Markets

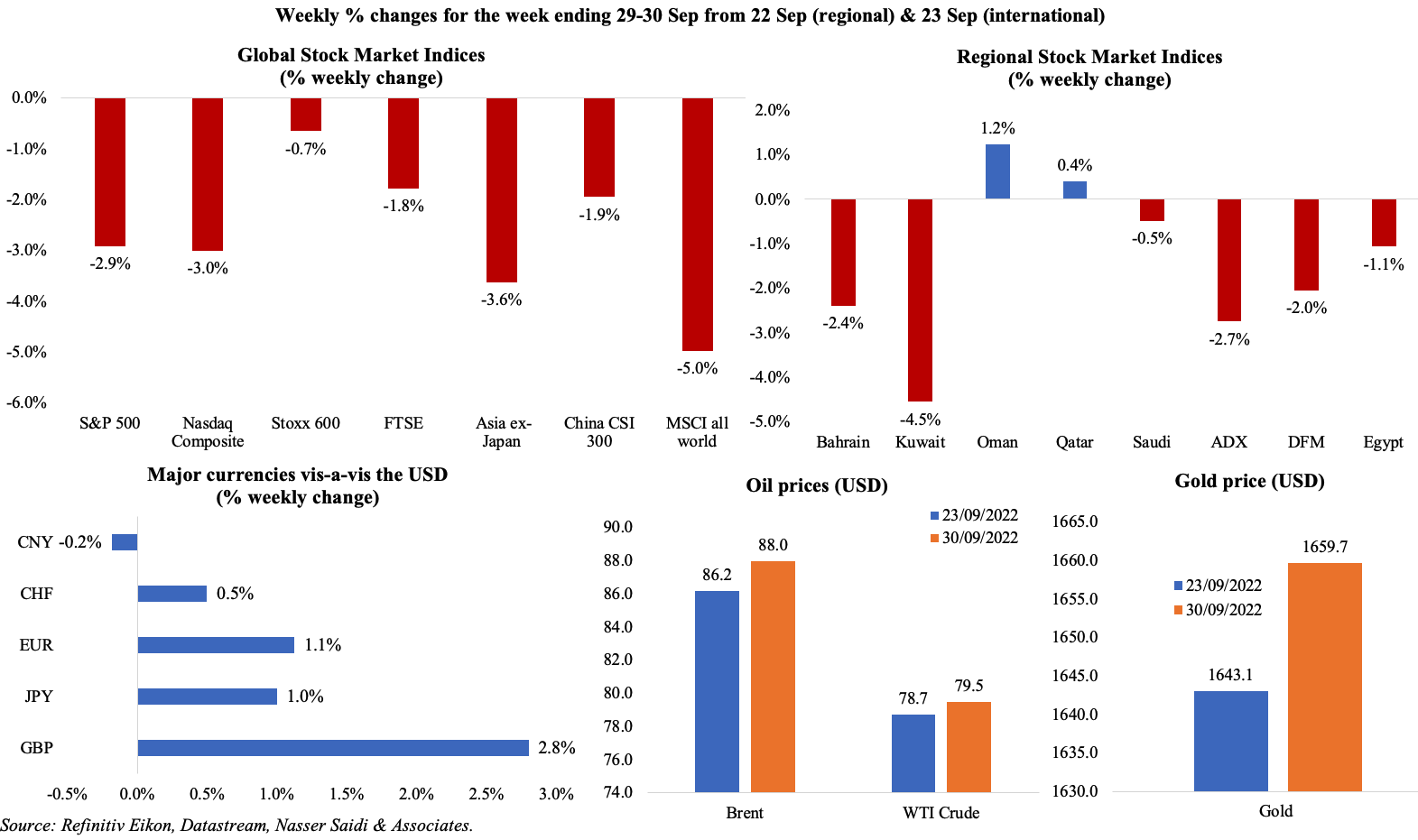

Most global markets ended in the red last week: S&P 500 declined by nearly 5% in Q3, the third consecutive quarter of losses – the longest streak since 2008; Stoxx also clocked in a 3rd straight quarter of losses while the MSC world equity index was down by 7.3% in Q3. Regional markets were mostly down with Oman and Qatar the only bright spots, the latter thanks to the rebound in natural gas prices; Saudi Tadawul hit its lowest in over 9 months last Monday, and posted a monthly loss in Sep. Sterling touched its highest level vis-à-vis the dollar on Friday after a steep sell-off earlier in the week, but remains about 9% lower in the past three months – the worst quarter since the 2008 financial crisis. Oil prices gained after 5 weeks of dips, on expectations of a cut in crude output (potentially to the tune of 1mn barrels per day) at the Oct 5th OPEC+ meeting. Gold price posted a very modest gain last week, but had the worst quarter since Mar 2021.

Global Developments

US/Americas:

- US GDP expanded at an unrevised 0.6% annualised rate in Q2, following a decline of 1.6% in Q1: this is in line with the definition of a technical recession. Real gross domestic income was revised much lower, from 1.4% to 0.1%. Core PCE increased to 4.7% qoq in Q2 (Q1: 4.4%).

- Personal income in the US inched up by 0.3% mom in Aug, while spending rose by 0.4%. Spending was led by services (+0.8%): though spending increased in transportation services, healthcare and dining out, that on recreational services fell.

- The PCE price index gained 0.3% mom and 6.2% yoy in Aug, while core PCE climbed (0.6% mom and 4.9% yoy).

- Durable goods orders edged down for the second consecutive month in Aug, by 0.2% mom (Jul: -0.1%). Orders for transportation equipment led the fall, down by 1.1% and within that, orders for non-defence aircraft and parts plummeted by 18.5% in Aug (Jul: +12.1%). Non-defence capital goods orders excluding aircraft grew by 1.3% (Jul: 0.3%).

- US goods trade balance deficit in Aug narrowed for a 5th consecutive month, to USD 87.3bn from Jul’s USD 91.1bn. Goods exports fell by 1.7bn to USD 179.8bn, led by declines in motor vehicles (8.9%) and industrial supplies (3.5%). Goods imports fell by USD 4.6bn to USD 367.1bn, as industrial supplies and capital goods declined by 6.9% and 1.8% respectively.

- S&P Case Shiller home price indices gained 16.1% in Jul, though decelerating from Jun’s 18.7% gain. In monthly terms, prices fell by 0.4% – the first decline since Feb 2012.

- New home sales unexpectedly surged by 28.8% mom to 685k units in Aug – most likely to be a temporary rebound. Pending home sales meanwhile fell for the 3rd consecutive month, down by 2% mom to the lowest level since Apr 2020. The 30-year fixed mortgage rate averaged 6.29% mid-Sep, the highest since Oct 2008. Expect higher mortgage rates to bite into new and pending home sales over the coming months.

- Chicago Fed National activity Index fell to zero in Aug, from Jul’s 5-month high of 0.29, pulled down by production related indicators. Dallas Fed manufacturing business index worsened to -17.2 in Sep, following the previous month’s -12.9 reading: new orders remained in a negative territory and falling for the 4th month (-6.4) though the production index rose 8 points to 9.3. Richmond Fed manufacturing index improved to zero in Sep (Aug: -8), with improvements in shipments (+14 from Aug’s -8) amid new orders easing to -11 from -20.

- Chicago PMI fell sharply to 45.7 in Sep (Aug: 52.2) – the lowest level in more than 2 years.

- Michigan consumer sentiment index was revised down slightly to 58.6 in Sep from the previous estimate of 59.5. This was a tad higher than Aug’s final reading of 58.2.

- Initial jobless claims fell by 16k to a 5-month low of 193k in the week ended Sep 23rd, with the 4-week average down to 207k. Continuing jobless claims declined by 29k to 1.347mn in the week ending Sep 16th – the lowest reading since July. Both indicators are descriptive of a continuing tight labour market.

Europe:

- Inflation in the eurozone soared to another record-high of 10% yoy in Sep (Aug: 9.1%), with energy prices rising by 40.8% (Aug: 38.6%) and prices for food, alcohol and tobacco up by 11.8% (Aug: 10.6%); core inflation rose to 4.8% (Aug: 4.3%). EU’s energy ministers have agreed on 3 proposals to lower energy costs for both consumers and businesses: this includes a 5% mandatory reduction in peak electricity consumption, a windfall levy on fossil fuel companies and a EUR 180/MWh cap on the price of electricity generated by non-gas power producers with revenues above that being recycled to consumers.

- The harmonised index of consumer prices in Germany jumped to a new 71-year high of 10.9% in Sep (Aug: 8.8%). Energy prices rose by 43.9% and food prices were up 18.7%.

- Germany’s Ifo readings suggest recession is just around the corner: business climate index declined to 84.3 in Sep (Aug: 88.6), the lowest value since May 2020. Current assessment and expectations readings slipped by 3 and 5.3 points to 94.5 and 75.2 respectively. Nearly two thirds of companies are concerned about supply bottlenecks.

- Unemployment rate remained unchanged at 5.5% in Germany in Sep, with the number of unemployed increasing by 14k to a seasonally adjusted 2.51mn. Unemployment rate in the eurozone stayed at 6.6% in Aug while the total number of unemployed fell by 30k to just below 11mn – the smallest monthly decline this year.

- Germany’s GfK consumer climate indicator worsened in Oct, with the reading hitting a new record low of -42.5 (Sep: -36.8). Economic expectations declined by 4.3 points to -21.9, lowest since May 2009 while willingness to buy fell 2.8 points to -19.5, lowest since Oct 2008.

- Economic sentiment indicator in the eurozone declined sharply to 93.7 in Sep, from Aug’s reading of 97.3, with households’ confidence falling to -28.8 from -25. Business climate indicator in the eurozone inched lower to 0.81 in Sep (Aug: 0.83).

- UK’s GDP grew by 0.2% qoq and 4.4% yoy in Q2, revised up from the earlier estimate of a 0.1% contraction, but remained 0.2% below its pre-pandemic peak. Separately, ONS data showed the current account deficit in Apr-Jun shrank to GBP 33.8bn, or 5.5% qoq from a GBP 43.9bn deficit in Q1 – which was the biggest deficit on record.

- Following widespread opposition, UK’s PM reversed the policy to remove the 45% top rate of income tax.

Asia Pacific:

- China’s NBS manufacturing PMI increased to 50.1 in Sep (Aug: 49.4), posting the first expansion in 3 months, thanks to 50+ readings in both output and buying activity while new orders shrank (49.8 from Aug’s 49.2). Caixin manufacturing PMI unexpectedly worsened in Sep, down to 48.1 (the lowest since May) from 49.5 in Aug. Sentiment touched the lowest since Nov 2019, given lockdowns and restrictions after every new outbreak.

- Non-manufacturing PMI in China eased to 50.6 (Aug: 52.6): new orders slipped (to 43.1 from Aug’s 49.8) as did foreign sales (46 from 48.9) while input and output costs stabilised.

- China’s central bank lowered the interest rate for housing provident fund loans by 0.15ppts for first-time home buyers from Oct. 1 – aiming to prop up the real estate market.

- Japan spent JPY 2.84trn (USD 19.7bn) intervening to defend the yen’s plunge: this was effective temporarily. However, so long as the BoJ continues its ultra-loose monetary policy, the yen will remain under pressure.

- Leading economic index in Japan was revised lower to 98.9 in Jul – the lowest reading since Jan 2021- and compared to the initial estimate of 99.6 and Jun’s 100.3. The coincident index was also lowered to 100.1 from an initial estimate of 100.6.

- Preliminary manufacturing PMI in Japan slipped to 51 in Sep (Aug: 51.5), the weakest pace of expansion since Jan 2021, with both output and new orders remaining sub-50 for the 3rd straight month. Services PMI rebounded to above-50, clocking in a reading of 51.9 from Aug’s 49.5, as restrictions were eased and both output and new orders grew.

- Industrial production in Japan increased for the 3rd consecutive month, with output up by 2.7% mom and 5.1% yoy in Aug. Supporting the monthly rise were machinery (3.5%) and iron and steel (3.6%) while automobiles (-4.0%) and petrochemicals (-2.4%) dropped.

- Japan’s unemployment rate edged down to 2.5% in Aug (Jul: 2.6%). Labour participation rate was unchanged at 62.9% while the job-to-application ratio improved to 1.32 (Jul: 1.29).

- Retail sales in Japan expanded by 1.4% mom in Aug, rising for the 6th consecutive month; in yoy terms, sales were up by 4.1%.

- The Reserve Bank of India increased the repo rate by 50bps to 5.9% while leaving the reverse repo rates unchanged at 3.35%. This is the 4th consecutive rate hike by the RBI, which has now raised rates by 190bps since May. The hike was largely anticipated amid rising inflationary pressures and the depreciating rupee.

- India’s current account deficit widened to USD 23.9bn in Apr-Jun 2022 from USD 13.4bn the previous quarter, thanks to a widening trade deficit (to USD 68.6bn from USD 54.5bn the previous quarter). Balance of payments unexpectedly moved into a surplus of USD 4.6bn from a deficit of USD 16bn in Jan-Mar, due to a sharp increase in banking capital (unlikely to be a recurring move).

- South Korea’s exports grew by 2.8% in Sep – the slowest pace since Oct 2020. Imports meanwhile grew at a faster pace of 18.6%, bringing trade balance into a deficit of USD 3.77bn (the 6th consecutive deficit month).

- Industrial production in Singapore grew by 0.5% yoy in Aug (Jul: 0.3%), with a slowdown registered in electronics production (-7.8% in Aug, more than Jul’s 5.9% drop).

Bottom line: The dismal global financial market performance during the quarter notwithstanding, other news that dominated were UK’s turmoil (mostly of its own making resulting in record-low sterling, and forcing the BoE to resume QE by intervening to calm bond markets), Russia’s nuclear threats as well as election results in Italy (markets have so far reacted to Meloni better, when compared to UK’s Truss) and Brazil (where a second round is expected after no candidate achieved more than 50% majority). This week will see PMI releases for Sep: though global shipping costs are falling, worries about Europe’s energy supply issues, pass-through of prices to consumers and weakening demand are likely to dominate businesses outlook.

Regional Developments

- Bahrain’s GDP grew by 6.95% yoy in Q2 2022 (Q1: 5.4%), the highest since 2011, with non-oil sector the main contributor to growth (62% of total GDP in Q2). Among non-oil sectors, Covid19 hit sectors continue to recover at a faster pace, given the easing of restrictions: hotels and restaurants grew by 18.1%, followed by transport & communication(15.1%).

- Non-oil exports from Egypt grew by 20% yoy in the fiscal year 2021-22, revealed the minister of planning and economic development.

- Egypt’s export revenue from natural gas and LNG touched USD 8bn in the 2021-22 fiscal year after volumes rose by 7.2mn tonnes, as disclosed by the cabinet.

- Money supply (M2) in Egypt grew by 24% yoy to EGP 6.8trn (USD 348.9bn) in Aug.

- Net FDI inflows into Egypt accelerated by 53% yoy to USD 7.3bn in the period Jul 2020-Mar 2022, according to the CEO of the General Authority for Investment and Free Zones.

- Egypt’s government plans to borrow EGP 878.5bn through issuing securities during Oct-Dec 2022: the Ministry of Finance aims to offer 52 Treasury bill issuances worth EGP 704bn, and 34 bond issuances worth of EGP 174.5bn during that period.

- Egypt disclosed a 84.5% yoy increase in tourist arrivals to 4.9mn in H1 2022.

- Egypt’s new social insurance and pension law will allow for investments of 75% of annual pension fund’s surplus in T-bills and bonds, signaling potential financial repression.

- Iraq is one track to complete the first phase of the USD 1bn Karbala airport by the end of 2023: when completed the airport could have a capacity of 3mn passengers.

- Kuwait’s opposition made gains in the parliamentary elections, following which the government’s resignation has been accepted by the crown prince.

- The Lebanese Parliament failed to elect a new President: the current President’s term ends on Oct 31st.

- Lebanon’s parliament passed the 2022 budget, endorsing a rate of LBP 15,000 to the dollar, with spending at LBP 41trn and revenues at LBP 30trn. The budget, which also tripled salaries of public sector employees, fell massively short of IMF reform requirements.

- After Lebanon’s finance minister stated that the current LBP 1507 official exchange rate would be replaced from Nov 1st, the PM stated that the rollout to a new official rate of LBP 15,000 would be more gradual.

- Oman and UAE agreed to boost trade and investment ties: a USD 3bn joint railway company was established to set up a link between Oman’s Sohar port and UAE; ADQ and Oman Investment Authority agreed to establish a AED 592mn VC fund to invest in Oman-based tech companies and also and identified investment opportunities worth over AED 30bn (USD 8.17bn) in new projects within Oman.

- S&P affirmed its credit rating for Oman at BB- with a stable outlook, thanks to the increase in oil prices and recent initiatives aimed at fiscal sustainability.

- The Qatar Investment Authority launched a new market making initiative to boost liquidity at the Qatar Stock Exchange.

- Qatar’s trade surplus surged by 89% yoy in Aug: exports grew by 72% yoy to QAR 46.8bn (USD 13bn) thanks to the exports of gas.

- Japan’s crude oil imports from the Middle East grew by 12.1% yoy to 2.82mn barrels per day (bpd) in Aug, making its dependence on the region at a high 94.5%.

- Credit Suisse Bank’s Global Wealth Report places Qatar as having the highest per capita wealth in the Arab World (USD 183,100), followed closely by Kuwait (USD 171,300) and the UAE (USD 122,800).

- Germany witnessed surge in overnight stays from GCC nationals in H1 2022, a 318% jump to 335,000. The region is the top Asian source market for the country.

- The UN’s E-Government Development Index has 3 GCC nations within the top 50: UAE, Saudi Arabia and Oman are ranked 13th, 31st and 50th this year.

Saudi Arabia Focus

- The Saudi Crown Prince has been assigned a new role as PM; the foreign minister, finance minister and investment minister retained their positions. The deputy defence minister was promoted to defence minister role: under him, self-sufficiency in military industries is expected to reach 50% from the 15% currently.

- Saudi Arabia’s budget surplus is estimated to hit SAR 90bn (USD 24bn) this year, according to the finance ministry. Next year, revenues are expected at SAR 1.123trn and expenditures at SAR 1.114trn, with a surplus of SAR 9bn. Real GDP is estimated to rise to 8% in 2022, with non-oil activity growing by 5.9%.

- Saudi Arabia’s Q2 unemployment rate eased to 5.8% (Q1: 6%), with citizens unemployment rate declining to 9.7% in Q2, and Saudi female unemployment rate was down to 19.3%(Q4 2016: 34.5%). Average monthly wages grew by 2% qoq among nationals & by 6% among expats (citizens earn on average 2.5 times more than expats). Major sectors that have recorded growth in jobs for Saudis include technology and communications, tourism and logistics.

- Per capita GDP in Saudi Arabia increased to SAR 29,820 in Q2, the highest level in years.

- Current account surplus in Saudi Arabia widened by 17.6% yoy to SAR 170.1bn (USD 45.26bn) in Q2 2022, supported by an increase in exports of goods (23.1% to SAR 272.2bn) while services posted declines (-53.9%). Foreign assets inched up by 2.4% qoq to SAR 4.9trn.

- Residential mortgage loans in Saudi Arabia surged by 76.6% mom to SAR 12.7bn in Aug, according to the latest central bank data. Consumer and credit card loans grew by 2.1% and 4.8% while total bank credit inched up by 1.6% to SAR 2.3trn in Aug.

- Saudi Capital Market Authority approved 5 new IPO applications: Power and Water Utility Co for Jubail and Yanbu (Marafiq) on Tadawul alongside Saudi Top for Trading Co., Molan Steel Co., Leen Alkhair Trading Co. and Meshkati Trading Co. on Nomu.

- The Saudi Central Bank granted permits to 4 new fintech firms to provide Open Banking Solutions in the Regulatory Sandbox. This brings the total number of permitted firms to 42, of which 15 have graduated to full authorisations and licenses.

- Bloomberg reported that Saudi PIF delivered a shareholder return of 25% last year, more than double the annual average of 12% between 2017 and 2020. This was disclosed in a prospectus for its debut green bond sale. A debut issuance will be under GACI First Investment Company and guaranteed by PIF and issued in tranches of five, 10 and potentially a longer-dated tenor will follow.

- NEOM’s tech unit rebranded and changed its name to Tonomus: according to the CEO, the company has invested USD 1bn in 2022 in AI including a metaverse platform, USD 1bn in the connectivity network and is investing USD 1.2bn in venture and entrepreneurship.

- Saudi Arabia’s average oil production increased by 20% this year to 10.5mn barrels per day at end-Aug, reported Saudi Gazette.

- The Saudi Ports Authority signed 7 contracts and MoUs with public and private sector partners worth more than SAR 900mn (USD 239mn); among the projects is one to establish a logistics park at Jeddah Islamic Port.

- The World Tourism Organisation disclosed that the number of tourists into Saudi Arabia surged by 121% in H1 2022. Saudi also topped G20 nations for the flow rating of international tourists in Jan-Jul 2022. The Saudi minister of tourism revealed that the sector is accelerating at a pace of 14% versus pre-pandemic.

- The electricity interconnection project between Saudi Arabia and Jordan is expected to become operational in the second half of 2025, with related agreements to be signed in 2022.

- Saudi Arabia’s minister of environment, water and agriculture disclosed that the nation has launched a food security action plan in coordination with its regional partners with an initial funding of USD 10bn. Furthermore, domestically, the nation successfully reduced the use of water for agriculture (sector has grown by 7.8% this year) purposed by more than 40%.

- ACWA Power’s CEO disclosed that the firm’s investment portfolio exceeds USD 67bn: it currently has 60% of its projects in progress and 40% in development stages. In UAE it has invested USD 10bn in renewable energy, water and clean gas projects.

- According to a KAPSARC report, Saudi Arabia is estimated to become 60% more resilient to oil price shocks by 2030, given the rollout of Vision 2030’s economic reforms; Saudi household consumption is expected to be 40% less volatile.

- Saudi Arabia’s Social Development Bank has disbursed around SAR 13.2bn (USD 3.5bn) loans to freelancers and productive families, supporting 342,000 beneficiaries. Overall since it started providing loans, the bank has provided SAR 138bn to over 3mn citizens.

- Saudi Arabia’s development fund stated that a USD 63mn loan will be given to Senegal, for financing the construction of a coastal highway from Dakar to Saint-Louis and Dakar to Tivaoune.

- The IMF plans to open a regional office in Saudi Arabia: an MoU will be signed today (Oct 3rd) in Riyadh.

UAE Focus![]()

- The UAE aims to reach 90% of global trade supported by the low customs tariffs in the country, according to the minister of state for foreign trade. He disclosed that UAE would move aggressively to sign free trade agreements and CEPAs, with a goal to increase diversification away from oil and gas.

- India’s non-oil exports to the UAE grew by 14% yoy to USD 5.92bn in Jun-Aug – after the bilateral Comprehensive Economic Partnership Agreement (CEPA) came into place. During this period, India’s global non-oil exports grew by 3% and India’s imports from the UAE grew by 0.9% yoy to USD 5.61bn.

- Bilateral trade between Oman and the UAE amounted to more than AED 362bn between 2012 and 2021: trade rose to AED 46.5bn in 2021 from just AED 23.4bn at end-2012. The share of re-exports accounted for 45.5% of total trade during the decade while exports and imports accounted for 33% and 21.5% respectively.

- Non-oil bilateral trade between UAE and China touched AED 1.72trn (USD 468bn) in the decade spanning 2012-2021. In Q1 2022, bilateral trade touched AED 118.4bn, with imports forming the bulk (AED 102.7bn).

- The Dubai Metaverse Strategy aims to attract over 1000 firms working in the blockchain and metaverse space. It was revealed that Virtual Reality and Augmented Reality contributed USD 500mn to the UAE economy and has created 6700 jobs. Separately, the Minister of State for AI disclosed that Dubai’s metaverse strategy would be deployed in tourism, education, government services, retail and real estate sectors.

- The UAE Ministry of Economy launched the ministry’s headquarters in the metaverse, also allowing it to sign bilateral agreements with other nations in the metaverse. The nation aims to become one of the top 10 metaverse economies.

- Dubai-listed Salik rose by around 20% on its market debut on Thursday, before settling at a lower price, still up 11% from its IPO price.

- Moody’s disclosed that net combined profits of UAE’s four largest banks grew by 10% to USD 4.4mn in H1 2022 thanks to higher income from interest and lower provisioning charges.

- Licenses registered by Chinese investors in Ajman DED increased by 27% to 113 till end-Sep 2022. It was also revealed that Ajman’s exports to China totaled AED 2.5mn till end-Sep.

- Expo City officially opened in Oct: it is expected that the legacy site, which retained 80% of the Expo infrastructure, will become a city with tech-driven businesses and entertainment offerings – much beyond just a tourist destination.

- According to a study by Knight Frank, the UAE’s hospitality market is set to expand by 25% by 2030: about 48,000 rooms will be added to the existing 200k rooms portfolio and of these 76% would be in Dubai (which already has more than 130k rooms).

Media Review

7 days that shook the UK

https://www.ft.com/content/1ace8d42-f3ee-4fdd-a103-5cd4234e8c42

The Cost of the Fed’s Challenged Credibility: El-Erian

The Crypto World Is on Edge After a String of Hacks

https://www.nytimes.com/2022/09/28/technology/crypto-hacks-defi.html

A study of lights at night suggests dictators lie about economic growth

Powered by: