Markets

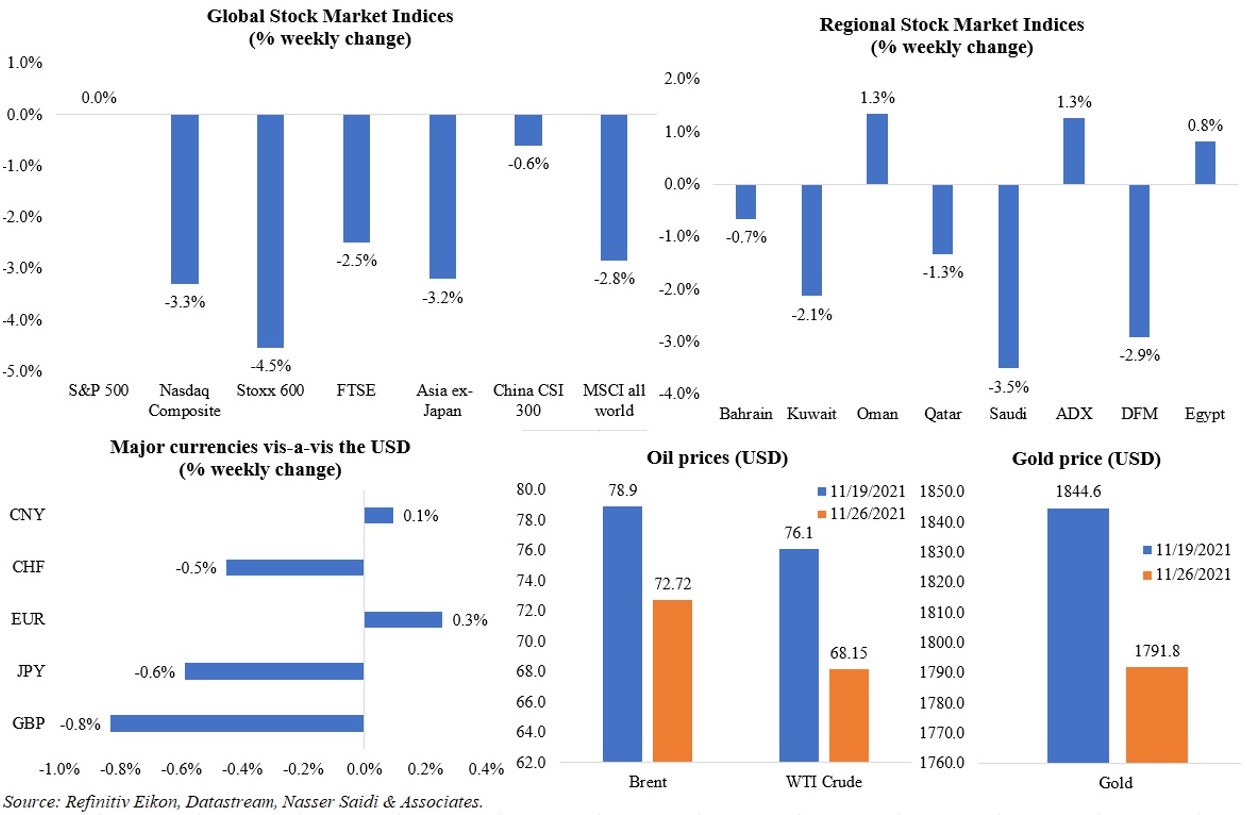

Global equity markets ended in the red after news spread about the Omicron variant that is potentially more transmissible and likely resistant to current vaccines. In the US, markets opened after Thanksgiving to declines (S&P 500 had its worse one-day drop since end-Fe; Nasdaq’s was the worst in 2 months). European stocks saw the biggest sell-off in 17 months and the MSCI global index dipped by close to 3%. Among regional markets, Saudi Arabia posted its biggest one-day drop on Sun (on news related to drone attacks) and recorded the biggest weekly loss in over a year (-3.5%). Safe-haven currencies the Japanese yen and Swiss franc gained. Oil prices fell sharply on fears of oversupply should the new variant lead to increased travel restrictions globally. Gold prices also slipped by nearly 3% to close below the USD 1800 mark.

Weekly % changes for last week (25 – 26 Nov) from 18 Nov (regional) and 19 Nov (international)

Global Developments

US/Americas:

- US GDP expanded at a 2.1% annualized rate in Q3, inching up from a previous 2% estimate, thanks to revisions in consumer purchases and private inventory investment while supply chain bottlenecks continue to have a negative impact. Personal income climbed by 0.5% mom in Oct, while consumption rose 1.3% (double that of the gain in Sep).

- Core PCE in the US increased to 4.1% yoy in Oct (Sep: 3.7%), posting the biggest yoy increase since the 1990s. Including energy and food prices, the PCE index was up by 5% (Sep: 4.4%).

- Fed minutes reveal discussions centered around inflation, which would “take longer to subside than they had previously assessed”. While there was a consensus that “maintaining flexibility” was key, the minutes do not indicate a bias towards acceleration of policy tightening. CME’s FedWatch tracker indicates a 61% probability of 3 hikes next year.

- The Chicago Fed National Activity Index inched up to 0.76 in Oct (Sep: -0.18). The Richmond Fed manufacturing PMI slipped to 11 in Nov (Oct: 12).

- Michigan consumer sentiment index fell to a decade-low of 67.4 in Nov, a tad higher than the preliminary estimate of 66.8 but lower than Oct’s 71.7. The survey shows inflation to be a major concern: 1 in 4 consumers reduced living standards due to price increases, while half of all families anticipated lower real income in the year ahead when adjusted for inflation.

- Existing home sales increased by 0.8% mom to 6.3mn in Oct, rising for the 2nd consecutive month after a summer slump. The median existing home price for all house types was up 13% yoy to USD 353,900: rising for the 116th straight month, the longest positive streak on record.

- Markit manufacturing PMI in the US inched up to 59.1 in Nov (Oct: 58.4) though raw material delays and labour shortages were key drawbacks. Services PMI slowed to 57 in Nov (Oct: 58.7) though sales were supported by an expansion in new export orders.

- Durable goods orders unexpectedly dipped by 0.5% mom in Oct (Sep: -0.4%), dragged down by a slump in transportation equipment orders (-2.6%, following a 2.8% drop in Sep). Orders for non-defense capital goods excluding aircraft, a key indicator of business spending, rose by 0.6% in Oct (Sep: +1.3%) while unfilled durable goods orders were up 0.2% in a sign of strong demand.

- An advance estimate showed goods trade balance in the US narrowed to USD 82.9bn in Oct (Sep: USD 97bn). Exports increased by 10.7% yoy while imports were up by a marginal 0.5%. Wholesale inventories gained by 2.2% and excluding autos, retail inventories were up by 0.4%.

- Initial jobless claims fell to 199k in the week ended Nov 19th – this was the lowest level since Nov 1969 and compares with a previous low of 205k recorded in Feb 2020. This could be due to seasonal adjustments as the unadjusted claims ticked up by 7.6% from the week prior. Continuing claims stood at around 2mn in the week ended Nov 12th, above pre-pandemic levels of 1.7mn.

Europe:

- Germany’s GDP grew by an adjusted 1.7% qoq and 2.5% yoy in Q3, as per the second estimate released last week. Household consumption was up by 6.2% qoq while both government expenditure and investment fell. Exports declined by 1.0% qoq and imports fell by 0.6%.

- German Ifo’s business climate index declined by 1.2 points to 96.5 in Nov. Respondents were also less satisfied with their current situation (down to 99 from 100.2 the month before) and expectations were even more pessimistic (slipped to 94.2 from 95.4 in Oct).

- Manufacturing PMI in Germany slipped to a 10-month low of 57.6 in Nov (Oct: 57.8). The increase in services PMI (to 53.4 from 52.4) supported the uptick in composite PMI by 0.8 points to 52.8. Business confidence was the weakest since Oct 2020, given concerns about the pandemic and rising inflation.

- Eurozone’s preliminary manufacturing PMI inched up by 0.3 points to 58.6 in Nov, with a notable drop in production in the autos sector. Again, the services PMI outperformed manufacturing for a 3rd consecutive month (up by 2 points to 56.6) and helped composite index to move up to 55.8 from Oct’s 6-month low of 54.2.

- UK’s manufacturing PMI climbed to 58.2 in Nov (Oct: 57.8), “driven by the strongest rises in output, new orders and employment since Aug”. However, the rate of costs inflation was the fastest since the series began in Jan 1992. Robust rebound in export sales and strong domestic demand supported the services PMI in spite of a dip in the headline reading to 58.6 (Oct: 59.1).

Asia Pacific:

- China’s central bank left interest rates unchanged (for the 19th straight month) at the latest meeting. The apex bank later disclosed that it would raise risk tolerance and increase medium- and long-term loans to bolster manufacturing, and ramp up financial support for technological innovation. Separately, the State Council revealed that the government would strengthen financial support for SMEs by reducing taxes and fees, while deploying new credit-line of CNY 300bn (USD 9bn) for small- and micro-sized enterprises.

- Profits of China’s industrial firms grew by 24.6% yoy to CNY 818.7bn (USD 128.1bn) in Oct. Year-to-date profits were up by 42.2% to CNY 7.2trn.

- Japan’s flash manufacturing PMI moved up by 1 point to 54.2 in Nov, thanks to an improvement in both output and new order growth. Input price inflation was pushed to the highest since Aug 2008. Flash services PMI showed the strongest rise in activity in 26 months, as the reading jumped to 52.1 (Oct: 50.7).

- Tokyo core CPI (excluding fresh food prices) surged to a 16-month high of 0.3% yoy in Nov, largely due to the uptick in fuel and electricity costs.

- South Korea raised interest rate by one percentage point to 1% (this is its 2nd hike, following the one in Aug 2021) over concerns of inflation and rising household debt. New Zealand also raised rates for the second time – rates are up to 0.75%.

- Singapore’s GDP grew by 1.3% qoq and 7.1% yoy in Q3 (Q2: -1.4% qoq and 15.2% yoy), better than the initial estimates. Manufacturing sector grew by 7.2% yoy (moderating from Q2’s9% growth) and construction sector expanded by 66.3% (partly due to a lower base) while food and beverage sector fell by 4.2% (given tighter restrictions in Q3). Growth is forecast at between 3-5% in 2022, according to the Ministry of Trade and Industry.

- Inflation in Singapore grew to 3.2% yoy in Oct (Sep: 2.5%) while core inflation rose to its highest in nearly 3 years (1.5% from Sep’s 1.2%). Food inflation ticked up to 1.7% in Oct, and services inflation rose to 1.6% (Sep: 1.2%).

- Singapore’s industrial production surged by 16.9% in Oct (Sep: -2.2%), thanks to a rebound in the pharmaceuticals sector.

Bottomline: The US last week released 50mn barrels of oil from its strategic reserves. While this is unlikely to have a substantial effect on overall supply, the new variant could throw a spanner in the works. The global economy was already bracing itself for rising inflation and monetary policy tightening from the Fed amid a strong dollar. With cases of the new variant was found in UK, Germany and Italy among others, many nations (including Brazil, Australia, UAE, Egypt etc) have restricted entry/ suspended flights from many African nations; in the UK, compulsory mask wearing has been reintroduced to combat the spread of the new strain.

Regional Developments

- Bahrain’s central bank governor stated that real GDP is expected to grow by 3.1% this year. Furthermore, he revealed that foreign reserves had increased to BHD 1.63bn in Sep, thanks to the hike in oil prices.

- Bahrain’s recently launched a USD 30bn strategic projects plan includes the construction of 5 new offshore cities as well as infrastructure development (including a causeway and the metro system) as part of over 20 new projects among others.

- S&P revised the outlook for Bahrain to stable from negative while reaffirming its ‘B+/B’ long and short-term foreign and local currency sovereign credit ratings.

- Egypt grew by 9.8% in Q1 of the fiscal year 2021-22: this compares to 0.7% growth in the same period a year ago. GDP growth is estimated at5-5.7% in Jul 2021- Jun 2022.

- The government of Egypt finalized a USD 2bn syndicated bank loan including a USD 1bn Islamic financing tranche and a USD 1bn ESG tranche.

- Power tariffs for Egypt’s consumers will be kept fixed given the current rise in gas prices, according to the minister of electricity, though no details were provided as to the level of tariff. He also disclosed that electricity exports to Sudan will be increased to 300 MW from 80 MW while exports to Jordan and Libya stand at about 250 MW and 150 MW respectively.

- The Asian Infrastructure Investment Bank approved USD 360mn in financing for Egypt, the funds of which will be used to support economic recovery and strengthen reform programs.

- Jordan, UAE and Israel signed a “declaration of intent” to build solar power and water desalination facilities: the plan is to develop 600-megawatt solar photovoltaic plants in the Hashemite kingdom to supply clean energy to Israel and a sustainable water desalination programme in Israel to provide Jordan with up to 200mn cubic metres of desalinated water.

- Kuwait reappointed Sheikh Sabah al-Khalid as the PM; the government had submitted its resignation on Nov 8th.

- Lebanon’s ministry of finance and central bank underscored their “full cooperation” with the consultancy firm Alvarez & Marsal in completing the forensic audit. This followed reports that A&M had informed the presidency about potential withdrawal from the audit given delays in getting the data.

- Banque du Liban plans to sign an MoU with the IMF by year-end, according to the governor. He also stated that BDL is yet to provide the IMF with estimates of the size of the financial system’s losses.

- A UNICEF report’s devastating statistics on Lebanon’s social conditions by Oct 2021 included that there was at least one child who skipped a meal in more than half of families, nearly half the households had insufficient drinking water and less than one in three families had received social assistance.

- Oman and Qatar signed 6 agreements on military cooperation, taxation, tourism, ports, labour and investment during a state visit by Oman’s Sultan.

- Fitch placed Qatari banks’ ratings on negative watch, citing overdependence on non-domestic funding. Foreign liabilities accounted for 48% of the sector’s funding at end-Q3 (38% at end-2018) and net external debt rose to 80% of GDP at end-Q3 (30% at end-2018).

- Egypt, Oman and the UAE have banned direct flights from seven African countries temporarily in response to the spread of a new coronavirus variant.

Saudi Arabia Focus

- Saudi Arabia’s finance minister disclosed that the non-oil sector has been gradually recovering from the pandemic since mid-2021, citing the latest Q3 non-oil GDP estimate of 11.1%. He also stated that both consumption and private investment levels are now much higher than pre-pandemic.

- The minister of finance revealed that Saudi has already started applying a spending cap irrespective of the price of oil and associated revenues. The nation is adopting financial rules based on the estimation of structural oil revenues (future expectations, average real historical revenues and estimates of non-oil revenues as % of non-oil GDP). Furthermore, the rules also include maximum and minimum limits for government reserves.

- Non-oil exports from Saudi Arabia surged by 38.2% yoy to SAR 25.3bn in Sep, largely due to the record level of re-exports at SAR 5.6bn (more than double the value in Aug). Domestic non-oil exports however rose by 23.9% (Aug: 31.1%). In Q3 this year, China was the top trading partner accounting for 18.7% of total exports and one-fifth of imports. Other top export partners were India and Japan with shares of 9.6% and 9.5% respectively while the 2 other top import partners were the US (10.3%) and UAE (7.2%).

- Customs data show that Saudi Arabia remained the biggest supplier of crude oil to China for the 11th consecutive month; volumes were up by 19.5% yoy in Oct.

- Saudi Arabia plans to give more operating licenses to digital banks, according to the central bank governor. This year two digital bank licenses were issued to STC Bank and Saudi Digital Bank.

- SAMA has licensed a new fintech company Al-Hulul al-Shamilah Finance which will offer services through the SADAD system, which facilitates bill payments in the country.

- Foreign inflows into Saudi Arabia’s capital markets have reached almost SAR 135bn (USD 35.98bn) since 2019, according to the chairman of the CMA. He also stated that plans are underway to issue a market-making system to boost institutional investors effectiveness in trading, not equity.

- Saudi finance minister revealed that plans for 160 privatisations were currently underway, including in the education and logistics sector.

- The number of licenses for new foreign investment projects in Saudi Arabia increased for the third consecutive quarter, hitting a record high of 575 in Q2 this year, driven by retail and e-commerce and manufacturing sectors which accounted for 30% and 18% respectively of the new licenses. About 46% of the projects are joint investments between Saudi and foreign partners.

- Saudi Arabia’s Tadawul Group’s indicative price range suggests that it could raise upto SAR 3.78bn (USD 1.01bn) for its IPO.

- The newest planned industrial city in Saudi Arabia, OXAGON, plans to expand a tiny local port near NEOM into a hub with a target capacity of 9mn twenty-foot equivalent units (TEUs). Another existing port in the Red Sea will also be transformed to handle 3.5-4mn TEUs by 2030.

- The Saudi tourism fund disclosed that it had deployed SAR 2bn (USD 533mn) on tourism projects worth a total of SAR 6bn since its establishment a year ago (till Sep 2021).

- Saudi Real Estate Development Fund has provided financing of SAR 32bn to Saudi families since it was launched in 2017. In Nov alone, a total of SAR 788mn was disbursed.

- Saudi Arabia will permit direct entry to travellers from Indonesia, Pakistan, Brazil, Vietnam, Egypt and India from Dec. 1; previously those travelling from these nations needed to spend 2 weeks outside the country to gain entry.

UAE Focus![]()

- Dubai’s new business licenses increased by 69% yoy in Jan-Oct 2021 to 55194. Professional category accounted for 59% of total new business licenses followed by commercial (41%).

- The 5-year license fee exemption provided to Emirati members of Dubai SME has been extended to 7 years. The licensing fee applicable on SMEs was AED 1,000 for the first three years from the issuance of the licence, and AED 2,000 for fourth and fifth years.

- Iran’s deputy foreign minister met with the diplomatic adviser to the UAE president and Emirati minister of state for foreign affairs last week, with discussions focusing on strengthening economic and commercial relations with an aim towards regional stability.

- The UAE announced a USD 10bn fund to support strategic investments in Turkey, including in health and energy. Furthermore, the two nations signed multiple MoUs between the Abu Dhabi Development Holding, Turkish Wealth Fund, the Turkish Presidency Investment Office and some Turkish companies.

- The Dubai Financial Services Authority issued guidelines for the listing of SPACs in a market brief, while also stating that the decision would be taken “on a case by case basis”. Earlier this month, the Abu Dhabi Securities Exchange and Abu Dhabi DED had submitted a Spac regulatory framework to SCA.

- The Dubai International Airport re-opened Concourse A in Terminal 3 after being shut down for close to 20 months due to pandemic: this brings the airport closer to 100% capacity.

- Property transactions in Dubai surged to AED 13.12bn (USD 3.57bn) from 5352 transactions in Oct: not only was this the highest number of deals since Jun 2019, but this also brought year-to-date transactions to 64.4% more than value for the full year 2020.

- The Emirates Development Bank allocated a financing package worth more than AED 700mn (USD 191mn) to the industrial sector this year. The priority sectors to which capital was allotted included industry, technology, healthcare, food security and infrastructure.

Media Review

The Omicron variant that has sparked global alarm

https://www.ft.com/content/42c5ff3d-e676-4076-9b9f-7243a00cba5e

https://www.economist.com/science-and-technology/2021/11/26/a-new-covid-19-variant-has-emerged

Amendments to the unified GCC Customs Law approved

https://www.arabnews.com/node/1976266/business-economy

Afghanistan shows the American dream of remaking the world is over

Measuring Climate Change: The Economic and Financial Dimensions

https://www.imf.org/en/News/Articles/2021/11/17/sp111721-measuring-climate-change-opening-remarks

Dr. Nasser Saidi’s Al Arabiya interview on global inflation, Fed and CB policies, QE and interest rates