Weekly Insights 6 Jan 2022: Covid19 cases rise in the GCC, but economic activity is supported by high vaccination rates, oil & consumer spending

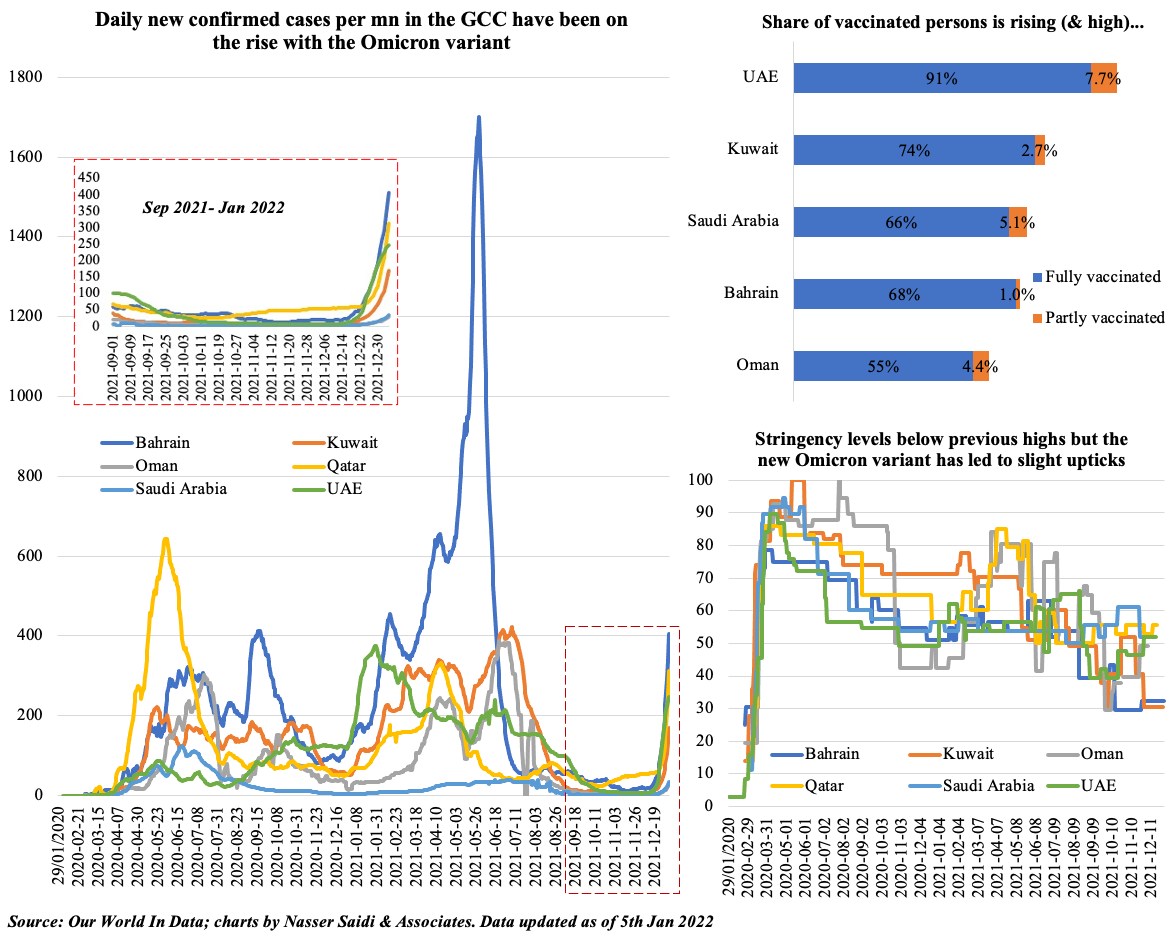

1. Covid19 cases have been rising in the GCC given the Omicron variant. The vaccination pace is strong & boosters are being rolled out. Stringency has ticked up slightly.

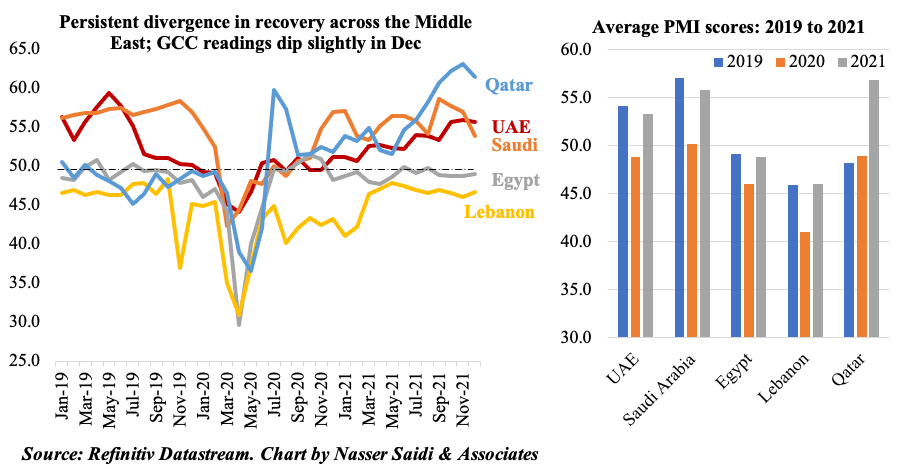

2. GCC PMIs remain expansionary in 2021. Divergent wrt other Middle East nations

- Average PMI in 2021 stayed above 50 in UAE, Saudi and Qatar, with the latter’s activity much higher than recorded in its 5-year history. Egypt and Lebanon saw the 2021 average reading lower than in 2019, but substantially higher compared to 2020

- The resurgence of Covid19 cases in GCC has led to a decline in sentiment in Dec 2021 with concerns about the spread of the Omicron variant and potential curbs on travel/ business

- Input prices are rising => inflation is a rising concern (firms in Qatar are passing on costs to the consumer); strong competition (& offering of discounts) is another concern (in Saudi & UAE)

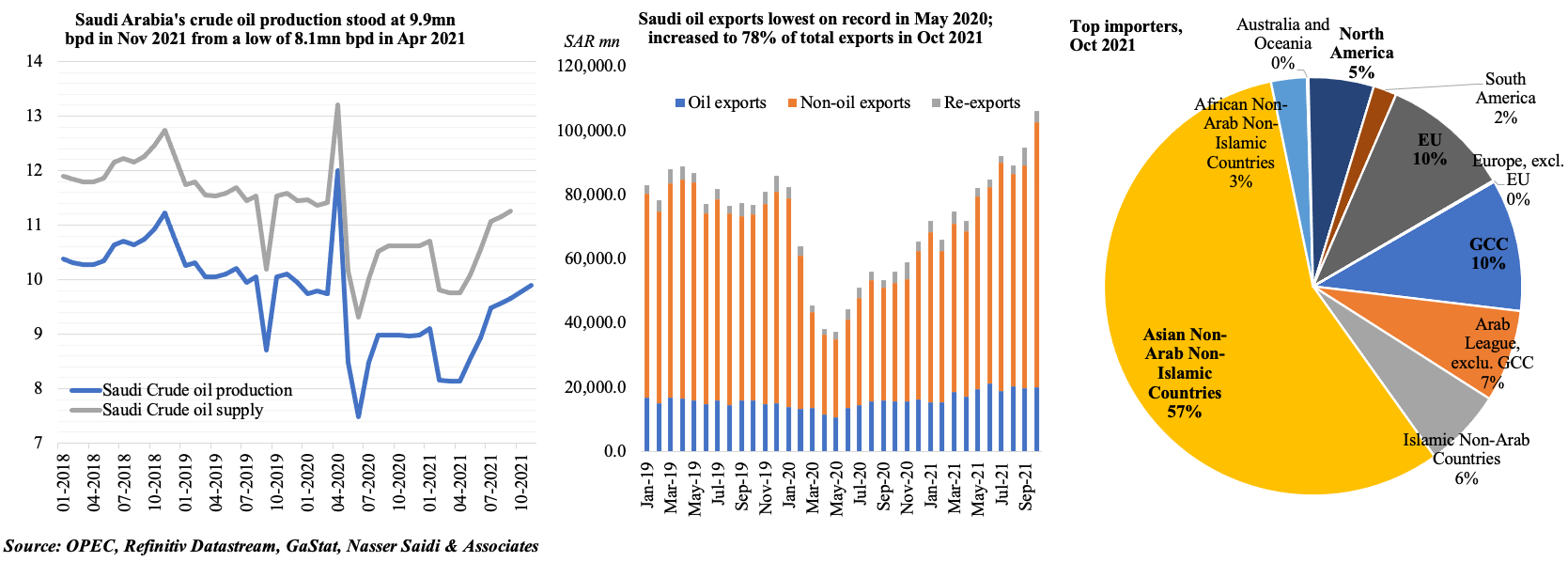

3. Oil continues to play a dominant role in Saudi Arabia’s economic activity

- Saudi Arabia’s oil production and supply have been gradually rising, in line with OPEC+ decisions. Production hit the highest since Apr 2021

- The latest OPEC+ meeting upheld the decision to raise production by 400k bpd in Feb, which will result in a surge in oil GDP growth in the quarter

- Thanks to rising demand and higher prices, oil exports accounted for 78% of the total in Oct 2021, with Asia the key import partner

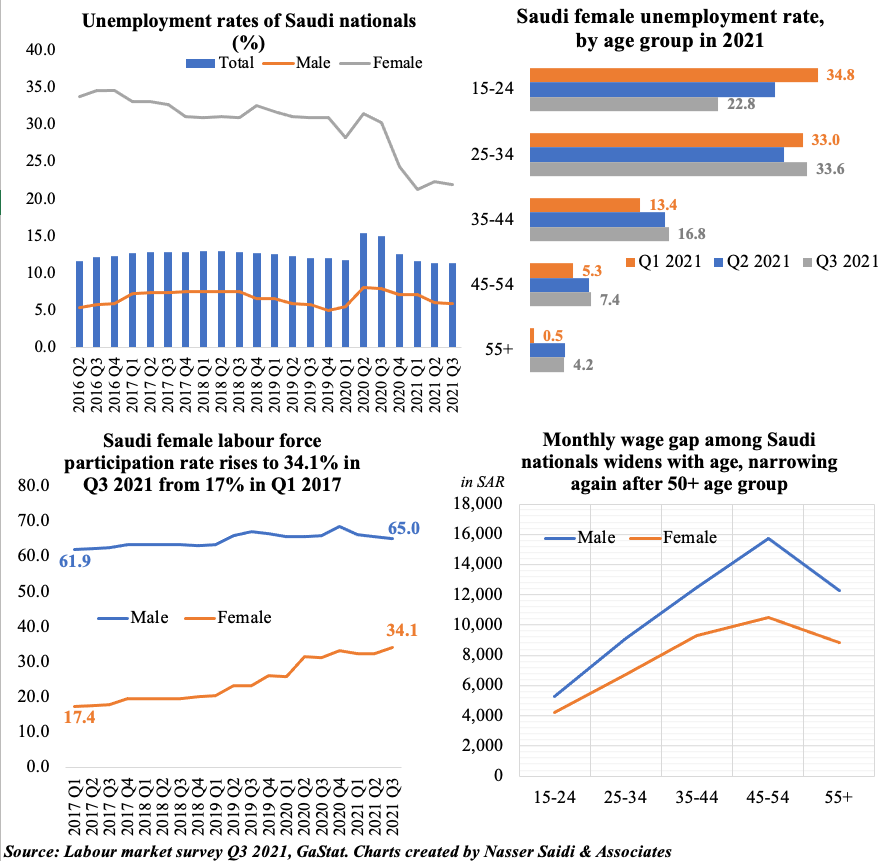

4. Unemployment rate for Saudi nationals held steady at 11.3% in Q3

- Supported by measures to boost local employment in the private sector, unemployment rate remains unchanged at 11.3% in Q3 2021

- As seen previously, female labour force participation rates are rising (34.1% in Q3 2021); wage disparity continues to widen for ages 15-54

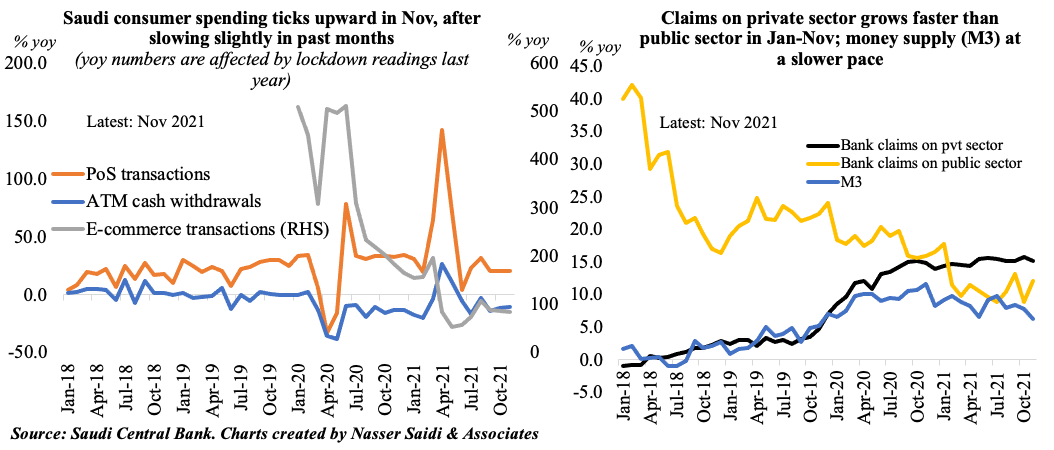

5. Consumer spending in Saudi Arabia is on the rise, in line with economic recovery

- Consumer spending has been rising in Saudi Arabia, with Point of Sales (20.5% yoy & 2% mom) and e-commerce (83.5% yoy and 7.7% mom) transactions driving the increase in Nov. Significant increases in spending has been recorded in sectors like hotels (47.7%) education (33.3%), transportation (39.8%) and restaurants (31%)

- In Nov, credit disbursed to the public sector (govt + quasi-govt institutions) ticked up by 4% mom vs private sector’s marginal 0.6% rise. Mortage lending continues to remain a strong contributor to loan growth.

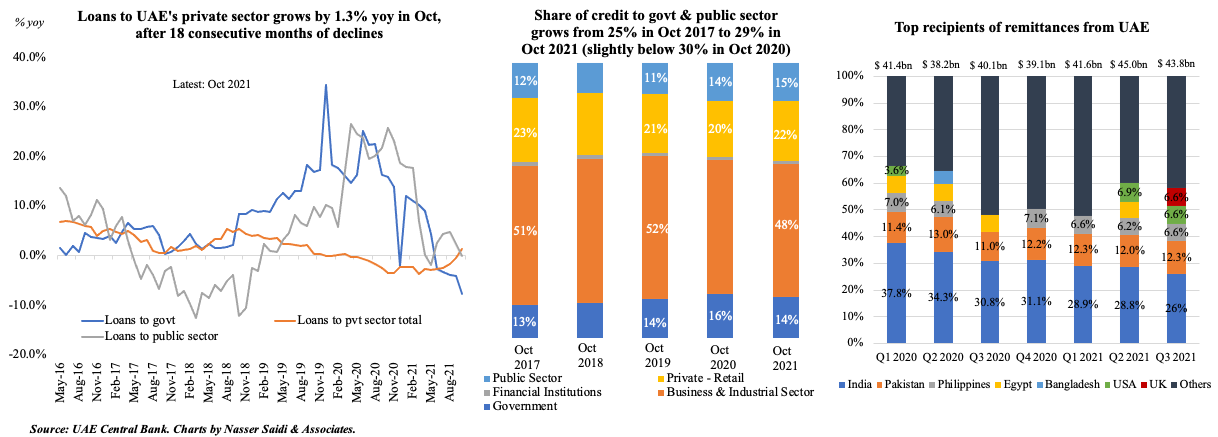

6. Credit growth in the UAE remains soft; private sector loans turn a corner

- Credit disbursed to the UAE’s private sector grew by 1.3% yoy in Oct, turning positive after 18 consecutive months of year-on-year declines.

- The share of credit to the public sector (i.e. govt & state-owned firms) stayed just under one-third of the total in Oct 2021 while business sector loans was lower than 50%

- Outward remittances from the UAE grew by 9.2% yoy in Q3 2021 to USD 43.8bn. India remained the top recipient, but its share is much lower (26% in Q3 vs 37.8% pre-pandemic)