Markets

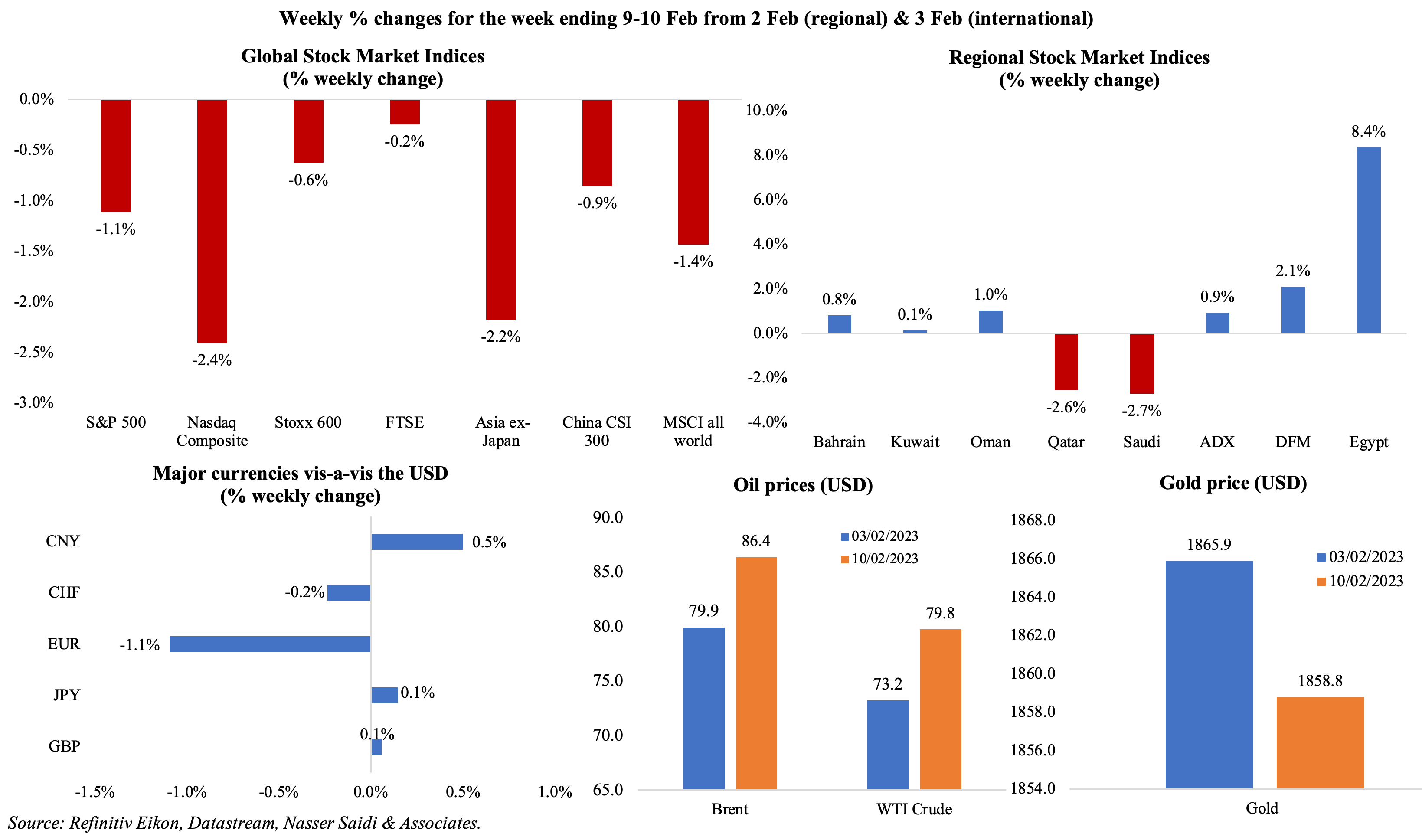

Equity markets ended in the red on concerns about further increases in interest rates – US stocks posted the largest drop in almost two months while European markets slid towards end of the week following positive news about easing inflation and gas prices. The VIX volatility index hit a one-month high on Friday. Regional markets were mixed: Egypt surged to a more than 4-year high following news about upcoming stake sales in 32 state-owned companies by end-Q1 2024 while UAE markets benefited on Friday mirroring the rebound in oil prices. The euro fell by 1.1% to the dollar last week, while news about the likely appointment of an academic as the new central bank governor (who could depart from the current ultra-dovish policies) led to a strengthening of the yen on Friday. Russia revealing that it would cut about 5% of its monthly oil output led oil prices to make significant gains (Brent closed at USD 86.4). Gold price, at USD 1859, is down almost USD 100 from its Feb peak.

Global Developments

US/Americas:

- Powell’s hawkish comments at a conference last week is noteworthy: he warned that the Fed may need to raise rates more than expected (if data continued to be “stronger than we expect”). Reducing inflation would still take a “significant period of time” given stronger labour market.

- Trade deficit in the US hit a record level of USD 948bn in 2022, up by 12.2%: exports grew by 17.7% yoy to over USD 3trn while imports rose by 16.3%. Despite strained relations, trade deficit with China grew by USD 29.4bn to USD 382.9bn in 2022.

- The US posted a USD 39bn budget deficit in Jan, as spending increased by 4% yoy (partly due to a one-time cost, the USD 36bn bailout of a union pension fund) and revenues slipped by 4% to USD 447bn. For Oct-Jan period, revenues have risen by 3% and spending by 9%.

- Michigan consumer sentiment index rose to a 13-month high of 66.4 in Feb (Jan: 64.9): the current economic conditions measure increased to 72.6 (from 68.4) while consumer expectations measure eased (62.3 from 62.7). The 5-year inflation expectation was unchanged at 2.9% for the 3rd month in a row while 1-year expectation inched up to 4.2% (Jan: 3.9%).

- Initial jobless claims increased by 13k to 196k in the week ended Feb 4th, rising for the first time since the last week of Dec, and the 4-week average fell by 2,500 to 189.25k (lowest since Apr 2022). Continuing jobless claims rose by 38k to 1.688mn in the week ended Jan 28th.

Europe:

- Sentix investor confidence in the eurozone improved to -8 in Feb (Jan: -17.5): the current situation sub-index increased to -10 (Jan: -19.3) while the expectations index rose to -6 (Jan: -15.8), the highest since Feb 2022.

- Retail sales in the eurozone fell by 2.7% mom and 2.8% yoy in Jan: declines were registered across the board, with non-food products and internet sales down by 2.6% mom and 2.3% respectively.

- Preliminary estimate of the harmonised inflation in Germany slowed to 9.2% yoy in Jan (Dec: 9.6%), the lowest in five months.

- Industrial production in Germany fell by 3.1% mom and 3.9% yoy in Dec, with output in the energy-intensive sectors falling by 6.1% mom. IP was 0.6% yoy lower in 2022 and down 5.0% from the pre-pandemic year of 2019.

- Germany’s factory orders rebounded by 3.2% mom in Dec (Nov: -4.4%), thanks to an increase in large-scale orders. Both foreign (1.2%) and domestic (5.7%) orders increased. New orders from the eurozone grew by 9.8% while from the rest of the world dropped by 3.8%.

- UK’s GDP growth was flat in Q4, after a decline of 0.2% in the previous quarter, thereby avoiding a technical recession; in yoy terms, growth was 0.4% (Q3: 1.9%). While residential investment fell by 3.2%, real consumer spending increased marginally amid an uptick in business investment and government spending by 4.8% and 0.8% respectively. In Q4 2022, the UK was still 0.8% below the level in Q4 2019, the only G7 nation to not have recovered to its pre-pandemic level.

- Industrial production in the UK increased by 0.3% mom in Dec (Nov: 0.1%), with manufacturing remaining flat. IP fell by 4% yoy and manufacturing was down by 5.7%.

Asia Pacific:

- Inflation in China increased to 2.1% yoy in Jan (Dec: 1.8%), driven by food prices (6.2%, a 3-month high), while core inflation inched up to 1.0% (Dec: 0.7%). Producer price index shrank at an annualised 0.8% (Dec: -0.7%) as domestic demand worsened.

- Money supply in China grew by 12.6% yoy, the fastest pace since Apr 2016 and outstanding yuan loans were up by 11.3%. New yuan-denominated loans surged to a monthly record high of CNY 4.9trn in Jan (three times Dec number and beating the previous record of CNY 3.98trn in Jan 2022), driven by an uptick in corporate borrowing (to CNY 4.68trn from Dec’s CNY 1.26trn). Growth of outstanding total social financing eased to 9.4% in Jan (Dec: 9.6%) – this is the slowest pace since Jan 2016.

- Japan’s leading economic index edged down slightly to 97.2 in Dec (Nov: 97.4), the lowest reading since Dec 2020, while the coincident index slipped to 98.8 from Nov’s 99.3.

- Overall household spending in Japan fell by 1.2% yoy in Dec, following a 1.2% drop the month before. Labour cash earnings grew by 4.8% (Nov: 1.9%), the largest gain since Jan 1997, and real wages rose by 0.1%, the first gain since Mar thanks to strong bonuses.

- Current account surplus in Japan narrowed to JPY 33.4bn in Dec (Nov: JPY 1803.6bn). This brings the full year current account surplus to JPY 11.44trn, the lowest in 8 years, due to a record trade deficit (in the backdrop of a weakened yen).

- The Reserve Bank of India raised repo rate by 25bps to 6.5% while leaving the reverse repo rate unchanged at 3.35%. The RBI chief stated that real policy rate had moved into positive territory.

- Industrial output in India moderated to 4.3% yoy in Dec (Nov: 7.1%), with manufacturing growth posting a sharp drop (to 2.6% from Nov’s 6.1% gain) alongside mining and electricity production rising at around 10% for the 2nd successive month. Cumulative output grew by 5.4% in Apr-Dec 2022.

Bottom line: Inflation and central bank decisions were top discussion points last week – Powell’s comments that the Fed may need to raise rates more than expected and reports about BoJ central bank governor’s potential successor and his policy views affected capital market behaviour. Meanwhile, positive macro data in China is leading to a stock-buying frenzy: foreign investors have bought a record high USD 21bn worth of Chinese equities this year, betting on its rapid recovery (growth which will also spillover onto the rest of the world). On the cards this week are macro releases that could add to the discussions, including inflation in the US (expected to ease, but likely at a slower pace) as well as inflation and wage growth in the UK (if core inflation rate remains high amid rising services costs and strong wage growth, the BOE’s signalling that rates may have peaked will need to be revisited).

Regional Developments

- Speaking at the Arab Fiscal Forum, the head of the IMF stated that “public debt is a concern” in some MENA nations, urging nations to adopt “robust” fiscal frameworks. The region needs to boost its average tax-to-GDP ratio to at least 15% from a current 11%.

- Foreign ministers of Bahrain and Qatar met in Riyadh last week, initiating talks via bilateral committees to end unresolved issues (following the lifting of boycott two years ago).

- Inflation in Egypt surged to 25.8% yoy in Jan (Dec: 21.3%), the fastest since Dec 2017, thanks to higher food and beverages costs. However, core inflation also jumped, rising to 31.2% in Jan (Dec: 24.5%).

- Egypt plans to sell stakes in at least 32 state-owned firms, including 3 major banks (Banque du Caire, United Bank of Egypt and Arab African International Bank) as well as insurance, electricity and energy companies, by end-March 2024. The first firms will be offered by end-Mar, and a quarter will be on the market by end-Jun, according to the PM.

- Moody’s lowered Egypt’s sovereign rating to B3 from B2, while also changing the outlook to stable from negative, citing the nation’s liquidity and external positions.

- Iraq revalued its currency, setting the exchange rate to IQD 1300 per dollar (from IQD 1,460 in place since Dec 2020).

- Kuwait is planning to “reconsider the mechanisms” of the work undertaken by its economic development fund. Details of the changes have not been disclosed, but it has to be seen in the context of an earlier announcement from Saudi Arabia of imposing reform conditionalities versus previous policies of unconditional grants and/ or deposits. Kuwaiti newspaper Al Qabas quoted unnamed sources stating “free loans will be reviewed”.

- Lebanon’s central bank chief disclosed that he will not seek a new term in office once his term ends this July.

- Banks in Lebanon began an open-ended strike, closing indefinitely (though ATMs will remain open), urging authorities to pass a capital control law.

- Oman LNG has signed its first contract with a Chinese firm (Unipec): it will supply around 1mn metric tonnes of LNG per year for 4 years.

- Deloitte predicts positive growth in Saudi Arabia and Dubai real estate sectors in 2023, citing post-pandemic recovery, spending on infrastructure, rebound in tourism and occupancy rates among others.

Saudi Arabia Focus

- Overall industrial productionin Saudi Arabia grew by 17.5% yoy in 2022, after years of decline, supported by mining & quarrying (+16.7%) and manufacturing (+22.3%). Manufacturing growth has been positive for 17 straight months, with double-digit growth for the past 11 months. Furthermore, industrial licenses issued reached 885 in Jan-Nov 2022 with investments of ~SAR 29.7bn and creating 40k+ job opportunities. Separately, at the LEAP conference, the deputy minister of industry and mineral resources revealed plans to raise number of factories by 50% in the next 5 years and invest SAR 1.4trn into the industrial sector.

- Saudi Arabia’s investment licenses surged by 54% yoy to 4,358 in 2022: construction licenses had the lion’s share, not surprising given the mega/ gigaprojects in the pipeline. Manufacturing continues to attract investments as well, thereby confirming strength in industrial production numbers in the coming months.

- FDI into Saudi Arabia grew by 10.7% yoy to SAR 7.2bn in Q3 2022, according to a report released by the investment ministry.

- The head of Saudi Capital Markets Authority disclosed that 23 companies have been approved to list on the exchange, with more than 75 applications pending approval. Last year, there were 49 new listings with firms raising about SAR 40bn. The CMA is also planning to create a regulatory framework for dual listings.

- Saudi Tadawul Group signed a MoU with Hong Kong Exchanges and Clearing to explore listing opportunities and collaborate in sectors like fintech and ESG.

- At the LEAP 23 conference held in Riyadh last week, 8 investment funds worth USD 646mn were announced to boost innovation and entrepreneurship.

- Saudi Arabia has attracted more than USD 9bn in investments in future technologies, disclosed the minister of communication and information technology. The investments will be made over several years, and includes big names like Microsoft and Oracle that are building cloud regions in the country.

- Saudi PIF raised USD 5.5bn via its second green bond issuance last week: the issuance was more than 6 times oversubscribed and was sold to a wide range of global institutional investors (including Asia). An amount equal to the net proceeds of the issuance will be allocated to fund eligible green projects in accordance with its Green Finance Framework. PIF expects to invest more than USD 10bn by 2026 in eligible green projects.

- The number of mining complexes in Saudi Arabia rose to 377 in 2022, with an estimated area of 44,365 sq km. Within Saudi, Makkah has the most complexes, at 76, followed by Riyadh (60) and Madinah (53).

- Saudi Arabia raised prices for its flagship crude for Asian buyers for the first time in six months: for the March-loading, official selling price was increased by 20 cents a barrel to USD 2.0 over Oman/ Dubai quotes.

- The merger of the General Authority of Zakat and Tax with the General Authority of Customs will be completed by the end of Q1 2023, revealed Zakat, Tax and Customs Authority (ZATCA)’s governor.

UAE Focus![]()

- UAE PMI eased to a 12-month low of 54.1 in Jan: while output was unchanged at a 16-month low, new exports orders declined to 47.5 – the lowest level since Jun 2021. Dubai PMI slipped to an 11-month low of 54.5 in Jan (Dec: 55.2), while delivery times improved at the strongest rate in 3.5 years. Businesses have a dim view about prospects: only 9% of panellists in the UAE and 11% in Dubai forecast growth over the next 12 months.

- UAE’s industrial sector contributed over AED 180bn (USD 49bn) to GDP and industrial exports grew to AED 174bn in 2022, according to the minister of Industry and Advanced Technology. The ministry issued 263 new industrial production licenses in 2022 (+20% yoy) while the national In-Country Value (ICV) program redirected AED 53bn into the economy.

- Non-oil foreign trade in the UAE grew by 17% yoy to AED 2.2trn (USD 599bn) in 2022, with non-oil exports rising by 6% to AED 366bn and imports up 22% to AED 1.25trn.

- UAE’s First Abu Dhabi Bank stated that it was not currently evaluating an offer for Standard Chartered, following a Bloomberg News report.

- The UAE central bank launched its Financial Infrastructure Transformation Programme to accelerate digital transformation in the financial services sector. In the first stage, various initiatives are expected to launch including a Card Domestic Scheme, an Instant Payments Platform, and the issuance of Central Bank Digital Currency for cross-border and domestic uses.

- International overnight visitors into Dubai surged by 97% yoy to 14.36mn in 2022, closing in on a record 16.73mn in 2019. Average occupancy at Dubai hotels rose to 73% in 2022 (2021: 67%; 2019: 75%), while the average daily room rate rose to the highest since 2017.

- Sharjah airport reported a 84.37% jump in passenger growth to nearly 13mn passengers in 2022. Aircraft movement grew by 51.69% to 87,495 flights last year.

- The Ras Al Khaimah Economic Zone launched a new “Instant Business Licence” system, enabling the issuance of business licences in less than five minutes.

- UAE’s private firms will be required to increase Emiratisation in skilled jobs by 1% every six months: failure to comply with this target will be fined AED 7000 for each national who has not been hired.

Media Review

What Big Oil’s bumper profits mean for the energy transition

https://www.ft.com/content/16f8800b-7300-42e0-a3c7-3400ed6c4fa5

There Is More Inflation Complexity Ahead

https://www.project-syndicate.org/commentary/why-the-resurgent-transitory-inflation-narrative-is-dangerous-by-mohamed-a-el-erian-2023-02

Arab petrostates must prepare their citizens for a post-oil future

https://www.economist.com/leaders/2023/02/09/arab-petrostates-must-prepare-their-citizens-for-a-post-oil-future

Dubai’s VARA issues specialised regulations for virtual assets

https://www.vara.ae/en/#varaGuidlinesDownloads_7

COVID-19 and its impacts on Arab economic integration: Paper by Dr. Nasser Saidi & Aathira Prasad, published by UN ESCWA

https://www.unescwa.org/publications/covid-19-impact-arab-economic-integration

Powered by: