Weekly Insights 29 Jul 2022: Global Growth to Slow in 2022 & Potential Risks

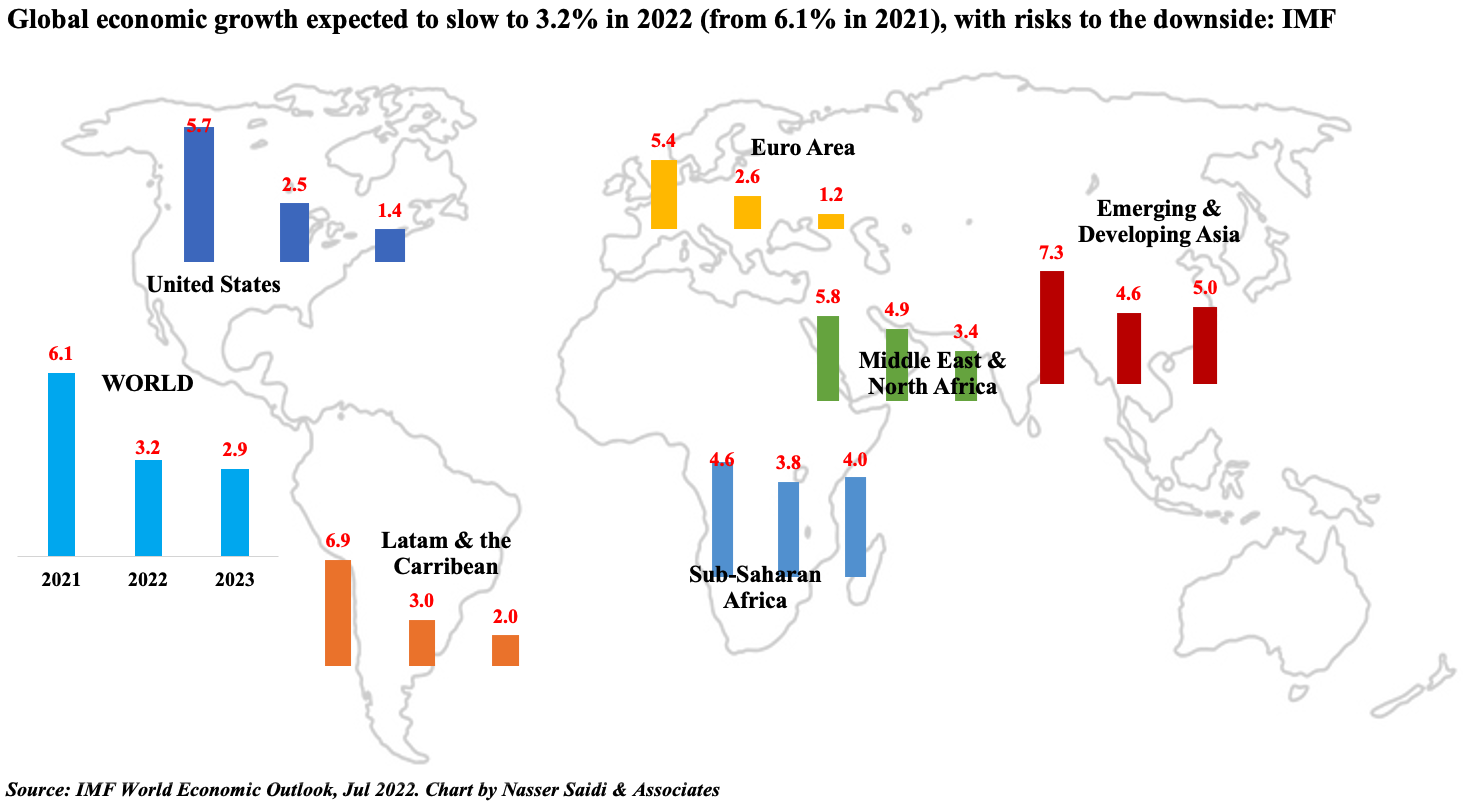

1. IMF revises down global economic growth forecast to 3.2% in 2022; MENA growth expected at 4.9%

- The IMF lowered growth forecasts for many regions including emerging and developing Asia; MENA outlook has also been lowered slightly to 4.9% this year (down by 0.1% compared to the Apr 2022 forecast)

- As expected, shocks affecting growth include Covid19 outbreaks and lockdowns, high inflation rates, tighter financial conditions, slowdown in China as well as spillovers from the war in Ukraine

- Looking forward, risks are tied to the outcome of the war in Ukraine (gas imports to Europe from Russia, higher food prices), inflationary pressures (wage inflation?), debt crisis (higher interest rates, financial tightening), geopolitical risks (from conflicts stemming from rising prices/ food security)

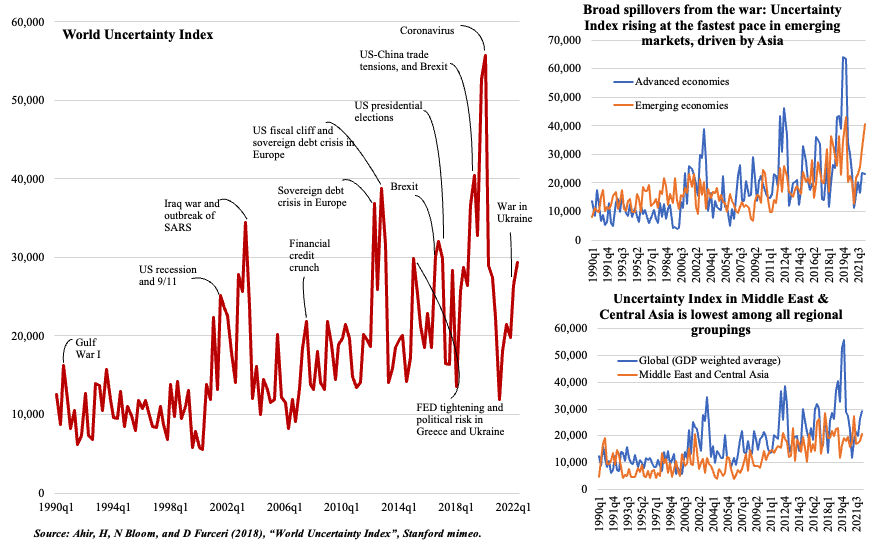

2. World Uncertainty Index ticks up

- The World Uncertainty Index is computed by counting the percent of word “uncertain” (or its variant) in the Economist Intelligence Unit country reports. A higher number means higher uncertainty and vice versa.

- The Ukraine war led to the recent increase in uncertainty; broad economic spillover from the war (higher food, oil prices) was initially high in Europe but uncertainty is now much higher in emerging markets (than in advanced nations)

- The lowest regional reading is for the Middle East & Central Asia

3. However, risks are evident across MENA region (where recovery is occurring at divergent paces)

| Oil exporters | Oil importers | |

| Economic Growth | Increases vs 2021 | Decreases |

| Inflation | Increases (much higher in non-GCC nations) | Increases |

| Fiscal balance | Turns to surplus (Improves) | Deficit narrows (as Covid-related spending slows) |

| Tourism | Improves | Improves |

| Remittances | Outward remittances rise | Inward remittances from the GCC increase |

| Current account balance | Surplus increases | Deficit widens |

| Monetary policy | GCC raises rates in line with Fed hikes; Currency depreciation | Central banks tighten monetary policy to combat inflation; Currency depreciation |

| Risks | Higher food prices => subsidies for low-income families | Higher food prices => potential for social unrest (a la Arab Spring) |

| Over-dependence on food imports => food security? | Higher food + oil prices => additional fiscal support required (subsidies, wage increases) | |

| Tighter financial conditions: debt repayments | Rising borrowing costs => increases interest expense burden + worse impact on countries with high debt & reduced capital flows | |

| Procyclical spending | Rising unemployment, inequality | |

| Common risks: extended slowdown in China, new pandemic waves, impact from climate change | ||

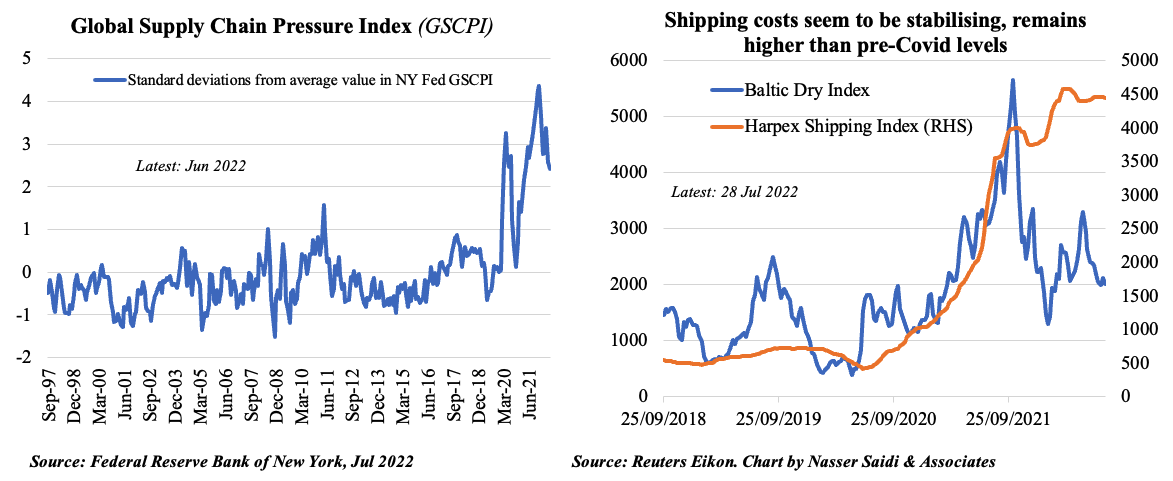

4. Supply Chain Pressures appear to be easing

- New York Fed’s Global Supply Chain Pressure Index suggests that appear pressure has been easing in recent months.

- A combination of factors resulted in supply chain pressures earlier this year: Ukraine-Russia war (affecting food supply, prices) + higher demand for goods + congestion (given delays at ports, delivery times) => higher inflation (also due to rise in oil prices). There is a downward momentum for container freight rates, well off peak rates, but higher than pre-Covid

- Some earning reports have evidence of the impact of supply disruptions: supply-chain pressures shaved off 9 ppts from GE’s Q2 aviation revenue; Apple stated supply and production headwinds was around USD 4bn in the quarter (vs an estimate for USD 8bn in Apr); Intel cited supply chain disruptions for a slump in its Q2 revenue.

5. Improvements in Flight Traffic in 2022

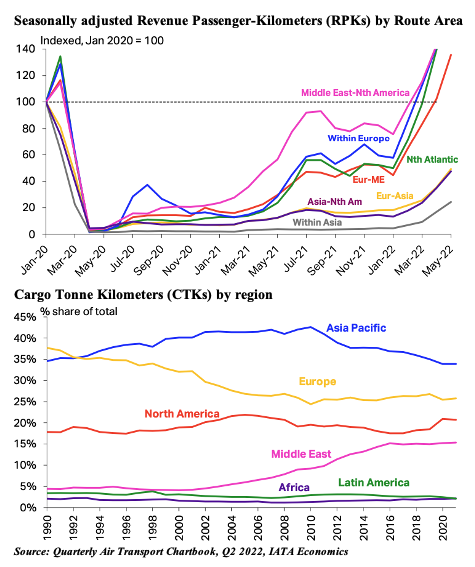

- Recovery of international air travel is evident in 2022, thanks to the easing of travel restrictions and opening of borders: global Revenue Passenger-Kilometers (RPKs) are currently at around 69% of the 2019 level

- As is evident from the chart on top, the North America and Middle East route has almost returned to its pre-pandemic level. At the other extreme, intra-Asia and Asia connections have been lagging behind

- Compared to pre-crisis levels, Cargo Tonne Kilometers (CTKs) have been outperforming passenger traffic; this was partly due to some switching to air cargo given supply chain pressures (recently, there has been a slower growth in cargo demand). Middle East’s share has remained relatively stable.

- IATA reported that passenger aircrafts which were turned into cargo flights due to increased demand for cargo capacity during the pandemic have recorded a decline in CTKs as well

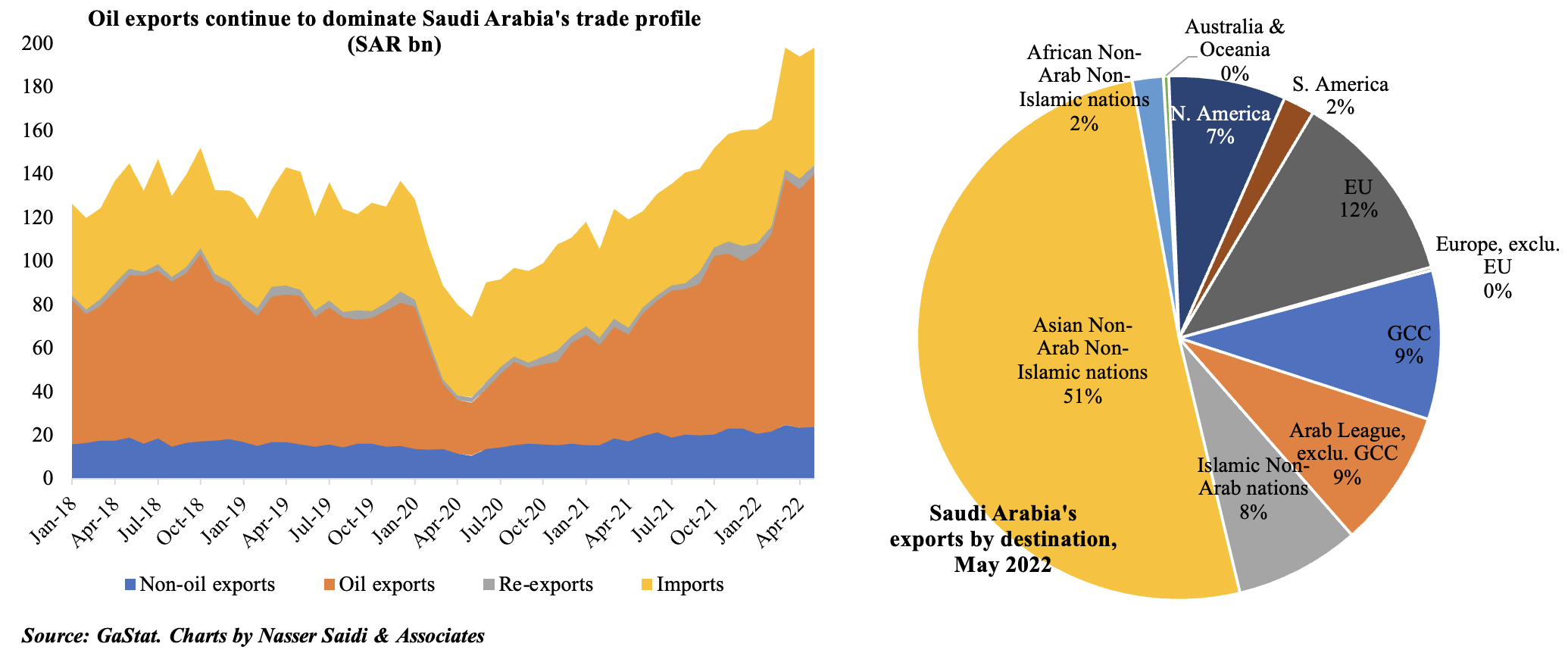

6. Saudi trade surplus reaches highest since 2017

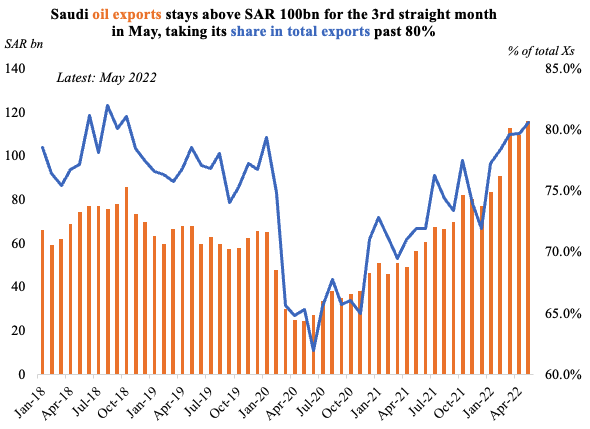

- Saudi oil exports grew by 106% yoy to SAR 116.2bn in May, staying above SAR 100bn for the third consecutive month. Its share of total exports was 80.6%

- Non-oil exports grew by 23% (the 17th month of double-digit growth) to SAR 23.9bn. Trade surplus of SAR 90bn in May

- Asian non-Arab non-Islamic nations were the top export and import location (51% & 36%of totals respectively). China, India & Japan were top importers