Weekly Insights 7 Oct 2022: Easing global input costs & supply chain pressures – whither inflation in the Middle East?

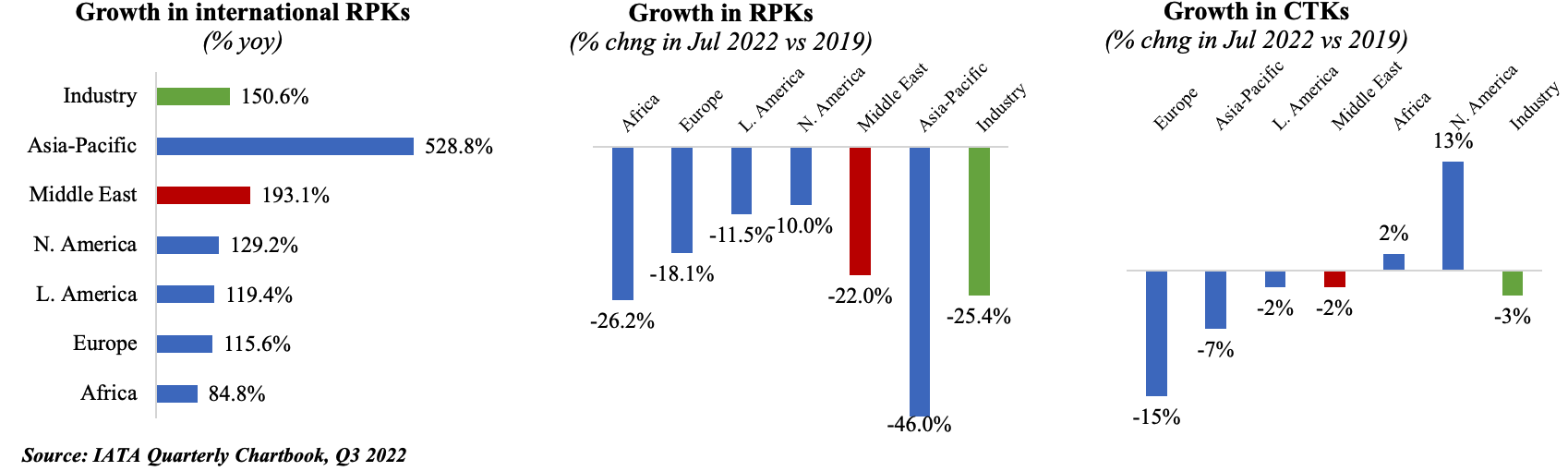

1. PMIs in the GCC, diverging from the global trend, stay high on expectations of economic recovery

- Expansionary headline readings in Saudi Arabia and UAE were underpinned by strong demand: alongside gains in output and new orders, input costs rose moderately (slower vs previous months)

- Given various megaprojects underway in Saudi Arabia, it comes as no surprise that construction recorded the strongest uptick in employment (& biggest rise in costs)

- UAE businesses continue to prioritise sales growth by offering competitive pricing (amid higher wages & input costs): charges have declined in 13 of the last 14 months, aiding demand

- Qatar, ahead of the World Cup 2022, saw business sentiment improve to a 12-month high. However, new orders fell for the first time in 27 months (likely on hold given World Cup) + both employment and inventories saw consecutive monthly declines

- Weak demand, unfavourable exchange rates and inflation have kept Egypt and Lebanon’s PMI readings below-50. Business confidence also remains weak due to energy rationing and import restrictions in Egypt and the ongoing political uncertainty in Lebanon

- Bottomline: Divergence in PMI continues; uptick in input costs seem to be moderating while firms continue to absorb costs (in the GCC)

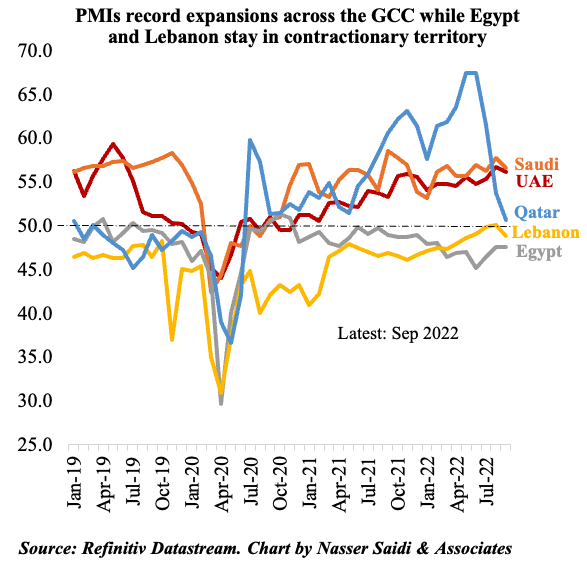

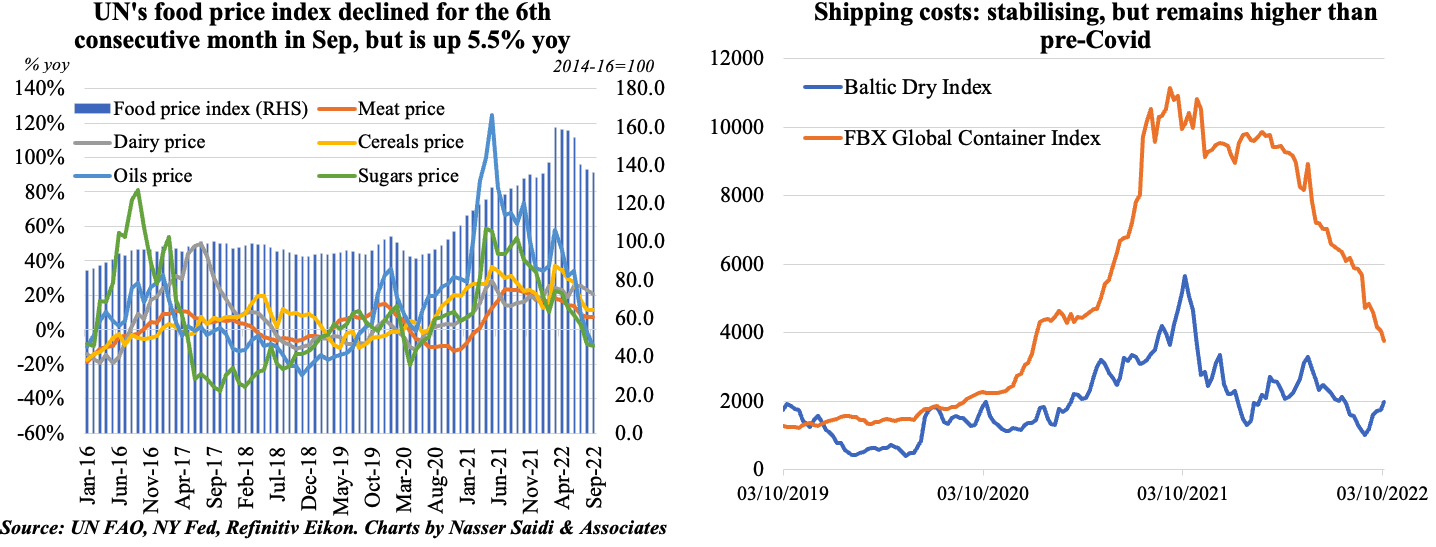

2. The decline in input prices stem from the recent drop in food prices, easing shipping costs & supply chain pressures

- Food prices fell for a 6th consecutive month in Sep => but high vs 2021 due to higher food production costs (inclu labour) + Russia-Ukraine crisis (& sanctions)

- Supply chain pressures have eased significantly, but GOSCPI is still almost six times higher than in 2017-19

- Factories are scaling back production (global PMIs)

- Evidence of decline in freight orders as a result of higher inventories (to weather short-term disruptions) & consumers’ reduced demand & spending (due to inflation)

- Cost of shipping has also declined dramatically from recent months, though remains high vs pre-pandemic

- But, higher energy prices and exchange rate fluctuations and could offset decline in supply chain pressures

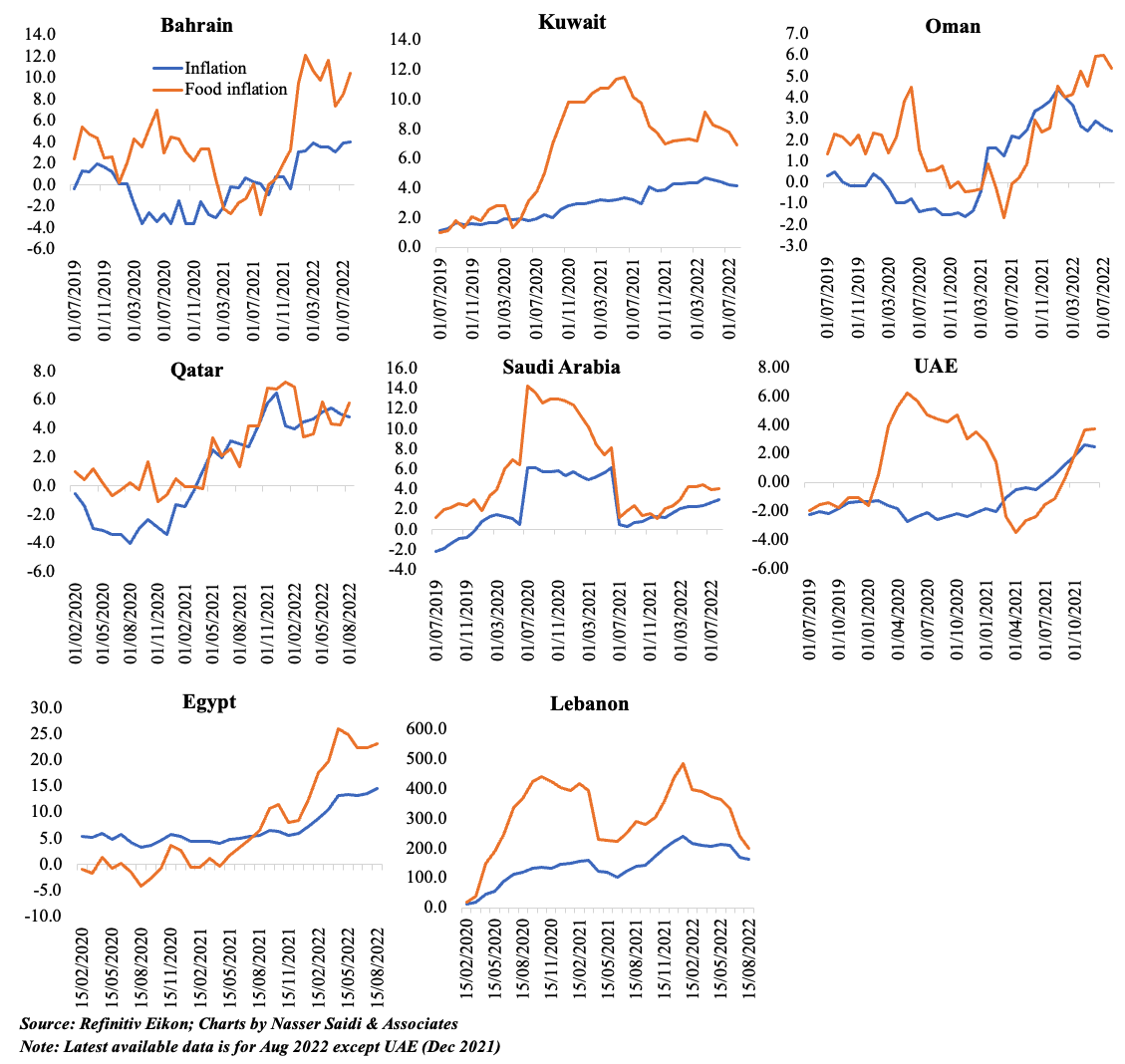

3. Is this decline already visible in Middle East inflation readings?

- Inflation has moderated slightly: relatively lower food prices + price controls/ subsidies + effects of monetary tightening could be the main factors

- Food inflation is still higher than headline

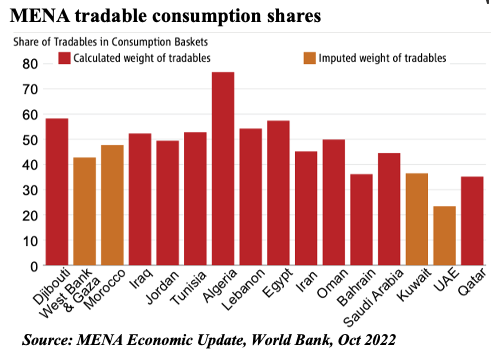

4. Why is inflation relatively low in the MENA region?

- Inflation has been relatively low (vs global & regional counterparts) even though there is a high dependence on food imports (about 1/5-th of total imports)

- A look at the CPI basket breakdowns indicate that the share of tradeable goods account for a small part of the basket => headline inflation is reflecting lower inflation in non-traded goods and services (i.e. those that are not sold on the international market like public services, real estate, local transportation etc). For example, in Dubai, weight of housing & utilities is 40.68% of the CPI basket while food is 11.7%

- In addition, governments in the region have rolled out food & fuel subsidies and financial support in addition to price controls to lighten the burden on households. Some oil importers have also introduced cash transfers to support low-income households (e.g. Lebanon, Egypt). However, these policies will widen fiscal deficits; worse for those running high public debt levels

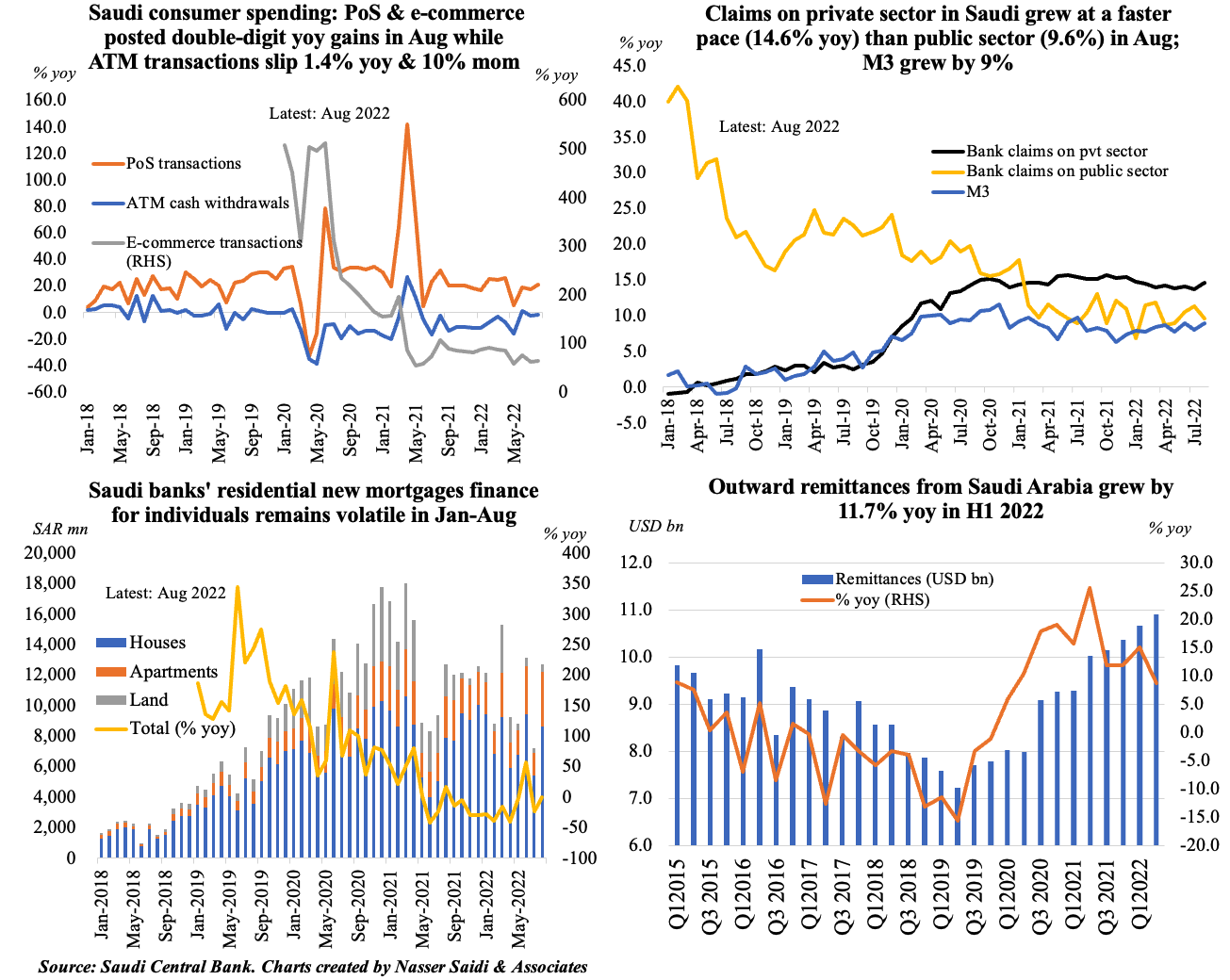

5. Have spending habits been affected? Evidence from Saudi Arabia

- Consumer spending has increased: falling ATM transactions are more than offset by double-digit upticks in PoS and e-commerce transactions; a breakdown of PoS transactions show seasonal increases (e.g. education in Jul-Aug)

- Strong domestic demand & improved business confidence are reflected in an increase in credit growth

- Mortgage lending soared 76.6% mom to SAR 12.7bn in Aug: though volatile, remains much higher than pre-pandemic

- Remittances from Saudi Arabia are also on the rise: thanks to dollar appreciation & higher wages (this might reduce domestic spending)

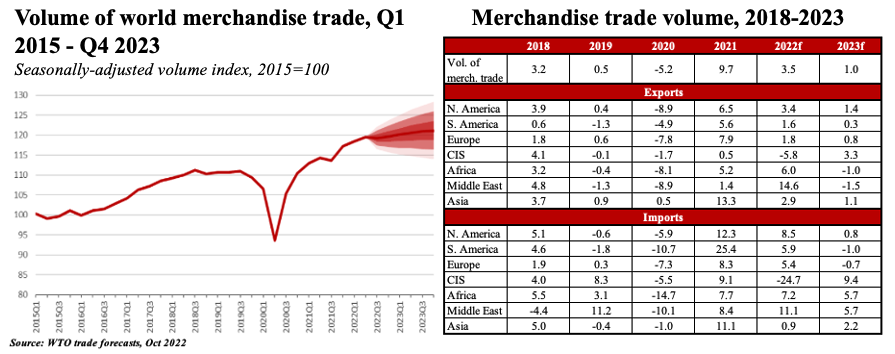

6. Inflationary pressure is one of the factors that led WTO to predict slower global trade growth in 2023

Others include the Russia-Ukraine crisis, higher energy prices, & monetary tightening

- WTO forecasts global merchandise trade volume to grow 3.5% in 2022 & at a slower pace of 1.0% in 2023 (revised down from 3.4%)

- Middle East is expected to have the strongest trade volume growth of any region in 2022: both export (14.6%) and import side (11.1%)

- Given the uptick in prices, merchandise trade values are growing at double digit rates versus trade growth in volume terms (which is still in the low single digits). In terms of value, trade in H1 2022 was up 32% vs H1 2019

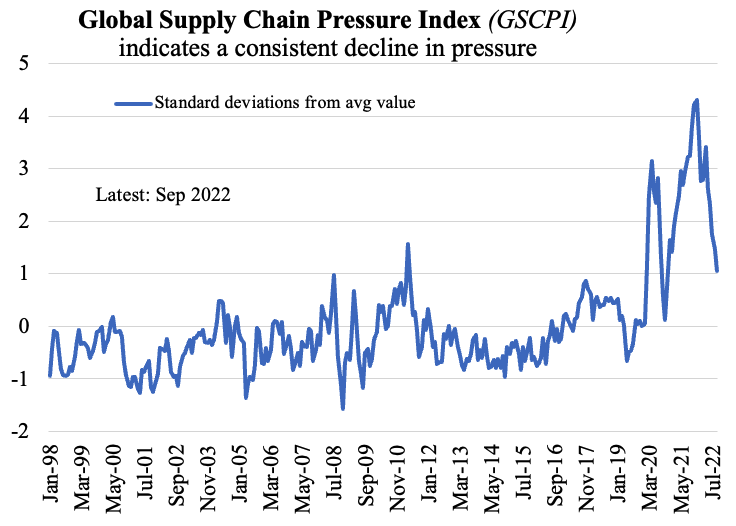

- Meanwhile, exports of travel and transport services rebounded strongly in many countries as pandemic-related restrictions have eased: this is evident from data on international flights

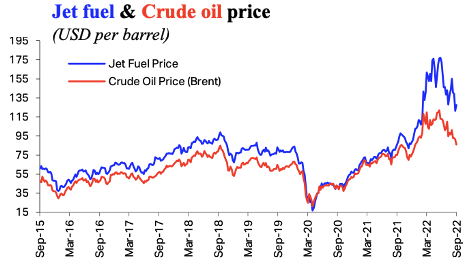

7. Travel has recovered well in the Middle East; however, jet fuel prices have surged (vs crude oil) & should airlines pass on costs to consumers, it could curb demand

- Middle East airlines reached 78% of the overall revenue passenger-kilometers (RPKs) from its pre-pandemic level in Jul. International RPKs have grown much faster, rising by 193% in Jul: this was among the highest yoy rise compared to other regions (next to Asia Pacific). The route between North America and Middle East has already returned to their pre-pandemic level.

- IATA’s latest Air Passenger Forecast (Sep 2022) estimates total passenger traffic in the region is expected to recover to the pre-pandemic level by 2025

- Cargo Tonne Kilometers (CTKs) continue to outperform passenger traffic. Cargo traffic from Middle Eastern airlines is down by 2% from its 2019 level, but its market share has remained broadly the same as for the past five years (under 15%)