Markets

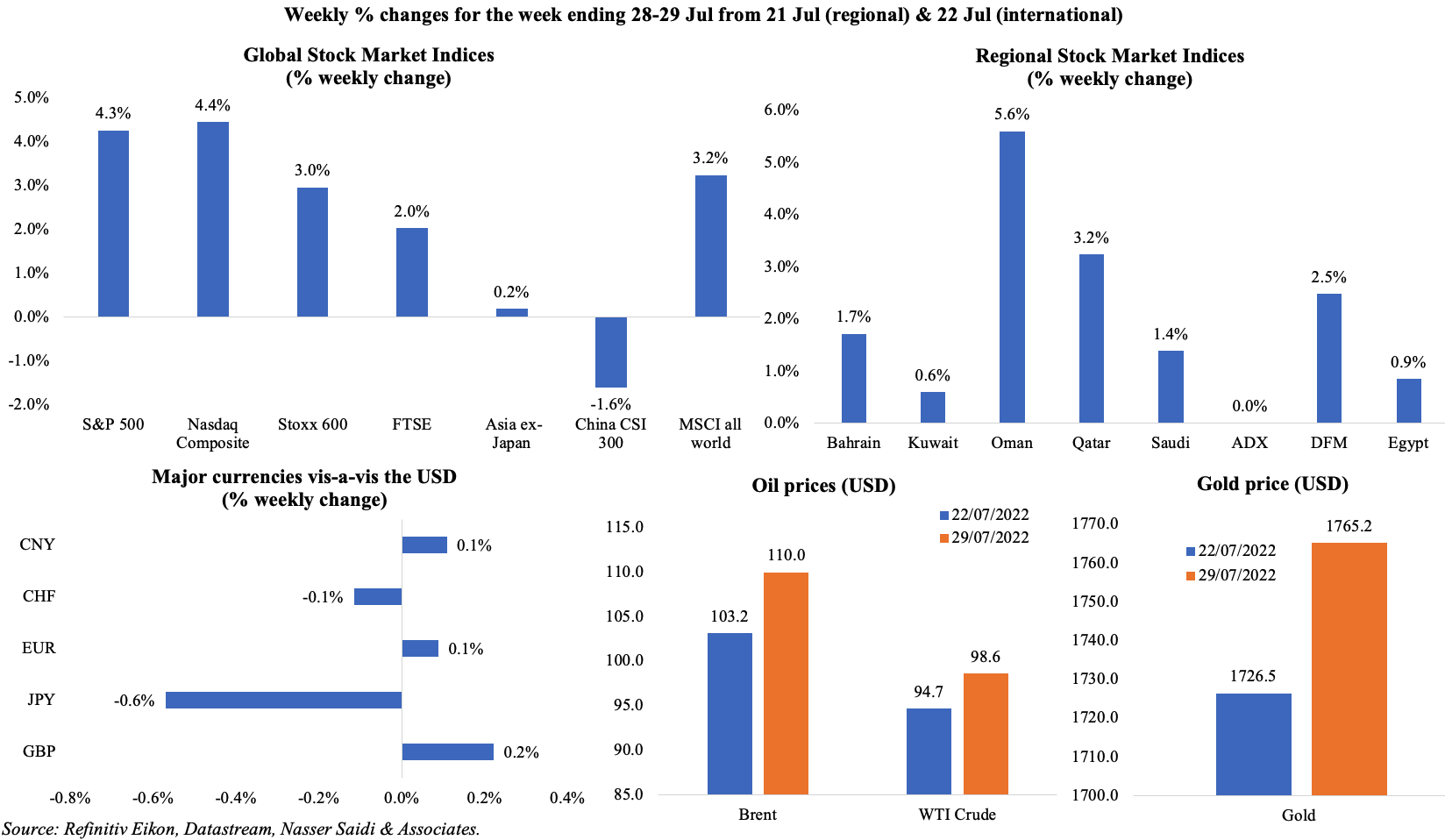

Global equity markets climbed up. The S&P 500 and Nasdaq in the US posted the biggest monthly percentage gains since 2020, aided by positive earnings statements from big corporate firms (like Apple and Amazon) and despite the 75bps hike by the Fed.. Stoxx closed higher as did MSCI all world index, while the UK FTSE posted the strongest monthly performance this year. China’s stocks dropped by around 7% in Jul, ending a 2-month rally while the Hang Seng China Enterprises Index of stocks posted its worst monthly performance in a year. Regional markets posted gains last week, supported by strong oil prices and corporate earnings gains: Oman and Qatar gained the most, while in the UAE, DFM outperformed the ADX. According to Refinitiv, global equity funds posted weekly outflows for a fifth straight week in the week to July 27th. Among currencies, the dollar weakened after Powell’s post FOMC comments, while euro settled near its lowest levels versus GBP in more than 3 months on Fri. Both Brent and WTI ended the week higher, though posting the 2nd consecutive monthly loss in Jul; gold gained on a softer dollar, taking price to a more than 3-week high.

Global Developments

US/Americas:

- The Fed increased interest rates by 75bps to a range 2.25%-2.50%, the highest since Dec 2018: this was the 4th increase in 5 months, and the second 75bps hike in a row). Powell stated that he was looking for “compelling evidence” that inflation was cooling before easing the rate hikes.

- US GDP declined by 0.9% on an annualised basis in Q2, following the 1.6% drop in Q1: this meets one of the common criteria for a technical recession. The biggest drag on Q2 GDP was a drop in business inventories while personal consumption grew at 1% (Q1: 1.8%).

- Personal income in the US increased by 0.6% mom in Jun, while personal spending increased at a faster pace of 1.1%. Personal savings rate declined to 5.1% of disposable income in Jun (May: 5.5%).

- The Personal Consumption Expenditures (PCE) price index jumped by 6.8% yoy in Jun (May: 6.3%), posting its steepest increase since 1982, while the core PCE accelerated to 4.8% (from 4.7% in May). In mom, PCE price index rose by 1%, the largest gain since Sep 2005.

