Weekly Insights 22 Apr 2022: Global Recovery Dragged Down by Rising Economic Uncertainty

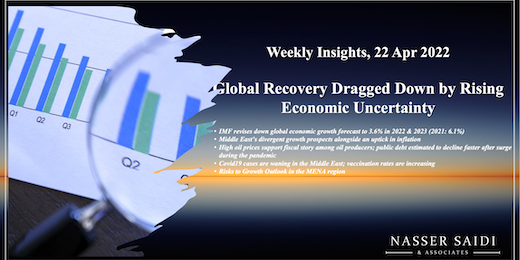

1. IMF revises down global economic growth forecast to 3.6% in 2022 & 2023 (2021: 6.1%)

- The ongoing Russia-Ukraine war and rising inflation have been key drivers of the downgrade in growth forecasts, alongside monetary policy tightening and withdrawal of pandemic stimulus.

- China’s slowdown will also lead to global spillovers: lockdowns + mobility restriction + port closures => lower domestic consumption + supply chain delays

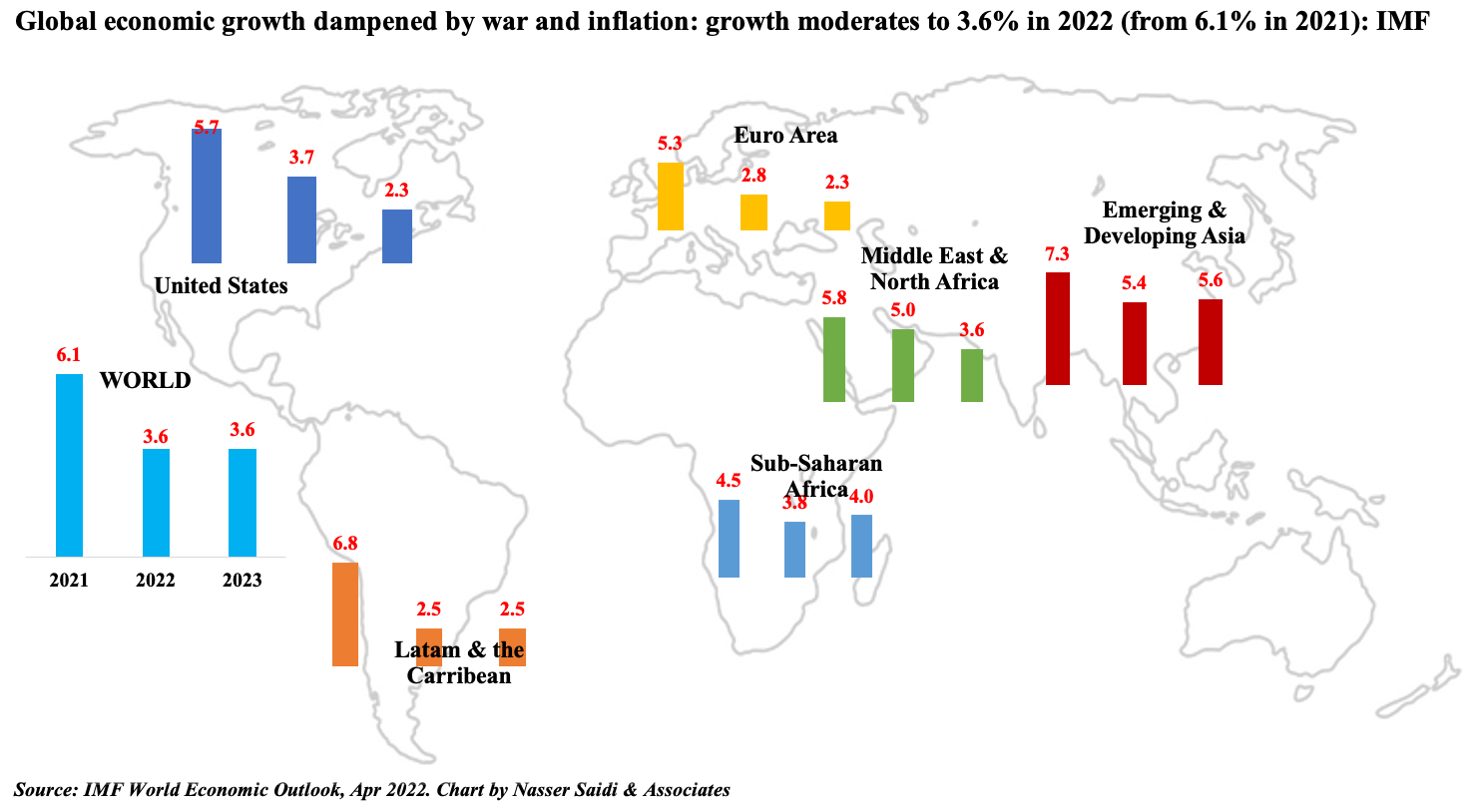

2. Middle East displays divergent growth prospects alongside an uptick in inflation

- The MENA region is estimated to grow by 5% in 2022 and 3.6% in 2023; breakdown shows divergence

- Oil exporters: oil sector growth is supporting non-oil sector activity; high vaccination rates & lower stringency levels support recovery, especially in the retail and travel & tourism sectors

- Inflationary pressures are evident across the MENA region, though relatively subdued in the GCC nations; food & fuel prices are the main factors driving inflation

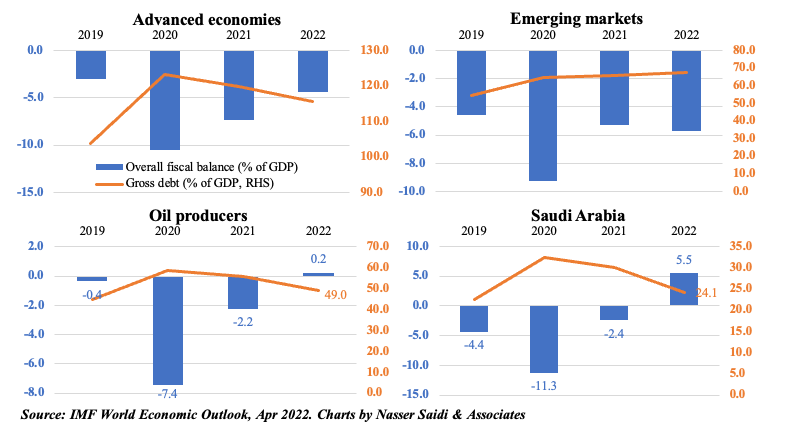

3. High Oil Prices Support Fiscal Windfall among Oil Producers; Public Debt Estimated to Decline Faster after surge during the pandemic

- Total global debt rose to 256% of GDP in 2020, with government debt accounting for 40% of total

- With tighter financial conditions, borrowing costs will rise significantly for emerging market economies => widening the divide; deficits are falling globally, but will remain above pre-pandemic levels (except for oil producers)

- Debt vulnerabilities could worsen as advanced nations raise rates to tackle inflation

- Public debt is estimated to decline faster among oil producers (from 56% in 2021 to 50% in 2024) thanks to jump in exports

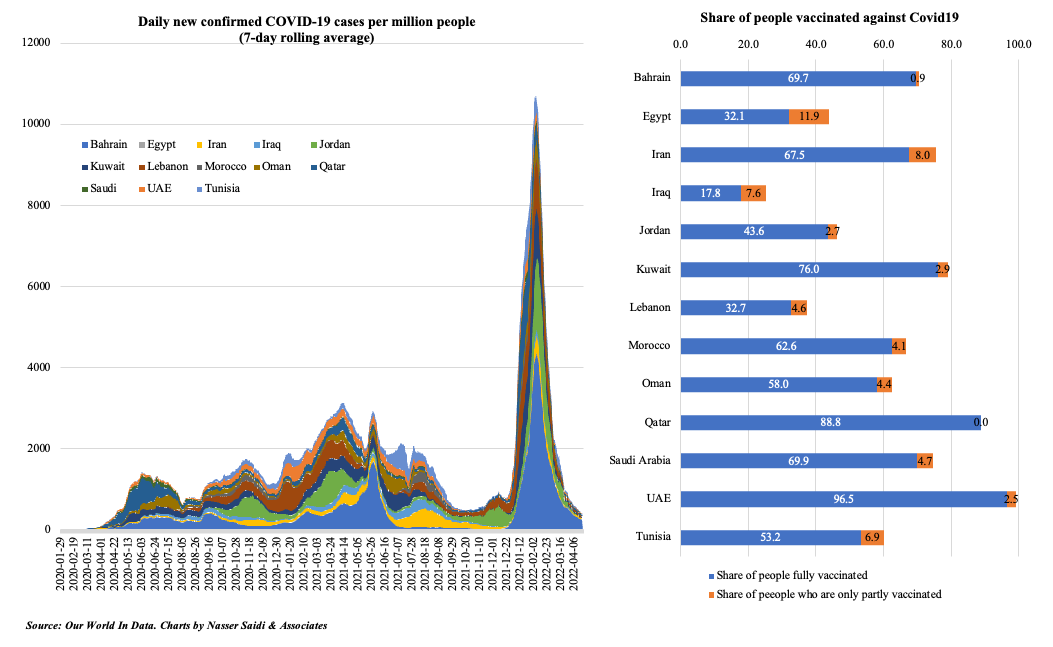

4. Covid19 cases are waning in the Middle East; vaccination rates are increasing

- Covid cases in the region have come off previous highs & confirmed Covid19 deaths are declining.

- Not all countries have attained high vaccination rates like the GCC; risks of new strains remain but availability of medicines + previous immunities imply less strain on economic activity

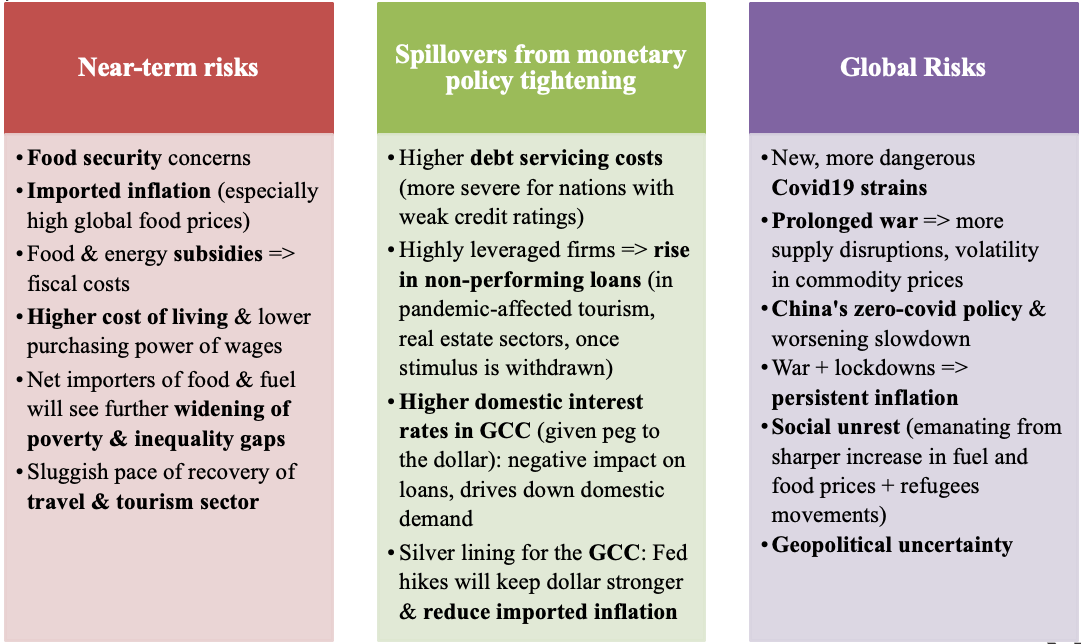

5. Risks to Growth Outlook in the MENA region