Markets

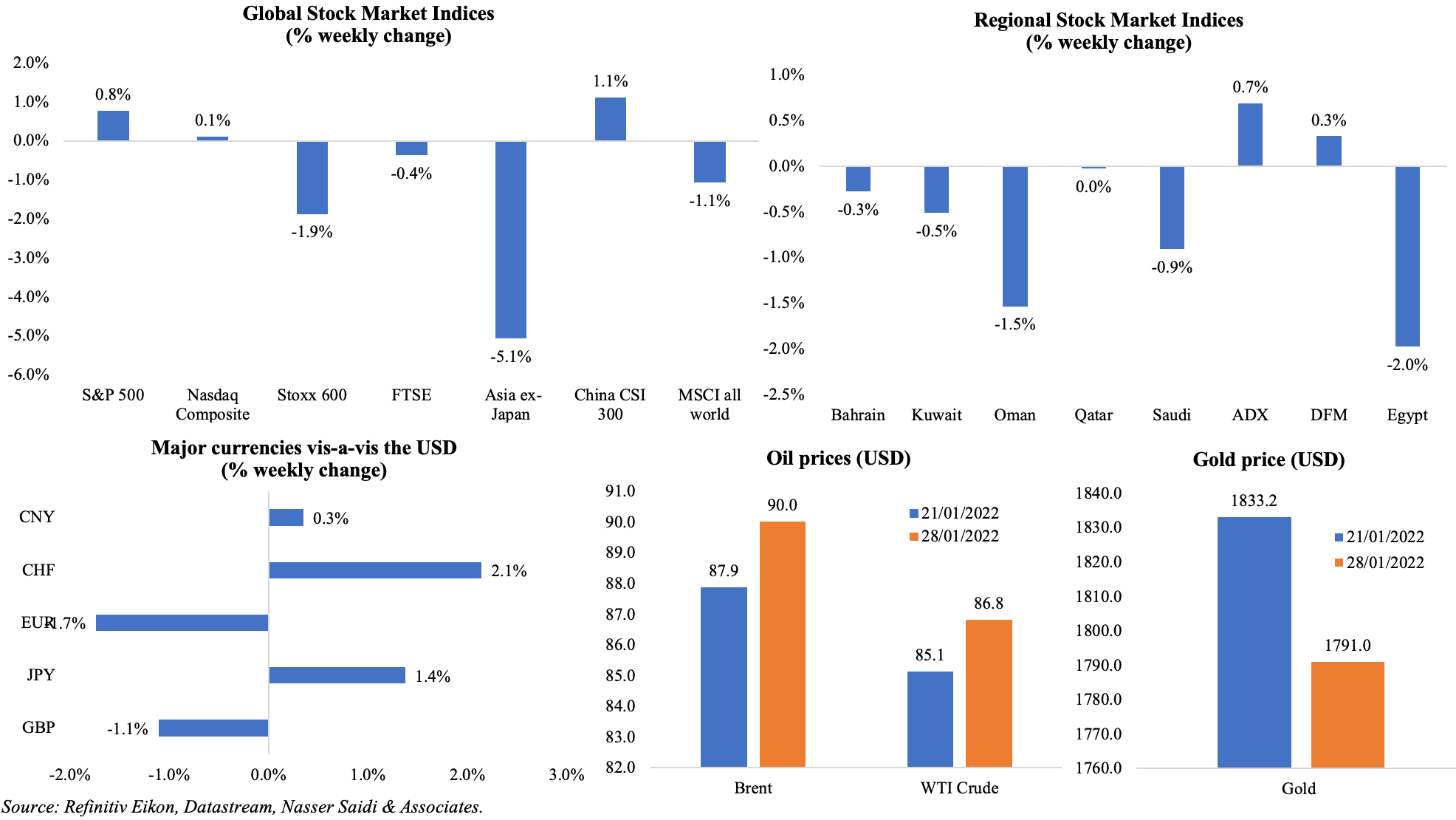

Most markets ended in the red after a volatile week dominated by the Fed’s announced tightening stance and Russia-Ukraine concerns amid strong corporate earnings; S&P recovered on Friday, reversing 3 weeks of losses, after Apple’s upbeat earnings report; Nasdaq posted a marginal gain. Europe’s Stoxx, MSCI Asia ex-Japan and MSCI all-world index fell sharply while the CSI 300 dropped to its lowest in nearly 16 months ahead of the Lunar New Year holidays. Regional markets were mostly down last week. Property stocks supported Dubai’s recovery from its biggest fall in over a month after the missile attack on the UAE last week while telecoms helped Abu Dhabi post gains. The dollar posted its biggest weekly rise in 7 months while the GBP rose close to a two-year high versus the euro (ahead of the BoE meeting this week and expected hiking of rates). Oil prices rose to a 7-year high on rising geopolitical concerns (and ahead of the OPEC+ meeting on Feb 2nd) while gold price fell by 2.3% on dollar strength.

Weekly % changes for last week (27 – 28 Jan) from 20 Jan (regional) and 21 Jan (international).

Global Developments

US/Americas:

- The Fed’s hawkish stance sparked a market sell-off early last week. While Powell stated that the central bank would be “humble and nimble” and “guided by the data” when asked about the frequency of the rate hikes, he confirmed a rate hike in March and that the Fed will wind down its bond-buying programme.

- GDP accelerated at a 6.9% annualized pace in Q4, supported by consumer activity (+3.3%) and gross private domestic investment (+32%). This reading meant a 5.7% increase in annualized GDP for the full year 2021 – the strongest since 1984. Core PCE jumped by 4.9% yoy in Dec – the fastest gain since Sep 1983. The PCE index, rising by 5.8% in Dec, reported the fastest pace since Jun 1982.

- Personal income inched up by 0.3% in Dec (Nov: 0.5%) though when adjusted for inflation, disposable personal income dipped by 0.2% for the 3rd consecutive month. Personal spending fell by 0.6% in Dec (Nov: +0.4%). Personal saving as a percentage of disposable income jumped to 7.9% in Dec (Nov: 7.2%).

- The advance report on durable goods shows that orders fell by 0.9% in Dec, following two months of monthly increases. Excluding transportation, new orders increase by 0.4%. Non-defense new orders for capital goods declined by 2.4%.

- Chicago Fed National Activity index slipped to -0.15 in Dec (Nov: 0.44), dragged down by production related indicators (-0.13 from +0.25 in Nov). Separately, the Dallas Fed manufacturing business index eased to +8.1 in Dec (Nov: 11.8) despite production index remaining steady at 26.7.

- The Richmond Fed manufacturing index fell to a 4-month low of 8.0 in Jan (Dec: 16), with respondents citing difficulty in finding labour (despite higher wages) while new orders fell.

- Markit’s preliminary manufacturing PMI for the US was down to a 15-month low of 55 in Jan (Dec: 57.7) and services PMI slowed to an 18-month low of 50.9 (57.6) – a result of the spike in Omicron cases, containment measures and related labour shortages. Composite PMI clocked in at 50.8 from Dec’s 57, posting the slowest reading since Jul 2020.

- S&P Case Shiller home prices climbed by 18.3% yoy in Nov, easing from Oct’s 18.5% uptick.

- New home sales in Dec soared by 11.9% mom to a seasonally adjusted 9-month high of 811k. This brings the new home sales total in 2021 to about 762,000, down 7.3% from 2020.

- Pending home sales dropped by 3.8% mom and 6.9% yoy in Dec. A total of 6.12mn previously owned homes were sold in 2021, the most since 2006 and up 8.5% from 2020.

- Goods trade deficit in the US hit a record high of USD 101.0bn in Dec, thanks to an increase in goods imports (+2% to USD 258.3bn) largely from capital goods, motor vehicles and consumer goods. Exports were up by 1.4% to USD 157.3bn.

- Initial jobless claims dropped to 260k in the week ended Jan 21st, ticking lower for the first time in 4 weeks as Omicron-related disruptions ease, and lower than the previous week’s upwardly revised 290k; the 4-week average was up by 15k at 247k. Continuing claims increased by 51k to 1.675mn in the week ended Jan 15th.

Europe:

- GDP in Germany in Q4 contracted by 0.7% in Q4, affected negatively by the Omicron variant and disruption in supply chains. Private consumption fell during the quarter while government consumption increased. Compared with Q4 2019 (pre-Covid), GDP was 1.5% lower. With the nation going through a “difficult catch-up phase”, GDP was lowered to 3.6% for 2022.

- Germany’s preliminary manufacturing PMI increased to 60.5 in Jan (Dec: 57.4), thanks to an increase in new orders and slight acceleration in private sector employment. Services PMI also rose to 52.2 from 48.7 in Dec, helping the composite index move into expansionary territory (54.3 in Jan from Dec’s 49.9).

- Preliminary manufacturing PMI in the eurozone edged up by 1 point to 59 in Jan, thanks to “an alleviation of supply chain delays”. Services PMI slipped to 51.2 (Dec: 53.1) as tourism and recreation activity declined given Covid19 restrictions while the composite PMI eased to 52.4 from 53.3.

- The Ifo business climate in Germany unexpectedly recovered in Jan, rising to 95.7 from 94.8 in Dec. The current assessment, fell to 96.1 (Dec: 96.9) while the expectations index jumped to 95.2 (Dec: 93).

- EU business climate indicator increased to 1.81 points in Jan (Dec: 1.78). However, the consumer confidence decreased to -10 points in Jan (Dec: -9.6).

- Preliminary readings of both manufacturing and services PMI in the UK declined to 11-month lows in Jan: manufacturing slipped by 1 point to 52.4 and services by 0.3 points to 53.3. Input cost inflation remained high, especially in the services sector while manufacturers reported a slowdown in purchase price inflation to its weakest since Apr 2021.

Asia Pacific:

- Japan’s preliminary manufacturing PMI for Jan inched up to 54.6 (Dec: 54.3) – the strongest improvement in operating conditions since Jan 201 Services PMI however fell to 46.6 in Jan (Dec: 52.1).

- Japan coincident index was 92.8 in Nov, the highest since Jul. However, it was lower than the flash reading of 93.6 but higher than the previous month’s 89.8. The leading economic index jumped to 103.2 in Nov from the preliminary reading of 103 and 101.5 in Oct.

- Tokyo inflation stood at 0.5% yoy in Jan, slowing from the 0.8% recorded in Dec 2021. Excluding fresh food, prices were up by 0.2% (Dec: 0.5%). Excluding food and energy, prices fell by 0.7% yoy (Dec: -0.3%).

- South Korea’s GDP grew by 1.1% qoq and 4.1% yoy in Q4, supported by demand for exports (+4.3% qoq) and private consumption (+1.7%). The full year GDP growth touched a 11-year high of 4% in 2021.

- Inflation in Singapore rose to 4% yoy in Dec (Nov: 3.8%) while core inflation, excluding accommodation and private transport costs, was up by 2.1% yoy (Nov: 1.6%). For the full year, inflation and core inflation stood at 2.3% and 0.9% respectively (2020: -0.2% for each).

- Singapore’s industrial production expanded by 15.6% yoy in Dec (Nov: 14.1%), supported by the volatile biomedical manufacturing (87.7%) as well as transport engineering (40.8%) while electronics production fell (-2.9%) due to semiconductors.

Bottomline: The IMF, in its latest World Economic Outlook (WEO) report, forecast global growth this year to moderate to 4.4% this year, from 5.9% in 2021. Preliminary PMIs show that the recent surge in Covid19 cases and restrictions seem to have affected the services sector more than manufacturing. Fewer supply shortages and easing shipping delays seem to have improved perception of manufacturers while inflation looks on track for further increases. It is in this backdrop that multiple central banks meet this week: after the Fed’s hawkish stance last week, the Bank of England is expected to hike rates while the ECB is likely to keep rates unchanged (with comments suggesting that inflation will slow to below the 2% target this year). The OPEC+ also meets this week and is likely to stick to the planned production hike. The recent price rally resulting from geopolitical worries is likely to be short-lived (unless it escalates).

Regional Developments

- In the IMF’s latest WEO report, Middle East & North Africa region is expected to grow by 4.4% in 2022, slightly higher than the 4.1% in 2021, thanks to the economic recovery among oil exporters. Saudi Arabia is estimated to grow by 4.8% from 2.9% in 2021. Egypt’s real GDP growth was revised up to 5.6% this year, citing the nations reforms though the Omicron variant could bring uncertainty for the tourism sector’s recovery.

- Egypt is planning to raise revenues by 13-15% in the 2022-23 budget to support wage hikes, according to the deputy finance minister. In H1 of the 2021-22 fiscal year, Egypt posted a deficit of 3.9% of GDP (vs. 3.6% and 4.1% in the prior two years). The nation also expects to make a primary surplus of 1.1-1.2% in the current fiscal year.

- Gross local public debt in Egypt has inched up to EGP 4.7trn by end of fiscal year 2020-21, according to the central bank. This represents 81% of gross GDP and compares to EGP 4.3trn in 2019-20. External debt increased by 11.6% yoy to USD 137.9bn in 2020-21, with external debt to GDP ratio at 34.2%.

- Egypt’s planning minister disclosed that privatization of state-owned companies will be rolled out every month or two. Though the privatization of 23 state firms were announced in 2018, almost all have been delayed (partly due to the pandemic).

- Production of petroleum products in Egypt increased by 30% during the period 2014-2020, according to the minister of petroleum and mineral resources.

- Customer deposits at Egypt’s banks inched up by 1.9% mom and 18.22% yoy to EGP 6.191trn in Oct. The volume of government deposits increased to EGP 1.2trn in Oct from EGP 1.166trn the month before (+2.9% mom).

- Iraq has already scheduled crude shipments for loading in Mar due to strong demand projections, revealed a senior official. He also stated that Iraq’s average oil exports are expected to rise to 3.3mn barrels per day (bpd) in Feb (Jan: 3.2mn bpd).

- Iraq and Saudi Arabia signed a MoU for an electrical connection between the two nations, expected to generate one gigawatt of power initially.

- Kuwait’s draft budget report for 2022-23 forecasts a deficit of KWD 3.1bn (USD 10.26bn), narrowing by 74.2% from the previous year. Oil income is expected to surge by 83.4% yoy to KWD 16.7bn while total revenues stand at an estimated KWD 18.8bn (assuming an oil price of USD 65 per barrel). Capital spending is penciled in at KWD 2.9bn while overall spending is set to touch KWD 21.9bn.

- Fitch Ratings downgraded Kuwait’s long-term foreign currency issuer default ratings to AA- from AA before, citing the political constraints in advancing reform in the state.

- Kuwait’s parliament approved a capital hike of KWD 300mn (USD 993.31mn) of the state-run Kuwait Credit Bank to offer more financial support for residential housing. This compares to the proposal submitted to raise the Bank’s capital by KWD 750mn.

- Lebanon’s government met last week, after more than three months, to discuss the budget (which the finance minister has labelled “an emergency budget”). Separately, the Deputy PM disclosed that the two-week discussions with the IMF (which began on Monday) would cover the banking sector and exchange rate in addition to the budget.

- The World Bank, in its latest report on Lebanon, revealed that the country’s GDP has plunged by 58.1% since 2019, falling to an estimated USD 21.8bn in 2021. The report was highly critical of the ruling class, stating that they have “captured” the state for economic gain and that the nation’s elite were still abusing their position. Access the latest report via: https://www.worldbank.org/en/country/lebanon/publication/lebanon-economic-monitor-fall-2021-the-great-denial

- Oman launched an electricity spot market – the first in the Middle East – in a bid to improve the efficiency of power procurement. The market will allow Oman Power and Water Procurement Company (OPWP) to purchase the required electricity on a daily basis through the offers received from licensed generation companies (of their surplus capacity). This will co-exist with the existing system of long-term power purchase agreements.

- ACWA Power launched a USD 417mn solar project in Oman: completed in 13 months, this is the nation’s largest utility-scale renewable energy project, and will utilize solar PV technology to generate 500 MW of renewable energy.

- Qatar’s trade surplus widened to QAR 25.6bn in Dec (Nov: QAR 8.6bn) thanks to the surge in exports (+107.8% to QAR 35.6bn) while imports grew at a slower pace of 16.2% to QAR 9.9bn. China remained the largest trade partner, accounting for 20.1% of total exports while imports from China accounted for 17.7% of total imports in Dec.

- Saudi Arabia called for all GCC nations to complete the establishment of a customs union and implement the common market, in a bid to achieve economic unity by 2025.

- According to Wamda, investments raised by MENA-based startups increased to USD 2.87bn from 639 deals in 2021. However, (exclusively) women-led startups received only USD 34.6mn last year (from 52 deals) accounting for just 1.2% of the total.

Saudi Arabia Focus

- Saudi Arabia’s non-oil exports grew by 26.1% yoy in Nov, supported by the exports of chemicals or allied industries: accounting for 34% of non-oil exports, this segment’s growth surged by 70.6% yoy. Oil exports, grew by 112.8% yoy in Nov, continue to dominate overall exports (75.8% of overall exports in Nov 2021 vs just 65% in Nov 2020.)

- Saudi plans to refinance SAR 43bn worth of debt in 2022, according to the National Debt Management Centre. According to the 2022 budget statement, public debt is estimated at SAR 938bn by end-2022.

- Aramco’s CEO, at a media briefing, disclosed that the firm is “optimistic” about oil demand and expects it will exceed pre-pandemic levels by end-2022. Stating that the “current [energy] transition is not going smoothly”, he said that to move towards a sustainable energy future, it was necessary to continue investments in both existing and new energy.

- The Saudi Industrial Development Fund plans to launch new financing products worth between SAR 10-11bn (USD 2.6-3bn) this year (focusing on Supply Chain Finance program one of the 4 targeted sectors). So far, the fund has approved the financing of more than 100 projects in the mining sector, to the tune of SAR 28bn.

- The Saudi National Automotive Manufacturing Co will produce 10,000 cars by 2023, according to its CEO. This was disclosed while laying the foundation stone for the first car assembly plant, the production capacity of which is set to hit 30k cars annually (in 2-3 years).

- Revenue from gaming in Saudi Arabia is estimated to reach USD 8bn in 2030, according to a BCG report. Home to 23.5mn gaming enthusiasts (~67% of the population), about 21.1 million have already played esports titles on a semi-pro or amateur basis.

- The share of electronic payments in retail business exceeded 57% of the total transactions conducted in 2021, according to the Saudi Central Bank. This is slightly higher than the 55% target set in the Financial Sector Development Program; plan is to raise this to 70% by 2025.

UAE Focus![]()

- Industrial exports from the UAE totaled AED 120bn (USD 33bn) in 2021, according to the ministry of industry and advanced technology. The Minister disclosed that 220 new factories went into production last year, while 45 public entities and 13 major national institutions and firms joined the National In-Country Value Programme – which had circulated AED 41bn back into the local market.

- Non-oil trade in Abu Dhabi increased by 2.9% yoy to AED 190.2bn (USD 51.8bn) in Jan-Nov 2021. Non-oil exports stood at AED 71.17bn while imports touched AED 83.63bn. Saudi Arabia was Abu Dhabi’s largest non-oil merchandise trade partner in Nov, with bilateral trade at AED 4.87bn, followed by the US (AED 1.46bn), China (AED 1.15bn) and Oman (AED 1.144bn).

- Dubai attracted AED 15.9bn in FDI into 378 projects (+16% yoy) during Jan-Sep 2021, according to data from the FDI Monitor released by the Dubai Investment Development Agency (Dubai FDI). High and medium technology investments comprised 64% of inbound FDI capital while job creation due to overall FDI jumped by 36% yoy to 16,430 new jobs in Jan-Sep 2021. The UK, France, the US, Saudi Arabia and India were the top FDI source countries, together accounting for 72% of total capital inflow.

- UAE’s Securities and Commodities Authority approved a regulatory framework for special purpose acquisition companies (SPACs), also allowing for sponsors abroad to apply to list SPACs on the Abu Dhabi Securities Exchange. Sponsors will be required to raise a minimum of AED 100mn (USD 27mn) in the IPO.

- Dubai issued 16,409 e-trader licences between Mar 2017 until end–2021, as per a Dubai Media Office tweet. Of these, in 2021, 6217 licenses were issued, up 6% yoy. This license allows UAE citizens and GCC nationals to practice business activities online.

- The Abu Dhabi Department of Economic Development revealed that more than 20,000 requirements to set up businesses had been scrapped by 26 local and federal partner entities – in a bid to attract more investment and improve doing business in the emirate.

- Abu Dhabi issued a new family business ownership law: this prevents selling shares or dividends of family-owned businesses to individuals or companies outside the family, and requires prior approval from family partners if such equity stake sales are to be undertaken.

- The volume of property transactions in Dubai grew by 66% to 84,196 in 2021 while the value surged by 72% to a record high AED 300bn (USD 82bn).

- Energy demand in Dubai increased by 10% yoy to 50,202 gigawatt-hours in 2021, according to DEWA’s CEO. In line with rising demand, DEWA production capacity increased to 13,417 megawatts of electricity and 490mn imperial gallons of desalinated water per day.

- The Dubai Duty Free projects annual sales to reach AED 5.1bn (USD 1.4bn) this year, up 40% yoy, with overall average spending per passenger at more than pre-pandemic levels. Dubai Airports forecasts 57 million annual passengers for 2022.

- Dubai is planning to host 400 global economic events annually by 2025, after winning bids to host 120 last year.

- The Dubai Metro has eliminated about 1bn journeys on private vehicles from its launch in Sep 2009 till end-2020, thereby reducing carbon dioxide emissions by 2.6mn tons, according to the Chairman of the Roads and Transport Authority (RTA). The cumulative benefits of the metro amounted to AED 115bn (USD 31.33bn) during this period.

- The Etihad Rail Project is estimated to contribute AED 186bn (USD 50.6bn) to the UAE economy, according to an article by Investment Monitor sponsored by the Abu Dhabi Investment Office. Over 40 years, the project aims to generate transport cost savings worth AED 84bn, tourism revenues (AED 21bn) and wider economic benefits (AED 23bn).

- The Dubai Culture and Arts Authority disclosed that its museums, heritage sites and public libraries attracted 521,753 visitors in 2021 with heritage sites and libraries the most visited (accounting for 50% and 39% of total visits last year).

- Demand for gold in the UAE surged by 57% to 33.8 tonnes in 2021, supported by a recovery in tourist traffic and improved consumer sentiment, according to a report from the World Gold Council. Overall demand in the Middle East jumped by 41% to 159.9 tonnes.

Media Review

Rising IPO tide could lift all Gulf boats

https://www.reuters.com/markets/asia/rising-ipo-tide-could-lift-all-gulf-boats-2022-01-20/

Lebanon’s middle class squeezed by crisis

Frankly Speaking: Saudi Arabia can be a leading oil exporter while also fighting climate change, says deputy minister for environment

https://www.arabnews.com/node/2010286/saudi-arabia

Dubai population to surge to nearly 6m in 20 years amid urban transformation

Can China create a world-beating AI industry?

https://www.economist.com/business/2022/01/22/can-china-create-a-world-beating-ai-industry

Dr. Nasser Saidi’s CNBC Arabia interview on Lebanon’s recent banking, exchange rate developments and negotiations with the IMF