Weekly Insights 28 Oct 2021: GCC Climate Commitments need to be translated into Robust Climate Strategies

1. GCC Climate Commitments need to be translated into Robust Climate Strategies

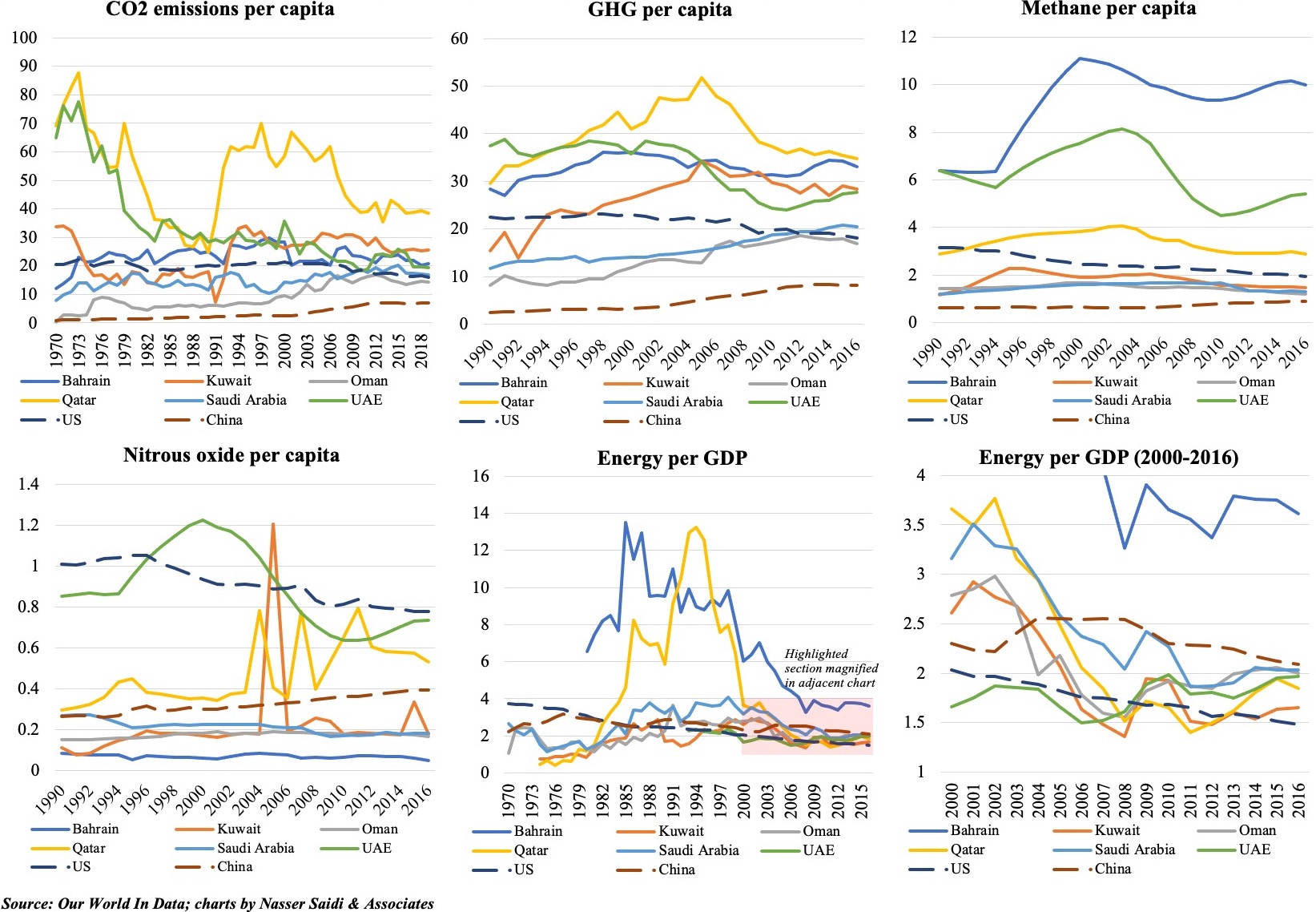

- China, the US and the EU are the top 3 greenhouse gas emitters (on an absolute basis): together they contribute 41.5% of total global emissions vs. the bottom 100 nations’ 3.6%.

