Markets

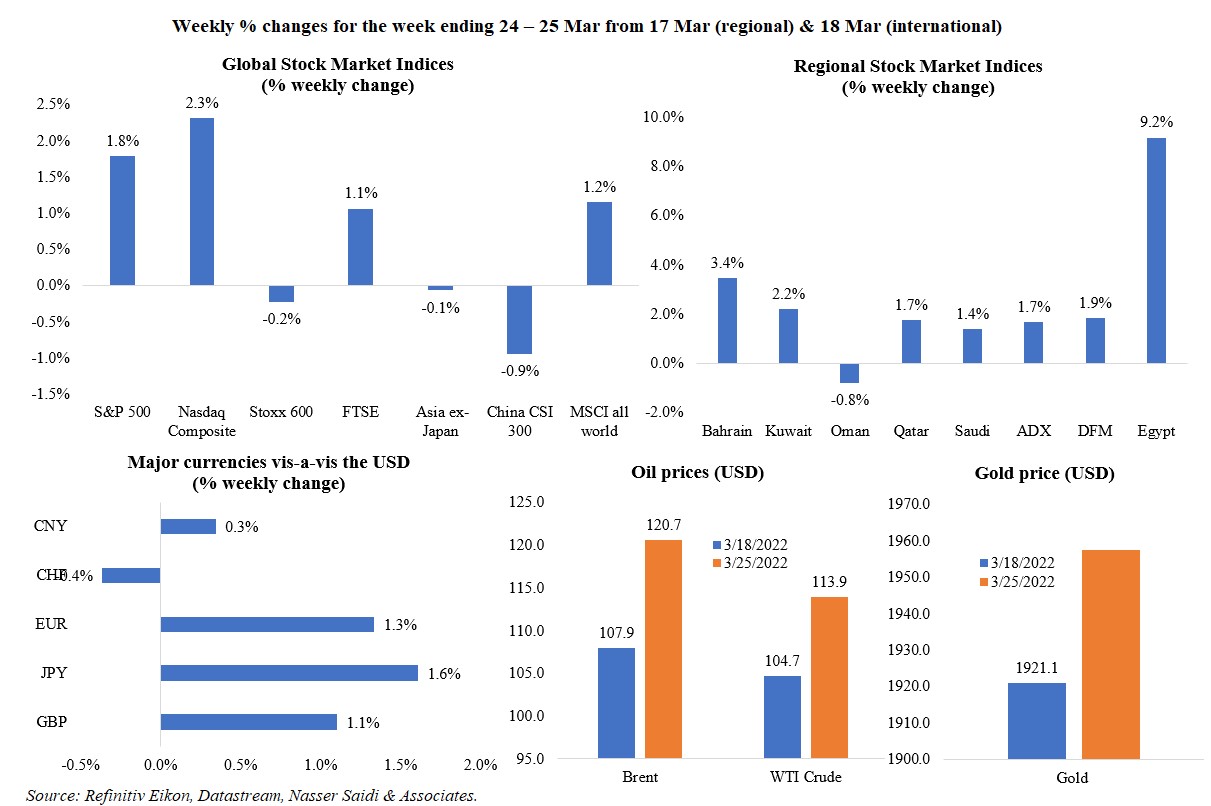

Global markets showed a mixed picture last week, with US equities supported by a tech rally (amid rising US Treasury yields) while Stoxx600 and Chinese equities ended the week lower. The MSCI all world index posted gains for a 2nd consecutive week. Regional markets were mostly higher compared to a week ago, with Egypt’s index posting the biggest percentage gain in nearly 2 years (4.5%) last Monday when the central bank hiked rates. Oil prices increased (first weekly gains in 3 weeks) after an attack on a Saudi Aramco facility in Jeddah while safe haven assets gold and the Swiss franc remaining robust.

Global Developments

US/Americas:

- Chicago Fed national activity index eased to 0.51 in Feb (Jan: 0.59), with declines in contribution of both production related indicators (0.22 from 0.25 in Jan) and personal consumption and housing indicators (0.04 from 0.21).

- Durable goods orders fell by 2.2% mom in Feb (Jan: -1.6%). Non-defence capital goods orders excluding aircraft however fell by 0.3%, posting the first decline in a year, and down from a 1.3% gain in Jan.

- Markit flash manufacturing PMI in the US inched up to 58.5 in Mar (Feb: 57.3). Services PMI also improved to 58.9 from 56.5. Flash composite PMI output index rose to an eight-month high of 58.5 (Feb: 55.9), thanks to strong demand for both goods and services.

- New home sales in the US unexpectedly declined by 2% mom to a seasonally adjusted 772k in Feb, as mortgage rates increased, and median house prices rose by 10.7% yoy. Data also indicated that there were 407,000 new homes on the market, the highest since Aug 2008, with 65% of the inventory being houses under construction.

- Pending home sales fell for the 4th consecutive month, down by 4.1% mom in Feb. The average rate on the 30-year fixed mortgage is now more than a full percentage point higher compared to a year ago.

- Initial jobless claims fell to 187k in the week ended Mar 18 – the lowest level since Sep 1969 – with 4-week average falling to 211.75k, consistent with a heated labour market. Continuing claims also declined, by 67k to 1.35mn in the week ended Mar 12th – this was the lowest since Jan 1970.

Europe:

- Germany’s producer price index inched up to a new record high of 25.9% yoy in Feb (Jan: 25%), with energy costs posting the largest increase (+68%) alongside metals (36.2%), fertilisers (71.7%) and food (7.5%) among others. It is worthwhile remembering that these readings do not yet include the impact from the Russia-Ukraine conflict.

- Germany flash manufacturing PMI slipped to 57.6 in Mar (Feb: 58.4) – given the impact from supply bottlenecks and a drop in export demand amid rise in Covid cases. Services PMI also declined to 55 in Mar from 55.8 the month before, resulting in a slight drop in the composite PMI to 54.6 (Feb: 55.6). Rising input and output costs are also weighing down expectations.

- German Ifo showed a collapse in business climate (90.8 in Mar from Feb’s 98.5), current assessment (97 from 98.6) and expectations (a “record collapse” to 85.1 from 98.4) – all due to the Ukraine crisis.

- Eurozone flash manufacturing PMI slowed to a 14-month low of 57 in Mar (Feb: 58.2): output growth slowed and new orders fell for the first time in 21 months. Services PMI eased to 54.8 from 55.5 (given a drop in services exports), causing the composite PMI to slow to a 2-month low of 54.5. Manufacturing input costs posted a steep rise alongside a record increase for service sector input costs.

- Consumer confidence in the euro area slipped to -18.7 in Mar (Feb: -8.8): this was the lowest level since May 2020, dragged down due to the ongoing Russia-Ukraine conflict.

- Current account in the euro area posted a surplus of EUR 22.6bn in Jan, unchanged from the month before. In the one-year to Jan 2022, current account surplus stood at EUR 294bn, up from EUR 247bn in the same period a year earlier.

- Inflation in the UK surged to 6.2% yoy in Feb (Jan: 5.5%) – the highest reading since Mar 1992 – on higher food, fuel and energy costs. Core CPI also accelerated, to 5.2% from 4.4%. Separately, the PPI core output rose to 9.9% in Feb (Jan: 9.5%). Retail price index in the UK increased to 8.2% yoy in Feb (Jan: 7.8%) –the highest reading since Mar 1991.

- UK flash manufacturing PMI slipped to a 13-month low of 55.5 in Mar (Feb: 58), with production rising at the weakest pace since Oct 2021. Services PMI however inched up to 61 in Mar (Feb: 60.5), recording the fastest expansion in 9 months, benefitting from the reopening of the economy after Covid19 restrictions.

- Retail sales in the UK unexpectedly fell by 0.3% mom in Feb; excluding fuel sales, retail was down by a higher 0.7%. While the proportion of retail sales online fell to 28% in the last month lowest since Mar 2020), it is much higher than pre-pandemic levels.

- GfK consumer confidence declined for the 4th consecutive month, falling to -31 in Mar (Feb: -26): this is the lowest since Nov 2020 and was dragged down due to worries about surging inflation, higher interest rates as well as the conflict in Ukraine.

Asia Pacific:

- The People’s Bank of China kept the benchmark interest rate unchanged: the one-year loan prime rate stood at 3.70% while the five-year LPR remained at 4.60%.

- Japan leading economic index was revised lower to 102.5 in Jan (Dec: 103.7): this is the lowest reading since last Oct. Coincident index was at 95.6, down from a preliminary estimate of 95.7.

- Japan’s flash manufacturing PMI increased to 53.2 in Mar (Feb: 52.7) – this was the weakest growth since Sep 2021 though output finally returned to expansion territory and new export order growth slowed. Services PMI stayed below 50 but increased to 48.7 from 44.2 the month before.

- Singapore CPI edged up to 4.3% in Feb (Jan: 4%) while core inflation (which excludes accommodation and private transport costs) eased to 2.2% (Jan: 2.4%).

- Singapore industrial production jumped up by 17.6% yoy in Feb (Jan: 2.4%): this is the 5th consecutive month of increase in IP and the strongest pace since Jun 2021, largely due to substantial surges in electronics (32.4%) and biomedical manufacturing (25.4%).

Bottomline: The OPEC+ meeting this week is likely to result with staying on track (calling to raise output by 400k bpd) given that the current uptick in prices is largely due to geopolitical reasons (but, Russia’s oil production is estimated to fall by as much as 3mn barrels per day from Apr). With calls for a complete ban of energy from Russia gaining traction, the call from Putin to pay in roubles is making several nations uneasy (check our Media Review section for a recent IMF working paper that explores the erosion of dollar dominance). Eyes are on inflation numbers from the eurozone this week: the flash PMIs have equivocally shown rising costs of both inputs and outputs, paving the way for a new record high (up from Feb’s 5.9%) i.e. more than 3 times the ECB target of 2%.

Regional Developments

- The value of Bahrain’s domestic-origin exports increased by 121% yoy to BHD 417mn (USD 1.1bn) in Feb 2022. US, Saudi Arabia and Italy were the top recipients of exports of national origin. Overall trade deficit narrowed to BHD 9mn versus BHD 178mn a year ago.

- Bahrain recorded a 50% increase in foreign tourists for the Formula 1 Grand Prix 2022, compared to 2019.

- Islamic banking’s market share in Bahrain rose to 38.8% of domestic banking assets and 17.8% of total banking assets (including foreign assets) at end-2021. Fitch Ratings forecast that rising public demand will drive Islamic banks growth in Bahrain.

- Egypt lowered its GDP growth target to 5.5% for the next financial year (from a previous forecast of 5.7% in the 2022-23 financial year). The country also plans to restructure its 2022-23 public budget to cope with the global crisis: it is targeting a primary surplus of 1.5%, a budget deficit of 6.1% of GDP and debt ratio to 80.5%.

- Egypt is in talks with the IMF on a new program with an aim to maintain economic and financial stability while promoting comprehensive structural reforms. The potential new IMF deal will not include additional burdens on citizens, stated the finance minister.

- Egypt’s 1% hike last Monday turned real interest rate positive; this, along with allowing the pound to depreciate by 14% should encourage exports, attract FDI and remittance inflows. The government announced an EGP 130bn economic relief package, which will work in favour of the requested IMF support to implement a “comprehensive support programme”.

- Egypt set a fixed price for unsubsidised bread at EGP 11.50 (USD 0.66) per kg; this move followed a jump in prices by around 25% in 3 weeks after the Russia-Ukraine conflict began. Separately, Egypt is in talks with Argentina, India, France and US for future wheat imports.

- Egypt’s sovereign wealth fund, which was set up in 2019, has attracted more than USD 2bn in investments, revealed the government.

- Bloomberg reported that Egypt plans to raise USD 500mn worth of Samurai bonds (5-year debt in a private placement with a target yield of 0.8-0.85%) in a bid to diversify funding.

- Egypt Suez Canal Authority will temporarily raise a surcharge on laden crude oil and petroleum products tankers transiting the canal to 15% of normal dues from 5%. This will come into effect from May 1st. In Feb, the Suez Canal posted a 15.1% yoy jump in revenue to USD 545.5mn.

- Bilateral trade between Egypt and Saudi Arabia touched USD 8.02bn in 2021, disclosed Egypt’s minister of trade and industry.

- Kuwait and Saudi Arabia agreed to develop the Durra gas field: the field is expected to produce one billion standard cubic feet per day of gas and 84k barrels per day of condensates.

- Lebanon will start talks with the IMF delegation on March 29th: the PM expressed hopes that a deal will be agreed to in the coming weeks, and prior to elections in mid-May.

- A draft capital control law in Lebanon (which has incorporated IMF’s comments) will be discussed by parliamentary committees on Mon (28 Mar); if the text is agreed to, a vote could happen as early as Tuesday.

- Inflation in Lebanon touched 215% yoy in Feb, the 20th consecutive triple-digit increase, driven up by transportation costs (510%), restaurants and hotels (449%), health (413%) and food (396%) among others.

- Banks in Lebanon will be allowed to sell the local currency for USD and vice-versa starting March 28, according to the central bank, at the approved rate determined by the “Sayrafa” platform. Fuel imports will be based on an exchange rate of 22,200 Lebanese pounds per dollar, until March 29th.

- Lebanon, in a bid to find alternatives to grain from Ukraine, is planning a tender to import 50k tonnes of wheat from India. However, it will depend on the central bank opening a credit line. The country is also waiting to hear from the US and Kazhakstan on specifications and prices, according to the economy minister.

- Oman’s nominal GDP grew by 16.1% yoy to OMR 33bn in 2021, thanks to broad-based recovery across both hydrocarbon and non-hydrocarbon sectors (rising by 38.5% and 8.4% respectively). Among the non-oil sectors, transport & warehousing, wholesale & retail trade, and industrial sectors grew the fastest, by 19.4%, 15.5% and 13.6% respectively.

- As fiscal balances improve given higher oil prices and fiscal consolidation measures, Oman’s Sultan stated that any additional oil revenues would be used to settle public debt first and the rest would be allocated to development projects. Furthermore, an additional spending of OMR 200mn (USD 520mn) was announced to the 2022 budget, bringing total expenditure to OMR 1.1bn. In Jan 2022, a budget deficit of USD 3.9bn was forecast for 2022 by the Ministry of Finance (at an estimated oil price of USD 50).

- Oman has opened a new land port at UAE’s Hatta, linking both countries, allowing for smooth movement of travellers from both sides.

- Qatar and the Gates Foundation will jointly invest up to USD 200mn over the next 2 years to help farmers in developing countries adapt to climate change.

- UAE accounted for 77% of GCC investments in Latin American markets between 2016 and 2021 (which stood at USD 4bn). Saudi Arabia and Qatar accounted for another 22% and 1% respectively. Half of the overall investments were in logistics, distribution and transportation companies.

- Bloomberg reported that the Americana Group (partly owned by the PIF) is in discussions to raise USD 1bn via a dual listing in the UAE and Saudi Arabia.

- GCC luxury market is projected to grow to USD 11bn by 2023 from USD 9.7bn currently, according to a Chalhoub Group report. E-commerce recorded double-digit growth with the beauty sector experiencing a 63% growth while fashion grew by 89%.

- At a meeting between the leaders of Egypt, UAE and Israel, the UAE committed to invest around USD 2bn in Egypt by buying state-held stakes in companies, reported Bloomberg. The 3-way meeting also discussed food security and energy markets stability in the backdrop of the Russia-Ukraine conflict.

Saudi Arabia Focus

- Saudi Arabia’s exports jumped by 49.6% yoy to SAR 107.6bn in Jan 2022. Oil exports still account for more than ¾-th of overall exports (a far cry from the lowest reading of 62% in Jun 2020); ratio of non-oil exports to imports increased to 46.5% in Jan (Jan 2021: 39.4%). China is Saudi Arabia’s main trading partner, followed by India, South Korea, US, and the UAE. Interestingly, UAE was the top recipient of Saudi Arabia’s non-oil exports in Jan 2022, with transport equipment & parts the largest product (34.6% of overall non-oil exports sent to the UAE).

- Almost a week before OPEC+ is scheduled to meet, Saudi Arabia emphasised “the essential role” of the OPEC+ agreement in bringing balance and stability to oil markets. The Saudi cabinet also stated that it would not bear responsibility for a global supply shortage if it were due to Houthi attacks on Saudi installations.

- S&P revised Saudi Arabia’s outlook to “positive” thanks to improvements in GDP growth and better fiscal dynamics over the medium term while reaffirming the rating at “A-/A-2”.

- At the Saudi Capital Markets Forum, Tadawul’s CEO disclosed that the exchange has seen 16 listings so far in 2022, three were awaiting approval from the market regulator and that more than 70 applications were pending. He underscored the sector diversity in recent listings and stated that it plans to provide companies with “new financing tools such as debt instruments”.

- Saudi Arabia’s capital market is gearing up for measures to improve post-trade services infrastructure (to be implemented on Apr 3rd): Saudi exchange plans an enhanced mechanism for short selling activities, in addition to buy-in trades executed at the exchange and settled on the same day; Securities Clearing Center Co will clear services to cover equities, sukuk, bonds, and traded funds markets to facilitate the introduction of new products and services for clearing members; Securities Depository Center Co will introduce a new central securities depository system and post-trade services, in alignment with international standards.

- The pharmacy chain operator Nahdi Medical Co, which had raised USD 1.36bn from its IPO, saw its shares surge in trading after making its market debut on Tadawul. With its stock closing at SAR 150 on Tues, its market value was as high as SAR 19.5bn.

- Saudi Arabia provided more than USD 80bn in support to SMEs, according to the governor the SME Authority Monsha’at. In addition to cash injections, support was also provided via regulatory improvements and advisory hubs.

- Saudi Arabia launched a MENA regional Voluntary Carbon Market (VCM), with Aramco, Saudia airlines, ACWA Power, Ma’aden, and ENOWA (a subsidiary of NEOM) announced as first potential partners. The VCM will connect the supply of carbon credits with demand from investors, corporates and institutions wanting to reduce their carbon footprint.

- Saudi Arabia’s minister of transport disclosed that though there were no plans to impose fees on roads presently, such a move could be initiated in the future. He also stated that the first Riyadh metro lines will likely launch towards end-2022 with the rest of the lines expected to be fully operational before end-2023.

- Riyadh’s strategy aims to raise the capital’s ranking from 40th level to reach among the top 10 cities’ economies globally by 2030, according to the Mayor of Riyadh region. Population in the city is expected to rise to 15-20mn by 2030 from 7.5mn currently.

- Aramco aims to launch 140 projects in various energy fields during the next three years, reported Al Arabiya, citing a senior official.

UAE Focus![]()

- The Dubai Electricity and Water Authority (DEWA) is looking to raise as much as AED 8.06bn (USD 2.19bn) via its IPO, with the indicative price range set at between AED 2.25 and 2.48 each. This is expected to be the biggest IPO on the exchange since 2007. Emirates Investment Authority, state holding company ADQ, Multiply Group, Alpha Dhabi Partners and Investment Holdings Est will become cornerstone investors in the IPO with a total commitment of up to USD 1.3bn.

- The UAE President issued a federal law allowing the use of foreign reserves and international debt instruments to maintain balance in the UAE’s 2022 general budget, according to a tweet from the finance ministry.

- The UAE Cabinet authorised the use of crowdfunding by both public and private sectors.

- Al Arabiya reported that UAE’s Sharjah emirate was seeking to raise USD 750mn from its first sukuk issuance in 2022.

- Dubai SME members won contracts worth AED 921.6mn in 2021, up 3% yoy, as part of the Government Procurement Programme. Contracts at the Expo topped the list (AED 161.7mn) followed by the Roads and Transport Authority (AED 95.2mn).

- Abu Dhabi’s sovereign wealth fund Mubadala launched a USD 1.5bn worth five and ten-year bonds for sale.

- UAE launched 10 initiatives to empower 15k coders in the UAE over a 15-month period including a coding ambassador programme, a language programmer challenge, and nomination of coders into career opportunities.

- Dubai will set up a specialised body to ensure fair trade and consumer rights protection. The Executive council approved the entity’s objectives including reducing anti-competitive practices, reviewing and developing consumer protection policies in addition to educating consumers on their rights and responsibilities.

- Dubai saved 329 megawatts in electricity consumption during Earth Hour 2022 – equivalent to a reduction of 132 tonnes of CO2 emissions, according to DEWA.

- The Abu Dhabi Fund for Development financed water, irrigation, and agricultural projects worth AED 2bn across 18 countries, it was disclosed in a report published on World Water Day (Mar 22nd).

- STR data showed that hotel occupancy in the UAE was 85% in the week ending March 12th: this is the highest in the world, compared to a global average of 50.8%. In Dubai, hotel occupancy was at 90.4%, with an average daily rate of AED 846.3 – this compares to 82.7% and AED 617.22 in the same week in 2019.

- Dubai property market is going strong: there have been 12,119 sales transactions till late-March, according to Property Monitor real estate data platform. This is 17.7% higher than in 2017, which had seen a similar good start to the year.

- Dubai airport will close 2 of its runways for a 45-day maintenance from May 9th; this would move some flights (to 34 of its more than 90 destinations) temporarily to Dubai’s second airport (Al Maktoum International).

Media Review

Saudi Arabia’s rise as global start-up hub attracts Egyptian entrepreneurs

https://www.arabnews.com/node/2050526/business-economy

When it comes to oil, the global economy is still hooked

https://www.reuters.com/business/energy/when-it-comes-oil-global-economy-is-still-hooked-2022-03-25/

War with Russia? Finland has a plan for that

https://www.ft.com/content/c5e376f9-7351-40d3-b058-1873b2ef1924

The Stealth Erosion of Dollar Dominance – Active Diversifiers & the Rise of Non-traditional Reserve Currencies: IMF working paper

https://www.ft.com/content/5f13270f-9293-42f9-a4f0-13290109ea02 (op-ed by Eichengreen)