Weekly Insights 5 Aug 2022: Middle East economic activity steadies as loan growth rises & inflation bites

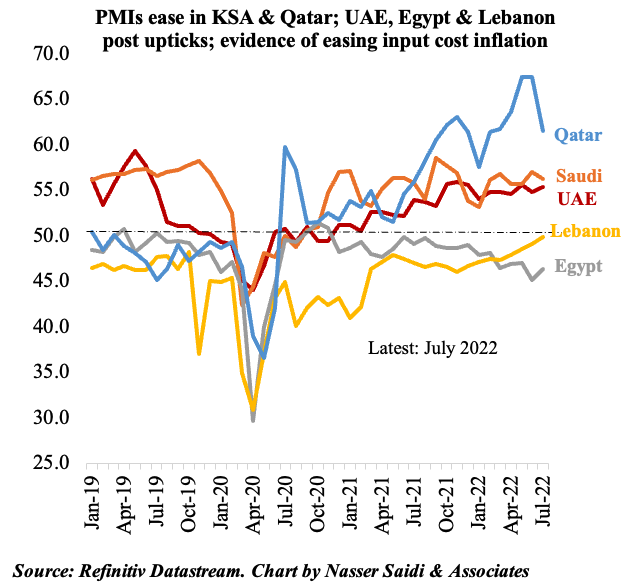

1. PMI stays strong in the GCC; cautious “recovery” in Egypt & Lebanon (seasonal uplift)

- The UAE PMI inched up to 55.4 in Jul (Jun: 54.8) while in Saudi, it eased to 56.3 from 57 the month before. Contrasts with Egypt and Lebanon where the readings remain sub-50, but seasonal high in Lebanon

- Inflation is a challenge, with oil and cost of raw materials rising. Input-cost .inflation edged slightly lower in July (but remains at a high level), while output cost inflation is still rising. UAE saw the latter accelerate to the second-highest reading in 4.5 years: but firms “opted to absorb additional cost burdens and cut their prices”: the trend is likely to reverse in the near-term as firms look to profits, probably one of the reasons sentiment fell to a 10-month low

- PMI in Lebanon jumped to the highest reading since Jun 2013 (staying below-50) linked to summer seasonality.

- Egypt’s PMI remained below-50 for the 20th straight month: employment stabilised and rate of declines for sub-indices slowed. Inflation remains an issue given rising prices for raw materials, fuel, and foodstuff

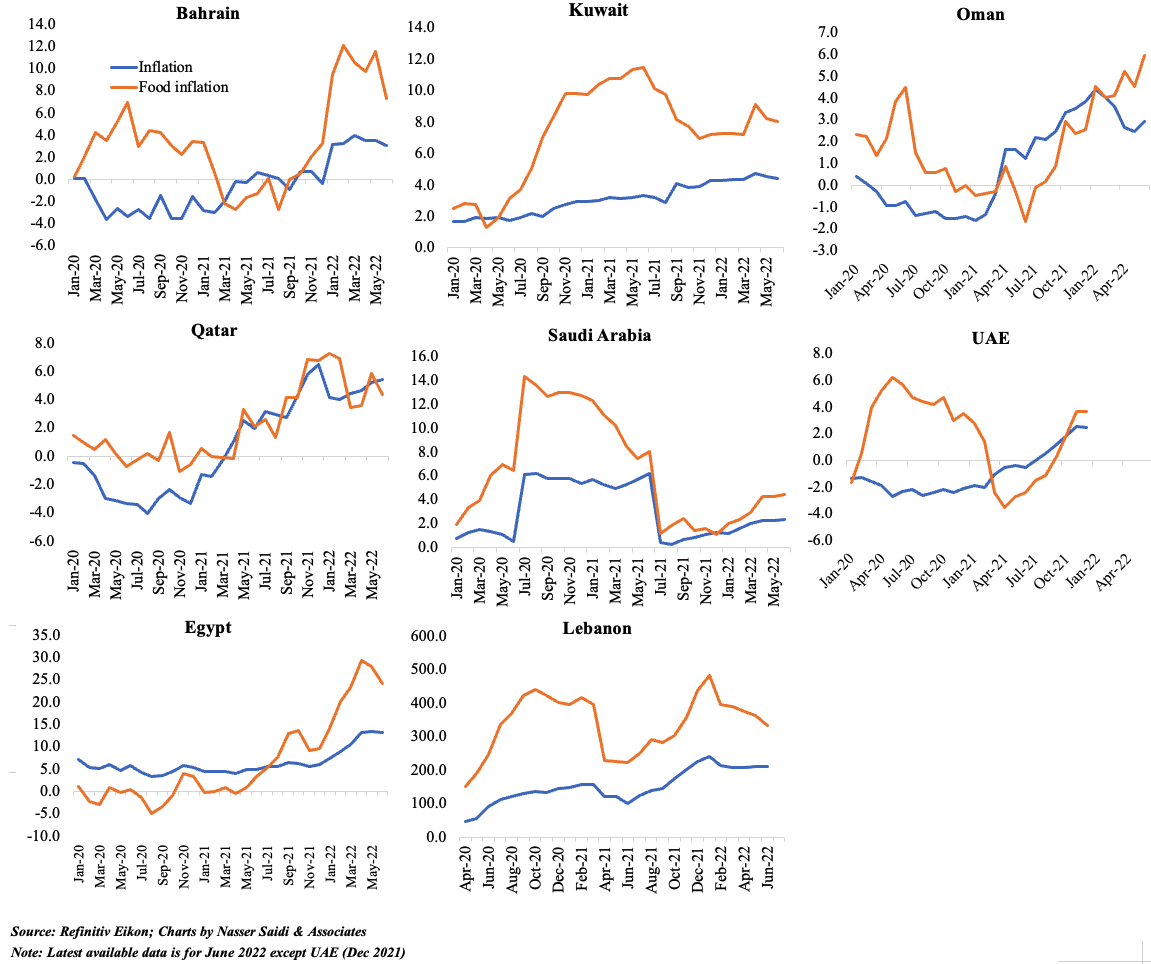

2. Inflation in the MENA region

- Relatively muted in GCC, given price controls, vs Egypt & Lebanon at triple digits

- Higher fuel costs in UAE likely to spillover into transport & other sectors

- Food prices appear to be stabilizing at the global level (UN FAO food price index posted a 4th consecutive month of decline in Jul, down 13.3% mom)

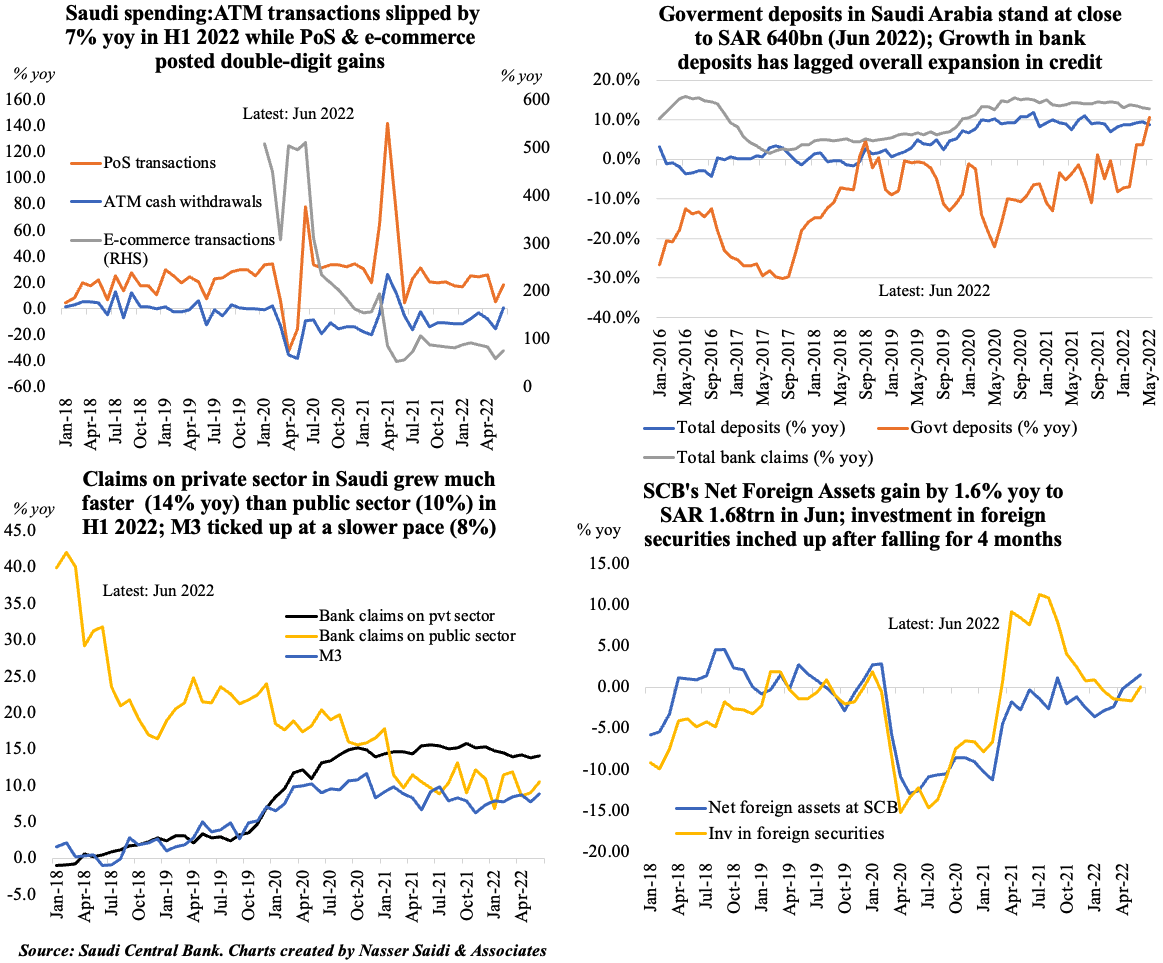

3. Saudi monthly statistics for June 2022: Key facts

- Saudi consumer spending increased in Jun

- Broad money supply ticked up as well as total demand deposits (thanks to gains in government deposits)

- Claims on private sector grew, with new residential mortgages for individuals rebounding after 9 straight months of yoy declines

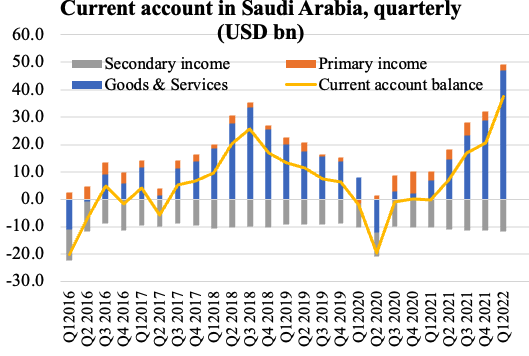

4. Saudi current account touches an 8-year high, supported by oil exports

- Current account surplus in Saudi Arabia jumped to USD 37.4bn in Q1 2022 (compared to Q1 2021’s deficit of USD 0.2bn), with the increase largely due to oil exports (+94.3% yoy); primary income touched USD 2.4bn in Q1 2022

- Remittances grew by 15% yoy and 3% qoq to USD 10.7bn in Q1 while net FDI grew by 9.5% yoy and 1.7% qoq to USD 1.97bn in Q1

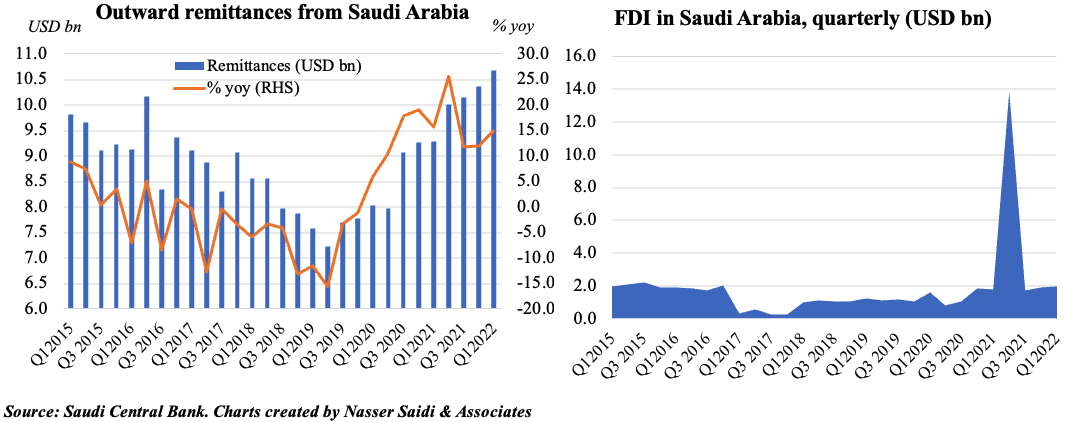

5. UAE released monetary statistics for Apr-May 2022

- Monetary aggregates M2 & M3 rebound in May by 0.1% mom and 1.7% respectively

- Deposit growth outpaced loans & advances in 2022: an average 6.8% vs 3.4%

- UAE credit growth driven by lending to GREs (average of 19.9% in Jan-May 2022) and private sector (2.5%)

- Lending to the business and industrial sector, which had rebounded in Mar after 20 months of declines, posted a 12.4% yoy growth in May

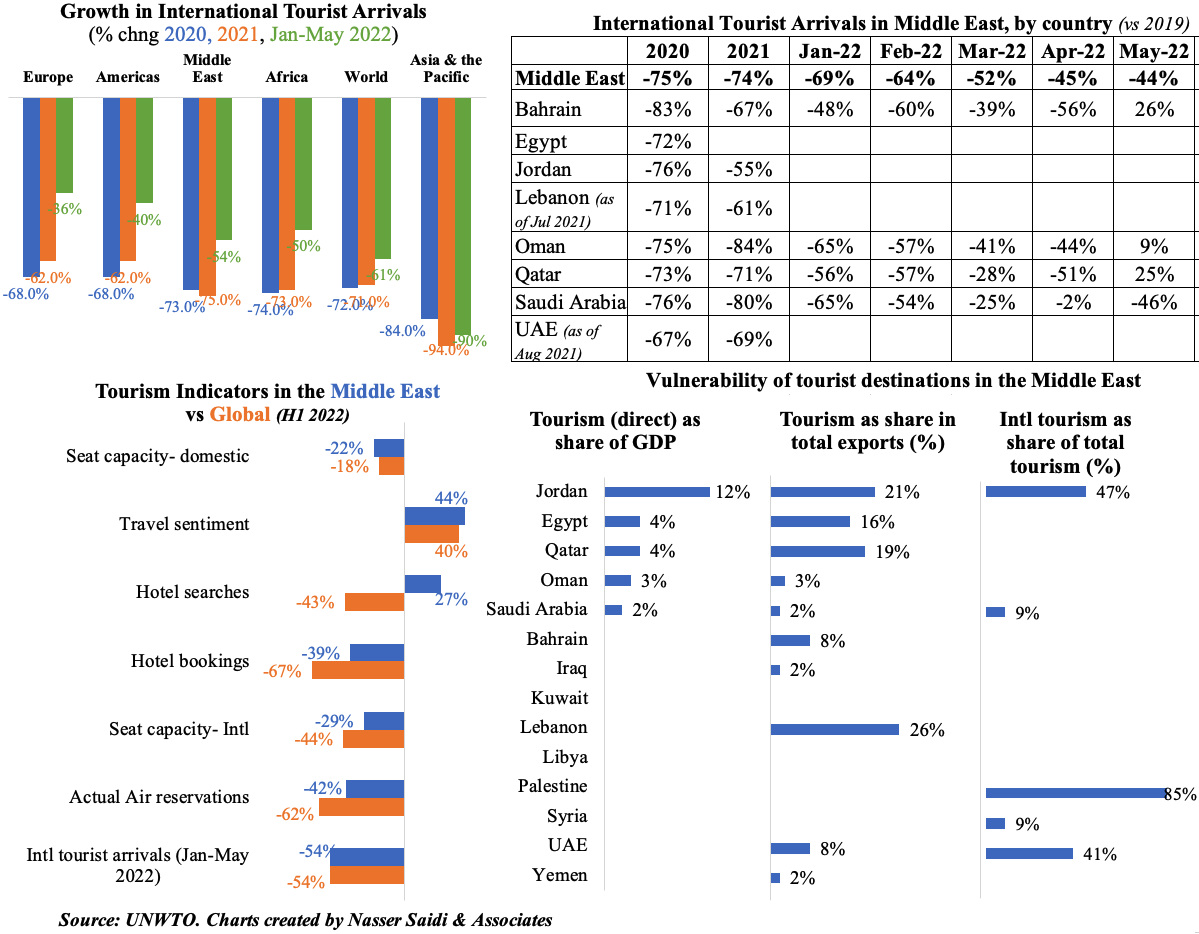

6. Travel & tourism recovery continues in the Middle East

- Strong rebound in international tourist arrivals: Middle East arrivals are down by 54% compared to 2019 (vs down by 75% in full year 2021 vs 2019)

- A breakdown by Middle East countries (where data is available) shows that, other than Saudi Arabia, all nations post increases in arrivals in May 2022 (vs 2019) since Covid hit

- Various tourism indicators collated by UNWTO indicate better Middle East performance vis-s-vis global in H1 2022: notably, Middle East hotel searches have risen by 27% in H1 2022, versus a decline of 43% globally

- Tourism shares have fallen significantly in 2022 (vs pre-Covid)