Markets

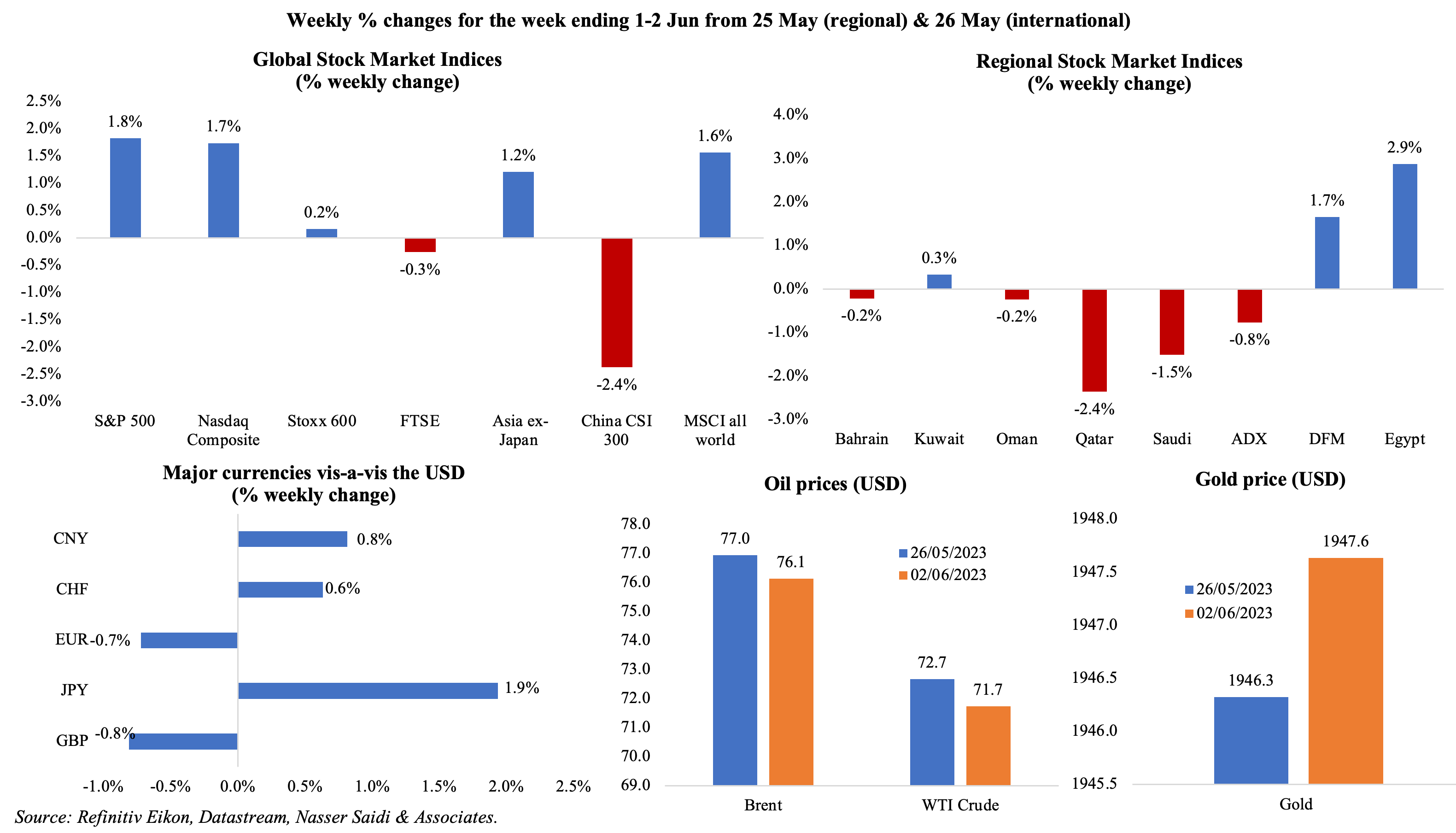

US equity markets were up last week, with S&P 500 touching a 9-month high, after the US debt ceiling legislation was passed and non-farm payrolls data indicated resilience; China’s market bucked the trend. The CBOE Vix “fear gauge” index fell to 14.6, the lowest since Feb 2020. Regional markets were mixed ahead of the OPEC+ meeting over the weekend. The dollar posted its biggest fall since early May (despite an uptick following a stronger than expected payrolls data); the euro touched a 2-month low last week after the ECB President stated that more policy tightening was necessary. Oil prices ended last week lower by around 1%; it surged earlier today as markets opened (after Saudi Arabia pledged to cut oil production by a further 1mn barrels a day) before paring gains. Gold price edged up only slightly for the week even though it had briefly gone higher than USD 1,980 during the week.

Global Developments

US/Americas:

- Fed’s Beige Book cited deterioration in “expectations for future growth” as the pace of inflation and job growth “cooled”. Consumer spending remained either steady or higher, with people spending more at restaurants, hotels and travel-related businesses.

- Non-farm payrolls increased by 339k in May (Apr: 294k).

- Private sector payrolls rose by 278k in the US in May (Apr: 291k), with services sector jobs gaining more (168k) than goods-producing jobs (110k).

- The number of unemployed persons in the US rose by 440k to 6.1mn and unemployment rate increased to a 7-month high of 3.7% (Apr: 3.4%). Labour force participation rate was unchanged for the 3rd straight month at 62.6% while average hourly earnings gained 0.3% mom and 4.3% yoy (Apr: 4.4%).

- JOLTS job openings increased by 358k to 10.103mn in Apr (Mar: 9.745mn), the highest level since Jan. There were 1.8 vacancies for every unemployed person (up from 1.7 in Mar), indicating strength in the labour market.

