Weekly Insights 1 Jul 2022: GCC’s non-oil sector & labour market recovery alongside rising inflation; global emissions ticking up while refinery capacity declined in 2021

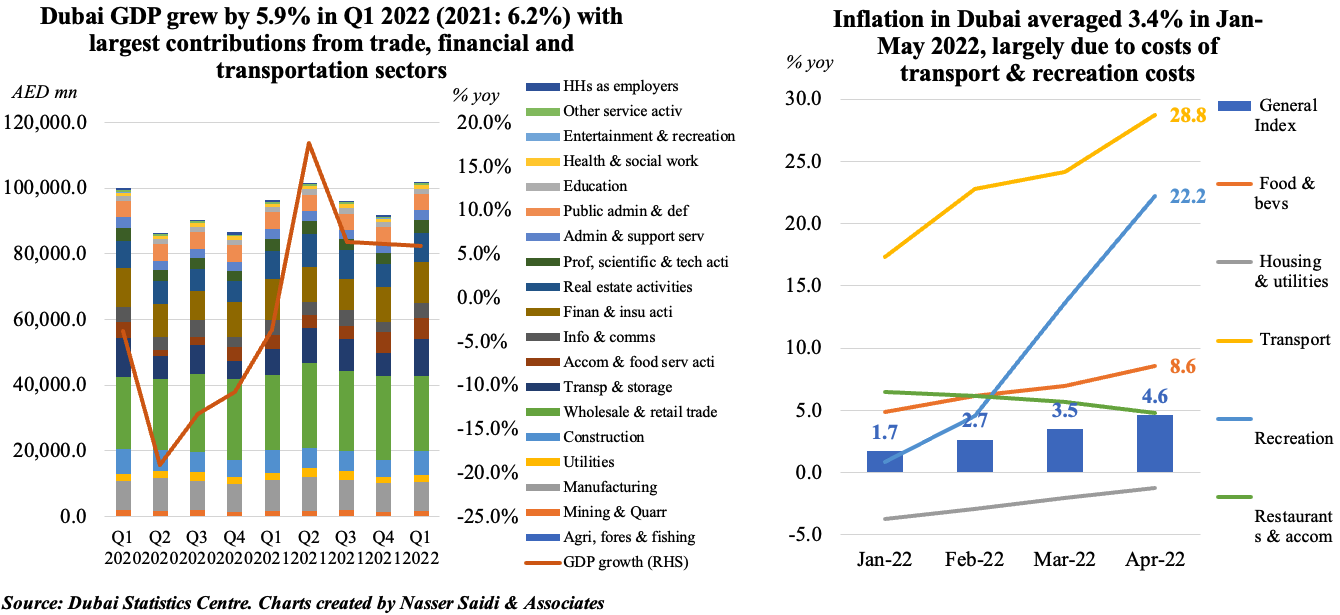

1. Dubai real GDP grows by 5.9% yoy in Q1 2022; inflation is rising, largely driven by transport and food costs

- Dubai’s real GDP growth of 5.9% yoy in Q1 2022 was supported by a recovery in Covid-affected sectors (transportation & storage which grew 40.35% and accommodation & food services up 47.07%)

- Jan-Mar 2022 also benefitted from Dubai’s low restriction levels, (including for travel, quarantines) and high vaccination rates as well as tourists’ visits (during the Expo). Mobility rates are at pre-pandemic levels

- Dubai PMI averaged 53.6 in Q1 2022 (vs 50.8 in Q1 2021): though costs were on the rise globally, businesses in the emirate chose to remain more competitive by absorbing most of the cost increases

- Inflation is ticking up in Dubai – to 4.7% in May from 1.7% in Jan – despite businesses reluctance in passing on costs; the increase in fuel prices (5 times this year) has been spilling over to other sectors. Petrol is now 3X more expensive than in Kuwait

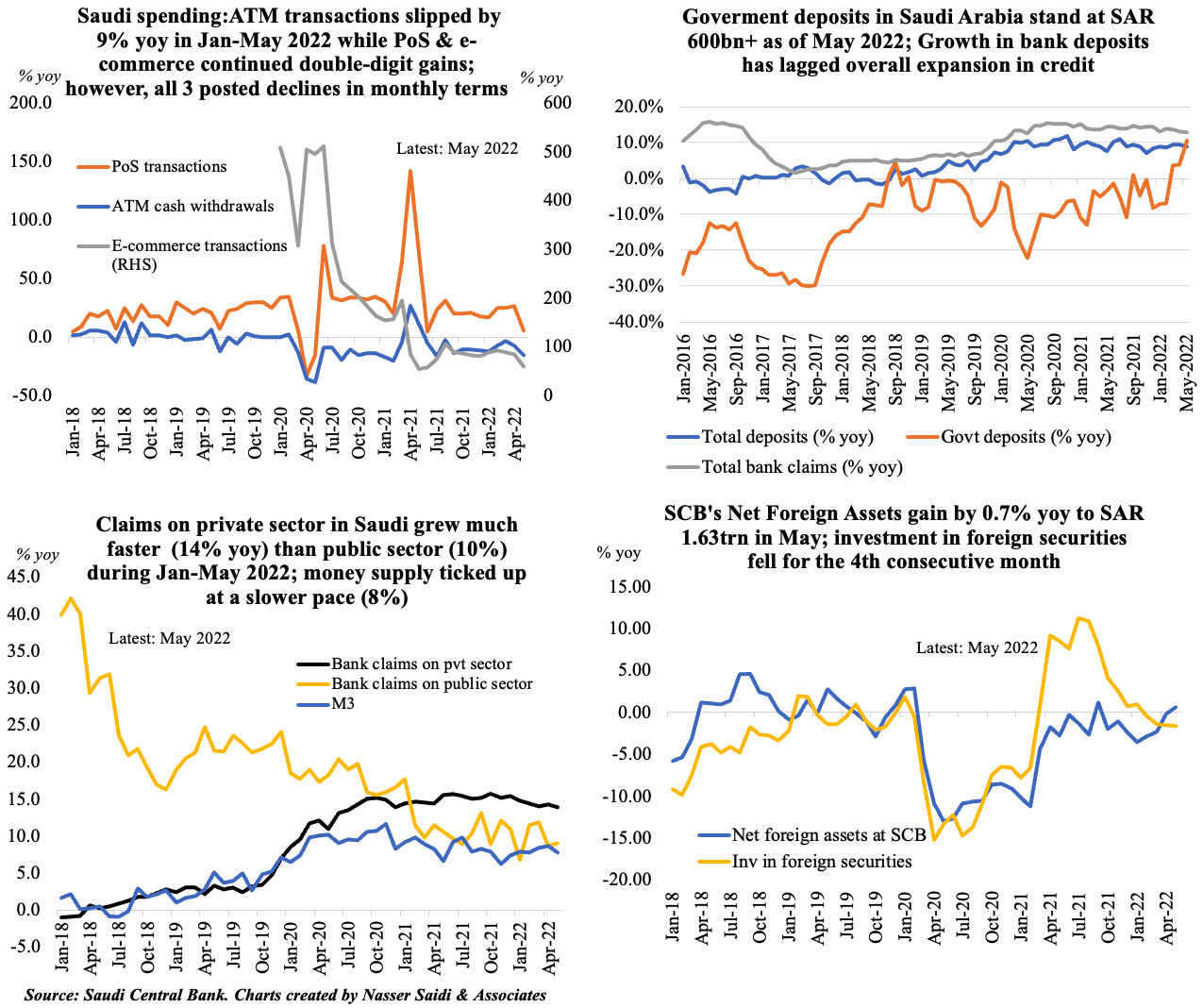

2. Saudi monthly monetary data (in % yoy terms) shows:

- A slight ease in overall spending; likely to rise again in Jun-Jul (summer holidays, Eid)

- Government deposits have not kept pace with higher oil prices; overall growth in bank claims (thanks to mortgage lending) has outpaced that of overall deposits

- Net foreign assets gained in yoy terms; while investment in foreign securities fell for the 4th straight month

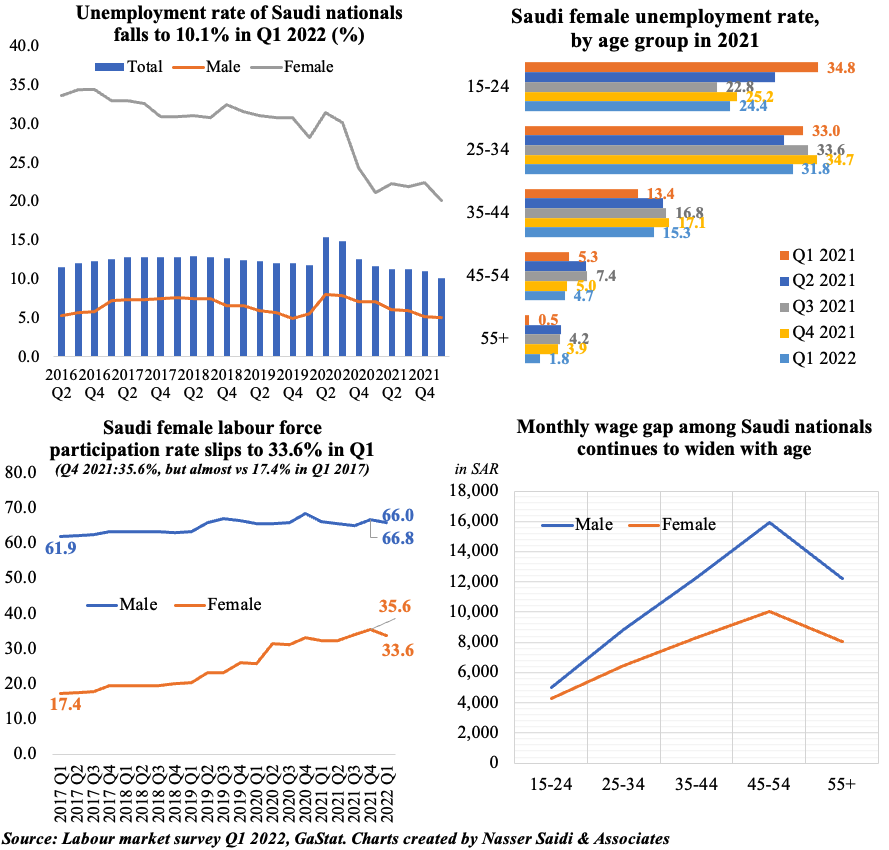

3. Saudi Arabia’s labour market recovering from pandemic woes: unemployment rate is the lowest since Q2 2016

- Unemployment rate for Saudi citizens has come down to 10.1% in Q1 2022; this compares to a peak of over 15% during the pandemic

- Gap between male and female unemployment rates persist: 5.1% for male Saudis and 20.2 for female citizens

- Saudi female unemployment rate declined across all groups in Q1 2022, but most sharply in the 55+ age bracket

- Labour force participation slipped in Q1 2022: 33.6% for Saudi women & 66% for men

- Last week, it was disclosed that Saudi citizens employed by the private sector crossed 2mn for the first time

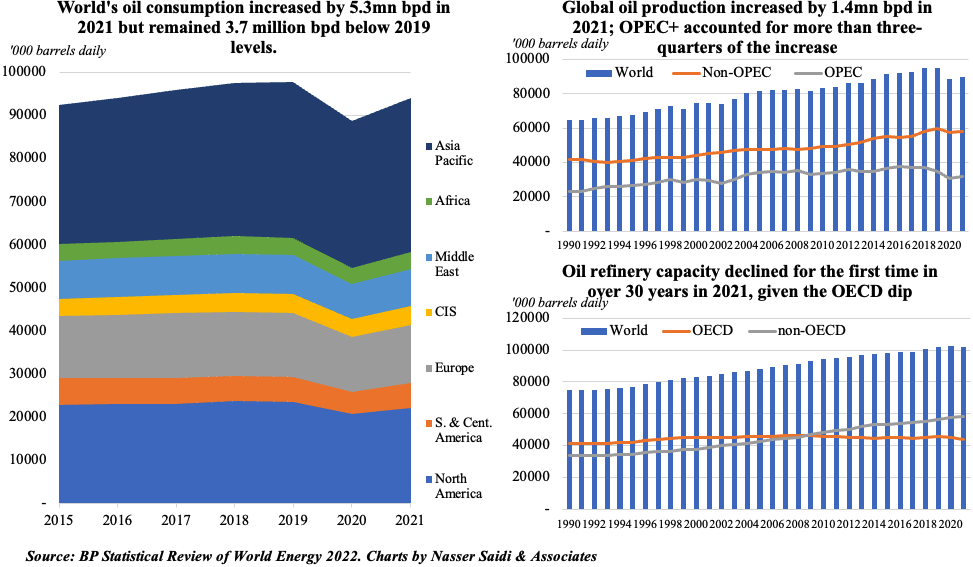

4. Global oil demand is bouncing back, but consumption remains much below pre-pandemic levels; OPEC+ is supporting production; refinery capacity in OECD fell to the lowest level since 1998

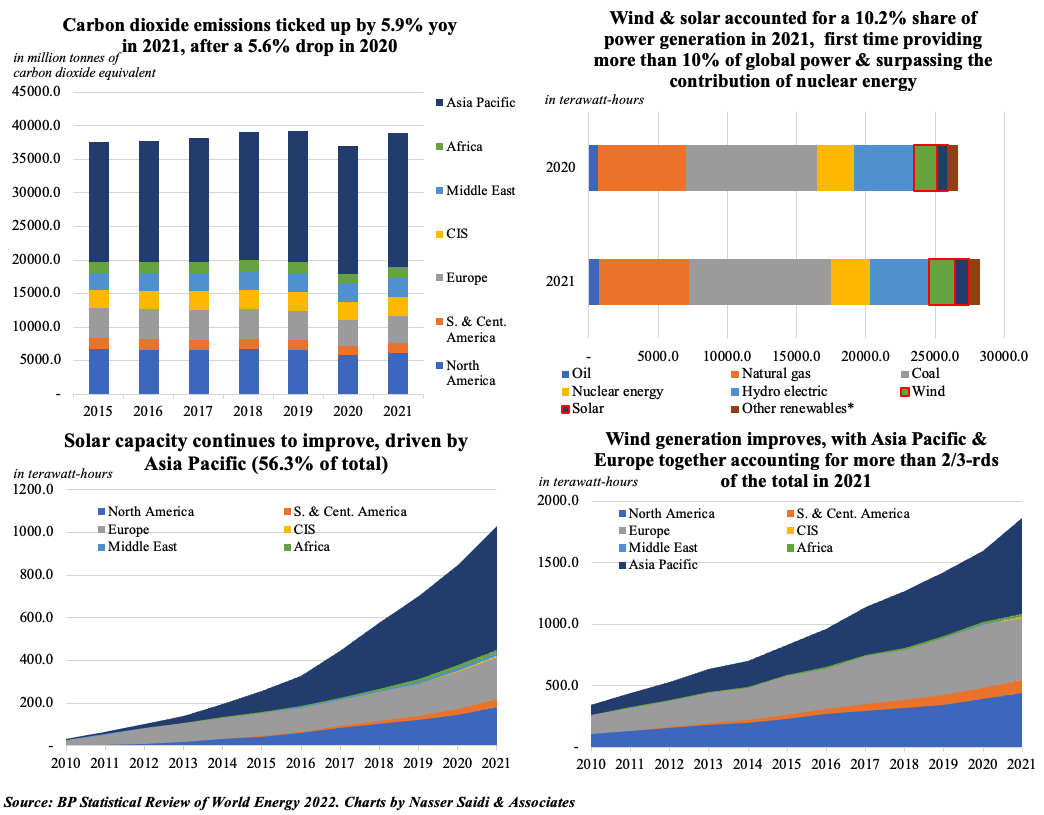

5. CO2 emissions are close to 2019 levels; but growth in renewable energy is rising – it was higher than that of any other fuel in 2021