Download a PDF copy of this week’s economic commentary here.

Markets

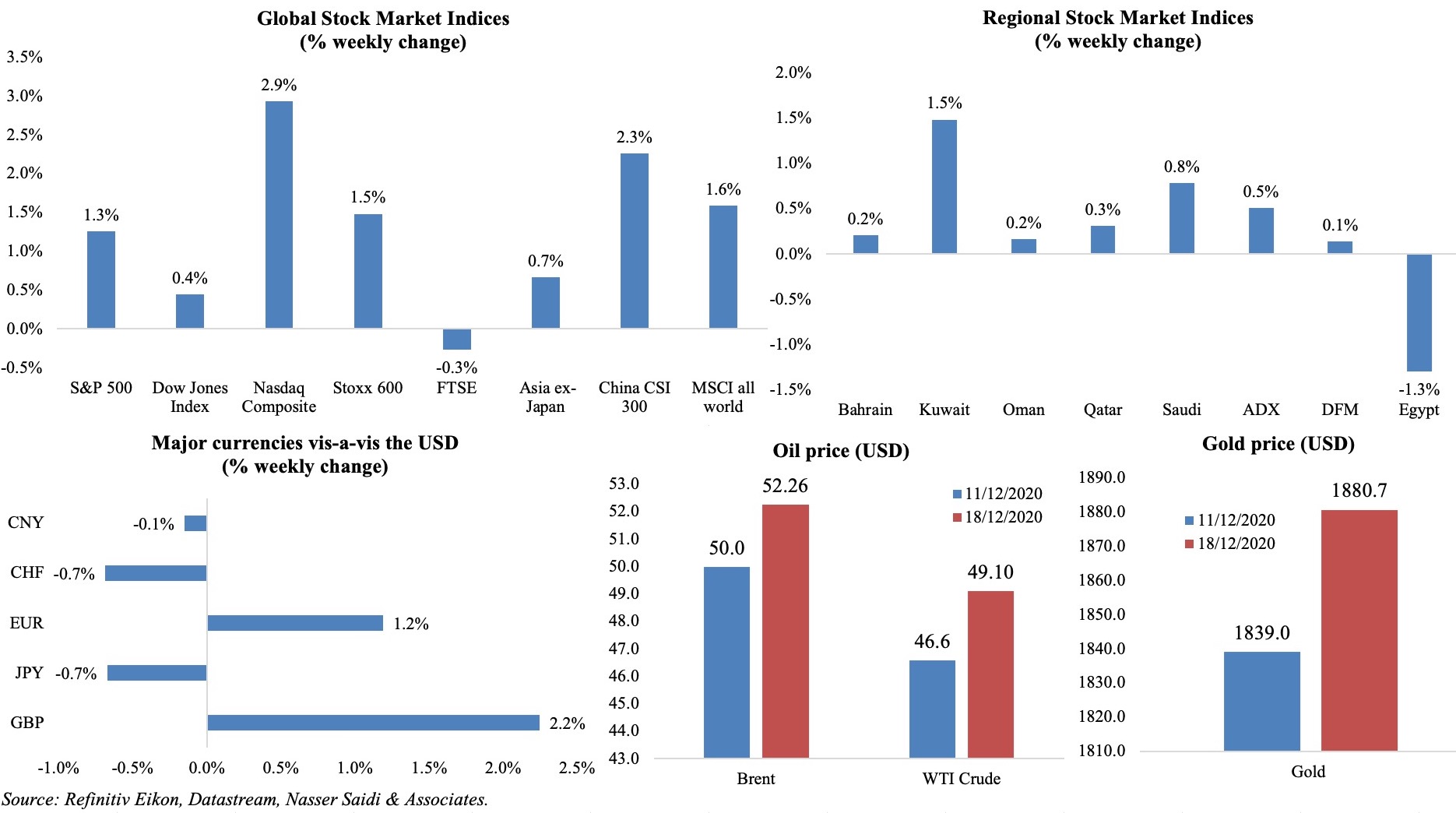

US equities touched record highs last week, as discussions progressed on a stimulus bill and as the Federal Reserve pledged to remain accommodative. Emerging-market stocks and currencies posted a seventh weekly gain, the longest winning streak since Jan. Regionally, most major Gulf markets ended higher while Egypt fell the most in 2 months. The pound hit its highest level in 31 months during the week, on hopes that an EU-UK trade deal could be close, though it slipped after. Among commodities, gold price gained while copper topped USD 8,000 a ton, reaching a 7-year high on an expected surge in demand.

Weekly % changes for last week (17-18 Dec) from 10 Dec (regional) and 11 Dec (international).

Global Developments

US/Americas:

- The Fed left rates unchanged, as expected, voted to maintain monthly bond purchases of at least USD 120bn, while the Fed Chair stated that “the case for fiscal policy right now is very very strong”. So far, no consensus has been reached on the stimulus deal, with talks trapped over a proposal to end the Fed’s emergency lending powers that allow it to provide loans to SMEs as well as state and local governments.

- Industrial production increased by 0.4% mom in Nov (Oct: 0.9%), with manufacturing output posting its 7th straight monthly gain, rising by 0.8%. Overall, IP index has risen to 5% below its pre-pandemic (Feb) reading.

- Retail sales in the US tumbled by 1.1% mom in Nov (from a downwardly revised Oct reading of -0.1%) – the most in 7 months – weighed down by the surge in Covid19 cases and declining household income. Sales plunged at clothing stores (-6.8%), restaurants and bars (-4%), electronics and appliances (-3.5%) and in motor vehicles (-1.7%).

- Markit flash US composite PMI fell to a 3-month low of 55.7 in Dec (down from Nov’s 68-month high of 58.6), as both manufacturing and services PMI inched down: manufacturing dropped 0.2 points to 56.7 while services slowed to 55.3 (Nov: 58.4).

- Housing starts grew by 1.2% mom to 1.547mn in Nov, inching closer to Feb’s pace of 1.567mn units. Building permits quickened by 6.2% to 1.639mn in Nov, supported by single-family houses rising by 0.4% to 1.186mn units – the highest level since Apr 2007.

- Initial jobless claims rose to 885k in the week ended Dec 12 from an upwardly revised 862k the prior week, with the 4-week average rising to 812.5k. Continuing claims slowed to 5.508mn in the week ended Dec 5 from 5.781mn the week before.

Europe:

- German Markit composite index remained resilient, rising to 52.5 in Dec (Nov: 51.7). Manufacturing PMI inched up to a 34-month high of 58.6 in Dec (Nov: 57.8), and though services moved up, it remained weak at 47.7 (Nov: 46). This uptick was mirrored in the eurozone PMI with composite PMI rising to 49.8 in Dec (Nov: 45.3) – the stronger manufacturing PMI (a 31-month high of 55.5 in Dec vs. Nov’s 53.8) helped lessen services’ reading below-50 (47.3 in Dec vs. Nov’s 41.7).

- Industrial production in eurozone increased for the 6th consecutive month, rising by 2.1% mom in Oct (Sep: 0.1%), with capital goods production showing the largest increase (+2.6%); in yoy terms, growth was down by 3.8%. Germany led the increase, with Belgium reporting a 6.9% rise while Greece posted a 3% decline.

- Ifo business climate for Germany climbed to 92.1 in Dec (Nov: 90.9): though it remains below pre-pandemic readings, there was optimism across both current assessment (91.3 from 90) and expectations (92.8 from 91.8).

- Inflation in the eurozone declined by 0.3% mom in Nov from Oct’s 0.2% reading. Annual inflation remained negative for the 4th consecutive month, clocking in -0.3% yoy in Dec, with energy prices lower by about 8% yoy.

- Producer price index in Germany was up by 0.2% mom in Nov (Oct: 0.1%), with energy prices up by 0.4% mom.

- The Bank of England kept its main lending rate at 0.1%, having cut twice from 0.75% since the pandemic began spreading, and retained its target stock of asset purchases at GBP 895bn (USD 1.2trn).

- Unemployment in the UK rose to 4.9% in the 3 months to Oct from 4.8% the previous time; about 370k persons were made redundant. Average earnings excluding bonus ticked up by 2.8% during this period from 1.9% before.

- Inflation in the UK eased to 0.3% yoy in Nov (Oct: 0.7%), with declines registered across clothing and footwear (-0.17 ppts), food and non-alcoholic drinks (-0.09 ppts); core inflation slipped to 1.1% (vs Oct’s 1.5%).

- Retail sales in the UK slowed in Nov: sales were down by 3.8% mom (following 6 months of gains) and up just 2.4% yoy (Oct: 1.3% mom and 5.8% yoy). While sales at clothing stores down almost a fifth in mom terms, booksellers’ sales were down by 40.3% while sales at food and household goods stores grew.

Asia Pacific:

- China left interest rate unchanged for an 8th straight month, but issued CNY 950bn (USD 96bn) in loans through a one-year medium-term lending facility (MLF) to financial institutions to support bank liquidity.

- Industrial production in China quickened by 7% yoy in Nov (Oct: 6.9%). Retail sales rose by 5% from 4.3% the month prior, thanks to communications equipment (+43.6%), auto sales (+11.8%) and household appliances (+5.1%). FDI inflows increased by 6.3% yoy in Jan-Nov.

- China’s fixed asset investment grew by 2.6% yoy in Jan- Nov, faster than the 1.8% rise in Jan-Oct 2020. Private sector fixed-asset investment, which accounts for 60% of total investment, rose 0.2% in Jan-Nov, compared with a 0.7% decline in the first 10 months.

- The Bank of Japan disclosed that it plans to buy USD 6bn from the MoF’s forex reserves between now and end-Mar, to boost the central bank’s US currency holdings.

- Japan Tankan large manufacturing index recovered to -10 in Q4 from -27 the prior quarter. Large all industry capex declined by 1.2% in Q4 from the 1.4% uptick in Q3.

- Industrial production in Japan fell by 3% yoy in Oct (Sep: -3.2%); in mom terms, IP was up 4% from an initial estimate of 3.8%. Capacity utilization grew 6%mom in Oct and declined 2.5% yoy.

- Core inflation in Japan declined by 0.9% yoy in Nov – the 4th straight month of decline and the fastest pace of yoy decline since Sep 2010. Inflation, excluding food and energy slipped by 0.3% from -0.2% the month before.

- Exports from Japan declined (for the 24th consecutive month) by 4.2% yoy in Nov while imports dropped by a faster 11.1%, narrowing the trade surplus to JPY 366.8bn. Exports slowed across the board to US (-2.5% yoy), Asia (-4.3%), EU (-2.6%) while those to China rose at the slowest pace in 5 months (+3.8%).

- Japan’s flash composite PMI remained below-50 in Dec (48 from Nov’s 48.1), with declining new orders and stronger dips in export orders.

- Consumer price index in India declined to 6.93% in Nov – still higher than the RBI’s upper margin of 6%; consumer food price index increased at a slower rate of 9.43% in Nov (Oct: 11%). Wholesale price inflation meanwhile edged up by 1.55% in Oct (Sep: 1.48%).

- Trade deficit in India widened to a 10-month high of USD 9.87bn in Nov (Oct: USD 8.71bn). Exports fell by 8.7% in Nov (Oct: -5.1%), dragged down by petroleum products (-59.7%), engineering goods (-8.1%), chemicals (-8.1%). Imports contracted by 13.3% during the month, with oil imports down by 43.36% to USD 6.27bn.

- South Korea cut its growth forecast for next year to 3.2% (from a previous 3.6%), thanks to a surge in exports, according to the finance ministry’s 2021 policy outlook; this follows a 1.1% dip in growth this year.

Bottom line: Exuberant markets remain disconnected with weak macroeconomic fundamentals as countries tackle the current Covid19 surge: from Sweden to UK, more nations are re-introducing stringent restrictions over the holiday period. Though vaccine distribution has begun, it will take many months before a sense of near-normalcy is restored. Meanwhile, as central banks across the globe stayed put on interest rates, the UK is inching closer to the realities of Brexit.

Regional Developments

- Bahrain’s Cabinet approved the widening of VAT exemptions to cover development projects financed by loans.

- The banking sector in Bahrain revived in Q3: personal and business loans were up by 5.6% and 4% since Feb this year; money supply increased by BHD 0.2bn since Feb to BHD 14bn at end-Sep; the number of point-of-sale transactions increased by 28.9% qoq to 21.4mn and value grew by 24.5% to BHD 588.1mn in Q3.

- Trade with UAE’s emirates and Bahrain has been on the rise: Abu Dhabi-Bahrain non-oil trade touched to AED 41.83bn during the period from 2015 to Nov 2020 (with AED 3.83bn this year); Dubai’s trade with Bahrain stood at AED 5.37bn in H1 2020 while it grew by 170% in a decade to AED 16.37bn in 2019.

- The IMF, following a review of the reform programme, allowed Egypt to draw USD 1.67bn under the standby arrangement.

- Egypt announced the allocation of EGP 1bn towards Covid19 related spending and a vaccine roll-out plan; more restrictions were introduced to control the spread of the outbreak by prohibiting wedding ceremonies and cultural events, in addition to reduce workforce attendance by government employees.

- Net foreign assets held by Egypt’s banks increased to USD 2.9bn in Oct, from the negative USD 5.3bn recorded in Apr; it is still low versus the USD 7.3bn recorded in Feb, pre-pandemic.

- Bank deposits of the household sector in Egypt amounted to about EGP 3.477trn in Oct, accounting for 82.92% of total deposits, according to the central bank.

- Egypt’s exports to Japan surged by 76% yoy to USD 176mn in the first 5 months of 2020.

- The output of natural gas in Egypt touched 6.2bn cubic feet per day – 13th globally and 5th in the MENA region – according to the minister of petroleum. Meanwhile, daily petroleum output reached about 1.9mn barrels of oil equivalent.

- Egypt’s Ministry of Aviation received investment offers from Saudi Arabia and Kuwait towards establishing cargo village and logistics areas at Cairo International Airport and Sphinx International Airport.

- Tourists into Egypt are estimated to reach just 3mn this year, just 23% of numbers last year, and a rebound is unlikely before 2022. In 2019, 13mn tourists visited the country, with receipts reaching more than USD 1bn a month.

- Egypt launched 416 projects in the electricity and renewable energy sector during the last two fiscal years, with a total investment cost estimated at EGP 95.6bn; of this, around 194 projects, worth EGP 33.6bn, were completed at the end of 2019-20.

- Calling it a preemptive step to avoid depletion of its foreign exchange reserves, Iraq devalued the dinar for the first time since 2003: the exchange rate is now set at 1,450 dinars per dollar, from a peg of 1,182 dinars.

- The IMF expects growth in Iraq to decline by 11% this year – the worst contraction in 17 years; decline in oil revenues will widen fiscal and external account deficits to 20% and 16% of GDP respectively. (More: https://www.imf.org/en/News/Articles/2020/12/13/pr20372-imf-staff-completes-2020-article-iv-mission-with-iraq)

- Iraq’s electric interconnection project with Jordan and Egypt is currently underway, according to the minister of electricity. The project connecting its grid with Jordan is scheduled for completion within 2 years and that with Egypt over 3 years.

- According to UNHCR, poverty rates in Jordan edged up during the Covid19 outbreak: poverty rose by around 38 percentage points (ppts) among Jordanians, and by 18 ppts among Syrian refugees; this amounts to 1.5mn+ Jordanians and more than 76k Syrian refugees.

- Jordan’s tax-exempted imports, excluding petroleum, touched JOD 9.6bn (USD 13.5bn) in 2019; of this around JOD 2.6bn were exempt from tariffs due to bilateral and international agreements, the investment law, public and private laws, or Cabinet decisions. The financial impact of these exemptions amounted to JOD 496mn in customs and JOD 79mn in sales tax.

- Kuwait approved a new cabinet that included new ministers of oil and finance. The re-appointed prime minister called for united efforts “and especially by the National Assembly” in moving forward, as the country is burdened by a fiscal deficit of USD 46bn this year.

- The 2020-21 budget in Kuwait estimates revenues from expatriates’ residency fees, specifically from the issuance of domestic workers’ visas and family visas, at KWD 9.6mn, reported Al Rai.

- Flights to and from Kuwait International Airport will restart from Jan 2021, including 34 “banned” countries; details of institutional quarantine will be revealed in a few days.

- Kuwait’s health ministry allocated about KWD 1.2mn for importing the drug Remdesivir, which is being given to patients infected with Covid19 in public hospital wards.

- Lebanon’s new government formation has stalled, with the PM designate and President exchanging a “war of words” over the delays – largely due to the disagreement over the distribution of portfolios and naming ministers – last week. Separately, the nation’s leading Christian cleric intervened to break the political impasse.

- Delayed bank earnings statements from Lebanon’s four big banks suggest the sector is insolvent, with government debt accounting for over half banks’ balance sheet. S&P estimates that the financial sector faces losses of LBP 154trn, or about USD 2bn, should a much-delayed restructuring plan be agreed.

- Oman’s registered SMEs accelerated by 12.9% yoy and 1.4% mom to 47220 at end-Oct.

- The pandemic has resulted in direct losses to Oman’s tourism sector at an estimated OMR 0.5bn as of end-Sep this year, according to a senior tourism ministry official. Hotel occupancy rates dropped to 26.1% by end-Oct from 52.3% in Oct 2019 while total number of guests plunged by 53.9% to 646k persons.

- About 2901 Omanis availed the Job Security System by end of November (84% males and 16% females), according to the Public Authority for Social Insurance.

- The number of expats in Oman has been declining: it stands at 1.7mn now versus 2mn two years ago.

- Though a normalization of relations between Qatar and its GCC counterparts will be a credit positive for the country, its high public sector debt will weigh heavily on its sovereign ratings, revealed Fitch Ratings.

- Saudi Arabia’s GDP declined by 4.3% in Q3, rebounding from the 7% plunge in Q2, with declines across oil and non-oil sectors (-8.2% and -2.1% respectively).

- Budget for 2021 was released by Saudi Arabia last week: spending will touch SAR 990bn (USD 263.91bn), down 7% yoy; deficit is expected to amount to SAR 141bn and will be covered through debt sales and a “very limited drawdown” from Saudi reserves. Saudi Arabia, which expects to receive between SAR 15-25bn in dividends this year from PIF, also plans to nearly balance its budget by 2023. (Read more: https://nassersaidi.com/2020/12/17/weekly-insights-17-dec-2020-weak-pmis-in-uae-dubai-inspite-of-vaccine-exuberance-takeaways-from-saudi-2021-budget/)

- Crude oil exports from Saudi Arabia increased to 6.159mn barrels per day in Oct from Sep’s 6.066mn bpd.

- Digital shopping gains ground in Saudi Arabia: online stores accelerated by 171% to 36447 shops in the last 9 months, revealed the minister of trade. the number of supermarkets providing home delivery services increased from just three pre-pandemic to 14 afterwards.

- Saudi Arabia’s Ministry of Industry and Mineral Resources issued 830 licenses to firms having a combined total capital of SAR 21bn and employing more than 36,750 workers during Jan-Nov.

- Saudi Arabia plans to attract SAR 220bn in new investments in tourism by 2023 and more than SAR 500bn by 2030, disclosed the minister of tourism. The sector currently accounts for 4% of jobs in the country.

- Pakistan returned USD 1bn to Saudi Arabia as a second instalment of a USD 3bn soft loan; USD 1bn was returned earlier in Jul and another billion will be repaid next month.

- UAE, Saudi Arabia and Egyptian startups raised USD 16.5mn, USD 8.7mn and USD 6mn respectively in Nov, out of total USD 37mn invested in all MENA startups, according to Wamda.

- Bahrain ranked first in the GCC for Islamic finance knowledge and fifth globally, according to the latest Islamic Finance Development Indicator.

- The number of 5G subscriptions to reach 130m in MENA region by 2026, representing 15% of the total mobile subscriptions, according to a report by Ericsson Mobile Services.

UAE Focus

- Dubai issued a new law governing unfinished and cancelled projects: a special tribunal will be set up to oversee the liquidation of unfinished and cancelled projects as well as the settling of related claims. The tribunal’s jurisdiction covers property disputes across the emirate, so cases over stalled projects cannot be filed at the DIFC Courts.

- Inflation in Dubai declined by 3.7% yoy in Nov (Oct: -3.41%), with decreases across utilities (-6.96%), transport (-6.29%) and recreation (-12.22%), as well as clothes (-2.25%).

- Dubai PMI slipped to 49 in Nov – the lowest since May – and from Oct’s 49.9, with declines in output and sales growth. In spite of potential rollout of vaccines, business expectations for the year-ahead slipped into negative for the first time since the series began in Apr 2012.

- The Abu Dhabi Department of Economic Development allows a 1-year extension to secure a ‘Tajer Abu Dhabi’ license even without an official business location. Around 14,613 ‘Tajer Abu Dhabi’ licenses have been issued since its launch in 2017 and end-Sep.

- Dubai-based district cooling provider Empower plans to lower fuel surcharge on electricity and water for its customers. This is expected to benefit more than 140k customers and reduce district cooling charges by more than AED 48mn (USD 13mn) a year.

- The value of exports of members of the Ras Al Khaimah Chamber of Commerce and Industry totalled AED 671bn in Jan-Sep this year. Saudi Arabia topped the list of countries, in terms of numbers of certificates of origin, with 3,208 certificates covering goods valued at AED 582mn.

- UAE ranked first in the Arab World in UNDP’s Human Development Report 2020, in a list topped by Norway, Ireland and Switzerland. UAE was ranked top in the Arab region for gender balance as well.

Media Review

Follow $100 through the 2020 market rollercoaster

https://ig.ft.com/2020-markets/

The $14 billion outflow from India’s bond market in 2020

https://www.bloomberg.com/news/articles/2020-12-17/global-investors-are-dumping-indian-bonds-like-never-before

Aramco, a gamechanger: may have to sell assets, borrow more to maintain Saudi dividend

https://www.arabnews.com/node/1778021/business-economy

https://www.reuters.com/article/saudi-budget-saudi-aramco/aramco-may-have-to-sell-assets-borrow-more-to-maintain-saudi-dividend-idUSKBN28Q247

The Arab spring: ten years on

https://www.economist.com/middle-east-and-africa/2020/12/16/the-arab-spring-at-ten

Doing Business Data Corrections and Findings of Internal Audit: World Bank Group

https://www.worldbank.org/en/news/statement/2020/12/16/world-bank-group-statement-on-doing-business-data-corrections-and-findings-of-internal-audit

Bitcoin surges towards USD 25k

https://www.ft.com/content/0a6507e9-d3f4-4319-bffb-eb915260e388

https://www.forbes.com/sites/billybambrough/2020/12/19/coinbase-ceo-brian-armstrong-issues-serious-warning-as-bitcoin-surges-toward-25000/

https://www.cnbc.com/2020/12/18/new-bitcoin-investors-buying-20-million-or-more-have-flooded-into-crypto-this-year-as-the-price-so.html

Powered by: