Weekly Insights 17 Feb 2022: Specter of Inflation Rising in MENA

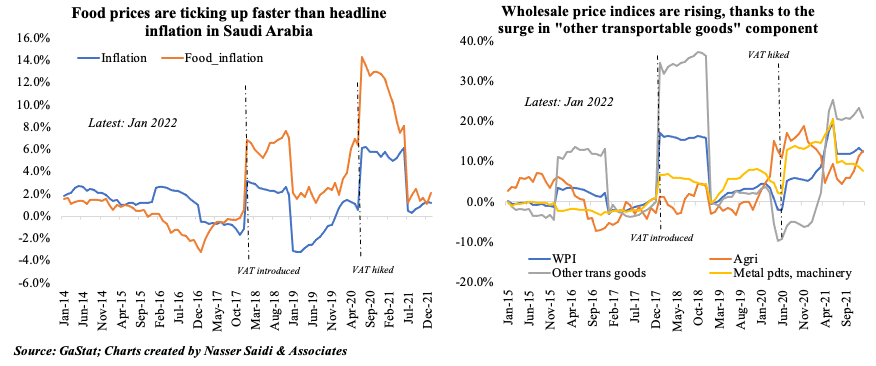

1. Inflation picking up again in Saudi Arabia. Higher consumer & producer prices in Jan

- The current increase in inflation in Saudi reflects global trends. However, the increase comes after prices eased in year-on-year terms (following the hike in VAT to 15% from Jul 2020 onwards)

- While the inflation reading stabilized at 1.2% yoy in Jan 2022, food prices were up by 2% (and 0.4% mom) and transport prices by 4.9% respectively. Global inflationary pressures and rising consumer demand domestically will play into an uptick in prices in Q1

- Wholesale prices accelerated by 12.3% in Jan, driven up by a 20.9% surge in “other transportable goods” which include basic chemicals and refined petroleum products: will likely spillover into CPI with a lag

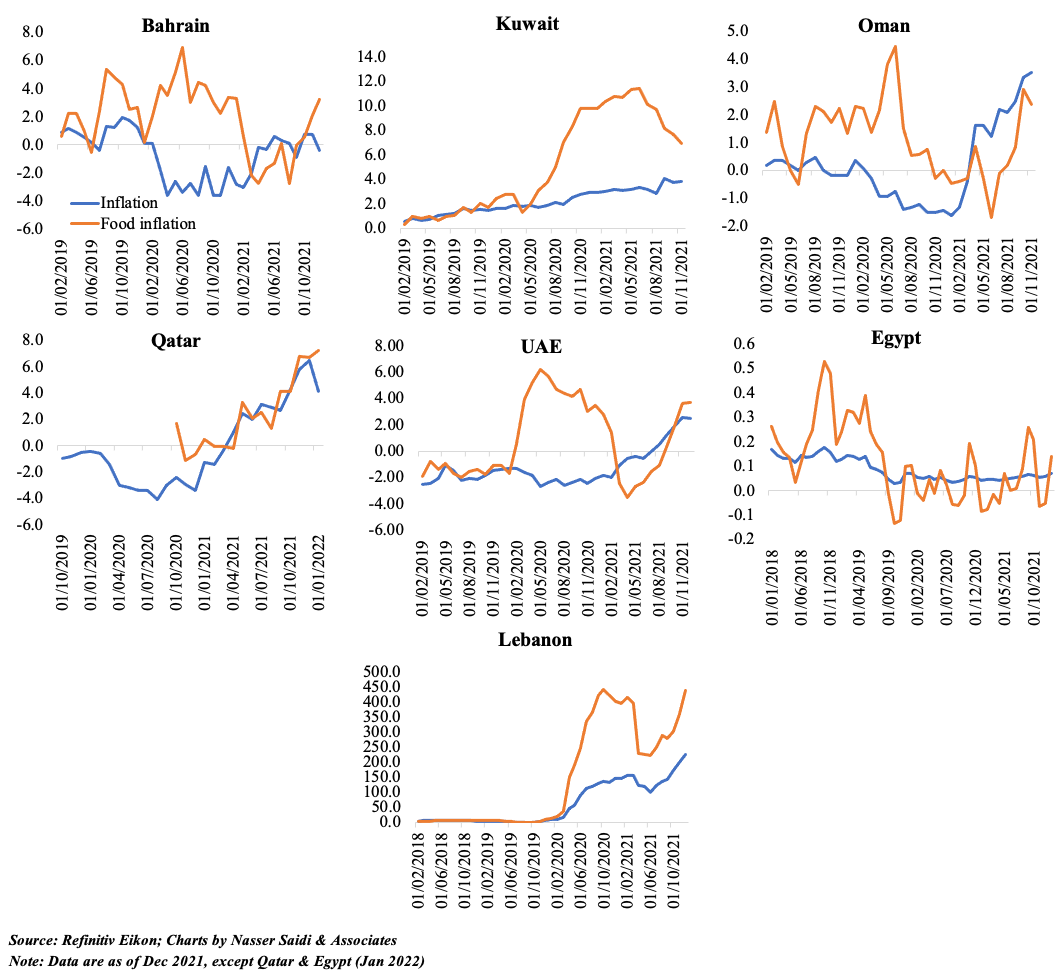

2. Inflation specter rising across major Middle Eastern nations

- Inflation in Lebanon averaged 150% in 2021, with food inflation running at 300%+ as the country continues to bear the brunt of the economic, social and financial turmoil

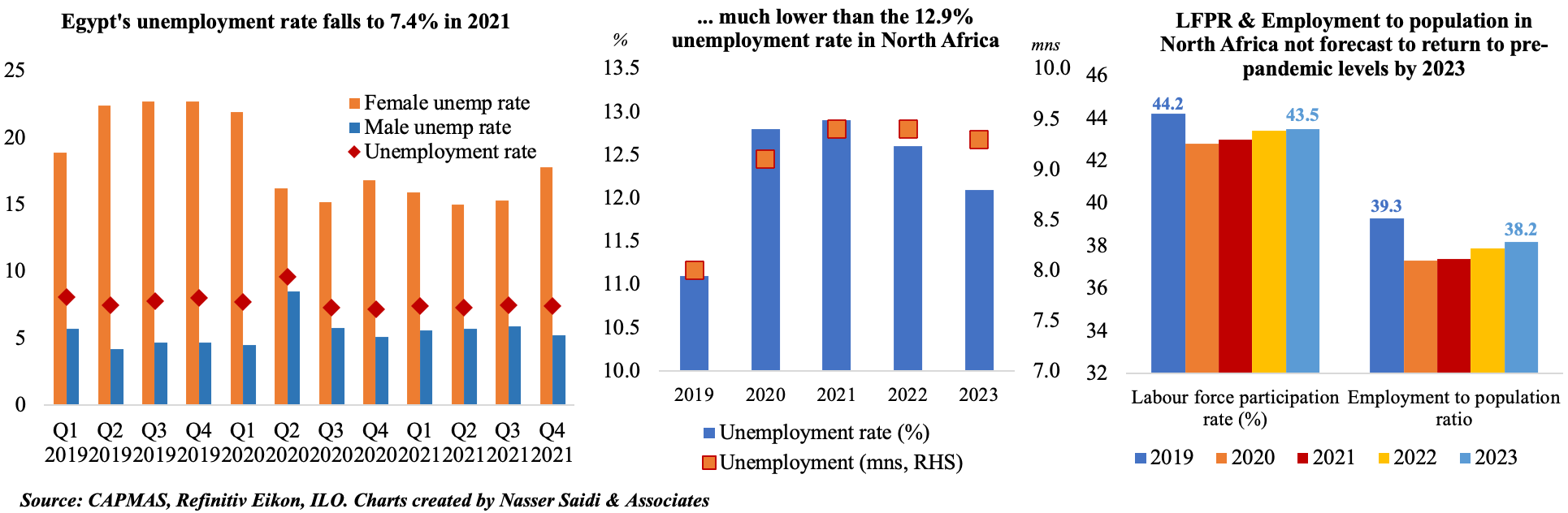

3. Inflation is rising in Egypt, while unemployment rates remain high though lower than the rest of North Africa

- Inflation in Egypt jumped to 7.3% yoy in Jan this year (Dec: 5.9%), with prices of fruits and vegetables up by 14%. Earlier this month, the central bank had left interest rates unchanged citing that inflation rate was still within the target rate of 7% on average in Q4. CB stance will likely be influenced by inflation rates in coming months

- The surge in Jan comes on the heels of higher oil prices and prices of commodities/ minerals; Egypt being an oil importer, prices look set to increase further this quarter

- Meanwhile, unemployment rate in Egypt is stabilizing, inching closer to pre-pandemic levels (2021: 7.4%); female unemployment rate (17.8% in Q4) is almost 3 times that of male unemployment rate (5.2%). Job losses during Covid were mostly among lower-skilled workers and in the informal sector; employment levels have been recovering

- Egypt, the most populous nation in North Africa, is performing much better than the rest of the North Africa region – where unemployment rate and levels are unlikely to fall to pre-pandemic levels even next year!

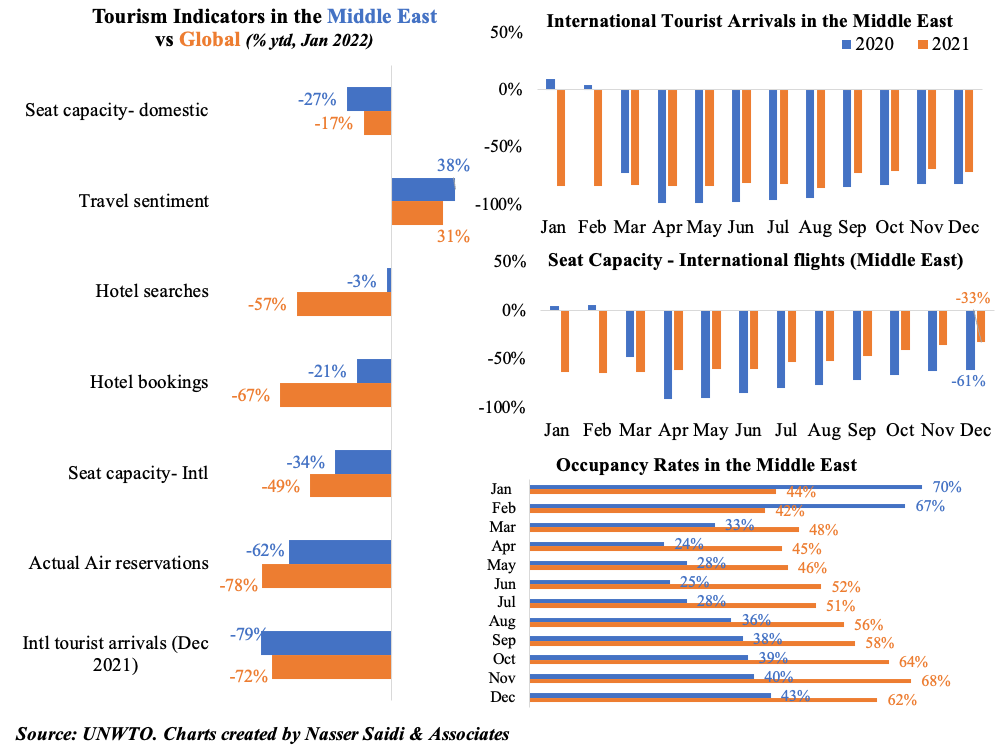

4. Tourism-dependent Egypt likely to take longer to recover, given current travel trends in Middle East

- Egypt’s international tourists plunged to about 3.6mn in 2020 vs over 13mn in 2019; in H1 2021, it received over 3.5mn visitors. The sector’s contribution to GDP was 3.8% in 2020 (2019: 8.8%): WTTC

- International tourist arrivals in the Middle East remained below global average in 2021 – another challenging year after Covid hit

- Monthly numbers indicate an improvement in H2 2021, as vaccines were rolled out, restrictions eased, and traveler confidence increased.

- However, fragile nature of the recovery is highlighted by the impact from the Omicron variant (which shows in Dec readings)

- Slow recovery expected: 50% of UNWTO’s ME panel of experts see international tourism into ME returning to pre-pandemic levels by 2023, and another 50% only in 2024 or later! (Survey conducted in Jan 2022)

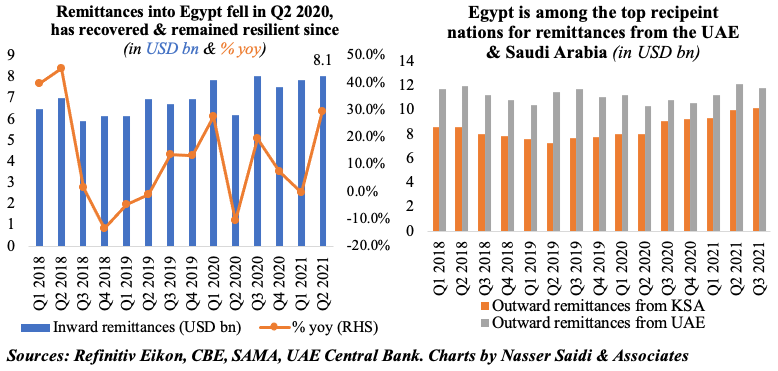

5. Remittances into Egypt have been resilient, but dependent on UAE & Saudi flows

- Remittances fell in Q2 2020 but recovered quite quickly & remained resilient (including into 2021)

- Egypt continued to see a surge in remittances: a trend seen since the liberalization of the currency. It surged by an estimated 12.6% to a record high USD 33bn in 2021, according to the World Bank; remittances stood at around 8% of GDP

- This was supported by a faster recovery in UAE and Saudi Arabia (two of the top 3 remittance sending nations globally) and where Egypt is among the top recipients of said remittances. Going forward, strong oil and non-oil sector recovery in these 2 nations bode well for remittance flows.