Markets

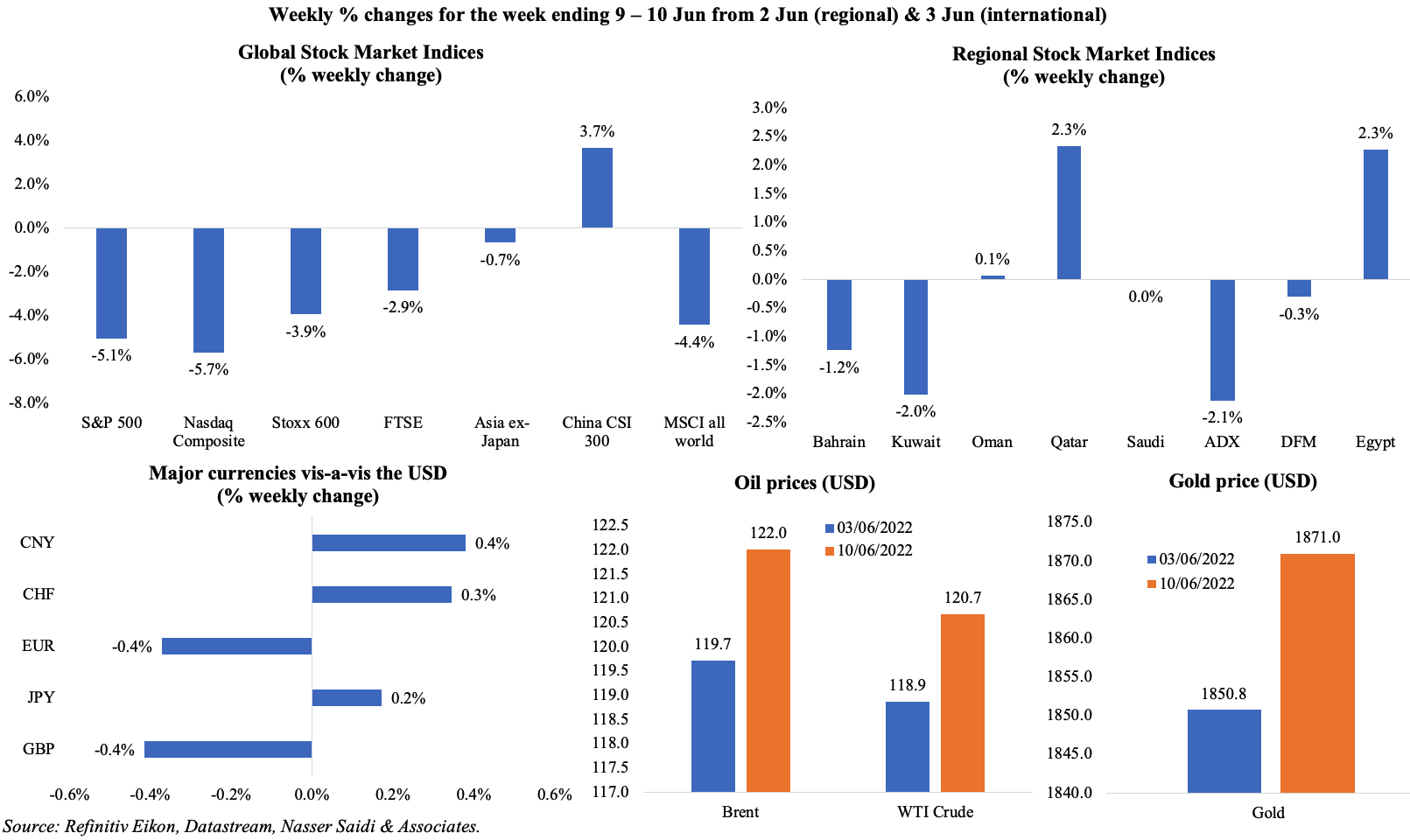

US equity markets posted their biggest weekly losses since Jan on the 8.6% high inflation reading, expectations of an aggressive rate hike and the growing likelihood of a recession. European markets also fell, after ECB disclosed its plans for monetary policy tightening. MSCI’s gauge of global equity markets also ended lower last week. Chinese equity markets were supported by strong buying from foreign investors and hopes of regulatory easing on tech firms and despite re-imposing some Covid19 restrictions in Shanghai and Beijing. The dollar index gained, rising to its highest level since mid-May while the yen hit a 24-year low against the dollar (on Monday, after touching 20-year lows last week) as Japanmaintained its ultra-loose monetary policy. Oil prices crossed the USD 120 mark though concerns are rising that high costs will reduce consumer demand amid new lockdown measures. Gold price rebounded, on its safe haven asset appeal.

Global Developments

US/Americas:

- US inflation rose to 8.6% yoy in May, highest since Dec 1981. The month-on-month increase of 1% was driven by a 3.9% rise in energy prices, a 4.1% gain in petrol prices and more concerning, a 0.6% in housing costs. Core CPI rose 0.6%, maintaining the same momentum as the previous month. Services inflation, ex-energy, rose 0.6% mom and 5.2% yoy.

- Foreign trade balance in the US narrowed to USD 87.1bn in Apr, down 19.1% from Mar’s record high (this was the largest decline since Dec 2012). Exports of goods and services grew by 3.5% (to a record high USD 252.6bn) – petroleum exports rose to an all-time high of USD 27.2bn, food exports touched a record high and capital goods exports were the highest since Mar 2019. Imports fell by 3.4%: imports from China fell USD 10.1bn (possibly as a result of the lockdowns).

- University of Michigan Consumer Sentiment, at 50.2 in Jun, is now substantially lower than it was during the Great Financial Crisis and comparable to the trough reached in the middle of the 1980 recession. Consumers’ views on current conditions tumbled to 55.4 in June (May: 63.3), while a barometer of expectations fell to 46.8 from 55.2.

- Initial jobless claims increased to 229k in the week ended May 27th (highest level since Jan 15th) from an upwardly revised 202k a week ago, taking the 4-week average higher to 215k. Continuing jobless claims were unchanged at over 1.3mn in the week ending May 27th.

Europe:

- ECB left interest rates unchanged as expected; it remained hawkish stating its plan to hike by 25bps in Jul while also hinting at an extra-large interest rate hike come September if inflation persists. The ECB also plans to end quantitative easing on Jul 1st.

- The final reading of Q1 GDP in the eurozone shows growth increased by 0.6% qoq and 5.4% yoy in Q1, higher than the previous estimate (0.3% qoq and 5.1% yoy). Growth was strongest in smaller countries (Ireland growing by 10.8%) versus larger nations (Germany growing at 0.2%, Italy at 0.1% and France falling by 0.2%).

- Sentix investor confidence in the eurozone improved, easing to -15.8 in Jun from -22.6 the previous month. The current conditions index improved to -7.3 in Jun (May: -10.5) and an expectations index rose to -24.0 (May: -34.0).

- Factory orders in Germany declined by 2.7% mom and 6.2% yoy in Apr – this is the third consecutive month of lower factory orders – with a large drop in foreign orders (-4%), especially to those to the eurozone (-5.6%). Orders for both capital and consumer durable goods declined: by 4.3% and 2.6% respectively.

- German industrial production recovered slightly in Apr: it rose by 0.7% mom but fell by 2.2% in yoy terms (Mar: -3.1%).

- UK services PMI inched up to 53.4 in May from the preliminary estimate of 51.8. Inflation is a concern with the latest input cost inflation the steepest since the index began (Jul 1996).

- Like for like retail sales in the UK declined by 1.5% yoy in May (Apr: -1.7%). Overall, sales decreased by 1.1% in May versus an increase of 28.4% in May 2021.

- Russia’s central bank cut its key interest rate by 150bps to the pre-crisis level of 9.5%; this follows three rounds of 300bps cuts each.

Asia Pacific:

- As Covid restriction eased, China’s exports surged by 16.9% yoy in May (Apr: 3.9%) while imports grew by 4.1% (the first expansion in 3 months). Trade balance widened to USD 78.76bn from a USD 51.12bn surplus recorded in Apr.

- Inflation in China declined by 0.2% mom in May (Apr: 0.4%) while remaining unchanged at an annual 2.1%.Non-food prices rose by 2.1% yoy, driven by housing (+1%), transportation and communication (6.2%) and education (1.8%) among others. Producer price index eased to a 14-month low of 6.4% in May, following the 8% increase the month before.

- Money supply in China grew by 11.1% in May (Apr: 10.5%). New loans nearly tripled to CNY 1890bn in May (from Apr’s CNY 645.5bn). Growth of outstanding total social financing, a broad measure of credit and liquidity, quickenedto 10.5% in May (Apr: 10.2%). Foreign exchange reserves inched up to USD 3.128trn in May from USD 3.12trn in Apr.

- The urban jobless rate in China rose to 6.1% in Apr, the highest since Feb 2020 and much higher than the target of 5.5%.

- China’s Caixin PMI stayed in contractionary territory for the 3rd month in May, though rising to 41.4 (from Apr’s 26-month low of 36.2). Input cost inflation eased to a nine-month low, while output costs climbed.

- Japan’s Q1 GDP fell by 0.1% qoq and 0.5% yoy in Q1, slightly less than previously reported. In annualised terms, GDP fell by 0.5% in Q1, lower than the preliminary reading of 1% decline. The increase was largely due to an upward revision in private consumption: it inched up to 0.1% qoq from the flat reading reported previously. Domestic demand contributed 30bps to revised GDP figures, while net exports took off 40 bps.

- Leading economic index in Japan inched up to 102.9 in Apr (Mar: 100.8), the highest reading since Dec 2021. The coincident index remained unchanged at 96.8.

- Current account surplus in Japan shrank to JPY 501.1bn in Apr (Mar: JPY 2549.3bn). Overall imports surged by 32.8% yoy to a record high, also inflated due to a weaker yen.

- Overall household spending in Japan fell by 1.7% yoy in Apr (Mar: -2.3%), dragged down by lower spending on cars and vegetables. Labour cash Inflation adjusted real wages shrank by 1.2%, the biggest fall since Dec 2021.

- India’s central bank increased the repo rate by 50bps to 4.9% in a bid to tame inflation; it left the reverse repo rate unchanged at 3.35%. The governor called expectation of rate hikes in June a “no-brainer”.

- Industrial production in India surged by 7.1% yoy in Apr (Mar: 1.9%), an 8-month high, powered mainly by higher electricity and mining output.

- Q1 GDP in Korea was revised down slightly: growth was revised down to a seasonally adjusted 0.6% qoq and 3% yoy in Q1 (prev estimate: 0.7 % qoq and 3.1% yoy).

Bottom line: An eventful week with a line-up of central bank meetings. The Fed and BoE are likely to lift rates again, especially with rising cost of living amid declines in inflation-adjusted wages; a 25bps hike is expected from the BoE, especially given this morning’s GDP print (0.3% drop in GDP in Apr), though it could opt for a higher 50bps hike in line with the Fed. In contrast, the BoJ looks ready to continue with its ultra-loose monetary policy stance (its argument being that a weaker yen had generally positive effects on the economy). In a rare move, the BoJ, Ministry of Finance and Financial Services Agency released a joint statement last week aimed at bringing some stability to the USD-JPY exchange rate. It would be interesting to see if the BoJ governor’s comments post-meeting shows a shift in stance (i.e. that further weakness could be detrimental to the economy).

Regional Developments

- The World Bank forecasts growth in the MENA region to rise to 5.3% in 2022 (+0.9 ppts from Jan), supported by rising oil reforms and some nations’ structural reforms. Though output in the region remains below pre-pandemic trends, the gap is expected to have roughly halved by 2023 relative to 2020. More: https://www.worldbank.org/en/publication/global-economic-prospects

- Bahrain attracted USD 1.766bn in FDI inflows in 2021, up 73% yoy, according to the UNCTAD’s World Investment Report. Inward FDI stocks grew by 6% to USD 33.47bn.

- Net profits of listed companies in Bahrain posted a 62.4% yoy surge to USD 922.5mn in Q1 2022, with the materials sector posting the largest net profit (up 181% to USD 389.3mn).

- Bahrain’s labour fund Tamkeen’s 16 programmes as part of the 2021-25 strategy have seen the approval of over 9300 proposals and funding support of BHD 39mn (USD 103.47mn). The programs were launched with the aim of developing local Bahraini talent and incentivize high potential sectors.

- Inflation in Egypt accelerated to a 3-year high of 13.5% yoy in May (Apr: 13.1%), falling outside the target range of between 5-9%: a rate hike seems almost certain at the meeting on June 23. Core inflation also ticked up to 13.3% yoy (Apr: 11.9%).

- The Sovereign Fund of Egypt plans to establish a USD 4bn IPO fund that will speed up the subscription process for companies. The CEO of the Sovereign Fund disclosed that it will be signing an MoU with Saudi PIF to attract USD 10bn worth investments into joint projects.

- A supply ministry official in Egypt disclosed that the country’s strategic wheat reserves were sufficient until end of this year. Reserves of sugar, vegetable oils and rice will last for 5, 6 and more than 3 months respectively.

- Japan’s Sumitomo signed an initial agreement to establish its largest factory in Egypt, to manufacture automotive wore harnesses. The project will begin operations by end-2023.

- Iraq passed the Emergency Law for Food Security and Development: this will allow the government to transfer IQD 25trn (USD 17.14bn) to support the buying of essential items like wheat, rice, gas and energy as well as pay salaries among others.

- Iraq and Jordan reached an agreement on an electricity grid interconnection: this will begin supplies starting next year.

- Jordan’s 10-year development strategy, unveiled last week, aims to attract USD 41bn in funds to raise GDP to JOD 58.1bn by 2033 (from JOD 30.2bn currently). The biggest challenge identified was to reverse current unemployment rate (24%) and find jobs for over a million youth in a decade’s time.

- The Saudi Jordanian Investment Fund (established by Saudi PIF) aims to invest USD 3bn in Jordan, revealed its CEO. The latest agreement was for a USD 400mn investment in a healthcare project in Jordan.

- Reuters reported that Kuwait Petroleum Corporation is seeking financing of up to USD 1bn; these funds are to be used for capital expenditure including on oil and gas production, according to the oil minister.

- According to EFG Hermes, Kuwaiti car distributorAli Alghanim and Sons Automotive Co raised more than USD 3bn in a private placement ahead of its IPO, which was 11 times oversubscribed.

- The value of Kuwait’s oil exports rose to an all-time high in Q1 2022, reported Al Qabas daily citing a special government report. Additionally, oil revenues in 2021-2022 accounted for 84% of total revenues, while non-revenues declined by 38.9% from the 2020-21 fiscal year.

- Wholesale prices in Kuwait increased by 2.3% yoy in Dec 2021, with prices of imported goods rising by 3.2% and that of domestic goods by 0.6%.

- Lebanon’s deputy PM called on the banks to “go first” in absorbing the losses from the financial collapse (the Associations of the Banks of Lebanon had rejected the plan). He also disclosed that the government would aim to return up to USD 100k of the depositors’ savings over time (using the banks’ foreign currency assets).

- Exports from Oman surged by 55.9% yoy in Jan 2022, with oil and gas exports standing at OMR 1.15bn (+58.7%) and non-oil exports up by almost 70% to OMR 626.8mn.

- The Oman Power and Water Procurement Company is currently developing 2 solar power plants and is expecting an investment of USD 600mn from the private sector. Altogether, the company plans to attract investments of more than USD 1.25bn to implement several projects in renewable energy and water resources.

- Reuters reported that Qatar picked Exxon, Total, Shell and ConocoPhillips as partners in the expansion of the world’s largest LNG project. This expansion is expected to boost Qatar’s LNG output by 64% by 2027.

- Listed firms in the GCC reported a 67% yoy increase in aggregate profit to USD 65.4bn in Q1, revealed a report by Kamco Invest. Saudi Arabia’s listed firms accounted for the largest share of aggregate profits, with its firms’ profits up by 73% to USD 49.8bn.

- Startups in MENA raised USD176mn from 42 deals in May, according to data from Wamda: this compares to amounts of USD 299mn and USD 297mn raised in Mar and Apr respectively while the deals count grew 31% mom. Egypt (USD 81mn raised from 11 deals), Saudi Arabia (USD 46mn from 9 deals) and UAE (USD 45mn from 8 deals) continue to dominate the startup space.

- FDI inflows into the GCC jumped to more than USD 44bn in 2021 (2020: USD 26bn), according to the latest UNCTAD World Investment Report. UAE attracted the largest amount of FDI (USD 20.7bn), followed closely by Saudi Arabia (USD 19.3bn), Oman (USD 3.6bn) and Bahrain (USD 1.7bn). More: https://worldinvestmentreport.unctad.org/world-investment-report-2022/

Saudi Arabia Focus

- Saudi Arabia’s Q1 GDP growth, at 9.9% yoy, was the highest since Q3 2011, anddriven by increase in oil sector activity (20.3%). Non-oil sector also expanded, though at 3.7%, it is growing much slower pace compared to previous quarters. In yoy terms, the maximum gains accrued in the mining & quarrying sector. However, growth was also recorded across manufacturing (8%), trade and transportation (6% each) and finance (4%). Private investment and exports supported GDP growth (by expenditure), rising by 20% and 22.1% respectively in Q1 while private consumption grew by just 7.1%.

- Industrial Production Index in Saudi Arabia, at 130.2 in Apr, was the highest level recorded since Apr 2020. Higher mining and quarrying production (+28.3% yoy) led to a 26.7% surge in overall industrial production in Apr 2022. The manufacturing component within the IPI (22% weight in overall index) also increased in tandem with oil production, up by 25.1% (Mar: 22%), supported by recovery in trade and exports.

- Industrial investments in Saudi Arabia increased in Q1 2022: 299 new factories started production in the quarter, 176 new licenses were issued, and the capital of newly licensed factories exceeded USD 1.1bn.

- Saudi Arabia reported arecord-breaking number of new foreign licenses in Q1 2022: at 9400, it was up 350% qoq and 19 times higher than Q1 2021. Wholesale and retail trade licenses accounted for the lion’s share (64.1%) while construction (12%), manufacturing (7.1%) and accommodation and food (6%) were the other prominent sectors.

- Saudi Ministry of Investment signed 101 deals in Q1 2022, with estimated investments of over USD 4bn,including with EV manufacturer Lucid to open a plant. With 57 of the 101 deals announcing investment amounts, it is estimated that about 6k jobs will be created.

- Saudi Arabia increased the July crude oil prices for Asian buyers (by USD 2.1 a barrel from June to USD 6.5 a barrel over Oman/ Dubai quotes) given concerns about tight supply and strong demand expectations in summer.

- Invested funds in equity crowdfunding platforms in the Saudi Exchange increased to SAR 210mn (USD 56mn) from 2019 to 2021 from 46 offerings.

- Saudi CMA has given the go ahead for two listings: (a) Alamar Foods plans to list 10.63mn shares (41.69% of its capital) on Tadawul; and (b) Saudi Networkers Services Company plans to trade 25% of its capital (1.50mn shares) on Nomu.

- Reuters reported that the Saudi PIF was shortlisted to buy a stake in the MENA and Central Asia Starbucks franchise held by Kuwait-based Alshaya Group.

- Saudi Arabia’s PIF is taking an 8.1% stake in Sweden’s gaming group Embracer: the latter issued 99.9mn shares raising SEK 10.3bn (USD 1.05bn). This follows a 5% stake in Nintendo last month.

- Moody’s affirmed Saudi Arabia’s rating at ‘A1’ with a stable outlook, supported by the effectiveness of its fiscal policy, progress on diversification and the rollout of capital and development projects among others.

- Bilateral trade between Saudi Arabia and Indonesia touched USD 5.5bn in 2021, up by more than 40% yoy. Saudi is Indonesia’s largest trading partner in the Middle East and it has invested around USD 24.6bn in Indonesia during the period 2016-21.

- Saudi Arabia’s tourism minister disclosed that USD 100mn has been allocated to provide training for 100,000 people to work in the tourism and sustainability sector. He also stated that USD 800bn had been allocated to be spent on the sector up to 2030.

- A new tourist visa scheme for GCC residents will be launched by Saudi Arabia soon, revealed the minister of tourism. He also disclosed that Saudi Arabia witnessed 64mn domestic trips and 5mn visitors from abroad in 2021.

- Occupancy at offices in Riyadh have hit 96%, the highest level in five years, according to Knight Frank. Thanks to an influx of foreign businesses, office space rents in Riyadh has increased by 6.5% in the last 12 months to SAR 1560 per square meter.

- Saudi Ministry of Human Resources and Social Development revealed that it had issued more than 800,000 visas to recruit foreign workers during the year 2021.

UAE Focus![]()

- UAE’s GDP grew by 3.8% in 2021 and is expected to increase to 5.4% and 4.2% in 2022 and 2023, according to the central bank’s annual report. Non-oil sector expanded by 5.3% in 2021 and its growth will moderate to 3.9% this year.

- Dubai PMI increased to a 35-month high of 55.7 in May (Apr: 54.7), thanks to a “fast recovering” tourism sector. Wholesale and retail companies registered a slowdown in the growth of new orders while new work in the construction sector softened for the first time since Sep 2021. Cost inflation increased to an over 4-year high, while overall output charges decreased for the 11th straight month in May.

- Dubai’s TECOM Group (which operates 10 business districts in the emirate) is planning an IPO, selling a 12.5% stake – the offer will open on Jun 16th, and expects to be admitted for trading on DFM on July 5th. The company expects to pay a dividend of AED 800mn (USD 217.83mn) for every financial year over the next three years.

- UAE’s oil minister revealed that OPEC+ was currently 2.6mn barrels per day short of its production target, while calling efforts to boost output “not encouraging”.

- Abu Dhabi’s holding company ADQ launched a USD 100mn technology-focused VC fund along with the Jordanian Ministry of Digital Economy and Entrepreneurship to invest in the “strong potential of Jordan’s tech ecosystem”.

- UAE’s trade surplus with the GCC stood at AED 134.7bn in 2021, given a 26% increase in total trade to AED 247.5bn.

- E-commerce spending in the UAE grew at double the rate of PoS transactions in Q1 2022, according to Network International. Overall card spends saw a double digit increase while the number of cards transacting online surged by 32% during Q1.

- In a bid to enhance water security, DEWA is building 3 water reservoirs valued at AED 550mn to increase storage capacity of desalinated water.

- The DMCC reported a 36% increase in the value of rough and polished diamonds traded in the UAE to USD 11bn in Q1 2022. It was the world’s largest rough diamond trading hub last year, recording USD 22.8bn in trade.

- Number of visitors to Dubai grew by 203% yoy to 5.1mn in Jan-Apr 2021; Oman, India and UK were the top source markets during this period (590k, 550k and 367k persons respectively).

Media Review

How Xi Jinping is reshaping China’s capital markets

https://www.ft.com/content/d5b81ea0-5955-414c-b2eb-886dfed4dffe

How to run a business at a time of stagflation

https://www.economist.com/business/2022/06/08/how-to-run-a-business-at-a-time-of-stagflation

How Should Developing Countries Deal with Inflation? A Q&A With Raghuram Rajan

Lebanese caretaker energy minister: “politics” behind delay of U.S.-backed electricity plan