Markets

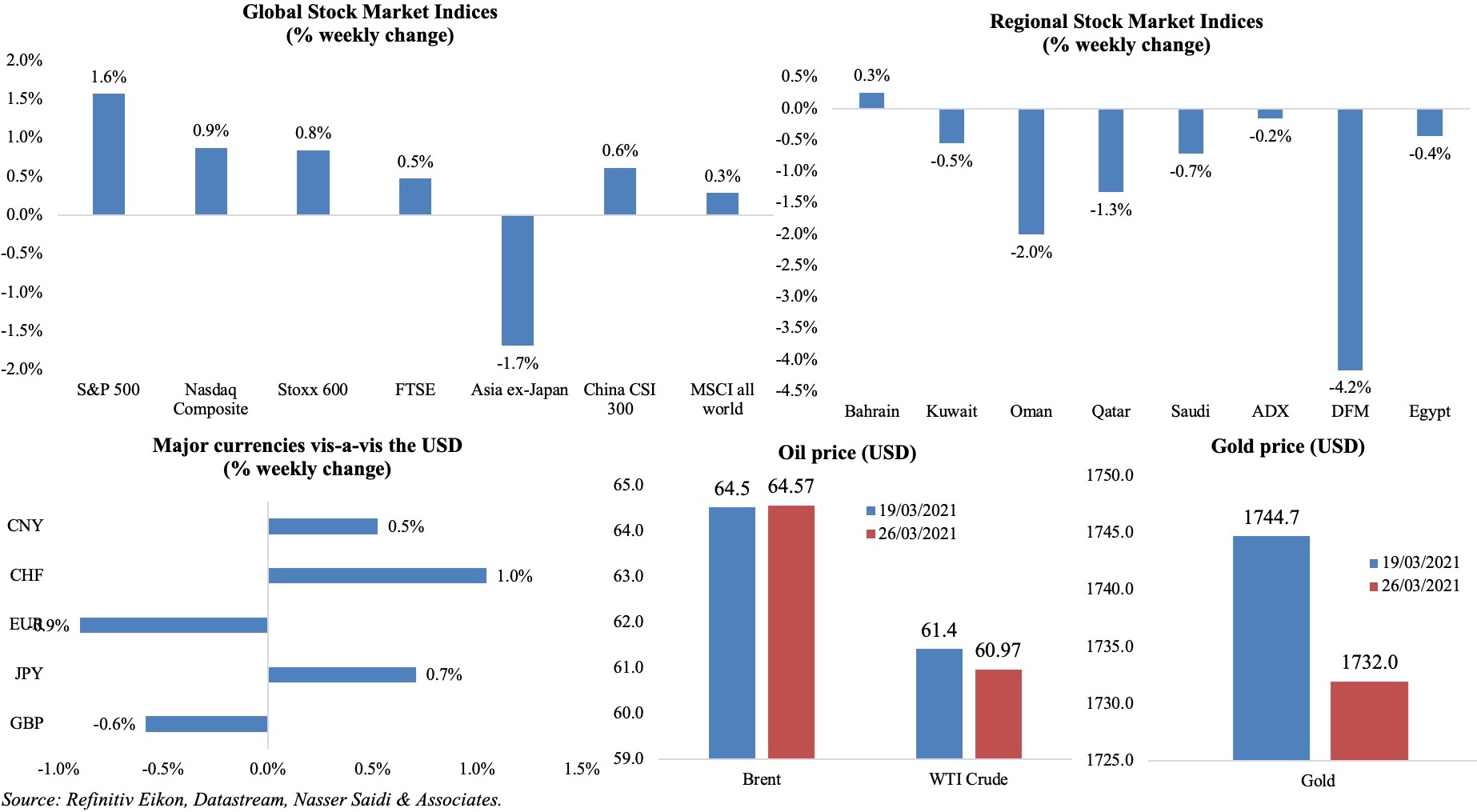

Equity markets were mostly up last week (S&P posted the strongest gains in 3 weeks), with Asia ex-Japan the only major global index down from the previous week (the index hit a near 3-month low on Thursday). In the Middle East region, most indices were down with DFM the worst hit (falling on ex-dividend stocks) while Egypt had to suspend trading after indices fell following the accident on the Suez Canal. Among currencies, dollar rose to a 9-month high versus the yen during the week and the euro-dollar was lower given divergent Covid19 outlooks. Emerging market currencies took a beating also given the near 10% plunge in the Turkish lira. Oil markets were affected by the Suez blockade though given the OPEC+ meeting on Apr 1st, it seems to have settled for now.

Weekly % changes for last week (25-26 Mar) from 18 Mar (regional) and 19 Mar (international).

Global Developments

US/Americas:

- Annualised GDP in the US increased by 4.3% in Q4, revised up from the previous estimate of 4.1%, thank to higher business investment. Core PCE eased to 1.3% qoq in Q4 while total US personal income rose by 6.1% last year to USD 19.7trn.

- Consumer spending dropped by 1% mom in Feb (Jan: +3.4%) – the largest decline since Apr 2020 – with spending on goods down 3% and declines in purchases of recreational goods and pharma products. Personal income plunged by 7.1% after Jan’s 10.1% increase. Core PCE price index climbed by 1.4% yoy and 0.1% mom in Feb (+1.5% yoy and 0.2% mom) – still under Fed’s 2% target.

- Chicago Fed National Activity Index fell to -1.09 in Feb (Jan: 0.75): it was below-trend growth for the first time since Apr, and only 34 of its 85 economic indicators made positive contributions in Feb.

- Existing home sales fell sharply by 6.6% mom to an annualized rate of 6.22mn units in Feb; supply of homes for sale fell 29.5% yoy, the largest annual decline ever, to 1.03mn homes. The supply constraint has been raising home prices – up 15.8% yoy in Feb. New home sales also plummeted in Feb, falling by 18.2% mom to 0.775mn. Higher interest rates, supply shortages and rising material prices are affecting affordability of houses.

- Durable goods orders fell – for the first time since Apr – by 1.1% mom in Feb (Jan: 3.5%), pulled down by a 1.6% drop in orders for transportation equipment though orders for civilian aircraft surged by 103.3%. Non-defense capital goods orders excluding aircraft fell by 0.8% (0.6%), after recording 9 consecutive months of increases.

- Markit manufacturing PMI inched up to 59.1 in Mar (Feb: 58.6), with the upturn in new business accelerating at the sharpest since June 2014, supported by new exports orders. Composite PMI slipped to 59.1 from 59.5. Services PMI ticked up to 60 from Feb’s reading of 59.8 – the strongest service sector output expansion since Jul 2014.

- Initial jobless claims decreased to 684k in the week ended Mar 20, easing from 781k the prior week, with the 4-week average slowing to 736k. Continuing claims fell to 3.87mn in the week ended Mar 13 (vs the previous week’s 4.134mn).

Europe:

- Germany’s Markit manufacturing PMI increased to 66.6 in Mar (Feb: 60.7), a record high (since Apr 1996). Services PMI went past the neutral 50-mark, rising to a 7-month high of 50.8 in Mar from Feb’s 45.7 reading. Composite PMI hence moved up to a 37-month high of 56.8 from Feb’s 51.1.

- Markit manufacturing PMI in the eurozone rose to 62.4 in Mar (Feb: 57.9), led by Germany’s factory production. Services PMI increased to 48.8 (Feb: 45.7), though posting a 7th consecutive monthly fall in business activity. The composite PMI rose above 50 to 52.5 in Mar (Feb: 48.8) – the first increase in business activity since last Sep.

- Ifo business climate improved to 96.6 points in Mar (Feb: 92.7) – its highest value since Jun 2019. The current assessment of the situation and expectations increased as well, by 2.4 and 5.4 points to 93 and 100.4 respectively.

- Current account surplus in the Eurozone narrowed to EUR 30bn in Jan (Dec: EUR 36.7bn). In the 12 months to Jan, the current account surplus was 2.3% of the bloc’s GDP, up from 2.2% in the preceding 12-month period.

- Consumer confidence in the euro area improved to -10.8 in Mar (Feb: -14.8), the highest reading since Feb 2020, in spite of the lockdowns and rising Covid19 infections. For the EU, consumer sentiment increased by 3.6 points to -12.1.

- Inflation in the UK unexpectedly eased to 0.4% yoy in Feb (Jan: 0.7%), largely to an unseasonal fall in prices for clothes, second-hand cars and toys. Core inflation slowed to 0.9 per cent (Jan: 1.4%) – the lowest reading in six months. Separately, the PPI core output eased to 1.4% yoy in Feb (Jan: 1.5%).

- UK manufacturing PMI increased in Mar to 57.9 (Feb: 55.1) – the highest since Nov 2017, supported by the fastest rise in employment for just over 3 years. Services PMI outpaced manufacturing for the first time since the start of the pandemic, with the index up to 56.8 in Mar (Feb: 49.5).

- Retail sales in the UK increased by 2.1% mom in Feb (Jan: -8.2), with clothing retailers seeing sales plunge by more than half on their pre-pandemic level; compared with Feb 2020, retail sales were down by 3.7%.

- The ILO unemployment rate in the UK slowed to 5% in the 3 months to Jan from the previous 5.1% reading.

Asia Pacific:

- China’s PBoC left interest rates unchanged for the 11th straight month after its last cut in Apr 2020.

- Japan’s leading economic index inched up to 98.5 in Jan (Dec: 97.7), the highest reading since Oct 2018, though lower than the preliminary estimate of 99.1.

- Core inflation in Tokyo fell 0.1% yoy in Mar, following a 0.3% fall in Feb. Gasoline prices rose 2.1% in Mar (Feb: 5.2%) and prices of household appliances rose 7% in Mar (Feb: 4%). Excluding both energy and fresh food, inflation inched up to 0.3% from Feb’s 0.2%.

- Inflation in Singapore increased to 0.7% yoy in Feb (Jan: 0.2%), driven by higher costs of private transport (+4.2%) while food inflation edged up to 1.6%. Core inflation turned positive for the first time in a year, rising by 0.2% yoy (Jan: -0.2%), largely due to an increase in service costs and higher food inflation.

- Singapore industrial production increased by 16.4% yoy in Feb (Jan: 9.2%), supported by the biomedical (+23.9%) and electronics sectors (30.3%).

Bottom line: Covid19 continues to dominate headlines more than a year after it took over: Europe’s slow pace of vaccination and rising cases, as well as the surging numbers in Brazil and India, amid new “double mutant” Covid19 variants, underscore concerns to the pace of global recovery even as global vaccinations cross 500mn doses. Other major events adding to “economic uncertainty” are the fight for vaccines between the UK and EU, renewed China-US tensions, the Suez Canal’s 1-ship blockage as well as higher bond yields. The OPEC+ meeting scheduled for Apr 1st, and with both Saudi Arabia and UAE calling for the need to tread lightly, production is likely to be held steady.

Regional Developments

- As Covid19 cases in the GCC increase, additional restrictions are being imposed: Oman announced a nighttime curfew from 8pm to 5am from today till Apr 8th as well as an extension of the evening ban on all commercial activities. Qatar issued orders to close leisure centres, gyms and swimming pools in addition to reduction of capacity at malls and movie theatres.

- Bahrain awarded contracts worth USD 4.1bn in 2020, via 1688 tenders: the value had declined by 14.6% yoy. Oil (USD 1.6bn), construction and engineering (USD 875.7mn), and aviation (USD 638.2mn) sectors accounted for just over 3/4th of the projects by value.

- The National Chamber in Bahrain voted in favour of three Royal Decrees supporting recovery in the Covid19 impacted nation: this includes allowing the government to withdraw USD 450mn from the Future Generations Fund to be injected to the national budget for emergencies.

- The IMF estimates Bahrain’s fiscal deficit to have risen to 18.2% of GDP in 2020, from 9% in 2019 and public debt to 133% of GDP from 102% a year earlier. Pressing for “urgent fiscal reform to address the large imbalances”, the IMF also called for “targeted support to the most vulnerable”. While growth is expected to rebound to 3.3% this year, and fiscal deficit to narrow to 9%, public debt looks set to rise further to 155% of GDP by 2026. (More: https://www.imf.org/en/News/Articles/2021/03/22/pr2175-bahrain-imf-executive-board-concludes-2021-article-iv-consultation)

- Prices of fixed broadband in Bahrain plummeted by up to 47% between 2019 and 2020, while internet penetration stood at 137% last year and internet usage increased by 93% yoy, according to a recent TRA report.

- Economic growth in Egypt is estimated to rise to 5.4% in the fiscal year 2021-22 from 3.3% estimated in 2020-21, revealed the planning minister.

- Egypt’s budget for the 2021-22 fiscal year estimates a 6.6% deficit, while primary surplus rises to about 1.5% of GDP (from 0.9% of GDP in the current fiscal year); revenues will rise by 16.4% yoy to EGP 1.3trn (USD 80bn) thanks to expanding the tax base and activating electronic payments, among others. While the total spending amount was not disclosed, around EGP 87.8bn were set aside to subsidise supply commodities and farmers.

- The closure of the Suez canal following the Ever Given accident has resulted in more than 200 ships anchored near the Suez, with 137 more set to join them within five days, according to Refinitiv. The accident is costing an estimated USD 10bn in lost trade for each day the block continues.

- Local debt sales will be used to cover as much as 90% of the upcoming budgetary requirements in Egypt, reported Asharq Business citing the deputy finance minister. In addition, an extension of existing debt maturity dates will also be considered.

- Egypt’s central bank and financial regulator agreed to create a fund to increase liquidity in the stock exchange, by providing financing to brokerage firms.

- The volume of credit facilities (loans granted, documentary credits, letters of guarantees) by banks operating in Egypt grew by 11.3% during the period Jul-Nov to EGP 2.448trn. During this period, funds granted to government and non-government entities grew by 19.2% and 7.8% respectively.

- EgyptAir plans to seek between EGP 5-7bn (USD 318-447mn) in government support this year, disclosed the CEO and chairman, as travel restrictions continue to impact operations. The airline had received EGP 5bn in government backed loans and direct state assistance last year.

- Egypt aimed to vaccinate 250k medical staff and eligible citizens last week, after having received a shipment of 300k doses, gifted from China.

- The Micro, Small and Medium Enterprises Development Agency in Egypt injected EGP 9.1bn via 623,500 loans to women’s projects between Jul 2014 and late-2020, according to the agency’s executive director.

- Iran and China signed a 25-year cooperation agreement. Though the details were not divulged, the pact includes ‘political, strategic and economic’ components. China was Iran’s top trading partner in the year ended Mar 20: Iran’s exports to China reached USD 9bn and imports from China stood at USD 9.7bn.

- Fitch maintained Iraq’s “B-” credit rating, but revised its outlook on sovereign debt to stable from negative, citing higher oil prices and smaller-than-expected decline in foreign reserves following the recent devaluation.

- Jordan is planning to create a virus-free “golden zone” for tourists that will include Wadi Rum, Petra and the Dead Sea. Being vaccinated will be the necessary criteria for being allowed entry into this zone for tourists, local suppliers and tourism staffers.

- The Cabinet in Jordan approved the central bank’s initiative to provide liquidity and financing for SME’s existing projects: the government will bear some of the loan interests on behalf of beneficiaries.

- Spending by Kuwait’s government institutions declined by 14.8% yoy to KWD 11.782bn during the 11 months to Feb 2021. This compares to the budget allocation of KWD 21.56bn for the full year.

- Bloomberg reported that state-owned Kuwait Petroleum plans to borrow as much as USD 20bn over the next five years to maintain its crude production levels.

- Kuwait has reduced the hours of its month-long night curfew to 11 hours (6pm to 5am) from 12 previously; furthermore, hotel quarantine has been replaced with home quarantine for travelers who have been vaccinated.

- Lebanon plans to impose a 3-day shutdown during the upcoming religious holidays of Easter (in Apr) and Eid (in May). Night curfew has been extended from 10pm to 3am while shops and restaurants are allowed to open for 2 extra hours from Mon onwards.

- Lebanon’s health minister stated last week that Syria responded to a humanitarian request and would be sending emergency oxygen supplies – about 75 tonnes – to Lebanon.

- With Lebanon currently vaccinating on average around 40k people a day, the first private sector initiative to assist the vaccination program began last week. The Sputnik V vaccine will be sold by Pharmaline to approved companies and organizations at the cost of USD 38 for the required two doses.

- Lebanon’s central bank has given April 16 as the deadline for commercial banks and licensed exchange dealers to prepare for the electronic currency exchange platform (announced two weeks ago after the pound traded at 15k to the dollar in the black market).

- Oman is expected release the tender for the main construction work for the Musandam airport by Q4 2021, reported Zawya Projects. The project, valued at USD 220mn, is expected to be completed by Q4 2024.

- Supported by the demand for Islamic products, Islamic financing in Oman grew by 9.5% in 2020, versus conventional banks’ loan growth of 2.1%, according to Fitch Ratings. The market share of Islamic banking and Islamic windows increased to 14.3% at end-2020 (end-2019: 13.6%), with total assets of OMR 5.1bn (USD 13.3bn).

Saudi Arabia Focus

- Saudi Arabia’s new initiative to end the Yemeni crisis includes a nationwide ceasefire under the supervision of the UN as well as political negotiations between the Yemeni government and the Houthis.

- Saudi Arabia announced two major and ambitious climate change initiatives: the Saudi Green Initiative and the Middle East Green Initiative. Highlighting desertification and air pollution as two of the significant challenges facing Saudi Arabia, the initiatives are expected to “raise vegetation cover, reduce carbon emissions, combat pollution and land degradation, and preserve marine life”. About 10bn trees will be planted in the Kingdom, a 12-fold increase on current levels while the Green Initiative will work to reduce its global carbon emissions by over 4% by 2030.

- Saudi Tadawul opened short-selling to all investors as of Mar 25th. However, the new rules stipulate that the short ratio to average daily traded volume of any security should not exceed 10 days and total net short positions must not exceed 10% of the free float.

- Oil exports from Saudi Arabia fell by 20.5% yoy in Jan, while non-oil exports increased by 15.6%: total value of exports declined by 13.4% yoy to SAR 71.9bn. Trade surplus in Jan widened by 24.5% mom to SAR 24bn – the highest since Feb 2020. China remained the top trading partner: exports to China was SAR 14bn and imports from China at SAR 9.6bn.

- Imports from Turkey into Saudi Arabia plummeted by 72.1% mom and 97.7% yoy to SAR1mn (USD 3.76mn) in Jan.

- Saudi Arabia’s investment minister stated that the country’s infrastructure and transportation sectors are seeking to attract around USD 420bn in foreign investments over the next decade. The ministry is planning to establish two agencies with a specialized portal to offer investment opportunities and facilitate investors.

- The Saudi Central bank granted licenses to two more FinTech firms – International Digital Solutions Co and Azm Fintech Co – to provide payments services, bringing the total number of such licenses to 13.

- Saudi General Authority for Zakat and Tax issued 40,500 fines for tax violations in Q1 2020.

- A record 91 industrial licenses were issued in Saudi Arabia this Feb, up 21% yoy, with a total capital of SAR 857mn (USD 229mn). About 21 of these licenses were for food production factories.

- Saudi Arabia created the Register of Privatization Projects as a comprehensive central database of documents related to privatization projects, which has details about privately financed schemes while also protecting confidential information related to specific projects.

- Saudi Aramco’s debt-to-equity ratio more than doubled to 55% yoy in 2020 (net debts stood at SAR 605.9bn), given the company’s decision to deliver the USD 75bn dividend in spite of a decline in profits. Net profit of the company fell by 44.4% to SAR 183.8bn for the year ended Dec 31st. The company, which scaled back spending to around USD 35bn this year from a range of USD 40-45bn previously, expects an Asia-led recovery in energy demand.

- Reuters reported that Aramco has sent an RfP to its relationship banks for pipeline deal financinge. plans to extract value from its assets (similar to what UAE’s Adnoc had done).

- Saudia airlines signed a financing agreement with 6 local banks worth SAR 11.2bn (USD 3bn) to expand its aircraft fleet.

- Vaccines have been declared mandatory for those providing services to pilgrims in Makkah and Madinah; they either need to get the jabs by Ramadan 1 or provide weekly negative PCR test results at the expense of the employer. Those who want to perform Hajj must also have taken the vaccination, reported Al Rai daily. Separately, at the nationwide level, various ministries have instructed that employees working in restaurants, cafes, food outlets, gyms, sports centres as well as drivers in public transport need to be vaccinated effective from May 13 (Shawwal 1).

UAE Focus![]()

- UAE launched “Operation 300bn” last week, with the aim of more than doubling manufacturing’s contribution to economic output to AED 300bn over the next 10 years (from AED 133bn currently) as well as increase the in-country value. Priority will also be given to R&D: volume of spending on R&D in the industrial sector will increase from AED 21bn, constituting 1.3% of GDP, to AED 57bn in 2031, raising the contribution to GDP to 2%. In addition to attracting foreign investment, the initiative will support over 13500 SMEs, and support job creation while the use of advanced technology would be encouraged and dedicated financing would be made available to meet the target. Separately, UAE’s industrial exports stood at AED 84.2bn in Jan-Oct 2020, according to FCSA data.

- A 5-year plan to raise the value of Dubai’s foreign trade to AED 2trn (from AED 1.4trn now) was approved last week. Dubai also announced a restructuring of the Dubai Chamber, forming three separate chambers: one for commerce, one for international trade and another for digital economy.

- The UAE and UK agreed to invest GBP 1bn (USD 1.38bn) in Britain’s life sciences industry: Mubadala will invest GBP 800mn into the industry over the next 5 years, while GBP200mn will come from UK’s Life Sciences Investment Programme.

- The UAE invested USD 10bn with the Indonesia Investment Authority (set up last month), to be used in strategic sectors like road and port infrastructure as well as tourism and agriculture.

- Abu Dhabi’s Taqa announced its plans, as part of a new 2030 strategy, to spend AED 40bn in infrastructure development as it prepares to add about 27GW of power capacity by 2030 and expand its renewables portfolio.

- Dubai Airport Free Zone Authority generated AED 8.47bn of trade or 10% of the emirate’s total trade in Jan-Sep last year. The number of registered companies in the free zone grew by 64% to 1800 during this period.

- UAE improved its ranking, up 4 spots to 15th globally, in the latest edition of AT Kearney’s FDI Confidence Index US, Canada and Germany top the list.

Media Review

The Suez Canal accident

https://www.ft.com/content/87cb4674-6db7-41cf-a82e-44b83eaa436c

https://www.economist.com/the-economist-explains/2021/03/26/why-the-suez-canal-and-other-choke-points-face-growing-pressure

https://www.reuters.com/article/us-egypt-suezcanal-ship/suez-canal-steps-up-efforts-to-remove-blockage-as-shipping-rates-surge-tankers-diverted-away-idUSKBN2BI0GZ

Covid19 China proposes global rules for central bank digital currencies

https://www.reuters.com/article/us-cenbanks-digital-china-rules-idUSKBN2BH1TA

Avoiding a K-Shaped Global Recovery: Project Syndicate

https://www.project-syndicate.org/commentary/global-economy-avoiding-k-shaped-recovery-by-michael-spence-et-al-2021-03

Why Covid-19 has had a different impact on MENA companies

https://www.thenationalnews.com/business/why-covid-19-has-had-a-different-impact-on-mena-companies-1.1188972

New York gobbles up SPAC listings from UAE

https://www.arabnews.com/node/1831091/business-economy

Turkey’s economic woes should be a warning for other countries

https://www.economist.com/leaders/2021/03/25/turkeys-economic-woes-should-be-a-warning-for-other-countries