Markets

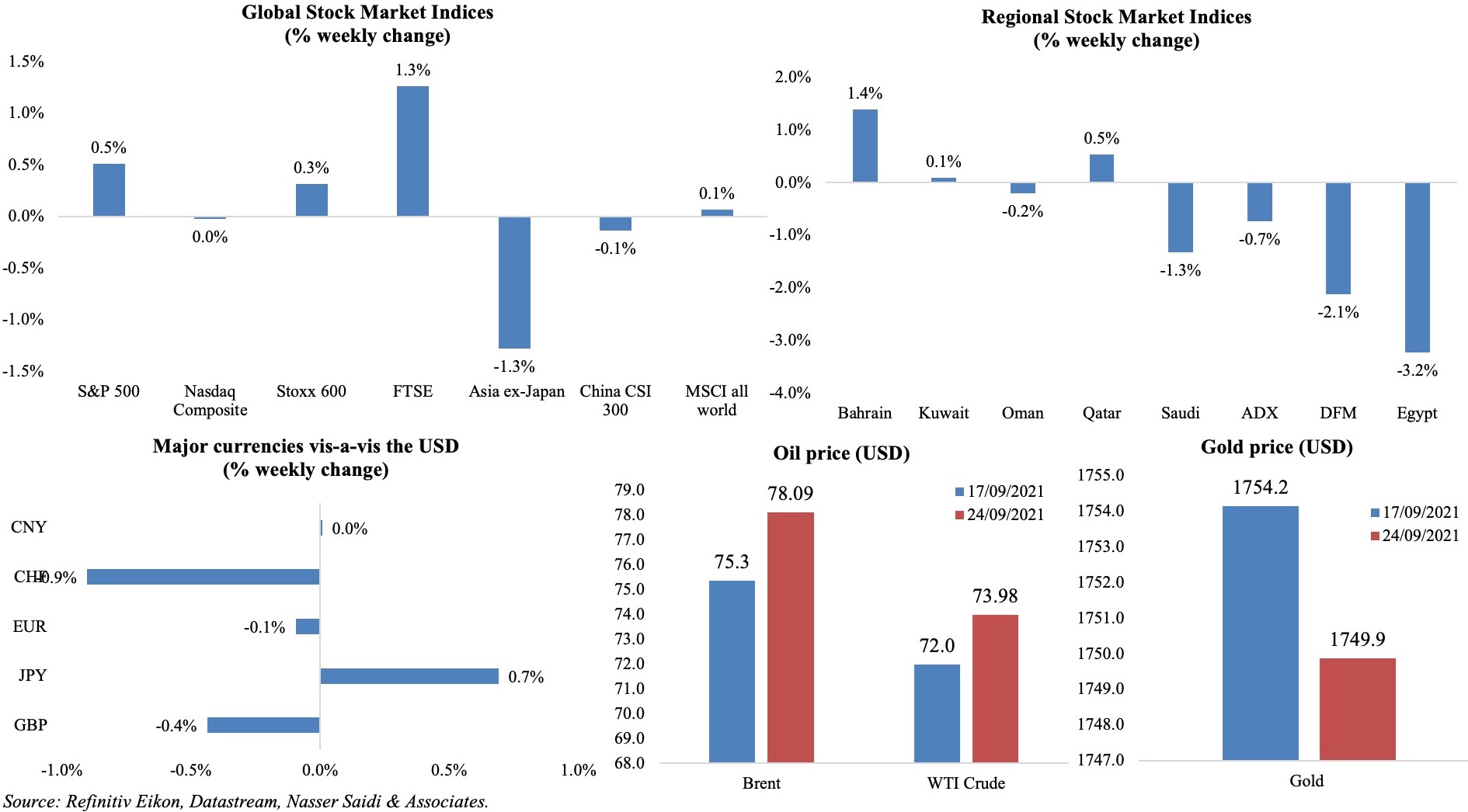

A turbulent week for global markets, as it digested the hawkish signals from major central banks while keeping a close eye as the Evergrande crisis unfurled (more in Media Review section). Asian markets were further affected by China’s announcement of a crackdown on cryptocurrencies – Asia ex-Japan ended the week down by 1.3% and Hong Kong’s index by almost 3%. Regional markets were mixed with Bahrain and Egypt the best and worst performers in the week. Among currencies, the euro and pound were down while the Japanese yen weakened. Oil prices increased to the highest in almost 3 years while gold slide to a 6-week low.

Weekly % changes for last week (23-24 Sep) from 16 Sep (regional) and 17 Sep (international).

Global Developments

US/Americas:

- The Fed cut its 2021 growth forecasts and projected a 5.9% rate this year (vs. 7% previously) while reiterating that a “gradual” tapering of bond buying was coming “soon” with the intention of withdrawing the stimulus completely by H2 2022.

- US current account deficit widened to a 14-year high of USD 190.28bn in Q2 (Q1: USD 189.4bn). The current account gap was 3.3% of GDP in Q2 (Q1: 3.4% of GDP).

- Overall housing starts were up by 3.9% mom to 1.615mn units in Aug, though single family home building fell for the 2nd straight month (-2.8% to 1.076mn). Building permits increased by 6% mom to a rate of 1.728mn units in Aug: as single-family permits gained by 0.6%, the multi-unit building permits surged by 19.7% to 632k units – the highest level since Jan 1990.

- Existing home sales declined by 2% mom to 5.88mn in Aug; in yoy terms, sales were down by 1.5% – recording the first annual decline in 14 months. The supply of homes for sale fell 1.5% mom to 1.29mn at end- The share of first-time buyers, at 29%, was the lowest since Jan 2019 – a result of higher home prices (median price was up by 14.9% yoy to USD 356,700).

- New home sales grew by 1.5% mom to a seasonally adjusted rate of 740k in Aug. Supply is at the most since Oct 2008, with 378k new homes on the market: houses under construction made up 62.7% of the inventory, with homes yet to be built accounting for a record 27.8%.

- Markit manufacturing PMI fell to a 5-month low of 60.5 in Sep (Aug: 61.1): though new orders were supported by strong demand, supply constraints and material shortages affected output. Services PMI slowed to a 14-month low of 54.4 (Aug: 55.1) with new export orders posting a quicker decline while employment levels remained broadly unchanged.

- Kansas Fed manufacturing activity index slowed in Sep: the composite index fell to 22 (Aug: 29) while the production index plunged to 10 in Sep (Aug: 22) and the volume of new orders index decreased sharply to seven from 34.

- Initial jobless claims unexpectedly rose for a second consecutive week, to 351k in the week ended Sep 17th, from an upwardly revised 335k the week before, slowing the 4-week average to 335.75k (lowest level since Mar 14, 2020). Continuing claims inched up by 181k to 2.845mn in the week ended Sep 10th.

Europe:

- Germany’s Ifo business climate index fell for the 3rd straight month to 98.8 points in Sep (Aug: 99.6). Expectations slipped by 0.5 points to 97.3 and the current assessment of business situation dipped to 100.4 in Sep (Aug: 101.4).

- German producer price index increased by 1.5% mom in Aug, also recording a 12% yoy rise.

- Preliminary manufacturing PMI in Germany declined to an 8-month low of 58.5 in Sep (Aug: 62.6), with output sub-index falling to a 15-month low of 53.8. Services PMI fell to 56.0 from 60.8 in Aug while private sector employment rose for a ninth straight month.

- Eurozone’s manufacturing PMI (preliminary) fell to a 7-month low of 58.7 in Sep (Aug: 61.4) “reflecting the peaking of demand in the second quarter, supply chain bottlenecks and concerns over the ongoing pandemic”. Services PMI ticked down to 56.3 from 59.0 the month before. According to Markit, selling price inflation accelerated in Sep, rising to the third-highest rate seen over the past two decades.

- Consumer confidence in the eurozone improved in Sep, rising to -4 (the highest level since Jun) from -5.3 the month before. Morale rose by 1.1 points to -5.2 in the wider EU.

- At the BoE meeting, policy rates were left unchanged at the historic low of 0.1% and the rhetoric was that the case for “modest tightening of monetary policy” over the next few years was getting stronger. The Bank also warned about surging inflation, predicting that it could peak above 4% (much higher than the BoE’s 2% target) and stay so into Q2 2022.

- UK’s preliminary composite PMI dropped to a 7-month low of 54.1 in Sep (Aug: 54.8), with slowdown more evident in manufacturing. Manufacturing PMI slipped to 56.3 from 60.3 in Aug, with material shortages amid a softening of demand. Services PMI declined to 54.6 (Aug: 55.0), with hotels, restaurants and catering sector posting a solid expansion while companies raised their own charges at the fastest pace since the series began in Jul 1996.

- UK GfK consumer confidence survey weakened to a 5-month low of -13 in Sep (Aug: -8), with all 5 components posting a decline. Expectations for the general economic situation over the coming year plunged ten points to -16.

- Norway’s Norges Bank became the first Western Central Bank to raise rates to 0.25% from zero, while stating that another hike was likely in Dec. The apex bank stated that not only was activity higher than its pre-pandemic level, but also that unemployment had fallen further while capacity utilisation appeared to be close to a normal level.

Asia Pacific:

- The People’s Bank of China kept interest rates on hold for the 17th consecutive month. Separately, the PBoC stated that services offering trading, order matching, token issuance and derivatives for virtual currencies were declared illegal and strictly prohibited.

- At its latest meeting, the BOJ left its short-term interest rate target at -0.1% and that for 10-year bond yields around 0%. The governor stated that economic recovery was on track despite sharing a disappointing outlook on exports and output as supply bottlenecks continued.

- Inflation in Japan fell by 0.4% yoy in Aug, slipping further from Jul’s 0.3% drop; food prices fell 1.1%, the most in four months, after a 0.6% decrease in Jul. Core CPI (excludes fresh food but includes oil prices) was flat, posting a non-negative number for the first time since Jul 2020. Excluding food and energy, prices were down by 0.5% (Jul: -0.6%).

- The preliminary reading of Japan’s manufacturing PMI slipped to 51.2 in Sep (Aug: 52.7), with both output and new orders posting below-50 readings. Services sector activity improved to 47.4 from the previous month’s final reading of 42.9. Input prices across the private sector rose at the fastest pace for 13 years, with costs of freight, raw materials and staff rising alongside supply shortages.

- Industrial production in Singapore grew by 11.2% yoy and 5.7% mom in Aug (Jul: 16.3% yoy), thanks to expansions in transport engineering (23.5%) and precision engineering (22.9%). Semiconductor output in particular grew 16.8%, supported by demand from 5G markets.

Bottomline: All eyes are on the German elections this Sunday, as most recent sentiment indicators suggest a loss of momentum due to supply chain bottlenecks. Furthermore, the preliminary PMI estimates for Europe and the US continue to highlight supply bottlenecks and rising input costs. Meanwhile, with major central banks churning out hawkish statements, global equity funds saw their first outflows in 2021 (BofA estimates). Last, but not the least, focus is also on Evergrande crisis to see if its “damage” could potentially reverberate through the rest of the world (a la Lehman and the sub-prime crisis).

Regional Developments

- Egypt’s state-controlled payments firm e-finance for Digital and Financial Investments is planning an IPO in Q4 2021, offering up to 14.5% of its capital.

- Revenues from Egypt’s Suez Canal grew by 11% yoy to USD 4.09bn in Jan-Aug 2021.

- Iraq climbed up 5 places to 137th place (out of 167 nations) in the 2020 Legatum Prosperity Index, scoring higher thanks to economic quality, market access and infrastructure as well as social inclusion.

- Kuwait is undertaking a government restructuring process in 2022: the ministries of electricity, water and oil will be merged to form the “Ministry of Energy” while a ‘Ministry of Economy and Trade’ will also be created, reported Al Qabs. The roadmap also includes new strategies like reviewing investment laws, foreign ownership, bankruptcy and public-private partnership among others.

- Kuwait expanded refinery capacity of the Mina Abdullah refinery to 454k barrels per day (bpd) and the Mina Al-Ahmadi refinery to 346k bpd, also complying with environmental standards Euro-4 and Euro-5 for reducing emissions and pollutants. The capital cost of this refining capacity expansion stood at KWD 4.680bn (USD 15.56bn).

- Lebanon’s PM stated that talks with the IMF were a “necessity” and not a choice. The French President urged the implementation of reform measures and to proceed with talks with the IMF while guaranteeing the country’s support. Separately, the President, in his speech at the UN, underscored the nation’s need for international support to revive the economy.

- A total blackout by end-Sep is a possibility in Lebanon, according to the state electricity company, given diminishing fuel oil reserves. The company revealed that less than 500 megawatts could be generated from the fuel oil secured from the Iraq deal.

- Lebanon raised gasoline prices again by 16% on Wednesday (following a 37% hike on Fri); new fuel prices were based on an exchange rate of LBP 14k to the dollar versus an official rate of LBP 1,500 to the dollar.

- Goldman Sachs, in their latest report, revealed that Lebanon’s bond investors could see a haircut of 75%: this is based on assumptions of strengthening of the LBP (to 8000 from 14,500 currently), negative or low real interest rates on public debt, fiscal adjustments and an improvement in growth. Separately, a group of bondholders (holding a “blocking stake” of more than 25% in 40% of various bond series) urged the government to begin restructuring talks and “engage meaningfully” with the IMF.

- Qatar’s energy minister attributed the currently high gas prices to lack of investment alongside a shortage of supply. He also stated that “we want to have a reasonable price that is sustainable”. Separately, UAE’s energy minister said the current spike reflected “market fundamentals” and a lack of investment, while also stating “the market will drive the price”.

- The jurisdiction of the Qatar International Court and Dispute Resolution Centre has been expanded to include the Qatar Free Zones and the Qatar Free Zones Authority in addition to matters referred to the Court or Regulatory tribunal by any Law in the State. This gives a strong legal dispute resolution mechanism for international firms operating in the country.

- Reuters reported that Venezuela and Iran entered a contract to swap Venezuela’s heavy oil for Iranian condensate that it can use to improve the quality of its tar-like crude; the agreement is planned for 6 months, with possibility of an extension, according to sources.

- Research by LinkedIn shows a 50-70% increase in employment levels in Saudi Arabia and UAE, thanks to a surge in retail sector jobs (as they emerge from Covid19 restrictions) as well as in healthcare.

- Four IPOs raised USD 425.8mn in H1 2021 in the MENA region: the number of listings stayed the same as 2020 but the proceeds fell by 48%. According to EY, an increase in SPACs activity counters the IPO activity.

- Moody’s 2021 survey of chief investment officers from eight leading fund firms in the GCC nations finds that half of them expect double-digit growth in net inflows, and a further 33% expected a high single-digit increase – supported by a significant increase in demand for ESG-compliant investment products and faster sales of Islamic products.

- Production and export of blue and green hydrogen could generate USD 100bn for GCC by 2050, according to a report by Columbia University and Qamar Energy. These nations could meet up to 10 (conservative target) to 30% (ambitious) of demand in Europe and East Asia by 2050.

Saudi Arabia Focus

- Saudi Arabia’s non-oil exports grew by 17.9% yoy to SAR 20.8bn in Jul 2021 while overall exports surged by 79.6%. Oil exports accounted for 77.4% of the total exports in Jul. Imports from UAE fell by 33% mom and 6% yoy to SAR 3.1bn (USD 827mn) in Jul after the former amended its rules on imports to exclude goods from free zones. Given this drop, the UAE slipped to being the third-largest import nation following China and the US – from being second in the list in Jun.

- Saudi Arabia’s finance minister disclosed that over the past 4 years, about SAR 500bn (USD 133.3bn) was saved through increased efficiency and budgetary discipline. He also revealed that digital payment options were available for 36% of government transactions in 2019, exceeding the 2020 target of 28%.

- The Saudi Capital Markets Authority stated that there are around 45 companies waiting for approval to list on the stock market. The number of new listings in the Saudi market since the beginning of 2021 (including traded investment funds) has reached 11, bringing the total number listed to 217.

- Saudi remained China’s top crude oil supplier for the 9th consecutive month: shipments surged by 53% yoy to 1.96mn barrels per day (bpd) in Aug, following 1.58mn bpd in Jul.

- The Saudi Data and Artificial Intelligence Authority plans to attract SAR 20bn of investments in data and AI, and is also training 25,000 data and AI specialists to position Saudi Arabia as one of the top 10 countries in the field, revealed its head of strategy.

- Saudi Arabia will announce its first green debt deal “soon”, according to the governor of the Public Investment Fund; the fund is tasked with developing nearly 70% of renewable projects in Saudi Arabia. He also stated that Saudi would announce its “Green Initiative” next month, followed by the “Middle East Initiative”, which includes planting 50bn trees.

- Construction on NEOM’s ‘The Line’, a 170-kilometer, zero-carbon, urban-development project, is expected to start by the end of this year. About 150 design and construction companies had visited NEOM last week to explore partnership opportunities.

- Saudi Red Sea tourism project Amala plans to raise up to USD 7bn “green” loan next year, to finance 9 new hotels (that will be opened in 2024), according to CEO of the Red Sea Development company. This would follow a larger loan of SAR 14bn raised earlier this year.

- Saudi Telecom Company completed the retail and institutional subscription to the IPO of Arabian Internet & Communications Services Co, raising SAR 624bn (USD 966.35mn).

UAE Focus![]()

- UAE announced a new government cabinet, with new finance and environment ministers. Other structural changes were also announced including merging of federal entities like the Ministry of Industry and Advanced Technology with the Emirates Authority for Standardization and Metrology, and the Federal Human Resources Authority transferred to the UAE Cabinet Office. Furthermore, 50% of government service centers will be turned digital within 2 years.

- The central bank expects UAE growth to rebound by 2.1% this year (2020: -6.1%), supported by a recovery in the non-oil GDP (+3.8% from -6.2% in 2020). Growth is expected to increase further to 4.2% next year. Earlier in June, GDP was forecast by the central bank at 2.4% this year and 3.8% next.

- The central bank will start “a gradual and well-calibrated withdrawal of its Targeted Economic Support Scheme” given the recent gradual increase in economic activity while taking care to avoid restricting credit supply and economic growth. Regulatory relief measures that allow banks to maintain lower capital and liquidity buffers might be extended beyond end of this year while the temporarily lowered reserve requirements for banks will be left unchanged.

- The Dubai Department of Economic Development forecasts Dubai’s GDP to increase by 3.1% yoy in 2021, with recoveries fastest among Covid19-affected sectors like accommodation and food services (+8.5%) and wholesale & retail (4.7%). This is underscored by the 5 stimulus packages announced by the emirate’s government since the pandemic that amounted to AED 7.1bn, or 1.6% of Dubai’s GDP. Dubai Statistics Centre preliminary estimates for GDP growth stood at an estimated 1% qoq in Q1 2021.

- India and the UAE plan to conclude a Comprehensive Economic Partnership Agreement by end-2021: this is aimed to increase bilateral trade in goods to USD 100bn within five years of the signed agreement (current trade value stands at around USD 60bn), in addition to supporting job creation and investments.

- The UAE central bank warned of increased risks of illicit financial flows in the backdrop of the Covid19 pandemic – including money-laundering and terrorism financing, via the use of unlicensed money service providers as well as use of e-commerce.

- UAE’s Securities and Commodities Authority (SCA) signed an agreement with the Dubai World Trade Centre Authority supporting the trading of crypto assets in the free zone.

- ADNOC increased the size of its drilling unit IPO to USD 1.1bn (from 7.5% to 11% of share capital) given the oversubscription. It will list on ADX on Oct 3rd.

- The Dubai Airport Free Zone, Dubai Silicon Oasis and Dubai Commerce City will operate under the supervision of newly created Dubai Integrated Economic Zones Authority starting next year. More than 5,000 international firms, with 30k employees and covering 20 key economic sectors will operate under the Dubai Integrated Economic Zones Authority – together generating 5% of Dubai’s GDP.

- Dubai’s Roads and Transport Authority disclosed that AED 15bn had been spent on more than 15 road and infrastructure projects related to Expo 2020; this includes the completion of Dubai Metro’s Route 2020, as well as roads including 9 flyovers and organizing public transport access & parking spots.

- The minimum amount required to obtain a 3-year visa through property investment in Dubai has been reduced to AED 750k from AED 1mn previously. The Dubai Land Department’s official sales price index shows that the number of sales transactions in Aug was the 2nd highest since Dec 2013: Aug saw 5,780 sales transactions worth AED 97bn.

- About AED 65bn (USD 17.6bn) has been allocated to the Emirati housing program in Dubai, to be spent over the next two decades. Directives were issued to quadruple the number of Emiratis benefitting from the housing program from next year.

- Damac Properties have received regulatory approval to take the firm private. The firm, with a market cap of over USD 2bn plans to offer USD 595mn for outstanding shares of the company.

- Visa’s “Back to Business” study finds that 64% of SMEs in the UAE are very optimistic about their long-term success – the highest among all surveyed markets. About 92% of consumers stated that their payment habits have been permanently changed by Covid19 (vs 68% globally) and a third of UAE consumers had not used cash in the past week (2nd highest among all markets).

Media Review

The Evergrande crisis

https://www.wsj.com/articles/evergrande-china-crisis-11632330764

Soaring gas prices ripple through heavy industry, supply chains

Analysis: Who pays? Lebanon faces tough question in IMF bailout bid

Saudis enjoy Red Sea cruises as kingdom opens up tourism sector

Goldilocks is dying

Powered by: