Markets

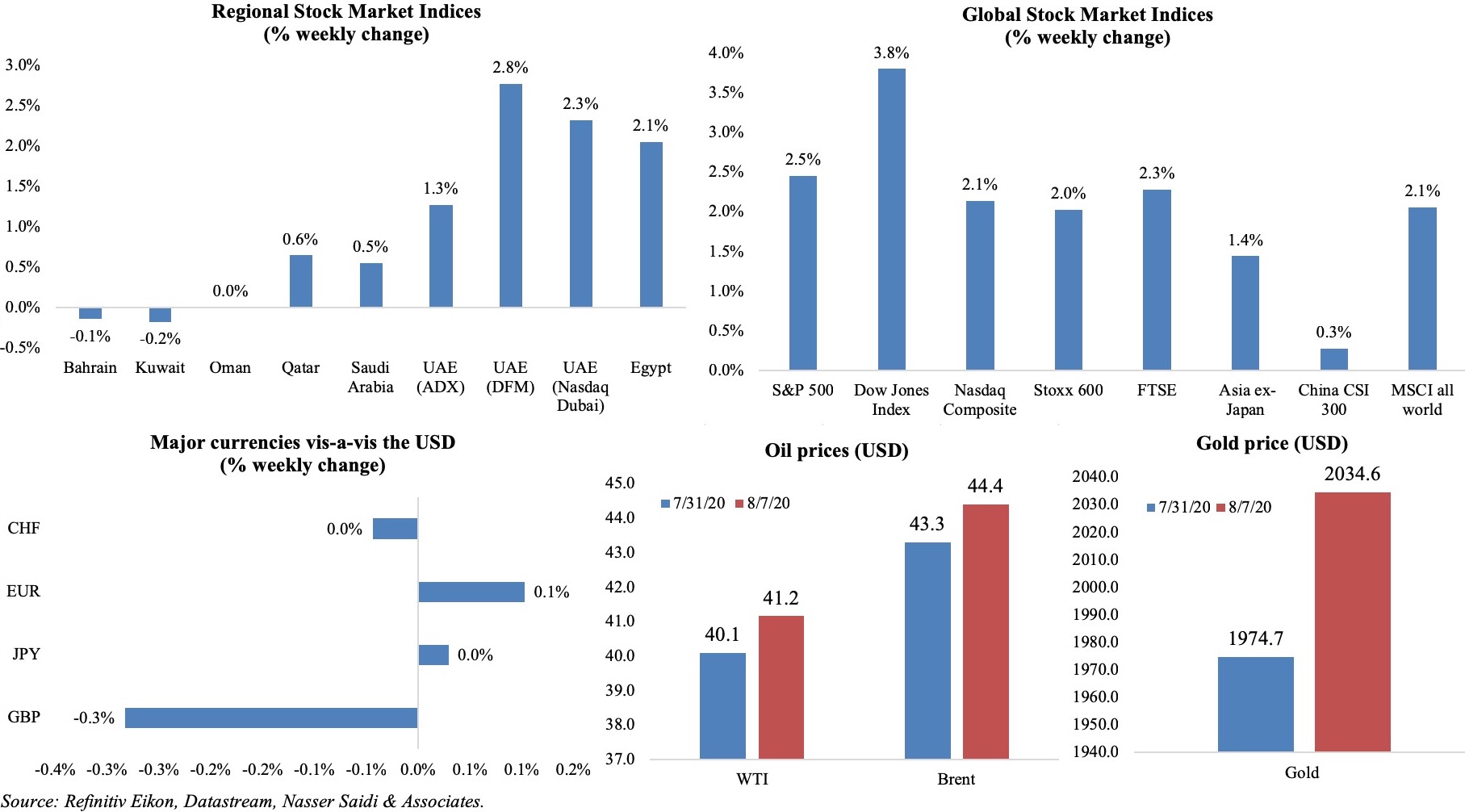

Global equity markets had a good week though taking a hit on Fri: in the US, Friday’s jobs report and lack of consensus on the stimulus bill stopped markets from touching a new record high; mounting tensions between US and China (banning US transactions with WeChat & TikTok) put a dampener on Europe and Asia-Pacific while markets dipped in China in spite of strong export numbers. Regional markets were mostly up, with UAE benefitting from Q2 earnings results and news of the latest stimulus measures announced to support economic recovery. During the week, the euro touched the highest vis-a-vis the dollar since May 2018 while the Turkish lira continued to slide. Oil prices edged up and gold surged to a record high above USD 2000 last week. Among asset classes, gold has been the biggest gainer this year (+36% ytd) and Brent crude the worst performer (-31.75%) Related chart: tmsnrt.rs/2yaDPgn.

Weekly % changes for last week (6-7 Aug) from 30th Jul (regional) and 31st Jul (international).

Global Developments

US/Americas:

- Non-farm payrolls increased by 1.763mn in Jul, led by the services sector, and following the record gain of 4.791mn in Jun. However, even with addition of 9.3mn workers in the 3 months – either newly hired or back to their old jobs – total employment level remained 12.9mn below the Feb level. Average hourly earnings inched up by 0.2% mom reversing Jun’s 1.3% decline. Unemployment rate declined to 10.2% in Jul from 11.1% the month before, but is double the 3.5% rate from Feb.

- The US President issued an executive order to implement 4 actions – extend unemployment benefits at a level of USD 400 per week (but requiring states to foot 25% of the bill), reinstate the eviction moratorium, cut payroll taxes (which is collected from both employers and employees to fund Social Security and Medicare) and continue a suspension of student loan repayments. More in the Media Review section.

- Factory orders grew by 6.2% mom in Jun, following a 7.7% mom rebound the month before. Orders for non-defense capital goods excluding aircraft grew by 3.4% in Jun while shipments of core capital goods were up 3.3%.

- ADP employment disappointed with a rise of 167k in Jul following an upwardly revised reading of 4.3mn jobs in the previous month. Services producing sector added 166k jobs.

- ISM manufacturing PMI rose to 54.2 in Jul – the highest level in nearly 1-1/2-years – supported by new orders (rising to 61.5 from Jun’s 56.4) as work restarted while the employment index remained weak (44.3 in Jul vs Jun’s 42.1).

- ISM non-manufacturing PMI improved to 58.1 in Jul (Jun: 57.1), rising for a 2nd straight month, supported by a surge in new orders (67.7 from 61.6 in Jun) while employment weakened to 42.1 from 43.1 in Jun.

- US Markit manufacturing PMI inched up to 50.9 in Jul from Jun’s 49.8; it was however revised down from a preliminary estimate of 51.3 for the month. Services PMI moved up to 50 in Jul (prelim estimate: 49.6; Jun:47.9), with the employment sub-index rising for the first time since Feb; business confidence improved to the strongest since Mar 2019. Composite PMI improved to 50.3 from the previous month’s 47.9, though new businesses fell.

- US trade deficit narrowed by 7.5% mom to USD 50.7bn in Jun; value of exports grew by 9.4% to USD 158.3bn, outpacing a 4.7% jump in imports to USD 208.9bn.

- Initial jobless claims declined to 1.186mn in the week ended Jul 31, the lowest level since Mar 14 during the Covid19 outbreak, with the 4-week average at 1.338mn. Continuing claims decreased by 0.844mn to 16.1mn in the week ended Jul 24.

Europe:

- Germany’s manufacturing PMI moved to expansion territory – for the first time since Dec 2018 – with the reading at 51 in Jul (Jun: 45.2), supported by a steep rise in new orders though rate of job losses was among the fastest since 2009. Services PMI increased to 55.6 in Jul (Jun: 47.3), with the strongest recoveries among “hotels and restaurants” as lockdown restrictions eased. Composite PMI picked up to 55.3 in Jul.

- Eurozone’s manufacturing PMI rose to 51.8 in Jul (Jun: 47.4), thanks to gains in both output and new orders. Only Greece and Netherlands posted reading below-50. Services PMI surged to 55.3 (Jun: 48.3) – recording the fastest rate of growth since Jun 2018. Composite PMI edged up to 54.9 from Jun’s 48.5 – the highest reading since Jun 2019.

- German factory orders rebounded by 27.9% mom in Jun, picking up by the largest since records began in 1991, supported by domestic demand (35.3%) and capital goods orders (45.7%). However, orders were down 11.3% yoy, and 11.3% lower than levels in Feb 2020. The automotive sector also recovered, with orders rising by two-thirds though 12.2% down compared to Feb levels.

- Industrial production Germany accelerated by 8.9% mom in Jun (May: 7.4%), with the automotive industry posting a 54.7% mom rise in output. Though the V-shaped recovery looks promising, in yoy terms, overall production is still down by 11.7%.

- Germany’s exports and imports posted a surge in Jun: exports posted a 15% mom rise following May’s 9% pickup while imports also grew by 7% (May: 3.6%). Trade surplus almost doubled to EUR 14.5bn from a month ago. China’s demand supported the pickup in exports, with the country buying 15.4% more vs Jun 2019 while demand from US and UK waned (shrinking by 20.7% and 15.7% respectively).

- Retail sales in the euro area recovered by 1.3% yoy and 5.7% mom in Jun (May: -3.1% yoy and 20.3% mom). Sales of textiles, clothing and footwear grew by 20.5% mom in Jun in the EU, after a record 130.7% jump in May.

- UK manufacturing PMI increased to a 16-month high of 53.3 in Jul (Jun: 50.1): while domestic new orders rose, new export business fell. Services PMI expanded to 56.5 in Jul (Jun: 47.1), the fastest pace of expansion since Jul 2015, and business optimism improved for the 4th consecutive month.

- The Bank of England left rates on hold at 0.1% at the latest meeting while keeping its target for the asset purchase facility unchanged at EUR 745bn. The apex bank forecast GDP to be 5%+ below its pre-pandemic peak at end-2020, only regaining its pre-crisis level at end-2021.

Asia Pacific:

- China’s Caixin manufacturing PMI rose to 52.8 in Jul from Jun’s 51.2 reading, supported by new orders (54.4) amid weak employment. New export orders (48.3) remained in contractionary territory for the 7th month running, indicating the rebound to be domestic demand-driven. Services PMI slowed to 54.1 in Jul (Jun: 58.4): while new orders were up for the 3rd month, new export business dropped and employment fell for the 6th straight month.

- Chinese exports accelerated by 7.2% yoy in Jul (Jun:+0.5%), driven by demand for medical supplies and automobiles, while imports fell by 1.4%, thereby narrowing the trade balance to USD 62bn, the 2nd highest level recorded since Oct 2015. China’s foreign reserves inched up to USD 3.154trn in Jul (Jun: USD 3.112trn).

- Japan’s GDP shrank by 0.6% qoq and an annualized real 2.2% in Q1 – unchanged from the second preliminary reading.

- Japan’s manufacturing PMI clocked in at 45.2 in Jul (Jun: 40.1), posting the 15th month of contraction. Exports, new orders and output fell at slower rates as employment declined for the 5th month in a row.

- The preliminary estimates for Japan’s coincident and leading economic indices increased in Jun: the leading economic index jumped to 85 – the highest reading since Mar – from the previous month’s 78.3 while the coincident index rose 3.5 points to 76.4.

- Tokyo CPI ticked up by 0.6% yoy in Jul while the core CPI (excluding food and energy) nudged up by 0.6% yoy; excluding just fresh food, prices were higher by 0.4%.

- Japan overall household spending fell for the 9th consecutive month in Jun, down 1.2% yoy, but there were signs of recovery. This reading follows a 16.2% plunge in May and a 11.1% fall in Apr. Spending on household goods (furniture, ACs, TVs, computers) rose; tumbled on cultural activities and recreation (-21.2%) and domestic/ overseas tours (-90.7%). In mom terms, spending was up 13%, the first increase in 4 months, supported by lifting of the state of emergency (May 25th) and government’s cash handouts (JPY100k per person).

- India’s central bank meeting resulted in no changes to interest rates: repo and reverse repo rates were left unchanged at 4% and 3.35% respectively. Separately, the governor proposed a one-time debt restructuring scheme allowing banks to restructure loans to companies in distress due to Covid19, without having lenders reclassify such loans as stressed assets.

- India’s manufacturing PMI slipped to 46 in Jul (Jun: 47.2), as both output and new orders continued to decline on subdued demand.

- South Korea’s manufacturing PMI ticked up to 46.9 in Jul (Jun: 43.4), as factory production reopened. This is the 7th month of contraction, but new orders fell at much slower rates and job losses eased amid ongoing weakness in export sales.

- Indonesia’s GDP contracted by 5.32% yoy in Q2 – for the first time in 20 years (Q1 1999) – dragged down by household consumption (-5.51%) and investment (-8.61%); in qoq terms, GDP dipped by 4.19%. The government slashed growth forecast this year to between -0.4-1%.

- Singapore PMI improved to 50.2 in Jul (Jun: 48), posting the first expansion since Jan, thanks to an improvement in new orders index, a first-time expansion in the indices of new exports and factory output, as well as a faster rate of expansion in the inventory index.

- Singapore retail sales surged by 51.1% mom in Jun, following the circuit breaker imposed in Apr-May; in yoy terms, sales were still down by 27.8% (the 4th straight month of double-digit declines).

Bottom line: Confirmed cases of Covid19 hit almost 5mn in the US while in India it crossed 2mn (took only 9 days for India to go from 1.5mn to 2mn!); with second waves appearing in Europe (France and Germany reported their highest daily number of new cases in 3 months) and Asia (Hong Kong, Japan, Singapore, Australia – the latter recording more daily cases than at the peak of the first wave in Mar-Apr), the road to recovery is unlikely to be V-shaped. Until a vaccine is found, localized restrictions are the likely way forward while avoiding nation-wide lockdowns (unless necessary). Global manufacturing PMI ticked up to a 6-month high of 50.3 in Jul, given a revival in both output and new orders. However, all is not smooth: restrictions have not been eased fully, demand is largely domestic-driven, and supply chains issues remain – average vendor delivery times lengthened for the 12th consecutive month. A resurgence in cases will only add to the burden.

Regional Developments

- Bahrain will accept applications for new work permits starting this week, according to the Labour Market Authority. The fees imposed by the Authority to issue and renew all types of work permits has been reduced by 50% for the period Jul-Sep.

- Partial salary payments (50%) have been completed for 60,416 insured Bahrainis in 1,120 firms in the private sector most affected by Covid19; half their salaries were covered for the period Jul-Sep from the unemployment insurance fund.

- Value of Bahrain-origin exports declined by 9% yoy to BHD 540mn (USD 1.42bn) in Q2 this year. Top export destinations remained unchanged: Saudi Arabia, UAE and the US.

- Travel through the King Fahad Causeway – connecting Bahrain and Saudi Arabia – has dropped by 99% since the Covid19 outbreak, according to the Finance and National Economy Minister. Though the bridge was opened to permit Saudi citizens to return home, operations are not expected to return to normal before Oct.

- A proposal to defer all loans payments from Bahrainis for 3 months has been submitted to the Parliament

- PMI in Egypt improved to 49.6 in Jul (Jun: 44.6), thanks to expansions in output (50.9, highest in 12 months) and new orders (51.4, highest since Nov 2017). Employment sub-index moved up to 46.1 from 44 the month before.

- Net foreign reserves increased by 0.3% mom to USD 38.315bn in Jul; this is down from a high of more than USD 45bn earlier this year.

- Money supply in Egypt grew by 17.47% yoy to EGP 4.53trn in Jun. Local bank deposits were up by 2.4% mom to EGP 3.268trn in Jun 2020.

- FDI into Egypt declined by 57.8% yoy to USD 970.5mn in Jan-Mar 2020; in the first three quarters of FY 2019-20, FDI inflows increased 1.6% to USD 12.7bn.

- Government investments in Egypt’s 2020-21 budget grew by 35% yoy to EGP 280.7bn, disclosed the finance minister.

- Egypt’s total budget deficit fell to 7.8% of GDP in the fiscal year 2019-20, down from 8.2% in FY 2018-19. The country posted a primary surplus of 1.8% of GDP during the year.

- Mortgage finance in Egypt plummeted by 84.2% yoy to EGP 62.7mn in Apr, according to the Financial Regulatory Authority. Value of mortgage refinance also dropped by 79.5% to EGP 33mn.

- Egypt’s tourism revenues are expected to drop by 73% yoy this year (more than 2% of GDP), according to the IMF (based on UN WTO estimates).

- Revenues from Egypt’s Suez Canal have dipped marginally during the Covid19 outbreak: during the full year 2019-20 (Jul-Jun), revenues were down by a minimal 0.52% yoy to USD 5.72bn. Revenues had increased by 4.7% during 2015-2020 to USD 27.2bn.

- Egypt and Greece signed an agreement to set up an exclusive economic zone between the two nations.

- Iraq will cut an additional 400k barrels per day in Aug to compensate for oil overproduction in May-Jun. Iraq’s total oil exports averaged 2.763mn bpd in Jul.

- An Iraqi delegation to Lebanon informed the latter’s PM that the country would provide fuel aid and wheat to Beirut, following the blast on Aug 4.

- Iraq’s PM called an early general election on June 6, 2021, roughly a year ahead of when it would normally be held. The parliament must still ratify the election date.

- Jordan decided to postpone the reopening of its airports to international commercial flights (scheduled for Aug 5th) “until further notice”.

- The average hotel occupancy rate in Jordan’s Aqaba did not exceed 50% during the Eid Al Adha holidays.

- Jordan has set Nov 10th as the date for parliamentary elections.

- Kuwaitization gains speed: 50% of expats working for contracting firms are to be laid off in the next three months, reported Arab Times.

- In a bid to reduce the number of foreigners, Kuwait has stopped the transfer of residency permits of expat children to their mothers in the case of the father’s final exit from the country or expiry of residency permit. Exceptions are in place for 3 categories: female teachers (employed by the education ministry), female healthcare workers (at the health ministry) and women doctors (at the general directorate of criminal evidence).

- Kuwait and India have agreed to facilitate Indian expats to depart Kuwait during the period 10-24 Aug, capped at 1000 per day.

- The explosion on Aug 4th in Lebanon’s Beirut port led to calls for resignation of the government, with demonstrations gaining traction over the weekend. It was disclosed that various letters to the judiciary requesting the removal of the explosive material had gone unheeded for years. France’s President Macron during his visit to the location, stated that he would “propose a new political pact” to all political forces in Lebanon, while also assuring that aid would “not go to corrupt hands”. Paris is hosting a donor conference today to raise emergency relief for Lebanon.

- Costs of the explosion will be high and require international support: Beirut’s governor stated that the repair bill for the capital alone will cost up to USD 5bn. A financial adviser to the government estimates the cost of damages at around USD 15bn. The Cabinet approved an exceptional allocation of LBP 100bn to deal with the crisis. The finance minister stated that working with the IMF was the only way out for the country, given its “very limited” financial capacity.

- Lebanon’s central bank froze the accounts of the heads of the Beirut port and Lebanese customs along with 5 others, reported Reuters. Separately, banks were instructed to offer exceptional dollar loans at zero interest to individuals and firms affected by the explosion.

- Support from international organisations: The IMF called for movement on reforms in Lebanon, also stating that the organization is “exploring all possible ways to support” the country. The World Bank stated that it was willing to “reprogram existing resources and explore additional financing” to rebuild the economy.

- Lebanon’s foreign minister tendered his resignation early last week, blaming lack of political will to roll out reforms required to revive the economy.

- Oman has lifted internal travel restrictions and reduced the hours of nighttime curfew (to 9pm-5am), except in the Dhofar governorate.

- Hotel revenues in Oman dived by 51.5% to OMR 56.11mn (USD 145.2mn) until end-Jun; hotel occupancy rate fell to 32% from 55.3% in the same period a year ago.

- Qatar disclosed that it had submitted a request to the International Olympic Committee to host a future Games, possibly in 2032.

- Saudi Arabia’s PMI rose to a 5-month high of 50 in Jul (Jun: 47.7), with pickups across 4 of the 5 sub-indicators – new orders (+1.5 points), output (+0.8), stocks of purchases (+0.6) and employment (+0.2); new export orders continued to fall sharply. Employment fell for a 5th consecutive month while average wages and salaries dropped for a record 7th successive month in an attempt to control overheads.

- Overall consumer debts in Saudi Arabia increased by 5.3% yoy to SAR 335.77bn in Q2 2020; credit card loans grew by 20.1% yoy to SAR 20.08bn.

- Foreign investors bought a net SAR 928.14mn (USD 247.45mn) of stocks in Jul, according to Tadawul. Saudi individuals bought SAR 94.88bn of stocks (85.18% of total buys) in Jul and sold SAR 97.04bn of stocks (87.11% of total sells).

- Saudi Customs has relaxed restrictions on the movement of trucks coming from other GCC nations.

- SAMA assets declined by 7.8% yoy to SAR 1.8trn in Jun; in mom terms, assets grew by 2.6%. Saudi foreign reserves contracted by 13% in June to reach SAR 1.677trn (USD 447.43bn).

- Banks in Saudi Arabia have lowered purchase of government bonds in H1 2020: investments were down by 4.6% to SAR 44.5bn in the first 6 months.

- Deposits held by banks in Saudi Arabia grew by 8.9% yoy to SAR 1.843trn in Q2, with demand deposits accounting for 66.01% of the total. Loan to deposit ratio touched 90.72% in Q2, with bank credit rising by 13.2% to SAR 1.672trn.

- Point-of-sale transactions in Saudi Arabia accelerated by 14% yoy to SAR 155.9bn in H1 this year, with food and beverages dominating POS purchases (about 1/5th of the total).

- Remittances by expats in Saudi Arabia picked up by 13% yoy to SAR 69.43bn (USD 18.5bn) in H1 this year. Jun alone witnessed a 60.22% surge in remittances to SAR 13.959bn.

- Saudi Arabia posted a fiscal deficit SAR 109.2bn (USD 29.12bn) in Q2, as oil revenues dipped by 45% yoy to USD 25.5bn. Expenditures dropped by 17% to around USD 65bn.

- The number of FDI projects launched by the GCC declined by 8% to 70 in Q1 2020, while investments sank by 79.3% to USD 4.9bn. According to Dhaman data, Saudi Arabia was the top GCC investor overseas with a share of 49%, followed by UAE (38%).

UAE Focus

- UAE PMI improved marginally to 50.8 in Jul (Jun: 50.4), while employment fell for the 7th consecutive month. Survey respondents attributed the rise in activity partly to “starting of new projects and an increase in marketing”, according to Markit.

- The UAE ministry of economy plans to roll out a flexible plan in 3 phases, with 33 initiatives, to support economic growth – covering 8 aspects ranging from “support for labor market, stimulation of trade, enhanced flexibility of financing activities, increased productivity, support for digital transformation, acceleration of green economy growth and enhanced food security”. SMEs will be a key area of focus in the 1st and 2nd phases of the plan.

- The UAE central bank will “temporarily relax” the thresholds of two prudential ratios – the Net Stable Funding Ratio (NSFR) and the Advances to Stable Resources Ratio (ASRR) – effective until end of 2021. Banks can go below the 100% threshold, but not lower than 90% for NSFR; for ASRR, banks can go above the 100% threshold, but up to 110%. This will boost capacity of banks to implement the Targeted Economic Support Scheme (launched in Mar).

- As of Jul, 260k individuals and 9,527 SMEs availed the interest-free loans worth AED 3.2bn and AED 4.1bn (9.3% of total disbursed amount) respectively under the central bank’s Targeted Economic Support Scheme.

- UAE dirham will be included as a settlement currency in the Arab regional payments clearing and settlement system called “Buna”, designed to support and boost inter-Arab trade and investment.

- Value of Abu Dhabi’s non-oil foreign trade declined by 7.3% yoy to AED 66.5bn in Jan-Apr 2020. Imports touched AED 35.14bn, while exports and re-exports reached AED 18.3bn and AED 13bn respectively.

- Dubai attracted AED 12bn in FDI in H1 this year, into 190 announced projects. In H1 2019, Dubai witnessed the inflow of AED 46.6bn in foreign investments (+135% yoy).

- Abu Dhabi government disclosed that it would spend AED 2.78bn (USD 757mn) to disburse mortgage loans for 1500 Emirati citizens and exempt mortgage repayments for 476 retirees.

- Abu Dhabi’s Department of Economic Development will permit businesses to renew licenses for 3 years, with the aim to also reduce and simplify the number of processes involved in the renewal process. In H1 this year, renewed licenses touched 33116, accounting for 42.3% of the total number of expired licenses.

- The Dubai Land Department launched a fractional title deed programme i.e. an investor will be able to buy up to half or a quarter of a hotel or serviced apartment; transfer fee will be paid only on the amount invested, and not the total value of the unit. These fractional title deeds can be transferred, sold or mortgaged.

- The Dubai Airport Freezone Authority (DAFZA) posted a 54% rise in general exports in Q1, with China, India and Switzerland accounting for 21%, 16.6% and 14% of DAFZA’s trade. The number of companies registered in DAFZA increased by 19% yoy in H1 this year, while new businesses including SMEs grew by 23% yoy.

- Consumer confidence in the UAE fell to 92 points in Q2 – its lowest since Q4 2009 (100 denotes optimism) – bogged down by job prospects, economy and health, according to the Conference Board Gulf Center for Economics and Business Research.

Media Review

Beirut blasts and beyond

https://www.ft.com/content/0e8aff25-629c-4737-a1dc-8ed4ee32447e (long read, paywall)

https://www.economist.com/leaders/2020/08/08/a-big-blast-should-lead-to-big-change-in-lebanon

https://www.nytimes.com/2020/08/05/opinion/beirut-explosions.html

Trump’s executive actions on coronavirus relief

https://www.businessinsider.com/trump-coronavirus-relief-executive-actions-face-legal-battles-other-challenges-2020-8

A Historian of Economic Crisis on the World After COVID-19

https://nymag.com/intelligencer/2020/08/adam-tooze-how-will-the-covid-19-pandemic-change-world-history.html

Are mergers the way ahead for the GCC’s airline industry post pandemic?

https://nassersaidi.com/2020/08/05/are-mergers-the-way-ahead-for-the-gccs-airline-industry-post-pandemic-opinion-piece-in-gulf-business-aug-2020/

IMF’s 2020 External Sector Report: Global Imbalances and the COVID-19 Crisis

https://www.imf.org/en/Publications/ESR/Issues/2020/07/28/2020-external-sector-report

Coronavirus Vietnam: The mysterious resurgence of Covid-19

https://www.bbc.com/news/world-asia-53690711

The Pandemic Workday is 48 minutes longer and has more meetings

https://www.bloomberg.com/news/articles/2020-08-03/the-pandemic-workday-is-48-minutes-longer-and-has-more-meetings

Oil industry reels from historic crash: 4 charts

https://www.ft.com/content/a34cbb86-ef8b-4b2c-b693-e0b6e405c5ab

Powered by: