Weekly Insights 20 Jan 2022: Oil is the shining star for the MENA region amid weak labour market recovery

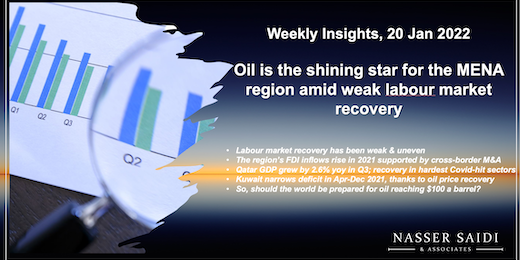

1. ILO’s labour market outlook for the MENA region is weak and uneven

- Covid19 led to substantial losses in working hours & a net decline in employment, especially in North Africa (yet to receover to pre-Covid levels). The ILO estimates that youth accounted for ~1/3-rd of net job losses in N. Africa (share in employment is 11%)

- Even pre-Covid, Arab States were characterised by low LFPRs and Employment to Population ratios (EPRs), alongside high unemployment & labour underutilisation. GCC sees a faster recovery in the labour market & EPR is slowly ticking up

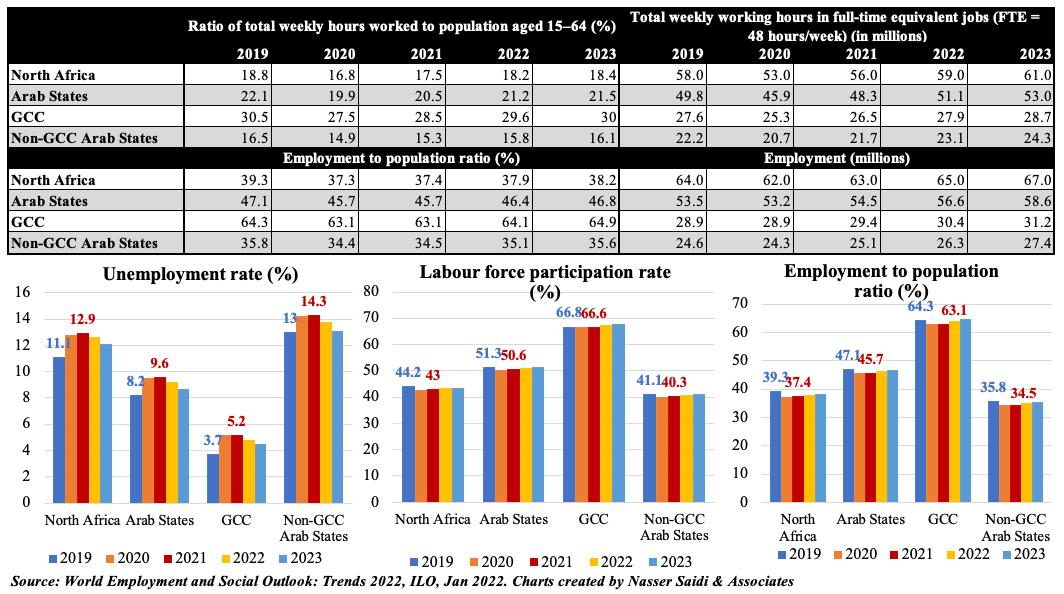

2. FDI into West Asia jumps in 2021, thanks to cross-border M&As

- The UNCTAD’s latest Investment Trends Monitor shows a 77% yoy jump in global FDI to an estimated USD 1.65trn in 2021; developed nations’ FDI grew to USD 777bn (3-times FDI in 2020)

- The report finds that project finance in infrastructure now exceeds pre-pandemic levels across most sectors; boom in cross-border M&As is most pronounced in services

- Uptick in West Asia, where FDI rose by 49% to USD 90bn. Inflows to Saudi Arabia quadrupled to USD 23bn, in part due to an increase in cross-border M&As