- Initial jobless claims inched up by 2k to a seasonally adjusted 232k in the week ended May 26th, with the 4-week average declining to 229.5k. Continuing jobless claims rose by 6k to 1.795mn in the week ended May 19th.

- S&P Case Shiller home price index was up by 0.5% mom in Mar, rising for the second straight month; it however declined by 1.1% in yoy terms.

- US consumer confidence fell to a 6-month low to 102.3 in May (Apr: 103.7), with the present situation and expectations indices fell to 148.6 and 71.5 respectively (Apr: 151.8 and 71.7).

- ISM manufacturing PMI slipped to 46.9 in May (Apr: 47.1), staying below the 50-mark for the 7th consecutive months as new orders declined to 42.6 (Apr: 45.7). Meanwhile employment rose (to 51.4 from 50.2) and prices paid fell to 44.2 from 53.2 the month before.

- S&P Global US manufacturing PMI was down to 48.4 in May (Apr: 50.2), as new orders declined while input costs dropped for the first time since May 2020.

- Dallas Fed manufacturing business index worsened in May, down to -29.1 (Apr: -23.4), the lowest since Q2 2020. The production index moved into negative (-1.3 from Apr’s 0.9) while new orders plunged further (-16.1 from -9.6).

- Chicago PMI fell for the 9th consecutive month to 40.4 in May, down from an 8-month high of 48.6 in Apr.

Europe:

- Eurozone’s Economic Sentiment Indicator fell to a 6-month low of 96.5 in May (Apr: 99). The ESI worsened in Spain, Germany, and Italy while it rose in Poland and France. Business climate index fell to 0.19 (Apr: 0.51) while consumer confidence nudged up by 0.1 to -17.4.

- Inflation in the eurozone slowed to 6.1% in May (Apr: 7%), the lowest level since Feb 2022, as energy costs decreased (1.7% from Apr’s 2.4% gain). Core inflation also eased, down to 5.3% from Apr’s 5.6%. HICP in Germany eased for the third consecutive month, to the lowest since Mar 2022 (6.3% from Apr’s 7.6%).

- Manufacturing PMI in the eurozone fell to a 36-month low of 44.8 in May (Apr: 45.8), with output and new orders declining at the strongest rates in 6 months. Input costs fell at the fastest rate since Feb 2016 while output prices reduced for the first time since Sep 2020.

- Germany’s manufacturing PMI declined to 43.2 in May (Apr: 44.5), the lowest in 3 years as output contracted and new export orders posted the steepest decline since Oct 2022 (respondents highlighted lower demand from China, Europe and the US). Input prices meanwhile fell the most since Feb 2016.

- Retail sales in Germany rebounded by 0.8% mom in Apr (Mar: -2.4%), as food and non-food sales inched up by 0.5% and 0.7% respectively. Sales however fell by 4.3% in yoy terms.

- Unemployment rate in Germany remained unchanged at 5.6% in Apr. In the wider eurozone, unemployment rate inched lower to 6.5% in Apr (Mar: 6.6%).

- UK manufacturing PMI declined to 47.1 in May, down from Apr’s 47.8 but higher than the flash estimate. New orders fell for the 16th straight month on weak domestic sentiment, low overseas demand and client destocking.

Asia Pacific:

- China’s manufacturing PMI unexpectedly fell for the second straight month in May, to 48.8 (Apr: 49.2), as output contracted (49.6 from Apr’s 50.2) while new orders, export sales and buying activity fell further. Non-manufacturing PMI eased to 54.5 in May (Apr: 56.4), with both new orders, foreign sales and employment all fell below-50.

- China’s Caixin manufacturing PMI moved up to 50.9 in May (Apr: 49.5), thanks to a 2-year high of new orders growth, increase in foreign sales and an 11-month high in output. However, employment fell the most since Feb 2020 and sentiment slipped to a 7-month low on global uncertainty and weak domestic activity.

- Jibun Bank manufacturing PMI in Japan moved into expansion territory in May (50.6 from Apr’s 49.5), after 6 months, given increases in production and new work. Supplier performance improved for the first time since Jan 2020 and helped to lower purchase price inflation while business optimism was the highest since Jan 2022.

- Industrial production in Japan unexpectedly fell by 0.4% mom and 0.3% yoy in Apr, with output dragged down by factory machinery, metal products and automakers’ output.

- Retail trade in Japan grew by 5% yoy in Apr (Mar: 6.9%), rising for the 14th month in a row, with increases across automobile retail (15.1%), drug and cosmetic retailers (7%) and department stores (6.9%) among others.

- Japan unemployment rate dropped to 2.6% in Apr (Mar: 2.8%), with the number of unemployed declining by 150k to 1.8mn. Jobs-to-applicants’ ratio stood unchanged at a 7-month low of 1.32.

- GDP in India grew by 6.1% yoy in Jan-Mar (Q4: 4.4%), thanks to government spending (2.3% yoy vs -0.6% in the previous quarter) and capital formation (8.9% from 8%) while manufacturing grew by 4.5% (Oct-Dec: -1.4%).

- Demand boosted manufacturing PMI in India: May’s reading ticked up to 58.7 (Apr: 57.2), the most since Oct 2020, supported by output growth (28-month high) and new orders (expanding for the 23rd straight month).

Bottom line: Global manufacturing PMI stood unchanged at 49.6 in May, but production increased to an 11-month high and input costs fell for the first time since May 2020. However, new export orders fell for the 15th straight month, as international trade volumes weighed on demand. Meanwhile, labour market tightness continues in the US ahead of the inflation print and Fed meeting next week. Europe inflation moderated but manufacturing remains in contractionary territory. China’s post-Covid recovery appears to be limping.

Regional Developments

- OPEC+ will extend the oil production cut of 500k barrels per day (bpd), announced in Apr, till end-2024. Saudi Arabia will also reduce oil output by an additional 1mn bpd for July (which could be extended). UAE has been allowed to increase its production by 200k bpd to 3.22mn bpd, in recognition of its larger production capacity. Additionally, a new lower output target of 40.46mn bpd from 2024 was also agreed to by OPEC+ members.

- The MENA region faces an estimated USD 993.9bn infrastructure funding gap between 2016 and 2040, according to the ICD-Refinitiv OIC Infrastructure Outlook 2023 report. While funding gaps in infrastructure development run across roads (USD 684.9bn), water (USD 110.8bn), rail (USD 47.3bn), ports (USD 33.6bn) and airports (USD 24.7bn), only electricity infrastructure sees a funding surplus (of USD 27.4bn).

- The DMCC’s report on the future of trade looks in-depth at gaming and e-sports in the MENA region: it expects gaming revenues to almost double by 2027 to USD 6bn (vs 2021) and identifies Saudi Arabia and the UAE as the main drivers.

- S&P affirmed Bahrain’s ‘B+/B’ long- and short-term foreign and local currency sovereign credit rating, also maintaining a positive outlook. The rating was based on financial sector stability alongside potential for higher current account surpluses.

- PMI in Egypt remained in contractionary territory, below-50 in May but the reading of 47.8 (Apr: 47.3) was the highest since Feb 2022. Furthermore, the output and new orders sub-indices rose to the highest levels in 17 and 7 months respectively. However, job losses continued for the 6th month in a row and only 6% of firms expected an expansion in output levels in the next 12 months.

- Egypt’s Parliament approved a new tax of 27.5% levied on citizens earning annual income of over EGP 1.2mn. The tax will be effective from July and is expected to add AED 1.2bn in additional revenues. Furthermore, the income tax exemption limit is to be raised to EGP 36k from EGP 24k.

- Egypt signed two agreements with Saudi Arabia to increase the former’s participation in Saudi’s industrial and mining sectors. Bilateral trade between the two nations stood at USD 5.6bn in 2022 (+23.9% yoy) and Egyptian investments in Saudi was USD 1.6bn.

- Oman posted a budget surplus of OMR 1.14bn in 2022 (2021: deficit OMR 1.22bn), thanks to increased oil production (+10% yoy) and higher oil prices (+54% yoy to USD 94) alongside spending up by just 7%. Public debt narrowed by 15% yoy to OMR 17.74bn (or 43% of GDP) in 2022; external loans at end-2022 stood at OMR 13.2bn.

- Oil exports from Oman accounted for 79.5% of total oil production (127,768mn barrels) in Apr, adding OMR 101.6mn given the average oil price of USD 81.7. China, Japan and India were the top importers of oil from Oman. Gas production meanwhile exceeded 17bn cubic meters in Apr.

- Qatar posted a trade surplus of QAR 22bn (USD 6bn) in Apr: imports fell by 6.3% yoy to QAR 8.7bn while the value of oil and gas exports plunged by 33.2% yoy to QAR 18.6bn. China and South Korea together accounted for over a third of Qatar’s exports in Apr.

- The CEO of QatarEnergy disclosed that the firm had signed a 15-year LNG supply deal with Bangladesh’s PetroBangla for 1.8mn tonnes a year starting in 2026.

Saudi Arabia Focus

- PMI in Saudi Arabia dropped to 58.5 in May (Apr: 59.6), given declines in both new orders and output. However, respondents mentioned improved demand, “greater travel and tourism and increased business investment”. Firms reported the joint-fastest growth in employment since 2018, and salaries pushing up staff expenses (quickest since Sep 2016). These charges were passed on to consumers, resulting in the sharpest recorded increase in output charge inflation since Aug 2020.

- Saudi Arabia’s net foreign assets fell for the 5th straight month to SAR 1.538trn in Apr – lowest in more than 13 years (despite oil gains last year). SAMA’s reserves stood at SAR 1.632trn in Apr. Deposits grew by 10.38% yoy to SAR 2.4trn, after months of being outpaced by credit expansion, though government deposits are still falling (-3% mom & -15.1% yoy in Apr). Aggregate profits of Saudi banks grew by 3.4% yoy to SAR 5.78bn (USD 1.55bn) in Apr, though this was down by 22.2% compared to a month ago.

- Saudi Arabia’s overall exports fell by 14.6% yoy in Q1, because of declines across both oil (-14.9%) and non-oil (-21.5%) exports. Re-exports meanwhile increased by 34.1% in Q1. Despite the decline, share of oil in overall exports stands at 78.3%. The top destination for non-oil exports (including re-exports) was UAE, with transport equipment and parts the largest export item. Merchandise imports dropped by 4.9% to SAR 186.4bn (USD 49bn).

- In 2022, Saudi Arabia’s exports increased by 48.9% yoy to SAR 1.54trn (USD 410bn) given the surge in oil exports (+61.8% to SAR 1.22trn). Oil exports share hence increased to 79.5% in 2022 (2021: 73.2%).

- Saudi Arabia’s population jumped to 32.2mn as per the latest census, with foreigners accounting for 41.6% of the total (lower than 2016’s peak of 14.6mn). Of the non-Saudi population, only 23.5% are female. The average age is 29 in the country, with regional variations (lowest is 25.3 in Al Jawf region), while 63% of Saudis are under the age of 30.

- Saudi Arabia’s Milling Company 3 is planning an IPO in Q1 2024, reported Reuters, citing two sources.

- Investments into Saudi Arabia jumped by 31% to more than SAR 1trn (USD 266.6bn) in 2022, revealed the minister of investment. Separately, it was disclosed that total anchor investments in its four special economic zones reached SAR 47.2bn (USD 12.6bn) to date.

- Saudi Arabia officially issued licenses for its 4 new Special Economic Zones located in Riyadh, Jazan, Ras Al-Khair and King Abdullah Economic City. The minister of human resources disclosed that while the SEZs will be exempt from Saudization requirements, Human Resources Development Fund plans to provide extra benefits for firms that hire Saudi citizens.

- SAMA has granted permits for two more BNPL (buy now pay later) firms Spotii and Madfu. Separately, SAMA has also permitted open-banking platform Tarabut Gateway to operate in the country.

- Saudi Arabia issued 55 mining licenses in Apr, following the 18 and 27 licenses given in Feb and Mar respectively. The Apr permits include 34 licenses for exploration and 17 for quarrying building materials among others.

- Industrial sector and SMEs were the main beneficiaries of Saudi Arabia’s National Development Fund in Q1 2023: over SAR 30bn (USD 8bn) was provided in funding. The Saudi Industrial Development Fund approved financing agreements valued at SAR 875mn to 24 businesses while the Tourism Development Fund provided SAR 260mn in financing for 11 businesses.

- Total number of SMEs in Saudi Arabia increased by 4.8% qoq to over 1.2mn in Q1 2023, according to Monsha’at. About 88,858 new businesses were launched in the quarter alone. SME financing touched a record-high of SAR 1.35bn (USD 359mn) in Q1 2023, with e-commerce and retail the most active sectors.

- Saudi citizens working in the construction sector, at 369,600 employees, accounted for 14.6% of the total. The number of female employees in the sector reached 152,500 employees: Saudi women accounted for the largest share within this.

- Lucid Group plans to raise USD 3bn through a stock offering: about 2/3-rds of this is expected from Saudi PIF while the rest will come from a public offering of 173.5mn shares of common stock.

UAE Focus![]()

- UAE PMI slipped to 55.5 in May (Apr: 56.6): new business was driven by just domestic demand as export sales remained flat. Employment levels grew at the second- fastest pace since Jul 2016 and the Future Output Index indicated an increase in optimism – the highest level since Oct 2021. Selling prices continued its declining trend, though at a weaker pace than Apr’s 31-month record.

- UAE was MENA’s top mergers and acquisitions (M&A) destination in Q1 this year, with 42 deals worth USD 2bn, according to EY MENA M&A report. The MENA witnessed a 42% yoy increase in total M&A value during the quarter. Technology sector reported the most deals: 19 worth USD 461mn.

- At the UAE’s “Make it in the Emirates” Forum, the government announced 30 innovative industrial projects worth more than AED 6bn (USD 1.63bn), including pioneering initiatives such as setting up the first hydrogen electrolyzer plant in the UAE; these projects are expected to create about 5,000 jobs for UAE nationals. The UAE’s minister of industry disclosed that industrial exports from the country touched AED 175bn in 2022, up by 48% from 2020. Industrial licenses renewal in Sharjah rose by 7% yoy to 2,401 in 2022, disclosed the Sharjah FDI Office during the “Make it in the Emirates” Forum.

- Abu Dhabi initiated an AED 1bn (USD 272mn) program to boost industrial investments in the capital. Investments will cover 6 programmes including Industry 4.0, circular economy, talent development, ecosystem enablement, homegrown supply chain and value chain development, and aims to more than double the size of its manufacturing sector to AED 172bn by 2031. Separately, eight new projects have been announced to boost the industrial sector in Abu Dhabi: this covers areas including manufacturing, banking, oil & gas, pharmaceuticals and healthcare.

- UAE’s National In-Country Value Program has seen more than USD 14.43bn redirected into the local economy last year alone (up 25% yoy).

- Dubai’s Road and Transport Authority is exploring the option of an IPO of its taxi business, reported Reuters. Discussions are at very early stages. The taxi sector posted a 6% yoy growth clocking in 27.3mn trips in Q1 2023.

- UAE’s minister of economy disclosed that FDI into India from the UAE touched AED 56.5bn at end-2022, mainly into renewable energy and telcos, roads infrastructure, real estate and start-ups. Bilateral trade grew by 15% yoy to AED 189bn in 2022.

- UAE Central Bank issued new anti-money laundering and counter-terrorism financing guidance for financial institutions when dealing with virtual assets, such as cryptocurrencies and non-fungible tokens, and virtual asset service providers. More: https://www.centralbank.ae/media/avwlktgy/cbuae-guidance-for-lfis-on-risks-related-to-virtual-assets-and-virtual-assets-providers_final-clean-version1.pdf

- The Investment Corporation of Dubai reported a profit of AED 36.1bn (USD 9.83bn) in 2022, compared to the AED 10.1bn profit in 2021 and a loss in 2020.

- Petrol prices in the UAE was lowered by 6.7% to 7% mom for the month of June; this is the 2nd straight month of lower prices following 2 months of increases in Mar-Apr.

- The Dubai World Trade Centre announced that its events generated USD 3.55bn in economic output last year, supported over 48k jobs (+110% yoy) and increased disposable household income by USD 651mn.

- Dubai announced a new development plan for the Palm Jebel Ali: spanning 13.4 square kms, this will be about double the size of the Palm Jumeirah. It will add 110km of coastline to Dubai and have 80 hotels and resorts on the island. No opening date has been confirmed.

- In 2022, high net worth individuals spent USD 3.8bn on homes priced at over USD 10mn in Dubai, according to Knight Frank’s Destination Dubai report. In Q1 2023, Dubai witnessed 88 home sales above USD 10mn, totalling over AED 6bn (USD 1.6bn).

Media Review

Riskless Capitalism

https://www.imf.org/en/Publications/fandd/issues/2023/06/POV-riskless-capitalism-rajan-zingales

The AI boom has turbocharged Nvidia’s fortunes. Can it hold its position?

https://www.economist.com/leaders/2023/06/01/the-ai-boom-has-turbocharged-nvidias-fortunes-can-it-hold-its-position

BRICS meet with ‘friends’ seeking closer ties amid push to expand bloc

https://www.reuters.com/world/brics-meet-with-friends-seeking-closer-ties-amid-push-expand-bloc-2023-06-02/

The West could turn to Brazil, India, and South Africa for its green hydrogen ambitions

https://www.piie.com/research/piie-charts/west-could-turn-brazil-india-and-south-africa-its-green-hydrogen-ambitions

Powered by: