Weekly Insights 21 Oct 2022: Strategies to Support Post-Covid Growth, but will Rising Costs Play Havoc?

1. Saudi Arabia announces a National Industrial Strategy, to support Vision 2030 objectives

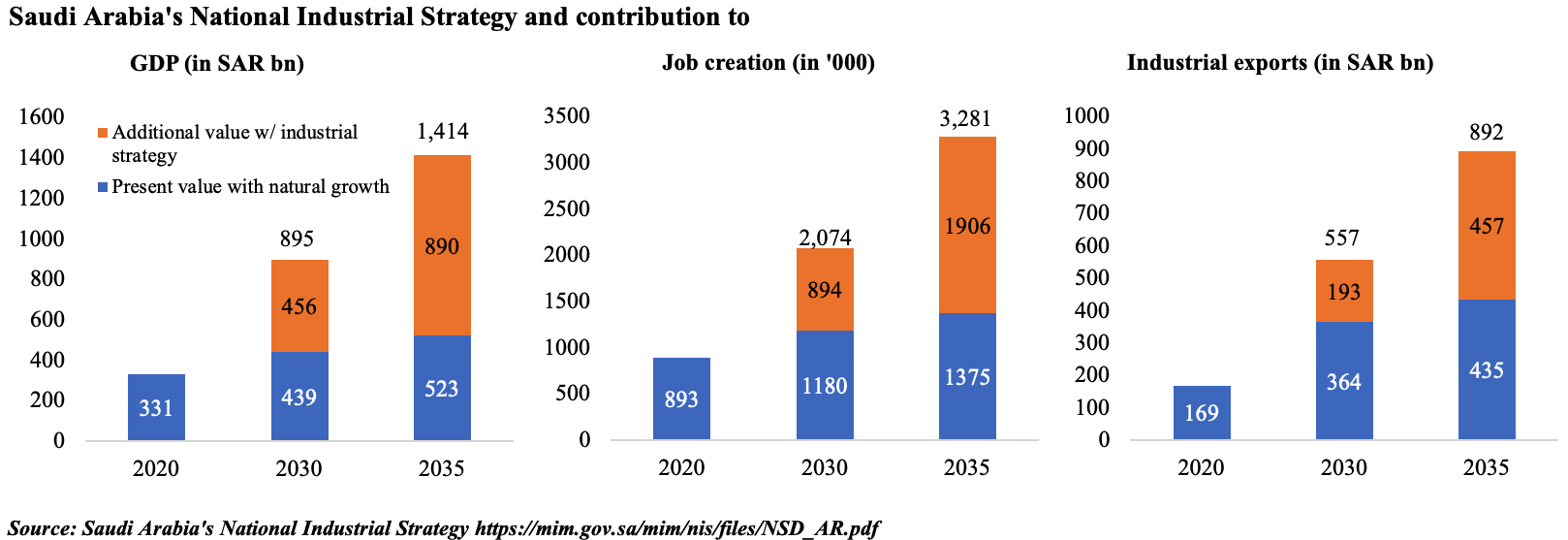

- Saudi Arabia’s National Industrial Strategy, with more than 136 initiatives, boasts ambitious targets to meet the Vision 2030 objectives of diversification and developing non-oil exports.

- The strategy expects to almost quadruple manufacturing GDP by 2035 (its contribution stands at around SAR 340bn now), add 3.7-times the total jobs compared to 2020 and result in more than 5-times jump in industrial exports to SAR 892bn, diversifying exports.

- Focusing on 12 sub-sectors (including food, medicine, medical equipment and marine industries), the strategy would see a surge in the number of industrial facilities to ~36,000 by 2035 (ytd in 2022: 10,640) and plans to attract SAR 1.3trn of additional investment into the sector. An Industrial Council has also been created to include participation of the private sector & industrial investors.

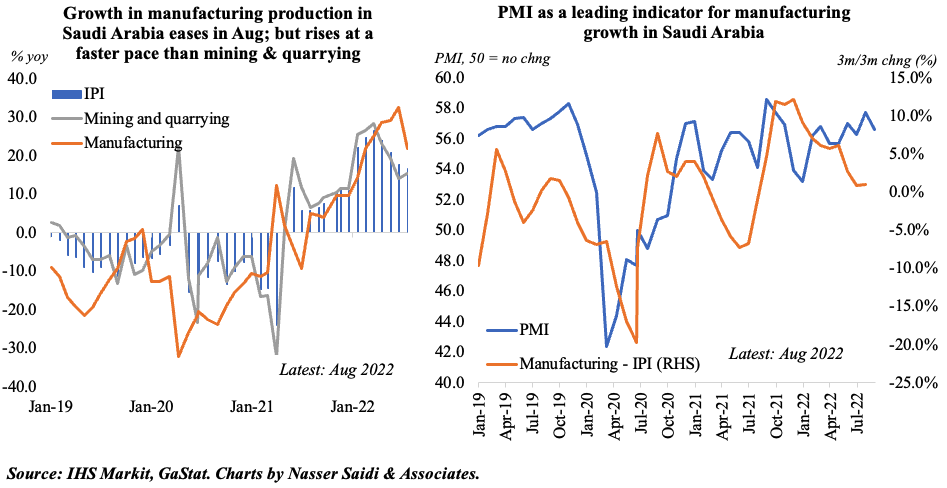

2. Saudi Arabia’s manufacturing sector posts double-digit yoy growth for the 7th consecutive month in Aug

- Overall industrial production (IP) grew by 16.8% yoy in Sep, supported by mining & quarrying (+15.5% yoy) and manufacturing (+22%). The increase in oil production to more than 11mn barrels per day (bpd) supports the uptick in mining; manufacturing growth has been positive for 13 straight months, with double-digit growth for the past 7 months.

- While IP has rebounded from pandemic-lows, growth has been easing after a high 26.7% yoy in Apr 2022. The 3m-rolling average displays this easing, but the uptick in output and new orders within PMI (above average for the ongoing 25-months of expansion) bodes well for the overall index. Furthermore, interest in industrial sector remains strong: as of Aug this year, industrial licenses issued touched 647 + number of existing & under-establishment factories stood at 10,707.

- The New Industrial Strategy will support further growth in the sector, especially diversification into non-oil sectors.

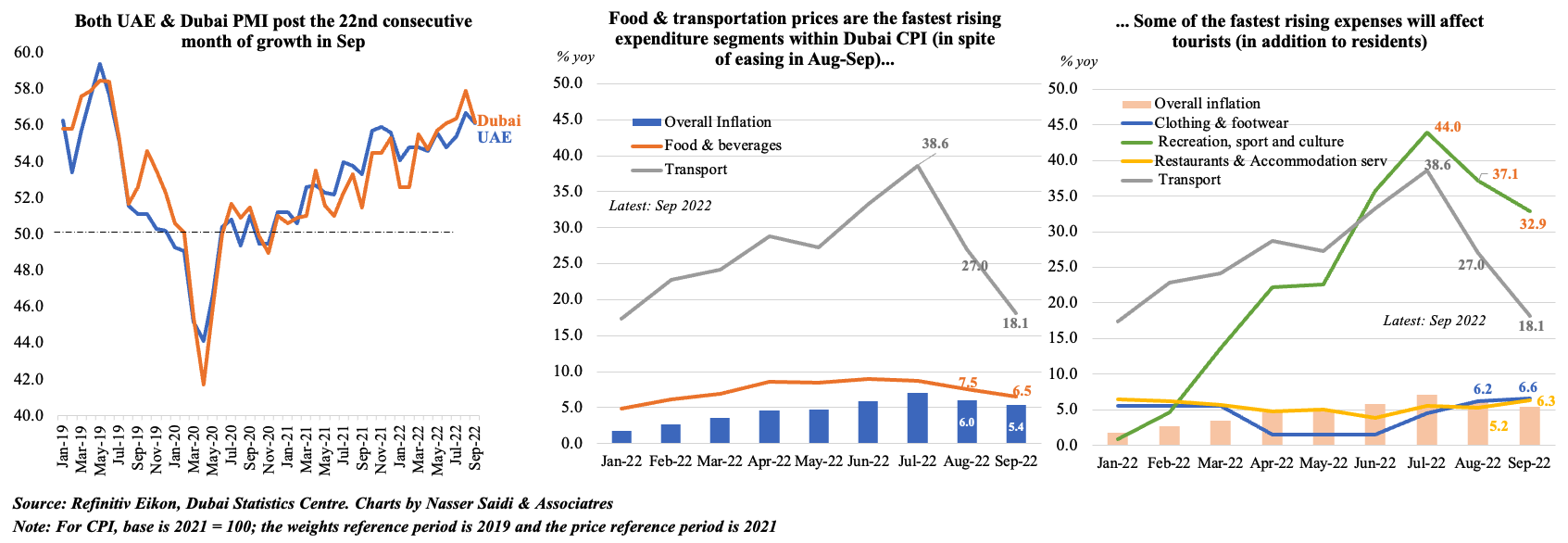

3. Dubai PMI softens; inflation rate eases to 5.4% in Sep (from Jul’s peak of 7.1%), averages 4.6% in Jan-Sep 2022

- Both UAE and Dubai PMIs softened in Sep, though remaining in expansionary territory for the 22ndconsecutive month. In Dubai, wholesale and retail business reported a 38-month high reading while travel & tourism businesses growth was the weakest since Jan. This might have been partly due to summertime and given the rise in costs related to the sector (hotels, recreation etc.).

- Inflation in Dubai inched lower to 5.4% yoy in Sep (from the peak of 7.1% yoy in Jul): while the pace of increase in food and beverage and transport costs eased (to 6.5% and 18.1% in Sep, from Jul’s 8.8% and 38.6% respectively), it remains quite high. These sectors have a high weightage in the overall index (11.66% and 9.32% respectively); housing, which is weighted at 40.68%, has seen a steady increase in costs (2.8% in Sep from Aug’s 1.9% and Jul’s 0.9%).

- While the moderation in energy costs will help rein in overall costs, rise in prices of services could affect tourist spending in Q4 in addition to the strong dollar & weaker euro (we are yet to see an impact on tourism arrivals; spending data is not available).

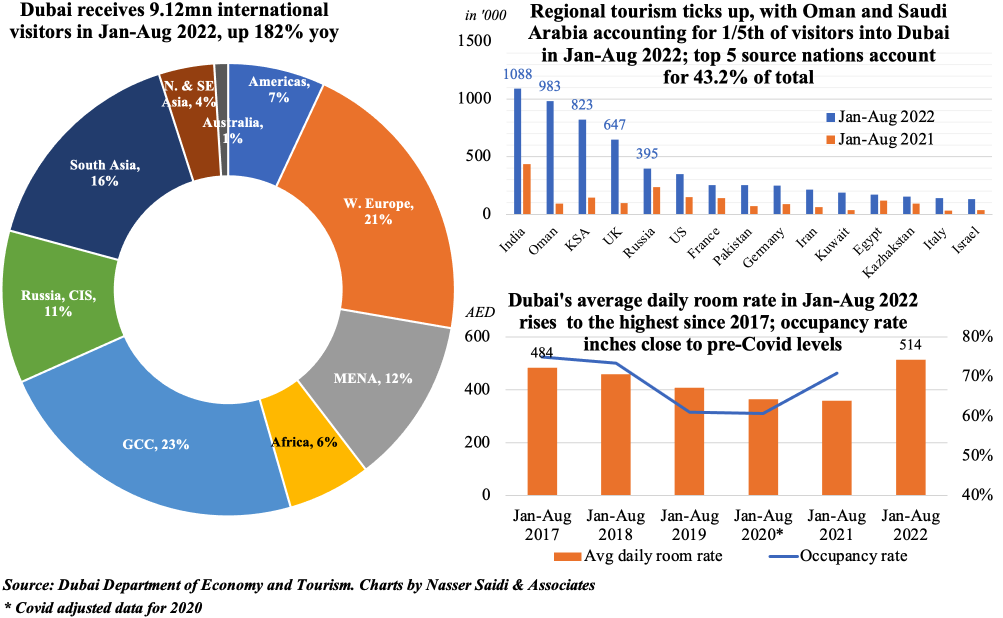

4. Dubai tourism emerges strong even during the summer months: total visits crosses 9mn in Jan-Aug, surpassing 2021’s total (7.28mn). A stronger recovery is expected come winter, but will rising room rates & other costs have a significant effect? Will Qatar World Cup positive effect outweigh?

5. UAE’s Banking Statistics, Jul 2022

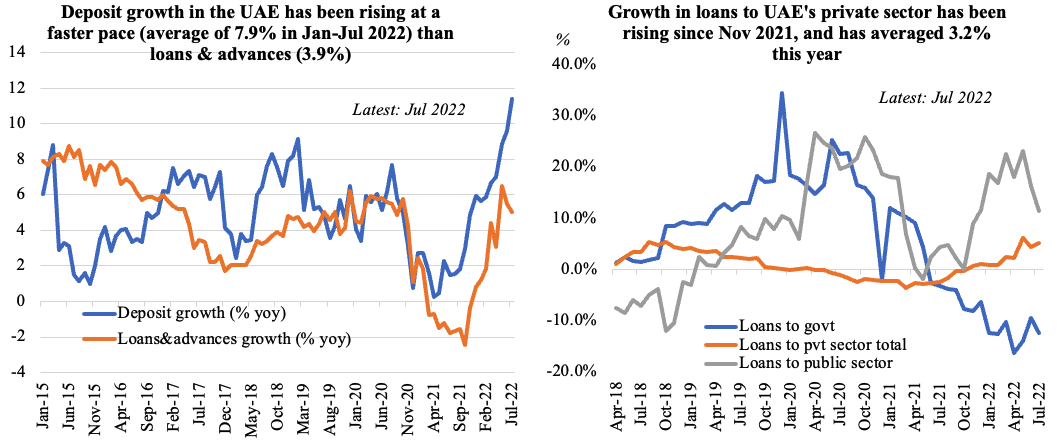

- Deposit growth in the UAE outpaced loans & advances in 2022: deposits grew by an average 7.9% in Jan-Jul 2022, driven by a double-digit rise in government deposits (which account for 1/5th of total residents’ deposits) while GRE deposits have declined vs end-2021.

- Together, governments and public sector accounted for close to 30% of total domestic credit in Jul. Credit to the public sector (GREs) has grown in double-digit (year-on-year) terms since Dec 2021, while credit to the government has been steadily declining.

- In Jul alone, overall domestic credit disbursed in the UAE declined by 0.7% mom, following a 0.6% mom drop in Jun. Credit to private sector grew by an average 3.2% this year.

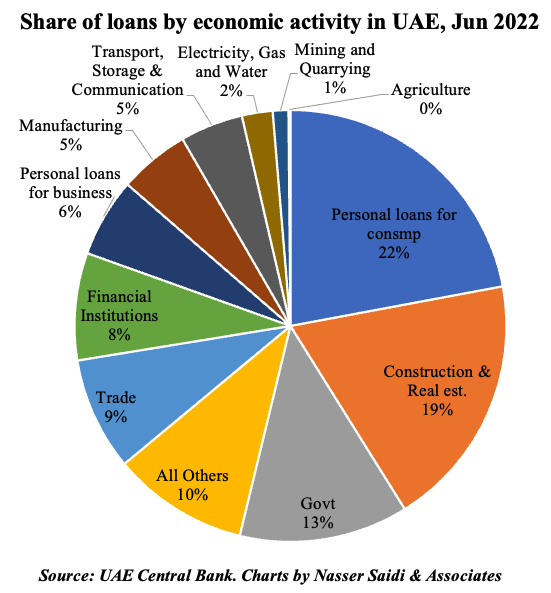

- A breakdown of loans by economic activity for Jun 2022 shows that close to 1/5th of overall loans disbursed goes to the construction and real estate sector activity while another 17% is split between trade and financial institutions.