- Inter-Arab investments (2020, data from Dhaman): UAE, Saudi Arabia & Bahrain together accounted for more than 75% of the number of inter-Arab investment projects & close to 90% of the total capex in 2020

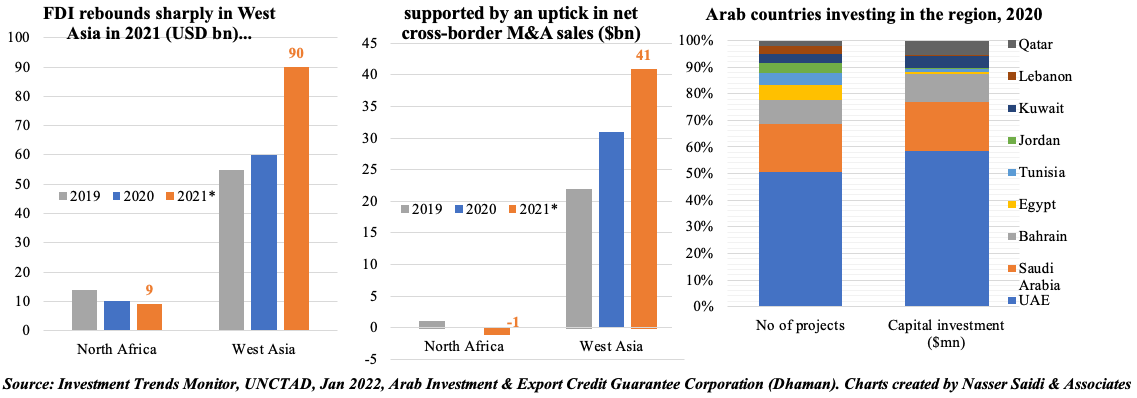

3. Inter-Arab FDI flows into “new” sectors: restricted to pandemic years or a shift?

Sector composition of inter-Arab FDI flows shifted in 2020 (data from Dhman) with a major fall in the share of real estate sector

- Rise in renewable energy projects (both in number and value): one of the top 5 inter-Arab projects in 2020 was the water desalination plant project in Abu Dhabi

- Investments into “services” increased: financial services (14% in 2020 vs 1.7% in 2018), business services (8% in 2020 vs 1.6% in 2018), communication and business services (18% and 8% respectively in 2020)

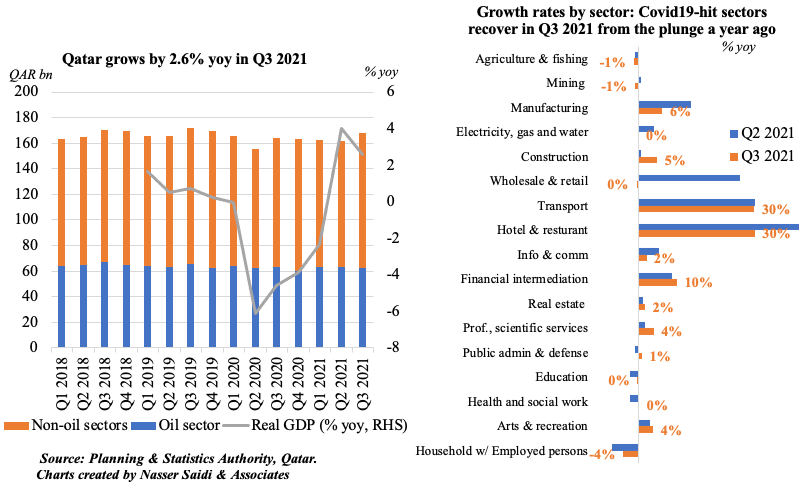

4. Qatar GDP grows by 4% qoq in Q3 2021, thanks to non-oil sector recovery

- Qatar GDP grew by 2.6% yoy and 4.0% qoq in Q3 2021. Growth was supported by the non-oil sector (+4.7% yoy) while the mining & quarrying sector activity dipped by 0.7%.

- Among non-oil sectors, those that were hit hardest by Covid19 recovered the most, hospitality & transportation (both up by 30% yoy)

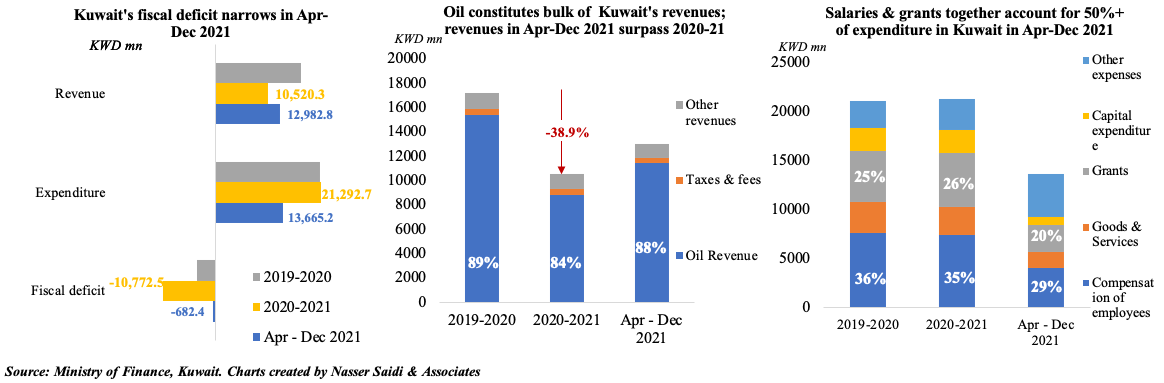

5. Kuwait deficit slips to KWD 682.4mn in Apr-Dec 2021 due to higher oil revenues

- Kuwait’s total revenue in Apr-Dec 2021, at KWD 11.5bn (USD 38.1bn), surpassed the total revenue collected in the last fiscal year Apr 2020 – March 2021 (KWD 10.52bn)

- Oil revenues accounted for 88% of the total revenue collected in the first 9 months of 2021

- Spending cuts (reducing private sector wage subsidies, restrianing non-essential sepnding etc) and withdrawal of Covid19 related fiscal measures has slowed expenditure

- Given the sharp rebound in oil prices, there has been a significant improvement in fiscal balance: a deficit of KWD 682.4mn was recorded in Apr-Dec 2021, down from the KWD 10.8bn deficit last year

6. Oil price: is USD 100 a barrel too far off? A price above USD 80 is likely to be short-lived

Oil prices hit a 7-year high on Tuesday this week. Many factors have led to this increase:

(A) On the demand side:

- Demand for oil has held up, in spite of the spread of Omicron (many nations in Europe are still reporting highest daily cases, but elected to avoid lockdowns )

- Fears about the variant are diminishing. To take air travel as an example: even after initial news about the new variant broke (on 24th Nov), air travel bookings made for Dec performed better than those for travel in Nov (51% and 46% of 2019 levels respectively, according to IATA). International travel bookings show a slowdown, but demand for summer travel is rising

- China’s zero-Covid policy could derail oil demand, but only if its city-lockdowns are extended over a longer period across the nation (e.g. during Winter Olympics or Lunar New Year)

(B) Supply issues are varied:

- Tight short-term supply, given concerns about production & spare capacity: increase in OPEC oil output has undershot the monthly target (given outages and downtimes in Libya, Nigeria…); snails pace of Iran’s nuclear deal negotiations (unlikely to get Iran’s exports on board this quarter or next)

- Shale oil could come into play if prices rise further; for now, production is still low given supply chain issues & high overheads

- Geopolitics: Russia-Ukraine tensions & recent attack on fuel depot in the UAE (following which oil firm ADNOC tweeted that business continuity plans had been activated to ensure supply was not disrupted) add a new layer of uncertainty to energy markets

The Fed is expected to raise rates this year in a bid to reduce inflation & higher oil prices will only feed further into food, hospitality and consumer goods prices among others, leading to demand for higher wages => an inflationary spiral