The Executive Summary of the White Paper titled “Taxation, Illicit Trade in Tobacco Products and Finance of Terrorism in the Middle East” is posted below. Click to download the English and Arabic versions.

The sharp decline in oil prices alongside an appreciating US dollar has resulted in a “double whammy” for oil-exporting nations, including the GCC. Given their high dependence on oil exports for government revenue, countries face massive losses. To address the volatility and vulnerability of oil revenue and address fiscal sustainability the GCC countries will need to prioritize fiscal reform and put in place policies to diversify the sources of government revenue, as well as revise expenditure plans. This could happen through a reduction in fossil subsidies alongside the introduction of taxes. Current discussions focus on the introduction of value added taxes and increasing trade tariffs and taxes on consumption of tobacco and alcohol among others.

This White Paper addresses two important issues relevant to imposing and increasing excise taxes on tobacco: (a) the need to avoid sudden, large tax hikes that would lead to an increase in illicit trade and (b) as a result provide financing to organised crime groups (OCGs) and terrorist organisations operating in or out of the Middle East region. The vastness of the illicit trade network is evident in the fact that trade in illicit (and untaxed) tobacco recently became the fourth-largest global tobacco business by volume, just behind British American Tobacco, Philip Morris International and Japan Tobacco International.

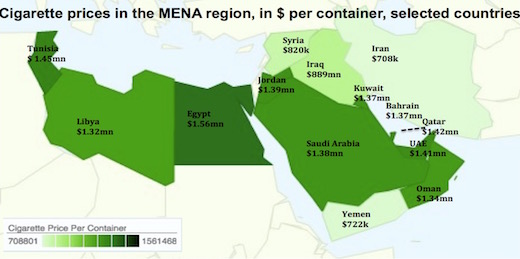

The GCC countries currently have relatively low illicit penetration rates, but are wedged between the tobacco industry’s established smuggling centres. Tariff and tax induced price differentials along with the lack of secure borders within the Middle East are a major driver of illicit trade. We find that an increase in ad-valorem taxes could lead to a massive spread (of more than USD 1 million per container) in cigarette prices between the lowest and highest markets across the region: a definite incentive for a surge in illicit trade.

This policy paper puts forward a GCC action plan to impede illicit trade growth. This multi-pronged approach includes both legal and regulatory measures, alongside tax and capacity building. These include: (i) Support the GCC countries to become members of the Protocol to Eliminate Illicit Trade in Tobacco Products (ITP) (ii) Assist the GCC in developing common standards to comply with the ITP through a track and trace solution (iii) GCC policy harmonisation and coordination to introduce domestic excise taxes (iv) Gradual implementation of excise tax introduction and tax increases (v) Invest in the build-up of taxation capacity and administration (vi) Use modern technologies for tax administration including digital fiscal markers (vii) Develop Public-Private-Partnerships to ensure compliance