- Together, top 10 emitters account for over two-thirds of global GHG emissions (Source: World Resources Institute)

- Globally, the energy sector (including electricity, transport, manufacturing, buildings, fugitive and other fossil fuels) continues to dominate as the biggest GHG emitter

- In the MENA region: (a) Emissions from Saudi Arabia top the list: it contributes only 1.34% to global emissions; (b) Energy accounts for 82.3% of total emissions (as of 2018), more or less unchanged from 1990 (83%)

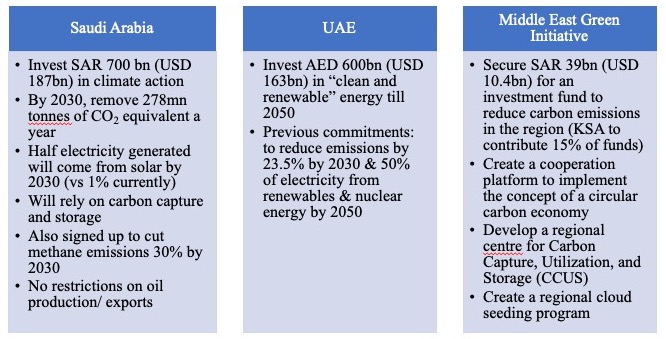

- However, with climate change on the top of the agenda of governments across the globe, it is little wonder that in the past few days, UAE announced net-zero emissions commitment by 2050 and Saudi Arabia and Bahrain by 2060. (Qatar this morning announced its aim to reduce GHG emissions and reduce carbon intensity of its LNG facilitate by 25% by 2030)

- While details of these commitments will be released at a later stage, we ask: (a) What can be done to support such goals? (b) What do these commitments imply for oil producers?

2. How do the GCC nations compare to top (absolute basis) emitters China & the US? A long way to go…

3. Saudi, UAE Net-Zero Emissions Commitments

Bottomline: Headlines need to be translated into Climate Strategies & Policies

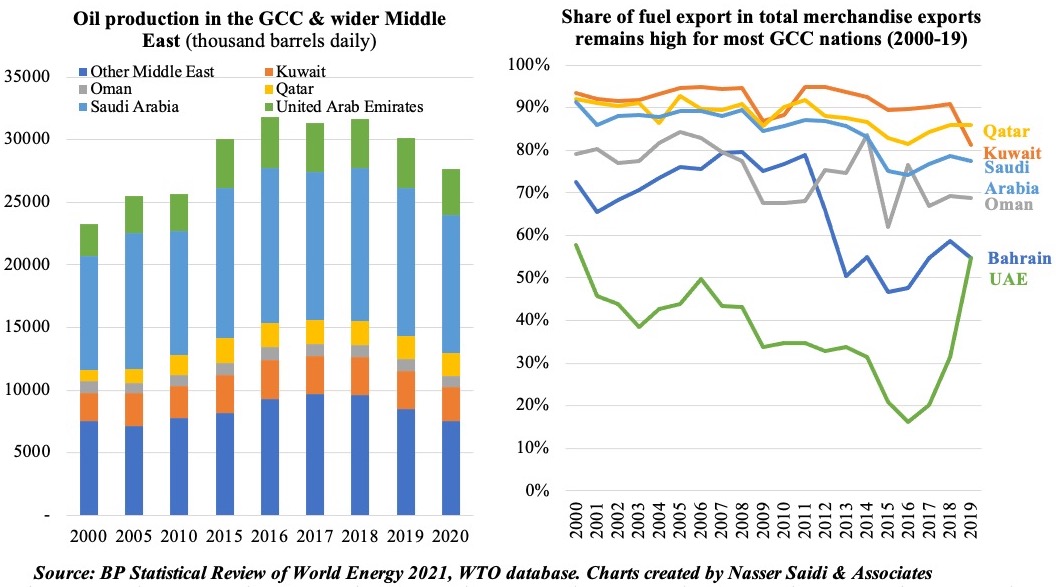

4. Oil production to tick up given OPEC+ agreement; oil exports dominate overall exports in most GCC nations

- UN carbon accounting rules imply that emissions from fossil fuels are counted where they are burned, not where they are produced

- However, rising oil & gas production will leave count towards domestic emissions; these need to be countered by investing in cleaner machinery, monitoring gas leaks and regular repairs

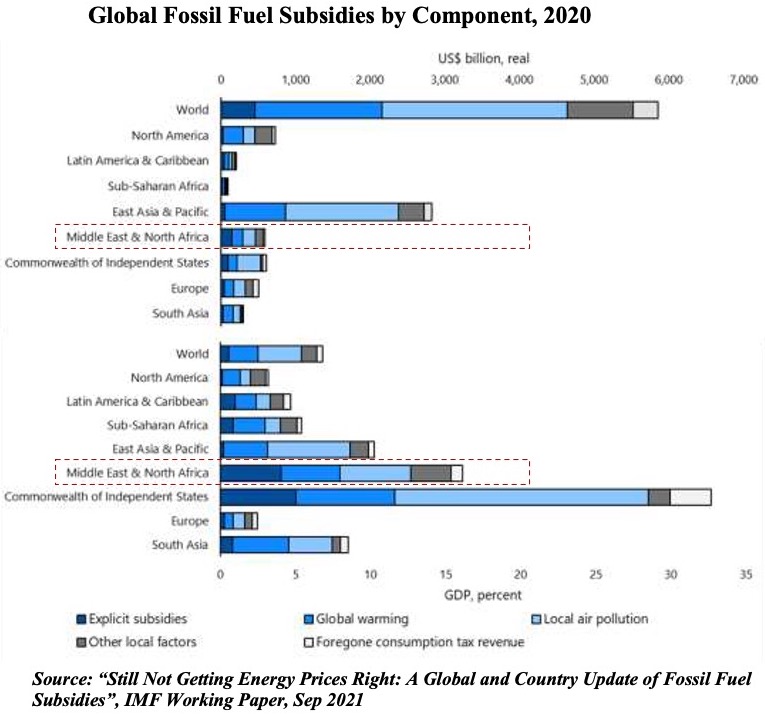

5. What can be done to support NZE goals? Eliminate fossil fuel subsidies (USD 5.9trn globally in 2020)

- Countries subsidize fossil fuels in 2 ways: undercharge for the product or for other costs (like damage to the planet & people’s health)

- According to the IMF, just 8% of the 2020 subsidy reflects undercharging for supply costs (explicit subsidies) and 92% for undercharging for environmental costs and foregone consumption taxes (implicit subsidies).

- Efficient fuel pricing in 2025 would: (a) Reduce global CO2 emissions 36% below baseline levels (in line with keeping global warming to 1.5 degrees); (b) Raise revenues worth 3.8% of global GDP; (c) Prevent 0.9 million local air pollution death

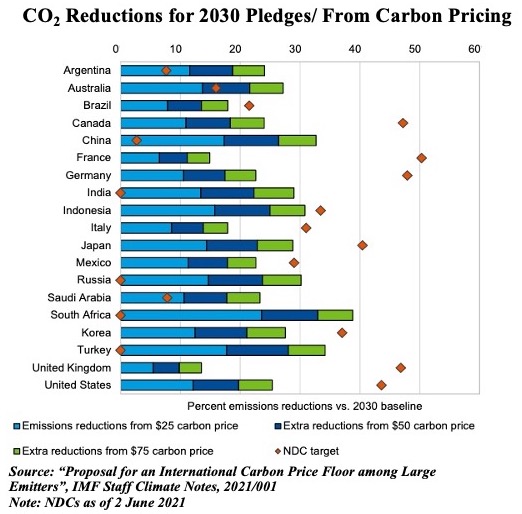

6. What can be done to support these goals? Carbon pricing / taxes

Ahead of COP26, 60+ carbon pricing schemes have been implemented globally

- However, only about one-fifth of global emissions are covered by pricing programs and the global average emissions price is only $3 per ton.

- An international carbon price floor can be strikingly effective. IMF proposes $75 a ton for advanced economies, $50 for high-income EMEs such as China, and $25 for lower-income EMEs such as India (to keep warming below 2 deg)

- The figure suggests that a $25 price floor would be binding for Saudi Arabia

Carbon tax is the most efficient price mechanism to:

- Improve energy efficiency in consumption & production;

- Accelerate energy transition;

- Encourage RE & CE investment + R&D

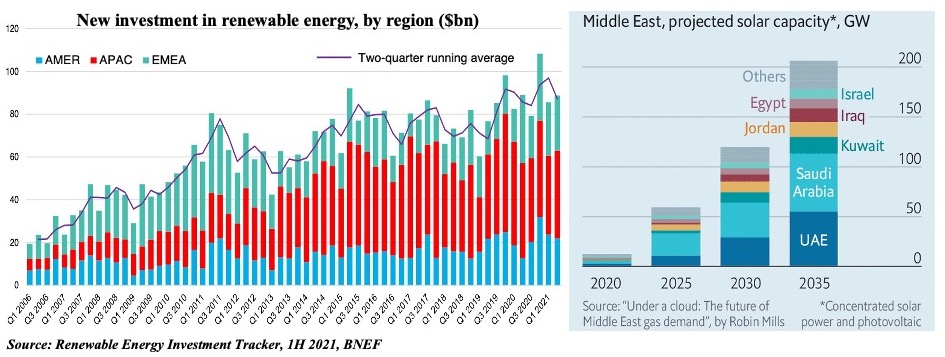

7. What can be done to support these goals? Investments in Renewable Energy

- Government efforts to curb climate change alongside advances in technology and falling costs has meant that renewables are becoming more competitive

- Decarbonisation & ‘green economy’ present opportunities for economic diversification and technological innovation

- Solar capacity is predicted to increase substantially in the Middle East; reinforce electricity-distribution grid; large & community-scale energy storage; encourage activity in new avenues like hydrogen market

- Improve energy efficiency: retrofit buildings/ LED streetlights; Improve industrial energy efficiency (replace equipment, upgrade waste-heat technologies)

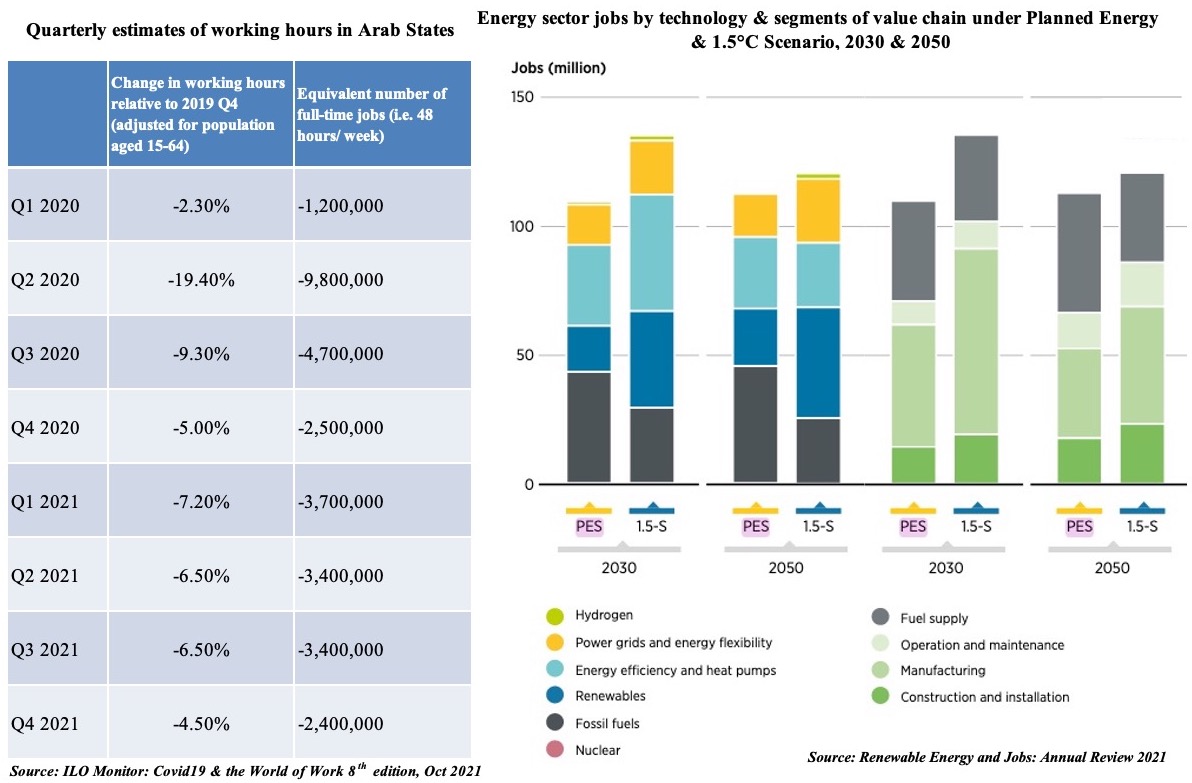

8. In post-Covid19 era, investments in renewable energy will support job creation & growth

- Pre-Covid19 pandemic, the Middle East needed 33.3mn new jobs to be created between 2020 and 2030 to reduce the unemployment rate to 5%. However, with the COVID-19 crisis, nearly one third of the employed population in the region is facing high risks of layoff or reduction of wages and/or hours of work

- Renewable energy jobs could provide support: according to a recent ILO/ IRENA report, about energy sector jobs will reach 122mn by 2050 (of which 43mn will be in renewables); electrolysers and other green hydrogen infrastructure can create about 2 million jobs globally from 2030 to 2050

9. Positive implications of NZE commitments for oil producers. But reality typically diverges!

BENEFITS for oil-producing nations

- Build more diversified, resilient, greener & fairer economies post-Covid19; create a new alternative export base

- Reduce emissions, support climate policies

- Greater fiscal consolidation: remove fossil fuel subsidies & gradually introduce carbon taxes

- These provide cost incentives to improve energy efficiency & shift the energy mix away from fossil fuels towards renewables

- Reduce dependence on oil AND (a) address potential stranded asset risk by privatizing / selling participation in energy reserves & related assets; (b) divest away from fossil fuel assets (esp GCC wealth funds)

REALITY CHECK

- A total of 49 countries + the EU had pledged a net zero target (as of mid-Sep), according to an UNEP report released this week

- Covers over half of global domestic GHG emissions, over half of global GDP and a third of the global population

- However, only eleven targets are enshrined in law, covering 12% of global emissions

- Key questions to ask: (a) How will commitments be enforced?; (b) How can one ensure that governments stick to their pledges?