- Durable goods orders increased by 1.9% mom in Jun (May: 0.8%), with increases across most categories; excluding defense, orders grew by a modest 0.4%. Non-defense capital goods excluding aircraft climbed by 0.5% following a 0.6% gain the month before. In H1 2022, core capital goods grew by 10.1% yoy.

- Chicago PMI slipped to 52.1 in Jul (Jun: 56), the lowest reading since Aug 2020. Separately, the Chicago Fed national activity index remained unchanged at -0.19 in Jun: this is the first back-to-back negative readings since the pandemic began. The 3-month moving average decreased to -0.04 from +0.09, the first negative reading in two years.

- Dallas manufacturing business index plunged to -22.6 in Jul (Jun: -17.7), staying at the lowest since May 2020, with the new orders sub-index remaining negative (-9.2 in Jul vs -7.3 in Jun). In contrast, Kansas Fed manufacturing activity rebounded to 7 in Jul, following Jun’s reading of -1.

- Richmond Fed manufacturing index remained flat in Jul, improving from Jun’s -11, thanks to increases in shipments (7 from -17) and new order volumes (-10 from -20).

- Michigan consumer sentiment index inched up to 51.5 in Jul (Jun: 50), in line with the preliminary estimates. The one-year economic outlook fell to its lowest reading since 2009.

- S&P Case Shiller home price index increased by 20.5% yoy in May, down from 21.2% in Apr: this is the second straight month of slower price growth.

- New home sales fell by 8.1% mom to 590k in Jun, the lowest level since Apr 2020. Pending home sales fell by 20% yoy and 8.6% mom, thanks to increasing mortgage rates and higher house prices. The contract rate on a 30-year fixed-rate mortgage is averaging 5.54%, according to data from Freddie Mac.

- Initial jobless claims eased to 256k in the week ended Jul 22nd, up from an upwardly revised 261k a week ago (the highest since mid-Nov), raising the 4-week average to 249.25k. Continuing jobless claims declined by 25k to 1.359mn in the week ending Jul 15th.

Europe:

- GDP in the eurozone increased by 0.7% qoq and 4% yoy in Q2. Germany’s poor performance was offset by increases elsewhere: France (0.5% qoq), Italy (1%), Spain (1.1%).

- Inflation in the eurozone rose to 8.9% yoy in Jul (Jun: 8.6%), way surpassing ECB’s 2% target, as energy prices soared (39.7%) as did food, alcohol and tobacco prices (9.8%). Core inflation also inched up, rising to 4% from 3.7% the month before.

- GDP in Germany stagnated in Q2 on a quarterly basis; in yoy terms, GDP grew by 1.4% yoy in Q2 (Q1: 3.6%). The harmonised index of consumer prices in Germany ticked up to an all-time high of 8.5% yoy in Jul (Jun: 8.2%).

- German Ifo business climate eased to 88.6 in Jul (Jun: 92.2), to reach its lowest value since June 2020; both current assessment and expectations slipped – to 97.7 and 80.3 (from 99.4 and 85.5 respectively the month before).

- The GfK consumer confidence survey in Germany declines to a record low of -30.6 in Aug (Jul: -27.7), with respondents revealing “fears about sufficient gas supplies for the economy and private households next winter”.

- Unemployment rate in Germany inched up to a 9-month high of 5.4% in Jul (Jun: 5.3%).

- Economic sentiment indicator in the euro area declined for a 17-month low of 99 in Jul (Jun: 103.5) while business climate reading eased to 1.14 in Jul (Jun: 1.45). Consumer confidence in the euro area worsened to a record low of -27 (Jun: -23.8), as did industrial confidence (to 3.5, the lowest since Feb 2021, from 7 in Jun).

Asia Pacific:

- China’s NBS manufacturing PMI fell unexpectedly to 49 in Jul (Jun: 50.2), as output, new orders and buying levels falling below the 50-mark given lockdowns across multiple cities during the month. Non-manufacturing PMI eased, but remained above the 50-mark, clocking in at 53.8 (Jun: 54.7).

- FDI into China increased by 17.4% yoy to CNY 723.31bn in H1 2022 (Jan-May: 17.3%). FDI into the high-tech industries accelerated by 33.6% in H1.

- Japan’s finance ministry announced that JPY 257bn had been set aside in budget reserves to tackle rising oil and price increases.

- Japan’s leading economic index in May eased to 101.2 (Apr: 102.9) while the coincident index dropped 6 points to 94.9, reflecting the rise in Covid cases and global uncertainty.

- Japan’s industrial production rebounded by 8.9% mom in Jun (May: -7.5%): this is the first rise in industrial output since Mar and the steepest on record. In yoy terms, IP fell by 3.1%, following the previous month’s 4.7% drop.

- Retail trade in Japan fell by 1.4% mom in Jun (Apr: 0.7%), the first decline in 4 months. In yoy terms, sales grew by 1.5%, following May’s upwardly revised 3.7% uptick.

- Unemployment rate in Japan held steady at 2.6% in Jun, with the number of unemployed unchanged at 1.8mn.

- South Korea’s preliminary GDP accelerated by 0.7% qoq and 2.9% yoy in Q2, led by a pickup in private consumption (4% yoy) and exports (4.7%).

- Industrial production in Singapore fell by 8.5% mom in Jun (May: 9.2%); in yoy terms, IP grew by a weak 2.2%. as electronics output growth eased given an unexpected 2.6% yoy fall in semiconductors.

Bottom line: Last week, the IMF revised its global economic growth forecast down to 3.2% in 2022, with shocks affecting growth ranging from Covid19 outbreaks and lockdowns, high inflation rates, tighter financial conditions, and slowdown in China to spillovers from the war in Ukraine. Looking forward, risks are tied to the outcome of the war in Ukraine (gas imports to Europe from Russia, higher food prices), inflationary pressures (wage inflation), debt crisis (higher interest rates, financial tightening), geopolitical risks (from conflicts stemming from rising prices/ food security) and de-anchoring of inflation expectations. Meanwhile, cross-border outflows by international investors in EM stocks and domestic bonds rose to more than USD 38bn in the past five months – according to the Institute of International Finance (IIF), this is the longest period of net outflows since 2005. This week sees the OPEC+ meeting (output likely to be kept steady) as well as central bank meetings in UK, Australia, India (hikes expected) and Brazil (unlikely to hike).

Regional Developments

- The IMF, in its latest update of the World Economic Outlook report, forecast the MENA region to grow by 4.9% this year (down by 0.1ppts compared to Apr 2022 forecast) and continuing at 4.9% in 2023. (Our Weekly Insights last week identifies specific risks for the MENA region – https://nassersaidi.com/2022/07/29/weekly-insights-29-jul-2022-heading-to-a-global-recession-potential-risks/)

- Bahrain joined the UAE, Egypt, and Jordan as part of the Industrial Partnership for Sustainable Economic Development which aims to increase manufacturing value added. At the latest meeting, 12 “top priority” projects worth USD 3.4bn were identified spanning agriculture, pharmaceuticals, textiles, minerals and petrochemicals. Bahrain is home to 95,000+ firms in the industrial sector, 55k employees and USD 4.3bn in industrial sector FDI.

- The IMF called on Egypt to make “decisive progress” on fiscal and structural reform, given “vulnerability from a high public debt burden and large gross financing requirements” in an evaluation of the USD 5.2bn stand-by arrangement agreed in 2020. Separately, Egypt’s finance minister disclosed that talks with the IMF were ongoing over a new extended fund facility. More: https://www.imf.org/en/Publications/CR/Issues/2022/07/25/Arab-Republic-of-Egypt-Ex-Post-Evaluation-of-Exceptional-Access-Under-the-2020-Stand-By-521257

- Egypt announced that one million families will be added to a social safety net programme that provides direct cash transfers, bringing the total number of beneficiaries to more than 20mn. The aid programme was further expanded with another 9mn families estimated to receive financial aid for the next 6 months at a total cost of EGP 1bn: this would include retirees (with monthly pension less than EGP 2500) and state employees (with salaries below EGP 2700).

- Oil production in Egypt is expected to increase by 18% to a value of EGP 790.9bn during the 2022-23 fiscal year, according to the economic and social development plan. Furthermore, EGP 49.5bn will be invested in the development of the petroleum and mineral wealth sector.

- India and Egypt signed a MoU to build a green hydrogen factory (estimated to produce 20,000 tonnes a year, with investments worth USD 8bn) in the Suez Canal Economic Zone.

- Egypt’s minister of supply stated that wheat and sugar reserves are sufficient for 7 months. Separately, the nation announced the cancellation of contracts for a total of 240,000 tonnes of Ukrainian wheat booked for Feb-Mar delivery but never loaded due to the Russia-Ukraine war. These cargoes were bought at prices ranging between USD 346-360 per tonne.

- Egypt topped the list of Arab countries in the production of wind power and solar energy, with a 3.5-gigawatt (GW) capacity. In 2024, production is expected to reach 6.8 GW, including 1.6GW capacity of wind power and 1.9GW capacity of solar energy.

- Iraq’s political deadlock continues – infights between Shi’ite and Kurdish groups have delayed the formation of a government more than 9 months since the Oct 2021 This has now surpassed the last longest deadlock in 2010, which lasted 289 days.

- Kuwait named the Emir’s son as Prime Minister last week.

- Housing real estate market in Kuwait witnessed a 50% drop in transactions in H1 2022, partly due to real estate price inflation and stagnant purchasing power of Kuwaitis. In H1 2022, there were 2,470 deals worth KWD 1.13bn (or USD 3.3bn), compared to 4,814 deals worth KWD 1.4bn in H1 2021.

- Kuwait awarded contracts worth nearly KWD 1.85bn (USD 6.1bn) in 2021, nearly 6 times higher than the value of projects awarded in 2020. Kuwait Oil Company accounted for bulk of the 236 contracts awarded in 2021.

- Lebanon’s parliament passed amendments to an existing banking secrecy law, which was requested by the IMF as part of a Staff level Agreement, reported Reuters. However, these amendments were watered down (the wording to investigate “all financial crimes” was removed) and does not allow for retroactivity – there is no effective combating of corruption, tax evasion or money laundering among others.

- Inflation in Lebanon continued to post triple-digit increases for the 24th consecutive month, rising to 210% yoy in Jun; in mom terms, inflation ticked up by 9.23%. Water, electricity, gas and other fuels prices surged by 594% yoy, prices of health segment was up 492% and transport costs grew 462%.

- Lebanon’s parliament speaker stated that a Presidential election session will not happen before passing the reforms that are a precondition for an IMF bailout, potentially leading to a presidential hiatus.

- Part of the grain silos at Beirut Port collapsed yesterday due to neglect of fires in the silos, just days before the second anniversary of the explosion (Aug 4th).

- Inflation in Oman rose to 2.85% yoy in Jun, largely due to the uptick in food and beverage prices (6.09%) while transport costs rose by 4.2%.

- Oman announced via the Ministry of Labour the availability of 301,172 hours of part-time jobs as part of an initiative named “A Million Hours of Employment” in government units.

- Qatar’s exports of crude oil and condensates grew by 11% mom to 970,000 barrels per day (bpd) in Jun; crude oil exports rose by 16% while exports of condensates fell by 2%.

- GCC central banks increased benchmark borrowing rates, following the Fed move. Kuwait, which is pegged to a currency basket than the USD, hiked its discount rate by 25bps to 2.5%; the rest mirrored the Fed’s 75bps move.

- Saudi Arabia led the GCC IPO boom in H1 2022, with 17 companies listing and raising USD 5.07bn; Tadawul saw 8 listings generating USD 4.4bn while Nomu saw 9 listings worth USD 649mn. Top IPOs by value were DEWA (USD 6.1bn), Borouge (USD 2bn) and Nahdi Health (USD 1.4bn).

- GCC’s financial wealth grew by 9% to USD 7trn in 2021, the 4th fastest growing region globally, according to BCG. UAE accounted for the largest share in the GCC (30% of the region’s total), growing by 20% yoy.

- Oil imports from Saudi Arabia and the UAE together accounted for nearly 80% of the total of Japanese imports in Jun 2022; further, Kuwait and Qatar supplied another 14%.

Saudi Arabia Focus

- Saudi Arabia’s GDP grew by 11.8% yoy in Q2 (Q1: 9.9%), the fastest rate recorded since Q3 2011, driven by a 23.1% surge in oil sector while non-oil activity grew by 5.4%. Separately, the IMF in its latest WEO outlook expects Saudi to grow by 7.6% this year and by 3.7% in 2023.

- Saudi Crown Prince disclosed that the NEOM project (estimated to cost USD 500bn) will be partly financed through a floatation (expected in 2024); this listing will add about SAR 1trn to the stock market value. The first phase of NEOM is estimated to cost SAR 1.2trn (USD 319bn), with half the funding coming from the PIF; this will be completed in 2030 and is estimated to have 1.5mn residents (rising to 9mn by 2045). Saudi Arabia will also allocate SAR 300bn for a fund linked to NEOM, which will invest in companies that set up there. Furthermore, all PIF companies will be listed on the stock market in the future.

- Saudi oil exports grewby 106% yoy to SAR 116.2bn in May, staying above SAR 100bn for the third consecutive month; its share of total exports was 80.6%. Non-oil exports grew by 23% (17th month of double-digit growth) to SAR 23.9bn, widening the trade surplus of SAR 90bn in May (highest since at least 2017).

- The Saudi Crown Prince visited Greece and France last week, leading to cooperation being boosted across many fronts including renewable energy (green hydrogen and clean energy) and stabilising global energy markets.

- The Saudi-Greek Investment forum saw deals worth SAR 14bn (USD 3.7bn) being signed; it covers deals across communications, transport, logistics and energy among others.

- The share of Saudi citizens working in finance companies stands at 85% or 5039 employees, according to SAMA data.

- The number of new housing units in Riyadh grew by 37% to 4,826 during Jun 2022, according to a report issued by the Ministry of Municipal and Rural Affairs and Housing.

- Saudi food security entities allocated USD 2.66bn to provide support during rising food prices: Saudi Grains Organization allocated a total of SR 4.5bn in its budget to support the strategic inventory of wheat and barley as well as compensate importers; SAR 4.2bn was allocated in the Agricultural Development Fund’s budget to lend the private sector to finance contracts; SAR 800mn was given as additional support for subsidies to breeders and producers.

- Riyadh Region Municipality’s mayor launched a development arm to enhance the quality of services: this will focus on 3 main sectors urban development, asset management and municipal services.

UAE Focus![]()

- Dubai formed a higher committee for future technology and digital economy with an aim to design policies and analyse trends for the digital economy and future technologies (including metaverse, AI, blockchain, Web3, virtual reality, augmented reality, Internet of Things, data centres and cloud computing) as well as attract international companies and specialist conferences.

- UAE and Kenya initiated discussions towards a Comprehensive Economic Partnership Agreement (CEPA). Non-oil bilateral trade between two nations stood at USD 2.3bn in 2021.

- Value of interbank fund transfers in the UAE grew by 26.2% yoy to AED 3.96trn in Jan-Apr 2022. Separately, credit facilities provided by national banks to the business and industrial sector rose 1.92% yoy to AED 696.7bn in Jan-Apr.

- Petrol prices in the UAE will decline by 13-13.5% mom in Aug, depending on the grade of petrol. This follows three consecutive months of double-digit increases.

- New trademark applications submitted in the UAE surged by 98% to to 10750 in H1 2022; this is partly supported by amendments to the trademark law that no longer requires persons to have a trade license to register a trademark.

- DEWA’s capacity reached 14,117 megawatts of electricity and 490mn imperial gallons per day of desalinated water; this was provided to the 3.514mn persons living in Dubai. DEWA commissioned 287 of 11,000 volts substations in the emirate during H1 2022.

- UAE’s Vice-President and Ruler of Dubai approved 2000 plots of land for Emirati housing in Dubai; interest free loans of up to AED 1mn each will be provided for construction.

- Abu Dhabi Fund for Development disclosed that funds amounting to AED 117.42bn had been allocated for various development projects in 103 nations since it was formed in 1971. It also offered soft loans worth AED 58.12bn to developing countries and disbursed AED 59.30bn in government grants.

- High-net-worth individuals (HNWIs) in the UAE (i.e. who have a net worth above USD 1mn) accounted for 28% of the UAE’s wealth in 2021 while about 41% was derived from UHNWIs (net wealth of USD 30mn+), according to BCG.

- Cryptocurrency exchange FTX disclosed that it has been fully approved to operate its exchange and clearing house in Dubai. It will initially offer regulated crypto derivative products and trading services to institutional investors in addition to operating a NFT marketplace and provide custodial services. The license also expands to retail customers though this will be done in a phased manner.

- Dubai’s real estate market recorded a total of 8,897 sales transactions (34% mom) worth AED 22.75bn (24.8%) in Jun, according to the latest figures from Mo’asher. Separately, a Betterhomes report stated that Dubai’s residential real estate transaction volumes were up 60% in H1 2022 with an 85% rise in the value of properties sold; top buyers were from India (-8%), UK (+18%), Italy (-17%), Russia (+164%) and France (+42%).

- A Cooper Fitch report showed a 10% qoq increase in job vacancies in the UAE in Q2: this was the fastest rate among the GCC nations (Bahrain at 9%, Oman at 6%, Qatar at 4% and Saudi at 3% while in Kuwait it fell by 2%). According to the report, new employment is being generated in sales and marketing, cloud, public sector, strategy software development, cybersecurity and finance.

Media Review

Yes, the US Economy Is Likely in Recession

Inside the Kuwait Investment Authority: ‘It’s chaos there now’

https://www.ft.com/content/e2d7b536-c4c6-49ee-9a2c-63d6a81cff0f

Egyptian start-ups brace for funding crunch

The Line, Neom City Saudi Arabia

https://www.youtube.com/watch?v=8oeakLBgAGo

Under a boiling sun, Kuwait keeps cool as Iraq reaches boiling point