Markets

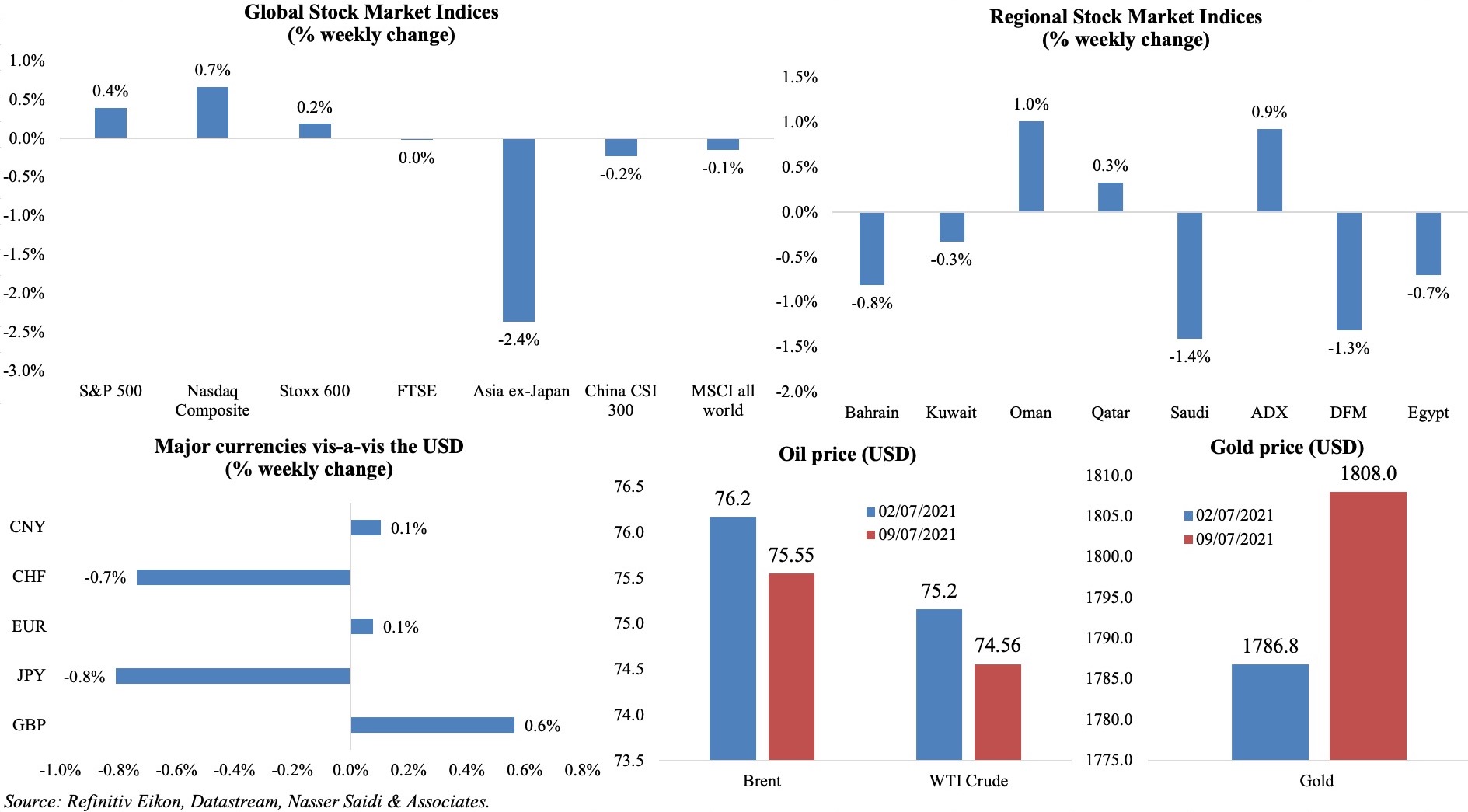

Equity markets dropped across the globe towards the end of last week: US markets posting a slight weekly gain after rallying to new record highs while European stocks gained on bargain buys after the week’s selloffs; Asian stocks hit a 2-month low on the Delta variant scare. Regional markets posted a mixed picture last week, with Oman and Abu Dhabi markets posting gains. Safe-haven currencies yen and swiss franc weakened as risk appetites recovered while the euro edged up slightly. Oil prices posted a weekly loss after rising to multi-year highs during the week given the OPEC+ deadlock and related uncertainty. Gold posted its 3rd consecutive weekly gain, crossing the USD 1,800 mark.

Weekly % changes for last week (8-9 Jul) from 1 Jul (regional) and 2 Jul (international).

Global Developments

US/Americas:

- FOMC minutes showed that though the topic of tapering was raised, the dominant call was that no significant policy shifts were to be made unless the economy showed “substantial further progress”.

- The latest JOLTS report showed that while 9.2mn jobs were open in May (about the same as in Apr’s 9.193mn), about 3.6mn opted to leave jobs (a quit rate of 2.5%). While those who left jobs were less than Apr’s 20-year high of 3.9mn, it is still one of the highest levels since Dec 2000. About 859k workers left their “trade, transportation and utilities” jobs, while the quit rate was highest in leisure and hospitality (5.3%).

- Initial jobless claims unexpectedly increased to 373k in the week ended Jul 3rd from an upwardly revised 371k the week before. Continuing claims fell by 145k to 3.34mn in the week ended Jun 12th, with the 4-week average down by 44.5k to 3.44mn – the lowest since Mar 2020.

- ISM services PMI slipped to 60.1 in Jun (from May’s record high of 64), with the employment index down to below-50 (49.3) as new orders and new export orders slowed to 62.1 and 50.7 respectively from 63.9 and 60 the month before.

- Markit services PMI edged lower to 64.6 in Jun from the preliminary estimate of 64.8 and May’s all time high of 70.4, though growth rates in new businesses and export remained strong.

Europe:

- Industrial production in Germany fell by 0.3% mom in May, following a similar drop the month before; the drop was largely due to a plunge in the production of capital goods, which fell 3.4%. In yoy terms, IP grew by 17.3%.

- German exports inched up by 0.8% mom in May – the 13th consecutive month of increase – alongside a 3.4% uptick in imports, thereby narrowing the trade balance to a surplus EUR 13.3bn. In yoy terms, exports were up by more than 36% and have now almost returned to pre-crisis levels. The UK dropped out of the top 5 export destinations (thanks to Brexit) – a list now comprising the US and China on top.

- German factory orders fell by 3.7% mom in May (Apr: 1.2%), the first drop in new business this year, driven by a 6.7% plunge in foreign orders (Eurozone -2.3% and rest of the world -9.3%). Compared to Feb 2020, new orders were higher by 6.2%.

- The ZEW survey’s current situation index in Germany improved to 21.9 this month, from -9.1 in Jun. The Economic sentiment index eased to 63.3 from 79.8 the month before. The economic sentiment index for the eurozone slipped by 20.1 points to 61.2 while more than 75% of the experts still expect inflation in the euro area to rise further in the next six months.

- Retail sales in the eurozone increased by 4.6% mom and 9% yoy in May (Apr: -3.9% mom and +23.3% yoy). As restrictions were eased, sales of non-food products (excluding fuel) increased by 8.8% mom (Apr: -6.1%) while sales of auto fuel were up 8.1% mom.

- Germany’s services PMI quickened to 57.5 in Jun (May: 52.8), the highest reading since Mar 2011. Composite PMI rose to a 10-year high of 60.1 (56.2), with the 12-month expectations also touching a series-record high.

- Services PMI in the EU climbed up to 58.3 in Jun (May: 55.2), with all nations posting an increase in activity (led by Ireland and Spain). The composite PMI moved up 0.3 points from the flash estimate to 59.5 (May: 57.1), thanks to an improvement in service sector expansion to its best since mid-2007.

- GDP in the UK grew by just 0.8% mom in May (Apr: 0.2%), after a contraction in building work and a slump in car production while services sector edged up by 0.9% (37.1% rise in accommodation and food service activities from low lockdown base). Transport equipment manufacturing fell by 16.5%, its largest fall since April 2020. Over the three months to May, GDP grew by 3.6%, mainly because of strong retail sales.

- Industrial production in the UK increased by 0.8% mom and 20.6% yoy in May. Manufacturing grew by 27.7% yoy but slipped by 0.1% in mom terms.

- UK trade data shows that exports to the EU rose to their highest since Oct 2019 in May (+8.8%), after a slump in the start of the year; imports are still relatively weak (+0.8%).

- UK’s services PMI was revised to 62.4 in Jun from a preliminary reading of 61.7 and 62.9 in May – this was the second highest reading since Oct 2013. Meanwhile costs pressures continued: respondents stated that higher staff wages, increased raw material prices and greater transportation charges were the main factors pushing up costs.

Asia Pacific:

- The People’s Bank of China (PBoC) will cut the reserve requirement ratio for banks by 50bps effective on July 15, releasing around CNY 1trn in long-term liquidity. This will be the first RRR cut since Apr 2020.

- Inflation in China fell by 0.4% mom in Jun; in yoy terms, inflation was down to 1.1% in Jun (May: 1.3%). Producer price index stood at 8.8% last month (May: 9%), as prices for copper and steel fell (after domestic price stabilization policy measures were introduced).

- China money supply accelerated by 8.6% yoy to CNY 231.78trn in Jun. New loans surged to CNY 2120bn (May: CNY 1500bn) while total social financing, a broad measure of credit and liquidity in the economy, rose to CNY 67trn (May: CNY1.92trn). Foreign exchange reserves eased to USD 3.214trn in Jun (May: USD 3.22trn).

- China’s Caixin services PMI eased to a 14-month low of 50.3 in Jun (May: 55.1), given the spread of the Covid19 Delta variant. Though the gauge of new export business rose into positive territory, new orders grew the least since Apr 2020 while employment shrank.

- Japan’s leading economic index slipped for the first time in a year to 102.6 in May (Apr: 103.8) while the coincident index slowed to 92.7 from 95.3.

- Current account surplus in Japan widened to JPY 1979.7bn in May (Apr: JPY 1321.8bn), up 85.3% yoy, thanks to an acceleration in exports (+46.5% to JPY 6.18trn).

- Retail sales in Singapore fell by 6.8% mom in May, given the Phase 2 restrictions introduced from mid-May to mid-Jun; mom changes were positive only for retailers of computers and telecom equipment (+18.9% mom) and supermarkets (+12.3%). In yoy terms, sales were up by 79.7% given the base year effects.

Bottomline: Just as summer travel season begins comes news about fresh surges in Covid19 cases – many European nations that had opened for tourists (including France and Spain) are introducing partial restrictions, while Tokyo Olympics will continue spectator-less. Bouts of new cases in China are dragging down activity in ports and factories and the RRR cut signals concern of potentially slower GDP growth. Meanwhile, the oil prices are on a roller-coaster ride given uncertainties: if current deal holds and there is no new deal, demand is likely to outpace supply driving up prices; if countries begin deciding their own production limits, it could lead to a price war and tumbling oil prices. At this stage, a reasonable solution seems a “temporary” increase in production levels for some producers. At this juncture, oil producers are also asking if oil demand is going to peak sooner than later (given countries’ decarbonization efforts to meet Paris climate goals and growing demand for renewables).

Regional Developments

- Bahrain’s GDP contracted by 2.1% yoy in Q1, with declines of 3% and 2% in the non-oil and oil sector respectively. This follows a 5.1% plunge in GDP last year; the ministry of finance and national economy estimates non-oil sector to grow by 3.8% this year and 3.7% in 2022, while the oil sector remains flat.

- In a new regulatory statement, it was revealed that the planned sale of Ithmaar Holding’s assets to the Bank of Bahrain and Kuwait has been cancelled and talks abandoned.

- Egypt’s PMI increased to 49.9 in Jun, its highest reading since Nov 2020 and up from May’s 48.6, thanks to an increase in both output and new orders (above-50) while employment contracted. Input prices rose at the sharpest pace for nearly two years due to a steep increase in raw material prices, but firms often absorbed the costs.

- Annual urban inflation in Egypt edged up to 4.9% in Jun (May: 4.8%); in mom terms, inflation eased to 0.2% mom from 0.7% in May largely due to a slowdown in food inflation. Core inflation accelerated to 3.8% yoy in Jun (May: 3.4%).

- Egypt eased guest limits for hotels, restaurants, cinemas and theatres to 70% of their capacity from 50% before; Covid19 cases stood at a 7-day average of 173.29 on Jul 8th.

- In H1 2021, Egypt welcomed 3.5mn visitors, earning revenues worth between USD 3.5-4bn, according to the deputy minister of tourism. In 2020, tourism revenues had plunged by 70% to USD 4bn. Separately, hotel occupancy in Cairo rose to 45% in H1 this year vs 27% during the same period last year. In the Red Sea resorts of Sharm el-Sheikh and Hurghada, occupancy rates were up to 35-40% from 20-23% in H1 last year.

- The Sovereign Fund of Egypt plans to raise about EGP 1.75bn (USD 111.5mn) to invest in providing high-quality education to the middle class.

- Egypt’s Financial Regulatory Authority and the Tax Authority agreed to exempt consumer finance services from VAT.

- Saudi Arabia has allocated EGP 270mn (USD 17.25mn) to support SMEs in Egypt, revealed the minister of international cooperation. This includes EGP 70mn to finance purchases of factory machinery and medical equipment, EGP 100mn to finance clean energy and another EGP 100mn to finance microenterprises.

- Moody’s affirmed the Caa1 long-term non-investment grade rating of Iraq and maintained its stable outlook. Key challenges for the nation include the high reliance on oil (fiscal and economic), low competitiveness as well as weak institutions and governance.

- Kuwait’s Jazeera Airways completed its capital increase subscription process with a total value of KWD 10mn (USD 33mn) through the issuance of 20 million shares.

- PMI in Lebanon fell to 47.5 in Jun, down from a 19-month high of 47.9 in May: weak purchasing power (given the collapse of the currency), reduced business volumes and fall in employment rate were noted by respondents.

- Lebanon’s central bank stated that it would pay out to USD 400mn to finance the imports of essential medicines and flour.

- A report from the Crisis Observatory found that in Lebanon, a family of five now spends more than three times the minimum wage for main meals for a month (about LBP 1mn) while about three-quarters of families have a monthly income of less than LBP 2.4mn.

- The IMF disclosed that Oman had requested technical assistance to help develop a medium-term debt strategy and strengthen its fiscal framework. According to the latest Article IV consultation, Oman is expected to grow by 2.5% this year following a 2.8% decline in GDP last year, alongside a budget deficit of 19.3% of GDP while debt-to-GDP ballooned to 80% (from 15% in 2015). More: https://nassersaidi.com/2021/07/08/weekly-insights-8-jul-2021-diverging-pmi-readings-saudis-new-import-rules-omans-imf-ta-request/

- Oman’s foreign reserves grew by 8.1% yoy to OMR 7bn (USD 18.2bn) in Apr. Total loans and financing of commercial banks was up by 3% yoy to OMR 18bn.

- Oman’s Tax Authority started to receive its first set of VAT returns starting July 1st.

- State energy company in Oman, OQ, is considering a sale of its drilling unit Abraj Energy Services as part of a broader divestment plan, reported Reuters.

- PMI in Qatar rebounded to 54.6 in Jun, following a 7-month low of 51.5 in May, driven by new orders and output, each up by 1.3 and 1.5 points respectively. Manufacturing was the best performer (56.4), followed by wholesale and retail (54.8), construction (52.5) and services (50.5). Wage inflation reached a 28-month record.

- Qatar Investment Authority’s stake in Credit Suisse will increase to 6.01% when convertible assets are taken into account in addition to the 128mn shares it owns in the company (which is equivalent to a 4.84% stake).

- Global Sukuk issuance increased by 4.9% yoy to USD 90.6bn in H1 2021, according to S&P. This was led by an increase in sales from Saudi Arabia and Malaysia, in addition to Oman’s return to the market; about USD 20bn of sukuk will mature in H2 2021, and it is likely that some of it will be refinanced.

- Green financing linked to sustainability projects in the MENA region touched USD 6.4bn in H1 2021, according to a Bloomberg study: this is 38% higher than the USD 4.7bn raised through the full year 2020. The Red Sea Development Company’s SAR 14.12bn (USD 3.8bn) accounted for close to 60% of total. Separately, last week, Saudi Electricity Company agreed a USD 500mn green lending facility.

- The UN World Food Programme stated that acute food insecurity surged by 40% this year to affect a record 270mn persons: average wheat flour prices in Lebanon rose by 219% yoy amidst accelerating economic turmoil, while cooking oil prices soared 440% yoy in Syria.

- The Central Bank of Jordan and the Arab Monetary Fund have completed the inclusion of the Jordanian dinar as a settlement currency in the Buna platform for Arab payments – this is in addition to the UAE’s dirham, Saudi Arabia’s riyal, USD and the euro.

Saudi Arabia Focus

- Saudi Arabia’s non-oil sector PMI moved up to 56.4 in Jun, unchanged from a month ago, supported by a surge in new orders (boosted by stronger domestic sales vis-à-vis foreign sales) and job creation (the fastest pace since Nov 2019).

- The IMF, in its most recent Article IV for Saudi Arabia, forecasts economic growth to touch 2.4% this year, with the non-oil sector rising by 4.3% alongside a 0.4% drop in the oil sector. While fiscal deficit widened to 11.3% of GDP last year, given a 30% drop in oil revenues and though VAT was hiked to 15%, this year the gap is estimated to narrow to 3.5%. Fiscal consolidation was an underlying message through the report, and the PIF’s contribution was to contribute to growth recovery. (Download the report at: https://bit.ly/3yQnYml)

- Saudi Arabia announced a cap on domestic gasoline prices, at June’s levels, to “decrease the burden of living costs on citizens and residents” and “support local economic activity”. This is the first-time prices are being capped since it was liberalized in 2018. While on one hand, it will free up more disposable income for spending, it contrasts with the Kingdom’s long-term fiscal sustainability plan (which includes extensive subsidy reform). While this would quell the angst of citizens against rising prices (remember that the cost-of-living allowance was suspended in June last year & VAT hiked in Jul), a move to strengthen social safety nets would likely have been more cost-effective while ensuring that benefits reached the needy. The IMF estimates that additional social safety net spending would cost about 0.5% of GDP.

- Saudi Arabia approved rules on local content, labour and value-added: the decree stated that products made in free zones would not be considered “locally” made; in addition, products needed a valid certificate of origin and had to be shipped directly from the producing country to get a preferential tariff. The short-term impact will be that certain goods will be excluded from preferential tariffs implying an increase in customs duties and consequently the cost of doing business. UAE, a major re-exporting hub, is Saudi Arabia’s second largest trade partner after China (with respect to import value). It could affect trade as in 2019, UAE’s Jafza generated trade worth USD 99.5bn (roughly about the value of intra-GCC trade!). More: https://nassersaidi.com/2021/07/08/weekly-insights-8-jul-2021-diverging-pmi-readings-saudis-new-import-rules-omans-imf-ta-request/

- Saudi Arabia’s PIF assets have increased to SAR 1.6trn (USD 426.6bn), disclosed the Deputy Governor, while stating that the aim is to expand this to SAR 4trn by end-2025. The fund also plans to boost local investments to more than 3/4th of its total investments.

- Bloomberg reported, citing Aramco’s senior official, that the company plans to raise “tens of billions of dollars” in asset sales over the coming years. This seems to be in line with other energy firms (Oman’s OQ announcement this week and ADNOC just the week before) actively considering privatisation to earn revenue from their assets.

- July Sukuk issuance programme in Saudi Arabia closed at SAR 10.412bn (USD 2.78bn).

- Saudi Ports Authority plans to invite the private sector for build-operate-transfer contracts in 8 ports across the country; there was no indication of the financial investments required for these projects, but these seem to be in line with the transport/ logistics sector strategy that is being pursued. Separately, the transport and logistics services minister revealed that the sector strategy will generate SAR 550bn (USD 150bn) in investments by 2030 – of which the government would provide just 35% of needed funding.

- The Saudi Authority for Industrial Cities and Technology Zones (MODON) announced a second industrial city project in Makkah.

- An incentive for real-estate firms to list in Tadawul: firms listing on the exchange will automatically be licensed to sell off-plan properties. This comes hot on the heels of an incentive package announced by MODON to encourage listings.

- Housing supply in Saudi Arabia increased by 29% yoy and 0.6% qoq in Q1 2020. Construction started on 101k units in Q1, up 18% yoy, while 106k units were completed.

- Saudi Arabia’s Social Development Bank (SDB) provided financing of SAR 1.6bn (USD 426.6mn) to 30k beneficiaries in H1 2021. Bank financing to SMEs surged by 41% qoq in Q2. Separately, the General Entertainment Authority signed a MoU with SDB to provide soft financing worth SAR 500mn to support growth and sustainability in the entertainment sector.

- Saudi Arabia plans to localize 6 more new professions to provide around 40k jobs: this includes in legal advice, customs clearance, real estate activities, cinemas, driving schools, and technical and engineering professions.

- Around 48% respondents in Saudi Arabia stated that they would continue to use online shopping and banking more than in pre-Covid19 times, reported Al Eqtisadiah.

- With an aim to become a major data centre hub for the region, Saudi Arabia launched an USD 18bn plan to build a network of large-scale data centers across the country, to surpass the 1300MW data space target mark before the end of this decade (vs only 60 MW now).

UAE Focus![]()

- UAE non-oil private sector PMI eased to 52.2 in Jun (Apr: 52.3): this is the 7th consecutive month of expansion. While output growth was unchanged (raw material shortage was cited as a reason), new order growth weakened, export sales fell and purchase costs rose to a 3-month high. Employment meanwhile rose for the first time in five months, and at the fastest rate since Jan 2019.

- Bloomberg reported that Sharjah’s government plans to raise over USD 750mn from an Islamic bond offering, to support its fiscal stance.

- Dubai welcomed a total of 3.7mn tourists into the emirate since it reopened to tourists in Jul 2020 till May 2021; of this, 2.06mn visited this year. Domestic tourism also surged during the period, more than doubling to 5.5mn.

- The Dubai Multi Commodities Centre (DMCC) posted its best H1 performance since 2013, attracting 1230 new companies to the free zone; this follows the registration of 2025 new firms during the pandemic-hit 2020.

- Consumer confidence in Dubai touched a 10-year high, rising to 151 points in Q2 2021 (Q2 2020: 125). While 84% of respondents were positive on the Dubai economy, about 75% were positive about job prospects (vs 32% a year ago) and 91% were optimistic about finding a job within 12 months.

- Dubai’s property sales transactions hit an eight-year high of AED 14.79bn (USD 4.03bn) in June, according to Property Finder.

- Dubai’s external pharmaceutical and medical supplies trade grew by 31% yoy to AED 6.8bn in Q1 2021, according to Dubai Customs data.

- Abu Dhabi National Energy Co. (TAQA) and Abu Dhabi Ports signed an MOU to build a green hydrogen-to-ammonia project, which will include a storage facility creating potentially an export hub.

- Abu Dhabi’s airport operator cancelled a contract to build the AED 10.8bn terminal at the emirate’s main airport. This contract was awarded in 2012, with the terminal expected to open in 2017, though in 2019 it was reported to be only 97.6% complete.

- Shuaa Capital is exploring the setup of 3 SPACs, to be listed in the US, in the field of energy, finance and technology sectors, reported Bloomberg.

Media Review

G20 must act now to vaccinate the world

Is the emerging world still emerging?

https://www.imf.org/external/pubs/ft/fandd/2021/06/jim-oneill-revisits-brics-emerging-markets.htm

Which airlines will soar after the pandemic?

https://www.economist.com/business/2021/07/06/which-airlines-will-soar-after-the-pandemic

Saudi Arabia’s amended import rules (with Dr. Nasser Saidi’s comments)

Dr. Nasser Saidi’s interview with Al Arabiya on Oman (in Arabic)

https://nassersaidi.com/2021/07/09/interview-with-al-arabiya-arabic-on-omans-economy-8-jul-2021/

Dr. Nasser Saidi’s interview on Lebanon (Dubai Eye, in English)

Powered by: