Weekly Insights 18 Mar 2022: Saudi growth recovery & PetroYuan talks amidst Dubai’s IPO “rush” & Crypto hub

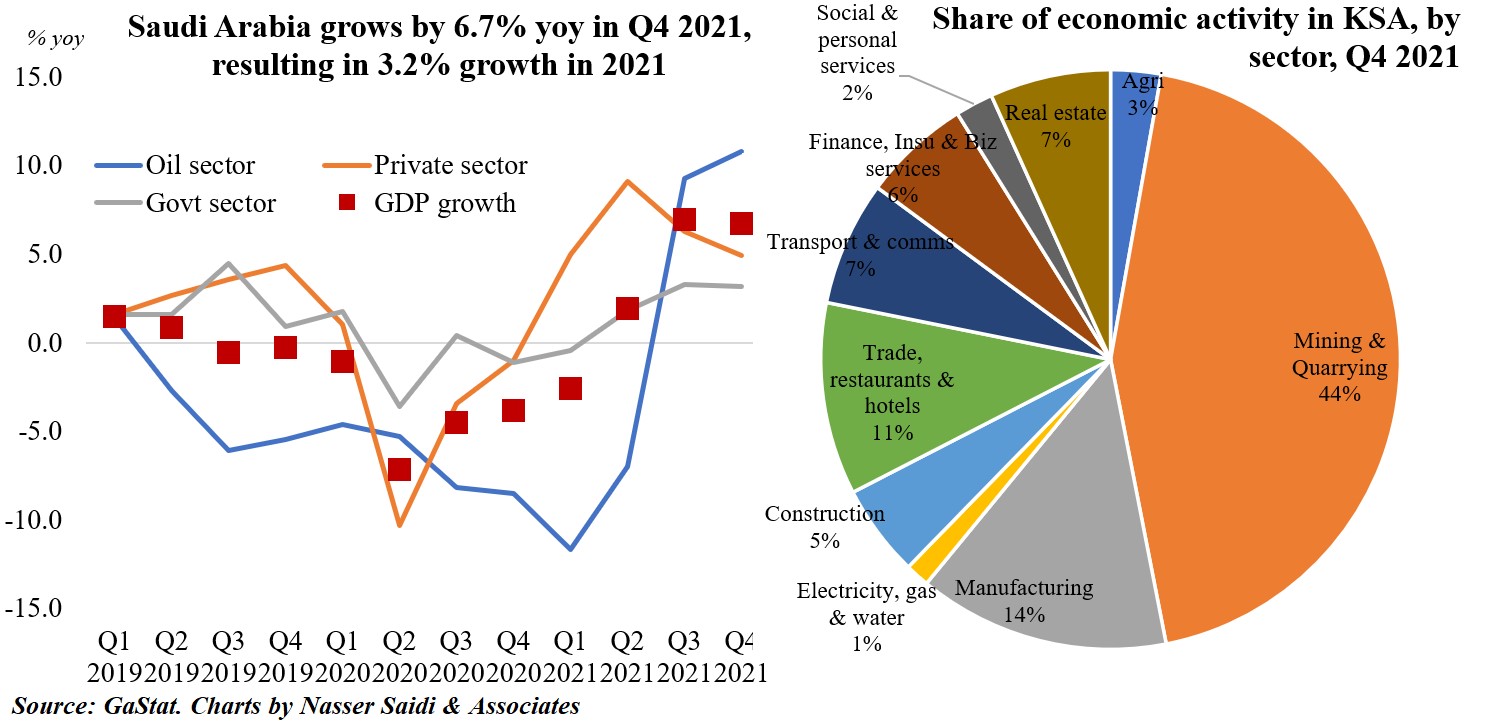

1. Saudi GDP grows by 3.2% in 2021, with rapid growth in non-oil private sector activity

- Overall Saudi GDP rebounded by 3.2% in 2021, the highest growth since 2015, largely supported by non-oil private sector activity (6.1%). The recently announced National Development Fund strategy aims to achieve a three-fold increase in non-oil GDP by 2030

- GDP grew by 6.7% yoy in the last quarter of 2021, driven by the oil sector (+10.8%) while the non-oil private sector grew at a slower pace (+4.9%). Private consumption and investment contributed the most to GDP growth in Q4 2021

- As always, mining and quarrying account for the largest share of economic activity (44%), followed by manufacturing (14%) and trade and hospitality (7%). Other than transport and hospitality, all other sectors have recovered to above pre-pandemic (Q4 2019) levels

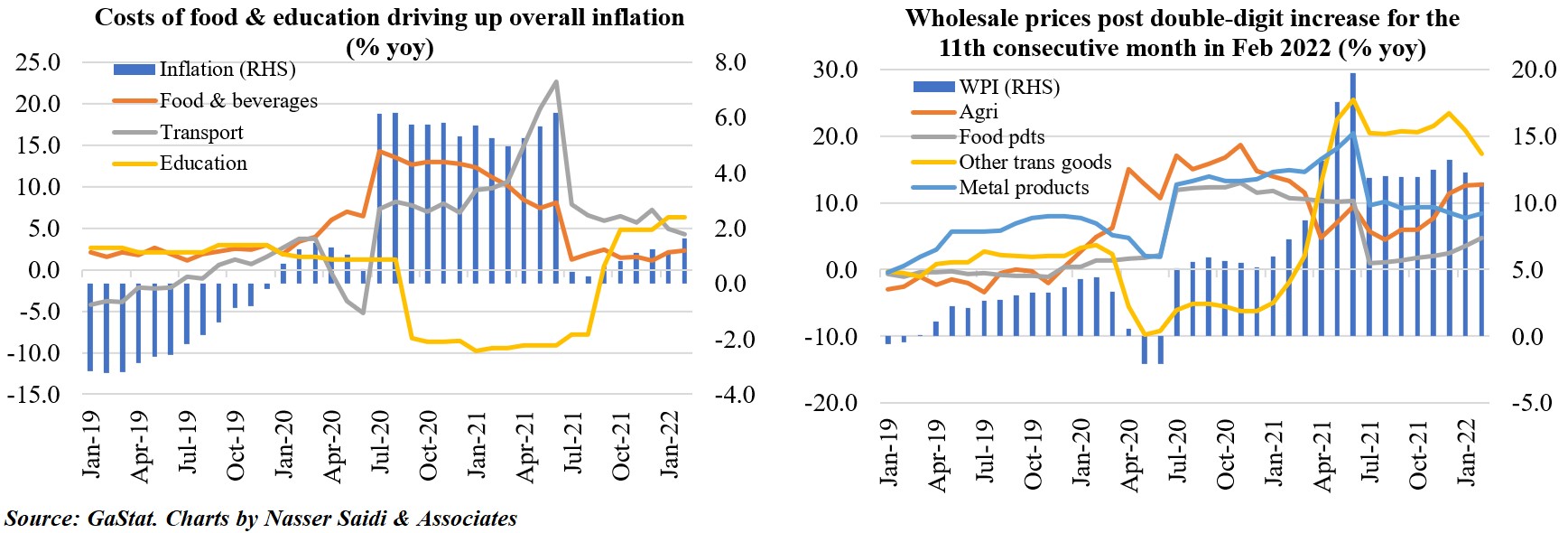

2. Inflation in Saudi Arabia is ticking up, similar to the rest of the region

- Though inflation in Saudi Arabia has been inching up, it clocked in at just 1.6% yoy in Feb 2022 (Jan: 1.2%): this is the highest rate since Jun 2021.

- Prices have been rising across the board, with food and beverages (2.4%), transport (4.3%) and education (6.3%) key drivers of costs. The contribution of food prices to the uptick in inflation has more than doubled since Dec 2021, with the Feb reading a 5-month high.

- Wholesale prices have been posting double digit increases in year-on-year terms since Apr 2021. In Feb, WPI rate was 11.5% (Jan: 12.3%), the lowest since March. In mom terms, WPI ticked up by 0.8% in Feb, much faster than Jan’s 0.1% gain.

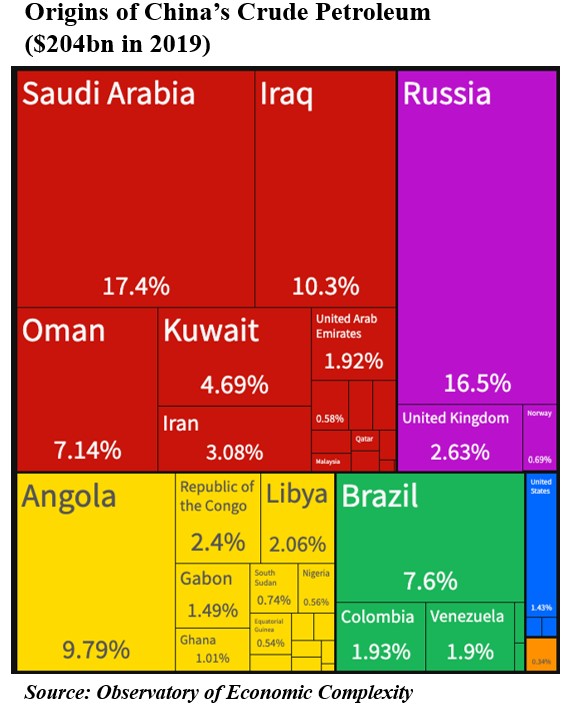

3. Chatter is picking up about the PetroYuan: a feasible plan?

- Reports state that Saudi Arabia is in talks with China to price and settle some of its oil sales in Yuan.

- More than 25% of Saudi oil exports are bought by China, so if priced and settled in yuan, it would boost the currency. CNY jumped following this report

- A yuan-rouble payment system has been in place since 2017, supporting Russia following the decision to block Russian banks from accessing SWIFT

- India is considering buying oil from Russia at a discounted rate: in this context, an Indian rupee-rouble trade arrangement is being discussed. Though Russian crude accounts for only about 2% of India’s oil imports, the discounts would help lower the cost of the import for India especially as domestic inflation is ticking up. Though not confirmed, the yuan is likely to be used as the reference currency to facilitate this oil trade

- Will this result in a setback for dollar dominance? Unlikely in the short-term. The yuan’s share in global cross-border payments stands at 3.2% in Jan, trailing behind USD, EUR and GBP

- With Saudi Arabia & Russia top two sources of China’s oil imports, such ties could have a significant impact if talks gain momentum

- We strongly believe that the GCC should adopt the PetroYuan. It is in GCC’s strategic interest to be part of the growing yuan zone, use PetroYuan for China oil trade, be active in the AIIB and integrate into the New Silk Road and the Belt and Road initiative

Throwback to an article from 2018: https://nassersaidi.com/2018/01/11/why-the-gcc-should-adopt-the-petroyuan-article-in-the-national-9-jan-2018/

4. Looking forward to a successful DEWA IPO

- DEWA announced its intention to list 6.5% of its issued share capital on the DFM, becoming the first state-owned entity going public since the Nov announcement about plans to list 10 SOEs. This will likely be Dubai’s biggest listing with valuations at around USD 25bn

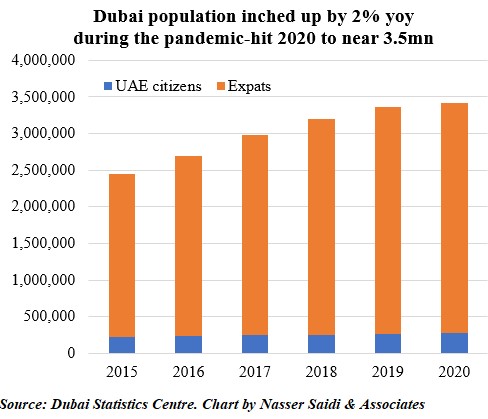

- The company has over 1mn customers and is expected to meet the rising demand for electricity & water, with population expected to rise to 5.8mn by 2040 from 3.5mn currently. Already in 2021, energy demand rose by 11% (3 times than expected)

- DEWA is an integral part of Dubai’s long-term strategy: be it its clean energy projects (the Mohammed bin Rashid Al Maktoum Solar Park) or investments in energy infrastructure to meet future demand or the forward-looking projects (hydrogen pilot with Siemens, innovative storage technology in renewable energy) or aiding in the emirate’s transition to net-zero economy by 2050

- Expect the DEWA offer to be oversubscribed many times over: DEWA’s bond sale in 2010 was 11 times oversubscribed). Underscored also by the assurance of guaranteed dividends of AED 6.2bn per annum (USD 1.69bn) to be paid out over the next 5 years

- The listing will help increase depth of the market and improve sector diversification; an active, diverse investor base will boost trading and liquidity, paving the way for a pipeline of listings

Related reading: https://nassersaidi.com/2021/11/18/weekly-insights-18-nov-2021-dubai-ipo-exuberance/

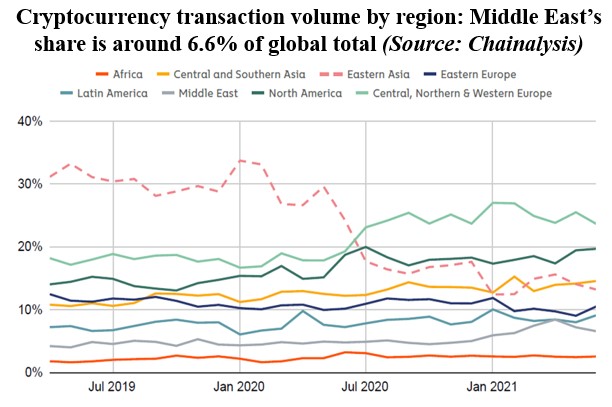

5. The Crypto push in the Middle East

- Dubai made headlines by announcing the adoption of its first law governing virtual assets and the establishment of a Virtual Assets Regulatory Authority (VARA) to oversee the sector (excluding in the DIFC where the regulator DFSA has issued a consultation paper on regulation of crypto tokens)

- Minimal details were provided at the time (including which virtual assets would be regulated), but Binance which is receiving a Virtual Asset License to operate has revealed more:

–License will allow Binance to operate within Dubai’s “test-adapt-scale” model; access to retail market will be open only after being “monitored progressively”

–The firm will be permitted to extend limited exchange products & services

–It will be able to serve pre-qualified investors and professional financial service providers

- FTX Exchange, another one of the world’s largest exchanges (by volume), was also recently granted a license to operate in the UAE

- While UAE’s Securities and Commodities Authority is close to launching its own regulatory framework for cryptocurrencies, the UAE central bank is yet to recognise cryptocurrencies as an official method of payment – in contrast to the central bank of Bahrain.

- Binance’s crypto license from Bahrain (a few days ago) allows it to operate as a crypto-asset service provider, meeting criteria set by the Central Bank of Bahrain. It will be able to provide crypto-asset trading, custodial services & portfolio management to customers