Weekly Insights 5 Aug 2021: Domestic Demand Drives Economic Recovery in Saudi Arabia & UAE +“Tanker Tensions”

1. UAE and Saudi Arabia’s PMI supported by domestic demand

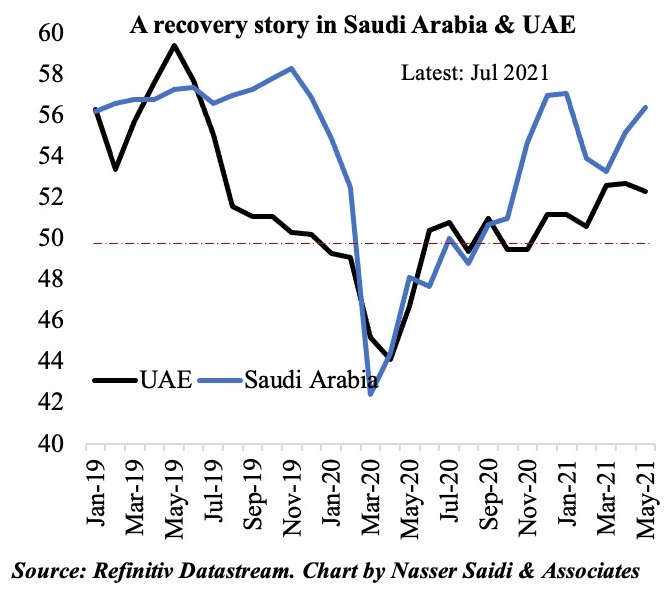

- Latest non-oil sector PMI for July remained in expansionary territory in both UAE & Saudi Arabia

- UAE’s PMI jumped to a 2-year high of 54 (Jun: 52.2), on strong output and new orders readings (highest since Jul 2019) while employment rose at the fastest pace since Jan 2019. Domestic demand played a significant role in the recovery.

- In Saudi Arabia, PMI eased to 55.8 (Jun: 56.4), on weaker growth in output, new orders and employment. The PMI readings have stayed above 50 for the 11th straight month. Respondents mention improvements in demand given competitive pricing.

- Both UAE and Saudi firms cited increase in input prices (given delays in shipments) and lengthened delivery times; these costs, however, were not passed on fully to consumers as the main objective still remains to stimulate demand/spending

- Looking forward:

-

- For UAE, Expo (starting from Oct) and easing of restrictions will offer further respite (flights for residence visa holders from India, Pakistan & 4 other nations have resumed)

- Higher oil output amid an OPEC+ agreement to support growth; services sector (especially tourism) to benefit from the recent opening up for vaccinated persons/ tourists

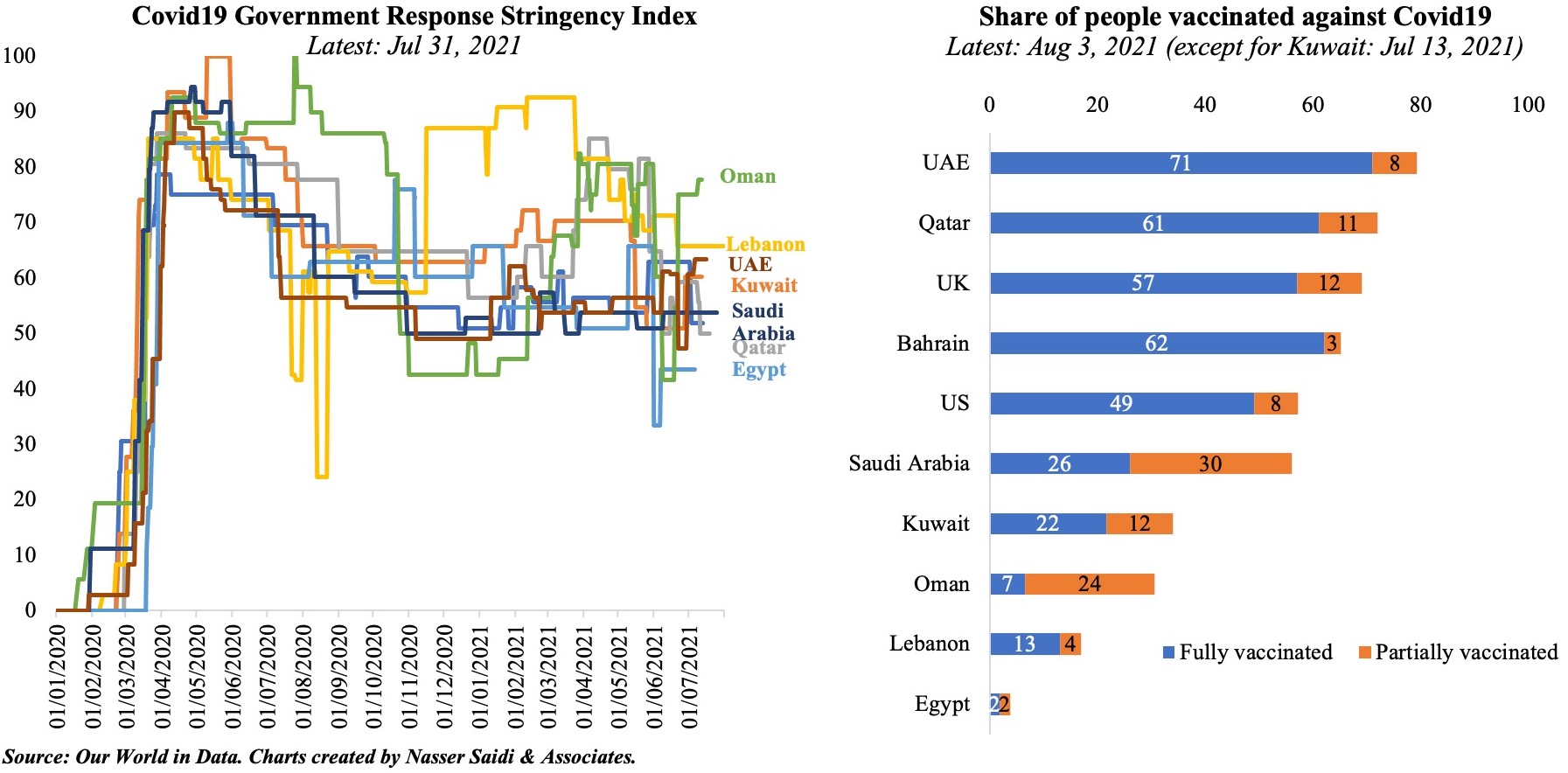

2. High vaccination rates & stringency levels will support a return to “normal”

- Both Saudi Arabia and the UAE have benefitted from a string of reform measures (100% foreign ownership, privatisations, visas, capital market reforms etc) in addition to the timely rollout of Covid19 stimulus packages.

- In addition, high immunization rates have also supported the recovery phase: UAE is home to one of the highest vaccination rates globally (71% fully vaccinated) while in Saudi Arabia, 56% have received one dose or more. UAE recently announced vaccination for 3 to 17 year olds to further curb the spread of the pandemic.

- The stringency index for the UAE has ticked up a notch (up 16 points since end-Jun till mid-Jul, during Eid holidays) and stands now as the second-most stringent among the GCC (Oman tops the list & Qatar the least)

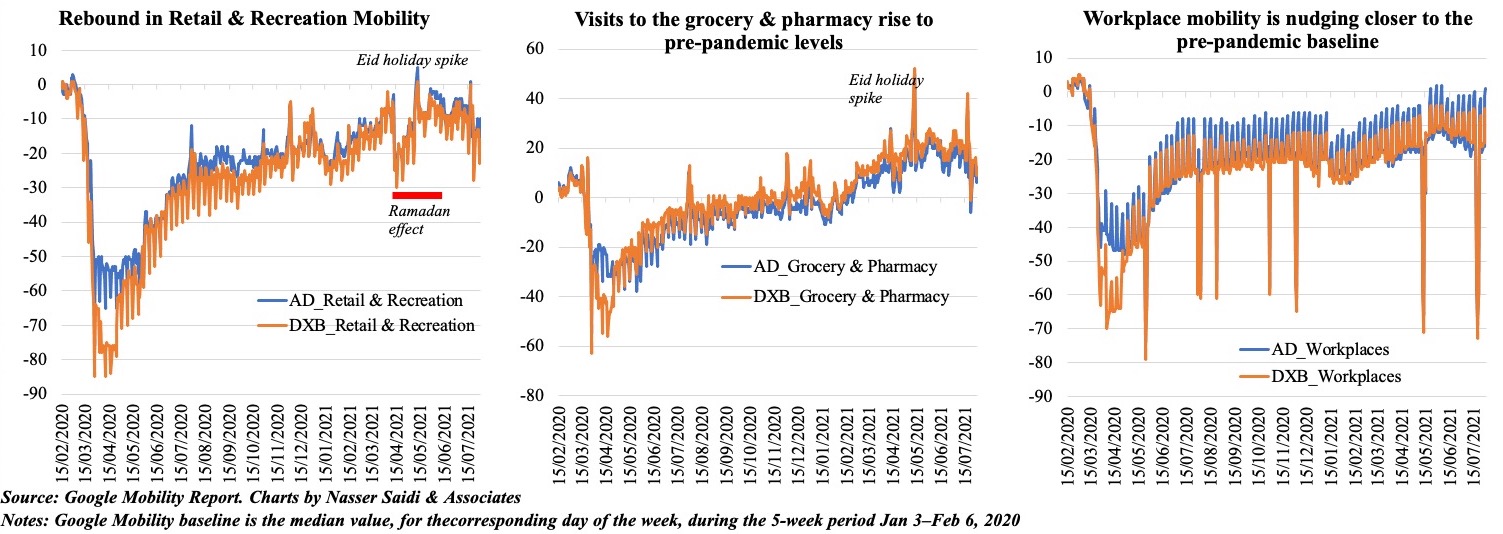

3. UAE mobility edged down slightly in Jul vs Jun 2021

- The increase in stringency is reflected in the latest UAE mobility data till end-Jul

- Both retail and recreation mobility as well as grocery and pharmacy visits have slipped during last month. Though the almost-week break for Eid saw an increase in mobility (except for workplace), it remained relatively subdued for the rest of the month, causing the overall Jul figure to be lower vs Jun. Grocery and pharmacy visits are in pre-pandemic territory.

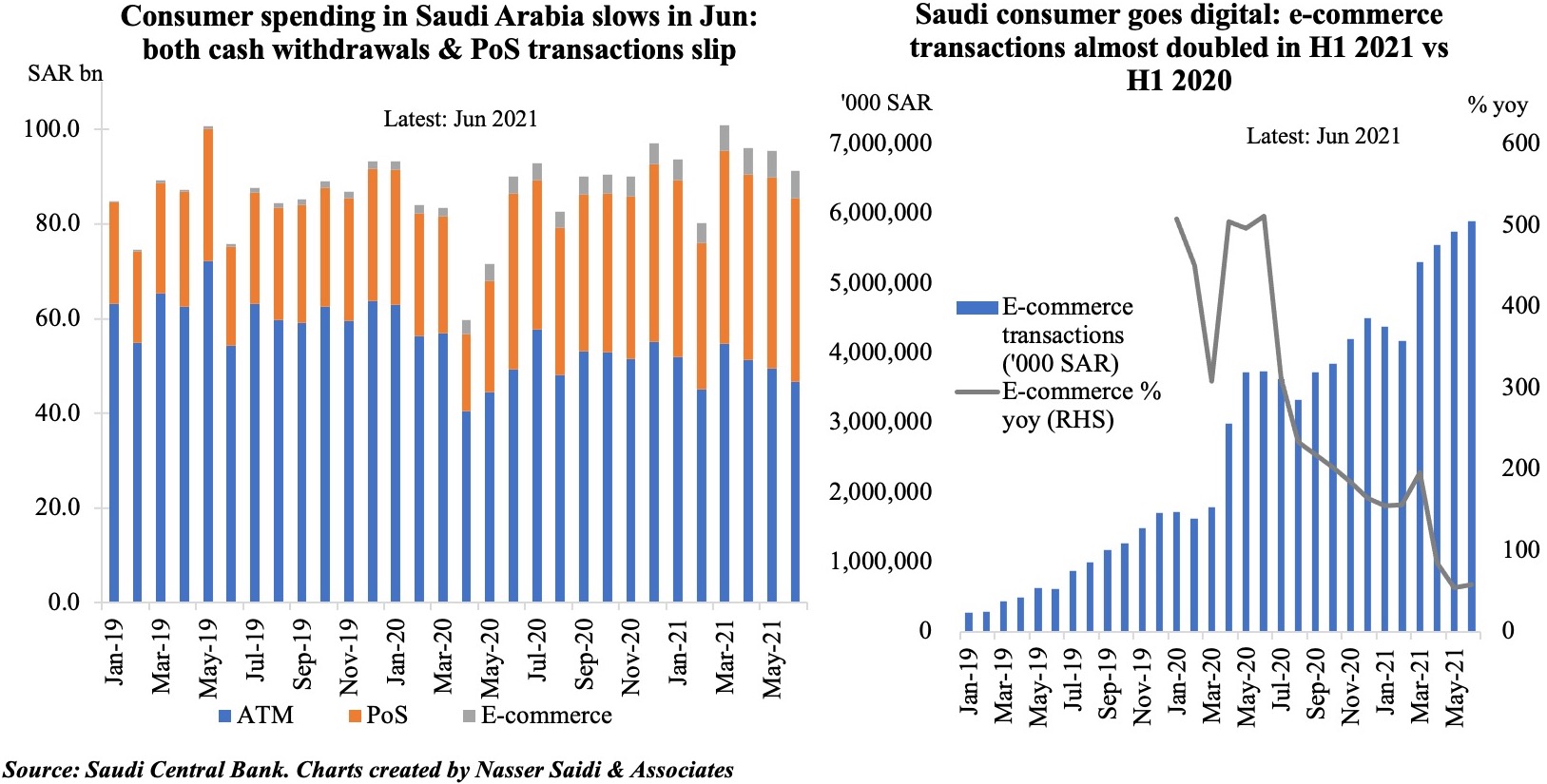

4. Consumer spending in Saudi Arabia slowed in Jun, but recovery from the initial Covid dip continues

- Overall consumer spending has been rising through 2021, with an increase in cashless transactions.

- While ATM transactions have declined by 4% yoy in H1, e-commerce transactions are still rising, having almost doubled in H1 2021 vs. the same period a year ago.

- Cash is no longer king: a report by Fintech Saudi found that only 18% of Saudis aged between 16 and 22 years use cash, while almost half of people who are 60 and above use cash till date

- Point-of-sale transactions in Jun increased the most (in yoy terms) within the “hotels” and “restaurants and cafes” categories. Big-ticket items like electronics and jewelry declined in yoy terms, given the impact of big purchases in Jun 2020 (ahead of the tripling of VAT)

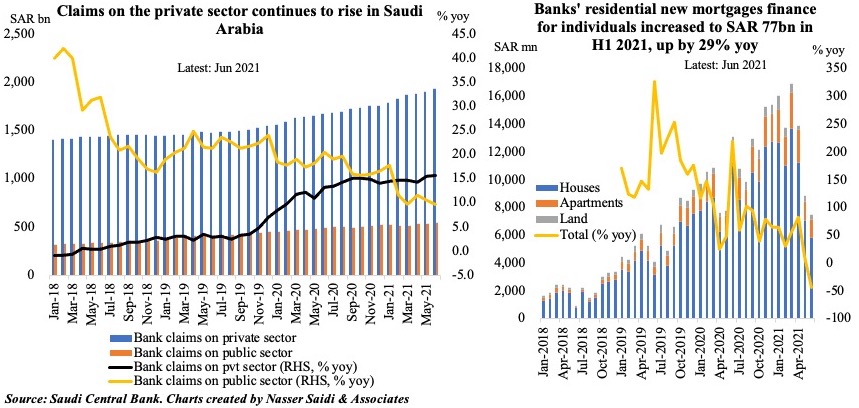

5. Bank claims to the private sector rise, with a healthy dose of mortgage loans

- Credit to the private sector has accelerated by an average of near 15% yoy in H1 2021, rising in line with the pre-pandemic pace. (This is in contrast to the UAE where private sector lending has been on the decline vs. an expansion in credit to both government and public sector entities. Read last week’s Insights)

- Residential mortgage finance has been one of the fastest growing segments, surging on the back of plans to increase home ownership. The banks have in H1 2021 lent SAR 77bn for new residential mortgages for individuals, up from USD 60bn in the same period a year ago.

6. Volatile oil prices amid tanker tensions in the Middle East

- Multiple tanker incidents in the Gulf of Oman in the span of a week is causing tensions in the Middle East region. Multiple countries have pointed the finger at Iran for these attacks.

- This is near the Strait of Hormuz chokepoint – famous for oil transit. Bloomberg estimates that 12mn barrels per day of crude and condensate passed through the Strait last year (from oil producers in the Middle East) in addition to a quarter of global LNG supplies.

- Two aspects to consider in this regard: 1. rise in geopolitical risk and more specifically, maritime risk. At a time when shipment delays are rampant given recent lockdown measures in Asia, the supply chain does not need further interruptions from attacks (increasing travel time and costs); 2. These tensions complicate the efforts to revive the nuclear deal (signed in 2015): while no future date has been set for the next meeting yet, the 6 rounds of informal negotiations have not been very successful. Iran’s political transition, with its new President, adds another layer of uncertainty to the picture.

- Whichever manner this plays out, oil prices are likely to remain volatile: prices remain an interplay between tight supply concerns amid a potential decline in demand. With cases rising in the US and China, two of the largest oil consumers globally, concerns are rife about lower global demand (weak PMI data in both nations support this notion). With the recent Reuters survey finding that OPEC July oil output hit a 15-month high, lower oil prices could be on the horizon sooner than later.

- Lastly, the commitment to fight climate change is also leading countries to greener paths of economic development. According to the World Bank, oil intensity of global output had already declined by about one-third in the two decades to 2019! The current commitments (including from the Middle East region) will further accelerate the move away from oil.

Powered by: