IMF MENA growth forecasts. Middle East PMIs. Current account and fiscal balances in MENA. Saudi Arabia’s fall in government deposits & SAMA’s net foreign assets. UAE’s credit sentiment is strong in Q1 2023.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 5 May 2023: MENA’s Divergent Economic Growth Paths

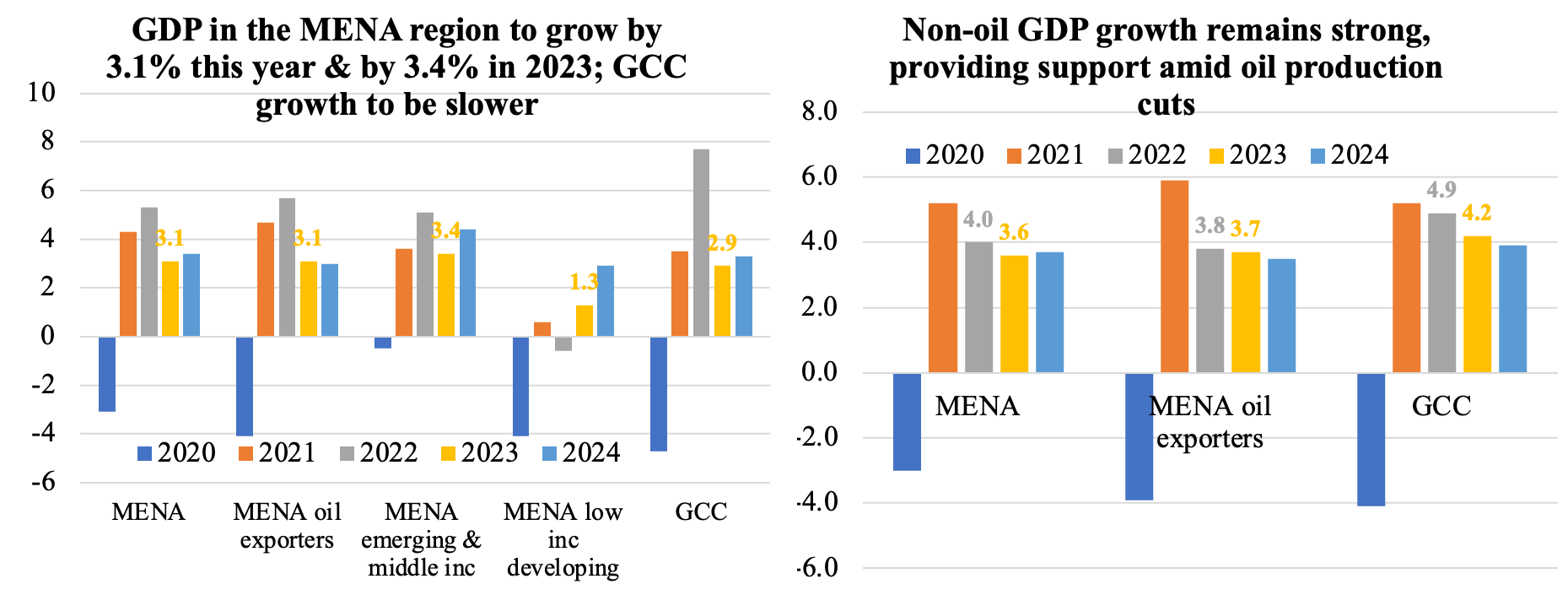

1.MENA to grow by 3.1% in 2023

- Real GDP growth in the MENA region was robust in 2022 (5.3%), including in some non-oil exporting nations (e.g. Jordan, Tunisia).

- Many emerging and middle-income countries in MENA will see growth slow this year, according to the IMF, as they deal with higher inflation rates, exchange rate depreciation, lower growth in domestic & external demand.

- Oil production cuts will lower GDP growth in the GCC (2.9% in 2023 vs 7.7% in 2022), but non-oil GDP is expected to remain strong (4.2% in 2023) given government’s diversification efforts and related reforms.

- Inflation is elevated in many MENA nations, higher in countries that experienced currency depreciations; services inflation leading to rise in core inflation as well.

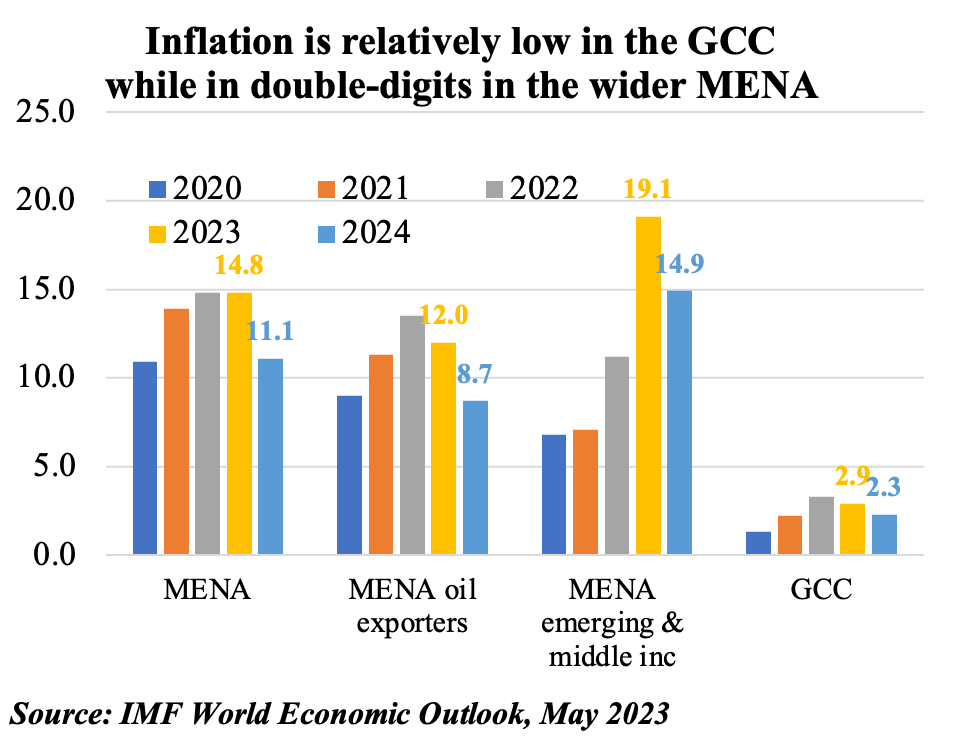

2. Divergence in Middle East PMIs persists

- An uptick in new orders resulted in higher PMI readings in the GCC: in Saudi Arabia and UAE, it rose at the fastest pace since Sep 2014 and Nov 2021 respectively. In Qatar, new business increased at the fastest pace in 9 months.

- All three nations have seen demand increase alongside the rollout of new projects across sectors.

- Supported by strong domestic demand, many businesses hired more staff: in UAE, employment was higher than the long-run trend; in Saudi, it was stronger than Q1 average; Qatar’s employment index jumped to a 9-month high.

- Input costs have been rising marginally, with increases in raw materials prices & salaries. Output cost inflation rose in both Saudi Arabia and Qatar, while selling prices in the UAE (in contrast) dropped at their quickest pace since Sep 2020.

- PMIs in Egypt and Lebanon stayed in contractionary territory.

- Egypt’s headline reading moved up in Apr, thanks to output and new orders rising to six and four-month highs, while sales and overall activity was dampened by lower demand (& higher prices).

- In Lebanon, PMI inched lower though there were some signs of relief: new orders from abroad increased; selling charges declined for the first time since Dec 2019 as input prices eased.

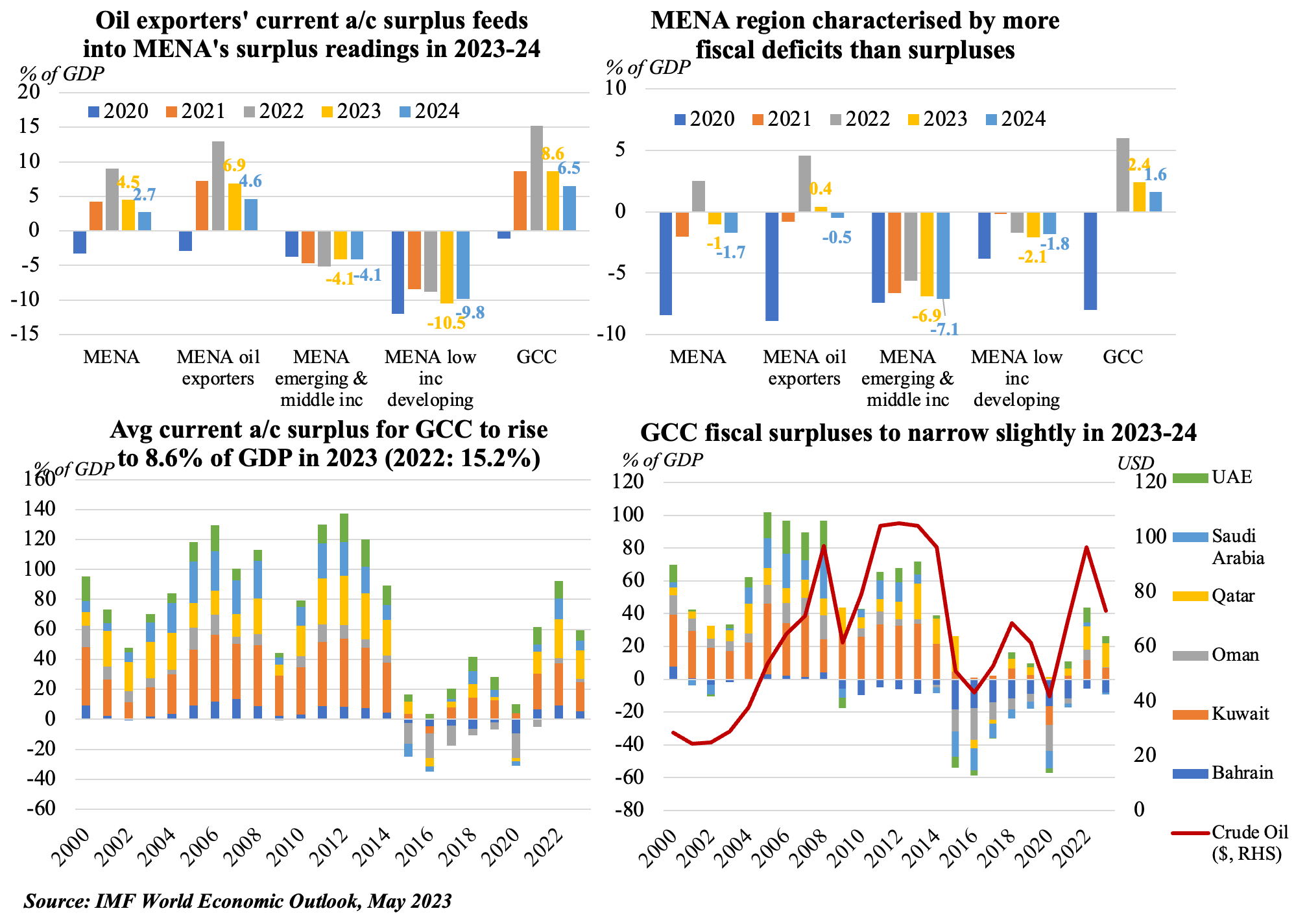

3. Oil revenues support improved fiscal stances in the GCC; fiscal consolidation in many MENA emerging nations (especially those with IMF support); oil exporters current account surpluses to decline but stay high; other MENA nations to see deficits narrow (thanks to rebound in tourism, increased remittances etc.)

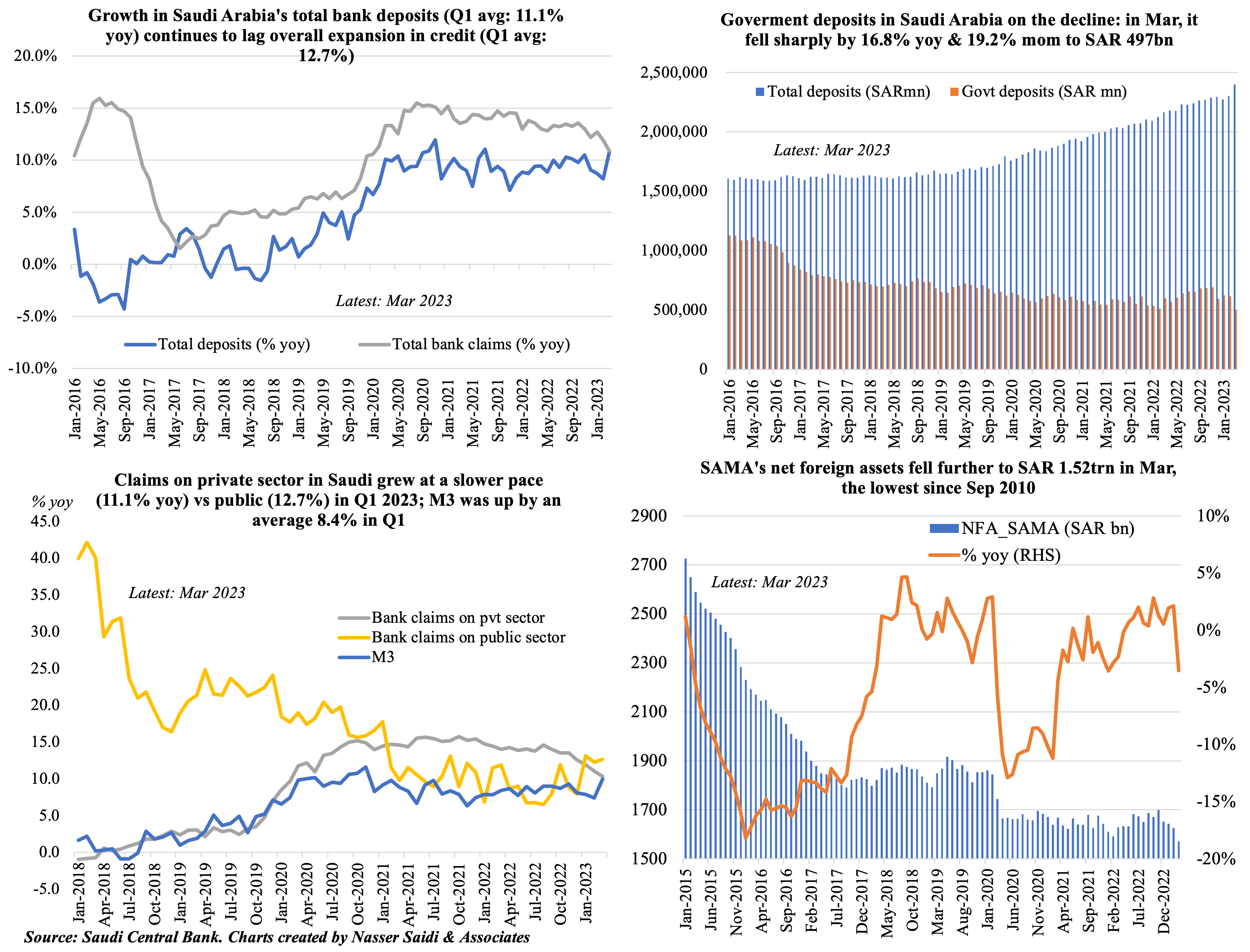

4. Saudi Arabia: Deposits grow faster than credit disbursed, but government deposits plunged in Mar. SAMA net foreign assets fell to SAR 1.52trn in Mar, lowest since Sep 2010

5. UAE’s Q1 2023 credit sentiment survey indicates healthy demand & banks’ increasing willingness to lend

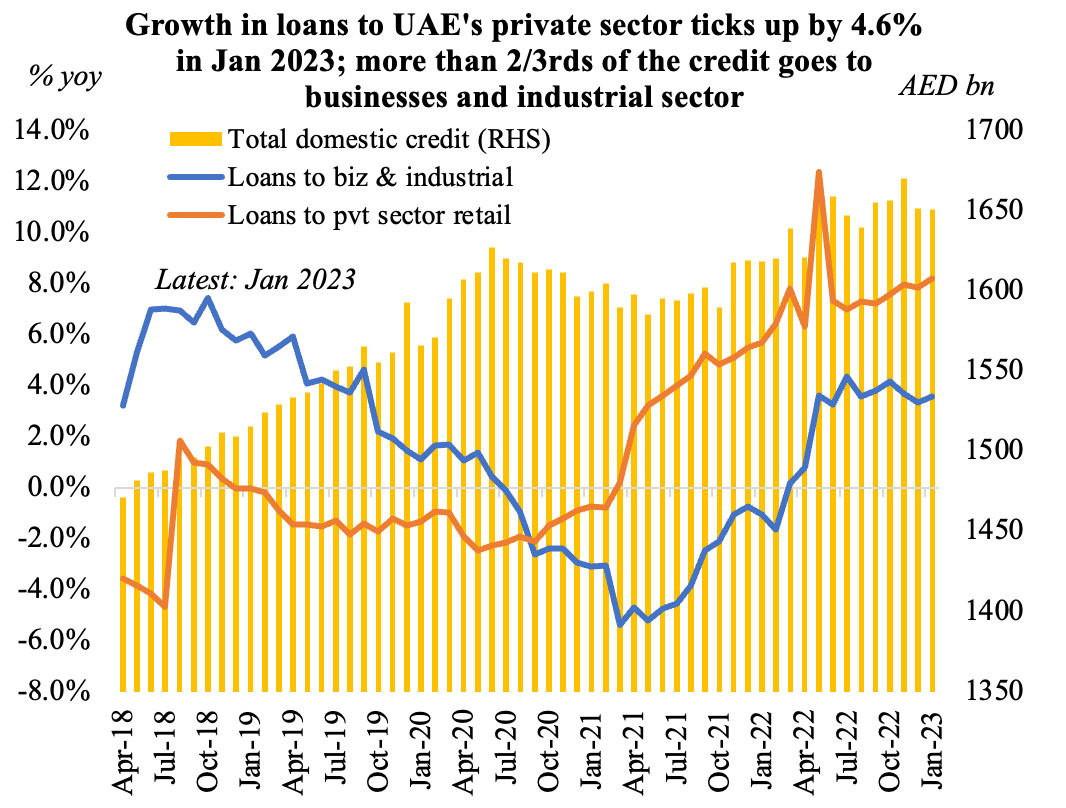

- Loans disbursed to UAE’s business & industrial sector accounts for ~50% of total domestic credit.

- UAE central bank’s credit sentiment survey shows a healthy credit appetite, with demand rising alongside banks willingness to lend (credit up 2% yoy in Jan)

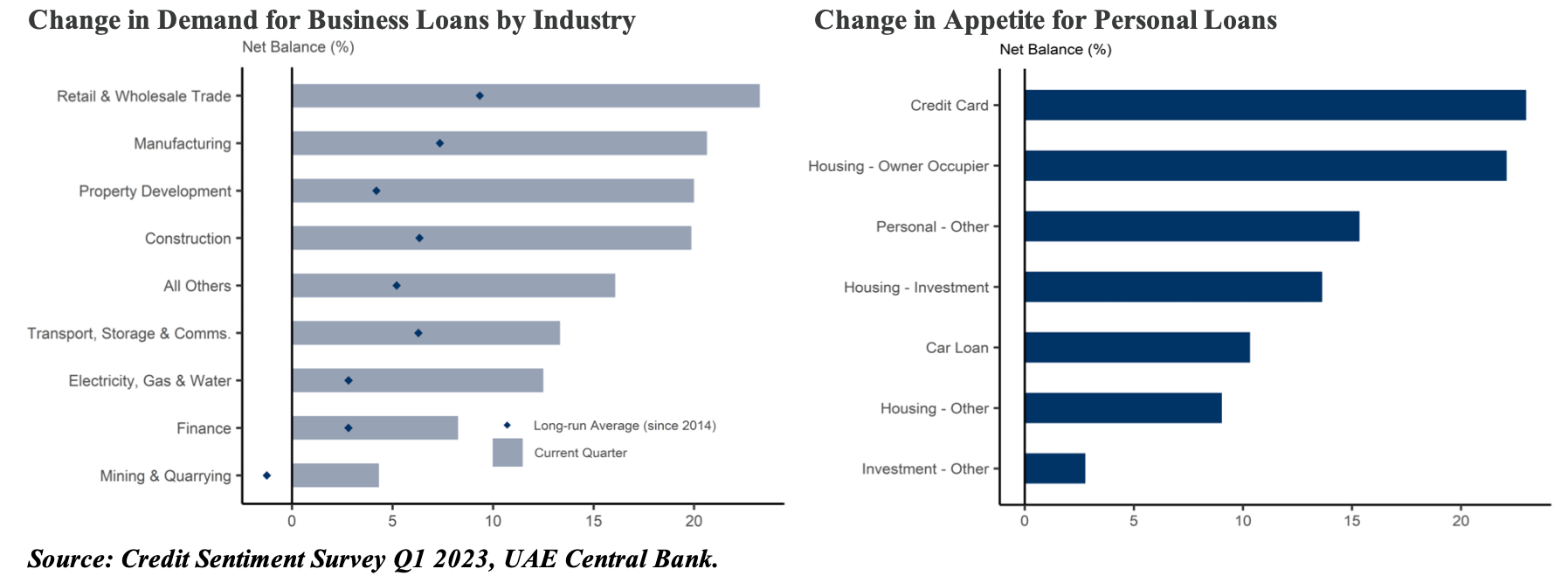

- Growth in demand for business loans rose in Q1 2023 (net balance of +23.4): it was high among large firms & SMEs. However, demand has come off previous quarter highs.

- By industry, demand was relatively strong in retail & wholesale trade, manufacturing, property development & construction.

- Personal loans demand showed an uptick in Q1 2023, with highest increase in the Northern Emirates. Credit cards and housing were the most significant segments.

Powered by: