Dr. Nasser Saidi’s interview “Ahead of The Curve” with The Buzz Business on CEBC’s pioneering role in MENA’s clean energy transition, Nov 2024

Ahead of the Curve

CEBC’s pioneering role in MENA’s clean energy transition

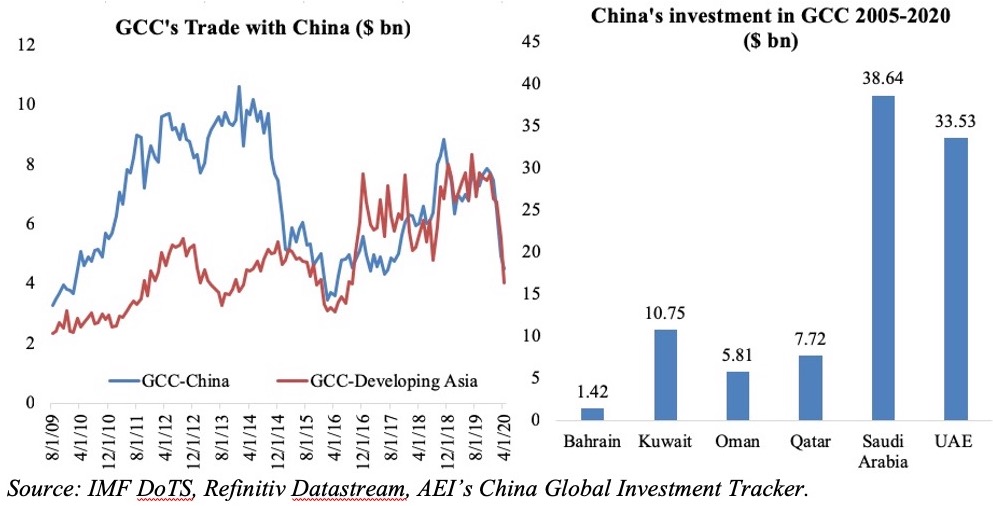

As climate change increasingly impacts economies and lives across the globe, the Middle East and North Africa (MENA) region finds itself at a crossroads. Here, in a land rich with fossil fuels but increasingly exposed to climate challenges, the need for a shift towards clean energy and sustainable practices is critical. Leading this charge is Dr. Nasser H. Saidi, founder and chair of the Clean Energy Business Council (CEBC), an organization fostering collaboration between the public and private sectors to catalyze the region’s transition to a cleaner future.

Dr. Nasser’s journey to the helm of CEBC has been as varied as it is impressive. With a career that spans academia, government, central banking, and senior positions in finance, he is no stranger to the complexities of building something from scratch. “I’ve always valued freedom and the ability to think independently,” he says, reflecting on his time contributing to establishing the Dubai International Financial Center, which started with just a few companies and grew into a global hub. This drive to create and innovate independently has become the backbone of his leadership at CEBC—a vision not only for clean energy but also for MENA’s potential to become a global leader in climate solutions.

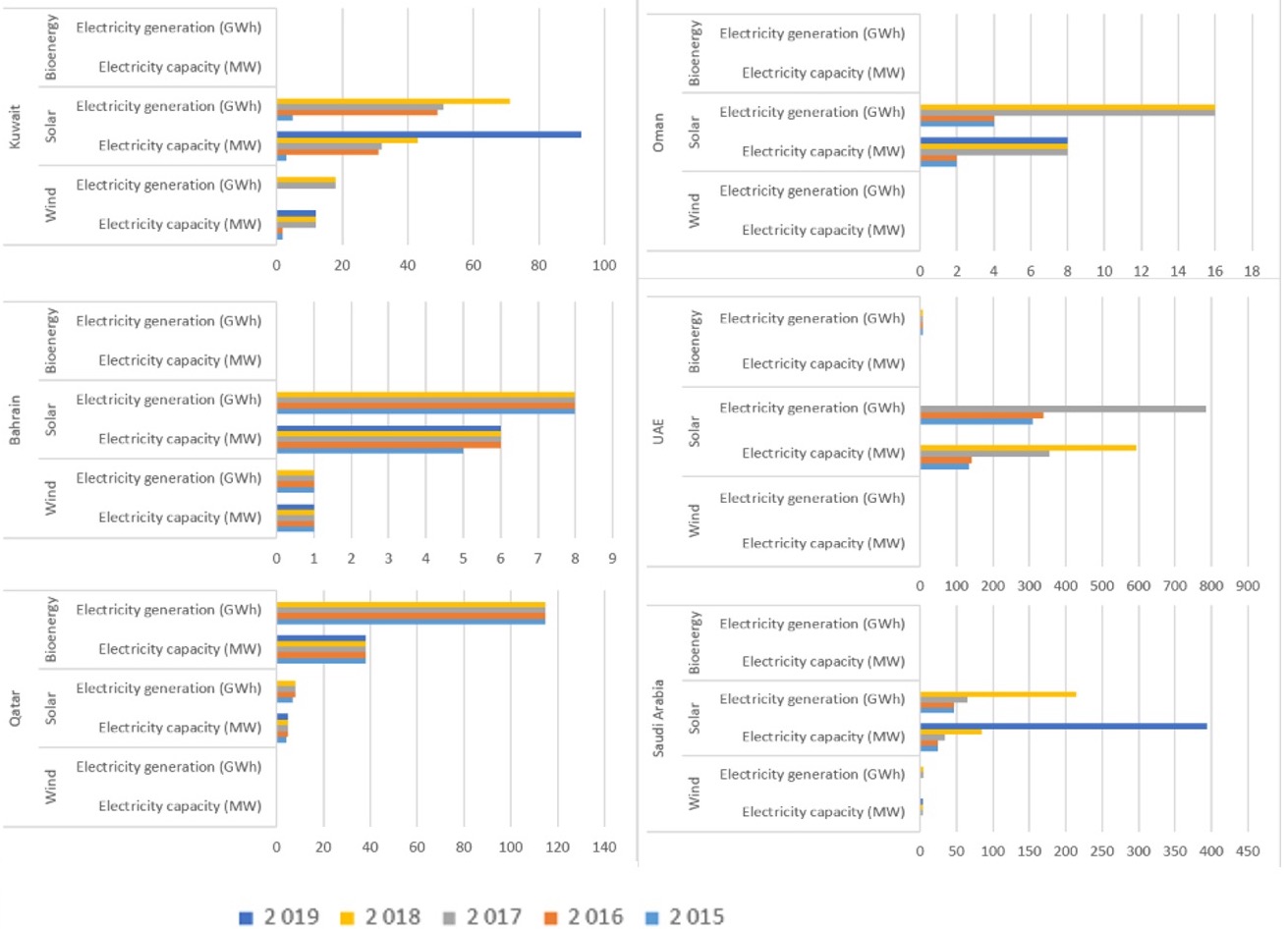

CEBC was born from an urgent need for more than dialogue; it was a call to action for the region’s leaders to reimagine MENA’s place in the global energy landscape. Dr. Nasser understood that while the region has long been defined by its fossil fuel wealth, it also possesses vast untapped potential for renewable energy, particularly solar. “This part of the world is blessed with some of the highest solar irradiation on Earth,” he explains. “With partners like ACWA Power, ENOC, ENGIE, and ABB at the forefront, we’re already seeing impressive advancements in solar capacity and innovative projects that could one day redefine energy systems globally.”

CEBC’s initiatives are built to tackle a diverse range of challenges, from energy efficiency to hydrogen innovation, e-mobility, and climate finance. Yet, Dr. Nasser emphasizes that the real breakthrough lies in fostering strong, lasting partnerships with both public and private sectors. This commitment to collaboration is evident in CEBC’s Annual Summit, now in its 12th year, which brings together policymakers, industry leaders, and technology innovators to align on regional sustainability goals. This year’s summit, themed “Strategic Levers for Decarbonizing MENA,” will be held at Expo City Dubai, reflecting the growing regional commitment to decarbonization and sustainability. “By bringing government and regulatory bodies to the table, we’re creating the conditions for action,” Dr. Nasser says. “CEBC is not just an organization; it’s a platform for real change in MENA’s energy future.”

The MENA region, he points out, is uniquely positioned in the global fight against climate change, with opportunities that extend beyond renewable energy into areas such as water desalination, desert agriculture, and district cooling. These technologies are critical in a region where temperatures are rising, and water scarcity is a daily reality. “Cooling alone accounts for up to 70% of peak energy demand in the Gulf,” Dr. Nasser notes. “We’ve pioneered district cooling systems that are not only more energy-efficient but can be powered by renewable sources. This technology could become a model for the world.”

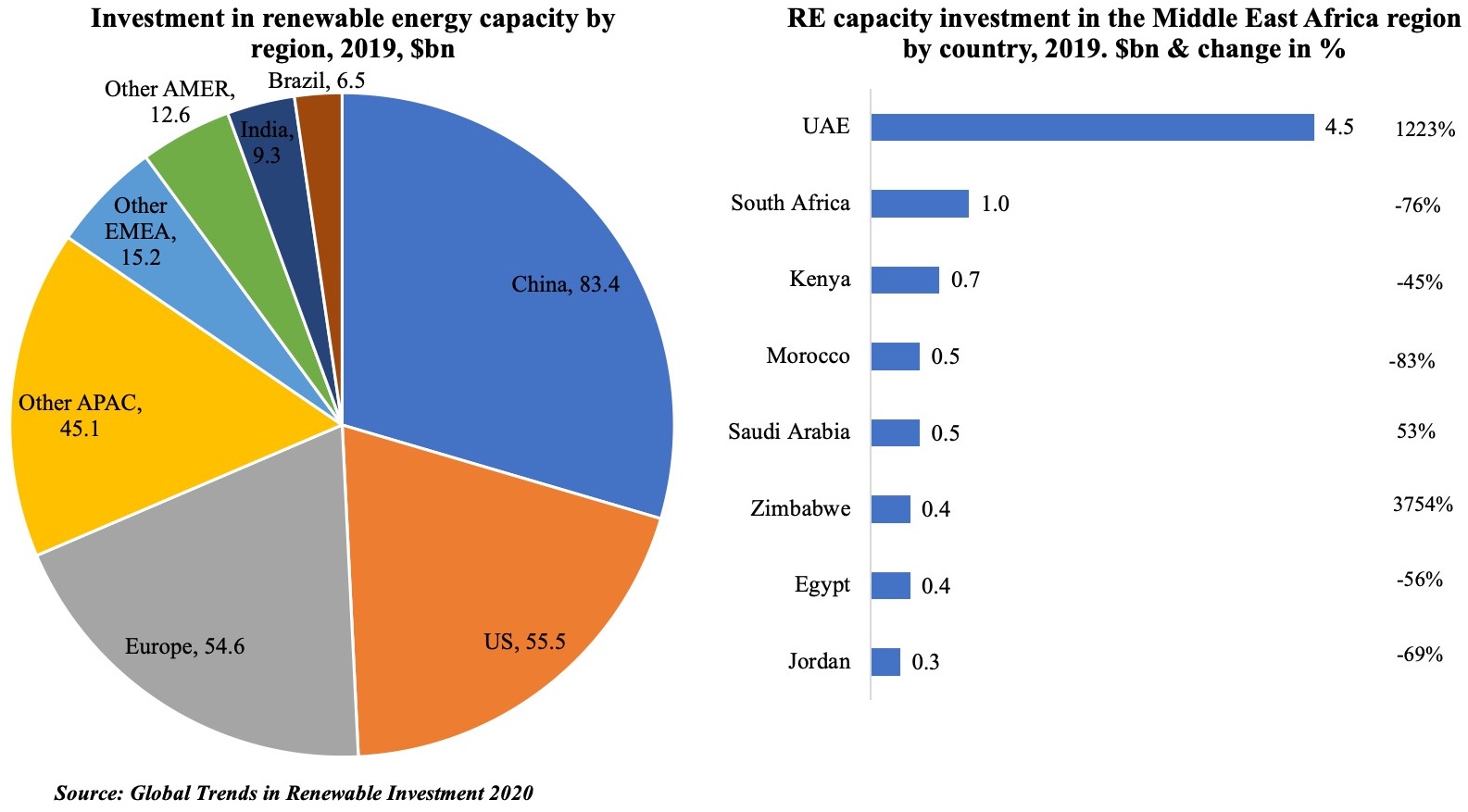

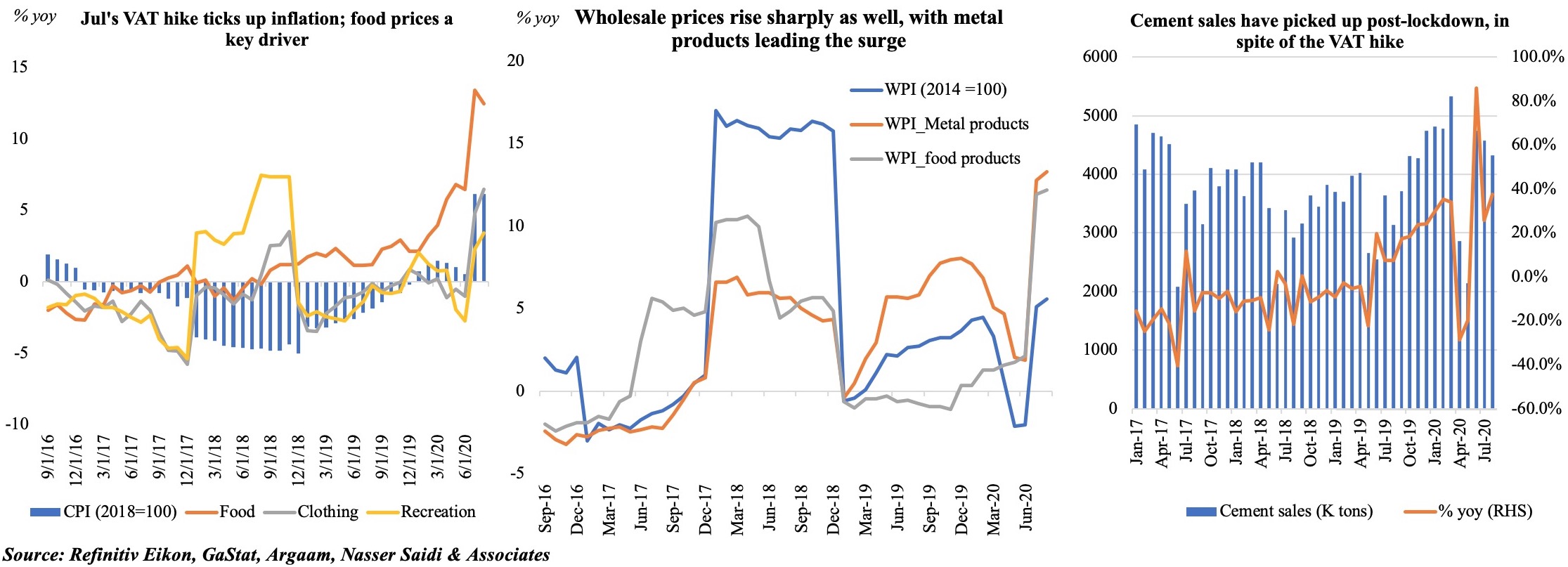

As climate disasters continue to reshape economies, MENA countries face both an urgent challenge and a significant opportunity. CEBC is working to help the region balance its reliance on traditional fossil fuels with the need for renewable energy development. According to Dr. Nasser, this transformation will require considerable investment and policy reforms, especially in terms of reducing fossil fuel subsidies and attracting private financing to fill funding gaps. The International Monetary Fund estimates that MENA will need to invest up to 4% of GDP annually to build climate resilience and meet emissions targets—a staggering number, but one Dr. Nasser sees as achievable with the right public-private partnerships. “For every dollar invested in climate adaptation, we see a return of ten in economic benefits,” he says, highlighting how companies across the region can drive these returns by investing in clean energy solutions.

The private sector, he believes, will play a pivotal role, especially with national initiatives like Saudi Arabia’s Vision 2030 laying the groundwork. “The goals set forth in Vision 2030 offer a roadmap for the private sector to contribute to decarbonization through investments in clean energy technologies and sustainable practices. Companies like ACWA Power, ABB, Totalenergies, BEEAH, and other CEBC partners are proving what’s possible with large-scale solar and wind projects that have the power to reshape our entire region.” CEBC, he adds, has been instrumental in creating platforms for private sector leaders to engage directly with policymakers, facilitating cross-border clean energy projects that address regional needs while also setting an example for the world.

Looking to the future, Dr. Nasser sees energy efficiency as a vital component in achieving MENA’s net-zero ambitions, especially in high-energy sectors like construction, transport, and infrastructure. CEBC has recently partnered with the Advancing Net Zero Volunteering Team to launch a white paper focused on retrofitting existing buildings—a crucial step in reducing energy consumption across the region. He believes this focus on efficiency, combined with technological advances like AI-driven energy management and smart grids, will be key to MENA’s sustainable development. But Dr. Nasser stresses that the most critical driver will be awareness, both public and governmental. “We’re at a tipping point where climate adaptation isn’t a choice; it’s a necessity,” he says, echoing the urgent tone that has defined his work and vision.

What are CEBC’s key achievements to date?

“I’d say the most critical achievement is public awareness. Climate and clean energy are now part of our regional discussions, which is something we couldn’t have imagined a decade ago. Today, we have ministers in charge of climate portfolios, notably in the UAE, and I hope other countries follow. Our partnerships are creating regulatory frameworks that involve both government and the private sector in the transition to clean energy.”

How optimistic are you about the region’s clean energy transition?

“I am cautiously optimistic. The region’s leadership has a clear vision of what’s needed, and we’re seeing an unprecedented level of commitment to clean energy and climate adaptation. Yet, challenges remain—subsidies for fossil fuels need to be removed, and people’s perceptions around the ‘cost’ of energy must shift. Still, I am inspired by the strides we’ve made and confident that with ongoing collaboration, we can achieve real, lasting change.”

What advice would you give to companies in the private sector?

“Start with energy efficiency—look at your own operations, from building temperatures to energy sources, and be ready to invest in clean technologies. Long-term success will depend on this. I also advise companies to get involved with CEBC or similar platforms to stay aligned with national goals and regulatory developments. The future will belong to companies who adapt early and invest in sustainable practices.”

Looking ahead, Dr. Nasser’s vision for CEBC reflects both urgency and optimism. As the region grapples with the realities of climate change, CEBC stands as a catalyst, turning MENA’s unique challenges into opportunities. With the right partnerships and a clear focus, CEBC is not just imagining a cleaner future—it’s building one.

“CEBC isn’t just an organization; it’s a platform for real change in MENA’s energy future.”

Dr. Nasser H. Saidi, founder & chair, Clean Energy Business Council (CEBC)