Dr. Nasser Saidi’s comments on Lebanon’s foreign currency reserves appeared in the article titled “Lebanon set to default for first time as foreign currency reserves dive” published in the FT on 8th March 2020.

The full article can be accessed at: https://www.ft.com/content/bda10536-6145-11ea-a6cd-df28cc3c6a68

Comments are posted below:

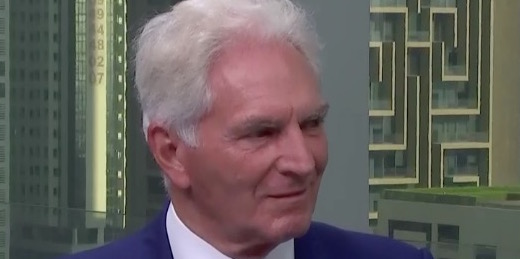

Nasser Saidi, a former central bank vice-governor, estimated that usable reserves had fallen to “about $3bn to $4bn”. He said this was because the gross reserves included $18bn to $19bn set against deposits for commercial banks that the BdL could not spend because of reserve requirements. In addition, the BdL has lent local institutions about $6bn to $7bn to help them cover their commitments to correspondent banks, Mr Saidi said.

“It is now urgent that the government opens up negotiations with the IMF,” Mr Saidi said, “because you’re going to need help with balance of payments, even to fund your imports”.

Comments on Lebanon's foreign currency reserves in FT, 8 Mar 2020

9 March, 2020

read < 1 minute

Read Next

media page

“Digital remittances will unlock financial inclusion in the Middle East”, Oped in The National, 21 Jan 2026

The article titled “Digital remittances will unlock financial inclusion in the Middle East” appeared in

22 January, 2026

media page

Comments on UAE’s Sheikh Mohammed bin Zayed’s visit to India in 24.ae, 19 Jan 2026

Dr. Nasser Saidi’s comments on the UAE’s President Sheikh Mohammed bin Zayed’s visit to India

20 January, 2026

TV and radio

Interview with Al Arabiya on macroeconomic outlook & financial markets, 15 Jan 2026

In this TV interview with Al Arabiya aired on 15th January 2026, Dr. Nasser

16 January, 2026