Middle East PMIs. Saudi GDP & manufacturing. Global trade & transport.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 10 Mar 2023: Global trade slows but economic activity ticks up in the Middle East

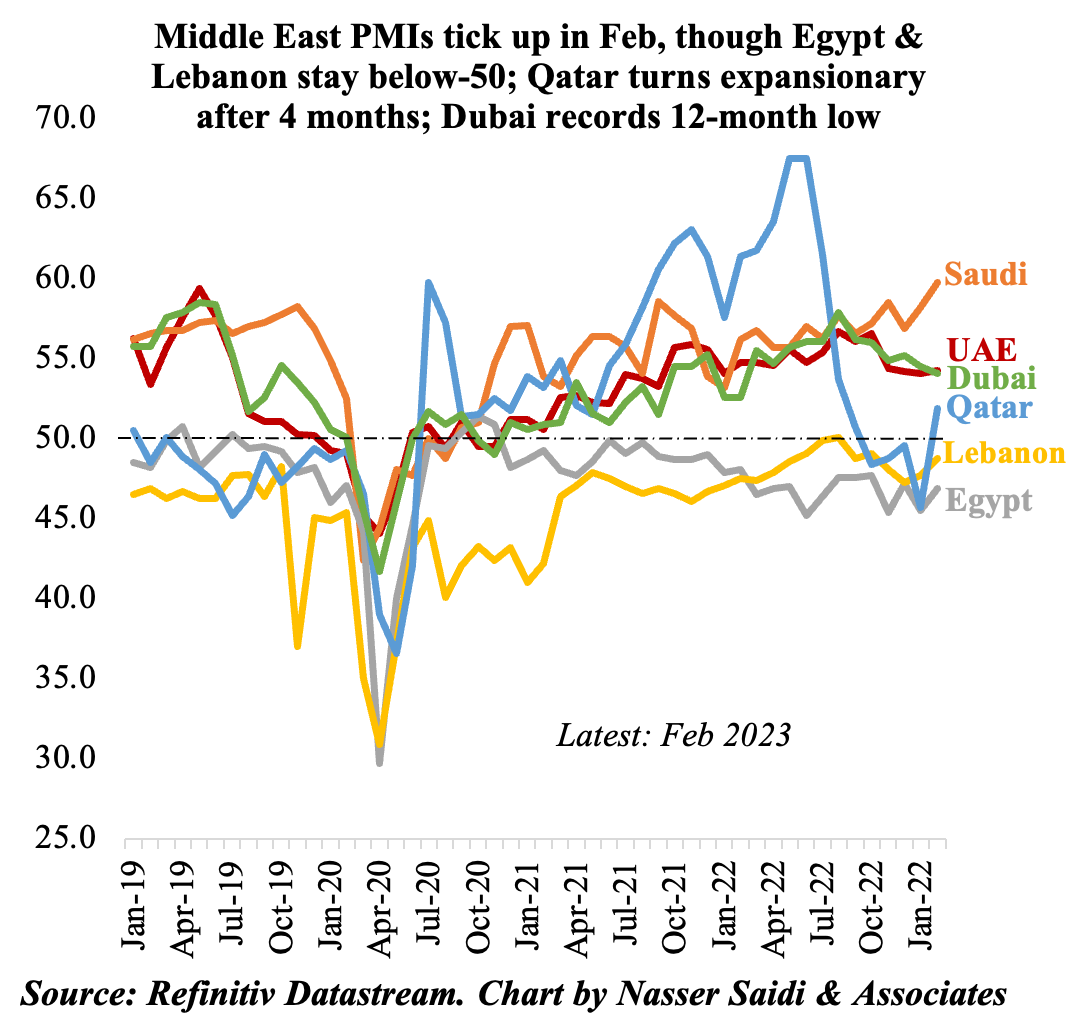

1. Middle East PMIs rise in Feb, alongside a fresh increase in input costs

Most PMI readings in the Middle East mostly increased in Feb: only Dubai reported a slight decline in the headline reading (while remaining above-50).

Most PMI readings in the Middle East mostly increased in Feb: only Dubai reported a slight decline in the headline reading (while remaining above-50).- Qatar moved into expansionary zone after 4 months, as new projects were initiated after the World Cup frenzy.

- Both Egypt and Lebanon showed an improvement the overall reading (in spite of being below-50), indicating that the pace of declines (in output, new orders or other sub-indices) was slower.

- A few interesting observations from the PMIs:

- New increases in input costs (a 32-month high in case of Lebanon and Dubai’s fastest rise since Jul 2022). Some panelists trace it back to costs of imported raw materials and/ or shipping costs.

- Output costs patterns varied: while firms in Qatar raised costs for the 9th time in 10 months, those in Dubai reduced output charges for the 7th consecutive month.

- Vendors cut their delivery times as supply chain performance improved: UAE recorded the fastest pace since Sep 2019, while Saudi posted the strongest pace in 3 months. Egypt saw delivery times lengthen, but largely owing to import controls than other factors.

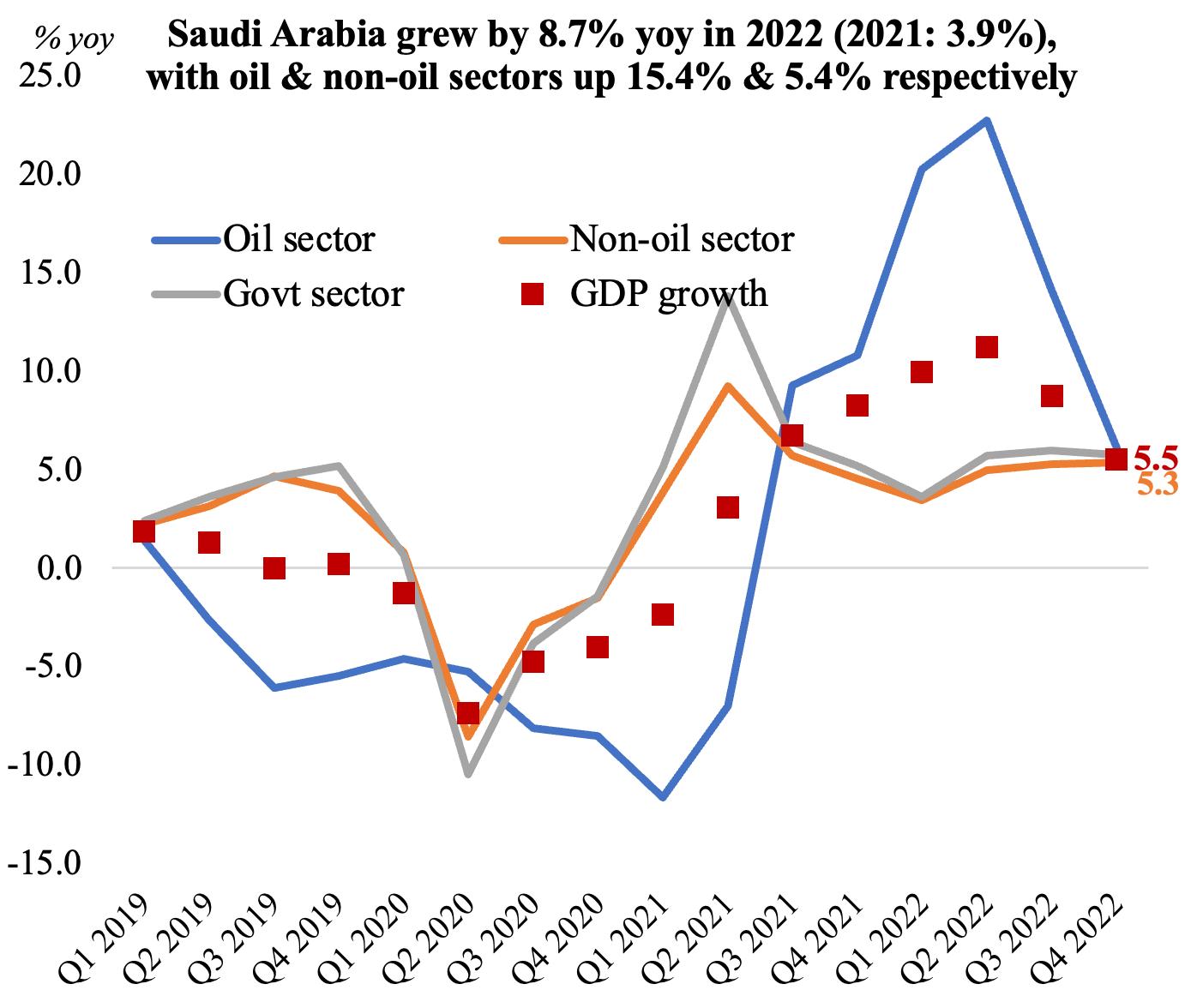

2. Saudi Arabia grew by 8.7% in 2022, the fastest growth in over 10 years & highest among G20 nations

- While both oil and non-oil sectors supported economic growth in 2022, easing oil production growth will leave an impact in 2023. The government’s ambitious project pipeline will support non-oil sector growth.

- Private consumption and public investment contributed most to GDP growth in 2022 alongside net exports

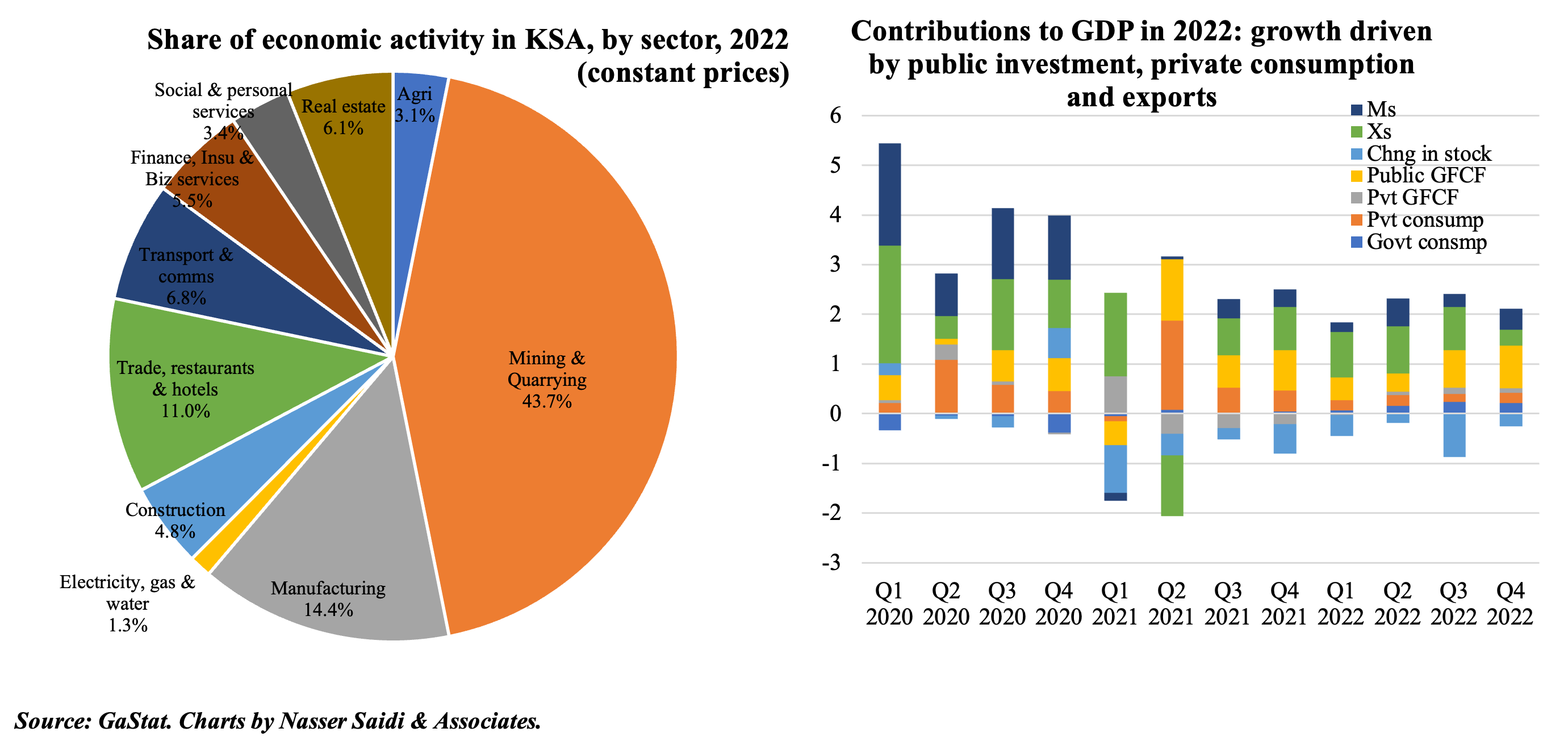

- Mining & quarrying accounts for the lion’s share of activity by sector (43.7%), but it is important to note the prominent role of manufacturing (14.4% in 2022).

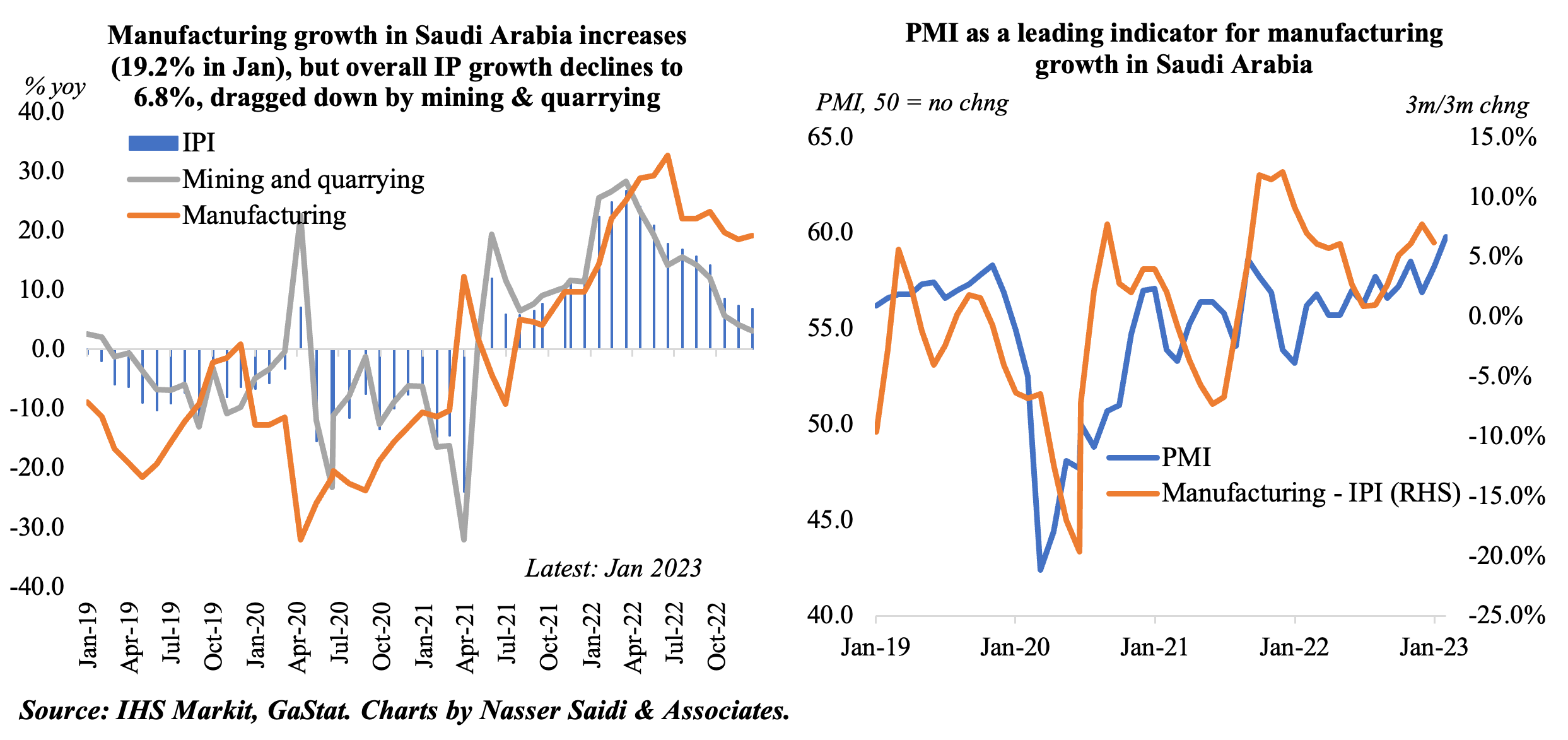

3. Industrial production in Saudi Arabia eased for the 10th straight month in Jan 2023; manufacturing remains a bright spot

- Industrial production in Saudi Arabia grew by 6.8% yoy in Jan, following Dec’s 7.3% uptick and a full year gain of 17.5% in 2022. Manufacturing has been the main driver of gains, ever since OPEC+ decision to undertake production cuts, though its weightage in the IP index is just 22.6%.

- Manufacturing grew by 19.2% in Jan (Dec: 18.5%, 2022: 22.3%) and the recent surge in non-oil sector PMI indicates a sustained pace of increase in the coming months thanks to the uptick in output, new orders & new export orders. The 3m-rolling average of PMI displays this strength.

- The increase in industrial investments will also support overall IP growth: it touched SAR 32bn in 2022, with the creation of 51,723 job opportunities (of which about 43% were Saudi citizens).

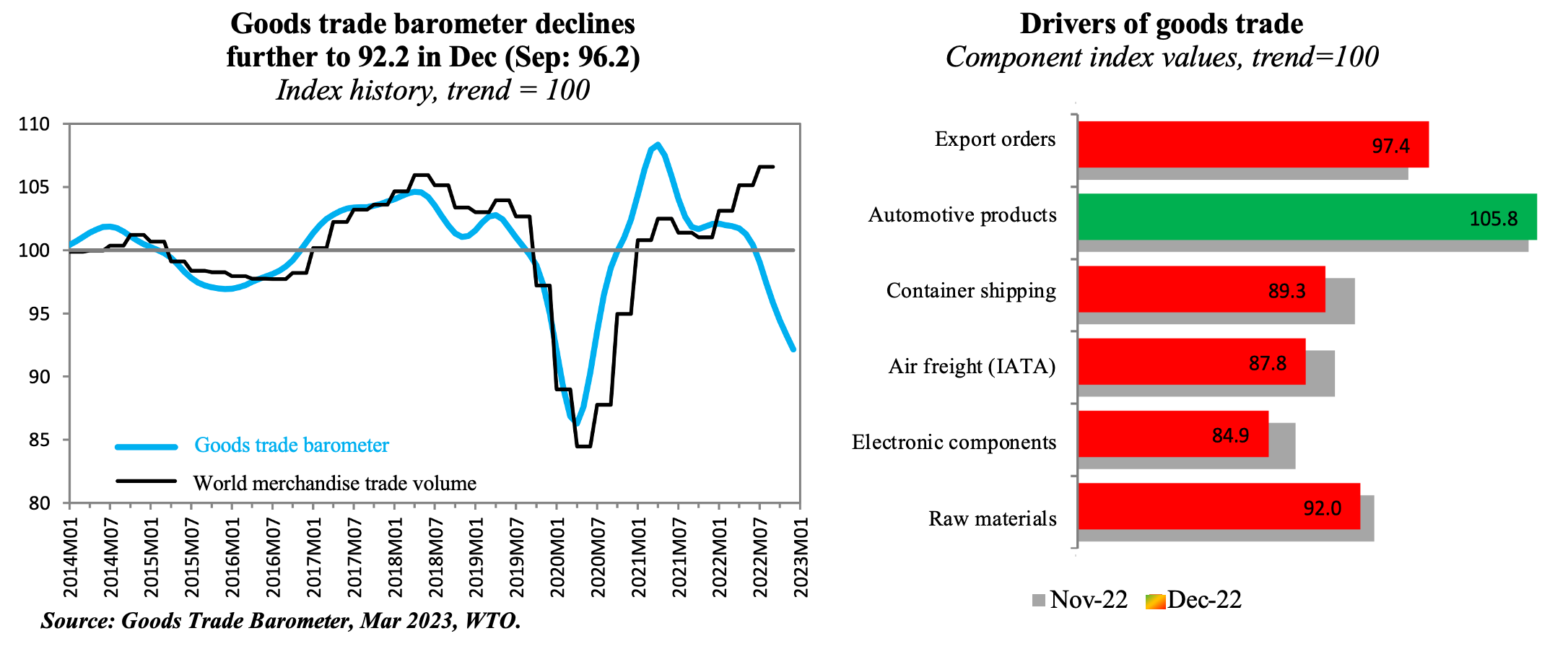

4. Global Trade Growth Lost Momentum in Q4 2022; but China’s re-opening likely to provide support from Q1 onwards

- WTO’s Goods Trade Barometer declined further in Dec (to 92.2 from Sep’s 96.2), indicating a potential decline in qoq trade volume growth in Q4 2022.

- Among the various forward-looking indicators, only automotive products have shown an increase: this is largely due to the increase in sales/ production in US, Europe & Japan offsetting China’s plunge.

- However, weakness is broad-based and visible across other components including raw materials, shipping, freight (detailed in the next point) and electronic components.

- Improvements are just around the corner, with China’s reopening: a surge in China’s consumption will boost global export demand. This is already evident in Jan’s global manufacturing PMI data: though export orders remained below trend in Dec, it has moved into expansionary zone in Jan. Even the NY Fed’s index of supply chain pressure indicates a return to “normal”, with the Feb 2023 reading at a negative -0.26 standard deviations, the lowest reading since Aug 2019.

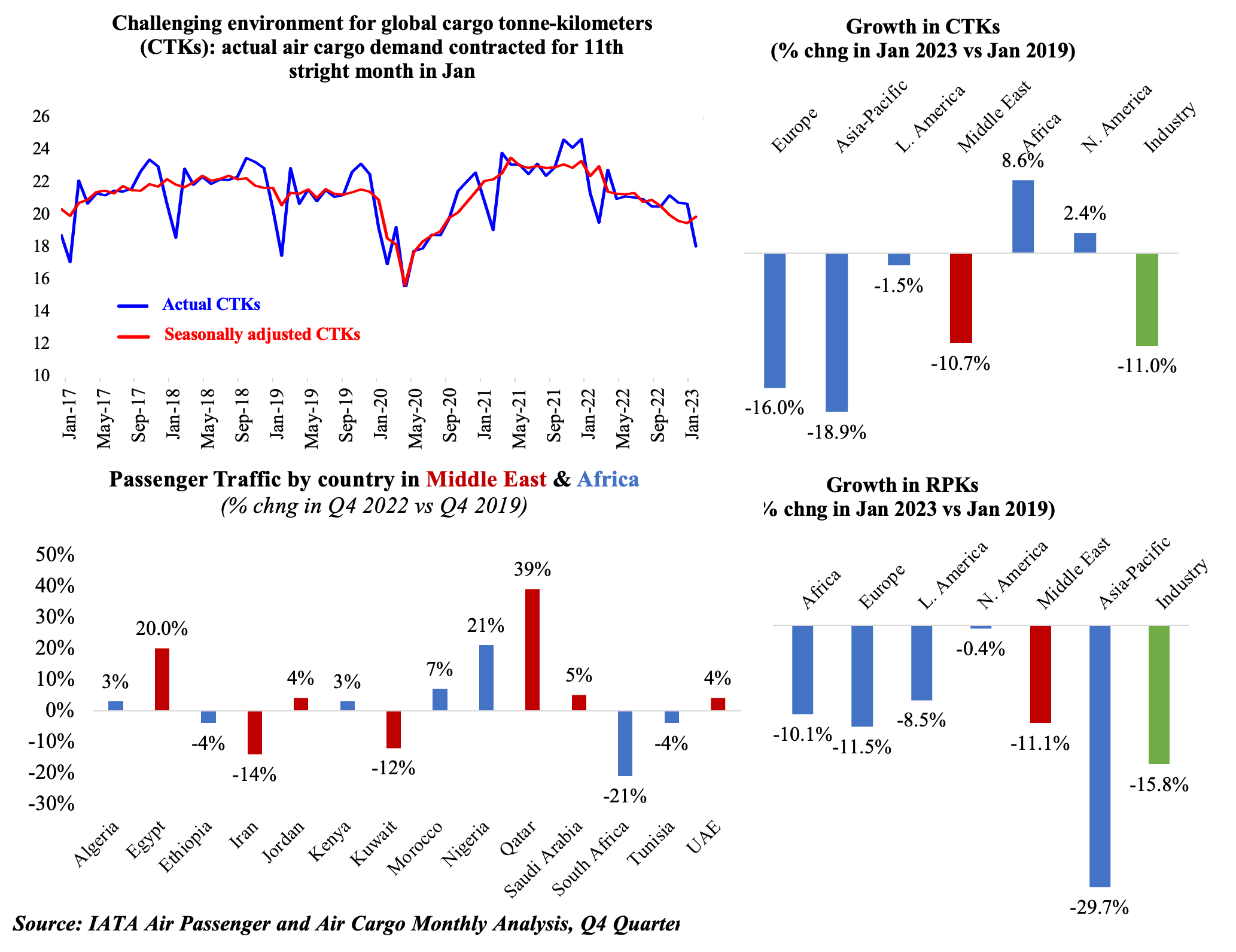

5. Air cargo demand has been waning. Even a recovery in global trade is likely to benefit maritime transport more than air cargo. Air passengers, in contrast, has seen an acceleration in recovery (% yoy) thanks to a steady increase in international traffic. Ticket sales in the Middle East surged in Q4, staying above global average (thanks to the Qatar World Cup)

Powered by: