Weekly Insights 14 Oct 2022: IMF downgrades global growth forecast; MENA to grow at a strong 5% pace

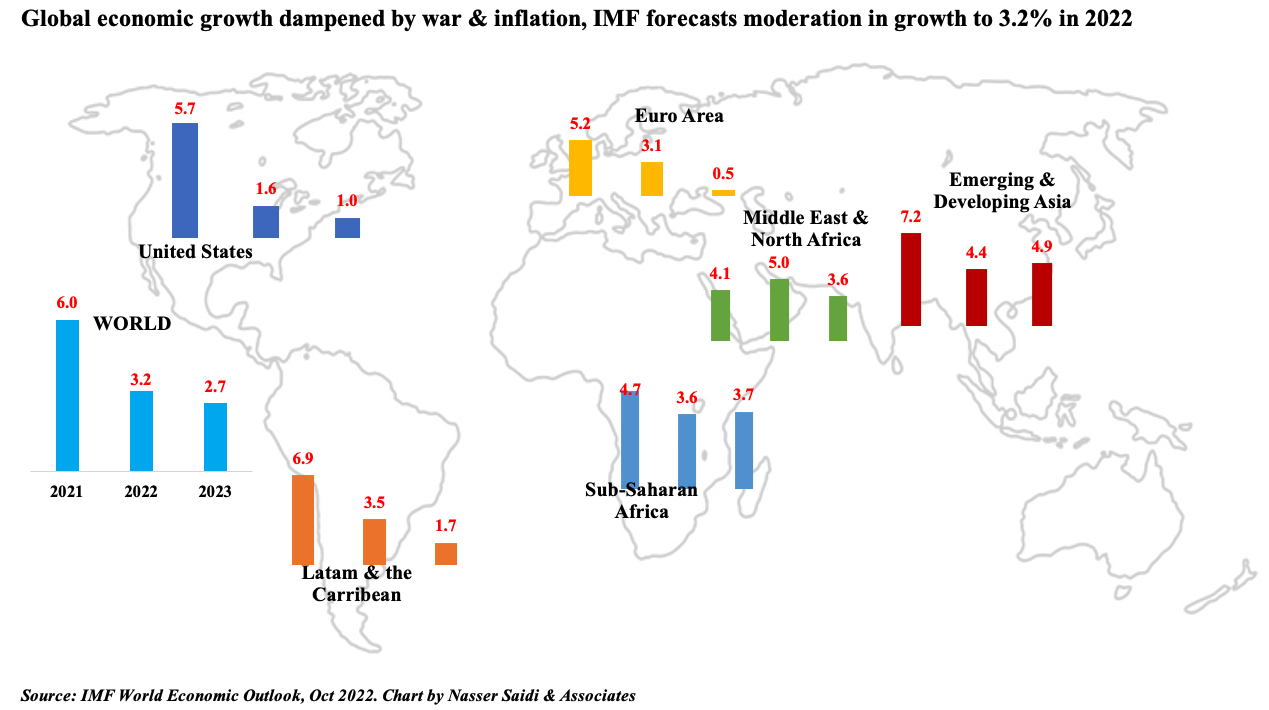

1. IMF revises down global economic growth forecast to 3.2% in 2022 & lower to 2.7% in 2023 (2021: 6.0%)

The year 2022 has been primarily about rising inflation (driven by higher food and energy prices) and subsequent monetary policy tightening across most nations amid the ongoing Russia-Ukraine crisis

An ensuing cost-of-living “crisis” and the ever-present threat of another Covid19 outbreak has the world sitting on the cusp of an economic recession. The IMF expects more than 1/3-rd of the nations to experience a recession while the US, EU & China continue to slow: given how interlinked nations are, we can anticipate a relatively gloomy 2023

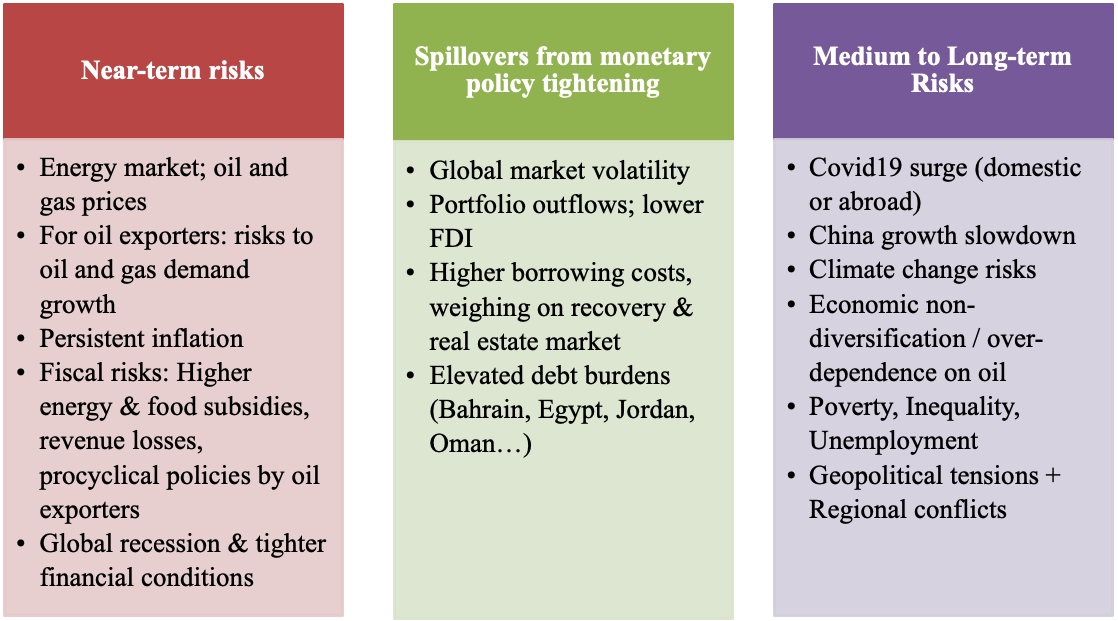

Added risks to this scenario are debt distress/ crisis owing to a rapidly tightening financial conditions (and as Covid-stimulus measures are fully withdrawn), food insecurity and social unrest as well as the brewing trade and tech war with China among others

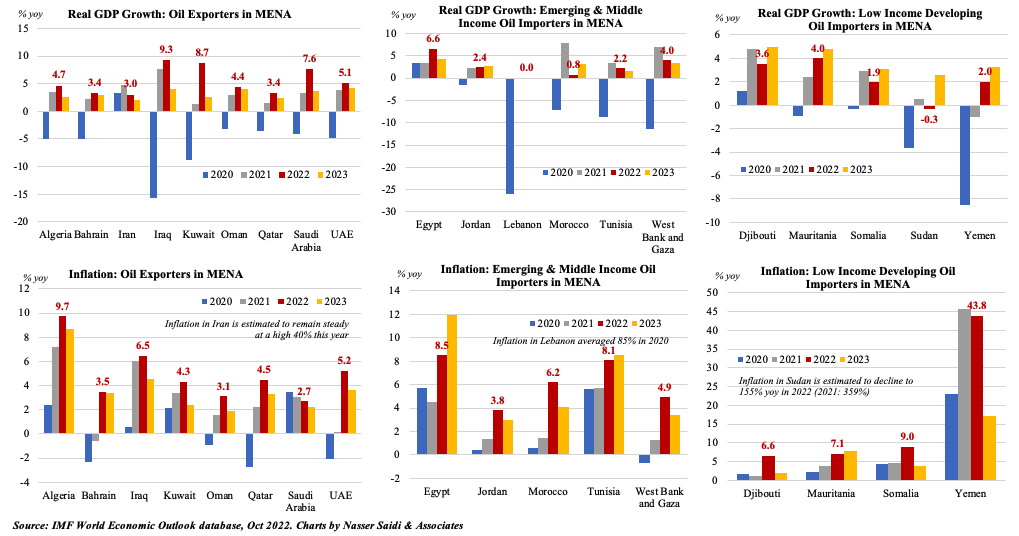

2. Middle East continues to display divergent growth prospects, with oil importers’ growth downgraded

The IMF estimates MENA region to grow by 5% in 2022 and 3.6% in 2023; breakdown shows divergence, with oil exporters benefitting (including non-oil activity) but importers lagging & facing headwinds

The pandemic has led to a significant acceleration in the pace of reforms in the GCC: from shift in focus to new economic sectors (manufacturing, SMEs, digital assets), new FTAs, long-term residency & visas for skilled workforce etc

Inflation is relatively subdued in GCC alongside surging rates across rest of MENA; food prices are rising faster, leading to concerns of poverty / inequality, food security and potential social unrest

Headwinds from potential global recession, tighter financial conditions amid persistent inflation and risks to oil and gas demand growth

3. Risks to Growth Outlook in the MENA region

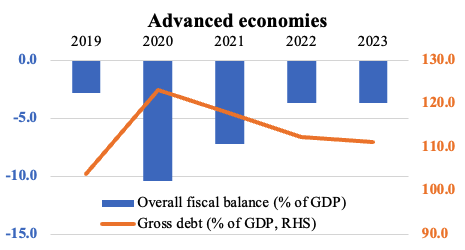

4. Public Debt Estimated To Edge Down After Pandemic-Surge, But Still Higher Than Pre-Pandemic

According to the IMF, global government debt will be equivalent to 91% of the world’s GDP in 2022 (2020: 256%) and government deficits fell from 9.7% of GDP in 2020 to 4.7% in 2022. However, both debt and deficits are expected to remain above pre-pandemic levels

Governments in emerging market economies are facing high inflation, weaker currencies & rising interest rates; borrowing costs will rise significantly given tightening financial conditions; debt vulnerabilities to rise as advanced nations raise interest rates at a faster pace to tackle inflation

Public debt estimated to decline faster among oil exporters, thanks to jump in exports: as can be seen in the case of Saudi Arabia

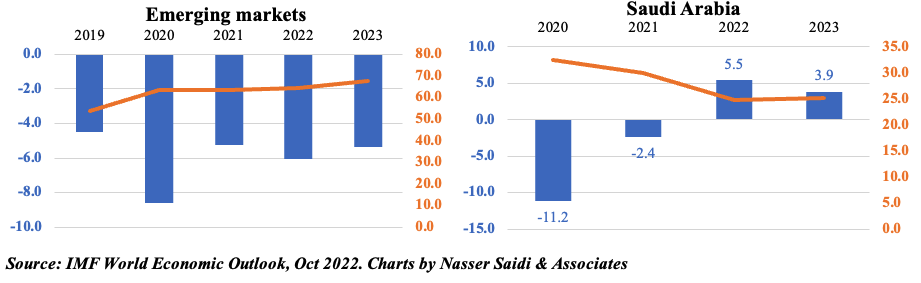

5. Inflation ticks up in both Saudi Arabia & Egypt, but at different paces

Inflation in Saudi Arabia increased to a 15-month high of 3.1% yoy in Sep while in Egypt it surged to a 4-year high of 15% – in both cases, driven by higher food and beverage costs (4.3% & 21.7% respectively)

Saudi Arabia’s weekly point-of-sale transactions data is evidence of a change in spending patterns: both value & volume of transactions declined in the week ending Oct 8th, with a sharp 13% weekly fall in clothes category

Core inflation in Egypt is also rising, at 18% in Sep. Ongoing restrictions on imports & foreign exchange scarcity adds to costs; recent increases in gas prices (some 109%) for cement factories could see spillover effects

While Saudi Arabia is also supporting low-income citizens with direct cash transfers, one significant difference between the 2 nations’ inflation pace could be the weight of tradeables in the consumption basket – Saudi’s 45% versus Egypt’s close to 60% (Read our previous Weekly Insights piece for more)

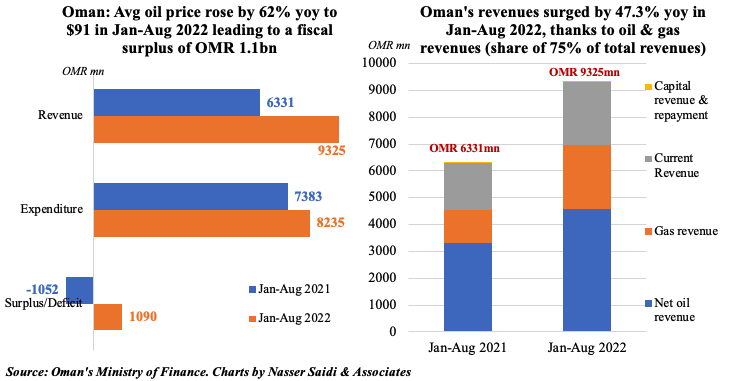

6. Oman continues its good fiscal run, posting a fiscal surplus of over OMR 1bn in Jan-Aug 2022

Ongoing implementation of the Medium-Term Fiscal Plan and higher oil prices have moved Oman into posting a fiscal surplus of OMR 1.09bn in Jan-Aug 2022 vs a deficit of OMR 1.05bn the same period a year ago. Average oil price stood at USD 91 during this period, versus USD 56 a year ago, while average daily oil production grew by 9.6% yoy to 1047 thousand barrels during Jan-Aug 2022

Dependence on oil & gas for overall revenues stays high, with its share at 74.9% in Jan-Aug 2022. Net oil revenues grew by 38.8% yoy while gas revenues almost doubled to OMR 2.4bn. Spending grew by 11.5% in H1 (68% of estimates for full year); government subsidy has been rising slowly: it touched OMR 498mn (for oil products) and OMR 11mn (for basic food subsidy) as of Aug 2022

The IMF expects Oman’s central government debt to decline to about 44% of GDP from 62.9% recorded in 2021