Weekly Insights: Charts this week maps the downward revisions to IMF’s growth forecasts this year to analysing the latest initial jobless claims (are they as promising as they look?) before ending with a snapshot of the Government Response Stringency Index in the GCC nations.

Markets

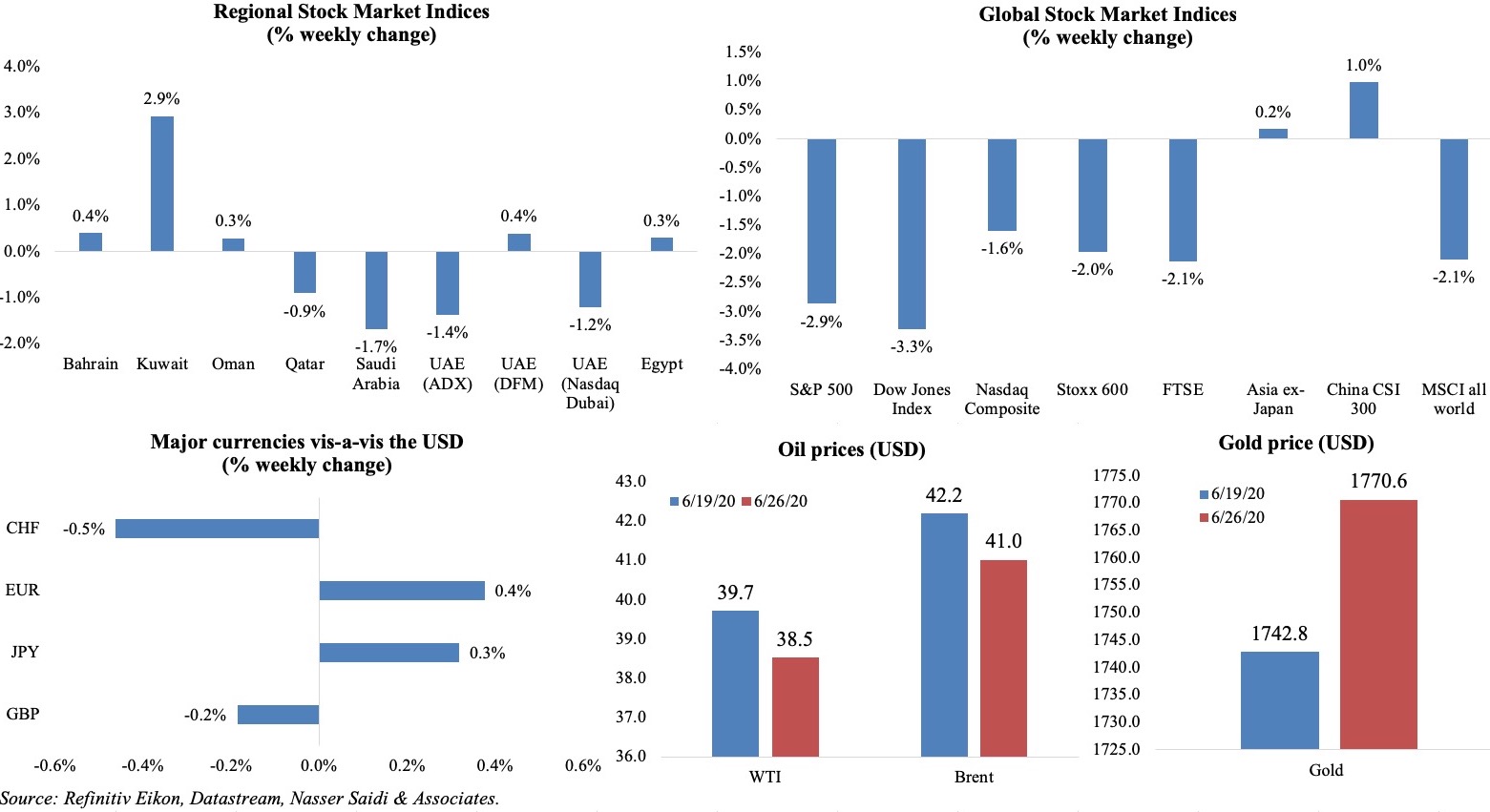

Stock markets in the US ended in the red, as daily Covid19 cases hit new highs in many states thereby raising concerns over economic recovery; European markets declined compared to a week ago, though rebounding mid-week after relatively rosy PMI numbers, while the Asian markets posted marginal increases. Regional markets were mixed, as Covid19 cases in the region continue to increase: UAE, Saudi Arabia and Qatar markets were down. The euro and yen posted a weekly gain vis-à-vis the greenback while the pound continued to be battered given the rising Covid19 cases, potential localized lockdowns and outlook. Oil prices ended the week lower while gold price climbed to multi-year highs on concerns over a second-wave. (Graphs in the last section.)

Global Developments

US/Americas:

- US GDP fell by 5% in Q1 this year, unrevised from the preliminary estimate: this is the sharpest quarterly decline since the 8.4% dip in Q4 2008. But wait for Q2.

- Personal consumption expenditures increased by 8.2% mom in May following a record drop in Apr (-12.6%), thanks to spending on vehicles, healthcare and restaurants while personal income declined by 4.2%.

- Durable goods orders accelerated by 15.8% mom in May, the most since Jul 2014 and falling a 18.1% fall in Apr, supported by a surge in transportation equipment (+80.7%). Excluding transportation, orders were up by a modest 4%. Orders for nondefense capital goods excluding aircraft rose 2.3% after dropping 6.5% in Apr.

- Rebounds in activity indices: the Chicago Fed National Activity Index increased to a record-high 2.61 in May from Apr’s record-low -17.89. Richmond Fed manufacturing index recovered to 0 in Jun from -27 in May, with manufacturers optimistic that conditions would improve in the next 6 months.

- Existing home sales fell by 9.7% mom to a seasonally adjusted annualized rate of 3.91mn units in May – the lowest level since Oct 2010. In yoy terms, sales declined by 26.6%, posting the largest annual decline since 1982.

- New home sales accelerated by 16.6% mom and nearly 13% yoy to 676k in May, supported by record-low mortgage rates while supply of previously-owned homes remains quite constrained.

- US Markit manufacturing PMI inched up to 49.6 in Jun (May: 39.8) while the composite PMI output index posted 46.8 in Jun, up from 37.0 in May.

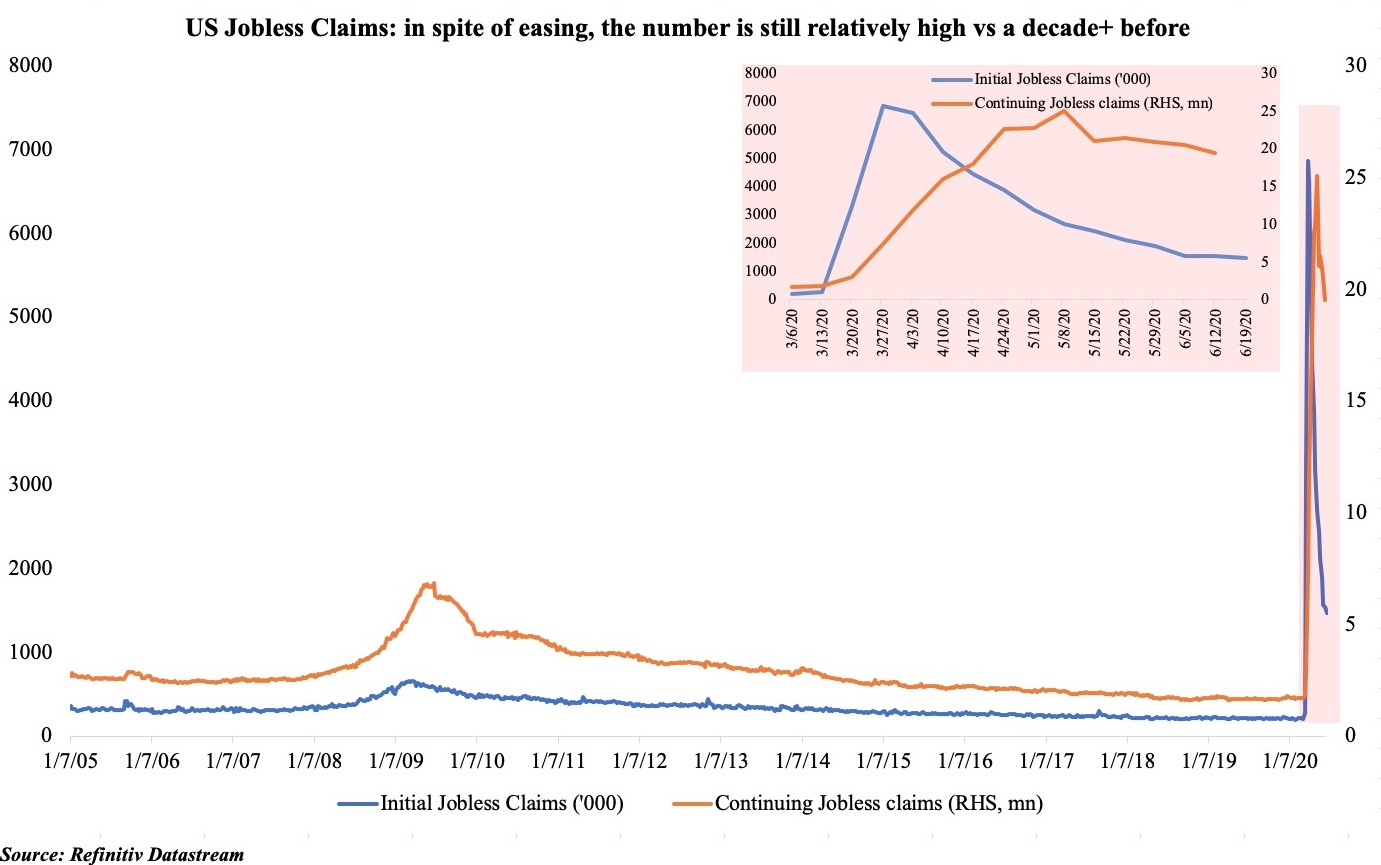

- Initial jobless claims eased to 1.48mn in the week ended Jun 20 – the 14th consecutive week that filings were above 1mn – raising the total to 47.3mn since Mar 21st. Continuing claims declined to 19.5mn in the week ended Jun 13.

Europe:

- Germany’s preliminary manufacturing PMI ticked up to a 3-month high of 44.6 in Jun (May: 36.6), with slower falls in new orders, output and employment. Services PMI activity index rose to a 4-month high of 45.8 (May: 32.6) while the composite output index touched 45.8 in Jun, from May’s 32.3.

- Preliminary manufacturing PMI for Eurozone improved to a 4-month high of 46.9 in Jun (May: 39.4), with the output sub-index rising to 48.2 (35.6). Services PMI also rose to a 4-month high of 47.3 (May: 30.5); composite PMI touch a 4- month high of 47.5 (May: 31.9) – this is the second-largest monthly rise in the survey.

- UK Composite Output index rose to 47.6 in Jun (May: 30). Manufacturing PMI increased to a 4-month high of 50.1 in Jun (May: 40.7) while the output sub-index moved back to growth (50.8) after 3 straight declines. Services PMI surged to 47 from 29 in May, with financial intermediation was the best performing area of activity in June, followed by transport & communication services. Job losses were the lowest since Mar.

- German Ifo rose to 2 in Jun, from an upwardly revised 79.7 in May, also posting the largest monthly increase in the index. After 2 months of declines, assessment of the current situation edged up to 81.3 (May: 78.9) while expectations surged to 91.4 (May: 80.5).

Asia Pacific:

- The People’s Bank of China left the benchmark lending rate unchanged at 3.85% for the second consecutive month, while the 5-year loan prime rate also stayed put at 4.65%.

- Japan’s preliminary manufacturing output index eased to 28.9 in Jun (May: 30.3), with the headline PMI down lower to 37.8 in Jun (May:38.4) – the 14th straight negative month and the lowest reading since Mar 2009. Services PMI recovered to 42.3 in Jun (May: 26.5) while the composite index was down to 37.9 (May: 27.8).

- Japan’s leading economic index edged up to 77.7 in Apr, up from the preliminary reading of 76.2, but below Mar’s 85.1. The coincident index dropped to 80.1 in Apr, the weakest score since Mar 2008. The lagging index also declined to 97.8 in Apr (Mar: 100.7).

- Japan all industry activity index dropped to -6.4% in Apr (Mar: -3.4%); the previous low was -6.3% in Mar 2011.

- Tokyo inflation eased to 0.3% yoy in Jun (May: 0.4%) while core CPI (excluding food and energy) was 0.4% yoy, down from 0.5% the month before.

- Singapore inflation fell by 0.8% yoy in May (Apr: -0.7%), as private transport costs plunged (-6.8%) as did retail costs (-2.3%). Core inflation dropped for the 4th straight month, falling by 0.2% yoy (Apr: -0.3%).

- Industrial production in Singapore fell by 7.4% yoy in May, in line with a 4.5% decline in non-oil domestic exports reported earlier. Excluding biomedical manufacturing (which grew by 5.9%), industrial output declined by 10.4% yoy.

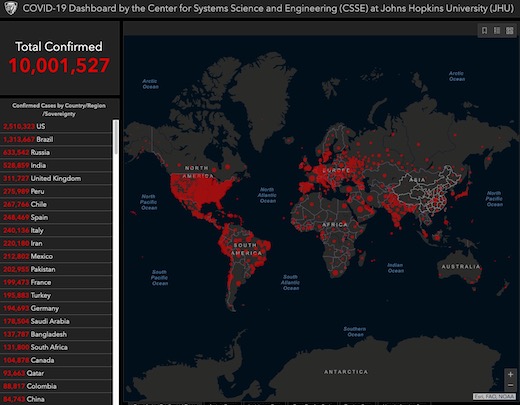

Bottom line: As we inch closer to end of H1, global asset market have held up surprisingly well during the Covid19 outbreak period (https://tmsnrt.rs/2YEBCcV), on hopes of monetary and fiscal stimulus and unprecedented support from central banks and governments, much in contrast with the state of the global economy (reeling under Covid19, which crossed the 10mn cases mark). The IMF released last week a sombre outlook for the global economy, as many economies try to kickstart their economies after months of lockdown. Global growth is forecast to decline by 4.9% this year – with advanced nations plummeting by a whopping 8% vs emerging markets shrinking by 3.0% – before rebounding to 5.4% next year. There have been reports of new Covid19 clusters in economies that have reopened; in the US, as 5 states hit daily highs for Covid19 cases, reopening measures are being rolled back. Europe has been opening up with a drive to push tourism, though the new normal includes social distancing measures and revised strategies to mitigate the risks of the ongoing outbreak (e.g. tourists can only take the stairs to reach the top of the Eiffel Tower). The path to recovery is not smooth either: Italy, which has been open for tourists since Jun3rd, is yet to see tourists flock to its many cities.

Regional Developments

- The IMF expects growth in the Middle East and Central Asia to decline by 4.7% in 2020, in its latest World Economic Outlook report, before rising to 3.3% next year. It slashed Saudi Arabia’s growth: after shrinking by 6.8% this year, growth will rebound to 3.1% in 2021.

- Bahrain-origin exports declined by 16% yoy to BHD 176mn (USD 464mn) in May 2020. Saudi Arabia (BHD 34mn), Netherlands (BHD 18mn) and the UAE (BHD 14mn) were the top destinations for Bahraini exports. Value of imports declined by 10% during the month, widening the trade deficit by 13% to BHD 162mn.

- With government’s support to pay citizens wages in the private sector ending this month in Bahrain, MPs are in talks to either extend the support or introduce a new stimulus package.

- According to UNCTAD data, Bahrain attracted USD 942mn of FDI in 2019 (2.45% of GDP), recording the 3rd consecutive year of inflows around USD 1bn.

- The IMF Board approved a USD 5.2bn 12-month Stand-By Arrangement to support health and social spending in Egypt while dealing with Covid19 and to “advance a set of key structural reforms”.

- Egypt is slowly easing its restrictions: the night-time curfew, in place since Mar 25, has been lifted from Jun 27; restaurants, cafes and places of worship have been partially reopened. EgyptAir will resume flights (at 20-30% capacity) to 24 international destinations from the first week of Jul. All cultural and artistic activities – including museums and theatres – will resume from mid-Jul.

- Egypt’s central bank kept its interest rates on hold: the overnight lending rate was left at 10.25% and the overnight deposit rate at 9.25%, the lowest rates since early 2016.

- Egypt will support SMEs as part of the USD 6.2bn financing initiative created to support the industrial, agricultural and construction sectors, reported Al-Ahram.

- Egypt will implement the new income tax law from the beginning of next Jul: the basic income tax exemption limit has been raised by 60% to EGP 15k while the personal income tax exemption limit was increased to EGP 9k from EGP 7k.

- Egypt’s economic committee approved the proposed amendments to VAT law – which include exempting exported goods and services from projects in free zones as well as special and economic zones from VAT. The bill is still subject to the cabinet’s final approval.

- Daily oil output in Egypt fell in Mar-Apr to its lowest level since Jul 2009: oil production declined to 589,950 barrels per day in Apr from Mar’s 594,620 bpd from close to 612,300 bpd in Jan-Feb. Overall, during Jan-Apr, oil production was down by 2.5% compared to Dec 2019.

- Iraq’s total oil exports averaged 3.21mn barrels per day (bpd) in May, with oil revenue dropping to USD 2.41bn (in Mar, it had already declined to USD 2.98bn).

- Jordan’s public debt increased to JOD 31.394bn (USD 44.2bn or 101.7% of estimated GDP) by end-Apr 2020 versus JOD 30.076bn (96.7% of GDP) at end-2019.

- Domestic revenues in Jordan declined by JOD 569mn (USD 802.5mn) in Jan-Apr 2020, while total spending fell by JOD 157mn to JOD 2.7bn, widening the deficit to JOD 695mn (Jan-Apr 2019: JOD 304mn). Given the decline in revenues, a decision was taken to defer a salary hike for public sector employees to next year.

- Jordan’s tourism revenues plummeted by 36.6% yoy to JOD 784mn during Jan-Apr. The central bank’s data also showed a 5.9% yoy decline in remittances to JOD 800mn in Jan-Apr.

- Kuwait will ease its curfew from Jun 30th to between 8pm to 5am, and work can be resumed at less than 30% capacity. Reopening is on the cards for shopping malls, financial and construction sector, as well as retail shops and parks. This 2nd phase will run for 3 weeks.

- The total assets of banks operating in Kuwait declined in Apr – for the first time since Oct 2019: assets were down by 0.48% mom to KWD 72.44bn (USD 235.76bn) in Apr. Foreign reserves were down by 1.5% mom to KWS 17.03bn.

- Kuwait’s central bank disclosed that local banks had provided KWD 2.7bn (USD 8.9bn) worth of credit facilities to businesses under the economic stimulus package.

- Reuters reported, citing a government official, that Kuwait is considering that the annual transfer of 10% of state revenues to the Future Generations Fund be conditional on achieving a budget surplus.

- Kuwait’s stock exchange will resume some suspended operations (e.g. transfer of private properties) starting Jun 28th, with the system of unlisted securities (OTC) to be reactivated as of Jul 9th.

- MSCI will reclassify Kuwait to Emerging Market in Nov 2020, from its frontier market status, reconfirmed Kuwait’s Capital Market Authority.

- IMF officials continue to work with Lebanon, but more unity is needed among leaders, stakeholders and society to proceed with reforms to stabilize the country, according to the Fund’s MD.

- Exchange rate crisis is touching new levels in Lebanon: the exchange rate on the black market has reached LBP 7000 to one dollar (vs the official rate of LBP 1515 to USD 1). In the absence of a clear policy path ahead, there is no bottom to the value of the Lebanese pound.

- Oman posted a fiscal surplus of OMR 134.2mn (USD 349.48mn) in Jan-Apr 2020, as spending by defence and security establishments was reduced by over 17% yoy while investment expenditure fell 24.5%. An average crude sale price of USD 63.36 and partial privatization of the Oman Power Transmission Company helped Oman’s government revenues touch OMR 3.82bn at end-Apr, less by just OMR 47mn from a year ago.

- Total deposits in Oman’s banking sector grew by 3.6% yoy to OMR 23.9bn (USD 60bn) at end-Apr.

- Oman’s ruler ordered rolling out interest-free emergency loans to support entrepreneurs negatively affected by the Covid19 outbreak.

- Expat population in Oman has declined by nearly 40k from Mar 2020 to 1,622,241 in May.

- Government subsidy to Oman’s electricity sector increased by 10.9% yoy to reach a record OMR 624.69mn (approximately USD 1.6bn) in 2019.

- Inflation in Saudi Arabia rose by 1.1% yoy in May, as hikes in food prices (+7.4%) were offset by declines in transport (-3.8%) and housing costs. Wholesale price index (WPI) in Saudi Arabia fell by 2.1% in May (Apr: 0.6%) – posting the first drop since Feb 2019 – thanks to a plunge in the prices of refined petroleum products (-20.9%).

- Saudi Arabia’s oil exports dropped by 65.4% yoy in Apr, after recording a 21.9% yoy decline to USD 40bn in Q1. Total exports – including non-oil exports of goods such as chemicals and plastics – decreased by 23.5% yoy or about USD 3bn in Apr.

- China’s oil imports from Saudi Arabia surged by 95% yoy and 71% mom to an all-time high of 9.165mn tonnes or 2.16mn barrels per day in May.

- Saudi Arabia’s finance ministry disclosed that it receives about 95k requests worth a total value of SAR 47bn for financial support from the private sector; average daily requests touched SAR 522mn (USD 139.2mn).

- Saudi Arabia will limit the number of domestic pilgrims attending the Haj to around 1k to prevent the spread of Covid19. The week-long Haj usually attracts close to 2.5mn pilgrims to the holy site, enabling the country to earn close to USD 12bn from both Haj and Umrah.

- Saudi banks NCB and Samba have signed an initial agreement to create a combined entity with almost USD 214bn in assets. If completed, the merger would create the region’s 3rd largest lender by assets, after Qatar National Bank and UAE’s First Abu Dhabi Bank.

- The value of contracts awarded in Saudi Arabia touched SAR 45.2bn (USD 12bn) in Q1 2020, with military sector accounting for 33% of total contracts. The value of contracts were up 28% qoq but down 9% yoy, according to a report by the US-Saudi Business Council.

- Saudi Arabia created a SAR 15bn (USD 4bn) Tourism Development Fund to support the development of tourism industry.

- Saudi mortgage lender Amlak is selling its shares for between SAR 15-17: the book-building process for the IPO began on Jun 22nd and will close on Jun 29th.

- Saudi Arabia reiterated that the suspension of international flights and entry and exit by land and sea via all ports and crossing points will continue until further notice.

UAE Focus

- UAE’s federal and local authorities have rolled out more than 227 economic and commercial incentives to support the economy during the Covid19 outbreak and its impact, according to the Federal Competitiveness and Statistics Authority.

- Bank deposits in the UAE edged up by 2.1% to AED 1.865trn during the period Mar-May from AED 1.828trn in Feb.

- ADNOC signed a USD 20.7bn deal with an international consortium to invest in the former’s natural gas pipelines infrastructure. This is the biggest single infrastructure deal globally this year and will see UAE attract over USD 10bn in FDI. The part-privatisation signals openness to PPP & greater private sector involvement in energy development.

- Dubai ranked 2nd globally in greenfield FDI capital flows and 3rd globally in terms of number of FDI projects during Jan-May 2020 – 155 newly announced FDI projects with AED 10bn+ of expected capital – disclosed the CEO of Dubai Investment Development Agency.

- UAE ranks 19th in the 2020 Kearney FDI Confidence Index, up from 21st place in the 2017 edition.

- Moody’s changed its outlook to negative from stable for eight UAE banks citing a potential “weakening in their standalone credit profiles” given the impact from Covid19, low oil prices and economic challenges.

- Shopping malls and commercial establishments in Dubai have been permitted to operate regular working hours, after all movement restrictions were lifted.

- Real estate transactions in Dubai slowed in Apr, but is picking up in Jun: the Dubai Land Department disclosed that real estate transactions worth AED 5.2bn were closed during Jun 1-19, compared to AED 2.8bn during the same period in Apr.

- Dubai will open to tourists from Jul 7th: tourists need to either present a negative Covid19 certificate or take the test at the Dubai airport. Citizens and residents have been permitted to travel from Jun 23rd to selected destinations.

- UAE’s trade in food commodities and products touched AED 31.7bn in Q1 this year, of which imports totaled AED 17.98bn.

- Dubai’s manufacturing index declined by 1.73% qoq and 2.66% yoy in Q1 this year, due to a decline in prices of several products including refined petroleum and pharma products.

- After finding that it takes an average of 63 days to open a bank account in the UAE and that 30% of startups fail to open a bank account domestically, Hub71 is working with Mashreq Bank and First Abu Dhabi to identify and solve the major challenges faced by startups, including the KYC and documentation processes.

- District 2020’s global entrepreneur programme Scale2Dubai will support UAE’s start-ups and SMEs, given its collaboration with Dubai SME and Mohammed bin Rashid Innovation Fund. Successful applicants will benefit from two years’ free working space in District 2020, support in visa and business set-up, as well as two years’ subsidised urban living and access to funding among others. District 2020 will evolve over 9 months after the Expo ends, repurposing more than 80% of the Expo’s built environment.

Weekly Insights: Charts of the Week

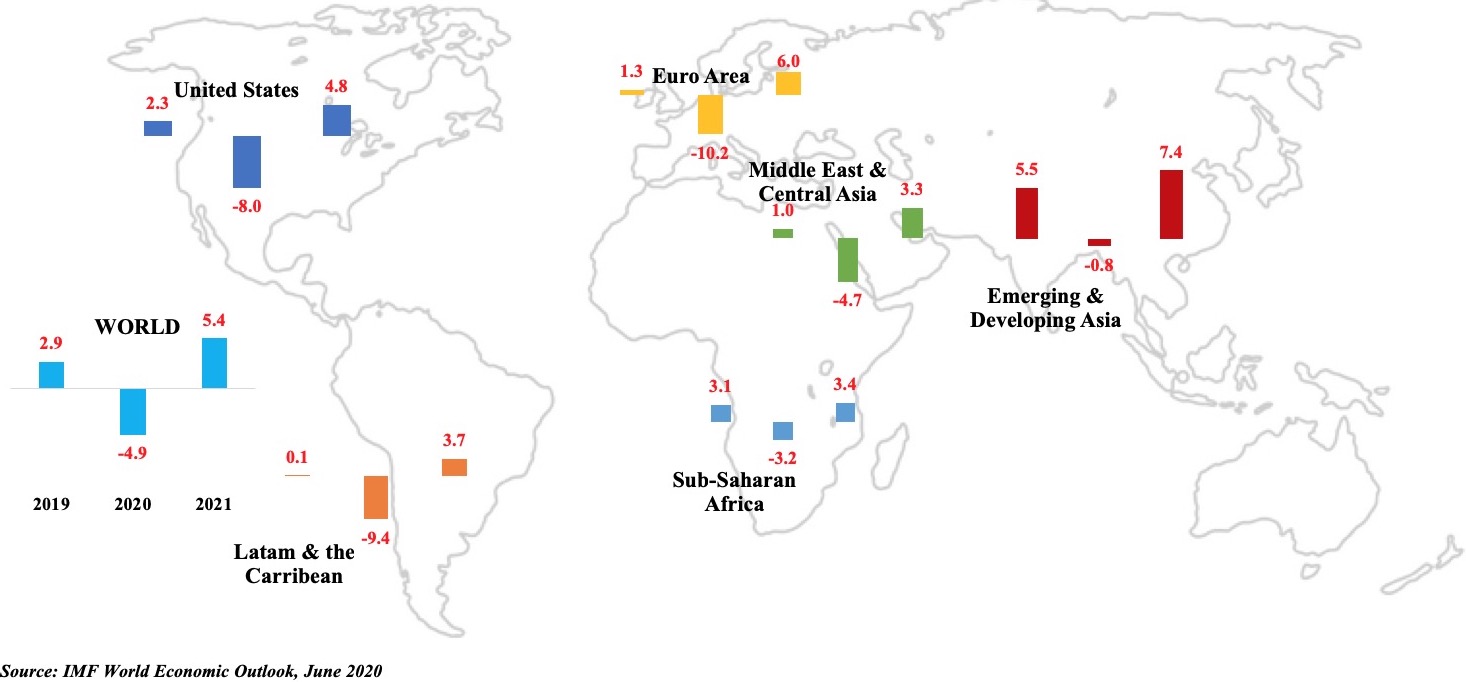

Fig 1. Global Economic Growth to decline by 4.9% this year, before rebounding to 5.4% in 2021

The downgrades to growth forecasts have a been a result of the extended lockdowns across the globe: the cumulative output loss facing the global economy during the 2020-21 period is around USD 12.5 trillion. With 75% of nations globally easing restrictions, there have been month-on-month rises in consumer spending (retail sales) and a partial recovery in PMI (and firms’ relative optimism on economic recovery). However, the potential risk of a second-wave could see reintroduction of lockdowns (as seen in some US states) which could dampen economic recovery further. The IMF forecasts seem relatively optimistic, with all regional aggregates indicating a V-shaped recovery. It is more likely that the recovery will take longer, either like the Nike swoosh or Arabic “Ba”.

For the Middle East (which is facing lower oil prices, world recession as well the Covid19 impact), growth is expected to recover a tad slower compared to the rest, rising to only 3.3% from a 4.7% dip this year. As countries in the Middle East emerge from three-months of Covid-19 containment, policy makers need to plan for a transformed post-pandemic world and create a new development model (More: https://www.thenational.ae/business/comment/how-gcc-countries-can-adapt-policies-for-a-post-covid-19-world-1.1036395).

Fig 2. US jobless claims ease, but potential reinstatement of lockdowns could risk further job losses

US jobless claims have been easing from the peak of 6.87mn touched in the week ended 27th Mar: this is the 14th consecutive week of claims above the 1mn mark. Continuing claims have edged down to 19.5mn, but still equivalent to 13.4% of the workforce. The points to remember however are that (a) almost all jobs created in the past decade have been wiped out; (b) the rate of job creation will be slow as states emerge from lockdowns; (c) rising Covid19 cases in many states could see a reinstatement of lockdowns which could risk further job losses.

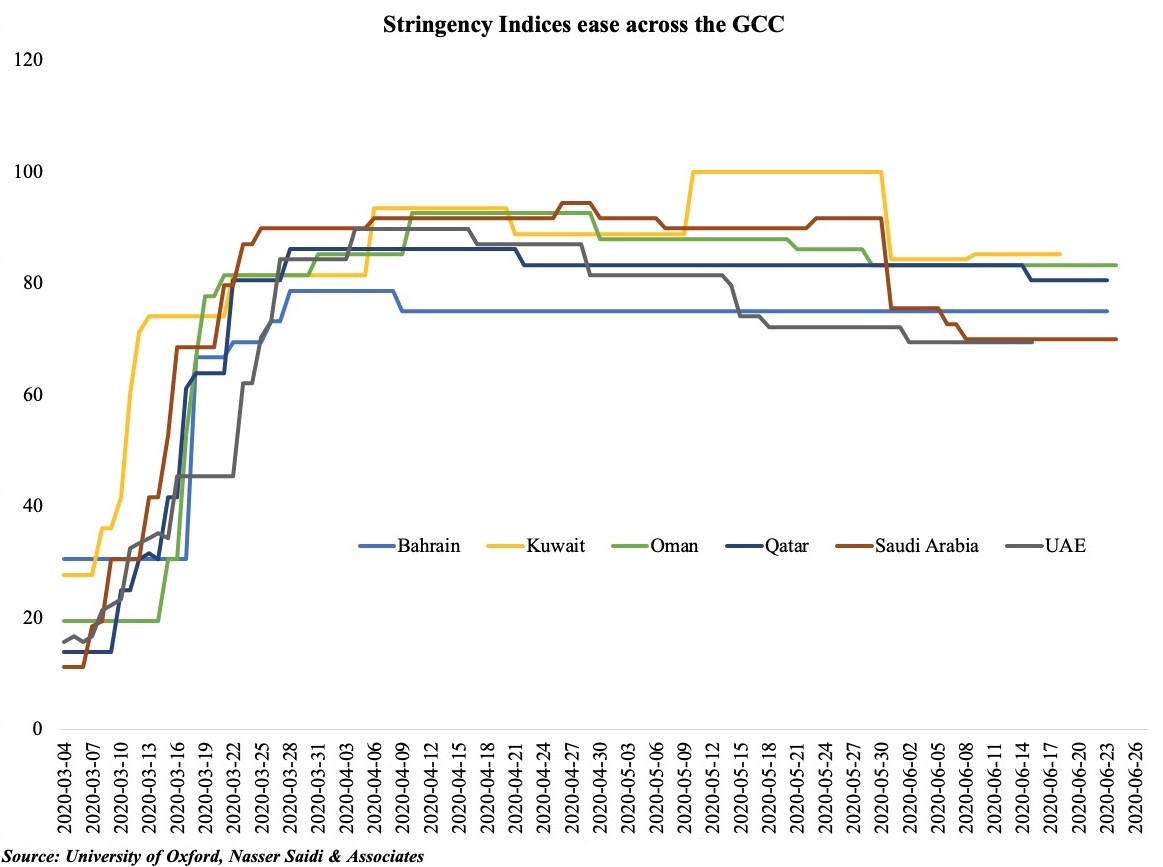

Fig 3. Government Response Stringency Indices

The University of Oxford’s Stringency Index tracks nine separate metrics including school closures, cancellation of public events, restrictions on public gatherings and the like to record how strict government policies are. A higher score implies strict government response (as the chart is close to 100 in Kuwait during the full lockdown period till a few weeks ago); however, the index does not track the effectiveness. Kuwait is relatively more stringent than the rest of the GCC nations, followed closely by Oman. Though the unwinding is happening in phases, capacity restrictions are still in place in most GCC nations. Social distancing measures, masks and gloves have become ubiquitous in this new normal.

This index, along with the previous charted Google Mobility reports, provide a good understanding of people’s movements across the nations, which can be read as a proxy for consumer spending (e.g. visits to malls, recreation) and potential well-being (e.g. visits to parks, beaches). These high-frequency indicators point towards an uptick in economic activity in the coming quarter.

Dubai has already announced that it is open for visitors from Jul 1 – what remains to be seen is how visitor numbers measure up vs pre-Covid19. Saudi Arabia, UK, Russia, Oman and China followed India as the top source markets as of Feb 2020 and many of these nations are still grappling with their Covid19 outbreaks. Two, the reduced number of flights and seating capacity will also restrict visitor movement.

Media Review

IMF projects an “uncertain recovery” & insolvencies loom large

https://www.imf.org/en/Publications/WEO/Issues/2020/06/24/WEOUpdateJune2020

https://blogs.imf.org/2020/06/24/reopening-from-the-great-lockdown-uneven-and-uncertain-recovery/

https://blogs.imf.org/2020/06/25/financial-conditions-have-eased-but-insolvencies-loom-large/

Technology is splitting the job market

https://review.chicagobooth.edu/economics/2019/article/technology-splitting-job-market

How GCC countries can adapt policies for a post Covid-19 world

https://www.thenational.ae/business/comment/how-gcc-countries-can-adapt-policies-for-a-post-covid-19-world-1.1036395

The Pandemic must transform global agriculture

https://www.project-syndicate.org/commentary/covid19-pandemic-must-transform-global-agriculture-by-mauricio-cardenas-and-juan-lucas-restrepo-2020-06

Market Snapshot as of 28th June 2020

Weekly % changes for last week (25-26 Jun) from 18th Jun (regional) and 19th Jun (international).

Powered by: