deal volume in Saudi Arabia stood at USD 955mn in Q1 2024, with chemicals sector accounting for 52.4% of the total (USD 500mn+ deals), according to Dealogic.

- Saudi PIF and a French PE group Ardian agreed to buy a 38% stake in London’s Heathrow airport for GBP 3.3bn: Ardian will become the biggest shareholder with a 22.6% stake, followed by the Qatar Investment Authority (20%) and PIF (15% stake).

- Saudi Arabia’s PIF plans to invest USD 15bn in Brazil, according to Brazil’s minister for energy: plans shared suggest investment in sectors such as green hydrogen, infrastructure and renewable energy.

UAE Focus

- The UAE central bank forecasts growth at 3.9% this year and 6.2% in 2025 in its latest Economic Quarterly Review report. The surge in growth next year can be traced to a recovery in the hydrocarbon sector (8.4% from 0.3% in 2024) while non-hydrocarbon GDP is estimated at 5.3% (from 5.4% in 2024). The apex bank revised down its inflation forecast for this year to 2.3% (from 2.5% previously) and projects the 2025 average to be 2.3% driven by non-tradeables.

- UAE’s gross bank assets increased further in Mar 2024, rising to AED 4.254trn (up 1.4% mom and 13% yoy). Deposits in the UAE grew by 1.5% mom & 15.2% yoy in Mar, thanks to a 1.5% mom & 16.4% uptick in resident deposits. Government and GREs together accounted for one-fourth of total deposits in Mar; these grew by 4.5% and 10.7% year-to-date.

- Overall domestic credit in the UAE grewby 1.1% mom and 6.1% yoy to AED 1.776trn in Mar. Credit to the private sector accounted for 72% of domestic credit. Within the private sector, credit to business and industrial (at AED 841.7bn) accounted for 2/3-rds. Credit disbursed to SMEs stood at AED 81.7bn as of end-Mar, down by 4.7% yoy and 1.0% year-to-date, accounting for about 6.4% of total domestic credit to the private sector.

- The value of gold reserves of the UAE central bank grew by 9.8% mom and 12.6% yoy to AED 19.615bn by end-Mar 2024. At end-2019, gold reserves value stood at AED 4.044bn.

- The DMCC freezone attracted more than 160 new companies from India last year, adding to the nearly 3900 registered Indian firms. DMCC attracted 2700 new firms last year, leading to a total of over 24k businesses in the free zone.

- UAE is the largest Arab investor in Morocco and the second largest globally, disclosed the President of the Casablanca-Settat Chamber of Commerce, Industry and Services, and investment volumes are expected to double in the near-term. UAE’s exports to Morocco was AED 4.85bn in 2023 while Moroccan exports to the country clocked in at AED 742mn.

- Masdar is set to acquire a 67% majority stake in Greece’s Terna Energy, the largest wind power operator in Greece and the largest investor in the country’s renewable sector. The deal is subjected to regulatory approvals; when completed, Masdar plans all-cash offer for the rest of the shares.

- Cerebras Systems, a chipmaker based in California backed by Abu Dhabi Growth Fund and G42, has confidentially filed for an initial public offering, according to The Information. The company also authorized new shares for an impending “F-1 round” at a steep discount to its prior round.

- Brookfield Asset Management is looking to raise USD 5bn for UAE-backed Catalytic Transition Fund announced at the COP28 climate talks. The fund aims to scale up climate finance in emerging markets and is anchored by a USD 1bn commitment from the UAE-based ALTERRA fund.

- About 6,700 millionaires are expected to move to UAE by end-2024, according to international investment migration advisory firm Henley & Partners. The UAE is ranked 14th globally in terms of millionaires: home to 116,500 millionaires (having USD 1mn+ in liquid investable wealth), 308 centi-millionaires (USD 100mn+) and 20 billionaires (USD 1bn+).

Media Review:

Why is Saudi Arabia cutting funding, reducing costs on ambitious projects? (with Dr. Nasser Saidi’s comments)

https://www.al-monitor.com/originals/2024/06/why-saudi-arabia-cutting-funding-reducing-costs-ambitious-projects

Scars Insight: Business boom builds Qatar-Saudi entente as Gulf rift fades

https://www.reuters.com/world/middle-east/business-boom-builds-qatar-saudi-entente-gulf-rift-fades-2024-06-12/

China warns of possible ‘trade war’ with EU

https://www.reuters.com/markets/china-says-eu-escalation-trade-friction-could-trigger-trade-war-2024-06-21/

Fiscal Policy Can Help Broaden the Gains of AI to Humanity

https://www.imf.org/en/Blogs/Articles/2024/06/17/fiscal-policy-can-help-broaden-the-gains-of-ai-to-humanity

Is artificial intelligence making big tech too big?

https://www.economist.com/business/2024/06/23/is-artificial-intelligence-making-big-tech-too-big

Powered by: