Markets

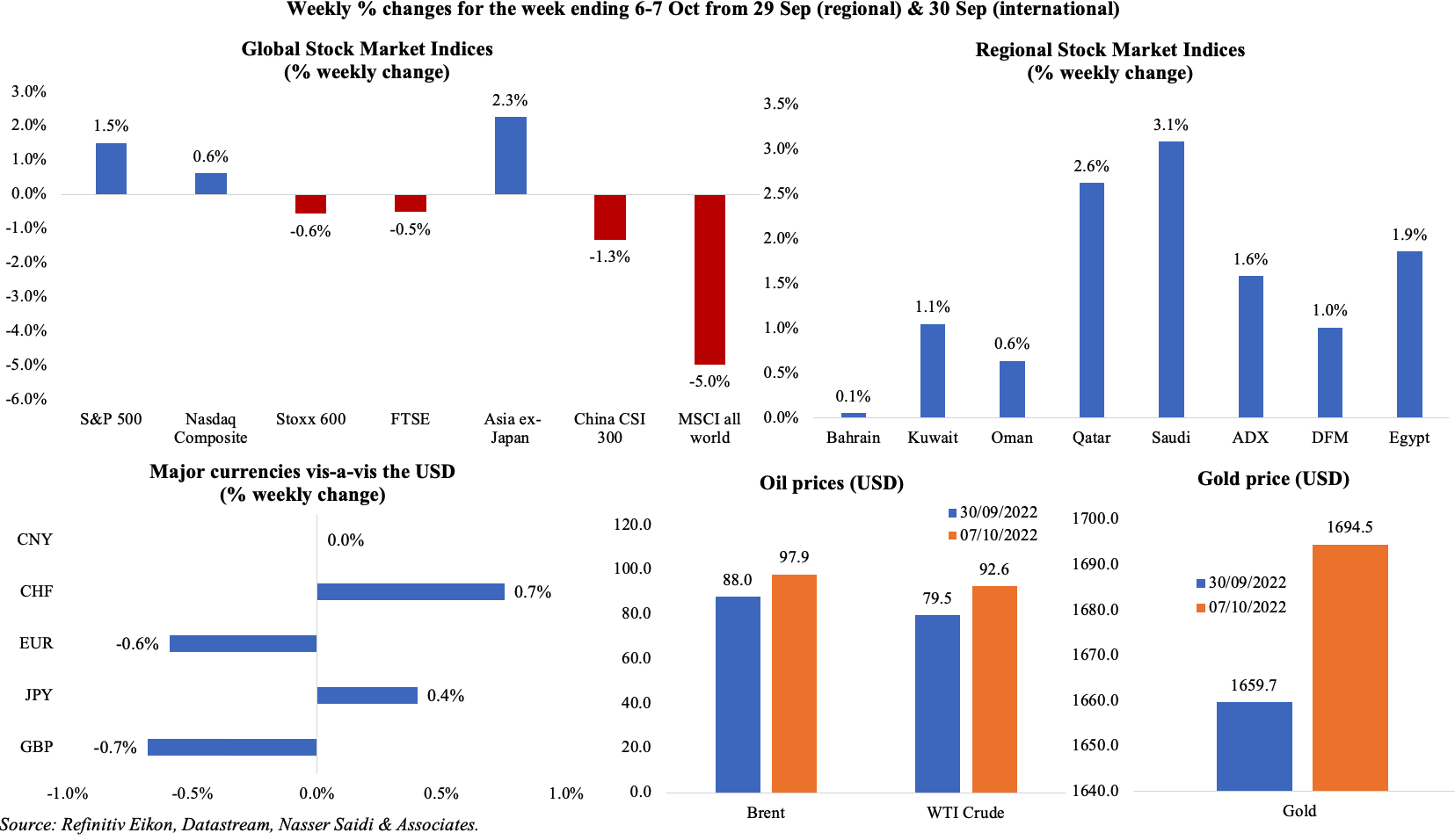

Equity markets were mixed last week, with US markets tumbling on Fri after stronger-than-expected payrolls data solidified expectations of Fed hikes (markets are pricing in 92% chance of another 75bps hike for next month’s meeting). Regional markets were mostly up, supported by the rising oil prices after OPEC+’s decision to reduce output by 2mn barrels per day (bpd) while Qatar recorded its biggest intra-day gain in more than 4 years on Tuesday. The dollar continues to grow stronger, supported by geopolitical tensions; the Korean won touched a 13.5-year low last week while the pound and euro posted weekly drops. Oil prices increased to a 5-week high, brushing off concerns of weaker demand amid a global slowdown. Gold price, which has been affected by a strong dollar and rising yields, closed slightly higher around USD 1695.

Global Developments

US/Americas:

- US non-farm payrolls increased by 263k in Sep, slower than Aug’s 315k gain, led by leisure and hospitality, health care and business and professional services led sector gainers. Unemployment rate fell by 2ppts to 3.5% in Sep and labour force participation rate edged down to 62.3% from 62.4% while the average hourly earnings eased to 5% yoy (Aug: 5.2%).

- Private sector jobs increased by 208k in Sep, higher than the previous month’s upwardly revised 185k gain. Trade, transportation and utilities recorded the most jobs gain of 147k.

- JOLTS job openings slipped sharply to 10.053mn in Aug (Jul: 11.17mn) – this was the 14th consecutive month of 10mn+ readings, but the largest drop since Apr 2020.

- Initial jobless claims increased by 29k to 219k in the week ended Sep 30th, with the 4-week average inching up slightly to 206.5k. Continuing jobless claims also rose, by 15k to 1.361mn in the week ending Sep 23rd.

- Goods and services trade deficit in the US narrowed by USD 3.1bn to USD 67.4bn in Aug, the lowest since May 2021. Imports declined by 1.1% to USD 326.3bn, a reflection of slower demand; exports slipped by 0.3% to USD 258.9bn, but exports of capital goods were the highest ever.

- Factory orders in the US remained flat in Aug, following a 1% mom decline in Jul. Excluding transportation, factory orders rebounded by 0.2%, after a 1.1% fall in Jul.

- ISM manufacturing PMI declined to 50.9 in Sep (Aug: 52.8), as new orders and employment sub-indices fell below the 50-mark (at 47.1 and 48.7 respectively). Prices paid decreased to 51.7 from 52.5 the month before.

- ISM non-manufacturing PMI dropped to 56.7 in Sep (Aug: 56.9): the employment sub-index surged to 53 (Aug: 50.2) while the new orders slipped to 60.6 (Aug: 61.8) and input prices paid dropped to 68.7 (lowest since Jan 2021).

- S&P Global manufacturing PMI was revised up to 52 in Sep from a preliminary reading of 51.8 and above Aug’s 51.5.

Europe:

- Germany’s exports rebounded by 1.6% mom in Aug (Jul: -2.1%) and imports grew at a faster pace of 3.4%, thereby narrowing trade surplus to EUR 1.2bn (USD 1.19bn) from Jul’s EUR 5.4bn. Exports to the EU dropped by 0.8% mom; the US was the major non-EU export destination while China was the main imports source.

- Factory orders in Germany declined by 2.4% mom and 4.1% yoy in Aug (Jul: 1.9%), owing to a fall in domestic orders (-3.4%) and those from the eurozone (-3.8%).

- German industrial production fell by 0.8% mom in Aug, faster than the 0.3% dip recorded in Jul: production of consumer and capital goods grew by 1.8% and 1.2% though in contrast intermediate goods production declined by 2.4%.

- Germany’s manufacturing PMI slipped to 47.8 in Sep from its preliminary estimate of 48.3, posting sub-50 reading for the 3rd consecutive month, as inflows of new work declined to the largest extent since May 2020. Services PMI also declined to 45 in Sep (prelim: 45.4, Aug: 47.7) and expectations plunged to the lowest since the initial Covid months. As a result, composite PMI fell to 45.7 from the previous month’s 46.9 reading.

- Manufacturing PMI in the eurozone edged down to 48.4 in Sep (prelim: 48.4, Aug: 49.6), recording the biggest contraction since Jun 2020, with declines in both output and new orders while energy prices are pushing up input costs. Services PMI slowed to 48.8, the lowest level since Feb 2021, and resulted in the composite PMI falling to 48.1. business confidence fell to its lowest level since the first COVID wave in 2020.

- Producer price index in the eurozone jumped to a new record high of 43.3% yoy in Aug (Jul: 38%), largely due to higher energy prices (116.8%).

- Higher prices are negatively affecting consumer spending: retail sales in the eurozone slipped by 0.3% mom (the 3rd consecutive monthly decline) and 2% yoy in Aug. Retail sales in Germany also shrank in Aug: by 1.3% mom and 4.3% yoy (Jul: -0.7% mom).

- UK manufacturing PMI declined to 48.4 in Sep from the preliminary estimate of 48.5, with intermediate goods producers witnessing the steepest output decline and new export business dropping the most since May 2020. Services PMI moved up to the neutral mark of 50 from the preliminary estimate of 49.2 – this is the lowest in 19 months amid weaker demand. Composite PMI inched up to 49.1 (prelim: 48.4) with a 20-month low in incoming new work across both services and manufacturing.

Asia Pacific:

- China’s foreign exchange reserves slipped to USD 3.029trn in Sep (Aug: USD 3.055trn), the lowest level this year. Japan’s forex reserves fell by a record USD 54bn to USD 1.24tn, the lowest level since 2017, after the authorities intervened to stem the JPY’s fall and given the falling value of foreign bonds.

- Caixin services PMI in China plunged to 49.3 in Sep (Aug: 55), the first contraction in activity since May: new orders shrank after 4 months of gains while employment declined for the 9th consecutive month; input cost increased for the 27th straight month.

- The PBoC conducted CNY 17bn (USD 2.39bn) of reverse repos to maintain liquidity in the banking system. The interest rate for the 7-day reverse repos was set at 2%.

- Inflation in Japan inched down to 2.8% yoy in Sep (Aug: 2.9%). Core CPI excluding fresh food moved up to 2.8% from the previous month’s 2.6%, posting the biggest gain since 2014. Excluding both foods and energy, prices were up by 1.7% (vs. 1.4% in Aug).

- Manufacturing PMI in Japan stood at 50.8 in Sep, lower than the flash reading of 51 and Aug’s 51.5: new orders fell the most in 2 years on weaker demand and output shrank for the 3rd straight month.

- Japan’s Tankan manufacturing index declined to 8 in Q3 (Q2: 9). Non-manufacturing index increased to 14 (Q2: 13) though outlook slipped 2 points to 11.

- Preliminary estimate of Japan’s leading economic index rose to 100.9 in Aug (Jul: 98.9), the highest since Apr. Thecoincident index was up to 101.7, the highest reading since May 2019, from 100.1 the month before.

- Overall household spending in Japan slid by 1.7% mom in Aug (Jul: -1.4%) as inflation continues to rise amid yen’s 24-year lows. Separately, real wages fell for the 5th month, down by 1.7% (Jul: -1.8%).

- Retail sales in Singapore grew by 13% yoy in Aug (Jul: 13.9%); vehicle sales were down by 7.9% and excluding motor vehicles, sales rose 16.2% yoy (Jul: 18.4%).

Bottom line: Global manufacturing PMI in Sep fell below-50 for the first time since Jun 2020, with downturns recorded in 21 out of 31 nations and new export orders falling further into contractionary territory. Though supply chain delays are easing, rising energy costs and a stronger dollar are putting pressure on prices. The stronger dollar is a key factor (alongside higher inflation readings) leading to rate hikes across Asian central banks that meet this week – South Korea and Singapore (not known how much the MAS will tighten, but the SGD is close to a post-2009 low). The PBoC also meets this week: but will the apex bank choose to support growth and recovery versus support for the CNY? US data, including inflation, will be closely watched to gauge Fed’s upcoming moves. Lastly, the IMF-World Bank annual meetings is expected to lower global growth rates, and highlight concerns about inflation, geopolitical risks and food security.

Regional Developments

- OPEC+ agreed to an output cut of 2mn barrels per day (bpd) from Dec: this is the largest cut since the pandemic; OPEC+ fell 3.6mn bpd short of its output target in Aug. The Saudi energy minister stated that the decision was taken to “sustain markets” with others also chiming in that the target was to balance supply and demand.

- The World Bank expects MENA region to grow by 5.5% this year, the fastest pace since 2016, and by 3.5% in 2023. Growth in the GCC nations, at 6.9% in 2022, will be supported by higher fuel prices while it is estimated to grow by 3.7% in 2023 as prices moderate. The report highlights that 6 of the 18 MENA countries are expected recover to pre-pandemic levels in 2022 and another 3 would achieve this by 2023. Access the report here.

- Bahrain attracted USD 290mn in investment in manufacturing and logistics in the period Jan-Sep 2022: 25 companies set up and/ or expanded their businesses and is expected to create more than 1,200 jobs over the next 3 years. Overall, 66 firms invested in the nation across multiple sectors (financial, communications, logistics etc) during the period, leading to the creation of 4,700 jobs in the next 3 years.

- Bilateral trade between Bahrain and China grew by 15% yoy to USD 2.2bn in 2021, with exports to China surging by 159% (led by semi-manufactured steel and iron).

- Money supply in Bahrain increased by 3.7% yoy to BHD 15.2bn at end-Aug: during this period private deposits grew by 6.1% to BHD 13.5bn while loans and credit facilities were up by 6% to BHD 11.4bn. In Q2 2022, capital adequacy ratio stood at 20.4% for conventional retail banks and 21% for Islamic retail banks.

- Egypt PMI remained below-50 for the 22nd consecutive month in Sep, clocking in at 47.6: output index dropped further to 45.4 (Aug: 45.8) while new orders inched up to 45.9 (Aug: 45.1) and input prices surged (64.6 from Aug’s 58.8).

- Current account deficit in Egypt narrowed to USD 2.96bn in Apr-Jun (Jan-Mar: USD 5.79bn), thanks to a decline in non-oil imports (down by USD 3.84bn to USD 16.69bn). Receipts from tourism surged by 46.3% yoy to USD 2.56bn in the quarter while remittances were up by 2.9% to USD 8.28bn. Sale of state assets to GCC investment funds saw net FDI jump to USD 1.59bn, almost 4 times from Apr-Jun 2021.

- Bloomberg reported that the Egyptian pound fell to a record low of 19.6736 last week in the offshore market, lower than the previous low of 19.6725 recorded in Dec 2016.

- Revenues from the Suez Canal rose by 23.5% yoy to USD 2.1bn in Q3, the highest ever: this was largely due to a historical record high of USD 744.8mn touched in Aug.

- World Bank approved USD 400mn to Egypt to develop the logistics and transportation sectors to support the shift to lower carbon emissions.

- Bilateral trade between Egypt and Kuwait increased by 21% yoy to USD 305mn in 2021 and in the period Jan-Jul 2022, this touched USD 242mn.

- Kuwait formed a new Cabinet on Wednesday: two women ministers are part of the cabinet (vs one previously) and many ministers from the previous Cabinet were reinstated (including the finance minister) alongside new oil and defence ministers.

- Lebanon’s PMI slipped below-50 in Sep, to 48.8 from Aug’s 50.1, dragged down by new orders (both domestic and foreign) and output while employment was down for a 2nd consecutive month.

- Oman’s GDP estimate was lowered to 4.3% yoy in 2022 by the IMF (from 5.6% forecast in May 2022). Higher oil prices and fiscal consolidation measures are supporting the nation’s recovery; central government debt to GDP is expected to fall to 44% from 62.9% last year.

- Moody’s upgraded Oman’s outlook to “positive” from “stable” while affirming its Ba3 ratings citing vulnerability to potential declines in oil demand and prices in the future.

- Oman reported a 142.1% yoy increase in international flights to 32,608 at its airports till end-Jul.

- Qatar’s PMI slipped to 50.7 in Sep (Aug: 53.7), after new orders fell for the first time in 27 months amid consecutive months of employment and inventories. Ahead of the World Cup 2022, business sentiment improved to a 12-month high.

- Qatar’s population surged by 13.2% yoy to 2.94mn in 2021, in the runup to the World Cup this year: Qatari citizens stand at around 380,000.

- QatarEnergy’s CEO expects the company to become the largest global LNG trader over the next 5-10 years, also stating that the profitability of trading is 20X what was expected. Separately, he disclosed that the country is planning to produce 500k barrels of oil outside its borders by 2030.

- Startup funding in the MENA region dropped by 54% mom in Sep, according to Wamda. The region raised USD 173mn from 51 deals in Sep, with Saudi logistics startup TruKKer responsible for USD 100mn of this. Saudi Arabia (USD 114mn from 6 deals) and UAE (USD 27mn from 12 deals) remained active.

- Startups venture capital funding in the MENA region grew by 20% yoy to more than USD 2.3bn till end-Sep 2022, according to Magnitt, with USD 512mn recorded in Q3 – the lowest since Q1 2021. Egypt, UAE and Saudi Arabia were among the top three in terms of both value and number of deals, together accounting for more than 75% of overall investments.

- MENA, one of the smallest crypto markets globally, witnessed a 48% yoy jump in the volume of crypto transactions to USD 566bn in the period Jul 2021-Jun 2022, according to Chainalysis. Saudi Arabia and the UAE were the 3rd and 5thlargest crypto market in MENA. Among the top 30 in Global Crypto Adoption Index were Turkey (12), Egypt (14) and Morocco (24).

- The metaverse is estimated to add USD 360bn to the MENAT region over the next decade, according to an official for Meta. This compares to USD 3trn to be added globally.

Saudi Arabia Focus

- Saudi Arabia’s PMI stood at 56.6 in Sep, slightly lower than Aug’s 10-month high 57.7 reading. Both output and new orders increased at rates above their averages for the 25-month consecutive above-50 readings. Given various megaprojects underway in Saudi Arabia, it comes as no surprise that construction recorded the strongest uptick in employment (& biggest rise in costs).

- The World Bank forecasts growth in Saudi Arabia to accelerate by 8.3% yoy in 2022, with oil sector the main driver of growth (15.5%) alongside non-oil sector’s 4.3% uptick. Budget is expected to post its first surplus in 9 years, estimated to be 6.8% of GDP this year.

- Saudi Arabia and Morocco aim to increase the volume of bilateral trade to USD 5bn annually. In H1 2022, bilateral trade jumped to SAR 9.7bn (USD 2.5bn), exceeding SAR 5bn recorded in the full year 2021.

- In a bid to strengthen partnerships with the private sector, Riyadh Region Municipality is offering 38 investment opportunities for investors covering an area of 397k square meters for resident units, community centers and gardens; contracts range from 5 to 25 years.

- The PIF raised USD 3bn from its debut green bonds, which included tranches of 5-year, 10-year and 100-year; overall demand was over USD 22bn.

- The PIF’s Governor disclosed that the fund made over 40% profits from investments of SAR 35bn made during the COVID-19 pandemic. He also noted that local content is estimated to reach 60% of the projects, driving the local economy.

- According to the investment migration consultancy firm Henley & Partners, the number of millionaires in Riyadh grew by 20% in H1 2022: Riyadh created 1,700 new HNWI who have assets worth USD 1mn, while 850 people are multimillionaires with assets worth USD 10mn.

- Saudi Arabia’s Power and Utility Company for Jubail and Yanbu (Marafiq), partly owned by the PIF, set a price range of SAR 41-46 (USD 10.9-12) per share for its IPO: book-building started on Sunday (Oct 9th) and will end on Oct 14th.

UAE Focus![]()

- UAE PMI inched slightly lower to 56.1 in Sep (Aug: 56.7, a 38-month high), but remains strong thanks to increases in output and employment amid mild increase in input prices (after Aug’s fall). Higher purchase prices and wages ticked up business expenses while firms’ reduced output charges for a 5th consecutive month.

- The UAE central bank assets grew by 4.2% yoy and 0.84% mom to AED 495.54bn in Jul. Domestic credit grew by 1.7% year-to-date to AED 1.7trn while resident deposits surged by 6.3% ytd to AED 1.9trn.

- The healthcare provider Burjeel’s IPO was 29 times oversubscribed, with the final offering price set at AED 2 (USD 0.54) per share.

- The Dubai Financial Market disclosed that it would adopt a new methodology for its main equity indices, expected to come into effect in Q4. Among the changes is that the limit on the weighting of a listed company would be raised to 10% from 20% to allow for larger representation of firms.

- DFM’s IPO listings raised AED 208.2bn (USD 56.7bn) in Jan-Sep 2022: among these were the listings of DEWA, TECOM and Salik.

- The DMCC became the Global Free Zone of the year 2022 for the 8th consecutive time, according to the FT fDi magazine.

- According to the Dubai Chamber of Commerce, e-commerce in the UAE is expected to touch USD 9.2bn by 2026, and its share in total retail sales rise to 12.6%. In 2021, UAE e-commerce sales surged to USD 4.8bn from USD 2.6bn in 2019.

Media Review

World Bank: MENA Economies Grow by 5.5% But Benefits are Uneven

The new oil war: OPEC moves against the US

https://www.ft.com/content/70853af8-b7a4-4a28-bdfe-b4f3e375a1f0

Where has all the liquidity gone?

How to Scale Up Private Climate Finance in Emerging Economies

Powered by: