Download a PDF copy of the weekly economic commentary here.

Markets

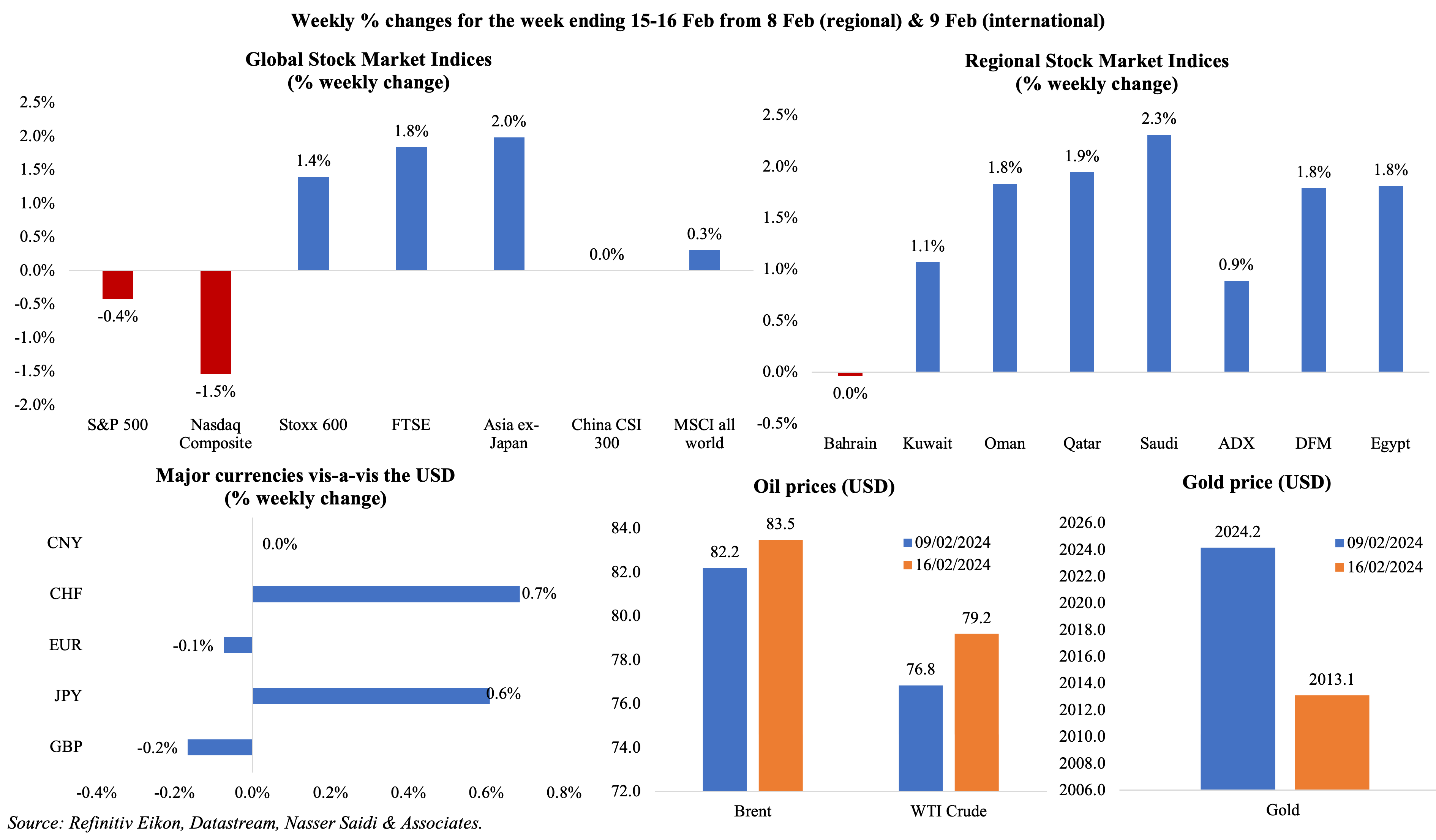

Equity markets were mostly up last week, except in the US; Japan’s Nikkei rose to a 34-year high. Regional markets ended higher during last week, predominantly on strong corporate earnings reports; Dubai came close to touching a near 9-year high. Among currencies, Japanese yen was affected by the governor’s statement (on Friday) that monetary stance is expected to remain accommodative with GDP data indicating a recession. Oil prices inched up during the week on rising geopolitical tensions while the IEA reported that oil demand was slowing alongside an expansion in non-OPEC supply. Gold price fell for the second week in a row, while the dollar gained and expectations for a Fed rate cut were pushed forward (to Jun).

Global Developments

US/Americas:

- Inflation in the US eased to 3.1% in Jan (Dec: 3.4%), as energy costs declined (-2% in Dec) while shelter rose at a softer pace (6% from 6.2% in Dec). Excluding food and energy, prices remained steady at 3.9%. These numbers reduce chances for an early rate cut from the Fed.

- Producer price index gained 0.9% yoy in Jan (Dec: 1.0%); in mom terms, prices grew by 0.3%, with services rising by 0.6% (the largest uptick since Jul 2023). Excluding food and energy, prices rose to 2% yoy (Dec: 1.7%).

- US industrial production unexpectedly fell by 0.1% mom in Jan (Dec: 0%), while mining and manufacturing output declining by 2.3% and 0.5% respectively. The decline was attributed to “winter weather”. Capacity utilisation was 78.5%, about 1.1 percentage points below the 1972-2023 average.

- US budget deficit narrowed to USD 22bn in Jan (Jan 2023: USD 39bn), taking the deficit for Oct-Jan to USD 532bn (-16% yoy). Interest costs jumped by 37% yoy to USD 357bn.

- Retail sales in the US shrank by 0.8% mom in Jan (Dec: 0.4%), the biggest decline in 10 months. Both gasoline sales and sales of motor vehicles & parts declined by 1.7% in Jan while online sales fell by 0.8% (Dec: +1.4%).

- NY Empire State manufacturing index improved to -2.4 in Feb (Jan: -43.7), with new orders declining (-6.3 from -49.4), shipments rising (2.8 from -31.3) and employment holding steady (-0.2 from -6.9).

- Philadelphia Fed manufacturing survey rose to 5.2 in Feb (Jan: -10.6), the first uptick since Aug 2023. New orders sub-index rose by 13 points to -5.2 while employment index fell to -10.3 (the lowest since May 2020).

- Michigan consumer sentiment index inched up to 79.6 in Feb (Jan: 79), the highest since Jul 2021, with the expectations index improving to 78.4 (Jan: 77.1). Inflation expectations for a year ahead moved up to 3% (from 2.9%) while 5-year inflation outlook remained at 2.9%.

- Building permits fell by 1.5% mom to 1.47mn in Jan: permits for single-family homes grew by 1.6% to 1.015mn, the highest in two years alongside a drop in multi-family permits (-9% to 405k). Housing starts plunged by 14.8% mom to 1.331mn, the lowest since Aug, largely due to a drop in multi-family housing starts (-35.8% to 314k units).

- Initial jobless claims fell by 8k to 212k in the week ended Feb 9th, falling for the second time in 4 weeks, and the 4-week average rose by 5.75k to 218.5k. Continuing jobless claims rose by 30k to 1.895mn in the week ended Feb 2nd.

Europe

- The European Commission forecasts growth to slow in 2024: to 0.9% in the EU and 0.8% in the eurozone (this is down from the forecast of 1.3% and 1.2% respectively in its autumn forecast). Inflation in the EU is projected to fall to 3% in 2024 (2023: 6.3%) and further to 2.5% in 2025.

- Industrial production in the eurozone grew by 2.6% mom in Dec (Nov: 0.4%), the biggest gain since Aug 2022, with production of consumer durables and capital goods increasing (by 0.5% and 20.5% respectively). In yoy terms, IP grew by 1.2%, the first increase in 10 months.

- ZEW Economic Sentiment Index in Germany increased to 19.9 in Feb (Jan: 15.2) while the current situation index plunged to -81.7, the lowest level since Jun 2020 (Jan: -77.3). The rise in sentiment stems from the expectation of ECB interest rate cuts over the next 6 months. In the eurozone, economic sentiment index rose to 25 in Feb (Jan: 22.7) while the situation indicator ticked up by 5.9 points to -53.4.

- UK GDP shrank by 0.3% qoq and 0.2% yoy in Q4 (Q3: -0.1% qoq and 0.2% yoy), slipping into recession. The ONS stated that manufacturing, construction, and wholesale were the main sectors dragging down growth.

- Inflation in the UK held steady at 4% in Jan, the same as in Dec: services inflation edged up to 6.5% (from Dec’s 6.4%) and core inflation stood unchanged at 5.1%. Retail price index eased to 4.9% (Dec: 5.2%), posting the smallest rise since Sep 2021.

- UK industrial production grew by 0.6% yoy and 0.6% mom in Dec (Nov: 0.1% yoy and 0.5% mom). Manufacturing output continued to expand, rising by 0.8% mom and 2.3% yoy.

- Retail sales in the UK rebounded by 3.4% mom in Jan (Dec: -3.3%), rising the most since Apr 2021. Food sales rose by 3.4% (Dec: -3.1%) while clothing was the only declining sub-category (-1.4%). Overall sales were still 1.3% below what it was just before the pandemic.

- UK’s unemployment rate fell to 3.8% in the 3 months to Dec (Nov: 3.9%). Average earnings excluding bonus eased in the 3 months to Dec (5.8% from 6.7% in the month before).

Asia Pacific:

- Domestic-tourism spending in China during the Lunar New Year holiday, which ended on Sunday, reached CNY 633bn (USD 88bn), a 47% jump on its pre-pandemic level. During the 8-day festival, tourists took 474mn domestic trips, up 34.3% versus a year ago.

- Japan unexpectedly slipped into a recession as GDP contracted by 0.1% qoq in Q4 (Q3: -0.8%) and annualised growth fell by 0.4% (Q3: -3.3%). Private consumption and capital expenditure fell by 0.2% and 0.1% respectively, both declining for the 3rd consecutive quarter.

- Industrial production in Japan fell by 1% yoy in Dec, slowing from Nov’s 1.4% drop. In mom terms, IP grew by 1.4% in Dec (Nov: -0.9%), the strongest pace since Jun.

- Industrial output in India grew by 3.8% yoy in Dec (Nov: 2.4%), taking the cumulative output growth to 5.1% in Apr-Dec. Consumer durables and non-durable goods grew by 4.8% and 2.1% respectively. Manufacturing output grew at a faster pace of 3.9% (Nov: 1.2%).

- Wholesale price inflation in India eased to 0.27% yoy in Jan (Dec: 0.73%), staying positive for the third month in a row, thanks to slowing prices of food (3.8% from 5.4%) while prices fell for fuel and power (-0.5% from -2.4%).

- GDP in Singapore grew by 2.2% yoy and 1.2% qoq in Q4, lower than an initial estimate of 2.8% yoy and higher than the 1% growth in Q3. For the full year, growth stood at 1.1%, driven by “other services industries” (+3.9%), construction (5.2%), information and communications (4.7%) and the finance & insurance sector (5.4%) among others.

Bottom line: Last week’s data releases showed both Japan and the UK slipping into recession at end-2023 while stronger than expected inflation and PPI data in the US alongside a dip in retail sales has strengthened the view that rate cuts are likely to happen later this year than as early as next month. The flash manufacturing PMIs are to be released this week: watch for evidence related to supply delivery times and input price inflation given ongoing supply disruptions from the Red Sea; expect Asia to show strong growth. Many central banks in Asia meet on rates this week (including China and South Korea), and are widely expected to keep rates unchanged.

Regional Developments

- According to the IMF’s MD, the reviews of Egypt’s USD 3bn loan program will be completed “within a few weeks”.She also disclosed that Egypt’s funding gap had been identified, and that the increase in funding would be of “mega size”; she also touched upon the need for a flexible exchange rate to absorb shocks.

- Egypt’s PM revealed that the country has implemented 144 reforms since May 2022 to support the private sector and attract investors (both foreign and local). He stated that 1,000+ firms were participating in state-run programs to promote private sector engagement.

- Egypt plans to raise USD 6.5bn in revenues in 2024 from the government IPO program, according to the finance minister. The government had announced in Aug 2023 its intention of stake sales in 35 state-owned firms by end-Jun 2024. Separately, the FM also stated that tax revenues surged by 42% yoy in the first 7 months of the fiscal year 2023-24 while budget deficit stood at 5.8% of GDP.

- Unemployment rate in Egypt fell to a record low of 6.9% in Q4 2023 (Q3: 7.1%).

- The Emir of Kuwait dissolved the parliament given “violation of the constitutional principles”. The constitution dictates that general elections must be held within two months from the date of the decree dissolving the National Assembly: this would be the fourth election in as many years.

- Oman ranked 11th in the Global Entrepreneurship Index out of 49 countries in the Global Entrepreneurship Monitor (GEM) Report 2023-2024, up 27 places from the previous edition.

- Inflation in Qatar clocked in at 2.99% in Jan, as recreation, food and communication costs rose by 23.2%, 5.2% and 3.6% respectively. In mom terms, prices fell by 1.3%.

- Remittances from Saudi Arabia and the UAE grew to USD 6.5bn between Jul 2023-Jan 2024, according to Dawn news, citing the State Bank of Pakistan data. Remittances from Saudi was nearly USD 4bn, almost 29% of total remittances inflow into Pakistan.

- Holdings of US Treasuries increased in Saudi Arabia (2.98% mom to USD 131.87bn), retaining its spot of 16th largest holder globally of US Treasuries. UAE’s holdings were up by 1.8% to USD 63.98bn while Kuwait’s rose by 7.6% to USD 46.3bn.

- UNCTAD disclosed that the damage from the Israel-Hamas conflict was already 4-times that incurred during the 7-week war in 2014 and that Gaza would need a new “Marshall Plan” to support reconstruction.

Saudi Arabia Focus

- Inflation in Saudi Arabia inched up to 1.6% yoy in Jan (Dec: 1.5%), with housing rents the main driver (9.3% yoy). Restaurants & hotel prices increased by 2.4% alongside food & beverages and education costs rising by 1% and 1.2% respectively.

- Saudi Arabia posted a budget deficit of SAR 80.946bn (USD 21.58bn) in 2023, according to the finance ministry. Deficit in Q4 stood at SAR 36.99bn, with revenues amounting to SAR 357.98bn. Oil revenues stood at SAR 754.6bn in 2023 (-12% yoy), accounting for 62.3% of total revenues and non-oil revenues grew by 11% to SAR 457.7bn, while spending totalled SAR 1.293trn in full year 2023. Public debt rose by 6.1% to nearly SAR 1.05trn in 2023.

- International reserve assets fell by 5% yoy to SAR 1.6trn (USD 437bn) in 2023, according to SAMA data. Foreign currency reserves made up more than 90% of total assets.

- FDI flows into Saudi Arabia grew by 6% yoy to SAR 52.9bn (USD 14.11bn) in Jan-Sep 2023, according to the Ministry of Investment. This is in line with the objective (as outlined in the National Investment Strategy) to increase FDI inflows to SAR 83bn by 2023.

- Regional HQs can benefit from a 0% income tax rate for corporate entities and withholding taxes for a period of 30 years under this initiative, subject to certain terms and conditions. For example, exemptions from withholding tax are not applicable in instances of non-approved activities or of tax avoidance outlined in the rules.

- Saudi Arabia closed its SAR-denominated Sukuk issuance at SAR 7.87bn (USD 2.1bn) in Feb (Jan: SAR 8.82bn).

- The first round of the Saudi government’s sukuk savings product subscriptions touched SAR 861mn (USD 229.6mn), revealed the National Debt Management Centre; maturity date of this sukuk is Feb 2025. The next savings round is coming up in Mar 2024.

- Saudi Ministry of Industry and Mineral Resources issued 37,553 certificates of origin in Jan, a 13.8% rise compared to Feb 2023 (a month after the program was launched).

- The Saudi Port Authority announced the completion of Jeddah Islamic Port expansion valued at SAR 1bn (USD 270mn), which more than doubles capacity to 1.5mn sqm and raises handling capacity to 6.2mn containers (from 2.5).

- Aramco is planning to invest more into the chemicals and renewable energy sectors, according to the Saudi energy minister. Separately, Aramco’s CEO disclosed that capital expenditure which had been allocated to Aramco’s now postponed plans to boost oil output capacity will be used to expand into the gas, liquid and chemicals sector.

- ACWA Power secured financing to build USD 3.4bn worth of solar energy plants across Saudi Arabia. The solar initiatives are part of the National Renewable Energy Program.

UAE Focus![]()

- UAE’s non-oil foreign trade crossed a record AED 3.5trn in 2023 (2022: AED 2.2trn). Bilateral trade between the UAE and its top 10 partners expanded by 26% in 2023: of this, trade with Turkey surged by 103% and with Hong Kong by 47% while US trade was up by 20%. Furthermore, non-oil exports of goods accounted for 17.1% of total non-oil foreign trade (2018: 13%).

- India and UAE signed an agreement on the India-Middle East Economic Corridor (agreed on the sidelines of the G20 conference held in India last Sep) to boost trade and connectivity though few details of the agreement were disclosed. Separately, the two nations also signed cooperation agreements in electric interconnectivity, digital infrastructure projects and financial connectivity. Another agreement inked was to link its respective digital payment platforms (India’s UPI and the UAE’s AANI instant payments platform) and domestic debit & credit cards (India’s RuPay and UAE’s Jaywan) to facilitate easier cross-border transactions.

- Bilateral trade between the UAE and India is expected to rise to USD 100bn by 2027, from the USD 84.5bn reported during Apr 2022-Mar 2023, revealed the UAE’s Minister of Investment. He also stated that the UAE, with investments estimated at USD 17bn by end-Sep 2023, is the seventh-largest investor in India.

- Dubai Chambers’ Quarterly Business Climate Index rose to 168 points in Q1 2024 (Q4 2023: 144). About 60% of respondents expect sales in Q1 to rise compared to Q4 2023 while 29% expect it to remain the same. About 41% are planning to expand into new markets (both regional and global) while one-fourth are focusing expansions within the local markets.

- The Dubai International Financial Centre (DIFC) reported a 34% jump in new registrations (to 1,451 firms) in 2023. While the total number of active companies rose to 5,523 last year (+26%), total financial and innovation-related active companies grew by 22% yoy to 1,674. Employees in DIFC-based firms grew to 41,597, up from 2022’s 36,100.

- UAE has no plans to introduce an income tax or raise VAT, reiterated the Undersecretary of the Ministry of Finance on the side-lines of the World Governments Summit in Dubai.

- UAE exchange houses have received an approval to raise remittance fees by 15% (which equates to AED 2.5), for physical branches. Offerings via mobile apps are likely to remain unchanged.

- Abu Dhabi’s Advanced Technology Research Council launched a USD 200mn tech investment platform to fund “resource and research costs” in six sectors covering transport, healthcare, aerospace & space, food & agriculture, safety & security, and sustainability, environment & energy.

Media Review

Global Economic Diversification Index 2024 launched at the World Governments Summit

https://www.zawya.com/en/economy/gcc/wgs-2024-uae-bahrain-lead-in-gcc-on-global-economic-diversification-index-vfpmigcx

https://nassersaidi.com/2024/02/14/global-economic-diversification-index-2024-report-released-at-the-world-governments-summit-feb-2024/

Why the world’s mining companies are so stingy

https://www.economist.com/business/2024/02/18/why-the-worlds-mining-companies-are-so-stingy

Supply shocks were the most important source of inflation in 2021-23

https://www.piie.com/blogs/realtime-economics/2024/supply-shocks-were-most-important-source-inflation-2021-23-raising

The Middle Truth in the Inflation Muddle by Barry Eichengreen: Project Syndicate

https://www.project-syndicate.org/commentary/why-fed-critics-are-wrong-about-monetary-policy-role-by-barry-eichengreen-2024-02

The Uninsurable World: What Climate Change is Costing Homeowners

https://www.ft.com/content/ed3a1bb9-e329-4e18-89de-9db90eaadc0b

Powered by: