Markets

Most global equity markets surged in 2021: the MSCI World Index was up 17% and Topix increased by 10.4%; tech stocks strongly supported gains in the S&P 500 and Stoxx600. However, the regulatory crackdown led to Hong Kong and Chinese mainland markets posting losses (more than 14% and 5% respectively). Among regional markets, while most markets ended posting gains in 2021, Abu Dhabi emerged the biggest gainer (+68% yoy, its best performance in 16 years) followed by Saudi (+30%) and Dubai (+28.3%) while Oman posted its first yearly gain in 5 years (+13%). Turkish lira was the biggest currency loser, but the euro and the yen dropped close to 10% versus the greenback. Oil was the biggest gainer across all asset classes posting a 53%+ increase in prices last year while by contrast the gold price dropped by 4.6%.

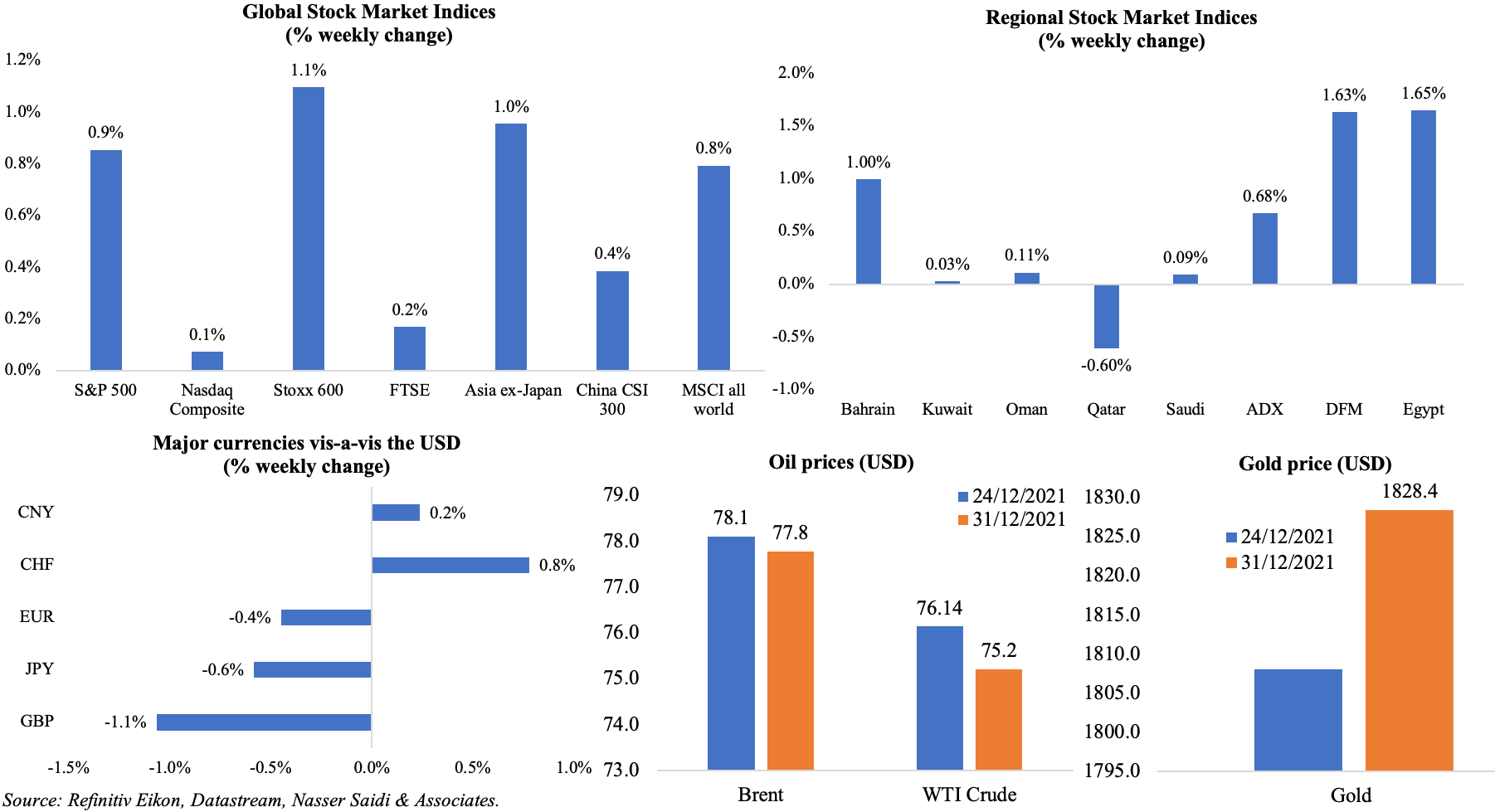

Weekly % changes for last week (26 – 31 Dec) from 23 Dec (regional) and 24 Dec (international). Updated 7am UAE time.

Global Developments

US/Americas:

- US goods trade deficit widened to a record high USD 97.8bn in Nov (Oct: USD 83.2bn). Exports declined by 2.1% in Nov, with only food exports posting an increase of 4.3% amid declines elsewhere; imports were up by 4.7% in Nov, led by record highs in imports of industrial supplies (to USD 63.2bn) and consumer goods (to USD 67bn).

- Dallas Fed manufacturing business index slipped to 8.1 in Dec (Nov: 11.8), with the production index holding steady at 26.7 while new orders index slipped to 18.1 (but higher than series average of 6.7). Separately, the Richmond Fed manufacturing index for Dec increased to a 5-month high of 16 (Nov: 12), thanks to rise in shipments and new orders.

- S&P Case Shiller home price index increased by 18.4% yoy in Oct, though down from the 19.1% growth recorded in Sep.

- Pending home sales slipped by 2.2% mom and 2.7% yoy in Nov, given limited housing stock amid higher prices.

- Initial jobless claims fell to 198k in the week ended Dec 24th, from the previous week’s 206k. The 4-week average slowed to 199.25k, posting the lowest level since Oct 25th1969, and from 206.5k in the prior week. Continuing claims dropped by 140k to 1.716mn in the week ended Dec 17, the lowest level since Mar 7th (pre-pandemic).

Europe:

- No major macroeconomic data was released last week.

Asia Pacific:

- China’s manufacturing PMI unexpectedly inched up to 50.3 in Dec (Nov: 50.1): new orders remained below-50 in Dec, though inching up to 49.7 (Nov: 49.4) while export orders shrank further (48.1 from Nov’s 48.5). Non-manufacturing PMI rose to 52.7 in Dec (Nov: 52.3) though new orders fell to 48.4 (Nov: 48.9) while both input costs and selling prices fell.

- Industrial production in Japan grew by 7.2% mom and 5.4% yoy in Nov (Oct: -5% yoy), with the increase driven by the 43.1% mom jump in car production. The ministry also revised its assessment of IP stating that the manufacturing sector was “showing signs of recovery” versus previous readings of “at a standstill”.

- Unemployment rate in Japan inched up to 2.8% in Nov (Oct: 2.7%), posting the first increase in 6 months. The jobs-to applications ratio remained unchanged from the month before at 1.15, meaning that there were 115 job openings for every 100 job seekers.

- Retail trade in Japan inched up by 1.9% yoy in Nov (Sep: 0.9%), with an increase in sales of fuel (+29.2%) and food and beverage (+4.1%). Large retailer sales also increased by 1.4%.

- Current account balance in India slipped to USD 9.6bn in deficit in Q3 from USD 6.6bn surplus in Q2. This was partly the result of a widening of trade deficit to USD 44.4bn in Q3 (Q2: USD 30.7bn) and an increase in net outflow of investment income. Private transfer receipts (mainly remittances) rose 3.7% yoy while net FDI inflows stood at USD 9.5bn in Q3 (from USD 24.4bn in the same quarter a year ago).

- India’s infrastructure output growth slowed to 3.1% yoy in Nov (Oct: 8.4%), a 9-month low, with monthly declines in cement and steel output (-21.1% mom and 5% respectively).

Bottomline: Covid19 cases continue to rise across the world, with many developed nations breaching new record highs with respect to daily cases and airline travel severely disrupted (over 4,000 flights were cancelled just on Sunday, of which more than half were in the US). While hospitalizations are relatively lower (versus previous strains), there are unanswered questions related to supply chains, overall costs and consumer/ business confidence amidst proposed tightening of monetary policies. Furthermore, a recent OPEC+ report, which estimates only a “mild” and “temporary” effect of the Omicron variant on the oil market, makes it more likely that OPEC+ will continue to raise oil output modestly at this week’s meeting.

Regional Developments

- The central bank of Bahrain gave an in-principle approval to Binance to become a crypto-asset provider in the country. Binance is the largest crypto exchange by trading volume.

- Egypt’s net foreign assets fell for a second month in Nov, falling to EGP 82.95bn from Oct’s EGP 114.2bn.

- Egypt is planning to sell shares in power plants that were built in partnership with Siemens, to maximise the “return on state-owned assets and refinancing state investments to ease the burden on the public budget” according to the head of the sovereign fund. Three 4.8GW power plants were built at a total cost of USD 7bn.

- Three IPOs applications were approved by the Egyptian Financial Supervisory Authority: together, the Macro Group Pharmaceuticals Nahr, El-Kheir Company for Development and Agricultural Investment, and the Industrial and Engineering Enterprises Company are valued at over EGP 4bn (USD 255mn).

- Egypt and Saudi Arabia are investing USD 8bn in an electricity interconnector with a capacity of 3,000MW: this is 1.5 times more than the production of the Nile’s High Dam.

- Iraq’s oil minister disclosed that the country’s average oil export rate for Jan will be 3.3mn barrels per day (bpd).

- Kuwait formed a new cabinet last week, with a new finance minister, while the oil minister was re-appointed. The cabinet also includes 3 opposition lawmakers (versus 1 in the past).

- Lebanon’s energy minister disclosed that though repairs to the Arab Gas pipeline would likely be completed by end-Feb, allowing for the delivery of Egyptian gas, the date is not yet confirmed. This is dependent on US clarification to Egypt that it would not be penalized by the Caesar Act (sanctions imposed on Syria).

- Oman’s budget deficit touched an estimated OMR 1.2bn or 3.8% of GDP in 2021. This is a massive improvement compared to 2020’s deficit at 19.3% of GDP. Furthermore, foreign reserves at the central bank are estimated at USD 18bn in 2021 (2020: USD 14bn).

- Oman announced that employees need to be fully vaccinated to be allowed entry to workplaces (both public and private sectors); foreign travelers need to have received at least 2 doses of the vaccine to enter the country.

- MENA’s quick-commerce market is expected to expand to USD 47bn by 2030, according to research from Redseer. Grocery and food delivery will dominate, accounting for more than 80% of the market share.

- Assets managed by sovereign wealth funds and public pension funds touched a record high USD 31.9trn in 2021, according to a report by Global SWF. SWF assets grew by 6% to USD 10.5trn while those managed by pension funds jumped by 8.7% to USD 21.4trn. Furthermore, state-owned investors divested USD 32.1bn through 45 transactions, half of which involved property and infrastructure assets.

Saudi Arabia Focus

- Saudi Arabia’s central bank announced a 3-month extension of the deferred payment programme to support the private sector.

- A major development strategy for the city of Riyadh up to 2030 will be “finalized” in 2022, after some “incomplete elements” delayed its launch, according to the state news agency.

- Saudi Arabia’s exports surged by 90% yoy and 12.2% mom to SAR 106.2bn (USD 28.32bn) in Oct, thanks to the jump in oil exports (+123% yoy). Overall imports increased by 7.6% yoy to SAR 46.3bn.

- Current account surplus in Saudi Arabia stood at USD 0.7bn in Q3, reversing a deficit of USD 21.7bn recorded in Q3 2020. The rebound was largely due to the surge in oil exports (19.4% qoq to USD 55.1bn in Q3) while services trade deficit narrowed by 17.6% to USD 10.1bn. Remittances grew by 11.8% yoy to USD 10.1bn and net FDI eased to USD 1.75bn in Q3 (Q2: USD 13.8bn).

- Net foreign assets held by SAMA increased by 3.2% mom to SAR 1.68trn ($447bn) in Nov.

- Credit disbursed to the private sector in Saudi Arabia inched up by 0.6% mom in Nov while credit to the public sector grew by 4%. Net foreign assets inched down by 0.17% to SAR 47.8bn. Value of points of sale transactions grew by 2% to SAR 41.3bn (USD 11bn) in Nov.

- Remittances from Saudi Arabia edged up by 0.8% yoy to SAR 13bn in Nov: this was down by 3.7% mom and the lowest amount since Jul 2021.

- Saudi Capital Market Authority approved IPOs of Al Nahdi Medical Co. and Saudi Home Loans Company in addition to 3 others planning to list on Nomu – Arabian International Healthcare Holding Co., Saudi Parts Center Co. and Saudi Azm for Communication and Information Technology Co. The approved applications are valid for 6 months.

- The National Debt Management Center in Saudi Arabia revealed the completion of 2021’s borrowing plan (of over SAR 125bn), of which 60.5% of debt was raised from local sources.

- Revenues of the Saudi mining sector jumped by 27% yoy to SAR 724mn (USD 192.8mn) in Jan-Oct 2021, according to the Ministry of Industry and Mineral Resources. About 690 mining licenses were issued last year.

- The real estate sector in Saudi Arabia provided 40k job opportunities in 2021 and increased private sector’s participation to more than SAR 385bn (USD 103bn), according to the minister of Municipal and Rural Affairs and Housing. Furthermore, the share of local content in real estate projects surged to 81% in 2021 from 35% previously.

- Saudi Arabia plans to generate over 15,000 GW hours by 2024, according to GaStat: this will supply close to 700k houses with energy and will likely provide 7870 job opportunities.

- The Saudi Central Bank will use Bloomberg’s auction system for repo, reverse repo, and open market operations starting this month.

- Saudi Arabia has tightened Covid19 restrictions, with residents asked to wear masks and practice social distancing both indoors and outdoors, at activities and events.

UAE Focus![]()

- The FT reported that UAE government plans to remove monopolies, held mostly by UAE family businesses, on the sale of imported goods. This would allow foreign firms the opportunity to distribute their own goods or change local agents. Following this news, the Ministry of Economy issued a statement that a draft law on commercial agencies was still going through the legislative process, and “it is still too early to give details”.

- The Dubai budget for 2022-24 was approved on Sun (2 Jan): expenditure for the period stands at AED 181bn (USD 49bn) whereas this year’s spending is penciled in at AED 59.95bn (USD16.32bn).

- Sharjah’s approved AED 34.42bn (USD 9.37bn) budget for 2022 is 2% higher than 2021: it prioritizes infrastructure (44% of budget), economic (27%) and social development (21%) and is expected to create about 1,000 jobs for newly graduated citizens.

- Dubai International Airport disclosed on Dec 30th that about 2 million passengers were expected to pass through the gates till Jan 10th.

- UAE will ban its unvaccinated citizens from travelling abroad starting Jan 10th, except those who are exempt on medical or humanitarian grounds.

Media Review

Ten economic trends that could define 2022

https://www.ft.com/content/432d78ee-6163-402e-8950-d961b4b1312b

Clouds over 2022

https://www.project-syndicate.org/commentary/economic-market-outlook-2022-by-nouriel-roubini-2021-12

IMF’s Top 10 Blogs of 2021 Show Breadth of Global Policy Challenges

https://blogs.imf.org/2021/12/23/top-10-blogs-of-2021-show-breadth-of-global-policy-challenges/

How a year outside the EU’s legal and trading arrangements has changed Britain

Slow progress as Lebanon awaits IMF economic deal

https://www.france24.com/en/live-news/20211229-slow-progress-as-lebanon-awaits-imf-economic-deal