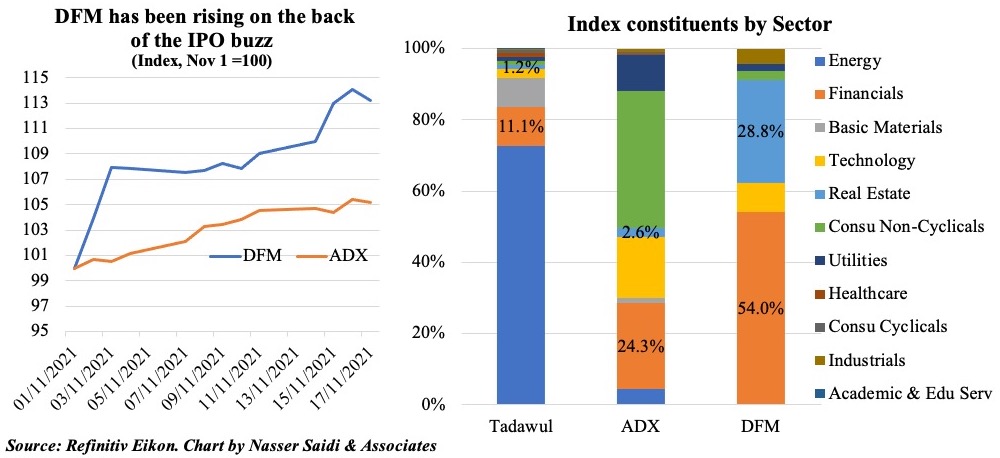

Ever since the announcement of plans to list 10 government and state-owned firms on the exchange, the Dubai Financial Market has gone into overdrive. The initiative, which aims to expand the market cap to AED 3trn (USD 816bn), has already sent the market on a roll: it has gained ore than 13% since the beginning of the month and 5% in just this week. Not surprising, given that every day has seen statements about potential listings: while the utility firm Dubai Electricity and Water Authority (DEWA) has already approached banks for a multi-billion-dollar IPO (to be ready by April 2022), another listing on the cards is the road toll-collection Salik system (in 2011, a securitization of Salik toll receipts had received strong response from banks), speculations are rife about listings from Emirates Airlines (or its units like Dnata) to Dubai Holding owned business parks operator Tecom.

There has been strong investor appetite and liquidity in the region’s equity markets, as can be seen from recent listings in Abu Dhabi and on Tadawul. An AED 1bn IPO support fund geared to encourage tech firms to list on the exchanges and the AED 2bn market-maker fund to boost trading, further adds on to the bullish sentiment on the market. Another positive is that the pipeline of IPOs is not limited to real estate and/ or the financial sector, which currently account for 82% of total market cap on DFM. However, the pertinent question is whether a successful stream of public sector listings will nudge the private sector to tap the equity market to raise funds. Interestingly, this week Dubai tech firm StarLink’s CEO stated the company’s intention to go public early next year on Nasdaq Dubai. The firm, which provides cybersecurity and cloud services across the Middle East, Africa and Turkey, will be the first time an IT firm would list on the Nasdaq Dubai platform. Up until recently DP World, which had a USD 5bn IPO in 2007, was the major listing on Nasdaq Dubai.

Dubai has not had a very successful listing track record in the recent past: DFM has seen just one listing since 2017. From the start of 2020, DXB Entertainments and DP World delisted from the Exchange, Marka (which IPO-ed in 2014) was declared bankrupt & assets brought into liquidation while Arabtec shares were suspended; Damac is planning to take the company private. All this begs the question what would make this current strategy a different and potentially successful one?

Who should list?

In addition to the established government entities, the market should gear up and persuade listings from a varied set of companies located in the country. Considering the number of home-grown and Dubai headquartered firms, there can be a steady stream of companies, should they be interested in listing (ranging from education, transport & logistics and retail among others)

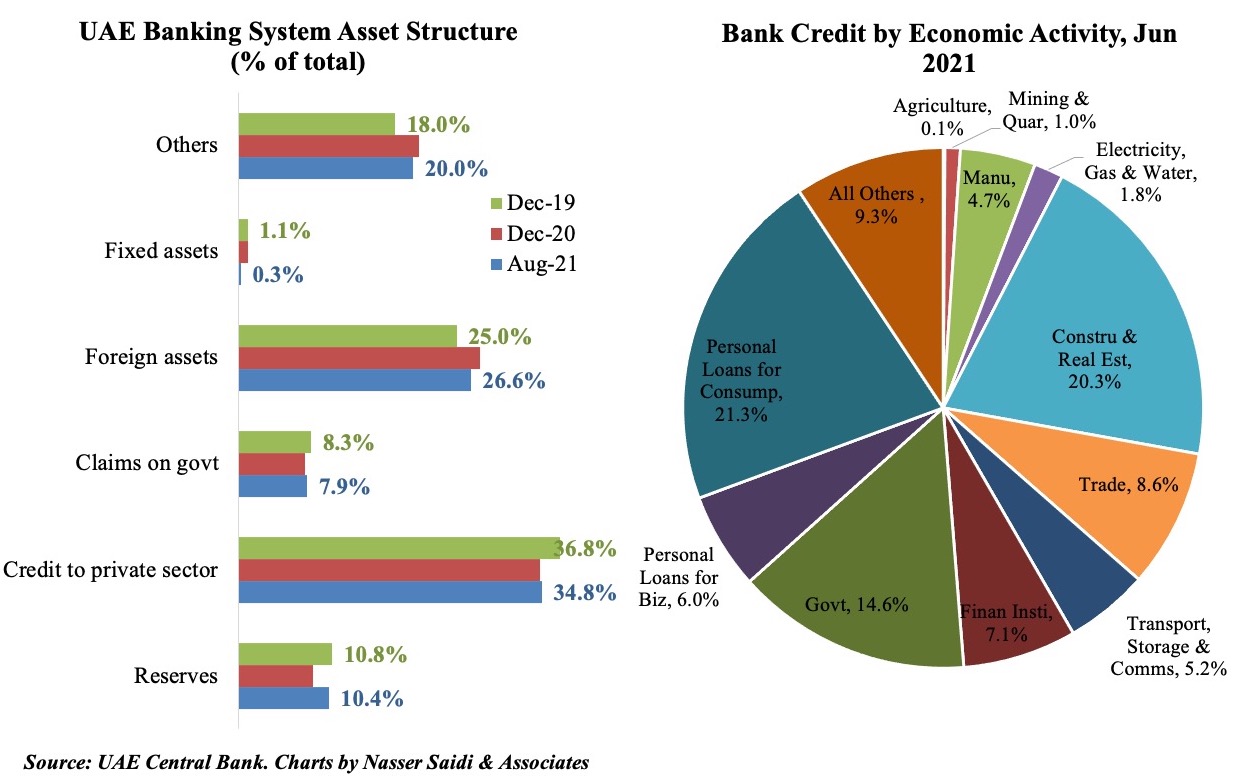

(a) A pipeline of private firms. It is well known that though financial systems have developed over time in the UAE, firms are still largely dependent on banks for funding business expansions. Domestic debt markets are less developed, and the equity markets have been quite narrow, dominated by a few large government related entities. UAE bank claims on the domestic private sector represents around 40% of total assets; it is well-known that the banks tend to prefer lending to large corporates and of these, financing is often geared to construction and real estate (20.3% of total as of Jun 2021), trade (8.6%), financial institutions (7.1%) and transport (5.2%)[1].  Market financing for infrastructure and development projects is more appropriate for longer-dated investments than bank financing. Total lending to SMEs accounts for just 5.9% of total domestic credit (as of Jun 2021): another area that can be supported by the development of active equity markets (catering to SMEs, with relatively “light” listing requirements). The move to increasing IPOs from private firms, if successful, will hence be a win-win.

Market financing for infrastructure and development projects is more appropriate for longer-dated investments than bank financing. Total lending to SMEs accounts for just 5.9% of total domestic credit (as of Jun 2021): another area that can be supported by the development of active equity markets (catering to SMEs, with relatively “light” listing requirements). The move to increasing IPOs from private firms, if successful, will hence be a win-win.

(b) Free zone companies. There are more than 40 free zones operational in UAE, of which the DIFC and ADGM are financial free zones with their own independent regulators. The Jebel Ali Free Zone (JAFZA) is home to more than 8,000 companies and the Dubai Multi-Commodities Centre (DMCC) expects to reach 20,000 firms by year-end. Offering the right set of incentives, attracting even 10% of these companies to list on the exchanges, would provide not only for sector diversification, but also attract a varied investor base. A new regulation issued by the Securities and Commodities Authority (SCA) allows for companies registered in any free zone in the UAE to offer shares to the public (this is applicable also to the financial free zones); when a free zone company is approved for IPO by SCA, the offering size can range between 25% and 70% of the free zone company’s shares. A few days back, SCA announced the signing of a pact with the Dubai Airport Free Zone Authority (DAFZA) to allow firms operating in DAFZA to offer shares to the public (DAFZA currently has more than 1,800 registered firms across 20 sectors/ industries).

(c) Family-owned businesses. Family businesses are already being encouraged to list on the exchange. The underlying law in this regard, the “Agency Law” – which allows for family-owned companies to turn into public joint stock companies – was approved in Jan 2020. However, there are often many hurdles to convince family-firms to list. This includes some internal difficulties like potential loss of control of the company, challenges to family/ business values and diluting family ownership to dilemmas related to acceptance of external investors, corporate governance and investor scrutiny of company financials (which may not comply with best international standards) among others.While the road to convincing such firms to take the IPO route may be long, empirical evidence suggest that family-owned firms outperform the wider market. The ‘Credit Suisse Family 1000: Post the Pandemic’ report found that since 2006, family-owned firms outperformed non-family-owned companies by an annual average of 370 basis points (bps), with outperformance strongest in Europe and Asia at 470bps and more than 500bps per annum respectively. This trend continued even during the Covid19 pandemic, with family firms’ returns outperforming others by about 300bps. Furthermore, these firms have performed better in terms of higher growth and profits, ESG scores and even furloughed a smaller number of employees compared to others.

(d) A “light” listing location. The Nasdaq Dubai Growth Market was announced last year as part of the Dubai Future District Initiatives. The market is open to SMEs based anywhere in the world and has many “light” requirements vis-à-vis the main market (including no minimum capitalization or number of shareholders, shorter financial track record, reduced costs) though reporting requirements and corporate governance regulations would be the same as in the main market. Though listings were expected in early 2021, there have been no further updates on this.

What additional support could be required to kickstart the IPO boom in the private sector?

Considering that multiple regulatory changes have been implemented in the recent months to nudge firms to list, with no clear indication of potential listings in the pipeline, one must assume that it is a combination of various factors including costs, listing requirements, regulatory challenges, as well as liquidity concerns.

(a) New products to increase depth and breadth. Introduce laws to facilitate mergers and acquisitions, as well as securitization to support the development of asset backed and mortgage-backed securities and other structured debt instruments. Introduction of Exchange Traded Funds and Abu Dhabi’s recent derivatives market are steps in the right direction. The UAE also needs to focus on developing local currency financial markets starting with a government debt market to finance budget deficits, infrastructure and development projects, along with a housing finance/mortgage market. The UAE successfully issued its first ever sovereign bond last month, but in order to develop a bond market in local currency, it needs a focused issuance program. Going forward, such a market would also enable the central bank to better control liquidity, by providing it with a market for Open Market Operations.

(b) Liquidity. Public ownership of a large share of equities and limited trading have constrained stock market liquidity. This needs to be corrected by allowing for a diverse investor base (local, regional and international institutional investors). This needs to be accompanied by supporting retail participation – hand in hand, however, with programs to improve financial and investment literacy. More liquid markets benefit both investors and issuers: for an investor, there are the benefits of lower costs of trading, lower price volatility and greater ease of buying and selling assets; as an issuer, liquidity implies lower cost of raising capital and more market based share price valuations.

(c) Financial and Investment Literacy. The world has seen the emergence of a new breed of retail investors that came on board during the Covid19 pandemic (e.g. GameStop and the Reddit revolution in the US). It is important in this part of the world not only for SME owners to better understand finance and accounting, but also for retail investors to read and understand financial reports as well as be aware of the benefits of investing (while avoiding debt traps). In many countries that have successfully created an enabling environment for retail investors, dispute resolution mechanisms are also rolled out for support.

(d) Costs. Earlier this week, the Dubai Financial Market announced a slew of incentives to encourage new listings in the form of financial support to the cost of IPOs in addition to post-listing support like participation in international roadshows, and a 3-year waiver on listing and AGM fees as well as dividend distribution fees. Between this and the Nasdaq Dubai Growth Market’s fee structure, support seems to be in place. Easier, “light” listing requirements to facilitate the entry of smaller firms into the market notwithstanding, reforms should also focus on enhancing corporate governance and investor protection while maintaining transparency and disclosure standards.

(e) Potential merger of the exchanges in the UAE, allowing for cross-listing across the Arab world. There are three operational financial markets in the UAE – the Abu Dhabi Securities Exchange, the Dubai Financial Market, and Nasdaq Dubai in the DIFC. These fragmented markets should be consolidated to create a deeper, broader, and more liquid and active market, regulated and supervised by an Emirates Capital Markets Authority. This should ideally allow for listings from across the region.

It has been an extraordinary year, with Covid19 and related challenges, so the recent push might be sufficient to kickstart a new era in UAE’s financial markets. This would also allow for gradual de-risking of fossil fuel assets through gradual privatization and divestment in the financial markets – key for both economic diversification and to meet UAE’s clean energy commitments.

[1] Of the overall bank credit to residents, lending to the government and personal loans for consumption purposes account for 14.6% and 21.3% of the total respectively (as of Jun 2021).